Fiinu PLC Operational & Strategic Update (7098F)

12 Julio 2023 - 1:00AM

UK Regulatory

TIDMBANK

RNS Number : 7098F

Fiinu PLC

12 July 2023

12 July 2023

Fiinu Plc

("Fiinu", the "Company" or the "Group")

Operational & Strategic Update

Fiinu, a fintech group, creator of the Plugin Overdraft(R),

provides an operational and strategic update.

In the Company's RNS announcement on 28 April 2023, the Company

outlined the challenges it had been facing in respect of raising

the full amount of funding required to provide the exit capital for

its subsidiary Fiinu 2 Limited (formerly Fiinu Bank Limited) to be

able to exit its mobilisation period and commence operations

without restrictions. As a result of these difficult market

conditions, it also stated that it had submitted an application to

the regulators to withdraw its banking licence with the aim of

re-applying after a short period of two to three months once exit

funding had been secured. The Company can confirm that the

application by its subsidiary to withdraw its restricted banking

licence was accepted by the regulators and, due to the continuing

challenging market conditions and limited timescale, it has not yet

been able to secure the necessary exit funding to consider seeking

re-application.

Given the ongoing expense of maintaining and enhancing the

development of the operationally ready banking technology by Group

companies, the Company has now determined that the best course of

action for its shareholders is for cost reductions to be initiated

at its subsidiaries, Fiinu 2 Limited and Fiinu Holdings Limited, by

various means including providing notice to reduce staffing levels,

the re-negotiation or termination of agreements with suppliers. By

reducing costs and satisfying all outstanding debts and liabilities

of Fiinu 2 Limited and Fiinu Holdings Limited, the balance of

resources available to the Company and across the Group will be

optimised as the best way forward for shareholders is

determined.

Unfortunately, due to the current circumstances the Company is

unable to utilise the funding options announced on 15 March 2023

with Dewscope Limited and GEM Global Yield LLC SCS and GEM Yield

Bahamas Limited.

As at 30 June 2023, the Group had available unaudited cash

resources of approximately GBP4.3m. This represents enough funds to

enable the Group to scale back its current operations in Fiinu 2

Limited and Fiinu Holdings Limited and continue to meet its

financial obligations as they fall due.

Whilst Fiinu 2 Limited proceeds with the controlled scaling back

of its operations, which may take a number of months, the Company

will continue to review all its options in respect of the business,

including trying to source the additional funding required for it

to re-apply to the regulators to re-start its banking licence

application, but also other options, which may include a change of

strategy and/or a sale of the Group's technology assets. A change

of strategy will include the Company's other subsidiary Fiinu

Holdings Limited, which holds the intellectual property for the

Group, and the Company.

The Company will make further announcements on progress and

other developments as and when appropriate.

Commenting on the proposals, Chris Sweeney, CEO of Fiinu,

said:

"It is with deep regret that we have had to scale back

operations in Fiinu 2 Limited and Fiinu Holdings Limited, following

the successful completion of the technology build of the Plugin

Overdraft(R). The current general capital, and market specific

conditions, are increasingly challenging for a business at Fiinu's

current stage of development.

"I would like to take the opportunity to thank our shareholders

for their support and colleagues for the considerable efforts in

developing the technology and the infrastructure to be in a

position to launch the product into the market. I would also like

to thank the PRA and FCA for their continued support during these

challenging times ."

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement.

ENDS

Enquiries:

Fiinu plc via Brazil London (press

Chris Sweeney, Chief Executive Officer office for Fiinu)

www.fiinu.com

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady / Adam Dawes

SP Angel Corporate Finance LLP (Joint Tel: +44 (0) 207 470 0470

Broker)

Matthew Johnson / Charlie Bouverat

(Corporate Finance)

Abigail Wayne / Rob Rees (Corporate

Broking)

Panmure Gordon (UK) Limited (Joint Tel: +44 (0)207 886 2500

Broker)

Stephen Jones / Atholl Tweedie (Corporate

Finance)

Hugh Rich (Corporate Broking)

Brazil London (press office for Fiinu) Tel: +44 (0) 207 785 7383

Joshua Van Raalte / Christine Webb

/ Jamie Lester

About Fiinu

Fiinu, founded in 2017, is a fintech group, that developed the

Plugin Overdraft(R) which is an unbundled overdraft solution that

allows customers to have an overdraft without changing their

existing bank. The underlying bank Independent Overdraft(R)

technology platform is bank agnostic, that therefore enables it to

serve all other banks' customers. Open Banking allows Fiinu's

Plugin Overdraft(R) to attach ("plugin") to the customer's existing

primary bank account, no matter which bank they may use. Fiinu's

vision is built around Open Banking, and it believes that it

increases competition and innovation in UK banking.

For more information, please visit www.fiinu.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDRBMPTMTMBBIJ

(END) Dow Jones Newswires

July 12, 2023 02:00 ET (06:00 GMT)

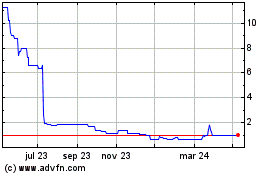

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

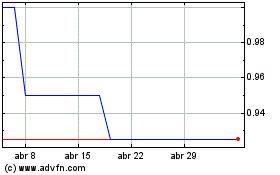

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024