TIDMBMD

RNS Number : 4602C

Baronsmead Second Venture Trust PLC

13 June 2023

Baronsmead Second Venture Trust plc

Half-yearly report for the six months ended 31 March 2023

The Directors of Baronsmead Second Venture Trust plc are pleased

to announce the unaudited half-yearly financial report for the six

months to 31 March 2023. Copies of the half-yearly report can be

obtained from the following website: www.baronsmeadvcts.co.uk

Our investment objective

-- Baronsmead Second Venture Trust plc (the "Company") is a tax

efficient listed company which aims to achieve long-term investment

returns for private investors, including tax free dividends.

Investment policy

-- To invest primarily in a diverse portfolio of UK growth

businesses, whether unquoted or traded on the Alternative

Investment Market ("AIM").

-- Investments are made selectively across a range of sectors in

companies that have the potential to grow and enhance their

value.

Dividend policy

-- The Board will, where possible, seek to pay two dividends to

shareholders in each financial year, typically an interim dividend

in September and a final dividend following the Annual General

Meeting.

-- The Board will use, as a guide, when setting the dividends

for a financial year, a sum representing 7 per cent. of the opening

NAV of that financial year.

Key elements of the business model

Access to an attractive, diverse portfolio

The Company gives shareholders access to a diverse portfolio of

growth businesses.

The Company will make investments in growth businesses, whether

unquoted or traded on AIM, which are substantially based in the UK

in accordance with the prevailing VCT legislation. Investments are

made selectively across a range of sectors.

The Manager's approach to investing

The Manager endeavours to select the best opportunities and

applies a distinctive selection criteria based on:

-- Primarily investing in parts of the economy which are

experiencing long-term structural growth.

-- Businesses that demonstrate, or have the potential for, market leadership in their niche.

-- Management teams that can develop and deliver profitable and sustainable growth.

-- Companies with the potential to become an attractive asset

appealing to a range of buyers at the appropriate time to sell.

In order to ensure a strong pipeline of opportunities, the

Manager invests in building deep sector knowledge and networks and

undertakes significant proactive marketing to interesting target

companies in preferred sectors. This approach generates a network

of potentially suitable businesses with which the Manager maintains

a relationship ahead of possible investment opportunities.

The Manager as an influential shareholder

The Manager is an engaged and supportive shareholder (on behalf

of the Company) in both unquoted and significant quoted

investments. For unquoted investments, representatives of the

Manager often join the investee board. The role of the Manager with

investees is to ensure that strategy is clear, the business plan

can be implemented and that management resources are in place to

deliver profitable growth. The intention is to build on the

business model and grow the company into an attractive target, for

it to be either sold or potentially floated in the medium term.

Strategic report

Financial highlights

NAV per share decreased 1.8% per cent. to 61.0p, before the

deduction of dividends, in the six months to 31 March 2023.

323.2p Net Asset Value ("NAV") total return to shareholders for

every 100.0p invested at launch (January 2001).

GBP4.6mn Investments made into two new and three follow-on

opportunities during the period (Unquoted: GBP3.4mn, Quoted:

GBP1.2mn).

GBP25.0mn raised in the period (before costs).

Cash returned to shareholders by date of Investment

The chart below shows the cash returned to shareholders based on

the subscription price and the income tax reclaimed on

subscription.

Cumulative dividends

Cash invested Income tax reclaim Net cash invested paid (#)

Year subscribed (p) (p) (p) (p) Return on cash invested (#) (%)

2001 (January) 100.00 20.00 80.00 162.55 182.6

============== =================== =================== ===================== ================================

2005 (March) - C

share* 100.00 40.00 60.00 117.69 157.7

============== =================== =================== ===================== ================================

2010 (March) 103.10 30.93 72.17 114.25 140.8

============== =================== =================== ===================== ================================

2012 (December) 117.40 35.22 82.18 96.25 112.0

============== =================== =================== ===================== ================================

2014 (March) 112.40 33.72 78.68 76.25 97.8

============== =================== =================== ===================== ================================

2016 (February) 107.20 32.16 75.04 59.75 85.7

============== =================== =================== ===================== ================================

2017 (October) 97.48 29.24 68.24 39.75 70.8

============== =================== =================== ===================== ================================

2019 (February) 85.30 25.59 59.71 32.25 67.8

============== =================== =================== ===================== ================================

2019 (November) 78.90 23.67 55.23 24.75 61.4

============== =================== =================== ===================== ================================

2020 (January) 84.80 25.44 59.36 24.75 59.2

============== =================== =================== ===================== ================================

2020 (February) 82.50 24.75 57.75 21.25 55.8

============== =================== =================== ===================== ================================

2020 (March) 64.30 19.29 45.01 21.25 63.0

============== =================== =================== ===================== ================================

2020 (November) 77.90 23.37 54.53 18.25 53.4

============== =================== =================== ===================== ================================

2020 (December) 80.90 24.27 56.63 18.25 52.6

============== =================== =================== ===================== ================================

2021 (January) 84.40 25.32 59.08 18.26 51.6

============== =================== =================== ===================== ================================

2021 (February) 82.20 24.66 57.54 14.75 47.9

============== =================== =================== ===================== ================================

2021 (March) 84.90 25.47 59.43 14.75 47.4

============== =================== =================== ===================== ================================

2021 (December) 88.10 26.43 61.67 11.75 43.3

============== =================== =================== ===================== ================================

2022 (January) 87.10 26.13 61.97 11.75 43.5

============== =================== =================== ===================== ================================

2022 (March) 76.60 22.98 53.62 8.25 40.8

============== =================== =================== ===================== ================================

2023 (January) 68.19 1 20.46 47.73 5.25 37.7

============== =================== =================== ===================== ================================

2023 (March) 65.72 2 19.72 46.00 2.25 33.4

============== =================== =================== ===================== ================================

The total return could be higher for those shareholders who were

able to defer a capital gain on subscription and the net sum

invested may be less.

* Dividends paid to C shareholders post conversion have been

adjusted by the conversion ratio (0.85642528).

# Includes interim dividend of 2.25p per share payable 8

September 2023.

Shares were allotted pursuant to the 2023 Offer at individual

prices for each investor in accordance with the allotment formula

as set out in each Offer's Securities Note.

1. Average effective offer price based on allotment prices

between 67.6p and 71.5p.

2. Average effective offer price based on allotment prices

between 64.8p and 67.9p.

Chair's statement

The UK economic backdrop continued to be challenging through the

end of 2022 and into the first quarter of 2023. Inflation and

interest rates remained at high levels and there was much

uncertainty across the financial markets. This led to uncertainty

in the debt markets and a liquidity squeeze. This was compounded in

the first quarter of 2023 by the collapse of Silicon Valley Bank

and then of Credit Suisse, which led to fears of a more widespread

banking sector contagion. Consumer and business confidence remains

fragile.

Against this backdrop, the quoted portfolio delivered strong

growth in the last quarter of 2022 as markets recovered from the

declines seen earlier in the year. This continued into the first

quarter of 2023 with some hopes of inflation and the cost-of-living

crisis easing. This partially offset the declines from the

uncertainty generated by the concerns within the banking sector and

recessionary fears. The Manager continues to believe that, in

aggregate, the fundamentals of the underlying portfolio companies

remain robust and the growth prospects for the majority of investee

companies continue to be positive over the medium term. The

portfolio also remains relatively defensively positioned with high

levels of diversification. The portfolio contains over 85 direct

investments, both quoted and unquoted assets, and a bias towards

sectors which have more resilient, contracted or recurring revenue

streams.

The Board is declaring an interim dividend of 2.25p to be paid

on 8 September 2023 to shareholders on the register as of 11 August

2023. The Board is aware that dividends are an important part of

the total return to the shareholders' investment in the Company.

Over the period, there were no capital proceeds realised from the

sale, or partial sale, of any portfolio companies. The Board has

considered the capital reserves available along with potential

known realisations and has made the decision to slightly reduce the

interim dividend amount compared to recent years. The Board

continues to aim to achieve its dividend policy objective of an

annual yield of 7.0 per cent of opening NAV.

I must, of course, remind shareholders that payment dates and

the amount of future dividends depend on the level and timing of

profitable realisations and cannot be guaranteed.

Results

During the six months to 31 March 2023, the Company's NAV per

share decreased 1.8 per cent. from 62.1p to 61.0p after the payment

of a final dividend of 3.0p per share on 3 March 2023. The table

below breaks down the movement in NAV over the six months.

Pence per

ordinary

share

----------------------------------------------- ----------

NAV as at 1 October 2022 (after deducting the

final dividend of 3.0p) 62.1

----------------------------------------------- ----------

Valuation decrease (1.8 per cent.) (1.1)

----------------------------------------------- ----------

NAV as at 31 March 2023 61.0

----------------------------------------------- ----------

Over the two months to 31 May 2023, NAV was 62.6p per share, a

2.6 per cent. increase over the NAV as at 31 March 2023. This was

driven by firmer quoted markets.

Portfolio review

The table below provides a summary of each asset class and the

return generated during the period under review.

Number

NAV % of % return

* of investees in the

Asset class (GBPmn) NAV* companies** period***

Unquoted 48 23 41 (14)

--------- ------ ------------- -----------

AIM-traded companies 78 37 46 2

--------- ------ ------------- -----------

LF Gresham House UK Micro Cap

Fund 25 12 48 7

--------- ------ ------------- -----------

LF Gresham House UK Multi Cap

Income Fund 20 9 40 7

--------- ------ ------------- -----------

LF Gresham House UK Smaller Companies

Fund 11 5 38 4

--------- ------ ------------- -----------

Liquid assets(#) 29 14 N/A 2

--------- ------ ------------- -----------

Total 211 100 213 (2)

--------- ------ ------------- -----------

* By value at 31 March 2023.

** Includes investee companies with holdings by more than one

fund. Total number of individual companies held is 164.

*** Return includes interest received on unquoted realisations during the period.

(#) Represents cash, OEICs and net current assets. % return in

the period relates only to the OEICs.

The value of the unquoted portfolio decreased 14.2 per cent. in

the six months to 31 March 2023. The drop in value was driven by a

combination of lower benchmark market comparables and softening

trading performance of the investee companies as a result of the

decline in consumer confidence.

The value of the Company's portfolio of investments directly

held in AIM-traded companies increased 1.8 per cent. in the six

months to 31 March 2023. The value of the Company's investment into

the LF Gresham House UK Micro Cap Fund ("Micro Cap") increased by

7.4 per cent., the LF Gresham House UK Smaller Companies Fund

("Small Cap") increased by 4.2 per cent. and the LF Gresham House

UK Multi Cap Income Fund ("Multi Cap") increased by 7.2 per cent.

in the period. This was primarily due to positive news flow across

the portfolio being well received by the markets with a number of

trading updates demonstrating better than expected financial

performance.

Investments and divestments

The Company's investments and divestments during the period are

set out below.

Investments

I am pleased to report that the Company made two new investments

totalling GBP1.4mn and three follow-on investments with a combined

value of GBP3.3mn in the six months to 31 March 2023. Below are

descriptions of the new investments made:

-- Cognassist (unquoted) - a platform for supporting those with learning needs.

-- Connect Earth (unquoted) - help businesses track their carbon emissions.

-- Patchworks (unquoted) - a platform for connecting businesses' applications.

-- Seeen (quoted) - a video technology business.

-- Oberon (quoted) - wealthy advisory service for individuals and businesses.

Following the period end, two further follow-on investments were

made into Airfinty and Panthera Biopartners, totalling GBP1.2mn,

and a new unquoted investment of GBP0.8mn was made into Dayrize, a

platform for assessing the sustainability of products.

Realisations

There were no realisations during the period. However, Glisser,

a provider of conference and educational software provider and

CMME, a specialist mortgage broker, went into administration. Both

businesses had experienced very challenging trading conditions over

the past year and their valuations had already been written

down.

Following the period end, in the unquoted portfolio; Evotix was

acquired resulting in a gross money multiple of 0.7x original cost;

the deferred consideration from the sale of Key Travel in 2018 was

received, resulting in a gross money multiple of 3.2x original

cost; and also the earn-out consideration from the Pho realisation

which, in addition to the proceeds received at the time of the

realisation, resulted in a gross money multiple of 3.1x original

cost. In the quoted portfolio, we continued to top-slice Cerillion

plc resulting in proceeds of GBP0.7mn.

Fundraising

I am pleased to report that, during the period, the Company

successfully raised GBP25.0mn (before costs) through an offer for

subscription which became fully subscribed in April 2023. The

Directors are pleased to welcome the 1,007 new shareholders who

invested during the offer period and are appreciative of the

continued support of 442 pre--existing shareholders.

The Board will consider whether to raise new funds in the

2023/24 tax year. This will be determined by the Company's cashflow

and its anticipated requirements to fund new and follow-on

investments over the next two to three years. The Board appreciates

that shareholders would like ample notice of its fundraising

intentions and will ensure that shareholders are informed of any

such fundraising at the earliest practical time.

Consumer Duty

The Financial Conduct Authority ("FCA") has introduced the

concept of Consumer Duty, the rules and principles which come into

effect in July 2023. Consumer Duty is an advance on the existing

concept of 'treating customers fairly' and looks to ensure good

outcomes for purchasers of investment products. As a listed entity,

Baronsmead Second Venture Trust plc, alongside other investment

companies, are not themselves subject to Consumer Duty.

Instead, in their role as promoter of the investment Manager to

the Company, it is Gresham House, and any other FCA regulated

parties associated with your investment in the Company, that must

uphold the principles behind the Consumer Duty. To that end, the

Board is working with Gresham House to review the information that

should be provided to assist investors and their advisers to

discharge their obligations under Consumer Duty.

VCT Regulation - Financial Heath Test

Since the various VCT rule changes in both 2015 and 2018, VCT

qualifying investments have become focussed on smaller, younger

companies. As a result, when the Manager makes a new investment,

they expect to make further follow-on investments as the investee

company progresses and where the business case for the investment

is justified. These follow-on investments are subject to the same

VCT compliance rules as new deals and both rely on certain criteria

being met, including the Financial Health Test.

The Financial Health Test is not something new and was primarily

introduced as an anti-abuse regulation. However, following

amendment to HMRC's guidance, there has been an effective

tightening of the interpretation of the Financial Health Test. This

is resulting in the restriction of potential follow-on VCT

investment to support certain portfolio companies. This has the

potential to negatively impact shareholders' returns as a result of

portfolio companies going into administration when they might

otherwise have gone on to be successful. Furthermore, as this is an

industry wide issue, this measure increases the uncertainties small

companies face at a particularly difficult time and may well result

in unnecessary job losses and hardship to employees and their

families and has the potential to reduce the overall tax efficiency

of the VCT scheme as a whole.

The Board continues to monitor developments in this area

carefully and supports the representations being made by the AIC

and the VCTA to HMRC and HM Treasury to seek a change to HMRC's

guidance in this area.

Outlook

The Board expects that market conditions will remain volatile

throughout 2023. It is likely that UK inflation will ease - whilst

remaining higher than Bank of England forecasts. Nonetheless, there

remains a material possibility of recession in the UK.

However, the portfolio is well diversified, and is largely

positioned in sectors of the economy which the Board expects will

benefit from long-term structural growth tailwinds. Whilst the

geopolitical and economic context for the next year is liable to be

challenging, experience suggests that investing through the cycle

can often produce superior returns. This can also provide an

opportunity for the Company to make high quality investments and

build strategic stakes in businesses with great potential for the

future. This applies to both new investments and further

investments in the portfolio. There are good prospects in the

pipeline across a variety of themes and sectors. The Company

remains suitably capitalised and the Manager is well resourced to

support investment into new and existing portfolio companies, which

is expected to drive value creation and steady dividend payments to

shareholders over the long-term.

Sarah Fromson

Chair

12 June 2023

Investments in the period

Book

cost

Company Location Sector Activity GBP'000

Unquoted investments

New

=====================================================================================================

A platform for supporting

Newcastle Healthcare those with learning

Cognassist UK Ltd upon Tyne & Education needs 902

============ =================== ============================ ==========

Helps businesses track

Connect Earth Ltd London Business Services their carbon emissions 451

============ =================== ============================ ==========

Follow on

Patchworks Integration A platform for connecting

Ltd Nottingham Technology businesses' applications 2,080

============ =================== ============================ ==========

Total unquoted investments 3,433

==========

AIM-traded investments

Follow - on

SEEEN plc London Technology A wide technology business 659

============ =================== ============================ ==========

Wealth advisory service

Oberon Investments for individuals and

Group plc London Business services businesses 531

============ =================== ============================ ==========

Total AIM-traded investments 1,190

==========

Total investments in the period 4,623

==========

Realisations in the period

There were no realisations in the period.

Responsibility statement of the Directors in respect of the

half-yearly financial report

Half-yearly report

The important events that have occurred during the period under

review, the key factors influencing the financial statements and

the principal uncertainties for the remaining six months of the

financial year are set out in the Chair's statement and the

Strategic report.

The principal risks facing the Company are mostly unchanged

since the date of the Company's Annual Report for the financial

year ended 30 September 2022 and continue to be as set out in that

Report on pages 18 and 19.

Risks faced by the Company include but are not limited to; loss

of approval as a Venture Capital Trust, legislative risk,

investment performance risk, risk of economic, political and other

external factors, regulatory and compliance risk and operational

risk. The Board considers the aftermath of the COVID-19 pandemic

and the Russian invasion of Ukraine to be factors which permeate

these risks, and their impacts for the remaining six months of the

year continue to be kept under review.

Responsibility statement

Each director confirms that to the best of their knowledge:

the condensed set of financial statements has been prepared in

accordance with FRS 104 Interim Financial Reporting Standards and

gives a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company.

This half-yearly report includes a fair review of the

information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place in the first

six months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

The half-yearly report was approved by the Board of Directors on

12 June 2023 and was signed on its behalf by Ms Sarah Fromson,

Chair.

Sarah Fromson

Chair

12 June 2023

Condensed income statement

For the six months to 31 March 2023 (Unaudited)

Six months to Six months to Year to

31 March 2023 31 March 2022 30 September 2022

--------------------- -----

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Losses on

investments 5 - (2,132) (2,132) - (27,719) (27,719) - (48,771) (48,771)

Income 1,201 - 1,201 961 - 961 4,951 - 4,951

Investment

management fee (620) (1,860) (2,480) (706) (2,116) (2,822) (1,367) (4,101) (5,468)

Other expenses (357) - (357) (359) - (359) (669) - (669)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit/(loss)

before taxation 224 (3,992) (3,768) (104) (29,835) (29,939) 2,915 (52,872) (49,957)

Taxation on

ordinary

activities - - - - - - (263) 263 -

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit /(loss) for

the period, being

total

comprehensive

income for the

period after

taxation 224 (3,992) (3,768) (104) (29,835) (29,939) 2,652 (52,609) (49,957)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Return per ordinary

share:

Basic and Diluted 2 0.07p (1.21p) (1.14p) (0.4p) (10.04p) (10.08p) 0.85p (16.85p) (16.00p)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

All items in the above statement derive from continuing

operations.

There are no recognised gains and losses other than those

disclosed in the Income Statement.

The revenue column of the Income Statement includes all income

and expenses. The capital column accounts for the realised and

unrealised profit or loss on investments and the proportion of the

management fee charged to capital.

The total column of this statement is the unaudited Statement of

Total Comprehensive Income of the Company prepared in accordance

with the Financial Reporting Standard ("FRS"). The supplementary

revenue return and capital return columns are prepared in

accordance with the Statement of Recommended Practice issued by the

Association of Investment Companies ("AIC SORP").

Condensed statement of changes in equity

Non-distributable reserves Distributable reserves

----------------------

Called-up share Revaluation Revenue

capital Share reserve Capital reserve Total

GBP'000 premium GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

---------------------- --------------------- ---------------- ----------- ---------------- -------- ------------

At 1 October 2022 35,789 106,099 18,834 49,142 3,122 212,986

(Loss)/profit on

ordinary activities

after taxation - - (3,433) (559) 224 (3,768)

Net proceeds of share

issues, share

buybacks & sale of

shares from treasury 1,933 10,718 - (771) - 11,880

Dividends paid - - - (9,116) (1,013) (10,129)

---------------------- --------------------- ---------------- ----------- ---------------- -------- ------------

At 31 March 2023 37,722 116,817 15,401 38,696 2,333 210,969

---------------------- --------------------- ---------------- ----------- ---------------- -------- ------------

For the six months to 31 March 2023 (Unaudited)

For the six months to 31 March 2022 (Unaudited)

Non-distributable reserves Distributable reserves

----------------------

Called-up share Revaluation Revenue

capital Share reserve Capital reserve Total

GBP'000 premium GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

---------------------- --------------------- ---------------- ----------- ---------------- -------- ------------

At 1 October 2021 31,206 74,231 77,481 63,698 1,758 248,374

(Loss)/ profit after

taxation - - (34,540) 4,705 (104) (29,939)

Net proceeds of share

issues, share

buybacks & sale of

shares from treasury 4,583 31,868 - (1,050) - 35,401

Dividends paid - - - (10,465) (308) (10,773)

---------------------- --------------------- ---------------- ----------- ---------------- -------- ------------

At 31 March 2022 35,789 106,099 42,941 56,888 1,346 243,063

---------------------- --------------------- ---------------- ----------- ---------------- -------- ------------

For the year ended 30 September 2022 (Audited)

Non-distributable reserves Distributable reserves

----------------------

Called-up share Revaluation Revenue

capital Share reserve Capital reserve Total

GBP'000 premiumGBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

---------------------- ---------------------- --------------- ----------- ---------------- -------- ------------

At 1 October 2021 31,206 74,231 77,481 63,698 1,758 248,374

(Loss)/Profit after

taxation - - (58,647) 6,038 2,652 (49,957)

Net proceeds of share

issues, share

buybacks & sale of

shares from treasury 4,583 31,868 - (1,302) - 35,149

Dividends paid - - - (19,292) (1,288) (20,580)

---------------------- ---------------------- --------------- ----------- ---------------- -------- ------------

At 30 September 2022 35,789 106,099 18,834 49,142 3,122 212,986

---------------------- ---------------------- --------------- ----------- ---------------- -------- ------------

Condensed balance sheet

As at 31 March 2023 (Unaudited)

As at As at As at

31 March 31 March 30 September

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

------------------------------------------------ ----- -----------------

Fixed assets

Unquoted investments 5 48,545 53,887 53,118

Traded on AIM 5 77,655 83,916 75,051

Collective investment vehicles 5 69,933 60,053 49,502

Listed on LSE 5 - 34 34

------------------------------------------------ ----- ----------------- --------------- ---------------

Investments 5 196,133 197,890 177,705

Current assets

Debtors 1,477 106 152

Cash at bank and on deposit 14,803 46,647 36,622

------------------------------------------------ ----- ----------------- --------------- ---------------

16,280 46,753 36,774

Creditors (amounts falling due within one year) (1,444) (1,580) (1,493)

------------------------------------------------ ----- ----------------- --------------- ---------------

Net current assets 14,836 45,173 35,281

------------------------------------------------ ----- ----------------- --------------- ---------------

Net assets 210,969 243,063 212,986

------------------------------------------------ ----- ----------------- --------------- ---------------

Capital and reserves

Called-up share capital 37,722 35,789 35,789

Share premium 116,817 106,099 106,099

Capital reserve 38,696 56,888 49,142

Revaluation reserve 5 15,401 42,941 18,834

Revenue reserve 2,333 1,346 3,122

------------------------------------------------ ----- ----------------- --------------- ---------------

Equity shareholders' funds 210,969 243,063 212,986

------------------------------------------------ ----- ----------------- --------------- ---------------

Net asset value per share 61.0p 74.2p 65.1p

Number of ordinary shares in circulation 345,640,159 327,596,768 327,288,384

------------------------------------------------ ----- ----------------- --------------- ---------------

Condensed statement of cash flows

For the six months to 31 March 2023 (Unaudited)

Six months to Six months to

31 March 31 March Six months to

2023 2022 30 September 2022

GBP'000 GBP'000 GBP'000

----------------------------------------------------------- -----------------

Net cash outflow from operating activities (2,035) (2,536) (1,872)

Net cash ( outflow) /inflow from investing activities (21,534) 12,689 12,058

Net cash ( outflow)/ inflow before financing activities (23,569) 10,153 10,186

Net cash inflow from financing activities 1,750 24,182 14,124

----------------------------------------------------------- ----------------- ------------------ ------------------

(Decrease)/ Increase in cash (21,819) 34,335 24,310

----------------------------------------------------------- ----------------- ------------------ ------------------

Reconciliation of net cash flow to movement in net cash

(Decrease)/ increase in cash (21,819) 34,335 24,310

Opening cash at bank and on deposit 36,622 12,312 12,312

----------------------------------------------------------- ----------------- ------------------ ------------------

Closing cash at bank and on deposit 14,803 46,647 36,622

----------------------------------------------------------- ----------------- ------------------ ------------------

Reconciliation of (loss)/ profit/ before taxation to net

cash outflow from operating activities

Loss on ordinary activities before taxation (3,768) (29,939) (49,957)

Losses on investments 2,132 27,719 48,771

Changes in working capital and other non-cash items (399) (316) (686)

----------------------------------------------------------- ----------------- ------------------ ------------------

Net cash outflow from operating activities (2,035) (2,536) (1,872)

----------------------------------------------------------- ----------------- ------------------ ------------------

Notes to the financial statements

For the six months to 31 March 2023 (Unaudited)

1. Basis of preparation

The condensed financial statements for the six months to 31

March 2023 comprise the unaudited financial statements set out on

pages 13 to 16 together with the related notes on pages 17 to 21.

The Company applies FRS 102 and the AIC SORP for its annual

Financial Statements. The condensed financial statements for the

six months to 31 March 2023 have therefore been prepared in

accordance with FRS 104 'Interim Financial Reporting' and the

principles of the SORP. They have also been prepared on a going

concern basis. The financial statements have been prepared on the

same basis as the accounting policies set out in the Company's

Annual Report and Financial Statements for the year ended 30

September 2022.

The financial information contained in this half-yearly

financial report does not constitute statutory accounts as defined

in sections 434 - 436 of the Companies Act 2006. The half-yearly

financial report for the six months ended 31 March 2023 and for the

six months ended 31 March 2022 have been neither audited nor

reviewed by the Company's Auditor. The information for the year to

30 September 2022 has been extracted from the latest published

audited financial statements, which have been filed with the

Registrar of Companies. The report of the Auditor for the audited

financial statements for the year to 30 September 2022 was: (i)

unqualified; (ii) did not include a reference to any matters to

which the Auditor drew attention by way of emphasis without

qualifying their report; and (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006. No

statutory accounts in respect of any period after 30 September 2022

have been reported on by the Company's Auditor or delivered to the

Registrar of Companies.

Copies of the half-yearly financial report have been made

available to shareholders and are available from Gresham House, 80

Cheapside, London, EC2V 6EE.

2. Performance and shareholder returns

Return per share is based on a weighted average of 330,678,751

ordinary shares in issue (31 March 2022 - 297,083,965 ordinary

shares; 30 September 2022 - 312,132,990 ordinary shares).

Earnings for the first six months to 31 March 2023 should not be

taken as a guide to the results of the full financial year to 30

September 2023.

3. Called-up share capital

The below table details the movement in called-up share capital

during the period.

Allotted, called-up and fully paid:

Ordinary shares GBP'000

--------------------------------------------------------- -------

252, 3357,889,473 ordinary shares of 10p each listed

at 30 September 2022 35,789

19,335,239 ordinary shares of 10p each issued during

the period 1,933

377,224,712 ordinary shares of 10p each listed at

31 March 2023 37,722

--------------------------------------------------------- -------

30,601,089 ordinary shares of 10p each held in treasury

at 30 September 2022 (3,060)

2,264,464 ordinary shares of 10p each repurchased during

the period and held in treasury (226)

1,281,000 ordinary shares of 10p each sold from treasury

during the period 128

31,584,553 ordinary shares of 10p each held in treasury

at 31 March 2023 (3,158)

--------------------------------------------------------- -------

345,640,159 ordinary shares of 10p each in circulation*

at 31 March 2023 34,564

--------------------------------------------------------- -------

* carrying one vote each

During the six months to 31 March 2023 the Company issued

19,335,239 shares at net proceeds of GBP12,543,000 (after costs).

During the same period, the Company purchased 2,264,464 shares to

be held in treasury at a cost of GBP1,430,000 (including costs).

The Company also sold 1,281,000 shares from treasury for proceeds

of GBP767,000. At 31 March 2023, the Company held 31,584,553

ordinary shares in treasury. Shares may be sold out of treasury

below Net Asset Value as long as the discount at issue is narrower

than the average discount at which the shares were bought into

treasury.

Excluding treasury shares, there were 345,640,159 ordinary

shares in circulation at 31 March 2023 (31 March 2022 - 327,596,768

ordinary shares; 30 September 2022 - 327,288,384 ordinary

shares).

4. Dividends

The final dividend for the year ended 30 September 2022 of 3.0p

per share (2.7p capital, 0.3p revenue) was paid on 3 March 2023 to

shareholders on the register on 3 February 2023. The ex-dividend

date was 2 February 2023.

During the year to 30 September 2022, the Company paid an

interim dividend on 9 September 2022 of 3.0p per share (2.7p

capital, 0.3p revenue).

5. Investments

All investments are initially recognised and subsequently

measured at fair value. Changes in fair value are recognised in the

Income Statement.

The methods of fair value measurement are classified into a

hierarchy based on reliability of the information used to determine

the valuation.

-- Level 1 - Fair value is measured based on quoted prices in an active market.

-- Level 2 - Fair value is measured based on directly observable

current market prices or indirectly being derived from market

prices.

-- Level 3 - Fair value is measured using a valuation technique

that is not based on data from an observable market.

The valuation of unquoted investments contained within level 3

of the Fair Value hierarchy involves key assumptions dependent upon

the valuation methodology used. The primary methodologies applied

are:

-- Cost of recent investment.

-- Earnings multiple.

-- Offer less 10 per cent.

The earnings multiple approach involves more subjective inputs

than the cost of recent investment and offer approaches and

therefore presents a greater risk of over or under estimation. Key

assumptions for the earnings multiple approach are the selection of

comparable companies and the use of either historic or forecast

revenue or earnings, as considered most appropriate. Other

assumptions include the appropriateness of the discount magnitude

applied for reduced liquidity and other qualitative factors. These

assumptions are described in more detail in note 2.3 in the

Company's Report and Financial Statements for the year to 30

September 2022. The techniques used in the valuation of unquoted

investments have not changed materially since the date of that

report.

Level 1 Level 2 Level 3

------------------- ----------- ----------

Collective

Traded Listed investment

on AIM on LSE vehicles Unquoted Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------- -------- --------- ----------- ---------- --------

Opening book cost 63,764 3,429 36,557 55,121 158,871

Opening unrealised appreciation/(depreciation) 11,287 (3,395) 12,945 (2,003) 18,834

----------------------------------------------- -------- --------- ----------- ---------- --------

Opening fair value 75,051 34 49,502 53,118 177,705

----------------------------------------------- -------- --------- ----------- ---------- --------

Movements in the year:

Purchases at cost 1,190 - 39,738 3,433 44,361

Sale - proceeds - - (22,500) (1,301) (23,801)

- realised gains on

sales - - - 1,301 1,301

Change in unrealised

appreciation/ (depreciation) 1,414 (34) 3,193 (8,006) (3,433)

----------------------------------------------- -------- --------- ----------- ---------- --------

Closing fair value 77,655 - 69,933 48,545 196,133

----------------------------------------------- -------- --------- ----------- ---------- --------

Closing book cost 64,954 3,429 53,795 58,554 180,732

Closing unrealised appreciation/(depreciation) 12,701 (3,429) 16,138 (10,009) 15,401

----------------------------------------------- -------- --------- ----------- ---------- --------

Closing fair value 77,655 - 69,933 48,545 196,133

----------------------------------------------- -------- --------- ----------- ---------- --------

Equity shares 77,655 - - 23,697 101,352

Preference shares - - - 18,842 18,842

Loan notes - - - 6,006 6,006

Collective investment

vehicles - - 69,933 - 69,933

----------------------------------------------- -------- --------- ----------- ---------- --------

Closing fair value 77,655 - 69,933 48,545 196,133

----------------------------------------------- -------- --------- ----------- ---------- --------

6. Other required disclosures

6.1 Segmental reporting

The Company has one reportable segment being investing in

primarily a portfolio of UK growth businesses, whether unquoted or

traded on AIM.

6.2 Principal risks and uncertainties

The Company's assets consist of equity and fixed interest

investments, shares in collective investment schemes, cash and

liquid resources. Its principal risks are therefore market risk,

price risk, credit risk and liquidity risk. Other risks faced by

the Company include loss of approval as a Venture Capital Trust,

legislative, investment performance, economic, political and other

external factors, regulatory and compliance and operational risks.

These risks, and the way in which they are managed, are described

in more detail in the principal risks and uncertainties table

within the Strategic report section in the Company's Annual Report

and Accounts for the year ended 30 September 2022. The Board

continues to regularly review the risk environment in which the

Company operates.

6.3 Related parties

Gresham House Asset Management Ltd (the "Manager") manages the

investments of the Company. The Manager also provides or procures

the provision of secretarial, accounting, administrative and

custodian services to the Company. Under the management agreement,

the Manager receives a fee of 2.5 per cent. per annum of the net

assets of the Company. This is described in more detail under the

heading 'The Investment Management Agreement' within the Strategic

Report in the Company's Annual Report and Accounts for the year

ended 30 September 2022. During the period the Company has incurred

management fees of GBP2,480,000 (31 March 2022 - GBP2,822,000; 30

September 2022 - GBP5,468,000) and secretarial and accounting fees

of GBP80,000 (31 March 2022 - GBP76,000; 30 September 2022 -

GBP149,000) payable to the Manager. No performance fee has been

accrued at 31 March 2023 (31 March 2022 - GBPnil; 30 September 2022

- GBPnil). This is described in more detail under the heading

'Performance fees' within the Strategic Report in the Company's

Annual Report and Financial Statements for the year to 30 September

2022.

6.4 Going Concern

After making enquiries, and bearing in mind the nature of the

Company's business and assets, the Directors consider that the

Company has adequate resources to continue in operational existence

for the foreseeable future. In arriving at this conclusion, the

Directors have considered the Company's cash balances, the

liquidity of the Company's investments and the absence of any

gearing. The Directors are therefore also satisfied that the

Company has adequate financial resources to continue in operation

for at least the next 12 months and that, accordingly, it is

appropriate to adopt the going concern basis in preparing the

financial statements.

6.6 Post balance sheet events

The following events occurred between the balance sheet date and

the signing of these financial statements:

-- The 30 April 2023 NAV of 62.3p was announced on 5 May 2023

and the 31 May 2023 NAV of 62.6p was announced on 6 June 2023. At

the date of publishing this report, the Board is unaware of any

matter that will have caused the NAV per share to have changed

significantly since the latest NAV.

-- 19mn shares were issued on 3 April 2023 at allotment prices

between 61.8p and 65.2p under the current offer.

-- Purchased 1.2mn Ordinary Shares of 10.0p on 5 April 2023 at a

price of 57.0p per share to be held in Treasury.

-- Follow-on investment, into Airfinity Ltd, completed in April 2023 totalling GBP0.7mn.

-- Follow-on investment, into Panthera Biopartners, completed in June 2023 totalling GBP0.5mn.

-- Follow-on investments, into LF Gresham House UK Multi Cap

Income Fund, completed in April and May 2023, totalling

GBP0.5mn.

-- Follow-on investments, into LF Gresham House UK Smaller

Companies Fund, completed in April and May 2023, totalling

GBP4.5mn.

-- One new investment, into Dayrize B.V., completed in May 2023 totalling GBP0.8mn.

-- Partial realisation of MXC Capital in April, as part of a

tender offer, realising proceeds of GBP0.02mn and making a return

of 0.6x cost.

-- Partial realisations in Cerillion plc were made in April and

May, realising proceeds of GBP0.7mn and making a return of 15.8x

cost.

-- Received earn-out proceeds of GBP1.4mn from Pho in May 2023,

which was realised in July 2021, making a total return of 3.1x

cost.

-- Realised Evotix in May 2023, receiving proceeds of GBP0.8mn

and making a return of 0.7x cost.

-- Received deferred proceeds of GBP0.4mn from Key Travel in May

2023, which was realised in May 2018, making a total return of 3.2x

cost.

Corporate Information Registrars and Transfer Office

Computershare Investor Services plc

Directors The Pavilions

Sarah Fromson (Chair) Bridgwater Road

Malcolm Groat* Bristol BS99 6ZZ

Graham McDonald Tel: 0800 923 1534

Tim Farazmand (#)

Brokers

Secretary Panmure Gordon & Co

Gresham House Asset Management Ltd One New Change

London EC4M 9AF

Registered Office Tel: 020 7886 2500

5 New Street Square

London EC4A 3TW Auditor

BDO LLP

Investment Manager 55 Baker Street

Gresham House Asset Management Ltd LondonW1U 7EU

5 New Street Square

London EC4A 3TW

Tel: 020 7382 0999 Solicitors

Dickson Minto

Registered Number Broadgate Tower

04115341 20 Primrose Street

London EC2A 2EW

VCT Status Adviser

PricewaterhouseCoopers LLP

1 Embankment Place

London WC2N 6RH

Website

www.baronsmeadvcts.co.uk

Chair of the Nomination Committee.

* Senior Independent Director and

Chair of the Audit & Risk Committee.

# Chair of the Management Engagement

and Remuneration Committee.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUBWQUPWGQP

(END) Dow Jones Newswires

June 13, 2023 02:00 ET (06:00 GMT)

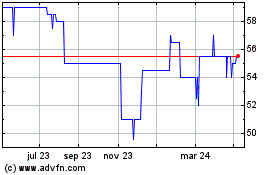

Baronsmead Second Venture (LSE:BMD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

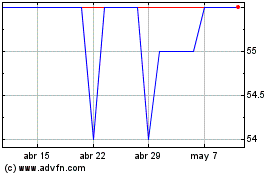

Baronsmead Second Venture (LSE:BMD)

Gráfica de Acción Histórica

De May 2023 a May 2024