TIDMCEG

RNS Number : 4525R

Challenger Energy Group PLC

27 October 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation ("MAR") (EU) No. 596/2014, as incorporated into UK law

by the European Union (Withdrawal) Act 2018. Upon the publication

of this announcement, this inside information is now considered to

be in the public domain.

27 October 2023

Challenger Energy Group PLC

("Challenger Energy" or the "Company")

Short-term conventional bridge loan to fully repay and cancel

the

previously advised convertible loan note funding facility

Challenger Energy (AIM: CEG) provides the following update in

relation to its financing arrangements:

-- The Company has secured a short-term bridge loan of

GBP346,500 (the "Bridge Loan"), the proceeds of which will be

applied to immediately redeem in full the drawn and unconverted

balance of the previously advised convertible loan note funding

facility (the "Funding Facility"), and thereafter permanently

cancel that Funding Facility.

-- In parallel, the holder of currently issued convertible notes

under the Funding Facility has issued a conversion notice in

relation to a small portion ( GBP55,000) of the notes on issue,

which, in accordance with their terms, will convert by agreement

into 100 million new ordinary shares of the Company ("New

Conversion Shares").

-- The net effect will be that the Company will issue the

Conversion Shares, receive GBP346,500 by way of proceeds from the

Bridge Loan, immediately apply those proceeds to fully redeem the

remaining balance of convertible notes issued under the Funding

Facility, and thereafter permanently cancel the balance of the

Funding Facility.

-- Key terms of the Bridge Loan are:

-- a 12% per annum coupon, accruing monthly;

-- a maximum term of 6 months, but with a proviso that the

Bridge Loan will be repaid earlier from proceeds received by the

Company from either (i) completion of the Cory Moruga asset sale

transaction in Trinidad, or (ii) completion of a farm-out of its

assets in Uruguay; and

-- the Bridge Loan is unsecured.

-- The Company will issue warrants to the provider of the Bridge

Loan, valid for 36 months, which will entitle the holder of the

warrants to subscribe for 250 million ordinary shares in the

Company, at an exercise of 0.1p per share, being a premium of

approximately 100% to the current share price.

Eytan Uliel, Chief Executive Officer, said:

"Eight weeks ago, we secured a convertible note funding facility

for up to GBP3.3 million. As we explained then, our immediate

funding requirement was relatively minimal, in that we were seeking

to bridge a short period of time until receipt of expected cash

inflows. We thus drew only a small portion of that facility,

although we saw value in putting a much larger line of funding in

place, in case it was needed it in the future.

However, given the progress in seeing those expected cash

inflows in the required timeframe, we have moved to refinance and

cancel the facility, and replace it with a more "traditional" loan,

with attached warrants.

We will thus continue to have the funds needed to bridge us

through the current period, although we will no longer have a

bigger facility in place to support us beyond that. Today's

transaction will also mean that the item of most concern to our

shareholders about the previous convertible facility - the

potential for future dilution at unknown value from future

conversions and any future facility draw-downs - is removed."

Admission and Total Voting Rights

-- Application will today be made for admission ("Admission") of

the New Conversion Shares to trading on AIM, which are expected to

be admitted on or about 2 November 2023, and it is expected that on

Admission the New Issue Shares will rank pari passu with the

Company's existing ordinary shares.

-- On Admission, the total issued share capital of the Company

will consist of 10,494,066,144 Ordinary Shares. The Company does

not hold any Ordinary Shares in treasury. Therefore, the total

number of voting rights in the Company is 10,494,066,144 and this

figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

For further information, please contact:

Challenger Energy Group PLC Tel: +44 (0) 1624 647

Eytan Uliel, Chief Executive Officer 882

WH Ireland - Nomad and Joint Broker Tel: +44 (0) 20 7220

Antonio Bossi / Darshan Patel / Isaac 1666

Hooper

Zeus Capital - Joint Broker Tel: +44 (0) 20 3829

Simon Johnson 5000

Gneiss Energy Limited - Financial Tel: +44 (0) 20 3983

Adviser 9263

Jon Fitzpatrick / Paul Weidman / Doug

Rycroft

CAMARCO Tel: +44 (0) 20 3757

Billy Clegg / Hugo Liddy / Sam Morris 4980

Notes to Editors

Challenger Energy is a Caribbean and Americas focused oil and

gas company, with a range of oil production, development,

appraisal, and exploration assets in the region. The Company's

primary assets are located in Uruguay, where the Company holds high

impact offshore exploration licences, and in Trinidad and Tobago,

where the Company has a number of producing fields and

earlier-stage exploration / appraisal projects.

Challenger Energy is quoted on the AIM market of the London

Stock Exchange.

https://www.cegplc.com

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKABBPBDDOKB

(END) Dow Jones Newswires

October 27, 2023 02:00 ET (06:00 GMT)

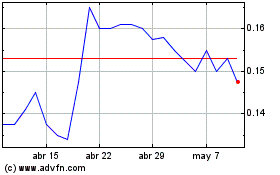

Challenger Energy (LSE:CEG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Challenger Energy (LSE:CEG)

Gráfica de Acción Histórica

De May 2023 a May 2024