TIDMCFYN

RNS Number : 2717V

Caffyns PLC

01 December 2023

HALF YEAR REPORT

for the six months ended 30 September 2023

Summary

Half year Half year

to to

30 September 30 September

2023 2022

GBP'000 GBP'000

Revenue 134,252 118,992

Profit before tax 44 1,558

Underlying EBITDA (see note 1

below) 2,564 3,283

Underlying profit before tax (see

note 1 below) 259 1,566

Pence Pence

Underlying basic earnings per

share 7.1 47.3

Basic earnings per share 1.1 47.0

Interim dividend per Ordinary

share 5.0 7.5

Financial and operational review

-- Underlying profit before tax of GBP0.26 million (2022: GBP1.57 million)

-- Profit before tax of GBP0.04 million (2022: GBP1.56 million)

-- Like-for-like revenue increase of 13% (see note 2 below)

-- Underlying basic earnings per share of 7.1 pence (2022: 47.3 pence)

-- Basic earnings per share of 1.1 pence (2022: 47.0 pence)

-- Interim ordinary dividend declared of 5.0 pence (2022: 7.5 pence)

-- Net bank borrowings at 30 September 2023 of GBP9.5 million (2022: GBP9.5 million)

Simon Caffyn, Chief Executive, commented:

"Revenue growth enabled us to maintain gross profits despite a

challenging economic background and significant pressures on used

car profitability. Inflationary pressures on costs remain elevated,

particularly for funding charges and energy costs, significantly

impacting overall profitability. In time, the levels of both these

costs are expected to fall back, although short-term pressures will

remain ."

Enquiries:

Simon Caffyn, Chief

Caffyns plc Executive Tel: 01323 730201

Mike Warren, Finance

Director

Note 1: Underlying results exclude items that have non-trading

attributes due to their size, nature or incidence. Non-underlying

items for the period totalled GBP0.22 million (2022: GBP0.01

million) and are detailed in Note 4 to these condensed consolidated

financial statements. Underlying EBITDA of GBP2.5 million (2022:

GBP3.3 million) represents Operating profit before non-underlying

items of GBP1.5 million (2022: GBP2.2 million) and Depreciation and

Amortisation of GBP1.0 million (2022: GBP1.1 million).

Note 2: Like-for-like comparisons exclude the impact of the

Lotus business at Lewes, as this dealership did not trade for the

full six-month period in the previous financial period and the LEVC

dealership in Eastbourne, which was closed in March 2023. All other

businesses operated throughout both the whole of the current and

prior six-month periods.

INTERIM MANAGEMENT REPORT

Summary

The underlying profit before tax of GBP0.3 million for the half

year ended 30 September 2023 ("the period") is a significant

reduction on the GBP1.6 million profit reported last year. While

our profit performance from new cars and aftersales in the period

has been satisfactory, we experienced a significant reduction in

used car profitability, compounded by scarcity of supply of

appropriately priced, one-to-four year old cars. Customer demand

for such cars has remained robust, despite the challenging economic

backdrop. Taken together, total gross margins generated in the

period fell by just GBP0.2 million, or 1%. However, inflationary

pressures on costs remained elevated and, in particular, funding

charges and energy costs alone increased by GBP0.9 million in the

period. In time, the levels of both these costs are expected to

fall back, although short-term pressures will remain.

Revenue for the period increased by 13% to GBP134.3 million

(2022: GBP119.0 million), primarily due to improved levels of new

car sales as supply constraints from our manufacturers eased.

The Company continues to own all but two of the freeholds of the

properties from which it operates, and this provides the dual

strengths of a strong asset base and minimal exposure to rent

reviews.

The Company's defined-benefit pension scheme deficit, calculated

in accordance with the requirements of IAS 19 Pensions, showed an

increase of GBP0.7 million from the March 2023 year-end to GBP9.5

million at 30 September 2023. Financial returns on investments were

slightly lower than had been expected, which resulted in the

widening of the deficit in the period.

Profit before tax for the period was GBP44,000 (2022:

GBP1,557,000) with basic earnings per share of 1.1 pence (2022:

47.0 pence). Underlying basic earnings per share were 7.1 pence

(2022: 47.3 pence).

T he Company has declared an interim dividend of 5.0 pence per

Ordinary share, reflecting the performance for the period and the

board's confidence in the prospects for the Company.

Operating review

New and used cars

Our new car deliveries rose by 23% on a like-for-like basis from

the prior year period. Nationally, the Society of Motor

Manufacturers and Traders reported a 21% increase in total new car

registrations but only a 3% increase in the retail and small

business market segment in which we primarily operate. We are

pleased that the majority of our brands performed ahead of the UK

market.

Our used car sales volumes for the period fell by 4% on a

like-for-like basis. Demand remained buoyant as customers looked

for used car purchases due to the lack of availability of new cars

but the supply of appropriately-priced used cars remained

challenging. We are putting in place actions to enhance our supply

of used cars and to increase margin retention. Increasing the

efficiency of our procurement processes is expected to enable

management to improve our sales performance in the second half.

Aftersales

Our aftersales revenues rose by 5% in the period on a

like-for-like basis despite the recruitment of vehicle technicians

remaining challenging and adversely affecting throughput levels. We

continued to realise improvements to our customer retention

processes.

Operations

During this period, we have seen some manufacturers move to

agency distribution models away from the traditional wholesale

agreements. In June, Volvo moved to an agency arrangement and,

after an initial transitional period, the new system is performing

in line with expectations. Under this model, the manufacturer

transacts with the customer for the sale of new cars whilst we

retain the handover process as an agent, for which we receive a

fee. Of our other brands, CUPRA and Skoda have already moved their

electric models to this agency arrangement and Volkswagen and Audi

brands are scheduled to transition in the coming months.

As mentioned above, we are putting in place actions to increase

our supply of used cars and to enhance margin retention. We

increasingly use market-driven data to secure better quality used

cars with higher expected margins and faster selling times.

Semi-automated systems will speed this process and improve the

efficiency of the procurement of used cars enabling sales

management to target a better sales performance in the second

half.

We have just completed the refurbishment of our Volvo dealership

in Worthing, providing much improved showroom and aftersales

facilities. In Tunbridge Wells we have refurbished and enlarged our

showroom to enable the addition of the CUPRA franchise.

Property

Capital expenditure in the period was GBP1.8 million (2022:

GBP0.6 million) and included assets in the course of construction

of GBP1.2 million (2022: GBP0.3 million), primarily being a

redevelopment of the Company's Volvo premises in Worthing.

We operate primarily from freehold sites and our property

portfolio provides additional stability to our business model.

Annually, we obtain an independent assessment of the values of our

freehold properties against their carrying value in our accounts

and had an unrecognised surplus to carrying value of GBP11.5

million at 31 March 2023, our last financial year-end. The board

does not consider there to have been any material movement in the

value of the Company's freehold properties since the year-end.

The board continues to evaluate opportunities for our freehold

premises in Lewes and no sale is expected to complete for at least

a twelve-month period. Currently, the main showroom is being

utilised for our Lotus Sussex operation, while the side showroom

and workshop are let to third-party tenants.

Pensions

The Company's defined-benefit pension scheme started the period

with a net deficit of GBP8.8 million. The board has little control

over the key assumptions in the valuation calculations as required

by accounting standards and the size and nature of the Scheme's

underlying assets and liabilities means that the deficit can be

subject to significant change. The actuary's estimate of the

deficit increased by GBP0.7 million to GBP9.5 million at 30

September 2023 (2022: GBP1.5 million). Net of deferred tax, the net

deficit at 30 September 2023 was GBP7.0 million (2022: GBP1.1

million).

During the period, the net present value of the Scheme's future

pension liabilities fell by GBP5.5 million due to a combination of

the payment of GBP2.2 million of pensions and changes to

assumptions on future mortality and discount rates . However, this

reduction was less than the fall in the value of the Scheme's

assets, producing an overall widening of the net deficit position

by GBP0.7 million.

The pension cost under IAS 19 Pensions is recognised in the

Condensed Consolidated Statement of Financial Performance and

continues to be charged as a non-underlying cost, amounting to

GBP215,000 (2022: GBP46,000).

As the Scheme is in deficit, the Company has in place a recovery

plan which has been agreed with the trustees, and which was last

updated in May 2021. During the period, the Company made cash

payments into the Scheme of GBP0.4 million (2022: GBP0.4 million).

These payments increase by a minimum of 2.25% per annum.

Bank and other funding facilities

The Company has banking facilities with HSBC, which comprise a

term loan of GBP5.6 million, originally of GBP7.5 million, and a

revolving-credit facility of GBP6.0 million, both of which will

become renewable in April 2026. HSBC also provides an overdraft

facility of GBP3.5 million, renewable annually. In addition, there

is an overdraft facility of GBP4.0 million provided by Volkswagen

Bank, renewable annually, together with a term loan of GBP0.3

million, originally of GBP5.0 million, which is repayable over the

period to March 2024.

The Company was cash generative during the period with GBP1.0

million (2022: GBP2.2 million) generated from operating activities.

Working capital levels remained broadly unchanged in the period, as

in the prior period. The primary cash outflows in the period were

from capital expenditure, dividends and lease payments.

Bank borrowings, net of cash balances, at 30 September 2023 were

GBP9.5 million (2022: GBP9.5 million), up from GBP8.1 million at 31

March 2023. As a proportion of shareholders' funds, bank

borrowings, net of cash balances, were 31% at 30 September 2023

(2022: 26%).

During the period, the Company received a loan of GBP350,000

from a manufacturer partner under their dealership development

assistance programme. The loan is repayable over a five-year

period.

Taxation

The tax charge for the period has been based on an estimation of

the effective tax rate on profits for the full financial year of

31% (2022: 19%). The current year effective tax rate is greater

than the standard rate of corporation tax in force for the year of

25% due to certain items that are disallowable for corporation

tax.

Payments of corporation tax in the period, net of refunds, were

GBP28,000 (2022: GBP196,000).

At 30 September 2023, the company recognised a deferred tax

asset on the Statement of Financial Position of GBP0.2 million

(2022: deferred tax liability of GBP1.8 million).

People

The response from everyone in the Company to inflationary

pressures and other marketplace challenges is commendable and the

board would like to express its gratitude to them for their hard

work and professional application. The efforts of our operational

and support teams to continue to improve our efficiency will be

instrumental in our ability to deliver a stronger second half

performance.

Dividend

Despite the uncertainty that remains over the outlook for the UK

economy and the effect on used car profitability in our second

quarter, the board remains confident in the prospects of the

Company and has, therefore, declared an interim dividend of 5.0

pence per Ordinary share (2022: 7.5 pence per Ordinary share). This

will be paid on 12 January 2024 to shareholders on the register at

close of business on 15 December 2023. The Ordinary shares will be

marked ex-dividend on 14 December 2023.

Strategy

Our continuing strategy is to focus on representing premium and

premium volume franchises as well as maximising opportunities for

used cars and aftersales service, with an emphasis on delivering

the highest quality of customer experience. We recognise that we

operate in a rapidly changing environment and carefully monitor the

appropriateness of this strategy while also seeking new

opportunities to invest in the future growth of the business.

We concentrate on stronger market areas so as to deliver higher

returns from fewer but larger sites. We are focusing on delivering

performance improvement, particularly in our used car and

aftersales operations.

Current trading and outlook

Our forward-order bank for new cars is strong with improved

levels of supply and we are targeting an improved used car

performance in the second half. However, the high level of economic

and political uncertainty, both in the UK and abroad, is a concern.

Given these uncertainties, the board remains cautious for the

second half of the financial year.

Our balance sheet is appropriately funded, and our freehold

property portfolio is a source of great stability. We continue to

enhance our online presence, as well as improving our productivity

and increasing the resilience of the business. We remain confident

in the longer-term prospects for the Company and are ready to

explore future business opportunities as they arise .

Simon G M Caffyn

Chief Executive

30 November 2023

Condensed Consolidated Statement of Financial Performance

for the half year ended 30 September 2023

Unaudited Unaudited Audited

Half year Half year Year ended

N o to to 31 March

t e 30 September 30 September 2023

2023 2022 Total

Total Total

GBP'000 GBP'000 GBP'000

Revenue 134,252 118,992 251,426

Cost of sales (118,262) (102,839) (217,844)

---------------------------------------- ------ -------------- -------------- ------------

Gross profit 15,990 16,153 33,582

Operating expenses (14,641) (14,088) (29,085)

---------------------------------------- ------ -------------- -------------- ------------

Operating profit before other income 1,349 2,065 4,497

Other income (net) 3 153 189 344

---------------------------------------- ------ -------------- -------------- ------------

Operating profit 1,502 2,254 4,841

---------------------------------------- ------ -------------- -------------- ------------

Operating profit before non-underlying

items 1,513 2,227 4,827

Non-underlying items within operating

profit 4 (11) 27 14

---------------------------------------- ------ -------------- -------------- ------------

Operating profit 1,502 2,254 4,841

Net finance expense 5 (1,254) (661) (1,687)

Non-underlying net finance expense

on pension scheme 4 (204) (35) (64)

---------------------------------------- ------ -------------- -------------- ------------

Net finance expense (1,458) (696) (1,751)

---------------------------------------- ------ -------------- -------------- ------------

Profit before taxation 44 1,558 3,090

---------------------------------------- ------ -------------- -------------- ------------

Profit before tax and non-underlying

items 259 1,566 3,140

Non-underlying items within operating

profit 4 (11) 27 14

Non-underlying net finance expense

on pension scheme 4 (204) (35) (64)

---------------------------------------- ------ -------------- -------------- ------------

Profit before taxation 44 1,558 3,090

Taxation 6 (14) (290) (566)

---------------------------------------- ------ -------------- -------------- ------------

Profit for the period 30 1,268 2,524

---------------------------------------- ------ -------------- -------------- ------------

Earnings per share

Basic 7 1.1p 47.0p 93.6p

Diluted 7 1.1p 46.4p 92.4p

Non-GAAP measure

Underlying basic earnings per share 7 7.1p 47.3p 95.1p

Underlying diluted earnings per

share 7 7.0p 46.6p 93.9p

Condensed Consolidated Statement of Comprehensive Expense

for the half year ended 30 September 2023

Note Unaudited Unaudited Audited

Half year Half year Year to

to to

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Profit for the period 30 1,268 2,524

--------------------------------------- ----- ------------- ------------- ---------

Items that will never be reclassified

to profit and loss:

Remeasurement of net pension

scheme obligation 12 (872) 958 (6,715)

Deferred tax on remeasurement

of pension scheme obligation 218 (239) 1,679

Other comprehensive (expense)/income,

net of tax (654) 719 (5,036)

--------------------------------------- ----- ------------- ------------- ---------

Total comprehensive (expense)/income

for the period (624) 1,987 (2,512)

--------------------------------------- ----- ------------- ------------- ---------

Condensed Consolidated Statement of Financial Position

at 30 September 2023

Unaudited Unaudited Audited

30 September 30 September 31 March

Note 2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current assets

Right-of-use assets 9 2,148 1,241 2,348

Property, plant and equipment 9 39,121 38,796 38,145

Investment properties 10 7,474 7,588 7,531

Interest in lease 145 306 225

Goodwill 286 286 286

Deferred tax asset 171 - -

Total non-current assets 49,345 48,217 48,535

--------------------------------------- ------- -------------- -------------- ----------

Current assets

Inventories 38,950 32,937 39,989

Trade and other receivables 6,903 6,138 7,121

Interest in lease 162 167 164

Current tax recoverable - - -

Cash and cash equivalents 2,739 3,214 4,226

--------------------------------------- ------- -------------- -------------- ----------

Total current assets 48,754 42,456 51,500

--------------------------------------- ------- -------------- -------------- ----------

Total assets 98,099 90,673 100,035

--------------------------------------- ------- -------------- -------------- ----------

Current liabilities

Interest-bearing overdrafts, loans

and borrowings 1,695 1,875 1,875

Trade and other payables 42,485 35,781 43,674

Lease liabilities 422 289 511

Current tax payable - 76 28

--------------------------------------- ------- -------------- -------------- ----------

Total current liabilities 44,602 38,021 46,088

--------------------------------------- ------- -------------- -------------- ----------

Net current assets 4,152 4,435 5,412

Non-current liabilities

Interest-bearing loans and borrowings 10,530 10,875 10,437

Lease liabilities 2,039 1,394 2,203

Preference shares 11 812 812 812

Pension scheme obligation 12 9,461 1,482 8,799

Deferred tax liability - 1,751 34

--------------------------------------- ------- -------------- -------------- ----------

Total non-current liabilities 22,842 16,314 22,285

--------------------------------------- ------- -------------- -------------- ----------

Total liabilities 67,444 54,335 68,373

--------------------------------------- ------- -------------- -------------- ----------

Net assets 30,655 36,338 31,662

--------------------------------------- ------- -------------- -------------- ----------

Shareholders' equity

Ordinary share capital 1,439 1,439 1,439

Share premium 272 272 272

Capital redemption reserve 707 707 707

Non-distributable reserve 1,724 1,724 1,724

Retained earnings 26,513 32,196 27,520

--------------------------------------- ------- -------------- -------------- ----------

Total equity 30,655 36,338 31,662

--------------------------------------- ------- -------------- -------------- ----------

Condensed Consolidated Statement of Changes in Equity

for the half year ended 30 September 2023 (unaudited)

Capital

Share Share redemption Non-distributable Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2023

Total comprehensive expense 1,439 272 707 1,724 27,520 31,662

Profit for the period - - - - 30 30

Other comprehensive expense - - - - (654) (654)

--------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

Total comprehensive expense

for the period - - - - (624) (624)

Transactions with owners:

Dividends (404) (404)

Share-based payment - - - - 21 21

-------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

At 30 September 2023 (unaudited) 1,439 272 707 1,724 26,513 30,655

--------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

for the half year ended 30 September 2022 (unaudited)

Capital

Share Share redemption Non-distributable Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2022 1,439 272 707 1,724 30,589 34,731

Total comprehensive income

Profit for the period - - - - 1,268 1,268

Other comprehensive income - - - - 719 719

--------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

Total comprehensive income

for the period 1,987 1,987

Transactions with owners:

Dividends - - - - (404) (404)

Share-based payment - - - - 24 24

-------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

At 30 September 2022 (unaudited) 1,439 272 707 1,724 32,196 36,338

--------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

for the year ended 31 March 2023 (audited)

Capital

Share Share redemption Non-distributable Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2022 1,439 272 707 1,724 30,589 34,731

Total comprehensive expense

Profit for the year - - - - 2,524 2,524

Other comprehensive expense - - - - (5,036) (5,036)

------------------------------ ---------- ---------- ------------ ------------------ ----------- ----------

Total comprehensive expense

for the year (2,512) (2,512)

Transactions with owners:

Dividends - - - - (606) (606)

Issue of shares - SAYE - - - - 3 3

Share-based payment - - - - 46 46

----------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

At 31 March 2023 (audited) 1,439 272 707 1,724 27,520 31,662

------------------------------ ---------- ---------- ------------ ------------------ ----------- ----------

Condensed Consolidated Cash Flow Statement

for the half year ended 30 September 2023

Unaudited Unaudited Audited

Half year Half year Year to

to to 31 March

30 September 30 September 2023

2023 2022 GBP'000

GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 44 1,558 3,090

Adjustments for:

Net finance expense and pension scheme

service cost 1,458 696 1,751

Depreciation of property, plant and equipment,

investment properties and right-of-use

assets 1,035 1,056 2,128

Cash payments into the defined-benefit

pension scheme (425) (403) (800)

Loss on disposal of property, plant and - - -

equipment

Share-based payments 21 24 46

Decrease/(increase) in inventories 535 (5,391) (12,444)

Decrease/(increase) in receivables 218 (875) (1,857)

(Decrease)/increase in payables (676) 6,367 14,296

------------------------------------------------ --------------- --------------- -----------

Cash generated from operations 2,210 3,032 6,210

Net tax paid (28) (196) (320)

Interest paid (1,201) (645) (1,653)

------------------------------------------------ --------------- --------------- -----------

Net cash generated from operating activities 981 2,191 4,237

------------------------------------------------ --------------- --------------- -----------

Investing activities

Proceeds generated on disposal of property,

plant and equipment - - 1

Purchases of property, plant and equipment (1,754) (717) (902)

Receipt from investment in lease 93 93 185

------------------------------------------------ --------------- --------------- -----------

Net cash used in investing activities (1,661) (624) (716)

------------------------------------------------ --------------- --------------- -----------

Financing activities

Manufacturer development loan advanced 350 - -

Secured loans repaid (437) (437) (875)

Issue of shares - SAYE scheme - - 3

Dividends paid (404) (404) (606)

Repayment of lease liabilities (316) (271) (576)

------------------------------------------------ --------------- --------------- -----------

Net cash used in financing activities (807) (1,112) (2,054)

------------------------------------------------ --------------- --------------- -----------

Net (decrease)/increase in cash and

cash equivalents (1,487) 455 1,467

Cash and cash equivalents at beginning

of period 4,226 2,759 2,759

------------------------------------------------ --------------- --------------- -----------

Cash and cash equivalents at end of

period 2,739 3,214 4,226

------------------------------------------------ --------------- --------------- -----------

Notes to the Condensed Consolidated Financial Statements

for the half year ended 30 September 2023

1. GENERAL INFORMATION

Caffyns plc is a company domiciled in the United Kingdom. The

address of the registered office is Meads Road, Eastbourne, East

Sussex BN20 7DR.

These condensed consolidated financial statements for the half

year to 30 September 2023 and similarly for the half year to 30

September 2022 are unaudited. They do not include all the

information required for full annual financial statements and

should be read in conjunction with the financial statements of the

Company for the year ended 31 March 2023.

The comparative financial information for the year ended 31

March 2023 in these condensed consolidated financial statements

does not constitute statutory accounts for that year. The statutory

accounts for 31 March 2023 have been delivered to the Registrar of

Companies. The Auditor's report on those accounts was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

These condensed consolidated financial statements have been

reviewed by the Company's auditor and a copy of their review report

is set out at the end of these statements.

These consolidated interim financial statements were approved by

the directors on 30 November 2023.

2. ACCOUNTING POLICIES

The annual financial statements of Caffyns plc are prepared in

accordance with UK-adopted International Accounting Standards . The

set of condensed consolidated financial statements included in this

half-yearly financial report has been prepared in accordance with

UK-adopted International Accounting Standard 34 'Interim Financial

Reporting'. As required by the disclosure guidance and transparency

rules of the Financial Conduct Authority, this set of condensed

consolidated financial statements has been prepared in accordance

with the accounting policies set out in the Annual Report for the

year ended 31 March 2023 .

Segmental reporting

Based upon the management information reported to the Group's

chief operating decision maker, the Chief Executive, in the opinion

of the directors, the Group only has one reportable segment. There

are no major customers amounting to 10% or more of the Group's

revenue. All revenue and non-current assets derive from, or are

based in, the United Kingdom.

Basis of preparation: Going concern

These condensed consolidated financial statements have been

prepared on a going concern basis, which the directors consider

appropriate for the reasons set out below.

The directors have considered the going concern basis and have

undertaken a detailed review of trading and cash flow forecasts for

a period in excess of one year from the date of approval of this

Interim Report. This has focused primarily on the achievement of

the Company's banking covenants.

Under the Company's first covenant test, it is required to make

underlying earnings before bank interest, depreciation and

amortisation ("senior EBITDA") for a rolling twelve-month period

which is at least four times the level of interest payable on bank

borrowings to HSBC and Volkswagen Bank ("senior interest"). In

November 2023, the multiple set for future tests of this covenant

was reduced from four to a multiple of three.

The Company's second covenant test requires total bank

borrowings to HSBC and Volkswagen Bank not to exceed 375% of senior

EBITDA for a rolling twelve-month period.

The Company's final covenant test requires that the level of its

bank borrowings do not exceed 70% of the independently assessed

value of its charged freehold properties.

These covenant tests are conducted biannually in March and

September and all tests were passed for the period under

review.

In the coming twelve months, each of the three covenant tests

must be passed at 31 March 2024 and 30 September 2024, with the

test on 30 September 2024 being the final test to be carried out

within the twelve-month period from the anniversary of the signing

of these condensed consolidated financial statements. The Company

has modelled this period and conclude that there is headroom that

would allow for an approximate 6% reduction in expected new and

used units over this period. External market commentary provided by

the Society of Motor Manufacturers and Traders ("SMMT") for the

2023 calendar indicate that new car registrations are forecast to

show a year-on-year increase of 17% to 1.89 million, followed by a

further 4% increase for the 2024 calendar year to 1.97 million

registrations as global supply chain pressures ease, allowing

manufacturing levels to rise. The used car market has remained

stable over the five years from 2015 to 2019, at between 7.6 and

8.2 million transactions and dropped by only 15% in 2020 due to the

effects of the covid-19 pandemic, compared to a comparable 29% fall

in new car registrations . As social-distancing regulations were

eased in 2021, demand for used cars was buoyant and transactions

grew by 12% in the calendar year, before falling back by 9% in 2022

to 6.9 million transactions. However, the continuing shortage in

new car supply has assisted the used car market and is expected to

continue to do so and indications for the quarters so far available

for 2023 is that the used market will regain what it lost in 2022,

returning the number of market transactions to that seen in 2021.

While the Company's overall financial results in the period were

disappointing, margin generation remained robust and the current

new car order take held for future delivery remains at elevated

levels.

The directors have also considered the Company's working capital

requirements. The Company meets its day-to-day working capital

requirements through short-term stocking loans and bank overdraft

and medium-term revolving credit facilities and term loans. At 30

September 2023, the medium-term banking facilities included a term

loan with an outstanding balance of GBP5.6 million and a revolving

credit facility of GBP6.0 million from HSBC, its primary bankers,

with both facilities being renewable in April 2026. HSBC also make

available a short-term overdraft facility of GBP3.5 million, which

is renewed annually in August. At 30 September 2023, GBP4.5 million

of these facilities was undrawn. The Company also has a ten-year

term loan from Volkswagen Bank with a balance outstanding at 30

September 2023 of GBP0.25 million, which is repayable to March

2024, and a short-term revolving credit facility of GBP4.0 million,

which is renewed annually in October. At 30 September 2023, GBP3.0

million of these facilities was undrawn. In the opinion of the

directors, there is a reasonable expectation that all facilities

will be renewed at their scheduled expiry dates. The failure of a

covenant test would render these facilities repayable on demand at

the option of the lender.

The directors have a reasonable expectation that the Company has

adequate resources and headroom against its covenant tests to be

able to continue in operational existence for the foreseeable

future and for at least twelve months from the date of approval of

this Interim Report. For those reasons, they continue to adopt the

going concern basis in preparing these condensed consolidated

financial statements .

Non-underlying items

Non-underlying items are those items that are unusual because of

their size, nature or incidence. Management considers that these

items should be disclosed separately to enable a full understanding

of the operating results. Profits and losses on disposal of

property, plant and equipment and property impairment charges are

disclosed as non-underlying, as are certain redundancy costs and

costs attributable to vacant properties held pending their

disposal.

The net financing return and service cost on pension obligations

in respect of the defined benefit pension scheme is presented as a

non-underlying item due to the inability of management to influence

the underlying assumptions from which the charge is derived. The

defined benefit pension scheme is closed to future accrual.

All other activities are treated as underlying.

3. OTHER INCOME (NET)

Unaudited Unaudited Audited

Half year Half year year to

to to 31 March

30 September 30 September 2023

2023 2022 GBP'000

GBP'000 GBP'000

Rent receivable 153 151 307

Liquidation distribution received - 38 37

Loss on disposal of tangible fixed - - -

assets

------------------------------------ -------------- -------------- ----------

Total other income 153 189 344

------------------------------------ -------------- -------------- ----------

4. NON-UNDERLYING ITEMS

Unaudited Unaudited Audited

Half year Half year year to

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Other income:

Liquidation distribution received - 38 37

Net loss on disposal of property, - - -

plant and equipment

------------------------------------------ -------------- -------------- ----------

Within operating expenses:

Service cost on pension scheme (11) (11) (23)

Total non-underlying items within

operating profit (11) 27 14

------------------------------------------ -------------- -------------- ----------

Net finance expense on pension scheme (204) (35) (64)

------------------------------------------ -------------- -------------- ----------

Total non-underlying items within

profit before taxation (215) (8) (50)

------------------------------------------ -------------- -------------- ----------

During the previous financial period the Company received a

final distribution from the liquidator to MG Rover Group

Limited.

5. NET FINANCE EXPENSE

Unaudited Unaudited Audited

Half year Half year year to

to to 31 March

30 September 30 September 2023

2023 2022 GBP'000

GBP'000 GBP'000

Interest in lease interest receivable (10) (8) (17)

Interest receivable on cash deposits (17) - -

Interest payable on bank borrowings 450 245 621

Interest payable on inventory stocking

loans 687 312 856

Interest on lease liabilities 63 24 51

Financing costs amortised 45 52 104

Preference dividends 36 36 72

---------------------------------------- -------------- -------------- ----------

Finance expense 1,254 661 1,687

---------------------------------------- -------------- -------------- ----------

6. TAXATION

Unaudited Unaudited Audited

Half year Half year year to

to to 31 March

30 September 30 September 2023

2023 2022 GBP'000

GBP'000 GBP'000

Current UK corporation tax

Charge for the period - 76 152

Adjustments recognised in the period - - -

for current tax of prior periods

-------------------------------------- -------------- -------------- ----------

Total current tax charge - 76 152

-------------------------------------- -------------- -------------- ----------

Deferred tax

Origination and reversal of timing

differences 39 209 442

Change in corporation tax rate - - 10

Adjustments recognised in the period

for deferred tax

of prior periods (25) 5 (38)

-------------------------------------- -------------- -------------- ----------

Total deferred tax charge 14 214 414

-------------------------------------- -------------- -------------- ----------

Total tax charged in the Income

Statement 14 290 566

-------------------------------------- -------------- -------------- ----------

The tax charge arises as follows:

Unaudited Unaudited Audited

Half year Half year year to

to to 31 March

30 September 30 September 2023

2023 2022 GBP'000

GBP'000 GBP'000

On normal trading 68 291 576

Non-underlying items (54) (1) (10)

-------------------------------------- -------------- -------------- ----------

Total tax charge 14 290 566

-------------------------------------- -------------- -------------- ----------

Taxation of trading items for the half year has been provided at

an effective rate of taxation of 31% (2022: 19%) expected to apply

to the full year. This effective rate is higher than the standard

rate of corporation tax in force of 25% due to certain items that

are deemed disallowable for corporation tax.

7. EARNINGS PER SHARE

The calculation of basic earnings per share is based on the

earnings attributable to Ordinary shareholders divided by the

weighted average number of shares in issue during the period.

Treasury shares are treated as cancelled for the purposes of this

calculation.

The calculation of diluted earnings per share is based on the

basic earnings per share, adjusted to allow for the issue of shares

and the post-tax effect of dividends and/or interest, on the

assumed conversion of all dilutive options and other dilutive

potential Ordinary shares .

Reconciliations of the earnings and the weighted average number

of shares used in the calculations are set out below.

Unaudited Unaudited Audited

Half year Half year year to

to to

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Basic

Profit after tax for the period 30 1,268 2,524

---------------------------------- ------------- ------------- ---------

Basic earnings per share 1.1p 47.0p 93.6p

---------------------------------- ------------- ------------- ---------

Diluted earnings per share 1.1p 46.4p 92.4p

---------------------------------- ------------- ------------- ---------

Underlying

Profit before tax 44 1,558 3,090

Adjustment: Non-underlying items

(note 4) 215 8 50

---------------------------------- ------------- ------------- ---------

Underlying profit for the period 259 1,566 3,140

Taxation on normal trading (note

6) (68) (291) (576)

---------------------------------- ------------- ------------- ---------

Underlying earnings 191 1,275 2,564

---------------------------------- ------------- ------------- ---------

Underlying basic earnings per

share 7.1p 47.3p 95.1p

---------------------------------- ------------- ------------- ---------

Underlying diluted earnings per

share 7.0p 46.6p 93.9p

---------------------------------- ------------- ------------- ---------

The number of fully paid Ordinary shares in issue at the

period-end was 2,879,298 (2022: 2,879,298). Excluding the shares

held for treasury, the weighted average shares in issue for the

purposes of the earnings per share calculation were 2,696,485

(2022: 2,695,586).

The shares granted under the Company's current SAYE scheme for

the period, and for the year ended 31 March 2023, are dilutive. The

weighted average number of shares in issue for the purposes of the

diluted earnings per share calculation were 2,730,331 (2022:

2,732,604).

The directors consider that underlying earnings per share

figures provide a better measure of comparative performance.

8. DIVIDS

Ordinary shares of 50 pence each

An interim dividend of 5.0 pence per Ordinary share has been

declared and will be paid to shareholders on 12 January 2024 to

those shareholders on the register at the close of business on 15

December 2023. The Ordinary shares will be marked ex-dividend on 14

December 2023 . An interim dividend of 7.5 pence per Ordinary share

was declared in respect of the half-year ended 30 September 2022

and a final dividend of 15.0 pence per Ordinary share was declared

in respect of the year ended 31 March 2023.

Preference shares

Preference dividends were paid in October 2023. The next

preference dividends are payable in April 2024. The cost of the

preference dividends has been included within finance costs.

9. PROPERTY, PLANT AND EQUIPMENT AND RIGHT-OF-USE ASSETS

The following is a reconciliation of changes in the balances of

Property, plant and equipment and Right-of-Use assets.

Property, plant and equipment:

Unaudited

Half year

to

30 September

2023

GBP'000

Property, plant and equipment at

1 April 2023 38,145

Less: Depreciation charges (778)

Less: Net book value of disposals -

Add: Purchases 1,754

------------------------------------- ---------------

Property plant and equipment at

30 September 2023 39,121

------------------------------------- ---------------

Purchases in the period included assets in the course of

construction of GBP1,233,000 (2022: GBP301,000).

Right-of-use assets:

Unaudited

Half year

to

30 September

2023

GBP'000

Right-of-use assets at 1 April 2023 2,348

Less: Amortisation of right-of-use

assets (200)

--------------------------------------- ---------------

Right-of-use assets at 30 September

2023 2,148

--------------------------------------- ---------------

10. INVESTMENT PROPERTIES

The following is a reconciliation of changes in the balances of

Investment properties.

Investment properties:

Unaudited

Half year

to

30 September

2023

GBP'000

Investment properties at 1 April

2023 7,531

Less: Depreciation charges (57)

----------------------------------------- ---------------

Investment properties at 30 September

2023 7,474

----------------------------------------- ---------------

11. LOANS AND BORROWINGS

Liabilities

Bank Revolving arising Bank

and credit Lease Preference from and cash Net

other facilities liabilities shares financing balances debt

loans GBP'000 GBP'000 GBP'000 activities GBP'000 GBP'000

GBP'000 GBP'000

At 1 April 2023

(audited) 6,312 6,000 2,714 812 15,838 (4,226) 11,612

Cash movement (87) - (316) - (403) 1,487 1,084

Non-cash movement - - 63 - 63 - 63

At 30 September

2023 6,225 6,000 2,461 812 15,498 (2,739) 12,759

(unaudited)

---------------------- ---------- ------------- ------------- ------------- ------------ ----------- ----------

Current

liabilities/(assets) 1,695 - 422 - 2,117 (2,739) (622)

Non-current

liabilities 4,530 6,000 2,039 812 13,381 - 13,381

---------------------- ---------- ------------- ------------- ------------- ------------ ----------- ----------

At 30 September

2023 6,225 6,000 2,461 812 15,498 (2,739) 12,759

---------------------- ---------- ------------- ------------- ------------- ------------ ----------- ----------

12. PENSIONS

The pension scheme deficit reflects a defined benefit obligation

that has been updated to reflect its valuation as at 30 September

2023. This has been calculated by a qualified actuary using a

consistent valuation method to that which was adopted in the

audited financial statements for the year ended 31 March 2023 and

in the period to 30 September 2022, and which complies with the

accounting requirements of IAS 19 Pensions (revised).

The net liability for defined benefit obligations increased from

GBP8,799,000 at 31 March 2023 to GBP9,461,000 at 30 September 2023.

The increase of GBP662,000 comprised the net charge to the

Condensed Consolidated Statement of Financial Performance of

GBP215,000, a net adverse remeasurement adjustment debited to the

Condensed Consolidated Statement of Comprehensive Income of

GBP872,000 reduced by employer contributions of GBP425,000.

Asset values fell in the period, by GBP6,138,000, including

divestments to pay pension transfers and benefits in the period of

GBP2,217,000. The net present value of pension liabilities also

fell, by GBP5,476,000, due to the combination of pensions settled

in the period and an increase in the rate applied to discount the

Scheme's liabilities from 4.75% at 31 March 2023 to 5.55% at 30

September 2023. The assumption on future CPI inflation also

increased from 2.95% applied at 31 March 2023 to 3.00% at 30

September 2023.

13. RISKS AND UNCERTAINTIES

There are a number of potential risks and uncertainties which

could have a material impact on the Group's performance over the

remaining six months of the financial year and could cause actual

results to differ materially from expected and historical results.

The board believes these risks and uncertainties to be consistent

with those disclosed in our latest Annual Report, including the

effect of increasing interest base rates on the UK economy and

their impact on the Group's defined benefit pension scheme,

liquidity and financing, the Group's dependency on its

manufacturers and their stability and ability to supply new car

product, used car prices and regulatory compliance.

14. CAPITAL COMMITMENTS

At 30 September 2023, the Company had capital commitments of

GBP0.6 million (2022: GBPNil), primarily in relation to the

redevelopment of its Volvo premises in Worthing.

15. RESPONSIBILTY STATEMENT

We confirm that to the best of our knowledge:

a) these condensed consolidated financial statements have been

prepared in accordance with IAS 34 'Interim Financial

Reporting';

b) these condensed consolidated financial statements include a

fair review of the information required by DTR 4.2.7R of the

disclosure guidance and transparency rules (indication of important

events during the first six months and their impact on the set of

financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year); and

c) the Half Year Report includes a fair review of the

information required by DTR 4.2.8R of the disclosure and guidance

transparency rules (disclosure of related parties' transactions and

changes therein).

By order of the board

S G M Caffyn

Chief Executive

M Warren

Finance Director

30 November 2023

INDEPENDENT REVIEW REPORT

to Caffyns plc

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2023 is not prepared, in all material respects, in

accordance with UK-adopted International Accounting Standard 34 and

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2023 which comprises the Statement of

Comprehensive Income, the Statement of Changes in Equity, the

Statement of Financial Position, the Statement of Cash Flows and

the related notes.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK-adopted International Accounting Standard 34,

Interim Financial Reporting.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the Group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

In preparing the half-yearly financial report, the directors are

responsible for assessing the Company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the Company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

Stephen Le Bas

BDO LLP

Chartered Accountants

Southampton, UK

30 November 2023

BDO LLP is a limited liability partnership registered in England

and Wales

(with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZMFMKGLGFZM

(END) Dow Jones Newswires

December 01, 2023 02:00 ET (07:00 GMT)

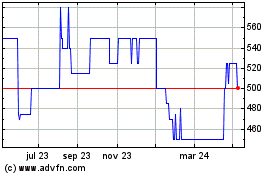

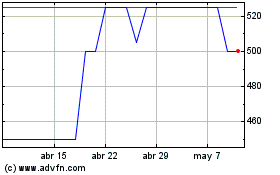

Caffyns (LSE:CFYN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Caffyns (LSE:CFYN)

Gráfica de Acción Histórica

De May 2023 a May 2024