TIDMCLDN

RNS Number : 0471U

Caledonia Investments PLC

21 November 2023

Caledonia Investments plc

Half-year results for the six months ended 30 September 2023

Financial highlights

6 months Year

30 Sep 2023 31 Mar 2023 Change

Net asset value per share total return* 3.7% 5.5%

Net asset value per share* 5203p 5068p +2.7%

Net assets GBP2,876m GBP2,798m +2.8%

Interim dividend per share 18.9p 18.2p +4.0%

*Alternative Performance Measure (please refer to Glossary of

terms and alternative performance measures at end). Net asset value

per share referred to throughout is calculated on a diluted

basis.

Highlights

- +3.7% NAV total return ("NAVTR") for the six months, with all

parts of the portfolio contributing to growth.

- Caledonia Public Companies returned 2.8%, following mixed performance

of global public equity markets.

- Caledonia Private Capital returned 5.9%, predominantly driven

by the agreed sale of Seven Investment Management ("7IM"). AIR-serv

Europe was acquired in April 2023 for GBP142.5m.

- Caledonia Private Equity Funds returned 4.6% with modest valuation

growth across both North American and Asian private equity funds.

- Final dividend of GBP27m (49.2p per share) paid to shareholders

in August 2023, in respect of the year ended 31 March 2023.

- Progressive dividend maintained, with the interim increased by

4.0% to 18.93p per share.

- Strong balance sheet. Total liquidity position remains healthy,

with undrawn facilities of GBP215m at 30 September 2023 and anticipated

cash proceeds of c.GBP255m from the upcoming disposal of 7IM

(net of transaction expenses).

Mat Masters, Chief Executive Officer, commented :

"We delivered a good return in the first half of the year

against a backdrop of continued market volatility, demonstrating

the benefits of our diversified portfolio. We have remained active

in our approach to enhancing shareholder value, demonstrated by the

successful acquisition of AIR-serv Europe, together with the agreed

disposal of 7IM with anticipated returns at the top end of our

target range.

The global economic outlook remains challenging, with ongoing

volatility influencing short-term performance. However, we believe

our long-term outlook and focus on investing in high-quality,

well-financed and managed companies, underpinned by our strong

balance sheet, leaves us well-placed to continue delivering strong

long-term returns in line with our aims."

21 November 2023

A presentation for analysts will take place at 11 am, with live

webcast available via this link.

Enquiries

Company contacts

Caledonia Investments plc

Mat Masters +44 20 7802 8080

Chief Executive Officer

Rob Memmott

Chief Financial Officer

Media contacts

Teneo

Tom Murray +44 20 7353 4200

Robert Yates

caledonia@teneo.com

Management report

Results

Caledonia's NAVTR for the six months to 30 September 2023 was

3.7% with net assets at the period end totalling GBP2,876m. The

NAVTR for the 12 months to 30 September 2023 was 4.6%. Revenue

income for the half year increased 33% to GBP33.8m largely due to

an GBP8.6m dividend received from retained private equity fund

income distributions. Net debt at the period end (comprising

external borrowings of GBP35m and cash of GBP15m) was GBP20m (31

March 2023: net cash of GBP222m) principally due to investments,

including the GBP143m acquisition of a majority stake in AIR-serv

Europe, a leading supplier of forecourt vending equipment. Total

liquidity remains healthy with undrawn bank facilities of GBP215m

(31 March 2023: GBP250m).

During the period the Company repaid GBP211.2m on a loan

facility with a wholly owned subsidiary. The wholly owned

subsidiary subsequently distributed GBP212.1m, with minimal impact

on group cash.

The directors have declared an interim dividend of 18.93p per

share, an increase of 4.0% compared with the previous year.

The tables below show Caledonia's performance track record and

asset allocation to 30 September 2023:

Performance record

6 months 1 year 3 years 5 years 10 years

% % % % %

------------------------------------- -------- ------ ------- ------- --------

NAVTR 3.7 4.6 59.4 63.2 183.8

Annualised

NAVTR 4.6 16.8 10.3 11.0

CPI-H 6.4 6.0 4.1 2.8

NAVTR vs CPI-H -1.8 10.8 6.2 8.2

FTSE All-Share Total Return 3.7 5.6

NAVTR vs FTSE All-Share Total Return 6.6 5.4

------------------------------------- -------- ------ ------- ------- --------

All three pools generated good, positive returns in the first

half of the year. The impact of foreign exchange rate movements was

limited, with Sterling weakening by 1.3% against the US dollar and

strengthening by 1.3% against the Euro in the period.

The Public Companies pool produced a return of 2.8%, reflecting

the mixed performance of global public equity markets. The Private

Capital portfolio produced a return of 5.9% following the biannual

revaluation of our holdings, reflecting the contractually agreed

disposal of 7IM and that most of the investee businesses are

performing well. The Private Equity Funds portfolio returned 4.6%

based on modest valuation growth across both our North American and

Asian private equity funds, although there has been a notable

slowdown in the level of fund distributions in the period

reflecting reduced market transaction activity.

Asset allocation

Net assets allocation Return

Strategic Sep 2023 Mar 2023 target

% % % %

--------------------- --------- -------- -------- ------

Public Companies 30-40 30 30 9.0

Private Capital 25-35 36 29 14.0

Private Equity Funds 25-35 33 31 12.5

--------------------- --------- -------- -------- ------

The movement in asset allocation recorded in the first half of

the year is a combination of the relative performance of each pool,

as explained below, together with the net impact of investment and

disposal activity.

Caledonia has continued to invest in and dispose of assets, in

line with our active approach to portfolio management. The movement

in net debt in the first half of the year was GBP242m, largely

reflecting net investments made by all three investment pools, and,

most significantly, the acquisition of a majority stake in the

European division of AIR-serv Europe in April 2023 by Private

Capital. The Public Companies pool made significant additions to

its holdings in three companies, refined positions in a number of

others and reduced positions in two high performing stocks,

resulting in a net investment outflow of GBP17m. The Private Equity

Funds pool has seen an increased level of drawdowns, including the

purchase of secondary positions in two Decheng Private Equity Funds

at attractive levels of discount, and only modest fund

distributions, resulting in a net cash outflow of GBP50m in the

period.

Performance for the first half of the year is summarised in the

table below.

Pool performance

31 Mar Invest- Realis- Gains/ Accrued 30 Sep

2023 ments ations losses income 2023 Income Return(3)

GBPm GBPm GBPm GBPm GBPm GBPm GBPm %

---------------------- ------- ------- ------- ------ ------- ------- ------ ---------

Public Companies 836.9 41.2 (24.7) 11.5 - 864.9 12.0 2.8

Private Capital(1) 824.0 157.1 (0.3) 44.2 2.1 1,027.1 11.6 5.9

Private Equity

Funds 873.8 64.5 (14.8) 39.6 - 963.1 1.5 4.6

---------------------- ------- ------- ------- ------ ------- ------- ------ ---------

Portfolio investments 2,534.7 262.8 (39.8) 95.3 2.1 2,855.1 25.1

Other investments(2) 260.2 4.9 (208.1) (7.1) - 49.9 8.7

---------------------- ------- ------- ------- ------ ------- ------- ------ ---------

Total investments 2,794.9 267.7 (247.9) 88.2 2.1 2,905.0 33.8

Cash and other 3.1 (28.9)

---------------------- ------- ------- ------- ------ ------- ------- ------ ---------

Net assets 2,798.0 2,876.1 NAVTR 3.7

---------------------- ------- ------- ------- ------ ------- ------- ------ ---------

1. The Private Capital valuation at September 2023 includes GBP3.3m

of accrued income (March 2023: GBP1.2m), and GBP248.5m classified

as an Asset Held for Sale in the Consolidated Statement of Financial

Position as at 30 September 2023, relating to the agreed sale

of 7IM.

2. Other investments comprised legacy investments and cash and receivables

in subsidiary investment entities. The GBP208.1m realisation

principally reflects a capital re-organisation, followed by a

return of capital by an investment subsidiary.

3. Returns for investments are calculated using the Modified Dietz

methodology and the return is Caledonia's NAVTR.

Caledonia Public Companies - Capital and Income portfolios (30%

of NAV)

The total return on the Public Companies pool was 2.8% over the

first half of the year. This outcome reflected the mixed

performance of major markets during the period with technology

stocks being in favour and US indices moving more positively than

the UK, together with muted performance in Asia.

The Capital portfolio delivered a return of 4.6%. Key stocks

Hill & Smith, Charter Communications, Microsoft, Oracle and

Watsco delivered very strong returns ranging from 10% to 30%, in

contrast to the first half of the previous financial year. However,

these gains were partially offset by notable price reductions for

Croda International, Spirax Sarco, Texas Instruments and Thermo

Fisher Scientific.

The Income portfolio delivered a return of -2.2% with the

majority of holdings recording adverse share price movements. These

adverse returns were partially offset by stronger performance from

RELX, Watsco and Sabre. The performance of Sabre reflects premium

growth following a difficult trading period last year.

Holdings were increased in Symrise, Croda International and

RELX. We sold down a portion of our holdings in Oracle and Watsco,

following a period of strong share price appreciation. Other

activity was restricted to refining positions in existing

investments resulting in our Income portfolio moving closer to its

target of GBP250m of invested cost.

Caledonia Private Capital (36% of NAV)

The Private Capital portfolio generated a total return of 5.9%

in the first half of the year.

Caledonia's Private Capital strategy is focused on high-quality,

UK mid-market companies. We take a long-term approach that aims to

deliver enduring value throughout the business cycle, enabling us

to give these businesses time to fulfil their potential and only

sell when the time is right to maximise value.

Caledonia's Private Capital portfolio is dominated by

significant positions in five UK-centric businesses and one private

European investment company. These six investments represent over

90% of the pool's value. Investee companies are revalued in March

and September each year. The portfolio generated a total return of

5.9% in the first half of the year. The five UK centric businesses

are well-established and have strong market positions. With the

exception of Cooke Optics, which has been impacted by temporary

industry issues as outlined below, all are growing, profitable and

cash generative.

Investee companies are revalued in March and September each

year. Excluding 7IM, the remaining four businesses are valued on an

earnings multiple basis, with multiples in the range 9 to 14 times

current year earnings. AIR-serv Europe was acquired in April 2023

and is valued on a transaction basis using cost of recent

investment. Gearing levels are modest, with net debt of

approximately two times earnings before interest, tax, depreciation

and amortisation ("EBITDA").

In early September 2023, Caledonia announced that we had agreed

terms for the sale of our majority stake in 7IM, a vertically

integrated retail wealth management business, to Ontario Teachers'

Pension Plan Board. The transaction is subject to change in control

approval by the Financial Conduct Authority and is expected to

complete by early 2024. Subject to the exact timing of completion,

we expect to receive cash proceeds of c.GBP255m, net of transaction

expenses, for the sale of our ordinary and preference shares in

7IM. The valuation at the end of September of GBP248m, reflects

expected cash proceeds less a 3% discount to equity value in

recognition of the very limited degree of transaction execution

risk. To reflect this transaction, this asset was disclosed as held

for sale on the condensed group statement of financial position as

at 30 September 2023. 7IM generated a return of 28.0% in the first

half of the year.

Cobepa, the Belgian based investment company, owns a diverse

portfolio of private global investments. The majority of the

businesses within the Cobepa portfolio continue to develop well,

with many delivering strong performance and valuation progression.

Two significant disposals, one of which completed in the period,

have been agreed which, together with progress from portfolio

companies, supported the overall modest uplift in valuation. The

valuation of Caledonia's holding of Cobehold, the holding company

of Cobepa, was GBP179m at the end September, a return of 3.1% for

the first half of the year.

Stonehage Fleming, the international multi-family office,

continues to deliver good earnings growth across both the Family

Office and Investment Management businesses. The former has seen a

positive combination of new client wins and increased activity

levels with existing clients; the latter has felt the benefit of

recovering equity markets. The valuation at the end of September

was GBP157m, a return of 11.7% for the first half of the year.

AIR-serv Europe, a leading designer and manufacturer of air,

vacuum and jet wash machines, which it provides to fuel station

forecourt operators across the UK and Western Europe, was acquired

in April 2023. The business is trading well with earnings slightly

ahead of expectations and demonstrating good year on year growth.

The valuation has been maintained at the equity purchase cost of

GBP143m, generating no return for the period. The position will be

reviewed in March 2024.

Liberation Group, an inns and drinks business with a pub estate

stretching from Southwest London to Bristol and the Channel

Islands, has traded slightly below expectations through the spring

and summer. It has been adversely impacted by the cost-of-living

crisis reducing consumer discretionary incomes, sustained cost

inflation (particularly UK energy costs) and poor UK weather

affecting peak early-summer trading months. However, the

integration of the Cirrus Inns business, whilst not complete, has

progressed well. The valuation at the end of September was GBP135m,

a return of 2.3% for the first half of the year.

Cooke Optics, a leading manufacturer of cinematography lenses,

has been heavily impacted by the Hollywood writers' strike which

started in early May 2023 and the subsequent actors' strike. With

film and TV production severely affected, Cooke has seen a

subsequent fall in sales and a resulting reduction in earnings. We

anticipate that these industrial disputes will be resolved, with

the writers' strike appearing to have concluded recently, and

product demand will return. However, the timing and nature of a

recovery in financial performance is uncertain. This is reflected

in our valuation at the end of September of GBP102m, which includes

a 15% equity discount to reflect this matter. The equity return is

-22.7% for the first half of the year.

Caledonia Private Equity Funds (33% of NAV)

The total return on the Private Equity Funds pool was 4.6% for

the first half of the year, including a 1% favourable impact from

exchange rate movements. Underlying performance reflects modest

valuation growth from holdings across the pool in both North

America and Asia, with local currency returns of around 4% and 1%

respectively.

Caledonia's fund investments are principally in third party

managed private equity funds operating in North America and in

Asia. The North American based private equity funds invest into the

lower-mid market, with a focus on small to medium sized, often

owner-managed, established businesses. These funds normally provide

the first institutional investment into these businesses, and

support their professionalisation and growth, both organically and

through M&A activity. The entry pricing levels are relatively

modest and there is a deep, robust market for future divestment,

either via trade sales or to other, larger private equity private

equity funds. The portfolio is a combination of directly owned

funds (45% of Private Equity Funds NAV), with a broad range of

managers generally managing funds in the range of US$250m to

US$500m. The balance is in fund of private equity funds investments

(13% of Private Equity Funds NAV) with HighVista Strategies

(formerly Aberdeen), our largest single manager exposure, over five

separate funds.

In contrast, our Asian based funds invest across a wide range of

sectors with a focus on businesses in the early years of

significant growth, having successfully developed their business

model. Whilst focused on local markets, a number, particularly

those with a healthcare focus, also invest into the US. The market

is less developed than in North America with divestments, in the

absence of a mature buyout market, mainly through an IPO or trade

sale. The portfolio is a combination of directly owned funds (24%

of Private Equity Funds NAV), with a broad range of managers, some

sourced through our fund of private equity funds relationships but

mostly through our own knowledge and contacts in the region. The

balance (18% of Private Equity Funds NAV) is invested with Asia

Alternatives, Axiom and Unicorn, all fund of private equity funds

providers.

During the first half of the year, GBP52m was invested via

drawdowns, GBP13m was invested in the secondary purchase of two

Decheng funds positions and distributions of GBP15m, evenly

balanced between North America and Asia, were received. The level

of distributions has declined compared to the last two years,

reflecting more challenging market conditions. We anticipate, based

on feedback from our managers, something of a recovery in

distributions over the next six to eighteen months.

Management and Board

Rob Memmott joined the board as Chief Financial Officer on 1

September 2023, succeeding Tim Livett.

Dividend

The board has declared an interim dividend of 18.93p per share,

an increase of 4.0% on last year's interim. This will be paid to

shareholders on 4 January 2024.

Outlook

The global economic outlook continues to be challenging with the

impact of high rates of inflation, elevated interest rates and

central bank debt reduction leading to mixed performance across

global markets. These factors may influence the short-term

performance of our portfolio but Caledonia's long-term outlook and

ethos of investment in high quality, well-financed and managed

companies, leaves us well-placed to withstand these pressures and

deliver long-term returns in line with our aims.

Change in pool investments value Net assets distribution

Sep Mar

GBPm 2023 2023

------------------------------- ------------- ------------------------ ---- ----

Opening portfolio balance 2,534.7 Public Companies 30% 30%

Investments 262.8 Private Capital 36% 29%

Realisations (39.8) Private Equity Funds 33% 32%

Gains/losses 95.3 Cash and other 1% 9%

------------------------ ---- ----

Accrued income 2.1

------------------------------- -------------

Closing portfolio balance 2,855.1

Cash and other 21.0

------------------------------- -------------

Closing net assets 2,876.1

------------------------------- -------------

Net assets geographic Net assets currency

distribution distribution

Sep Mar Sep Mar

2023 2023 2023 2023

------------------------------- ------- ---- ------------------------ ---- ----

United Kingdom 38% 31% Pound sterling 39% 41%

Europe 7% 8% US dollar 51% 50%

North America 39% 39% Euro 7% 7%

Asia 15% 13% Other currencies 3% 2%

------------------------ ---- ----

Cash and other 1% 9%

------------------------------- ------- ----

1. The geographic distribution is based on the country of listing,

country of domicile for unlisted investments and underlying regional

analysis for funds.

2. Currency distribution is based on the denomination of the securities

held. This does not look through to the underlying exposures,

which may be different.

Portfolio summary

Holdings of 1% or more of net assets at 30 September 2023 were

as follows:

Net

Value assets

Name Pool Geography(1) Business GBPm %

------------------------- -------------------- ------------- ----------------------- --------- ------

Seven Investment

Management Private Capital Jersey Investment management 248.5 8.6

Cobehold Private Capital Belgium Investment company 178.8 6.2

Stonehage Fleming Private Capital Guernsey Family office services 157.0 5.5

AIR-serv Europe Private Capital UK Forecourt vending 142.5 5.0

Liberation Group Private Capital Jersey Pubs, bars & inns 135.0 4.7

Private Equity

HighVista Strategies(2) Funds US Funds of funds 123.5 4.3

Cooke Optics Private Capital UK Cine lens manufacturer 102.3 3.6

Private Equity

Axiom Asia funds Funds Asia Funds of funds 88.1 3.1

Watsco Public Companies US Ventilation products 73.9 2.6

Microsoft Public Companies US Software 72.3 2.5

Oracle Public Companies US Software 69.8 2.4

Private Equity Asia/

Decheng funds Funds US Private equity funds 57.4 2.0

Texas Instruments Public Companies US Semiconductors 54.2 1.9

Tobacco & smoke-free

Philip Morris Public Companies US products 49.3 1.7

Asia Alternatives Private Equity

funds Funds Asia Funds of funds 47.3 1.6

Charter Communications Public Companies US Cable communications 46.4 1.6

Pharma & life sciences

Thermo Fisher Scientific Public Companies US services 41.6 1.4

Fastenal Public Companies US Industrial supplies 40.3 1.4

Hill & Smith Public Companies UK Infrastructure 40.2 1.4

Private Equity

Unicorn funds Funds Asia Funds of funds 39.6 1.4

Private Equity

CenterOak funds Funds US Private equity funds 38.9 1.4

Private Equity

Stonepeak funds Funds US Private equity funds 36.2 1.3

SIS Private Capital UK Content services 35.3 1.2

British American

Tobacco Public Companies UK Tobacco & vaping 33.6 1.2

Private Equity

Ironbridge funds Funds Canada Private equity funds 34.0 1.2

Becton Dickinson Public Companies US Medical technology 30.9 1.1

Private Equity

AE Industrial funds Funds US Private equity funds 27.7 1.0

Private Equity

PAG Asia funds Funds Asia Private equity funds 27.6 1.0

Spirax Sarco Public Companies UK Steam engineering 27.6 1.0

Moody's Corporation Public Companies US Financial services 27.5 1.0

------------------------- -------------------- ------------- ----------------------- --------- ------

Other investments 727.8 25.3

Investment portfolio 2,855.1 99.6

Cash and other 21.0 0.4

--------------------------------------------------------------------------------------- --------- ------

Net assets 2,876.1 100.0

--------------------------------------------------------------------------------------- --------- ------

1. Geography is based on the country of listing, country of domicile

for unlisted investments and underlying regional analysis for

funds.

2. Previously Aberdeen.

Risks and uncertainties

Caledonia has a risk management framework that provides a

structured process for identifying, assessing, and managing risks

associated with the company's business objectives and strategy.

The principal risks and uncertainties faced by the company are

set out in the strategic report section of Caledonia's annual

report 2023 pages 44-45. External risks arise from political,

legal, regulatory and economic changes. Strategic risks arise from

the conception, design and implementation of the company's business

model. Investment risks arise from specific investment and

realisation decisions. Market risks arise from equity price

volatility, foreign exchange rate movements and interest rate

volatility. Liquidity risks arise from counterparties, uncertainty

in market prices and rates and liquidity availability. Operational

risks arise from potentially inadequate or failed controls,

processes, people or systems. Regulatory risks arise from exposure

to litigation or fraud or failure to adhere to the taxation and

regulatory environment. Environmental, social and governance

("ESG") and climate change risks relate to the successful

incorporation of ESG matters and climate change impacts into

investment strategy.

The principal risks and uncertainties identified in the annual

report 2023 remain unchanged, other than the following

developments: the global economic outlook is increasingly

uncertain, with the ongoing conflict in Ukraine and the Middle East

coupled with elevated inflation and interest rates, leading to

greater volatility across global markets. Caledonia actively

monitors key risk factors, including portfolio concentration,

liquidity and volatility, and aims to manage risk by:

- diversifying the portfolio by sector and geography.

- ensuring access to relevant information from investee companies, particularly in the case

of unquoted investments through board representation. Consideration of changes to the economic

environment forms an important part of the valuation process for the assets within the Private

Capital pool.

- managing cash and borrowings to ensure liquidity is available to meet investment and operating

needs.

- reducing counterparty risk by limiting maximum aggregate exposures.

Going concern

The factors likely to affect the company's ability to continue

as a going concern were set out in the annual report 2023. As at 30

September 2023, there have been no significant changes to these

factors other than our cash position which has reduced in the

period.

The group has conducted an interim going concern assessment

which considered future cash flows including drawdown of all

outstanding private equity fund commitments, the availability of

liquid assets and debt facilities, and banking covenant

requirements over at least 12 months from the date of approval of

these financial statements. In making this assessment, several

stress scenarios were considered to reflect the increasingly

uncertain economic outlook, addressing the risks of foreign

exchange appreciation, investment income decline, a decline in

distributions from private equity funds, a delay in known Private

Capital pool disposal and market price reduction. A final scenario

considered the cumulative impact of all variables.

Under these scenarios the group would have a range of mitigating

actions available to it, including the sale of liquid assets and

usage of banking facilities. In all scenarios the group would have

sufficient cash reserves to enable it to meet all of its

liabilities as they fall due and still hold significant liquid

assets over the assessment period. As a result of this assessment

the directors are confident that the company will have sufficient

funds to continue to meet its liabilities as they fall due for at

least 12 months from the date of approval of the interim financial

statements and therefore have been prepared on a going concern

basis.

Directors' responsibility statement

We confirm that to the best of our knowledge:

- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted

by the United Kingdom;

- the interim management report includes a fair review of the

information required by:

- DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred

during the first six months of the financial year and their

impact on the condensed set of financial statements and a

description of the principal risks and uncertainties for the

remaining six months of the financial year;

- DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related parties transactions that have taken place in

the first six months of the current financial year and that

have materially affected the financial position or performance

of the entity during that period and any changes in the related

party transactions described in the last annual report that

could do so.

Signed on behalf of the board

Mat Masters, Chief Executive Officer

20 November 2023

Independent review report

to Caledonia Investments plc

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2023 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2023 which comprises condensed group

statement of comprehensive income, the condensed group statement of

financial position, the condensed group statement of changes in

equity and the condensed group statement of cash flows and the

related explanatory notes.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority. In preparing the half-yearly financial report, the

directors are responsible for assessing the company's ability to

continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of

accounting unless the directors either intend to liquidate the

company or to cease operations, or have no realistic alternative

but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

BDO LLP

Chartered Accountants

UK

20 November 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127)

Condensed group statement of comprehensive income

for the six months ended 30 September 2023

Unaudited Unaudited Audited

Six months 30 Sep Six months 30 Sep Year 31 Mar 2023

2023 2022

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

Revenue

Investment income 33.8 - 33.8 25.4 - 25.4 43.2 - 43.2

Other income 0.4 - 0.4 0.4 0.3 0.7 0.8 1.3 2.1

Net gains and losses

on fair value investments - 88.2 88.2 - 105.2 105.2 - 133.0 133.0

Net gains and losses

on fair value property - 0.3 0.3 - 0.3 0.3 - (1.4) (1.4)

--------------------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

Total revenue 34.2 88.5 122.7 25.8 105.8 131.6 44.0 132.9 176.9

Management expenses (12.1) (4.4) (16.5) (10.6) (2.9) (13.5) (21.3) (8.6) (29.9)

Profit before

finance costs 22.1 84.1 106.2 15.2 102.9 118.1 22.7 124.3 147.0

Treasury interest

receivable 1.8 - 1.8 1.5 - 1.5 4.6 - 4.6

Finance costs (7.2) - (7.2) (1.2) - (1.2) (2.4) - (2.4)

Exchange movements 4.8 - 4.8 1.2 - 1.2 - - -

--------------------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

Profit before

tax 21.5 84.1 105.6 16.7 102.9 119.6 24.9 124.3 149.2

Taxation (0.2) (1.1) (1.3) 1.4 (0.4) 1.0 (4.3) (2.0) (6.3)

--------------------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

Profit for the

period 21.3 83.0 104.3 18.1 102.5 120.6 20.6 122.3 142.9

Other comprehensive

income items never

to be reclassified

to

profit or loss

Re-measurement

of defined benefit

pension schemes - (0.4) (0.4) - (0.1) (0.1) - 1.4 1.4

Tax on other comprehensive

income - 0.4 0.4 - (0.5) (0.5) - (0.3) (0.3)

--------------------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

Total comprehensive

income 21.3 83.0 104.3 18.1 101.9 120.0 20.6 123.4 144.0

--------------------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

Basic earnings

per share 39.2p 152.7p 191.9p 33.4p 188.9p 222.3p 37.9p 225.3p 263.2p

Diluted earnings

per share 38.6p 150.3p 188.9p 32.9p 185.9p 218.8p 37.3p 221.7p 259.0p

--------------------------- ------- ------- ------ ------- ------- ------ ------- ------- ------

The total column of the above statement represents the condensed

group statement of comprehensive income, prepared in accordance

with IFRSs as adopted by the United Kingdom.

The revenue and capital columns are supplementary to the

condensed group statement of comprehensive income and are prepared

under guidance published by the Association of Investment

Companies.

The profit for the period and total comprehensive income for the

period is attributable to equity holders of the parent.

Condensed group statement of financial position

at 30 September 2023

Unaudited Unaudited Audited

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBPm GBPm GBPm

------------------------------------------------------ --------- --------- -------

Non-current assets

Investments held at fair value through profit or loss 2,656.5 2,479.3 2,794.9

Investment property 15.1 16.0 15.1

Property, plant and equipment 28.0 29.0 27.9

Deferred tax assets 4.8 21.1 5.7

Employee benefits 4.1 2.4 4.0

------------------------------------------------------ --------- --------- -------

Non-current assets 2,708.5 2,547.8 2,847.6

------------------------------------------------------ --------- --------- -------

Current assets

Asset held- for sale 248.5 - -

Trade and other receivables 14.9 8.3 6.9

Current tax assets 20.1 12.0 19.3

Cash and cash equivalents 14.9 242.7 221.6

------------------------------------------------------ --------- --------- -------

Current assets 298.4 263.0 247.8

------------------------------------------------------ --------- --------- -------

Total assets 3,006.9 2,810.8 3,095.4

------------------------------------------------------ --------- --------- -------

Current liabilities

Interest bearing loans and borrowings (49.2) - (266.0)

Trade and other payables (39.0) (23.6) (22.1)

Employee benefits (1.5) (1.2) (2.4)

------------------------------------------------------ --------- --------- -------

Current liabilities (89.7) (24.8) (290.5)

------------------------------------------------------ --------- --------- -------

Non-current liabilities

Interest bearing loans and borrowings (35.0) - -

Employee benefits (4.2) (3.2) (5.1)

Deferred tax liabilities (1.9) (1.3) (1.8)

Non-current liabilities (41.1) (4.5) (6.9)

------------------------------------------------------ --------- --------- -------

Total liabilities (130.8) (29.3) (297.4)

------------------------------------------------------ --------- --------- -------

Net assets 2,876.1 2,781.5 2,798.0

------------------------------------------------------ --------- --------- -------

Equity

Share capital 3.1 3.1 3.1

Share premium 1.3 1.3 1.3

Capital redemption reserve 1.4 1.4 1.4

Capital reserve 2,638.4 2,533.9 2,555.4

Retained earnings 239.9 252.4 247.4

Own shares (8.0) (10.6) (10.6)

------------------------------------------------------ --------- --------- -------

Total equity 2,876.1 2,781.5 2,798.0

------------------------------------------------------ --------- --------- -------

Undiluted net asset value per share 5286p 5120p 5150p

Diluted net asset value per share 5203p 5039p 5068p

------------------------------------------------------ --------- --------- -------

Condensed group statement of changes in equity

for the six months ended 30 September 2023

Capital

redemp-

Share Share tion Capital Retained Own Total

capital premium reserve reserve earnings shares equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Six months ended 30 September 2023

(Unaudited)

Balance at 1 April 2023 3.1 3.1 1.4 2,555.4 247.4 (10.6) 2,798.0

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total comprehensive income

Profit for the period - - - 83.0 21.3 - 104.3

Other comprehensive income - - - - - - -

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total comprehensive income - - - 83.0 21.3 - 104.3

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Transactions with owners of the

company

Contributions by and distributions

to owners

Share-based payments - - - - 3.6 - 3.6

Transfer of shares to employees - - - - (5.7) 5.7 -

Own shares purchased - - - - - (3.1) (3.1)

Dividends paid - - - - (26.7) - (26.7)

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total transactions with owners - - - - (28.8) 2.6 (26.2)

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Balance at 30 September 2023 3.1 3.1 1.4 2,638.4 239.9 (8.0) 2,876.1

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Six months ended 30 September 2022

(Unaudited)

Balance at 1 April 2022 3.1 3.1 1.4 2,527.0 263.2 (13.3) 2,782.7

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total comprehensive income

Profit for the period - - - 102.5 18.1 - 120.6

Other comprehensive income - - - (0.6) - - (0.6)

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total comprehensive income - - - 101.9 18.1 - 120.0

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Transactions with owners of the

company

Contributions by and distributions

to owners

Share-based payments - - - - 2.9 - 2.9

Transfer of shares to employees - - - - (6.2) 6.2 -

Own shares purchased - - - - - (3.5) (3.5)

Dividends paid - - - (95.0) (25.6) - (120.6)

Total transactions with owners - - - (95.0) (28.9) 2.7 (121.2)

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Balance at 30 September 2022 3.1 3.1 1.4 2,533.9 252.4 (10.6) 2,781.5

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Six months ended 30 September 2022

(Unaudited)

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Year ended 31 March 2023 (Audited)

Balance at 1 April 2022 3.1 3.1 1.4 2,527.0 263.2 (13.3) 2,782.7

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total comprehensive income

Profit for the year - - - 122.3 20.6 - 142.9

Other comprehensive income - - - 1.1 - - 1.1

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total comprehensive income - - - 123.4 20.6 - 144.0

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Transactions with owners of the

company

Contributions by and distributions

to owners

Share-based payments - - - - 5.8 - 5.8

Transfer of shares to employees - - - - (6.7) 6.7 -

Own shares purchased - - - - - (4.0) (4.0)

Dividends paid - - - (95.0) (35.5) - (130.5)

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Total transactions with owners - - - (95.0) (36.4) 2.7 (128.7)

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Balance at 31 March 2023 3.1 3.1 1.4 2,555.4 247.4 (10.6) 2,798.0

----------------------------------- ------- ------- ------- ------- -------- ------ -------

Condensed group statement of cash flows

for the six months ended 30 September 2023

Unaudited Unaudited Audited

6 months 6 months Year

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBPm GBPm GBPm

-------------------------------------------------- --------- --------- -------

Operating activities

Dividends received 30.8 24.6 41.6

Interest received 2.4 2.3 6.5

Cash received from customers 0.4 0.4 2.6

Cash paid to suppliers and employees (14.2) (14.3) (25.3)

Taxes received - - 0.1

Group tax relief received - 0.5 2.0

Group tax relief paid (0.8) - -

Net cash flow from operating activities 18.6 13.5 27.5

-------------------------------------------------- --------- --------- -------

Investing activities

Purchases of investments (253.1) (98.1) (468.1)

Proceeds from disposal of investments 241.1 111.5 192.1

Purchases of property, plant and equipment (0.3) (0.1) (0.3)

-------------------------------------------------- --------- --------- -------

Net cash flow (used in)/from investing activities (12.3) 13.3 (276.3)

-------------------------------------------------- --------- --------- -------

Financing activities

Interest paid (7.0) (1.1) (2.2)

Dividends paid to owners of the company (26.7) (120.6) (130.5)

Proceeds from bank borrowings 35.0 - -

Proceeds from group borrowings - - 266.0

Repayment of group borrowings (211.2) - -

Purchases of own shares (3.1) (3.5) (4.0)

-------------------------------------------------- --------- --------- -------

Net cash flow (used in)/from financing activities (213.0) (125.2) 129.3

-------------------------------------------------- --------- --------- -------

Net decrease in cash and cash equivalents (206.7) (98.4) (119.5)

Cash and cash equivalents at period start 221.6 341.1 341.1

-------------------------------------------------- --------- --------- -------

Cash and cash equivalents at period end 14.9 242.7 221.6

-------------------------------------------------- --------- --------- -------

Notes to the condensed financial statements

1. General information

Caledonia Investments plc is an investment trust company

registered in England and Wales with company number 00235481. The

address of its registered office is Cayzer House, 30 Buckingham

Gate, London SW1E 6NN. The ordinary shares of the company are

premium listed on the London Stock Exchange.

This condensed set of financial statements was approved for

issue on 20 November 2023 and is unaudited.

The information for the period ended 30 September 2023 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for the year

ended 31 March 2023 has been delivered to the Registrar of

Companies. The auditor's report on those accounts was not

qualified, did not draw attention to any matters by way of emphasis

of matter and did not contain a statement under section 498(2) and

(3) of the Companies Act 2006.

2. Accounting policies

Basis of accounting

This condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting and should be

read in conjunction with the annual financial statements for the

year ended 31 March 2023, which were prepared in accordance with

IFRSs adopted by the United Kingdom.

This condensed set of financial statements has been prepared in

accordance with the recommendations of the Statement of Recommended

Practice issued by the Association of Investment Companies.

Adopted IFRSs

The accounting policies adopted in the preparation of the

condensed consolidated financial statements are consistent with

those followed in the preparation of the group's annual report for

the year ended 31 March 2023, except for the mandatory amendments

that had an effective date prior to the start of the six-month

period. None of the mandatory amendments had an impact on the

reported financial position or performance of the group. The

changes in accounting policies will also be reflected in the

group's consolidated financial statements for the year ending 31

March 2024.

The group classifies assets as held-for-sale under IFRS 5

(Non-current assets held for sale and discontinued operations)

where it judges they meet the relevant criteria. This policy has

been applied in the current accounting period (see note 11).

A number of new amendments to standards and interpretations will

be effective for periods beginning on or after 1 April 2024. The

group plans to apply these amendments in the reporting period in

which they become effective.

Basis of consolidation

In accordance with the IFRS 10/IAS 28 investment entity

amendments to apply the investment entities exemption, the

consolidated financial statements include the financial statements

of the company and service entities controlled by the company made

up to the reporting date. All other investments in controlled

entities are accounted as held at fair value through profit or

loss.

Going concern

Under the UK Corporate Governance Code and applicable

regulations, the directors are required to satisfy themselves that

it is reasonable to presume that the company is a going concern. As

at 30 September 2023 the group holds GBP880m of liquid investment

assets, GBP15m of cash and has access to GBP215m of undrawn

committed banking facilities, of which GBP92.5m expires in July

2025 and GBP122.5m expires in November 2027.

The group has conducted an interim going concern assessment

which considered future cash flows, including drawdown of all

outstanding private equity fund commitments, availability of liquid

assets and debt facilities, and banking covenant requirements over

at least 12 months from the date of approval of these financial

statements. In making this assessment, several stress scenarios

were considered to reflect the increasingly uncertain economic

outlook, addressing the risks of foreign exchange appreciation,

investment income decline, a decline in distributions from private

equity funds, a delay in known Private Capital pool disposal and

market price reduction . A final scenario considered the cumulative

impact of all variables.

Under these scenarios the group would have a range of mitigating

actions available to it, including sale of liquid assets and usage

of banking facilities. In all scenarios the group would have

sufficient cash reserves to enable it to meet all of its

liabilities as they fall due and still hold significant liquid

assets over the assessment period. As a result of this assessment

the directors are confident that the company will have sufficient

Private Equity Funds to continue to meet its liabilities as they

fall due for at least 12 months from the date of approval of the

interim financial statements and therefore have been prepared on a

going concern basis.

Changes in accounting policies

As required by the Disclosure Guidance and Transparency Rules of

the Financial Conduct Authority and IAS 34, this condensed set of

financial statements has been prepared applying the accounting

policies and presentation that were applied in the preparation of

the company's published consolidated financial statements for the

year ended 31 March 2023.

Judgements and estimates

In preparing these interim financial statements, management has

made judgements, estimates and assumptions that affected the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense.

The significant judgements made by management in applying the

group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements for the year ended 31 March 2023.

3. Dividends

Amounts recognised as distributions to owners of the company in

the period were as follows:

6 months 6 months Year

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBPm GBPm GBPm

---------------------------------------------------------------------------------- -------- -------- ------

Final dividend for the year ended 31 March 2023 of 49.2p per share (2022 - 47.3p) 26.7 25.6 25.6

Special dividend for the year ended 31 March 2022 of 175.0p per share - 95.0 95.0

Interim dividend for the year ended 31 March 2023 of 18.2p per share - - 9.9

---------------------------------------------------------------------------------- -------- -------- ------

26.7 120.6 130.5

---------------------------------------------------------------------------------- -------- -------- ------

The directors have declared an interim dividend for the year

ending 31 March 2024 of 18.93p per share, totalling GBP10.3m, which

has not been included as a liability in this condensed set of

financial statements. This dividend will be payable on 4 January

2024 to holders of shares on the register on 1 December 2023. The

ex-dividend date will be 30 November 2023. The deadline for

elections under the dividend reinvestment plan offered by Link

Group will be the close of business on 12 December 2023.

4. Share capital

During the period, the company's Employee Share Trust sold

178,801 shares for GBPnil and purchased 90,158 shares for GBP3.1m

relating to the exercise of performance share and deferred bonus

awards.

In the six months ended 30 September 2022, the company's

Employee Share Trust sold 201,529 shares for GBPnil and purchased

93,198 shares for GBP3.5m relating to the exercise of performance

share and deferred bonus awards.

In the year ended 31 March 2023, the Employee Share Trust sold

221,581 shares for GBPnil and purchased 106,898 shares for GBP4.0m

relating to the exercise of performance share and deferred bonus

awards.

5. Net asset value per share

The group's undiluted net asset value per share is based on the

net assets of the group at the period end and on the number of

shares in issue at the period end less shares held by The Caledonia

Investments plc Employee Share Trust. The group's diluted net asset

value per share assumes the calling of performance share and

deferred bonus awards for nil consideration.

6. Operating segments

The chief operating decision maker has been identified as the

Chief Executive Officer, supported by the Investment Committee, who

reviews the company's internal reporting to assess performance and

allocate resources. Management has determined the operating

segments based on these reports.

The performance of operating segments is assessed on a measure

of group total revenue, principally comprising gains and losses on

investments and investment income. Reportable profit or loss is

after treasury income and 'Other items', which comprise management

and other expenses. Reportable assets equate to the group's total

assets. 'Cash' and 'Other items' are not identifiable operating

segments.

'Other'-portfolio investments' comprise subsidiaries and other

investments not managed as part of the investment portfolio.

Profit before tax Total assets

6 months 6 months Year

30 Sep 30 Sep 31 Mar 30 Sep 30 Sep 31 Mar

2023 2022 2023 2023 2022 2023

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------- -------- -------- ------ ------ ------ ------

Quoted Equity 24 (79) 1 865 744 837

Private Capital* 56 49 65 1,027 819 824

Funds 41 176 104 963 953 874

-------------------------- -------- -------- ------ ------ ------ ------

Portfolio investments 121 146 170 2,855 2,516 2,535

Other investments 2 (14) 7 50 (37) 260

-------------------------- -------- -------- ------ ------ ------ ------

Total revenue/investments 123 132 177 2,905 2,479 2,795

Cash and cash equivalents - 2 4 15 243 221

Other items (17) (14) (32) 87 89 79

-------------------------- -------- -------- ------ ------ ------ ------

Reportable total 106 120 149 3,007 2,811 3,095

-------------------------- -------- -------- ------ ------ ------ ------

*Private Capital investment in 7IM was classified as an asset

held for sale at 30 September 2023.

7. Related parties

Caledonia Investments plc repaid GBP211.2m to Caledonia US

Investments Ltd, a wholly-owned subsidiary of Caledonia, and

received a distribution of GBP212.1m from Caledonia US Investments

Ltd in the period.

Caledonia Group Services Ltd, a wholly-owned subsidiary of

Caledonia Investments plc, provides management services to the

company. During the six months ended 30 September 2023, GBP16.4m

was charged to the company for these services (30 September 2022:

GBP13.5m and 31 March 2023: GBP29.9m).

There were no other changes in the transactions or arrangements

with related parties as described in the company's annual report

for the year ended 31 March 2023 that have had a material effect on

the results or the financial position of the company or of the

group in the six months ended 30 September 2023.

8. Capital commitments

At 30 September 2023, the group had undrawn fund and other

commitments totalling GBP427.4m (30 September 2022: GBP339.0m and

31 March 2023: GBP422.6m). These commitments could, in theory, be

called upon simultaneously at any time. Although this is unlikely,

the going concern assessment has modelled this scenario and in such

circumstances the group would be able to meet all of these

liabilities.

9. Fair value hierarchy

The company measures fair values using the following fair value

hierarchy, reflecting the significance of the inputs used in making

the measurements:

Level Quoted prices (unadjusted) in active markets for identical

1 assets.

Level Inputs other than quoted prices included within Level 1 that

2 are directly or indirectly observable.

Level Inputs for the asset that are not based on observable market

3 data.

The table below analyses financial instruments held at fair

value according to level in the fair value hierarchy into which the

fair value measurement is categorised:

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBPm GBPm GBPm

-------------------------------------------- ------- ------- -------

Investments held at fair value

Level 1 865.0 744.1 836.9

Level 2 5.1 5.3 4.8

Level 3 2,034.9 1,729.9 1,953.2

-------------------------------------------- ------- ------- -------

2,905.0 2,479.3 2,794.9

------------------------------------------- ------- ------- -------

The following table shows a reconciliation from the opening

balances to the closing balances for fair value measurements in

Level 3 of the fair value hierarchy:

6 mths 6 mths Year

30 Sep 30 Sep 31 Mar

2023 2022 2023

GBPm GBPm GBPm

-------------------------------------------- ------- ------- -------

Balance at the period start 1,953.2 1,549.1 1,549.1

Purchases 226.5 69.7 413.5

Realisation proceeds (223.3) (81.3) (162.8)

Gains and losses on investments sold in the

period 5.0 15.2 126.7

Gains and losses on investments held at the

period end 71.4 175.3 27.3

Accrued income 2.1 1.9 (0.6)

-------------------------------------------- ------- ------- -------

Balance at the period end 2,034.9 1,729.9 1,953.2

-------------------------------------------- ------- ------- -------

Private asset valuation

Caledonia makes private equity investments in two forms: direct

private equity investments (the Private Capital pool) and

investments into externally managed unlisted private equity funds

and funds of funds (the Funds pool). The directors have made two

estimates which they deem to have a significant risk of resulting

in a material adjustment to the amounts recognised in the financial

statements within the next financial year, which relate to the

valuation of assets within these two pools.

For directly owned private investments (Private Capital pool),

totalling GBP1,027.1m (31 March 2023: GBP824.0m), valuation

techniques using a range of internally and externally developed

unobservable inputs are used to estimate fair value. Valuation

techniques make maximum use of market inputs, including reference

to the current fair values of comparator businesses that are

substantially the same (subject to appropriate adjustments). For

each asset, a range of valuation methods are considered and methods

judged most appropriate are used, taking into consideration the

quantity and quality of data points available. Methods include

inter alia: consideration of indicative offers from third parties,

applying an earnings multiple to the maintainable earnings of a

business, and net assets, sometimes employing third-party net asset

valuations.

For private equity fund investments (unlisted Private Equity

Funds pool), totalling GBP958.0m (31 March 2023: GBP869.0m) held

through externally managed fund vehicles, the estimated fair value

is based on the most recent valuation provided by the external

manager, usually received within 3-6 months of the relevant

valuation date. As at 30 September 2023, the majority of the

valuations included in these financial statements were based

principally on the 30 June 2023 managers' NAVs. Where required,

valuations are adjusted for investments and distributions between

valuation date and reporting date. These valuations depend upon the

reasonableness of the fair value estimation made by third-party

managers, whose approach is assessed by Caledonia through a

combination of initial due diligence, on-going analytical

monitoring and review of financial reporting.

At 30 September 2023

Description/Category Valuation Fair value Unobservable Weighted Input Change in

method input average input sensitivity valuation

GBPm +/- +/- GBPm

--------------------- --------------- ---------- --------------- -------------- --------------- --------------

Internally developed

Private companies

Large Earnings 302.0 EBITDA multiple 13.9x 10.0% +35.0/-33.0

Medium Earnings 137.6 EBITDA multiple 10.0x 10.0% +10.5/-11.7

Small Earnings 17.7 EBITDA multiple 4.6x 15.0% +1.4/-1.4

Transaction price 391.0 Multiple 1 3-5% +14.8/-14.8

Manager valuation Net assets 178.8 Multiple 1 0.1x +17.9/-17.9

--------------------- --------------- ---------- --------------- -------------- --------------- --------------

1,027.1 +79.6/-78.8

Non-pool companies 49.8

-------------------------------------- ---------- --------------- -------------- --------------- --------------

Total internal 1,076.9

Externally developed

Private equity funds

Adjusted

Net asset value Manager NAV 958.0 Multiple 1 5.0% 47.9 / (47.9)

--------------------- --------------- ---------- --------------- -------------- --------------- --------------

2,034.9 +127.5/-126.7

------------------------------------- ---------- --------------- -------------- --------------- --------------

The principal changes during the half-year were the change in

valuation method used to value 7IM and BioAgilytix. 7IM, an

investment manager, is valued at an agreed transaction price and

was previously valued on an EBITDA multiple. BioAgilytix, which

operates bioanalytical testing, is valued on an EBITDA multiple

(included in the 'Large, earnings' category above) and was

previously valued on a net assets basis.

The following table provides information on significant

unobservable inputs used at 31 March 2023 in measuring financial

instruments categorised as Level 3 in the fair value hierarchy.

At 31 March 2023

Description/Category Valuation Fair value Unobservable Weighted Input Change in

method input average input sensitivity valuation

GBPm +/- +/- GBPm

--------------------- --------------- ---------- --------------- -------------- --------------- --------------

Internally developed

Private companies

Large Earnings 460.6 EBITDA multiple 13.9x 10.0% +39.6/-55.5

Medium Earnings 160.6 EBITDA multiple 11.1x 10.0% +/-13.1

Small Earnings 10.3 EBITDA multiple 4.6x 15.0% +/-1.2

Net assets / manager valuation 192.5 Multiple 1 0.1x +/-21.8

-------------------------------------- ---------- --------------- -------------- --------------- --------------

824.0 +75.7/-91.6

Non-pool companies 260.2

-------------------------------------- ---------- --------------- -------------- --------------- --------------

Total internal 1,084.2

Externally developed

Private equity funds

Adjusted

Net asset value Manager NAV 869.0 Multiple 1x 5.0% +/-43.5

--------------------- --------------- ---------- --------------- -------------- --------------- --------------

1,953.2 +119.2/-135.1

------------------------------------- ---------- --------------- -------------- --------------- --------------

Private company (Private Capital) assets have been disaggregated

into categories as follows:

-- Assets in the large, earnings based category have an Enterprise

Value of >GBP150m, and benefit from a reasonable number of

comparative data points, as well as having sufficient size

to make their earnings reliable and predictable.

-- Assets in the medium, earnings based category have an Enterprise

Value of GBP50-GBP150m, with a more limited universe of comparable

businesses available.

-- Assets in the smaller, earnings based category have an Enterprise

value of <GBP50m. Their smaller size results in fewer data

points due to a lack of available listed comparators, and

makes them generally more vulnerable than larger assets to

changes in economic conditions.

-- Manager valuations are used for assets where the net asset

method is employed.

For private company assets we have chosen to sensitise and

disclose EBITDA multiple or tangible asset multiple inputs because

their derivation involves the most significant judgements when

estimating valuation, including which data sets to consider and

prioritise. Valuations also include other unobservable inputs,

including earnings and tangible assets, which are based on historic

and forecast data and are less judgmental. For each asset category,

inputs were sensitised by a percentage deemed to reflect the

relative degree of estimation uncertainty, and valuation

calculations re-performed to identify the impact. Private equity

fund assets (unlisted Funds Pool investments) are each held in and

managed by the same type of fund vehicle, valued using the same

method of adjusted manager valuations, and subject to broadly the

same economic risks. They also comprise a diversity of sector and

geographical exposure, reducing concentration risk. They have been

sensitised at an aggregated level by 5% to reflect a degree of

uncertainty over managers' valuations which form the basis of their

fair value.

10. Share-based payments

The group operates performance share schemes and a deferred

bonus plan. Details of these schemes were disclosed in the annual

report 2023 and the basis of measuring fair value was consistent

with those disclosures.

During the six months ended 30 September 2023, awards over

192,384 shares were issued under the performance share scheme (30

September 2022: 167,633 shares and 31 March 2023: 172,802 shares).

Compulsory deferred bonus awards over 1,976 shares were also

granted (30 September 2022 and 31 March 2023: 39,500 shares).

Expenses in respect of share-based payments in the period were

GBP3.9m (30 September 2022: GBP3.1m and 31 March 2023:

GBP7.4m).

11. Asset held for sale

In September 2023, Caledonia agreed terms for the sale of a

majority stake in 7IM, a vertically integrated retail wealth

management business, to Ontario Teachers' Pension Plan Board. The

transaction is subject to change in control approval by the

Financial Conduct Authority and is expected to complete by early

2024. Cash proceeds of c.GBP255m, are expected net of transaction

expenses. The valuation at the end of September of GBP248m reflects

expected cash proceeds less a 3% discount to equity value in

recognition of the very limited degree of transaction execution

risk. To reflect this transaction, this asset was disclosed as held

for sale on the condensed group statement of financial position as

at 30 September 2023.

Glossary of terms and alternative performance measures

Alternative performance measure ("APM'")

APMs are not prescribed by accounting standards but are industry

specific performance measures which help users of the annual

accounts and financial statements to better interpret and

understand performance.

NAV Total Return ("NAVTR")

NAVTR is a measure of how the NAV per share has performed over a

period, considering both capital returns and dividends paid to

shareholders. NAVTR is calculated as the increase in NAV per share

between the beginning and end of the period, plus accretion from

the assumed dividend reinvestment in the period. We use this

measure as it enables comparisons to be drawn against an investment

index in order to benchmark performance and the calculation follows

the method prescribed by the Association of Investment Companies

('AIC').

FTSE International Limited ('FTSE') (c) FTSE 2023. 'FTSE(R)' is

a trademark of the London Stock Exchange Group companies and is

used by FTSE International Limited under licence. All rights in the

FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors.

Neither FTSE nor its licensors accept any liability for any errors

or omissions in the FTSE indices and/or FTSE ratings or underlying

data. No further distribution of FTSE Data is permitted without

FTSE's express written consent.

END

Copies of this statement are available at the company's

registered office, Cayzer House, 30 Buckingham Gate, London SW1E

6NN, United Kingdom, or from its website at www.caledonia.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIBDBGBDDGXG

(END) Dow Jones Newswires

November 21, 2023 02:00 ET (07:00 GMT)

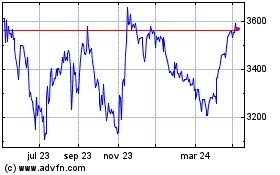

Caledonia Investments (LSE:CLDN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

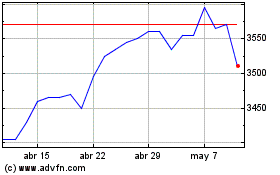

Caledonia Investments (LSE:CLDN)

Gráfica de Acción Histórica

De May 2023 a May 2024