TIDMCMET

RNS Number : 9123V

Capital Metals PLC

06 December 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

6 December 2023

Capital Metals plc

("Capital Metals" or the "Company")

Unaudited Interim Results for the Six Months Ended 30 September

2023

Capital Metals (AIM: CMET), a mineral sands company approaching

mine development stage at the high-grade Eastern Minerals Project

in Sri Lanka (the "Project"), announces its unaudited results for

the six months ended 30 September 2023 (the "Half Year").

Key Points:

During the Half Year

-- Offtake Memorandum of Understanding ("MoU") signed with LB

Group (002601:SHENZHEN; Market Cap: US$6 billion), the world's No.

1 manufacturer of high-performance titanium dioxide pigments, in

May 2023 to fund the Project into production

o 50/50 Joint Venture ("JV") - LB Group fully funds capex to

1.65Mtpa capacity estimated at US$81m; thereafter funding according

to JV interests

o LB Group guarantees 100% offtake of ilmenite and Heavy Mineral

Concentrate

o Capital Metals receives 50% of profits from start of

production (estimated 12 months after construction starts)

-- Raised gross proceeds of GBP0.86 million through a placing

and subscription for general working capital in June and July

2023

-- Greg Martyr, previously Non-Executive Chairman, appointed as

Executive Chairman in July 2023 concurrent with Michael Frayne

stepping down as CEO and director

-- Significant actions were undertaken during the Half Year to

resolve the illegal suspension of the Industrial Mining Licences

("IMLs"), including:

o Lobbying actions which likely contributed to implementation of

reforms in mineral licensing procedures

o Local legal proceedings to position the Company to uphold its

rights in-country

o Local statutory appeal proceedings to overturn the

cancellation of IMLs

o Preparation for international legal proceedings to position

the Company to prosecute its rights in international arbitration if

necessary

Post Half Year

-- Successful appeal against cancellation of IMLs in October 2023

o IMLs reinstated on 1 December 2023

-- Plans underway for commencement of construction of the Project

-- LB Group offtake MoU moving towards definitive agreement

Greg Martyr, Executive Chairman, commented:

"The illegal actions of the GSMB cost us the best part of a

year, and dilution at undesirable levels. We have come through that

experience intact and with extraordinary upside potential ahead of

us, with a market capitalisation at present of around a tenth of

the independently assessed Base Case discounted NPV of the Project*

. The discussions with LB Group continue to progress positively

towards the creation of a JV that will unlock the funding for the

total capital expenditure for the Project. With 17.2Mt of resource

at 17.6% Total Heavy Minerals, we have one of the highest-grade

heavy mineral sands projects globally, with additional upside not

yet included in the resource that we expect to define from

extensive undrilled lateral and depth extension. We have a very

exciting period ahead with mine construction planning

underway."

*Development Study and Preliminary Economic Assessment - May

2022 (see Company notification of 12 May 2022).

For further information, please contact:

Capital Metals plc Via Vigo Consulting

Greg Martyr (Executive Chairman)

Vigo Consulting (Investor Relations) +44 (0)20 7390 0234

Ben Simons / Peter Jacob capitalmetals@vigoconsulting.com

SPARK Advisory Partners (Nominated

Adviser)

Neil Baldwin / James Keeshan +44 (0)20 3368 3554

Tavira Financial

Jonathan Evans / Oliver Stansfield +44 (0)20 7100 5100

About Capital Metals

Capital Metals is a UK company listed on the London Stock

Exchange (AIM: CMET). We are developing the Eastern Minerals

Project in Sri Lanka, approximately 220km east of Colombo,

containing industrial minerals including ilmenite, rutile, zircon,

and garnet. The Project is one of the highest-grade mineral sands

projects globally, with potential for further grade and resource

expansion. In 2022, a third-party Preliminary Economic Assessment

provided a Project NPV of US$155-235m based on existing resources,

with further identified optimisation potential. We are committed to

applying modern mining practices and bringing significant positive

benefits to Sri Lanka and the local community. We expect over 300

direct new jobs to be created and over US$130m in direct government

royalties and taxes to be paid.

Visit our website:

www.capitalmetals.com

Follow us on social media:

Twitter: @MetalsCapital

LinkedIn: @Capital Metals plc

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

CHAIRMAN'S STATEMENT

Introduction

I am pleased to present the half year report for the six months

ended 30 September 2023.

This was an extraordinary period during which we had to apply

all available legal and diplomatic pressure-points to resolve the

illegal suspension of the Company's Industrial Mining Licences

("IMLs"). It was a huge achievement when on 1 December 2023 the

IMLs were reinstated following a successful statutory appeal

decision announced on 19 October 2023. To have emerged successfully

from this experience, while at the same time securing an offtake

Memorandum of Understanding ("MoU") with a global leader to fund

the Project into production, is a testament to the perseverance of

our team and the quality of our Project, and I would like to thank

all my colleagues both within and outside Sri Lanka.

Review of Activity

Activity during the Half Year was dominated by the actions to

resolve the illegal suspension of the IMLs. There were broadly

three strands to the strategy: lobbying; the preparation for breach

of international treaty proceedings; and local legal

proceedings.

Lobbying

Lobbying actions were directed towards the Sri Lankan

Government, financial stakeholders such as the International

Monetary Fund, and other diplomatic stakeholders including from the

United Kingdom and Australia, with a view to resolving our issues

amicably with the Geological Survey and Mines Bureau ("GSMB").

We believe our actions had a positive impact, with the conduct

of the chairman of the GSMB and Minister of Environment coming

under intense scrutiny. We were also pleased to note that a Sri

Lankan government cabinet paper setting out a change in mineral

licensing procedures was approved in late July 2023. Pursuant to

this new policy, the Board of Investment of Sri Lanka (the "BOI"),

the investment promotion agency with which we enjoy a constructive

relationship, will now be involved in the appraisal of and

recommendation for the approval of mineral licences. The GSMB, with

which we are also beginning to enjoy a more productive relationship

under its new leadership, will have a continuing role in managing

licences. The Company is in the final stages of establishing a BOI

company which will ultimately hold all its interests in Sri Lanka

and will be afforded the direct protections against nationalisation

under the Constitution of Sri Lanka as well as other fiscal

incentives.

International Proceedings

Preparatory work was undertaken with Boies Schiller Flexner to

pursue a claim, if necessary, against the Government of Sri Lanka

under the Bilateral Investment Treaty agreement between the

Government of the United Kingdom and Northern Ireland and the

Government of Sri Lanka for the promotion and protection of

investments. A Notice of Dispute was sent to the Attorney General

of Sri Lanka pursuant to the treaty and we are reserving our rights

in regards to pursuing this action further.

Local Proceedings

During the Half Year, the Company prepared for the first hearing

in the proceedings issued by the Company in the Court of Appeal of

the Democratic Socialist Republic of Sri Lanka which was held on 29

August 2023. While the main proceedings to overturn the

cancellation of the Company's IMLs will not be required to be

continued following the reinstatement of the IMLs on 1 December

2023, a separate further hearing to receive guidance on any

outstanding matters in connection of the Company's multiple pending

applications for additional IMLs related to the Project is due to

take place on 7 December 2023. These applications were approved by

the GSMB in 2020 and 2021 and have recently been discussed with the

GSMB at length and as a result we are confident of reinstating

these applications in the normal course of business.

Separately, the statutory appeal hearing against the

cancellation of the IMLs was prepared for and heard before the

Secretary to the Ministry of Environment (the "Secretary") on 27

September 2023. The Company's Country Manager and I, as well as our

legal counsel, made submissions in the capacity of the appellant;

while the Chairman, Director General, and other senior officers of

the GSMB and legal counsel appeared for the respondent. The

Director General of the GSMB refused to speak at the statutory

appeal hearing despite all the correspondence regarding the

temporary suspension and notice of cancellation of the IMLs coming

from him, which was noted with some concern by the Secretary.

Offtake MoU

A major achievement during the Half Year was the signing of an

MoU with LB Group (002601:SHENZHEN; Market Cap: US$6 billion), the

world's No. 1 manufacturer of high-performance titanium dioxide

pigments, in May 2023 to fund the Project into production. This MoU

was extended in August 2023 through to 31 December 2023.

Pursuant to the MoU, the parties will form a 50/50 Joint Venture

("JV"), with LB Group fully funding the estimated US$81m capex to

1.65Mtpa production capacity , and thereafter the parties

contributing funding according to their JV interests. LB Group will

guarantee 100% of the offtake of ilmenite and Heavy Mineral

Concentrate and Capital Metals will receive 50% of the profits from

the start of production (estimated 12 months after construction

starts).

The Company and LB Group are now moving towards a definitive

agreement.

Funding

During the Half Year, the Company raised gross proceeds of

GBP500,000 through a placing (the "Placing") as well as an

additional gross GBP364,705 through a subscription (the

"Subscription") for general working capital. The Placing and

Subscription were necessary to secure the Company's ability to

continue its successful actions to resolve the licence issues with

the GSMB and get Project development back on track.

Board Changes

With effect from 1 July 2023, I transitioned from Non-Executive

Chairman to Executive Chairman. I have since spent considerable

time in Sri Lanka, and connecting with stakeholders throughout the

world, lobbying and building relationships which should stand us in

good stead now we are able to get the Project back on track.

Michael Frayne stepped down as Chief Executive Officer and as a

director of the Company at the same time. The Board thanks Michael

for his contributions towards the development of the Project. With

the IML situation resolved, we are now looking to build the team

out to position us to commence construction of the Project as soon

as possible.

Post Half Year

We were encouraged by news in October 2023 that the Supreme

Court in Sri Lanka determined that a decision by the Sri Lanka

Muslim Congress to expel Naseer Ahamad from its party membership to

be legally valid. As a result of his expulsion, Mr Ahamad lost his

parliamentary seat and therefore his position as Minister of

Environment with responsibility for the GSMB. Mr Ahamad and the

Chairman of the GSMB, whom the Minister of Environment appointed to

the position, were named by the Company as respondents in the

Company's local legal proceedings. A New Minister of Environment

has been appointed. The Director General and Chairman of the GSMB

have both subsequently left office and a new Chairman and Acting

Director General were appointed at the GSMB last month, both of

whom the Company has recently met with on several occasions.

The most significant development was announced on 19 October

2023 when, having considered the written and oral submissions, the

Secretary determined that the cancellation of the IMLs was not

correct and ordered the GSMB to reissue the IMLs to the Company's

Sri Lankan subsidiary, Damsila Exports (Pvt) Limited. In his

decision, the Secretary criticised the conduct of the GSMB noting

that it had violated certain provisions within the Mines and

Minerals Act in its suspension and cancellation of the IMLs.

This cleared the path for the Company to start work towards

finalising an offtake and financing agreement with LB Group and

resuming mine construction planning - with both workstreams now in

full swing.

The IMLs were reinstated on 1 December 2023.

Outlook

The illegal actions of the GSMB cost us the best part of a year,

and dilution of shareholders at undesirable levels, given the

consequent requirement to raise equity finance during the period.

We have come through that experience intact and with extraordinary

upside potential ahead of us, with a market capitalisation at

present of around a tenth of the independently assessed Base Case

discounted NPV of the Project ( Development Study and Preliminary

Economic Assessment - May 2022). The discussions with LB Group

continue to progress positively towards the creation of a JV that

will unlock the funding for the total capital expenditure for the

Project. With 17.2Mt of resource at 17.6% Total Heavy Minerals, we

have one of the highest-grade heavy mineral sands projects

globally, with additional upside not yet included in the resource

that we expect to define from extensive undrilled lateral and depth

extension. We have a very exciting period ahead with mine

construction planning underway.

Greg Martyr

Executive Chairman

6 December 2023

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to 30 September to 30 September

2023 Unaudited 2022 Unaudited

Notes $ $

------------------------------------------ ------ ----------------- -----------------

Continuing operations

Revenue - -

Administration expenses (384,470) (382,400)

Share based payments (19,149) -

Foreign exchange (4,571) 1,681

Operating loss (408,190) (380,719)

------------------------------------------ ------ ----------------- -----------------

Finance income 558 2,531

------------------------------------------ ------ ----------------- -----------------

Loss before income tax (407,632) (378,188)

------------------------------------------ ------ ----------------- -----------------

Income tax - -

------------------------------------------ ------ ----------------- -----------------

Loss for the period (407,632) (378,188)

------------------------------------------ ------ ----------------- -----------------

Other comprehensive income

Items that may be reclassified to profit

or loss

Currency translation differences 79,989 (1,064,932)

Total comprehensive loss for the period (327,643) (1,443,120)

------------------------------------------ ------ ----------------- -----------------

Basic and diluted 5 (0.069)p (0.069)p

------------------------------------------ ------ ----------------- -----------------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at As at

30 September 31 March 30 September

2023 Unaudited 2023 Audited 2022 Unaudited

Notes $ $ $

------------------------------------- -------- ---------------- -------------- ----------------

Non-Current Assets

Property, plant and equipment 22,569 25,591 23,396

Other loans 131,730 125,371 -

Intangible assets 6 4,707,101 4,451,811 4,061,939

4,861,400 4,602,773 4,085,335

------------------------------------- -------- ---------------- -------------- ----------------

Current Assets

Trade and other receivables 109,035 40,017 61,475

Cash and cash equivalents 501,225 216,213 812,246

------------------------------------- -------- ---------------- -------------- ----------------

610,260 256,230 873,721

------------------------------------- -------- ---------------- -------------- ----------------

Total Assets 5,471,660 4,859,003 4,959,056

------------------------------------- -------- ---------------- -------------- ----------------

Non-Current Liabilities

Trade and other payables 600,000 600,000 600,000

------------------------------------- -------- ---------------- -------------- ----------------

600,000 600,000 600,000

------------------------------------- -------- ---------------- -------------- ----------------

Current Liabilities

Trade and other payables 731,180 841,891 731,711

731,180 841,891 731,711

------------------------------------- -------- ---------------- -------------- ----------------

Total Liabilities 1,331,180 1,441,891 1,331,711

------------------------------------- -------- ---------------- -------------- ----------------

Net Assets 4,140,480 3,417,112 3,627,345

------------------------------------- -------- ---------------- -------------- ----------------

Capital and Reserves Attributable

to

Equity Holders of the Company

Share capital 7 6,278,412 6,062,403 6,062,403

Share premium 7 49,767,108 48,946,676 48,946,676

Capital contribution and contingent

shares 3,218,750 3,218,750 3,218,750

Other reserves (40,046,992) (39,136,359) (39,790,729)

Retained losses (14,968,789) (15,570,928) (14,809,755)

Non-controlling interest (108,009) (103,430) -

------------------------------------- -------- ---------------- -------------- ----------------

Total Equity 4,140,480 3,417,112 3,627,345

------------------------------------- -------- ---------------- -------------- ----------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

Attributable to owners of

the Parent

------ ---------- ----------- --------------------------------------------------------- ---------------- ------------

Share Share Capital Other Retained Total Non-controlling Total

Note capital premium contribution reserves losses equity interest equity

$ $ and $ $ $ $ $

contingent

shares

$

---------- ------------ ---------------- ------------

Balance as at 1

April 2022 6,062,403 48,946,676 3,218,750 (38,725,797) (14,431,567) 5,070,465 - 5,070,465

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Loss for the period - - - - (378,188) (378,188) - (378,188)

Other comprehensive

income for the period - - - (1,064,932) - (1,064,932) - (1,064,932)

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Total comprehensive

loss for the period - - - (1,064,932) (378,188) (1,443,120) - (1,443,120)

Total - - - - - - - -

transactions

with owners,

recognised

in equity

--------------- ------ ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Balance as at 30

September 2022 6,062,403 48,946,676 3,218,750 (39,790,729) (14,809,755) 3,627,345 - 3,627,345

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Balance as at 1

April 2023 6,062,403 48,946,676 3,218,750 (39,136,359) (15,570,928) 3,520,542 (103,430) 3,417,112

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Loss for the period - - - - (407,632) (407,632) - (407,632)

Other comprehensive

loss for the period - - - 79,989 - 79,989 - 79,989

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Total comprehensive

loss for the period - - - 79,989 (407,632) (327,643) - (327,643)

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Shares issued 216,009 864,036 - - - 1,080,045 - 1,080,045

Cost of capital - (43,604) - - - (43,604) - (43,604)

Grant of options

& warrants - - - 19,149 - 19,149 - 19,149

Cancelled options - - - (1,009,771) 1,009,771 - - -

Foreign exchange

movements on NCI - - - - - - (4,579) (4,579)

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Total transactions

with owners,

recognised

in equity 216,009 820,432 - (990,622) 1,009,771 1,055,590 (4,579) 1,051,011

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

Balance as at 30

September 2023 6,278,412 49,767,108 3,218,750 (40,046,992) (14,968,789) 4,248,489 (108,009) 4,140,480

----------------------- ---------- ----------- ------------- ------------- ------------- ------------ ---------------- ------------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

6 months 6 months

to 30 September to 30 September

2023 2022 Unaudited

Notes Unaudited $

$

------------------------------------------- -------- ----------------- -----------------

Cash flows from operating activities

Loss before taxation (407,632) (378,188)

Adjustments for:

Share based payments 19,149 -

Depreciation 3,782 3,196

Interest income (470) (2,518)

(Increase) in trade and other receivables (73,063) (25,823)

(Decrease)/increase in trade and other

payables (110,713) 6,017

Foreign exchange 3,221 46,117

Net cash used in operations (565,726) (351,199)

-------------------------------------------- -------- ----------------- -----------------

Cash flows from investing activities

Purchase of property, plant and equipment (262) (3,376)

Disposal of property, plant and equipment 423 -

Exploration and evaluation activities 6 (183,438) (368,585)

Interest received 470 2,518

-------------------------------------------- -------- ----------------- -----------------

Net cash used in investing activities (182,807) (369,443)

-------------------------------------------- -------- ----------------- -----------------

Cash flows from financing activities - -

Proceeds from share issues 7 1,080,045 -

Cost of share issues 7 (43,604) -

-------------------------------------------- -------- ----------------- -----------------

Net cash generated from financing

activities 1,036,441 -

------------------------------------------- -------- ----------------- -----------------

Net increase/(decrease) in cash and

cash equivalents 287,908 (720,642)

Exchange differences on cash (2,896) (242,866)

Cash and cash equivalents at beginning

of period 216,213 1,775,754

Cash and cash equivalents at end of

period 501,225 812,246

-------------------------------------------- -------- ----------------- -----------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

Capital Metals plc is a mineral exploration company with its

shares admitted to trading on the AIM Market of the London Stock

Exchange.

The Company is domiciled in the United Kingdom and incorporated

and registered in England and Wales, with registration number

05555087. The Company's registered office is 6 Heddon Street,

London, W1B 4BT.

2. Basis of Preparation

The condensed consolidated interim financial statements have

been prepared in accordance with the requirements of the AIM Rules

for Companies. As permitted, the Company has chosen not to adopt

IAS 34 "Interim Financial Statements" in preparing this interim

financial information. The condensed interim financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 March 2023, which have been prepared in

accordance with UK adopted international accounting standards.

The interim financial information set out above does not

constitute statutory accounts within the meaning of the Companies

Act 2006. It has been prepared on a going concern basis in

accordance with the recognition and measurement criteria of UK

adopted international accounting standards.

Statutory financial statements for the year ended 31 March 2023

were approved by the Board of Directors on 14 September 2023 and

delivered to the Registrar of Companies. The report of the auditors

on those financial statements was unqualified with a material

uncertainty in relation to the Company's ability to continue as a

going concern. The condensed interim financial statements are

unaudited and have not been reviewed by the Company's auditor.

Going concern

These financial statements have been prepared on the going

concern basis. Given the Group's current cash position and its

demonstrated ability to raise capital, the Directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future. Thus,

they continue to adopt the going concern basis of accounting

preparing the condensed interim financial statements for the period

ended 30 September 2023.

Notwithstanding the above, a material uncertainty exists that

may cast significant doubt on the Group and Parent Company's

ability to continue as a going concern, due to low cash at the

period end and further funding being required to continue

activities in particular to prepare for project construction to

commence , and therefore, the Group and Parent Company may be

unable to realise their assets or settle their liabilities in the

ordinary course of business. As a result of their review, and

despite the aforementioned material uncertainty, the Directors have

confidence in the Group and Parent Company's forecasts and have a

reasonable expectation that the Group and Parent Company will

continue in operational existence for the going concern assessment

period and have therefore used the going concern basis in preparing

these consolidated and Parent Company financial statements.

The factors that were extant at 31 March 2023 are still relevant

to this report and as such reference should be made to the going

concern note and disclosures in the 2023 Annual Report and

Financial Statements ("2023 Annual Report").

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's medium

term performance and the factors that mitigate those risks have not

substantially changed from those set out in the 2023 Annual Report,

a copy of which is available on the Company's website:

www.capitalmetals.com . The key financial risks are liquidity risk,

credit risk, market risk and fair value estimation.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in Note 2 the 2023 Annual Report. The nature and amounts of

such estimates have not changed significantly during the interim

period.

3. Accounting Policies

Except as described below, the same accounting policies,

presentation and methods of computation have been followed in these

condensed interim financial statements as were applied in the

preparation of the Company's annual financial statements for the

year ended 31 March 2023.

3.1 Changes in accounting policy and disclosures

(a) New and amended standards adopted by the Group and

Company

A number of new and amended standards and interpretations issued

by the International Accounting Standards Board (IASB) have become

effective for the first time for financial periods beginning on (or

after) 1 April 2023 and have been applied by the Company and Group

in these interim financial statements. None of these new and

amended standards and interpretations had a significant effect on

the Company or Group because they are either not relevant to the

Company or Group's activities or require accounting which is

consistent with the Company or Group's current accounting policies

.

(b) New standards, amendments and Interpretations in issue but

not yet effective or not yet endorsed and not early adopted

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods and which have not been

adopted early.

4. Dividends

No dividend has been declared or paid by the Company during the

six months ended 30 September 2023 (six months ended 30 September

2022: $nil).

5. Earnings per Share

The calculation of earnings per share is based on a retained

loss of $407,632 for the six months ended 30 September 2023 ( six

months ended 30 September 2022: loss $ 378,188 ) and the weighted

average number of shares in issue in the period ended 30 September

2023 of 587,667,812 ( six months ended 30 September 2022:

545,380,934 ).

No diluted earnings per share is presented for the six months

ended 30 September 2023 or six months ended 30 September 2022 as

the effect on the exercise of share options would be to decrease

the loss per share.

6. Intangible fixed assets

The movement in capitalised exploration and evaluation costs

during the period was as follows:

Exploration & Evaluation at Cost and Net Book Value $

----------------------------------------------------- ----------

Balance as at 1 April 2023 4,451,811

Additions 183,438

Foreign exchange 71,852

As at 30 September 2023 4,707,101

----------------------------------------------------- ----------

7. Share capital and premium

Group and Company Number of shares Share capital

---------------------------- --------------------

No. Nominal GBP $

value

---------------------------- ------------ --------- ------------ -----------

Ordinary shares 277,621,598 0.0020 555,243 726,412

Deferred shares 356,277,502 0.0099 3,527,147 5,552,000

Total 633,899,100 4,082,390 6,278,412

---------------------------- ------------ --------- ------------ -----------

Number of Share

Issued at 0.02 pence per Ordinary capital Share premium Total

share shares $ $ $

---------------------------- ------------ --------- -------------- ------------

As at 31 March 2023 189,103,432 510,403 48,946,676 49,457,079

---------------------------- ------------ --------- -------------- --------------

Issue of shares 50,000,000 122,014 488,056 610,070

---------------------------- ------------ --------- -------------- --------------

Cost of capital - - (35,772) (35,772)

---------------------------- ------------ --------- -------------- --------------

Issue of shares 36,470,566 88,998 355,993 444,991

---------------------------- ------------ --------- -------------- --------------

Cost of capital - - (7,832) (7,832)

---------------------------- ------------ --------- -------------- --------------

Issue of shares 2,047,600 4,997 19,987 24,984

---------------------------- ------------ --------- -------------- --------------

As at 30 September 2023 277,621,598 726,412 49,767,108 50,493,520

---------------------------- ------------ --------- -------------- ------------

On 20 June 2023, the Company issued 50,000,000 new ordinary

shares of 0.2 pence at a price of 1p per share for gross proceeds

of GBP500,000.

On 17 July 2023, the Company issued 36,470,566 new ordinary

shares of 0.2 pence at a price of 1p per share for gross proceeds

of GBP364,705.

On 1 August 2023, the Company issued 2,047,600 ordinary shares

of 0.2 pence each at a price of 1p per share to various service

providers as consideration for services rendered.

On 1 August 2023, the Company granted 11,050,000 share options

to certain directors, employees and consultants and 1,000,000

warrants to various service providers and cancelled 8,750,000

historical share options.

Deferred Shares (nominal value of 0.0099 Number of Deferred Share capital

pence per share) shares $

-------------------------------------------- ------------------- --------------

As at 31 March 2023 356,227,502 5,552,000

-------------------------------------------- ------------------- --------------

As at 30 September 2023 356,227,502 5,552,000

-------------------------------------------- ------------------- --------------

8. Events after the balance sheet date

In October 2023 it was announced the Company had received a

favourable decision from the statutory appeal hearing against the

notice of cancellation of Industrial Mining Licences 16236 and

16237 (the "IMLs") which were issued in May 2023 by the Geological

Survey and Mines Bureau (the "GSMB"). The Statutory Appeal was

heard before the Secretary to the Ministry of Environment on 27

September 2023. Having considered the written and oral submissions,

the Secretary determined that the cancellation of the IMLs was not

correct and ordered the GSMB to reissue the IMLs to the Company's

Sri Lankan subsidiary, Damsila Exports (Pvt) Limited.

On 23 October 2023, the Company issued 1,625,000 new ordinary

shares pursuant to the exercise of 1p warrants issued in connection

with the Placing announced in June 2023.

On 1 December 2023 it was announced that the GSMB had formally

reinstated the IMLs to the Company's Sri Lankan subsidiary, Damsila

Exports (Pvt) Limited.

9. Approval of interim financial statements

The Condensed interim financial statements were approved by the

Board of Directors on 6 December 2023.

10. Availability of interim financial statements

Copies of these interim financial statements are available from

the Capital Metals website at www.capitalmetals.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFVFDLRIIV

(END) Dow Jones Newswires

December 06, 2023 08:35 ET (13:35 GMT)

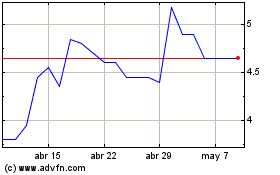

Capital Metals (LSE:CMET)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Capital Metals (LSE:CMET)

Gráfica de Acción Histórica

De May 2023 a May 2024