TIDMCMO

RNS Number : 1609Z

CMO Group PLC

12 May 2023

CMO Group Plc

("CMO" or "the Group")

Preliminary results for the year ended 31 December 2022

A year of revenue growth and company development

CMO Group Plc, the UK's largest online-only retailer of building

materials, today announces its preliminary results for the year

ended 31 December 2022.

CMO's vision is to be the retailer of choice for everyone

building or improving a house or home in the UK.

CMO is disrupting a GBP29 billion, predominantly offline, market

with a digital first proposition and market leading product choice,

supported by high quality customer service and technical

expertise.

Having grown to over 130,000 SKU's and a portfolio of specialist

SUPERSTORES, CMO has the leading product range driving organic

category authority. This, together with the unique dropship model

for delivery, is providing a different experience for its digital

native customers.

Financial and Trading Highlights

-- In a challenging year for retail, revenue increased by 9% to

GBP83.1m (2021: GBP76.3m) continuing to validate the model.

-- H2 revenue up by 9.3% to GBP42.3m (2021: GBP38.7m).

-- CMO outperformed the 6.9% increase in the builders merchant market in 2022 by 48%.

-- Online superstores LFL sales up 2% despite industry headwinds

and Total Tiles LFL contracted by -4% against a difficult

comparative.

-- Despite inflationary cost rises , gross margin maintained at

similar level to 2021, although Total Tiles margins declined due to

one off, previously reported, pricing management issue.

-- Adjusted EBITDA was GBP2.1m (2020: GBP3.7m).*

-- Operating profit of GBP0.6m 2022 (2021: GBP3.3m operating loss).

-- Adjusted earnings per share was 0.83p (2021: 2.28p).

*Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation, foreign exchange, exceptional and

acquisition costs.

Balance sheet

-- Cash on the balance sheet of GBP6.2m (2021: GBP9.1m),

reflecting GBP3m deferred consideration paid during the year for

Total Tiles.

-- The net cash position at the year-end was GBP1.4m.

-- The cash generative nature of our operations, a flexible

banking partner, and an undrawn working capital facility of up to

GBP4m, provides the Group with a sound financial position and

sufficient headroom for continued Group development.

Non-financial metrics

-- Revenue per session grew 34% Y-o-Y with over 46% of orders

from repeat customers, highlighting brand loyalty.

-- Digital marketing costs are in line with expectations at c.5% of sales.

-- Customer acquisition remains balanced between paid and non-paid digital marketing.

-- Average order value grew by 18%.

-- Marketable database grew by 13% year on year.

-- Product catalogue increased to over 130,000 SKUs.

Operational progress

-- Plumbingsuperstore.co.uk launched in 2022 to serve c.GBP1.6bn

online plumbing, heating, and bathroom market.

-- All SUPERSTORES websites rebranded and redesigned.

-- CMO Trade recently rebranded Buildingsuperstore.co.uk and in 2022 grew revenues 33%.

-- Good Build Superstore developed in 2022 and launched in H1 2023.

2023 key strategic priorities - Q1 progress

-- Margin improvement: 91 basis points (3%) Vs FY 2022

-- Carriage cost control: 55% recovery improvement.

-- Overhead efficiency: 15% reduction in headcount.

-- Modest revenue growth: trading in first quarter of 2023 in

line with management expectations. 10% down against strong 2022

comparatives and a declining market, but 41% up on 3-year LFL, and

Group growth up 88%. Growth weighted towards H2, set against

backdrop of ongoing market volatility.

-- Brand consolidation: 5 to 2 . Integration of JTM Plumbing,

Clickbasin into PLUMBING SUPERSTORE and integration of Total Tiles

into TILE SUPERSTORE.

Dean Murray, CEO of CMO Group said:

"Despite the macroeconomic challenges in 2022, CMO continued to

grow sales, while also generating more repeat sales and increased

average order values, further validating its model and continuing

to disrupt the largely traditional builders merchant market.

Our strategy remains unchanged, and we are focused on continuing

to drive profitable sales growth through our existing SUPERSTORES

and through the creation of new channels. The launch of PLUMBING

SUPERSTORES represents a significant addition to our portfolio of

SUPERSTORES and allows us this year to capitalise on our previous

acquisitions of JTM Plumbing and Clickbasin.

The new financial year has begun in line with our expectations

however the economic situation remains challenging and the timing

of recovery in consumer confidence uncertain. As we continue to

expand our SUPERSTORE portfolio and market leading product offer,

the Board is confident that its proven model will deliver value for

shareholders in the short, medium, and long term."

12 May 2023

Enquiries:

CMO Group PLC Via Instinctif

Dean Murray, CEO

Jonathan Lamb, CFO

Liberum Capital Limited (Nominated Adviser Tel: +44 20 3100 2000

& Broker)

Andrew Godber

Lauren Kettle

Instinctif Partners

Justine Warren Tel: +44 20 7457 2010

Matthew Smallwood Tel: +44 20 7457 2005

Joe Quinlan Tel: +44 20 7866 7856

Chairman's statement

2022

Despite the well-publicised challenges for businesses and

citizens alike, the CMO team has delivered another year of growth

and development. During 2022, the world has been attempting to come

to terms with new challenges, including war in Europe, dramatically

higher energy costs, surging inflation, higher interest rates and

the resultant impacts on consumer spending patterns. As we would

expect with our focus on the building trade, we have not been

completely immune to the challenges, and profitability for the year

was impacted by rising costs, particularly carriage. The closing

result, with revenue up 9% to GBP83.1m and adjusted EBITDA* down

from GBP3.7m to GBP2.1m, reflects temporary lower margins as we

came to terms with the new trading environment and isolated pricing

management issue on Total Tiles. This was consistent with the

issues many businesses faced of managing rapidly increasing product

and logistics costs, although demand remained robust.

The success in growing sales demonstrates that our business

model continues to be valid with the broadest product choice

supported by dropship direct delivery from suppliers, low digital

marketing cost, differentiated shopping experiences, and excellent

customer service. These underpin growth and continue to drive

disruption of the building materials sector which lags on

transitioning to e-commerce.

Strategy

We continue to progress our strategy to provide customers with

everything they need to build or maintain their home, or their

client's home, available through a seamless and dedicated ecommerce

experience. We will, however, approach acquisitions with caution

until consumer confidence returns.

The plan for new organic stores remains on track with the

mid-year soft launch of Plumbingsuperstore.co.uk to address the

very substantial plumbing and bathrooms market, and plans for

further stores are in progress.

To promote the Superstore story, we have united all the stores

under fresh new branding making sure the customer gets a clear,

unified experience. To support this, CMO Trade has now been

rebranded BUILDING SUPERSTORE to provide a consolidated shopping

experience for our Trade customers. In a similar vein, to support

our retail consumers, in Q2 2023 we are launching the first phase

of GoodBuilds.co.uk, a brand-new webstore dedicated to helping them

confidently manage their home improvement project, and shop in one

inspirational place.

Our vision for a better world

The Board takes its governance responsibilities very seriously,

our approach to which is set out in the Corporate Governance

section of our Annual Report. We recognise that our

responsibilities are wide ranging, and as we grow we expect to

continuously evolve and improve governance towards the best

practices required of a larger business.

The Board, alongside our wider team and other stakeholders, is

determined that the Group plays its part in addressing climate

change, not only for the intrinsic value in doing so, but also to

enjoy the benefits of being part of the solution. We wish to treat

the process with integrity and are proud of the action taken to

date. The use of science-based targets to reduce our greenhouse gas

footprint and to help our customers choose more sustainable

products is well underway.

More detail on our approach to these matters can be found in the

Environmental, Social and Governance section of our Annual Report.

The report also constitutes the Group's first instalment of

reporting under the Task Force on Climate-related Disclosures.

Senior management and team

The Board is an experienced group of people and has become

increasingly effective the longer we are together. I thank them for

their contribution, guidance, and wise counsel.

Once again, I would like to express my sincere thanks to Dean

and all at CMO for meeting the challenges of steering a newly

floated business through some of the most difficult trading

environments most of them will ever have encountered.

Outlook

At the time of writing, war in Ukraine is even more entrenched

than 12 months ago, fuel prices and inflation have been at levels

not seen for decades and consumer confidence, which saw a slight

elevation at the tail end of the year, has returned to all-time

lows. Predicting the year ahead is no easier than it was last year,

but I remain confident that the CMO team will again use its

ingenuity, agility, and clear business model to create a

sustainable and profitable, long-term future.

Ken Ford

CEO's statement

Operational update and market overview

2022 was CMO Group's first full year of trading as a public

company since its AIM IPO in July 2021. While the demand challenges

created by war in Europe and spiralling energy costs, following

almost directly on from COVID-19, were obvious to almost all

sectors, CMO's model proved its resilience and sales grew by 9%

year-on-year to GBP83.1m. As we continue to disrupt the traditional

Builders Merchant market, we have made considerable progress and

have grown market share by 64% to 1.15% against pre-pandemic levels

and enhanced the digital marketable Database by 13% during

2022.

Our sales growth is even more commendable against a market

backdrop of reported decline. Our superstores improved

like-for-like sales by 2% and JTM plumbing, our acquisition in

October 2021 in the bathroom space, also contributed to revenue

growth too in its first full year under our ownership.

Total Tiles, acquired two years ago, experienced a 4% revenue

decline year-on-year against a difficult comparative, as bricks and

mortar competitors, compromised by lockdown closures throughout

2020 and 2021, were open all year and some consumers chose to

return to physical stores. This still represented growth of 8%

versus pre-pandemic/pre-acquisition.

Gross margin was maintained at similar levels to 2021. Maturing

verticals and acquisitions drove margin improvements across most of

the Group, however, Total Tiles saw a margin decline documented

throughout H2 , triggered by issues in the management of the

complex pricing data and compounded by sharply rising fuel costs,

both in production and transport. This has now been resolved and

structural changes have been made in the management team and

processes to ensure there can be no repeat.

EBITDA adjusted for earnings before interest, tax, depreciation,

amortisation, foreign exchange, exceptional and acquisition costs,

was GBP2.1m, down 43% on the prior year.

Implementing our strategy

The CMO strategy has been successful in growing the business and

remains unchanged: to provide our customers with everything they

need to build or maintain their home, or that of their client,

through a simple, convenient, and supported shopping experience. We

recognise that our customers prefer to shop through specialist

stores offering sound advice and our strategy is to continue adding

specialist stores, either organically or through acquisition.

As outlined previously, 2022 saw the delivery and soft launch of

Plumbingsuperstore.co.uk which will list all products from the

acquisitions of JTM Plumbing, Clickbasin and new ranges. Whilst

these have historically both been stocked businesses; we will keep

the balance of trade heavily skewed towards CMO's successful

dropship model and have introduced a broad range of dropship

sanitaryware and all peripheral bathroom products into this new

store. This gives us full access to UK's c.GBP800m online bathroom

market and the similar sized first fix plumbing market. It also

gives CMO's customers a convenient way to shop both.

To support the specialist verticals, we recognise the need for

Horizontals to support trade customers and the homeowner. CMO

Trade, recently rebranded Buildingsuperstore.co.uk, was launched in

2019 and continued its impressive growth trajectory in 2022,

gaining 31% on the prior year. On track for delivery in the first

half of 2023 is our specialist Horizontal for the homeowner -

Goodbuilds.co.uk, the project-based, inspiration-rich store for the

homeowner - is progressing well and we are excited about its

prospects to enhance the homeowner experience and service. These

horizontals will complete the supported shopping experience promise

and maintain CMO's position as a major disruptor in its market.

It's vitally important that CMO's customers know exactly who

they're shopping with and can do so with confidence. Hence, we've

rebranded all stores with a strongly identifiable theme, uniting

them under one brand umbrella and a new SUPERSTORE logo. This fresh

start to a unified brand will allow effective use of higher funnel

advertising reaching out to the less digitally focused Trade

consumer.

CMO continues to pursue an active acquisition pipeline to speed

up the achievement of its strategic goal but recognises the need

for cautious cash investment until the current economic climate

improves.

People and culture

CMO is dependent upon its loyal workforce who have remained

dedicated to the growth strategy through a protracted period of

economic challenge and change. They remain agile, energetic and

have a strong belief in our ability to disrupt the market. This has

been essential over the last three years of unpredictable economic

climate.

Culture is defined and set by the people in the business through

our programme which has seen very strong participation and

brand-supporting outcomes.

Providing widespread share ownership in the Group has been an

ambition and we are pleased that all employees have the opportunity

to become shareholders through our CSOP scheme launched in

2021.

Headwinds

CMO is, of course, not immune to the general decline in consumer

confidence caused by war in Ukraine, spiralling inflation and

rising interest rates. Inevitably the cost-of-living crisis will

continue to provide challenges for all retailers and therefore we

remain cautious, yet focused, on continuing to improve choice,

drive margins, and leverage our efficient positive working capital

model. Technical agility, diversity of product offering, and the

dedicated and experienced team of people have enabled us to reach

broader customer demographics in different ways which has allowed

the business to continue to grow. The growth in the SUPERSTORES

during 2022 evidences that CMO does have a tested and proven

business model that has disrupted the traditional market.

Looking to the future

We fully recognise that homeowners and tradespeople require

differing shopping experiences, hence the decision to launch

Goodbuilds.co.uk in H1 2023. As CMO moves into more

consumer-focussed products such as tiles and bathrooms, our Good

Builds offer will support the user journey through project-based

inspiration and purchasing. A stronger social media journey,

already gaining momentum and traction, will further support the

consumer, as will the limited but strategic recruitment into

marketing of visual merchandising skills.

Our plan, which revolves around making sure our customers can

easily shop for everything they need in the way they want to shop,

remains a clear focus and we remain on track.

Throughout the last three disrupted years, our market share has

continued to increase, and we have expanded further the range of

available products to over 130,000, by far the largest range in the

industry. We remain poised to benefit from the coming generation of

tech savvy customers whose time is precious and for whom online

purchasing is the norm.

All aspects of our model; broad range supported through dropship

supplier agreements, differentiated shopping experiences, low

digital marketing spend, agile staff and tech, and great customer

service, have supported us in growing market share and further

disrupting the traditional bricks and mortar model through very

challenging times.

As we enter a new financial year, the board is confident that

CMO will deliver continued growth in the years to come.

Dean Murray

Cautionary Statement

Certain statements in this trading update are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, we can give no

assurance that these expectations will prove to have been correct.

Because these statements contain risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements. We undertake no obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Consolidated Statement of Total Comprehensive Income

FOR THE YEARED 31 DECEMBER 2022

31 Dec 31 Dec

2022 2021

GBP GBP

Revenue 83,072,635 76,339,771

Cost of sales (66,530,988) (60,996,550)

------------ ------------

Gross profit 16,541,647 15,343,221

Administrative expenses (15,913,839) (16,846,212)

Costs associated with AIM listing - (1,765,053)

------------ ------------

Operating profit/(loss) 627,808 (3,268,044)

Finance income 436 -

Finance expense (453,217) (1,153,508)

------------ ------------

Profit/(loss) before taxation 175,027 (4,421,552)

Taxation 191,951 65,600

Profit/(loss) for the year attributable to

owners of the parent 366,978 (4,355,952)

------------ ------------

Other comprehensive income for year - -

------------ ------------

Total comprehensive profit/(loss) for the

year attributable to owners of the parent 366,978 (4,355,952)

Earnings per share from continuing operations Pence Pence

attributable to owners of the parent:

Basic 0.51 (7.11)

============ ============

Diluted 0.51 (7.11)

============ ============

Adjusted basic earnings per share 0.83 2.28

============ ============

Adjusted diluted earnings per share 0.83 2.28

============ ============

Consolidated Statement of Financial Position

AS AT 31 DECEMBER 2022

31 Dec 31 Dec

2022 2021

GBP GBP

Assets

Non-current assets

Goodwill 20,445,122 19,413,122

Other intangible assets 2,967,848 2,691,735

Property, plant, and equipment 1,451,461 1,580,744

Right-of-use-assets 119,490 337,390

Deferred tax assets 324,449 128,860

Total non-current assets 25,308,370 24,151,851

------------ ------------

Current assets

Inventories 5,454,126 5,474,054

Trade and other receivables 2,731,988 2,942,236

Cash and cash equivalents 6,209,910 9,075,944

------------ ------------

Total current assets 14,396,024 17,492,234

------------ ------------

Total assets 39,704,394 41,644,085

------------ ------------

Liabilities

Current liabilities

Trade and other payables (16,325,520) (19,895,920)

Loans and borrowings (859) (2,839)

Lease liabilities (210,140) (311,192)

Current tax liabilities (253,579) (159,735)

------------ ------------

Total current liabilities (16,790,098) (20,369,686)

------------ ------------

Non-current liabilities

Loans and borrowings (4,787,678) (3,088,142)

Lease liabilities - (140,499)

------------ ------------

Total non-current liabilities (4,787,678) (3,228,641)

------------ ------------

Total liabilities (21,577,776) (23,598,327)

------------ ------------

Net assets 18,126,618 18,045,758

------------ ------------

Equity

Share capital 719,697 719,697

Share premium 25,873,451 25,873,451

Merger reserve (513,000) (513,000)

Share option reserve 133,630 419,748

Retained deficit (8,087,160) (8,454,138)

Total equity attributable to owners of the

parent 18,126,618 18,045,758

============ ============

Consolidated Statement of Changes in Equity

FOR THE YEARED 31 DECEMBER 2022

Notes Share Share Merger Reserve Share Option Retained Total

Capital Premium Reserve Deficit

GBP GBP GBP GBP GBP GBP

As at 1 January 2021 101 - - - (5,415,419) (5,415,318)

--------- ----------- --------------- ------------- ------------ ------------

Loss for the year - - - - (4,355,952) (4,355,952)

Total comprehensive loss for the

year - - - - (4,355,952) (4,355,952)

Transactions with owners

Issue of shares 719,596 25,873,451 - - - 26,593,047

Creation of merger reserve - - (513,000) - - (513,000)

Transfer to/ from profit and loss

account - - - (1,317,233) 1,317,233 -

Transfer to/ from share option

reserve - - - 1,736,981 - 1,736,981

Total transactions with owners 719,596 25,873,451 (513,000) 419,748 1,317,233 27,817,028

--------- ----------- --------------- ------------- ------------ ------------

As at 31 December 2021 719,697 25,873,451 (513,000) 419,748 (8,454,138) 18,045,758

========= =========== =============== ============= ============ ============

As at 1 January 2022 719,697 25,873,451 (513,000) 419,748 (8,454,138) 18,045,758

--------- ----------- --------------- ------------- ------------ ------------

Profit for the year - - - - 366,978 366,978

--------- ----------- --------------- ------------- ------------ ------------

Total comprehensive loss for the

year - - - - 366,978 366,978

--------- ----------- --------------- ------------- ------------ ------------

Transactions with owners

Share-based payment adjustments - - - (286,118) - (286,118)

--------- ----------- --------------- ------------- ------------ ------------

(286,118) - (286,118)

--------- ----------- --------------- ------------- ------------ ------------

As at 31 December 2022 719,697 25,873,451 (513,000) 133,630 (8,087,160) 18,126,618

========= =========== =============== ============= ============ ============

Consolidated Statement of Cash Flow

FOR THE YEARED 31 DECEMBER 2022

31 Dec 31 Dec

2022 2021

GBP GBP

Cash flows from operating activities 2,443,251 (1,857,167)

Investing activities

Payments to acquire intangible fixed assets (1,277,763) (603,385)

Payments to acquire tangible fixed assets (68,893) (90,871)

Cash outflow on business combination (4,661,217) (2,186,810)

Net cash used in investing activities (6,007,873) (2,881,066)

----------- ------------

Financing activities

Receipts from issue of shares - 26,179,897

Receipts from borrowings draw downs 1,699,536 3,088,142

Repayment of borrowings - (3,230,533)

Repayment of shareholder loans - (17,747,577)

Repayment of lease liabilities (547,731) (340,999)

Interest paid on lease liabilities (66,062) -

Interest paid (387,155) (185,147)

Net cash generated from financing activities 698,588 7,763,783

----------- ------------

Net (decrease)/ increase in cash and cash

equivalents (2,866,034) 3,025,550

Cash and cash equivalents at beginning of

year 9,075,944 6,050,394

Cash and cash equivalents at end of year 6,209,910 9,075,944

=========== ============

Notes to the Financial Statements

Year Ended 31 December 2022

1. Summary of significant accounting policies

a. General information and basis of preparation of the financial statements

CMO Group Plc is a public company limited by shares incorporated

in the United Kingdom and registered in England and Wales.

CMO Group Plc was incorporated on 11 June 2021 and began trading

on 23 June 2021. The period to 31 December 2022 is the second

period of accounts for the Company.

The principal activity of the group is the provision of

construction materials through the group's websites, with a

digital-first proposition and market-leading product choice,

supported by high-quality customer service and technical

expertise.

The financial statements are presented in pound sterling which

is the functional currency of the group. Monetary amounts in the

financial statements are rounded to the nearest GBP1.

b. Basis of preparation

The financial information contained within this preliminary

announcement for the years to 31 December 2022 and 31 December 2021

does not comprise statutory financial statements within the meaning

of section 435 of the Companies Act 2006. The financial statements

for the year ended 31 December 2021 have been delivered to the

Registrar of Companies and those for the year ended 31 December

2022 will be delivered following the Company's Annual General

Meeting. The auditors have reported on the 2021 and 2022 financial

statements; their reports were unqualified, did not included a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying the report and did not contain a

statement under Section 498 (2) or (3) of the Companies Act

2006.

The preliminary announcement has been prepared in accordance

with UK-adopted International Financial Reporting Standards

("IFRS") including standards and interpretations issued by the

International Accounting Standards Board. Whilst the financial

information included in this preliminary announcement has been

prepared in accordance with IFRS, this announcement does not itself

contain sufficient information to comply with IFRS.

The consolidated and Company financial statements have been

prepared on a going concern basis. The Group generated adjusted

EBITDA before exceptional costs of GBP2.3m for the year compared to

GBP3.7m in 2021 with a profit for the year of GBP0.4m compared to a

loss of GBP4.4m in 2021. The Group has net current liabilities of

GBP2,644,744 (2021: GBP2,877,452) at the year end, however this was

expected by the directors whilst the Group continues to reinvest in

growth. The secured rolling cashflow facility to support future

growth plans provides headroom to ensure that there are sufficient

cash resources to enable the Group to meet all liabilities as they

fall due. The Group has revolving credit facilities with Clydesdale

Bank plc totalling GBP10,000,000 of which GBP6,000,000 can be used

for financing permitted acquisitions and GBP4,000,000 can be used

for working capital. The carrying amount at the year-end is

GBP4,787,678.

The directors are continuing to identify acquisitions as well as

focussing on the continuation of the organic growth experienced in

recent years. New acquisitions have been brought onto the Group's

platforms and significant synergies are expected to be achieved

over the coming year from the recent acquisitions. The directors

expect continued growth in gross profits and operating profits in

2023.

The directors are confident that the measures they have

available will result in sufficient working capital and cash flows

to continue in operational existence. Taking these matters in

consideration, the Directors continue to adopt the going concern

basis of accounting in the preparation of the financial

statements.

2. Profit for the year

Profit/(loss) for the year has been arrived at after charging

(crediting):

31 Dec 31 Dec

2022 2021

GBP GBP

Depreciation of owned property, plant and equipment,

and other leases 206,978 474,649

Depreciation of leased property, plant, and

equipment - 8,871

Depreciation expense on right-of-use assets 512,080 245,499

Amortisation of intangible assets 1,088,650 698,161

Acquisition and other costs 156,349 635,741

(Gain)/expense on share-based payment (286,118) 419,748

Wages and salaries 6,435,439 5,431,846

Social security 640,123 512,484

Cost of defined contribution scheme 132,450 144,905

Costs associated with AIM listing - 1,765,053

Exceptional payroll costs 73,586 2,938,374

Costs associated with AIM listing include consultancy, legal and

professional fees incurred in relation to the listing of CMO Group

PLC on 8 July 2021.

3. Cash and Cash equivalents

For the purposes of the statement of cash flows, cash, and cash

equivalents include cash on hand and in banks and investments in

money market instruments. Cash and cash equivalents at the end of

the financial year as shown in the statement of cash flows can be

reconciled to the related items in the statement of financial

position as follows:

Group Company

31 Dec 31 Dec 31 Dec 31 Dec

2022 2021 2022 2021

GBP GBP GBP GBP

Cash and bank balances 6,209,910 9,075,944 91,308 57,192

========== ========== ======= =======

4. Loans Borrowings and Other Payables

Group Company

31 Dec 31 Dec 31 Dec 31 Dec

2022 2021 2022 2021

GBP GBP GBP GBP

Non - current

Bank borrowings 4,787,678 3,088,142 4,787,678 3,088,142

4,787,678 3,088,142 4,787,678 3,088,142

========== ========== ============ ============

Group Company

31 Dec 31 Dec 31 Dec 31 Dec

2022 2021 2022 2021

GBP GBP GBP GBP

Current

Hire purchase contracts 859 2,839 - -

859 2,839 - -

========== =========== ============ ========

The directors consider the value of all financial liabilities to

be equivalent to their fair value. The Group's exposure to

liquidity and cash flow risk in respect of loans and borrowings is

disclosed in the financial risk management and impairment note.

5. Share Capital

31 Dec 2022 31 Dec 2021

No. GBP No. GBP

Ordinary shares of GBP0.01 each 71,969,697 719,697 71,969,697 719,697

=========== ======== =========== ========

There were no share issues in the year ended 31 December 2022.

During the year ended 31 December 2021 the following shares were

issued:

Date Class No GBP

11 June 2021 Ordinary shares of GBP0.01 5,000,000 50,000

01 July 2021 Ordinary shares of GBP0.01 46,310,056 463,101

08 July 2021 Ordinary shares of GBP0.01 20,659,641 206,596

----------- --------

71,969,697 719,697

Shares issued on 11 June 2021 and 1 July 2021 were issued as

part of a shares for share exchange with the shareholders of

CMOStores Group Limited. GBP1.32 per share was paid for shares

issued on 8 July 2021. All other issues were at par value.

6. Earnings Per Share

The calculation of the basic and diluted earnings per share is

based on the following:

31 Dec 31 Dec

2022 2021

Earnings GBP GBP

Net profit/(loss) attributable to equity

holders of the parent for the purpose of

basic earnings per share calculation 366,978 (4,355,952)

Effect of dilutive potential ordinary shares - -

------- -----------

Earnings for the purposes of diluted earnings

per share 366,978 (4,355,952)

Add back: Exceptional payroll and other expenses 104,117 2,938,374

Add back: Costs associated with AIM listing - 1,765,053

Add back: Costs incurred directly related

to acquisitions and share option expenses 125,818 1,048,550

Adjusted earnings 596,913 1,396,025

======= ===========

31 Dec 31 Dec

2022 2021

Number of shares

Weighted average number of ordinary shares

for the purposes of basic earnings per share 71,969,697 61,271,965

Effect of dilutive potential ordinary shares 216,970 -

---------- ----------

Weighted average number of ordinary shares

for the purposes of diluted earnings per

share 72,186,667 61,271,965

========== ==========

7. Business Combinations

Acquisition completed in current year

On 6 June 2022, the Group acquired 100% of the equity

instruments of Whiteholme Limited, a UK based business, thereby

obtaining control. For the period to 31 December 2022, Whiteholme

Limited, generated revenue of GBP614,466 and profit after tax of

GBP31,531, these results were accounted for in accordance with

FRS102. These results were reviewed under IFRS convergence, and no

material differences identified. Had Whiteholme Limited been

consolidated from 1 January 2022, the consolidated statement of

comprehensive income would have included revenue of GBP1,205,285

and profit of GBP66,776.

Fair value adjustment on transition to

IFRS

Asset carrying value GBP

GBP Fair value

GBP

------------------------ --------------------------------------- ------------

Identifiable intangible assets - 87,000 87,000

Property, plant and equipment 9,632 - 9,632

Inventories 43,665 - 43,665

Trade and other receivables 1,243,812 - 1,243,812

Cash and cash equivalents 223,388 - 223,388

Trade and other payables (225,548) - (225,548)

Total fair value 1,294,949 87,000 1,381,949

------------------------ --------------------------------------- ------------

Consideration settled in cash - - 2,235,407

Fair value of deferred consideration - - 178,542

Goodwill - - 1,032,000

======================== ======================================= ============

Consideration transferred

The purchase agreement included a payment on completion and an

element of deferred consideration based on both a target net asset

value. The agreement includes an adjustment to the deferred

consideration calculated based upon the net current assets of

Whiteholme Limited at 1 June 2022. The deferred consideration is

payable on agreement of the new asset position as set out in the

draft accounts for Whiteholme for the period to 1 June 2022.

8. Changes in liabilities arising from financing activities

At January Financing cash At December

2022 flows Interest New leases 2022

GBP GBP GBP GBP Reclass GBP GBP

------------ ---------------- ----------- ----------- ------------- ------------

Long-term borrowings 3,088,142 1,312,381 387,155 - - 4,787,678

Short-term - - - - - -

borrowings

Other lease liabilities 2,839 (1,980) - - - 859

Lease liabilities 451,691 (613,793) 66,062 306,180 - 210,140

Total liabilities from

financing activities 3,542,672 696,608 453,217 306,180 - 4,998,677

------------ ------------ --------------- ----------- ------------- ------------

Financing cash At December

At January 2021 flows Interest New leases 2021

GBP GBP GBP GBP Reclass GBP GBP

---------------- ---------------- ----------- ----------- -------------- ----------------

Long-term

borrowings 20,080,008 (18,075,114) 1,083,248 - - 3,088,142

Short-term

borrowings 390,400 (390,400) - - - -

Lease liabilities 4,159 (1,320) - - - 2,839

Right-of-use asset

liabilities 734,591 (340,999) 58,099 - - 451,691

Total liabilities

from financing

activities 21,209,158 (18,807,833) 1,141,347 - - 3,542,672

---------------- ---------------- ----------- ----------- -------------- ----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKDBPPBKDFPD

(END) Dow Jones Newswires

May 12, 2023 02:00 ET (06:00 GMT)

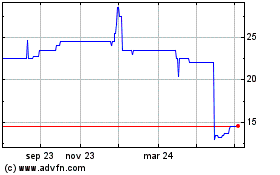

Cmo (LSE:CMO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Cmo (LSE:CMO)

Gráfica de Acción Histórica

De May 2023 a May 2024