TIDMCMO

RNS Number : 0775O

CMO Group PLC

29 September 2023

CMO Group PLC

Interim Results for the period ended 30 June 2023

Progress on key strategic priorities and Improvement in

trading

CMO Group PLC ("CMO" or the "Group"), the UK's largest

online-only retailer of building materials, today announces its

interim results for the half year to 30 June 2023.

H2 summary

Over the past six months, in line with its strategic priorities,

CMO has delivered improvement in product margins, carriage costs

and overhead efficiencies, and has thus adapted well to less

favourable market conditions.

We are pleased to report an improving sales trend in the

SUPERSTORES, but the online TILES market remains extremely

challenging with YTD volumes having experienced a c. 33% decline

(source: GFK).

The Group's trading position is improving on a like-for-like

basis with the SUPERSTORES growing market share in Q2, a position

which appears to be further improving as we move into Q3.

Strategic highlights

We are pleased to report success in the delivery of our

previously documented key strategic priorities:

-- Improvement in product margins*: Gross product margins

excluding carriage have moved upwards in the first six months and

improved by 1.9 percentage points compared to full-year 2022.

-- Carriage Cost Control: Carriage margin loss has decreased

from 67% H1 2022 to 29% H1 2023, an improvement of 56%.

-- Overhead Efficiency: Overheads have reduced 18% in accordance

with plan, including the headcount reductions announced for the

first quarter.

-- Brand Consolidation: JTM has been migrated into PLUMBING

SUPERSTORE and the integration of TOTAL TILES into TILE SUPERSTORE

is progressing.

*Excludes carriage

Financial highlights H1

-- Total sales of GBP36.9m (2022: GBP41.9m), 57% up on a four-year view.

-- Adjusted EBITDA** was GBP0.6m (2022: GBP1.3m).

-- Operating Loss of (GBP0.5m) (2022: profit GBP0.5m).

-- Basic earnings per share of (0.87p) (2022: 0.33p).

-- Net cash at the end of the period of GBP1.0m.

** Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share option expense, acquisition costs

and exceptional items and stated on an IFRS basis.

Operational KPIs H1

-- Cost of digital marketing in line with expectations at 6%.

-- Customer acquisition remains balanced at 24% paid to 76% non-paid channels.

-- Revenue per session up 16% YTD.

-- Repeat customers up 20% YoY.

-- Marketable database has grown 14% YoY.

Current trading and outlook

The Group has delivered positive performance during H1 against

its strategic key priorities aimed at driving profitable sales

growth for the future. Like-for-likes indicate that we are now

outperforming the market with a more encouraging trend in the

SUPERSTORES. We expect this improving sales trend to continue into

Q4. However, we are not immune to market conditions. Volumes in the

building materials market are down by 14% in the first 7 months of

this year (Source: GFK) and forecasts for 2023 from the

Construction Products Association, published in July, report a

reduction of 19% in newbuild housing and 11% in private

housing.

Since our last market update, consumer confidence has continued

to erode with increasing interest rates and persistent high levels

of inflation. This has meant that whilst we are seeing an improving

sales trend the rate of improvement is being slowed by reduced

market demand. This is particularly evident in direct-to-consumer

products like tiles. We anticipate that this slower rate of

improvement will continue, and the Board expects the Group to

deliver full year revenues of approximately GBP73m together with

Adjusted EBITDA for H2 of approximately GBP1m.

We continue to maintain a strong focus on cash with net debt at

the end of Sept. of c. GBP1.2m which is expected to be maintained

at the year-end. We maintain a sound financial position with an

undrawn working capital facility of up to GBP4m and flexible

banking partner expected to provide sufficient headroom for

continued Group development.

The Board expects that the actions taken to increase margins,

reduce costs and invest in enhanced digital marketing will maintain

the improving sales trend and deliver profitable sales growth going

forward.

Dean Murray, CEO of CMO Group PLC, said:

"Like many others in our industry, our experience of this period

has not been easy, especially with the tile market rebalancing

online versus in-person. We are however, seeing an improving trend

in our SUPERSTORES endorsing again our business model and strategy.

In the midst of difficulty lies opportunity and we have embraced

our opportunity wholeheartedly, improving margins, reducing costs

and working towards the next organic vertical launch. Consequently,

we are a better business and in good shape to go forward. We remain

confident in our model and in our strategy to take the business

forward and to deliver profitable progress."

29 September 2023

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act

2018.

Enquiries:

CMO Group PLC Via Instinctif

Dean Murray, CEO

Jonathan Lamb, CFO

Liberum Capital Limited (Nominated Tel: +44 20 3100 2000

Adviser & Broker)

Andrew Godber

Lauren Kettle

Cara Murphy

Instinctif Partners (Financial PR) Tel: +44 20 7457 2020

Justine Warren

Matthew Smallwood

Joe Quinlan

Half Year Trading Update (unaudited)

As reported in the July half-year trading update, we expected

the economic situation to remain challenging during 2023,

particularly with rises in interest rates seriously impacting the

construction industry and disposable incomes. Focus has therefore

been on the controllable elements of our business: product margin,

carriage costs, overhead efficiencies and improved customer

experience to promote profitable revenue growth. We are pleased to

report that considerable progress has been made on these strategic

priorities.

Sales

Against a challenging economic backdrop, sales were down 12% H1

2023 on H1 2022, but have increased 57% since 2019. Whilst this is

largely demand related, we have resisted competing in spaces where

it is not profitable to do so and have taken conscious decisions

which we recognised wouldcompromise sales in the short-term such as

the migration of JTM onto Plumbing Superstore. Despite this, we

have seen an improving sales trend following a difficult Q1.

The recent market for tiles has been particularly weak

(estimated down c. 23%) and the online market further impacted by

the return of customers to store (online estimated down c. 33%).

Total Tiles is trading approximately in line with the market which

means that, of the Group's H1 reduction in like-for-like sales,

Total Tiles accounts for 38% of the deficit while accounting for

only 17% of total reported sales.

We have taken significant steps to improve performance at Total

Tiles including changing the management team, investing in trend

data to assist with enhanced product selection and listing,

introducing a more consumer-focused journey with superior visual

assets, rebranding the site, and investing in the Ipswich tile

showroom to promote our hybrid model.

Conversely, the SUPERSTORES remain resilient and are seeing an

improving sales trend as we enter H2. The table below illustrates

how trading performance has changed during the year.

QTR 1 QTR 2 JUL and AUG

SUPERSTORES -10% -11% -5%

------ ------ ------------

TILES -20% -27% -37%

------ ------ ------------

Cost and Margin

In common with other operators, we experienced cost increases

across all major cost lines in H1 but are now starting to see some

of these moderate. Pricing and supplier negotiation have been a

strategic priority, and we are pleased to report that product

margins excluding carriage have improved by 1.9% compared to FY

2022.

Modestly increasing carriage charges to customers and

negotiation of better carriage supplier rates has delivered a

reduction in the carriage loss in H1 2022 of 67% to 29% in H1 2023,

a 56% improvement.

Direct labour costs have been closely matched to demand with

some redundancies necessary, and we have a continuous focus on

efficiency.

As detailed in the bridges below (Financial Review), delivery

against these strategic priorities gained momentum in Q2 favourably

changing the P&L dynamics, a change which we will clearly seek

to maintain in H2.

Operational KPIs, Customer and Brand

In H1 we continued to experience underlying robustness in our

Trade customer with improvement in our operational KPIs including

16% growth in revenue-per-session, the number of repeat customers

up 20%, and opt-ins to the marketable database up 14% YOY. Our

customer acquisition remains balanced between paid and non-paid

channels at 24% to 76%, and the digital cost of marketing was 6%

for the half year following a similar profile to H1 2022, albeit

slightly higher, due to volatility in the Tiles market.

We have made further progress since July in our program to

integrate JTM plumbing into PLUMBING SUPERSTORE. This is now

completed with commensurate synergies and savings that will be of

benefit going forward. The integration of Total Tiles into TILE

SUPERSTORE is also progressing.

Since migrating CMO Trade to BUILDING SUPERSTORE, prompted brand

awareness has risen 100% to 22% (Source: FIX Media).

Financial Review

Total revenue for the six months ended 30 June 2023 was GBP36.9m

(2022: GBP41.9m). Although largely the result of reduced market

demand, this 12% decline was partially an expected consequence of

adherence to the four key strategic priorities outlined in our

earlier Half Year Trading Update:

-- Margin growth.

-- Stronger carriage recovery.

-- Overhead cost reduction including brand consolidation.

-- Improving sales trend.

A successful concentration on delivering profitable business

through margin growth and carriage recovery has inevitably led to a

reduction in volume as we refuse to participate in the "race to

zero" pricing that has been detrimental to certain competitors. A

tightening of credit insurance on some trade customers has also

been a challenge to sales growth. Having said that, H1 is still up

15% like-for-like on pre-Covid levels and the Group is up 57% on a

four-year view.

Product margin has increased 1.9% compared to full year 2022 and

a 55% reduction in net carriage costs. The majority of these

benefits have come in the second quarter of the year as actions to

drive the key strategic initiatives have gained momentum. This can

be seen in the bridges shown below, with Q1 2022 - 2023 data (top

graph) shown on the left and Q2 on the right (bottom graph).

A Q1 reduction in sales of 10% against challenging comparatives

(Q1 2022 delivered 38% of 2022 EBITDA) manifested in a volume

driven margin reduction over Q1 2022 of GBP450k. Margin

improvements driven by better pricing and purchase costs recovered

GBP72k of this and variable marketing spend a further GBP12k, but

the Q1 execution of a redundancy programme alongside increased

infrastructure spend due largely to acquisitions, led to an overall

EBITDA reduction in Q1 of GBP585k.

The picture in Q2 was much improved. Continued trading pressures

delivered a volume related margin reduction of GBP525k, but this

was more than offset by margin enhancement, carriage and redundancy

initiatives really taking hold and leading to an increase in EBITDA

in Q2 of GBP176k. Overheads remain higher than the prior year, due

to inflationary pressures and costs in the acquired businesses.

The net effect is total EBITDA for H1 2023 of GBP0.6m (H1 2022:

GBP1.2m), 68% of which was delivered in Q2.

To understand performance, it is prudent to break out Total

Tiles. The UK tile market has dropped in volume terms an estimated

20% year-on-year and an estimated 33% online (source: GFK). Total

Tiles has performed in line with this somewhat dramatic market

decline and is the primary driver of the overall decline at Group

level. Performance in the SUPERSTORES, which represented 83% of

total sales, accounted for 31% of the decline in EBITDA excluding

Group costs while Total Tiles, at 17% of total sales, accounted for

69%.

Movements on prior year

---------------------------------------------------------------------------------

%age

Direct Other %age of of EBITDA

Sales Margin marketing cost EBITDA total sales decline

------------- ----- ------ ---------- ----- ------ ------------ ----------

GBPm GBPm GBPm GBPm GBPm

------------- ----- ------ ---------- ----- ------ ------------ ----------

Superstores -3.08 0.38 -0.09 -0.51 -0.22 83% 31%

------------- ----- ------ ---------- ----- ------ ------------ ----------

Total

Tiles -1.92 -0.77 0.00 0.27 -0.50 17% 69%

------------- ----- ------ ---------- ----- ------ ------------ ----------

Total

delta exc

Group costs -5.00 -0.39 -0.09 -0.24 -0.72 100% 100%

EBITDA Q2

EBITDA Q1 2022 780 2022 241

Sales (450) Sales (525)

Margin 72 Margin 708

Variable marketing Variable marketing

costs 12 costs 28

Wages (130) Wages 152

Overheads (89) Overheads (188)

EBITDA Q2

EBITDA Q1 2023 195 2023 417

==================== ====== =================== ======

Operating loss for the period to June 2023 was GBP0.5m, compared

to a GBP0.5m profit to June 2022. Exceptional costs for the period

were GBP0.1m (2022: GBP0.1m) principally relating to redundancy

costs and acquisition integration. Amortisation and depreciation

cost increases reflect acquisitions, platform investment and

right-of-use asset costs increases. The latter will reduce moving

forward as space costs are reduced.

The detailed profit and loss account is set out below:

Consolidated Income Statement for the Period Ended 30 June

2023

Half Half

year year Year

ended ended ended

30-Jun-23 30-Jun-22 31-Dec-22

GBP000 GBP000 GBP000

Revenue 36,878 41,869 83,073

Cost of sales (28,828) (33,380) (66,531)

GROSS PROFIT 8,050 8,489 16,542

Administrative expenses (8,418) (7,895) (15,684)

Exceptional administrative

expenses (133) (90) (230)

Cost associated with

AIM listing

---------- ---------- ----------

OPERATING (LOSS) /

PROFIT (501) 503 628

Finance income 1 0

Finance costs (263) (146) (453)

NET FINANCE COST (262) (146) (453)

(LOSS) /PROFIT BEFORE

TAX (763) 358 175

Income tax expense 136 (122) 192

(LOSS) / PROFIT FOR THE

PERIOD (628) 236 367

Other comprehensive

income 0 0 0

TOTAL COMPREHENSIVE

INCOME (627) 236 367

========== ========== ==========

Basic earnings per

share -0.87 0.33 0.51

Diluted earnings per

share -0.87 0.33 0.51

Adjusted Basic earnings

per share -0.69 0.45 0.83

Adjusted diluted earnings

per share -0.69 0.45 0.83

Consolidated statement of financial position

As at 30 June 2023

6 months 6 months Year

ending ending ended

30-Jun-23 30-Jun-22 31-Dec-22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Assets

Current assets

Inventories 5,385 7,137 5,454

Trade and other receivables 2,659 2,593 2,732

Cash and cash equivalents 4,669 7,285 6,210

Total Current Assets 12,713 17,015 14,396

----------- ----------- -----------

Non-current assets

Property plant and equipment 1,444 1,534 1,451

Right of use assets 1,182 208 119

Goodwill 20,481 20,367 20,445

Other Intangible assets 2,857 2,917 2,968

Deferred tax assets 460 37 324

Total Non-current assets 26,424 25,063 25,308

----------- ----------- -----------

Total Assets 39,137 42,078 39,704

----------- ----------- -----------

Liabilities

Current liabilities

Trade and other payables (16,540) (18,714) (16,579)

Loans and borrowings (1) (3) (1)

Lease liabilities (585) (172) (210)

Current tax liabilities (56) (196) 0

Current tax liabilities (17,182) (19,084) (16,790)

----------- ----------- -----------

Non-current liabilities

Loans and borrowings (3,688) (4,572) (4,788)

Lease liabilities (621) (140) 0

Total non-current liabilities (4,309) (4,712) (4,788)

----------- ----------- -----------

Total liabilities (21,491) (23,796) (21,578)

----------- ----------- -----------

Net assets / (liabilities) 17,646 18,282 18,127

----------- ----------- -----------

Consolidated Cash Flow Statement

6 months 6 months Year

ending ending ended

30-Jun-23 30-Jun-22 31-Dec-22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Cash flow from operating activities

Loss for the year (627) 236 367

SBP credit 0 0 (286)

Finance income 1 0 0

Finance costs 263 146 453

Corporation tax (136) 122 (130)

Operating profit / loss (501) 504 403

----------- ----------- -----------

Depreciation 409 250 719

Amortisation 573 411 1,089

(Increase)/Decrease in inventories 69 (1663) 20

(Increase)/Decrease in trade and

other receivables 73 350 (102)

(Increase)/Decrease in trade and

other payables 988 2,236 315

Net cash flow from operating activities 1,611 2,087 2,443

----------- ----------- -----------

Cash flow from investing activities

Payments to acquire intangible fixed

assets (472) (636) (1,278)

Payments to acquire tangible fixed

assets (43) (74) (69)

Deferred consideration paid 0 (3,415) 0

Cash outflow on business combinations (1,000) (790) (4,661)

Net cash flow from investing activities (1,515) (4,915) (6,008)

Cash flow from financing activities

Proceeds from other borrowing draw

downs (1,100) 1,484 1,700

Tax paid 0 (130) 0

Repayment of lease liabilities (274) (171) (548)

Interest paid on lease liability (23) 0 (66)

Interest paid (239) (146) (387)

Net cash flow from financing activities (1,637) 1,037 699

Net increase / (decrease) in cash

and cash equivalents (1,541) (1,791) (2,866)

Cash and cash equivalents at beginning

of period 6,210 9,076 9,076

Cash and cash equivalents at end

of period 4,669 7,285 6,210

----------- ----------- -----------

Stock levels at the half year have fallen by GBP1.8m compared to

June 2022, when stock weeks were selectively extended to secure

availability, reduce lead times, and maximise margins at a time of

continuously rising prices. H1 2023 stock levels remain in line

with 2022 year-end.

Trade and other receivables are in line with 2022. A reduction

in trade debtors due to the reduced availability of trade credit

insurance on certain customers and reduced order volumes as a

consequence is offset by an increase in prepayments.

Trade and other creditors have decreased by GBP2.2m, caused

primarily by a deferred consideration payment of GBP1m to JTM and

volume-related reductions in trade creditors and customer deposits,

which have been temporarily offset by GBP0.9m of VAT withheld at

the request of HMRC as it works to bring the Group under a single

VAT registration.

These movements, alongside an increase of GBP1m in right-of-use

assets and a GBP0.5m increase in lease liabilities both related to

the 5-year lease renewal of the leasehold premises at Plymouth and

extension at Ipswich and GBP0.9m reduction in the RCF drawn balance

have reduced reported cash by GBP2.6m to GBP4.7m.

Drawn facilities of GBP3.7m (2022: GBP4.6m) leave net cash of

GBP1m at the period end (2022: GBP1.4m) We continue to maintain a

strong focus on cash with net debt at the end of Sept. of c.

GBP1.2m which is expected to be maintained at the year-end. We

maintain a sound financial position with an undrawn working capital

facility of up to GBP4m and flexible banking partner expected to

provide sufficient headroom for continued Group development.

Opening net cash 1,422

Operating profit 480

Working capital 1,130

CAPEX (515)

Deferred consideration (1,000)

Lease and interest

cost (537)

Closing net cash 981

======================== ========

Financing

The Group has banking facilities with Clydesdale Bank through to

2027. The facilities comprise an amortising revolving credit

facilities of GBP5.75m at June 2023 and an undrawn working capital

facility of up to GBP4m.

1. General Information

CMO Group PLC ('the Company' or 'the Group') is a public company

limited by shares, incorporated in the United Kingdom under the

Companies Act 2006 (registration number 13451589) and registered in

England and Wales. The registered office address is Burrington

Business Park, Burrington Way, Plymouth, PL5 3LX.

Copies of this interim report may be obtained from the

registered address or from the investors section of the company's

website at cmogroup.com.

2. Basis of Preparation

These consolidated interim financial statements of the group of

for the six months ended 30 June 2023 were approved by the Board of

Directors on 28 September 2023.

They do not include all of the information required for a

complete set of IFRS financial statements and should be read in

conjunction with the Group's last annual consolidated financial

statements for the year ended 31 December 2022. However, selected

explanatory notes are included to explain events and transactions

that are significant to understanding changes in the Group's

financial position and performance since the last annual financial

statements.

The Annual Report and Accounts for the year ended 31 December

2022 was audited and has been filed with the Registrar of

Companies. The independent auditors report on the annual report and

accounts for the year ended 31 December 2022 was not qualified and

did not contain statements under Section 498 of the Companies Act

2006.

The financial information for the six months ended 30 June 2023

and 30 June 2022 is unaudited and has not been reviewed by the

Company's auditors.

The condensed consolidated interim financial statements for the

six months to 30 June 2023 has been prepared on the basis of the

accounting policies expected to be adopted for the year ending 31

December 2022. These are anticipated to be consistent with those

set out in the Group's latest annual financial statements for the

year ending 31 December 2022 with the exception of where there is a

difference between UK GAAP and IFRS. These interims have been

prepared in accordance with UK adopted international accounting

standards but does not include all of the disclosures that would be

required under International Financial Reporting Standards (IFRSs).

The interim financial statements are presented in pounds sterling,

which is the functional currency of the group. Amounts are rounded

to the nearest thousand, unless otherwise stated.

AIM-quoted companies are not required to comply with IAS 34

Interim Financial Reporting and accordingly the company has taken

advantage of this exemption.

The directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future and thus continue to adopt the going concern

basis in preparing these interim financial statements.

3. Significant Accounting Policies

The group has applied the same accounting policies in these

interim financial statements as in its 2022 annual financial

statements with the exception of where there is a difference

between UK GAAP and IFRS. Full disclosure of the transition to IFRS

was made in the Group's AIM admission.

4. Use of judgments and estimates

The significant judgments made by management in applying the

Groups accounting policies and key sources of estimation

uncertainty for the interim financial statements are the same as

those described in the 2022 annual financial statements.

5. Segmental Analysis

The group currently only report on one performance line being

the retail of construction materials.

6. EBITDA

EBITDA (earnings before interest, tax, depreciation and

amortisation and FX) has been calculated as follows:

6 months 6 months

ending ending

30-Jun-23 30-Jun-22

Unaudited Unaudited

GBP000 GBP000

Operating loss (501) 503

Depreciation and amortisation 981 661

Exceptional costs 133 90

EBITDA 613 1,254

----------- ---------------

7. Income tax

The income tax credit /charge for the period is based on the

estimated rate of corporation tax that is likely to be effective

for the year to 31 December 2022.

8. Dividends

No dividends were paid or proposed during the period and no

dividend was paid relating to financial year 2022.

9. Earnings per share

The calculation of basic and diluted earnings per share is based

on the following data:

6 months 6 months Year

ending ending ended

30-Jun-23 30-Jun-22 31-Dec-22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Earnings per share are as follows

Earnings from continuous operations

------------------------------------------------- ----------- ------------------ ------------------

Net profit / (loss) for the period attributable

to the owners of the parent (628) 236 367

Add back : exceptional payroll and other

expenses 133 90 104

Add back : costs incurred directly related

to acquisitions and share option expenses 126

Adjusted earnings (495) 326 598

Number of shares 000 000 000

------------------------------------------------- ----------- ------------------ ------------------

Weighted average number of ordinary

shares - basic earnings 71,970 71,970 71,970

calculation

Effect of dilutive potential ordinary

shares 217 217

Weighted average number of ordinary

shares for the purposes of basic earnings

per share 72,187 71,970 72,187

Weighted average number of ordinary

shares from share options - diluted

calculations

2023 2022 2022

pence pence pence

Basic earnings per share - 0.87 0.33 0.51

Diluted earnings per share - 0.87 0.33 0.51

Adjusted basic earnings per share - 0.69 0.45 0.83

Adjusted diluted earnings per share - 0.69 0.45 0.83

Earnings per share (EPS) is calculated by dividing the profit

for the year, attributable to ordinary equity holders of the

parent, by the weighted average number of ordinary shares

outstanding during the year.

Diluted EPS is calculated on the same basis as basic EPS but

with a further adjustment to the number of weighted average shares

in issue to reflect the effect of all potentially dilutive share

options. The number of people in potentially dilutive share options

is derived from the number of share options and awards granted to

employees and directors where the exercise price is less than the

average market price of the Company's ordinary shares during the

period. Under IFRS no allowances made for the dilutive impact of

share options which reduce a loss per share. The basic and diluted

EPS measures are therefore the same.

Loans and borrowings

6 months 6 months Year

ending ending ended

30-Jun-23 30-Jun-22 31-Dec-22

Unaudited Unaudited Audited

GBP0 GBP0 GBP0

Loans and borrowings

Senior debt (3,688) (4,572) (4,788)

Loan notes 0 0 0

(3,688) (4,572) (4,788)

---------- ---------- ----------

On 1 July 2021, the Company entered into a revolving credit

facility agreement with Clydesdale Bank Plc (trading as Yorkshire

Bank) in respect of revolving loan facilities in an aggregate

amount of GBP10 million to be made available to the Group (the

"Revolving Facility"). The borrowers under the Revolving Facility

are the Company, CGL, CMOStores Holdings Limited and Total Tiles.

The guarantors under the Revolving Facility are the Company, CGL,

cmostores.com Limited and Total Tiles.

The proceeds of the Facility A of the Revolving Facility (which

has a limit of GBP6 million) can be used for financing acquisitions

permitted under the Revolving Facility ("Facility A") and the

proceeds of Facility B under the Revolving Facility (which has a

limit of GBP4 million) can be used for the general corporate and

working capital purposes of the Group ("Facility B"). The final

maturity date of the Revolving Facility is six years after the date

of the Revolving Facility (the "Termination Date"). Facility A will

be reduced by GBP250,000 on each quarter from 30 June 2023, until

it is reduced by GBP3 million on 30 June 2026.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKFBDFBKDOCB

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

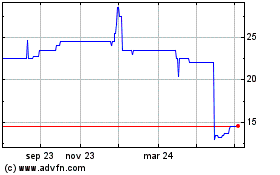

Cmo (LSE:CMO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

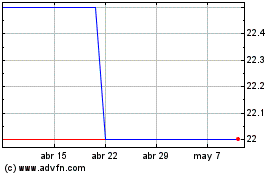

Cmo (LSE:CMO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024