TIDMCNS

RNS Number : 1150N

Corero Network Security PLC

21 September 2023

21 September 2023

Corero Network Security plc

("Corero," the "Company" or the "Group")

Unaudited H1 2023 Interim Results

Strong H1 2023 performance underpinned by ongoing ARR and new

business momentum

Corero Network Security plc (AIM: CNS), a leading provider of

distributed denial of service ("DDoS") protection solutions,

announces its unaudited results for the six months ended 30 June

2023.

Financial highlights:

-- H1 2023 order intake(1) increased 19% to $13.0 million (H1 2022: $10.9 million)

-- H1 2023 Group revenue up 19% to $10.5 million (H1 2022: $8.8 million)

-- Annualised Recurring Revenues(2) ("ARR") up 13% to $15.3 million (H1 2022: $13.6 million)

-- EBITDA(3) loss of $0.2 million (H1 2022: EBITDA profit of $0.9 million)

-- Adjusted EBITDA(4) profit of $0.2 million (H1 2022: Adjusted EBITDA of $0.0 million)

-- Net cash at 30 June 2023 of $6.2 million (30 June 2022: $5.8 million)

-- $1.2 million early repayment of bank term loan facility, with

no outstanding debt (30 June 2022: $1.7 million)

Operational highlights:

-- New strategic go-to-market partnership with Akamai Technologies Inc. ("Akamai")

-- Ideal Customer Profile ("ICP") focus driving significant customer growth across H1 2023

-- Strong momentum through Q2, delivering $6.0 million of significant customer contracts

-- Continued growth in the Company's subscription-based products

and DDoS Protection-as-a-service ("DDPaaS") offering, underpinning

revenue and earnings predictability

Outlook:

-- Solid start to H2 2023, with a number of significant customer wins

-- Robust new business pipeline continues to develop

-- Demand for DDoS mitigation from enterprises of varying sizes

continues to remain strong, driven by ongoing and high-profile DDoS

attacks(5)

-- The Board remains confident in the Company's near-term growth

prospects with Corero continuing to trade in line with market

expectations

Jens Montanana, Executive Chairman, commented :

"I am extremely pleased with the momentum that we have built

during the first half of 2023, securing a number of key customer

wins across the period. The increase in revenue, order intake and

ARR all demonstrate the fundamental strength of both Corero's

business model and ongoing demand for our market-leading

products.

"Our new strategic partnership with Akamai further expands our

routes to market and is expected to deliver incremental revenue

growth in the medium term.

"The robust foundations created during H1 2023, and the strength

of the Company's balance sheet following the repayment of the

outstanding term bank loan, gives us confidence for the full year

as we continue to focus on delivering on our growth strategy."

(1) Defined as orders received from customers in the period

(2) Defined as the normalised annualised recurring revenue and

includes recurring revenue from contract values of annual support,

software subscription and from DDoS Protection-as-a-Service

contracts

(3) Defined as Earnings before Interest, Taxation, Depreciation

and Amortisation

(4) Defined as Earnings before Interest, Taxation, Depreciation

less unrealised foreign exchange differences

(5) 2023 Corero Threat Intelligence Report

https://www.corero.com/2023_threatreport/

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

Enquiries:

Corero Network Security plc Tel: +44 (0) 20 7390 0230

Jens Montanana, Executive Chairman

Phil Richards, CFO

Canaccord Genuity Limited (Nominated Adviser Tel: +44 (0) 20 7523 8000

and Broker)

Simon Bridges / Andrew Potts / Harry Rees

Vigo Consulting Tel: +44 (0) 20 7390 0230

Jeremy Garcia / Kendall Hill

About Corero Network Security

Corero Network Security is a leading provider of DDoS protection

solutions, specializing in automatic detection and protection

solutions with network visibility, analytics, and reporting tools.

Corero's technology protects against external and internal DDoS

threats in complex edge and subscriber environments, ensuring

internet service availability. With operational centers in

Marlborough, Massachusetts, USA, and Edinburgh, UK, Corero is

headquartered in London and listed on the London Stock Exchange's

AIM market (ticker: CNS). For more information, visit:

https://www.corero.com .

For more information, visit www.corero.com , and follow us on LinkedIn and Twitter .

Executive Chairman's Interim review

Introduction

Corero delivered a solid six months of trading across H1 2023,

underpinned by the Company's focus on its ICP, which, alongside

targeted marketing and sales initiatives, delivered a 19%

year-on-year increase in both order intake and revenue for the six

months to 30 June 2023.

This growth builds upon the strong foundations already in place,

with the Company's market-leading SmartWall solution ensuring that

Corero remains well placed to continue to service customers to the

highest levels of satisfaction whilst attracting significant new

customers.

Additionally, Corero continues to experience high levels of

customer retention and renewals, and therefore very low levels of

customer churn at just 2%. The Group generated $15.3 million of ARR

as at 1 July 2023, an increase of 13% (H1 2022: $13.6 million),

driven by growth in DDPaaS and software subscription orders. ARR

remains a key performance indicator for the Company, providing

visibility over future revenue, with an ARR compound annual growth

rate of 28% since H1 2019.

Adjusting for unrealised FX gains and losses, Adjusted EBITDA

profit for the six months ended 30 June 2023 was $0.2 million (H1

2022: $0.0 million), demonstrating the continued underlying

profitability of the Group.

DDoS attacks continue to grow in both volume and sophistication,

as reported in the Corero 2023 DDoS Thereat Intelligence Report,

and, as a result, companies across a diverse range of sectors are

increasingly recognising the importance of obtaining cutting-edge

DDoS protection to safeguard their digital operations. Against this

favourable backdrop, Corero is well-positioned to continue to

deliver best-in-class products and services to its ICP.

The recently announced strategic partnership with Akamai will

further expand Corero's routes to market. This relationship with an

industry-leading security services provider reinforces the value of

Corero's market-leading SmartWall technology.

Strategic update

The Group's six core strategic drivers remain ever-present and

have been at the heart of the Group's operational and financial

performance.

Key progress in the period includes:

-- New business pipeline and revenue growth : Corero delivered

19% year-on-year revenue growth driven by the Company's successful

sales and marketing activities and long-standing sales channel

partners.

-- Leverage existing reseller and strategic partnerships and

develop new ones: The Group continues to invest in existing key

partners, including Juniper and GTT. Additional efforts have been

made in the development of new strategic partners, ensuring Corero

products continue to form an important component of its partners'

global cyber defence capabilities. The Company also continues to

look to new partnerships to expand its market footprint, including

the recently announced strategic partnership with Akamai which

further enhances Corero's reach and is expected to deliver

incremental revenue growth for the Company.

-- Target and expand ICP relationships: Our ICP focus has

yielded significant new customer wins during the first six months

of 2023 and forms an important component of our new business

pipeline.

-- Better monetise existing services and introduce new services:

We continue to explore and provide service initiatives that enhance

the protection and network security visibility for our customers,

developing product offerings that both the Group and our customers

can monetise.

-- Amplify demand generation programmes: We have created

targeted content at each stage of the buying cycle, and within the

key segments we serve. This includes targeted and sector-specific

email campaigns, customer database intelligence and expansion, and

speaking engagements with partners, amongst many other

initiatives.

-- Continue to enhance our technological innovation leadership:

We continue to further strengthen our portfolio of SmartWall

products. These developments include improved protection against

emerging DDoS threats such as so-called carpet bomb attacks and

enhanced analytics for DDoS Protection-as-a-Service customers.

DDoS addressable market and market drivers

Cybersecurity is a high-growth market and the segment for DDoS

protection and mitigation is forecast by MarketsandMarkets to grow

from $3.9 billion in 2022 to $7.3 billion in 2027 (a compound

annual growth rate of 13% over the forecast period). This growth is

being driven by the rise in multi-vector attacks, availability of

DDoS-for-hire services, impact of the growth in IoT devices,

roll-out of 5G services, and growing demand for hybrid DDoS

protection and mitigation services and solutions, where cloud-based

DDoS mitigation and on-premises DDoS protection (such as Corero's

SmartWall solution) work in combination to provide optimal customer

protection.

According to Technavio, North America is expected to contribute

39% to the growth of the global DDoS protection and mitigation

market from 2022 to 2027, underpinned by the fast-growing

popularity of cyber insurance in the region(6) . Corero secured a

number of contracts with companies based in North America across H1

2023, and has a robust network of experienced sales and marketing

employees operating out of the US and Canada to identify new

business opportunities and capitalise on the increasing demand for

DDoS protection and mitigation services from companies in the

region.

In terms of market dynamics, the competition in the cloud-based

DDoS protection market is increasing whilst the landscape for

on-premises DDoS solution providers is relatively stable. In

general, the two solutions remain complementary.

The key market drivers positively impacting Corero include:

-- Continued increase in the level of malicious DDoS activity

worldwide, with the threat showing no signs of abating. Corero's

recent report on the Mirai botnet(7) is one example of this

evolving threat.

-- The adoption of 100Gbps connectivity is accelerating, with

many providers, including existing customers and prospects,

increasing the roll out 100Gbps and 400Gbps networks which drives

demand for increased DDoS protection capacity.

(6) Technavio February 2023 DDOS Protection Mitigation Market by

Component, Application, and Geography - Forecast and Analysis

2023-2027

https://www.technavio.com/report/ddos-protection-mitigation-market-analysis

(7) https://www.corero.com/mirai-like-ddos-attacks/

Corero's competitive advantage

As DDoS attacks continue to grow in size, frequency and

sophistication, they reinforce the need for scalable, accurate and

automated DDoS mitigation solutions. Supporting multiple deployment

topologies, SmartWall utilises an always-on DDoS mitigation

architecture to automatically, and surgically, remove just the DDoS

attack traffic. In H1 2023, 98% of DDoS attacks on Corero's

customers were mitigated automatically, without further

intervention, by Corero or customers' security teams.

Corero continues to invest in its market-leading solutions

through its research and development efforts and its engineering

and customer service teams. Insights gained from observing millions

of DDoS attacks via the Company's SecureWatch service platform not

only inform customers but also serve to provide unique insights for

the Corero technology roadmap, ensuring the Company remains at the

forefront of the industry.

Outlook

The global DDoS mitigation market remains strong, which, coupled

with Corero's technological superiority, cost-effectiveness, and

efficacy, continues to underpin the Company's strong customer

traction. Corero anticipates that the strong cybersecurity market

dynamics and demand for the Company's solutions will remain robust

in the medium to long term despite wider macroeconomic conditions

and cycles, given both the critical role Corero's products and

services play in protecting businesses, and the growing awareness

from companies worldwide of the significant disruption DDoS attacks

can cause.

Corero's focus on targeting its ICP, alongside ongoing sales and

marketing initiatives, and the development of the Company's

strategic partnership relationships favourably position Corero to

build on the strong momentum generated in H1 2023.

The Group expects that H2 2023 will, consistent with seasonality

patterns of business in previous years, display characteristically

greater weighting of business activity towards the end of the year.

Corero anticipates that its recently announced partnership with

Akamai will expand the Company's routes to market and deliver

incremental revenue growth opportunities in the medium term.

The early repayment of all outstanding debt during the period

further demonstrates the robust nature and positive outlook for the

business.

Based on the Company's H1 2023 performance, growth in ARR, order

intake and new business pipeline, management expects trading for

the full year 2023 to be in line with market expectations and

believes Corero is well-placed for further growth in the medium and

long term.

Jens Montanana

Executive Chairman

21 September 2023

Chief Financial Officer's Review

The Group reported revenues of $10.5 million in the six months

ended 30 June 2023 (H1 2022: $8.8 million).

Total operating expenses before depreciation and amortisation

were $9.7 million (H1 2022: $6.9 million). When adjusting for

realised and unrealised FX movements on trading and intercompany

balances, operating expenses for H1 2023 amounted to $8.9 million

(H1 2022: $8.2 million). The underlying $0.7 million increase in

operating expenses year-on-year is primarily attributable to

additional investment in the Company's sales and marketing

team.

Depreciation and amortisation of intangible assets amounted to

$0.9 million (H1 2022: $1.0 million) , with capitalised R&D

costs of $0.9 million (H1 2022: $0.8 million).

EBITDA for H1 2023 was a loss of $0.2 million (H1 2022: profit

of $0.9 million). Adjusted EBITDA, adjusted for unrealised FX

losses of $0.4 million (H1 2022: gains of $0.9 million), was a

profit of $0.2 million (H1 2022: $0.0 million).

Loss before and after taxation was $1.2 million (H1 2022: loss

of $0.3 million). The reported loss per share was 0.2 cents (H1

2022: loss per share 0.1 cents).

Gross cash at bank as at 30 June 2023 was $6.2 million (30 June

2022: $7.5 million; 31 December 2022: $5.6 million), with $1.2

million of the remaining outstanding bank term loan facility repaid

during the period. Net cash at 30 June 2023 was $6.2 million (30

June 2022: $5.8 million; 31 December 2022: $4.4 million). The

Company is debt free as at 30 June 2023.

Net cash generated from operating activities before movements in

working capital in the first six months of 2023 was $0.1 million

(H1 2022: $1.3 million). Movements in working capital generated

cash of $3.1 million for H1 2023 (H1 2022: cash used of $2.5

million), reflecting the collection of significant trade

receivables invoiced in the final two months of the prior year.

This resulted in cash generated from operating activities during H1

2023 of $3.2 million (H1 2022: cash used of $1.2 million). Net cash

used in investing activities included similar sustained investment

in R&D to the prior year of $0.9 million (H1 2022: $0.8 million

spend), with capex investment also of a similar magnitude at $0.2

million (H1 2022: $0.3 million).

H1 2023 included repayments of borrowings of $1.2 million (H1

2022: $0.9 million), being the entirety of the outstanding bank

term loan facility, which was repaid during the period.

Overall, cash and cash equivalents for H1 2023 increased by $0.6

million (H1 2022: decrease of $3.3 million).

Phil Richards

Chief Financial Officer

21 September 2023

Condensed Consolidated Income Statement

for the six months ended 30 June 2023

Unaudited six months ended Unaudited six months ended Audited year ended 31

30 June 30 June December

2023 2022 2022

Continuing operations $'000 $'000 $'000

Revenue 10,526 8,820 20,121

Cost of sales (995) (1,042) (2,576)

---------------------------- ---------------------------- ----------------------------

Gross profit 9,531 7,778 17,545

Operating expenses (10,619) (7,942) (16,719)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Consisting of:

Operating expenses before

depreciation and

amortisation (9,741) (6,899) (14,776)

Depreciation and

amortisation of

intangible assets (878) (1,043) (1,943)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Operating (loss)/profit (1,088) (164) 826

Finance income 7 - 7

Finance costs (142) (161) (279)

---------------------------- ---------------------------- ----------------------------

(Loss)/profit before

taxation (1,223) (325) 554

Taxation charge (17) - -

---------------------------- ---------------------------- ----------------------------

(Loss)/profit after

taxation for the period (1,240) (325) 554

---------------------------- ---------------------------- ----------------------------

(Loss)/profit after

taxation attributable to

equity holders of the

parent for the period (1,240) (325) 554

---------------------------- ---------------------------- ----------------------------

Basic and diluted (loss)/earnings

per share

Cents Cents Cents

Basic (loss)/earnings per share (0.2) (0.1) 0.1

------------------------------------- ------ ------ ------

Diluted (loss)/earnings per share (0.2) (0.1) 0.1

------------------------------------- ------ ------ ------

EBITDA(1) (210) 879 2,769

Adjusted EBITDA(1) - adjusted for unrealised foreign exchange differences 220 (48) 1,808

--------------------------------------------------------------------------- -------- ------ --------

(1) See note 6 for definitions and reconciliation.

Condensed Consolidated Statement of Total Comprehensive

Income

for the six months ended 30 June 2023

Unaudited six months ended Unaudited six months ended Audited year ended 31

30 June 30 June December

2023 2022 2022

$'000 $'000 $'000

---------------------------- ---------------------------- ---------------------------- ----------------------------

(Loss)/profit for the

period (1,240) (325) 554

Other comprehensive

income/(expense):

---------------------------- ---------------------------- ---------------------------- ----------------------------

Items reclassified

subsequently to profit or

loss upon derecognition:

Foreign exchange

differences 631 (1,093) (1,087)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Other comprehensive expense

for the period net of

taxation attributable to

the equity owners

of the parent (609) (1,418) (533)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total comprehensive expense

for the period

attributable to the equity

owners of the parent (609) (1,418) (533)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Condensed Consolidated Statement of Financial Position

as at 30 June 2023

Unaudited Unaudited

as at 30 as at 30 Audited

June June as at 31 December

2023 2022 2022

$'000 $'000 $'000

Assets

Non-current assets

Goodwill 8,991 8,991 8,991

Acquired intangible assets 1 3 2

Capitalised development expenditure 4,647 4,429 4,500

Property, plant and equipment - owned assets 538 674 604

Leased right of use assets 21 104 62

Long term trade and other receivables 1,326 907 1,571

15,524 15,108 15,730

Current assets

Inventories 108 220 164

Trade and other receivables 4,106 3,087 5,294

Cash and cash equivalents 6,172 7,492 5,646

----------- --------- ------------------

10,386 10,799 11,104

----------- --------- ------------------

Total assets 25,910 25,907 26,834

----------- --------- ------------------

Liabilities

Current Liabilities

Trade and other payables (2,975) (3,483) (3,956)

Lease liabilities (71) (99) (78)

Deferred income (4,614) (4,271) (3,323)

Borrowings - (971) (971)

(7,660) (8,824) (8,328)

Net current assets 2,726 1,975 2,776

Non-current liabilities

Trade and other payables - (151) (100)

Lease liabilities - (27) -

Deferred income (2,844) (1,590) (2,285)

Borrowings - (728) (237)

----------- --------- ------------------

(2,844) (2,496) (2,622)

----------- --------- ------------------

Net assets 15,406 14,587 15,884

----------- --------- ------------------

Capital and reserves attributable to the equity owners of the parent

Share capital 6,983 6,914 6,980

Share premium 82,296 82,122 82,284

Capital redemption reserve 7,051 7,051 7,051

Share options reserve 1,890 1,692 1,777

Foreign exchange translation reserve (1,962) (2,599) (2,593)

Accumulated profit and loss reserve (80,852) (80,593) (79,615)

----------- --------- ------------------

Total shareholders' equity 15,406 14,587 15,884

----------- --------- ------------------

Consolidated Interim Statement of Cash Flows

for the six month period ended 30 June 2023

Unaudited six months ended Unaudited six months ended Audited year ended 31

30 June 30 June December

2023 2022 2022

Operating activities $'000 $'000 $'000

(Loss)/profit before

taxation for the period (1,223) (325) 554

Adjustments for movements:

Amortisation of acquired

intangible assets 1 1 2

Amortisation of capitalised

development expenditure 764 940 1,732

Depreciation - owned assets 231 252 497

Depreciation - leased assets 41 41 82

Finance income (7) - (7)

Finance expense 140 155 268

Finance lease interest costs 2 6 11

Share based payments expense 116 202 386

Cash generated from

operating activities before

movement in working capital 65 1,272 3,525

Movement in working capital:

Decrease/(increase) in

inventories and sales

evaluation assets 80 (74) (26)

Decrease/(increase) in trade

and other receivables 2,356 (1,258) (3,867)

Increase/(decrease) in trade

and other payables 664 (1,142) (1,361)

---------------------------- ---------------------------- ----------------------------

Net movement in working

capital 3,100 (2,474) (5,254)

Cash generated from/(used

in) operating activities 3,165 (1,202) (1,729)

Taxation (17) - -

---------------------------- ---------------------------- ----------------------------

Net cash generated

from/(used in) operating

activities 3,148 (1,202) (1,729)

Cash flows from investing

activities

Investment in development

expenditure (911) (841) (1,704)

Purchase of property, plant

and equipment (177) (257) (420)

Net cash used in investing

activities (1,088) (1,098) (2,124)

Cash flows from financing

activities

Net proceeds from issue of

ordinary share capital 15 - 228

Finance income 7 - 7

Lease liability payments (53) (51) (104)

Finance expense (61) (89) (158)

Repayments of borrowings (1,317) (880) (1,364)

---------------------------- ---------------------------- ----------------------------

Net cash (used in)/generated

from financing activities (1,409) (1,020) (1,391)

Increase/(decrease) in cash

and cash equivalents 651 (3,320) (5,244)

---------------------------- ---------------------------- ----------------------------

Effects of exchange rates on

cash and cash equivalents (125) (389) (311)

Cash and cash equivalents at

1 January 5,646 11,201 11,201

---------------------------- ---------------------------- ----------------------------

Cash and cash equivalents at

balance sheet dates 6,172 7,492 5,646

---------------------------- ---------------------------- ----------------------------

Consolidated Interim Statement of Changes in Equity

for the six month period ended 30 June 2023

Total

Foreign Accumulated attributable

Capital Share exchange profit and to equity

Share Share redemption options translation loss owners of

capital premium reserve reserve reserve reserve the parent

$'000 $'000 $'000 $'000 $'000 $'000 $'000

1 January 2022 6,914 82,122 7,051 1,490 (1,506) (80,268) 15,803

Loss for the period - - - - - (325) (325)

Other comprehensive expense - - - - (1,093) - (1,093)

-------- -------- ----------- -------- ------------ ------------ -------------

Total comprehensive expense for the period - - - - (1,093) (325) (1,418)

-------- -------- ----------- -------- ------------ ------------ -------------

Contributions by and distributions to owners

Share based payments - - - 202 - - 202

Total contributions by and distributions to owners - - - 202 - - 202

30 June 2022 6,914 82,122 7,051 1,692 (2,599) (80,593) 14,587

Profit for the period - - - - - 879 879

Other comprehensive expense - - - - 6 - 6

-------- -------- ----------- -------- ------------ ------------ -------------

Total comprehensive income for the period - - - - 6 879 885

Contributions by and distributions to owners

Issue of share capital - exercise of options 66 162 - - - - 228

Fully exercised share options - - - (99) - 99 -

Share based payments - - - 184 - - 184

Total contributions by and distributions to owners 66 162 - 85 - 99 412

31 December 2022 and 1 January 2023 6,980 82,284 7,051 1,777 (2,593) (79,615) 15,884

Loss for the period - - - - - (1,240) (1,240)

Other comprehensive expense - - - - 631 - 631

-------- -------- ----------- -------- ------------ ------------ -------------

Total comprehensive expense for the period - - - - 631 (1,240) (609)

-------- -------- ----------- -------- ------------ ------------ -------------

Contributions by and distributions to owners

Issue of share capital - exercise of options 3 12 - - - - 15

Fully exercised share options - - - (3) - 3 -

Share based payments - - - 116 - - 116

Total contributions by and distributions to owners 3 12 - 113 - 3 131

30 June 2023 6,983 82,296 7,051 1,890 (1,962) (80,852) 15,406

-------- -------- ----------- -------- ------------ ------------ -------------

Notes to the interim financial statements

1. General information and basis of preparation

Corero Network Security plc (the "Company") is a company

domiciled in England. The condensed consolidated interim financial

statements of the Company for the six months ended 30 June 2023

comprise the Company and its subsidiaries (together referred to as

the "Group").

These condensed interim consolidated financial statements have

been prepared in accordance with UK-adopted IAS 34,"Interim

Financial Reporting". They do not include all disclosures that

would otherwise be required in a complete set of financial

statements and should be read in conjunction with the Annual Report

and Accounts for the year ended 31 December 2022 ("2022 Annual

Report and Accounts"). The financial information for the half years

ended 30 June 2023 and 30 June 2022 do not constitute statutory

accounts within the meaning of Section 434(3) of the Companies Act

2006 and have neither been audited nor reviewed by the Group

Auditor.

The annual financial statements of Corero Network Security plc

are prepared in accordance with international accounting standards

in conformity with the requirements of the Companies Act 2006. The

comparative financial information for the year ended 31 December

2022 included within this report does not constitute the full

statutory accounts for that period. The statutory Annual Report and

Financial Statements for 2022 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Accounts for 2022 was unqualified and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

There have been no related party transactions or changes in

related party transactions described in the latest Annual Report

and Accounts that could have a material effect on the financial

position or performance of the Group in the first six months of the

financial year.

These consolidated interim financial statements were approved by

the Board on 19 September 2023 and approved for issue on 21

September 2023.

A copy of this Interim Report can be viewed on the company's

website: www.corero.com .

2. Significant accounting policies

The basis of preparation and accounting policies used in

preparation of these interim financial statements have been

prepared in accordance with the same accounting policies set out in

the 2022 Annual Report and Accounts.

3. Segment reporting and revenue

The Group is managed according to one business unit, Corero

Network Security, which makes up the Group's reportable operating

segment. This business unit forms the basis on which the Group

reports its primary segment information to the Board, which

management consider to be the Chief Operating Decision maker for

the purposes of IFRS 8 Operating Segments. Consequently, there are

no separable 'other segmental information' not otherwise showed in

these Condensed Consolidated Financial statements.

The Group's revenues from external customers are divided into

the following geographies:

Unaudited Unaudited Audited

six months six months year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$'000 $'000 $'000

The Americas 8,689 6,264 14,695

EMEA 1,292 1,915 4,388

APAC 545 641 1,038

Total 10,526 8,820 20,121

------------ ------------ -------------

Revenues from external customers are identified by invoicing

systems and adjusted to take into account the difference between

invoiced amounts and deferred revenue adjustments as required by

IFRS accounting standards.

The revenue is analysed for each revenue category as:

Unaudited Unaudited Audited

six months six months year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$'000 $'000 $'000

Software licence and appliance

revenue 3,866 2,878 8,107

DDoS Protection-as-a-Service

revenue 2,786 2,288 4,854

Maintenance and support services

revenue 3,874 3,654 7,160

Total 10,526 8,820 20,121

------------ ------------ -------------

The revenue is analysed by timing of delivery of goods or

services as:

Unaudited Unaudited Audited

six months six months year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$'000 $'000 $'000

Point-in-time delivery 3,866 2,878 8,107

Over time 6,660 5,942 12,014

Total 10,526 8,820 20,121

------------ ------------ -------------

4. Taxation

Due to the utilisation of past tax losses, the Group does not

recognise a material taxation income tax expense or credit.

5. Earnings per share

Earnings/(loss) per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the period. The effects

of anti-dilutive ordinary shares resulting from the exercise of

share options are excluded from the calculation of loss per

share.

30 June 2023 30 June 2022

weighted weighted

30 June 2023 average number 30 June 2023 30 June 2022 average number 30 June 2022

loss of 1p shares loss per share loss of 1p shares loss per share

$'000 Thousand Cents $'000 Thousand Cents

Basic loss per

share

From loss for

the year (1,240) 499,962 (0.2) (325) 494,852 (0.1)

--------------- --------------- --------------- --------------- --------------- ---------------

Diluted loss per share

Basic loss per share (1,240) 499,962 (0.2) (325) 494,852 (0.1)

Dilutive effect of share options - 47,823 - - 29,742 -

-------- -------- ------ ------ -------- ------

Diluted loss per share (1,240) 547,785 (0.2) (325) 524,594 (0.1)

-------- -------- ------ ------ -------- ------

31 Dec 2022 weighted 31 Dec 2022 profit per

31 Dec 2022 profit average number of 1p shares share

$'000 Thousand Cents

Basic earnings per share

Basic earnings per share 554 495,900 0.1

------------------- ---------------------------- -----------------------------

Diluted earnings per share

Basic earnings per share 554 495,900 0.1

Dilutive effect of share options - 15,248 -

---- -------- ----

Diluted earnings per share 554 511,148 0.1

---- -------- ----

6. Key performance measures

EBITDA and Adjusted EBITDA

Earnings before interest, tax, depreciation, and amortisation

("EBITDA") is defined as earnings from operations before all

interest, tax, depreciation, and amortisation charges. The

following is a reconciliation of EBITDA and further adjustment for

all three periods presented:

Unaudited Unaudited Audited

six months six months year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

$'000 $'000 $'000

Loss/(profit) before taxation (1,223) (325) 554

Adjustments for:

Finance income (7) - (7)

Finance expense 140 155 268

Finance lease interest costs 2 6 11

Depreciation - owned assets 72 61 127

Depreciation - lease liabilities 41 41 82

Amortisation of acquired intangible

assets 1 1 2

Amortisation of capitalised

development expenditure 764 940 1,732

------------ ------------ -------------

EBITDA (210) 879 2,769

Unrealised foreign exchange

differences 430 (927) (961)

Adjusted EBITDA - for unrealised

foreign exchange differences 220 (48) 1,808

------------ ------------ -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLEAAIIFIV

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

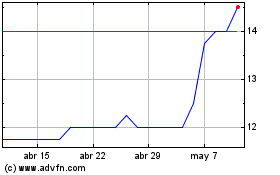

Corero Network Security (LSE:CNS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Corero Network Security (LSE:CNS)

Gráfica de Acción Histórica

De May 2023 a May 2024