TIDMCOG

RNS Number : 1880Y

Cambridge Cognition Holdings PLC

03 May 2023

3 May 2023

Cambridge Cognition Holdings Plc

("Cambridge Cognition", the "Group" or the "Company")

Preliminary results for the year ended 31 December 2022

Cambridge Cognition (AIM: COG), which develops and markets

digital solutions to assess brain health, is pleased to announce

its preliminary audited results for the year ended 31 December

2022.

2022 performance

Cambridge Cognition had a transformative year in 2022, recording

25% revenue growth and a profit before acquisition-related costs,

continuing to commercialise and develop new solutions, and making

two bolt-on acquisitions (including one completed post period end),

as it enhances its position as a leading digital health tech

provider for CNS clinical trials.

Corporate and operational highlights

-- 25% revenue growth year-on-year and underlying profitability.

-- Innovative new product development and acquisitions that

added to the technology offering and expanded the addressable

market.

-- Leading market position with unique digital technology

solutions and full commercial coverage of the clinical trial market

for cognitive assessments.

-- Major contract wins, including two over GBP2m for sizeable clinical trials.

-- Sales order intake of GBP13.1m, up 8% on like-for-like prior

year (2021: GBP12.1m excluding GBP3.6m of large one-off

orders).

-- Contracted order book increased to GBP19.1m following the

acquisition of Winterlight Labs on 10 January 2023.

Financial highlights

-- Revenue up 25% to GBP12.6m (2021: GBP10.1m).

-- Gross profit up 21% to GBP9.3m (2021: GBP7.7m).

-- Profit for the year, adjusted for acquisition-related

expenses of GBP0.5m, of GBP0.1m (2021: GBP0.5m).

-- Loss per share 1.3 pence (2021: 1.4 pence earnings per share).

-- Cash generative with cash balance of GBP8.3m at 31 December

2022 (31 December 2021: GBP6.8m).

Commenting on the results, Matthew Stork, Chief Executive

Officer, said:

"2022 was a transformational year for Cambridge Cognition,

marked by significant multi-year orders, sustained revenue growth,

and the expansion of our core product set. We also successfully

concluded an acquisition in 2022 with another right at the start of

2023. These have strengthened our technology portfolio and enable

us to provide a full offering for CNS clinical trials. Looking

ahead, we remain committed to our objectives of driving revenue and

profit growth by increasing our market share through offering the

most innovative technology, supported by outstanding scientific

evidence and a very experienced team, in the high-value market for

CNS drug development."

Investor webinar

Cambridge Cognition's management will be hosting an online

presentation and Q&A session at 5.30 p.m. BST on Wednesday 3

May 2023. This session is open to all existing and prospective

shareholders. Those wishing to attend should email

cog@investor-focus.co.uk and they will be provided with log in

details.

Participants will have the opportunity to submit questions

during the session, but questions are welcomed in advance and may

be submitted to: cog@investor-focus.co.uk .

Enquiries:

Cambridge Cognition Holdings Plc Tel: 012 2381 0700

Matthew Stork, Chief Executive Officer press@camcog.com

Stephen Symonds, Chief Financial Officer

Panmure Gordon (UK) Limited

(NOMAD and Joint Broker) Tel: 020 7886 2500

Freddy Crossley / Emma Earl / Mark Rogers (Corporate Advisory)

Rupert Dearden (Corporate Broking)

Dowgate Capital Limited (Joint Broker) Tel: 020 3903 7715

David Poutney / James Serjeant

IFC Advisory Limited (Financial PR and Tel: 020 3934 6630

IR) cog@investor-focus.co.uk

Tim Metcalfe / Graham Herring / Zach Cohen

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

CHAIR'S INTRODUCTION

2022 was a pivotal year for our business with significant

achievements at all levels of the organisation. We achieved growth

in like-for-like orders and revenues, underlying business

profitability, cash generation and major progress in innovation. In

addition, two acquisitions also further expanded our position in

the market, positively impacting both our technology capabilities

and future revenue growth.

Cambridge Cognition's strategy is to develop and commercialise

unique, well-protected, high-value solutions supported by extensive

scientific evidence and expertise for central nervous system

("CNS") clinical trials. There has been excellent progress in

delivering this strategy and we believe Cambridge Cognition is

exceptionally well-placed for the future.

Over the year, the Board has continued to focus on careful

capital allocation as the Company has expanded organically and

inorganically. The acquisitions of Clinpal (the trading name for

eClinicalHealth Limited) in October 2022 and Winterlight Labs Inc

("Winterlight") at the start of 2023 enhance our portfolio, expand

the addressable market for our products and add to our revenue

growth and drive to sustained profitability. We also expect the

acquired products and technologies to prompt incremental use of the

Company's existing products.

In April 2022, we welcomed Stephen Symonds as Chief Financial

Officer and he was appointed to the Board in August 2022. Stephen

brings a wealth of top-four audit and clinical trial market

expertise at a senior level and is already making a strong

contribution to the growth of our company. The Board has concluded

that with the Company's continued growth, adding a Non-Executive

Director would be beneficial later in 2023 to bring further

independent guidance, scrutiny and experience.

Cambridge Cognition is positioned for accelerated revenue growth

and sustainable profitability in the coming years, both from its

current offerings and new products in development. The Board

expects the Company to grow rapidly and deliver substantial,

sustainable shareholder value in both the short and medium

term.

Steven Powell

Chairman

CHIEF EXECUTIVE OFFICER'S REVIEW

Introduction

I am delighted by Cambridge Cognition's performance in 2022. We

worked on a record number of clinical trials and increased revenue

substantially, while laying the foundations for further growth in

future years. In tandem with this growth, we have focused on

delivering high-value technology solutions and excellent customer

service.

Our overarching strategy is to develop and commercialise a

unique set of high-value solutions for CNS clinical trials. Those

solutions are well protected and supported by extensive scientific

evidence and expertise. Our product offerings and capabilities have

undergone a step-change through customer-oriented product

development and strategic acquisitions . Specifically, we have:

-- Further developed our suite of leading cognitive assessments,

making them accessible on more devices, in more than 50 languages,

and in any country.

-- Set up a global software infrastructure that adheres to

stringent data protection requirements and enables us to store

patient data locally, as mandated by regulations.

-- Acquired leading voice-based and decentralised clinical trial

solutions to establish the broadest offering in CNS-related

outcomes measurement.

-- Brought in expert-level capability in machine learning for

digital biomarkers, deep knowledge of computational linguistics,

and new clinical trial solutions, such as electronic consent and

telemedicine.

-- Expanded our software team to accelerate the development of

new modules, opening an office and recruiting an entire team of

software developers in South Africa.

-- Invested in sales and marketing, bolstering our brand

presence and providing full coverage across the US and Europe.

Additionally, we have established a distributor relationship in

Asia to expand our reach further.

These accomplishments position Cambridge Cognition to secure

more contracts and capture a more substantial share of the growing

market opportunity.

Overall, our 2022 financial results were very strong, with

revenue growth of 25% to GBP12.6m (2021: GBP10.1m) and orders

growth of 8% (on a like-for-like basis) over 2021 to GBP13.1m.

Administrative expenses were well managed during the year, and

although the gross margin percentage was slightly down on the prior

year, this was in line with expectations. In 2022, we changed our

accounting policy for cost of sales and have included pay costs

directly related to revenue (with the prior year restated to the

same basis).

The financial results for the year were tempered by a slightly

slower-than-expected final quarter as we experienced delays and

scope reduction associated with large orders. Market forecasts

suggest that this is not representative of a long-term trend. The

Company's strategy is designed to address intermittent slow periods

through a broader product offering and increasing volumes across

all contract sizes.

Activity has been high in the first quarter of 2023 and a

positive response from customers to developments in 2022 and early

2023. The Company ended 2022 with a strong contracted order book of

GBP17.6m which increased further to GBP19.1m in January 2023

following the acquisition of Winterlight. Moreover, with the

broadened portfolio and additional business capabilities, we have a

solid platform to achieve future profitable growth.

Market Overview

Cambridge Cognition operates across three main business

areas:

1. Pharmaceutical clinical trials: The Company has a fully

serviced digital outcomes assessment solution including software,

configuration (with customisation options), consulting, and

reporting services that accounts for approximately 90% of

revenue.

2. Academic research: The supply of cognitive outcomes

assessments is via a software-as-a-service solution for use in

research by academics.

3. Healthcare: The Company has two products to aid in the triage

and diagnosis of cognitive impairment, one for primary care

practitioners and one for secondary care specialists, that are FDA

and EU-approved medical devices. Demand is currently limited as

there is minimal reimbursement; this may change with more interest

in using digital cognitive biomarkers with new drugs being approved

for Alzheimer's disease.

Primarily related to clinical trials, five areas represent

substantial market opportunities for the Company:

1. Digital Cognitive Outcomes Assessments

Approximately 500-600 clinical trials each year use measures of

cognition(1) . The traditional assessment method requires

clinicians to ask patients questions and score the answers and can

be subjective, costly, and inconvenient. Touchscreen or voice-based

cognitive assessments can be used alongside or even replace

traditional assessment methods. The US market for digital cognitive

assessments was estimated at GBP70m in 2022 and growing at 10% per

annum(2) .

2. Automated Quality Assurance

In later phase clinical trials for diseases such as Alzheimer's

and Parkinson's Disease, patient consults are reviewed for quality

assurance. This is a new market opportunity for the Company: our

new offering automates part of the process and enables quality

assurance at a lower overall cost. We commissioned independent

market research and estimate the market opportunity could be GBP16m

per annum within five years(3) .

3. Electronic Clinical Outcomes Assessment ("eCOA")

eCOA systems are designed to capture patient, carer, or

clinician-reported data on a patient's outcomes during a clinical

trial. This is accomplished through using licensed questions or

scales that are usually widely used in clinical studies. Uptake is

gradual and clinical trial sites report that they use eCOA half the

time or less(4) . The remainder still rely on pen-and-paper methods

to collect outcomes. Taking a proportion of the reported global

market for all therapeutic areas, the eCOA market for CNS disorders

was estimated to be GBP160m in 2022, growing at 15% per annum(5)

.

4. In-Clinic, Hybrid and Virtual / Decentralised Clinical Trial

Systems

Pharmaceutical companies and CROs depend on various information

technology systems to effectively communicate with patients,

schedule events, gather and analyse clinical data, and prepare

reports. Among the most used modules are e-Consent, which captures

participation agreements, Electronic Document Management ("EDC"),

which stores all the clinical data, and Telehealth, which enables

clinician-patient consults. A wide range of providers offer one or

more of these systems, with some designed for in-clinic or virtual

use or both. No provider currently markets a CNS-dedicated

solution. The global market for these solutions in CNS virtual

clinical trials was estimated to be GBP140m per annum, growing at

15%(6) .

5. Patient Recruitment

There is a market opportunity for Cambridge Cognition to recruit

patients for a wide range of CNS clinical trials. Recruitment is

notoriously challenging: less than half of studies meet enrolment

goals(7) . We collaborate with several partners to provide clinical

consulting, patient tracking systems and clinical screening as part

of a dedicated patient recruitment offering. The CNS clinical trial

patient recruitment market, excluding advertising, is estimated at

GBP100m annually growing at 10% per annum(8) .

Operational Review

In 2022, the Group significantly enhanced its operational

capability and performance across commercial, clinical services,

product development, people management, and delivery. We

successfully provided solutions to a more extensive customer base

than ever before.

Considerable investment has been made in expanding our

commercial team, increasing the number of sales and sales support

staff from four to eight. These investments were made towards the

end of the year, with the aim of making an impact in 2023. As a

result, we now have full coverage of the cognitive assessment

market for clinical trials, a new sales team dedicated to virtual

clinical trials, and an experienced proposal management

function.

We achieved 100% on-time-in-full delivery of clinical trial

starts and a continued high customer service record, enhancing our

brand position as a gold-standard provider of assessments.

Excellent clinical project management and scientific support were

provided to academic customers, scientific collaborators, and

pharmaceutical clients.

The numerous publications and presentations referencing new data

by Cambridge Cognition employees, leading scientists, and

pharmaceutical companies continue to provide valuable evidence to

help secure contracts. The total number of papers citing studies

using the Company's assessments now stands at over 3,000. Two

notable examples of such partnerships in 2022 are the Company's

participation in the IdeaFast project to develop new digital

biomarkers of fatigue, and the Brain Health Registry programme, to

understand mild cognitive impairment globally.

Cambridge Cognition has continued to provide a single-source

service by shipping hardware to support clinical trials. Chip

shortages and production delays throughout 2022 increased the

challenge of obtaining and shipping hardware to clients. Despite

this, we achieved all contractual obligations and established an

additional inventory of the most used tablets and mobile

phones.

Over the year, the Company transformed its product development

function, introducing new systems and roles to streamline and

improve the efficacy of product development and maintenance. We

recruited considerable expertise in the product and research and

development teams with several senior-level new starts.

Software development resources were enhanced by opening a new

office in South Africa. The region boasts a large pool of highly

skilled software developers. As a result of natural attrition in

the UK, most of the Company's software development capacity at the

year-end was based in South Africa.

Investments have been made in the management team, training for

people managers, and role-specific training and development. We saw

some pay inflation as we ensured salaries were competitive for the

sector. At the same time, we reduced our recruitment costs

substantially during a growth period through more successful direct

hires managed by our internal team.

Corporate Business Development Review

Over the last two years, Cambridge Cognition had established an

ambitious strategic roadmap to develop new product and service

offerings, including building out modules to support clinic-based

and virtual clinical trials and developing a free-speech-based

verbal cognitive assessment. To accelerate the development of the

business and respond to demand, we made two acquisitions to obtain

those technologies and competencies.

In October 2022, the Company acquired Clinpal(TM) (the trading

name for eClinicalHealth Limited), a digital technology provider of

virtual clinical trial solutions that has been working on trials

for three of the world's top ten largest pharmaceutical companies.

With a patient-centric platform that connects patients, sites, and

pharmaceutical companies, Clinpal(TM) enables all the essential

steps in a clinical trial.

Clinpal was acquired for a total amount payable of GBP1.7m, and

the acquisition is expected to positively contribute to

profitability in 2024. The Clinpal acquisition immediately allowed

the Company to offer full in-clinic and virtual clinical trial

solutions, including specialised CNS clinical trial patient

recruitment solutions. This has already enabled us to respond to a

tender issued by a top-ten pharmaceutical company for a recruitment

contract.

The acquisition of Winterlight was completed in January 2023.

Winterlight, based in Toronto, Canada, has developed

machine-learning-based voice assessments using free-speech inputs

or those that require deductive reasoning or interpretation, as

well as a unique automated quality assurance service for

clinicians. Winterlight has an excellent customer list, including

five of the top ten global life sciences companies, and limited

overlap with Cambridge Cognition's existing customer base,

providing the potential to cross-sell and generate further revenue

growth.

The acquisition of Winterlight was completed for a total amount

payable of GBP7.0m. As at the acquisition date, Winterlight had a

strong pipeline of opportunities and a contracted order book of

GBP1.5 million (reduced subsequently from the previously announced

GBP2.5m as a Winterlight customer failed to secure adequate

financing and is now seeking a sale of its assets). As well as

actively cross-selling solutions at this time, the unique quality

assurance offering has enabled Cambridge Cognition to bid on a

large tender for cognitive assessments and clinician services as a

single provider, differentiating us from competitors.

In December 2022, Cambridge Cognition also entered into an

agreement with Luca Healthcare to commercialise our suite of

cognitive assessment tools in the China market. Luca Healthcare,

which has existing contracts with pharmaceutical companies in other

therapeutic areas, is now offering solutions for CNS clinical

trials and developing a healthcare solution. Our assessments are

hosted on a secure cloud-based server in China and can be run

seamlessly on Luca Healthcare's platform using Application Process

Interfaces ("APIs").

Having made the two recent acquisitions, we have prioritised our

go-to-market strategy for the combined business, including

opportunities to cross-sell from the enlarged portfolio, and the

focus is now on integrating operations and supporting functions.

These are critical next steps to ensure we achieve the expected

acquisition returns. While the Company remains open to other

corporate business development opportunities, such as partnerships,

licensing opportunities, or mergers and acquisitions, future

opportunities will be considered primarily in relation to

contribution to the Company's profit.

Innovation Review

Cambridge Cognition has a well-established reputation for

leadership in the sector and a history of firsts, which supports

the brand's reputation and creates unique differential advantages.

These are protected mainly through trademarks, copyright, and some

patents, establishing our intellectual property (or 'moat').

With continued investment in innovation in 2022, the three

companies, Cambridge Cognition, Clinpal, and Winterlight, all made

major advances.

CANTAB(TM) cognitive assessments

Cambridge Cognition's core product, CANTAB(TM), constitutes most

of the Company's revenues. It comprises 18 main tasks that cover

all the cognitive domains typically measured in a clinical trial.

In 2022, the number of publications supporting CANTAB(TM) grew to

2,850 and as at the end of April 2023 stands at over 3,000.

CANTAB(TM) assessments are available on Apple iPads(TM) and most

can be accessed through a web browser. In 2022, a development

project enabled screen resizing and demonstrated validity of

results for an assessment on a mobile phone as well. This

development will enable use of CANTAB(TM) in a much broader context

in the future.

Daily cognitive assessments

In 2022, the Company broadened its existing range of daily

mobile phone assessments by developing four additional prototypes,

due for launch in 2023. Three of these are screen-based, and one

voice-based. This will bring the Group's total number of short

daily assessments covering the main cognitive domains to six by the

end of the current year.

The use of these daily assessments is gaining traction. Two

major pharmaceutical companies published the results of their

studies in 2022:

1. Takeda, together with the University of Toronto, presented

data showing that a short daily task was well correlated with the

pen and paper version concluding that it could help with guiding

treatment choice for patients with depression(9) .

2. Sage published data showing that patients with Parkinson's

and Alzheimer's disease improved using a novel drug as measured by

two quick daily cognitive assessments(10) . Early in 2023, Sage

also published data showing that they could demonstrate the

day-by-day impact of their drug on cognitive function.

These new daily assessment are ground-breaking, novel

application of digital technologies with the potential to

objectively demonstrate drug effects in ways that have not been

possible before.

Voice-based cognitive assessments

Significant progress was made in 2022, both within the Company

and by Winterlight, in advancing the development of voice-based

cognitive assessments.

The in-house solution developed by Cambridge Cognition

progressed by:

-- Establishing a roadmap for multi-language support development

in 2023, essential for the widespread use of assessments in

clinical trials.

-- Creating a short daily assessment prototype for a

pharmaceutical company with a well-known verbal assessment but with

daily monitoring, allowing for quicker observation of drug effects

and potentially shorter and more efficient trials.

-- Agreeing on collaborations with two major universities to

validate existing assessments. These projects took considerable

time from initial discussion to full grant funding and commencing

work, though are now underway.

Winterlight achieved a number of milestones with its free-speech

solution. These milestones include:

-- Adding additional languages to bring the total number to nine

(more than any other company in the sector).

-- Establishing a quality assurance solution for clinical trials

with considerable market potential.

-- Improving its automated solution with better speech

recognition to simplify and reduce transcription costs.

Cambridge Cognition is now the only company offering such a wide

range of automated voice-based cognitive assessments. These have

the potential to replace many of the existing assessments commonly

conducted in clinical trials.

Academic Collaborations

As well as co-creating solutions with pharmaceutical companies,

Cambridge Cognition participated in several widely recognised

academic collaborations in 2022. Some of the most high-profile ones

include: the EU IMI grant-funded IDEA-FAST study to identify

digital endpoints for fatigue; the US NIHR-funded Brain Health

Registry that assesses cognition worldwide; the Deep and Frequent

Phenotyping longitudinal study of dementia and AI Brain, an EU

Horizon grant-funded study developing multi-modal biomarkers for

dementia. As well as showcasing our solutions and gathering data,

these have provided reference points for and contact with target

customers. By way of example, 13 major pharmaceutical companies

take part in IDEA-FAST.

Clinical Trial Solutions

2022 saw significant progress in clinical trial solutions

through the combined efforts of Cambridge Cognition and Clinpal.

Prior to the acquisition, a proportion of the software development

for the Clinpal solution was completed by Cambridge Cognition under

contract. Progress made in the year included:

-- Moving from installed solutions in data centres to

cloud-based servers in two regions with a plan to open a third in

2023. This improves patient data management and facilitates

compliance.

-- The Clinpal solution added patient-data management

communication features designed for a global virtual study that

started in 2022.

-- A next-generation patient application for Android and iOS was

designed for the IMI grant-funded Radial clinical trial due to

start in 2023.

-- New or upgraded modules for eConsent and Telehealth with the release set for Q2 2023.

Combined product offering

A key objective is to provide a unified solution incorporating

modules developed by Cambridge Cognition, Clinpal, or Winterlight.

All three solutions feature APIs to allow seamless functionality

within a single front-end user interface. This currently puts us in

a strong position to select one of the solutions to run as the

customer user interface while incorporating modules from the other

two. We are now bidding with solutions that integrate the three

platforms.

We plan to converge all three solutions, which will require time

and investment. We plan to accomplish this gradually, likely on a

module-by-module basis, as we perform maintenance or make

improvements to the system, taking the best of each platform.

In the medium term, there is the opportunity to create

multi-modal digital biomarkers by combining solutions. As well as

using touchscreen and voice data, this could also include

actigraphy or other clinical information to provide even greater

accuracy of diagnostic information. This is an exciting area of

future development that is likely to be funded by grants or

development partners.

Growth Strategy

Our overarching goal is to achieve profitable growth. Our

strategy in the short to medium term from 2023-2025 is to complete

development and commercialise our unique set of well-protected,

high-value, and validated solutions. In addition, our strategy

includes having a watching-brief on the healthcare market with the

readiness to promote our medical devices should demand and

reimbursement surface.

To achieve our strategic goals, Cambridge Cognition's areas of

focus for 2023 are:

1. Driving sales of existing products, including Winterlight and

Clinpal and winning a greater volume of clinical trial work for our

broader portfolio, including combined offerings.

2. Establishing partnerships with high-impact organisations in

the sector, such as major pharmaceutical companies and CROs.

3. Investing in innovation to maintain our brand position and

complete the development of our offering.

4. Realising synergies from acquisitions and ensuring continued

customer focus as we integrate the three businesses.

5. Focusing on our people and ensuring Cambridge Cognition is a

'great place to work'.

Economic and Political Environment

Amidst the COVID-19 pandemic, there was a surge in the adoption

of digital solutions, with virtual trials gaining remarkable

traction among our customers. This interest continues.

The ongoing war in Ukraine was and continues to be a cause for

concern, and our thoughts are with all those affected, including

several academic centres in the region that use our solution. No

contracts are being progressed with Russian centres at this time.

The conflict has had no material effect on revenues.

Inflation has had an impact on salary levels and may be

contributing to a reduced investment in the development of CNS

drugs. This could lead to a short-term decline in demand. We expect

the situation to normalise during 2023 and do not anticipate any

material impact on the Group's overall performance.

Corporate Outlook

Despite a turbulent global economic and political environment,

2022 was an excellent year for Cambridge Cognition. We saw

remarkable growth in orders, strong revenue growth, cash

generation, and considerable progress in innovation and corporate

business development.

The Company had a strong contracted order book at the end of

2022 that provides excellent revenue visibility through 2023 and a

promising pipeline of further opportunities for the year. With our

broader portfolio, we expect a considerable step-up in our total

addressable market and there is the potential for a considerable

increase in investment in CNS drugs with the successes recently in

Alzheimer's Disease with new drugs being approved. There does

remain some uncertainty around the global macroeconomic outlook,

though that is expected to be transitory to our markets.

The Company has extensive market opportunities within existing

and new growth markets. We estimate average growth rates across the

markets we are targeting to currently be approximately 10 percent

per annum, and we believe our revenue growth will exceed this rate

of market growth. We will continue to manage costs carefully and

aim to move back into profitability.

The outlook is very exciting as we have a full commercial team

and a much broader portfolio and can win many more sizeable

contracts as we build on our current position over the coming

years.

Matthew Stork

Chief Executive Officer

References:

1. Global Data, April 2023

2. Astute Analytica (2021) US Cognitive Assessment Market;

Adjusted using internal data to 10% from 2022.

3. Extrapolated from independent market research report commissioned by Cambridge Cognition.

4. DT Consulting, Clinical Digital Tracker, 2022

5. Grandview Research (2023), eCOA Market Analysis; Adjusted by

CNS studies as a proportion of all.

6. Estimate from Global Data, April 2023, and Assessing the

Financial Value of Decentralised Clinical Trials, Therapeutic

Innovation & Regulatory Sciences, 57, 209-19, 2023.

7. Strategies to improve recruitment to randomised trials.

Cochrane Database Syst Rev. 2018 Feb 22;2(2)

8. Grandview Research (2022), Clinical Trial Patient Recruitment

Market; Adjusted by CNS studies as a proportion of all.

9. An App-Based DSST for Assessment of Cognitive Deficits in

Adults With Major Depressive Disorder: Evaluation Study, JMIR Ment

Health 2022;9(10).

10. Sage Therapeutics Conference Poster at CTAD 2022.

CHIEF FINANCIAL OFFICER'S REVIEW

Overview

The Company delivered another strong performance in 2022 with

growth in the contracted order book and revenues, coupled with

continued positive cash generation that has enabled the completion

of two acquisitions, one in October 2022 and one in January 2023.

This review includes a comparison of the financial KPIs used to

measure progress over the year:

KPI 2022 2021 Movement

-------------------------------------- ------------- --------------- ----------

Revenue GBP12.6m GBP10.1m GBP1.5m

Gross margin 73.9% 76.1% (220)bps

Profit before tax GBP0.6m loss GBP0.3m profit GBP(0.9)m

Profit for the year (after adjusting

for acquisition related expenses) GBP0.1m GBP0.5m GBP(0.4)m

Investment in R&D GBP2.2m GBP1.7m GBP0.5m

Sales orders GBP13.1m GBP12.1m GBP1.0m

Contracted order book GBP17.6m GBP17.0m GBP0.6m

Cash GBP8.3m GBP6.8m GBP1.5m

-------------------------------------- ------------- --------------- ----------

Revenues and Gross Profit

We are pleased to report that our revenue grew by 25%, reaching

GBP12.6m compared to GBP10.1m in 2021. A large proportion of our

contracts are for clinical trials, which usually commence three to

six months after the signing of the contract and run for several

months or even a few years. As a result, most of the revenue

recognised in the year came from orders won in previous years, with

the remaining balance from in-year contract wins.

We anticipate the GBP19.1m contracted order book as of 10

January 2023 (following the acquisition of Winterlight) will

generate, subject to customer delivery schedules, at least GBP9.5m

of revenue to be recognised in 2023, with the balance to be

recognised in subsequent years. Recognised revenue split by type

was as follows:

2022 2021 Increase Increase

GBPm GBPm GBPm

--------------------------- ------ ------ --------- ---------

Software 5.0 3.6 1.4 39%

Services 6.5 5.6 0.9 16%

--------------------------- ------ ------ --------- ---------

Total Software & Services 11.5 9.2 2.3 25%

Hardware 1.1 0.9 0.2 22%

--------------------------- ------ ------ --------- ---------

Total Revenue 12.6 10.1 2.5 25%

--------------------------- ------ ------ --------- ---------

Services revenue grew by 16% in 2022 as more implementation and

bespoke development work were carried out, as well as the

additional data and study management provided as part of our

support to larger clinical trials. Software revenue increased by

39% but given the time lag between contract signature and software

usage, we would expect this to grow further in 2023. Hardware,

which is procured from third parties, is supplied by the Company to

support specific projects.

Three large, one-off contracts won in 2021 were for supplying

and supporting digital wearables for CNS clinical trials in 2022.

These had a high third-party cost of sales component that reduced

overall gross margin percentage in 2022. Gross profit was GBP9.3m

(73.9% margin) compared with GBP7.7m (76.1% margin) in 2021.

In 2022, we have changed our accounting policy for cost of sales

and now include pay costs directly related to revenue, with the

prior period restated. The impact on the current year was to

include GBP477,000 (2021: GBP394,000) of pay costs in cost of sales

that would have been in administrative expenses under the previous

accounting policy.

Expenditure

Administrative expenses, excluding acquisition expenses,

increased by 29% to GBP9.6m (2021: GBP7.4m), driven by two main

factors. Firstly, investment in commercial activities increased

considerably as the team expanded to provide complete market

coverage and to support further sales of decentralised clinical

trial modules. Secondly, we expanded our in-house software and

product teams to develop new and existing solutions to meet

customer demands and provide future sales opportunities. As with

many technology companies, we experienced inflationary pressure on

pay during the year, which we have addressed in part with the

addition of a software team based in South Africa.

Maintaining our position at the forefront of the sector requires

a sustained focus on research and development, a subset of our

administrative expenses. In 2022, a total of GBP2.2m was invested,

an increase from GBP1.7m in 2021. These funds were primarily

allocated towards developing novel high-frequency cognitive

assessments to broaden the portfolio, moving to Amazon Web

Services, strengthening our cyber-security, and conducting

essential maintenance of existing products. R&D spending as a

percentage of revenue was 17.4% in 2022 (2021: 16.8%), reflecting

our continued investment in our product portfolio, and we expect

this to decrease as revenue grows.

Capital Expenditure and Cash

Capital expenditure was GBP0.2m, primarily related to IT

hardware and office equipment. We have not capitalised any

development expenditure in the year.

Excluding acquisition-related costs, we had a marginal loss

before tax of GBP0.1m (2021: profit before tax of GBP0.3m). R&D

tax credits receivable were GBP0.2m (2021: GBP0.2m). The post-tax

loss for the year was GBP0.4m (2021: profit after tax of GBP0.5m),

which equates to a loss per share of 1.3 pence (2021: 1.4 pence

earnings per share).

As of 31 December 2022, cash was at GBP8.3m (31 December 2021:

GBP6.8m), and the cash inflow from operating activities during the

year was GBP1.7m (2021: GBP3.9m), again driven by sales orders.

During the year, GBP1.1m of cash was utilised to acquire

eClinicalHealth Limited. Sales contracts for clinical trials

typically include a billable amount upon signing, which means that

cash flow is generally ahead of revenue recognition.

The Company continues to hold an investment in Monument

Therapeutics Limited ("Monument"), the digital phenotyping drug

development business that was spun out in 2021. The investment in

Monument is carried at fair value and reflects the risks

attributable to early-stage biotechnology companies. Monument's

progress with early clinical trials remains on track and aligned

with our expectations. It is currently seeking Series A

investment.

Financial Outlook

Cambridge Cognition ended 2022 with sufficient cash to acquire

Winterlight and fund expected growth through to profitability. We

are optimally positioned for further growth in orders of our

existing solutions and to support our continued commercial

expansion. Considered investments will continue to be made to

achieve our strategic goals.

While low double digit revenue growth is expected in 2023, the

positive impact of acquisitions and continued investment in product

development is expected to see a decrease in cash balances and

operating losses for the year. With this investment and the

associated increase in scale, we anticipate a return to

profitability in the second half of 2024 and growth in

profitability thereafter.

The Company will continue to manage costs carefully with a focus

on realising synergies as we review our operational structure

following recent acquisitions. We anticipate that administrative

expenses and research and development costs will reduce through

2023 relative to revenues whilst we continue to invest in the

product portfolio and increase sales coverage.

We have set out five strategies to help improve people's health

globally while generating future revenue growth above expected

rates of growth, currently estimated at more than 10%, in the

markets in which we are operating. Accordingly, the Company is

targeting revenue growth in excess of the market growth rates with

increasing levels of growth in the medium-term driving towards

material profitability in 2025.

Stephen Symonds

Chief Financial Officer

Consolidated Statement of Comprehensive Income

For the year ended 31 December

Notes Year to Year to

31 December 31 December

2021

2022 (Restated)

GBP'000

GBP'000

--------------------------------------- ------ ------------- -------------

Revenue 3 12,613 10,094

Cost of sales (3,291) (2,409)

--------------------------------------- ------ ------------- -------------

Gross profit 9,322 7,685

Administrative expenses excluding

acquisition expenses (9,616) (7,435)

Administrative expenses - acquisition (479) -

related

--------------------------------------- ------ ------------- -------------

Total administrative expenses (10,095) (7,435)

Other operating income 156 14

--------------------------------------- ------ ------------- -------------

Operating (loss) / profit (617) 264

Interest receivable 9 -

Finance costs (16) (11)

--------------------------------------- ------ ------------- -------------

(Loss) / profit before tax (624) 253

Tax credit 215 197

(Loss) / profit for the year (409) 450

--------------------------------------- ------ ------------- -------------

Other comprehensive (loss) / income

Items that may subsequently be reclassified

to profit or loss

Exchange differences on translation

of foreign operations (302) 14

---------------------------------------------- ------ ----

Total comprehensive (loss) / income

for the year (711) 464

---------------------------------------------- ------ ----

(Loss)/ earnings per share (pence) 4

-------------------------------------- ---- ------ ----

Basic earnings per share (1.3) 1.4

Diluted earnings per share (1.3) 1.4

All items of income are attributable to the equity holders in

the Parent.

The above results relate to continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December

Notes At 31 December At 31 December

2022 2021

GBP'000 GBP'000

------------------------------- ------ --------------- ---------------

Assets

Non-current assets

------------------------------- ------ --------------- ---------------

Intangible assets 1,421 373

Property, plant and equipment 188 52

Investments 49 49

Total non-current assets 1,658 474

------------------------------- ------ --------------- ---------------

Current assets

------------------------------- ------ --------------- ---------------

Inventories 216 126

Trade and other receivables 4,680 4,935

Current tax receivable 231 195

Cash and cash equivalents 5 8,322 6,810

Total current assets 13,449 12,066

------------------------------- ------ --------------- ---------------

Total assets 15,107 12,540

------------------------------- ------ --------------- ---------------

Liabilities

Current liabilities

------------------------------- ------ --------------- ---------------

Trade and other payables 15,012 11,908

Total liabilities 15,012 11,908

------------------------------- ------ --------------- ---------------

Equity

------------------------------- ------ --------------- ---------------

Share capital 312 312

Share premium 11,151 11,151

Other reserves 5,823 6,125

Own shares (71) (78)

Retained earnings (17,120) (16,878)

Total equity 95 632

------------------------------- ------ --------------- ---------------

Total liabilities and equity 15,107 12,540

------------------------------- ------ --------------- ---------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December

Share Share Other Own shares Retained

capital premium reserve earnings Total

s

GBP '000 GBP '000 GBP '000 GBP '000 GBP '000 GBP '000

----------------------------- --------- --------- --------- ----------- ---------- ---------

Balance at

1 January 2021 312 11,151 6,111 (78) (17,439) 57

Profit for year - - - - 450 450

Other comprehensive

income - - 14 - - 14

----------------------------- --------- --------- --------- ----------- ---------- ---------

Total comprehensive

income for the year - - 14 - 450 464

Credit to equity for

equity-settled share-based

payments - - - - 111 111

----------------------------- --------- --------- --------- ----------- ---------- ---------

Transactions with

owners - - - - 111 111

Balance at

31 December 2021 312 11,151 6,125 (78) (16,878) 632

----------------------------- --------- --------- --------- ----------- ---------- ---------

Balance at

1 January 2022 312 11,151 6,125 (78) (16,878) 632

----------------------------- --------- --------- --------- ----------- ---------- ---------

Loss for year - - - - (409) (409)

Other comprehensive

income - - (302) - - (302)

----------------------------- --------- --------- --------- ----------- ---------- ---------

Total comprehensive

income for the year - - (302) - (409) (711)

Transfer of own shares - - - 7 (7) -

Credit to equity for

equity-settled share-based

payments - - - - 174 174

----------------------------- --------- --------- --------- ----------- ---------- ---------

Transactions with

owners - - - 7 167 174

----------------------------- --------- --------- --------- ----------- ---------- ---------

Balance at 5,82

31 December 2022 312 11,151 3 (71) (17,120) 95

----------------------------- --------- --------- --------- ----------- ---------- ---------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December

Notes Year to Year to

31 December 31 December

2022 2021

GBP'000 GBP'000

-------------------------------------------- ------ ------------- -------------

Net cash flows from operating activities 5 1,668 3,945

Investing activities

-------------------------------------------- ------ ------------- -------------

Interest received 9 -

Purchase of property, plant and equipment (189) (56)

Purchase of investment - (49)

Net cash flow used in investing activities (180) (105)

-------------------------------------------- ------ ------------- -------------

Financing activities

-------------------------------------------- ------ ------------- -------------

Proceeds from exercise of share options 1 -

Repayment of borrowings 5 (133) -

Interest payments - (11)

Lease payments - (86)

-------------------------------------------- ------ ------------- -------------

Net cash flows from financing activities (132) (97)

-------------------------------------------- ------ ------------- -------------

Net increase in cash and cash equivalents 1,356 3,743

Cash and cash equivalents at start

of year 6,810 3,047

Exchange differences on cash and

cash equivalents 156 20

Cash and cash equivalents at end

of year 5 8,322 6,810

-------------------------------------------- ------ ------------- -------------

1. General information

Cambridge Cognition Holdings plc ("the Company") and its

subsidiaries (together, "the Group") develops and markets digital

solutions to assess brain health.

The Company is a public limited company which is listed on the

AIM market of the London Stock Exchange (symbol: COG) and is

incorporated and domiciled in the UK. The address of its registered

office is Tunbridge Court, Tunbridge Lane, Bottisham, Cambridge,

CB25 9TU.

2. Basis of preparation

The financial information of the Group set out above does not

constitute "statutory accounts" for the purposes of Section 435 of

the Companies Act 2006.

Statutory accounts for the year ended 31 December 2021 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 31 December 2022 will be delivered to the Registrar

in due course. Those accounts have been reported on by the

Independent Auditors; their report for the accounts for both

financial years was (i) unqualified; (ii) did not include a

reference of any matters to which the auditor drew attention by way

of emphasis without qualifying their report; and (iii) did not

contain a statement under 498 (2) or 498 (3) of the Companies act

2006.

The Group financial statements will be properly prepared in

accordance with UK adopted international accounting standards. The

accounting policies adopted will be consistent with those followed

in the preparation of the consolidated financial statements for the

year ended 31 December 2021, except as noted below.

The Group has reconsidered its accounting policy for the

presentation of expenses in the income statement to include staff

and related costs relating to the delivery of those services within

cost of sales. The prior year income statement has been restated

for the reclassification of costs between cost of sales and

administrative expenses. As a result, the prior year has been

restated to reflect an increase in cost of sales of GBP394,000 with

a corresponding decrease in administrative expenses. The overall

operating profit for 2021 remains unchanged.

At the time of approving the preliminary results statement, and

based on a review of the Group's forecasts and business plan, the

Directors have a reasonable expectation that the Company and the

Group have adequate resources to continue in operational existence

for the foreseeable future. Thus, they continue to adopt the going

concern basis of accounting in preparing the preliminary

statement.

3. Segmental information

An analysis of the Group's revenue for each major product and

service category is as follows:

2022 2021

GBP'000 GBP'000

-------------- --------- ---------

Software 5,027 3,609

Services 6,528 5,638

Hardware 1,058 847

-------------- --------- ---------

12,613 10,094

-------------- --------- ---------

4. Earnings per share

The calculation of basic and diluted earnings per share ("EPS")

is based on the following data:

Earnings

2022 2021

'000 GBP '000

--------------------------------------------------------------- ------- ----------

Earnings for the purposes of basic and diluted

EPS per share being net (loss)/profit attributable

to owners of the Company (409) 450

--------------------------------------------------------------- ------- ----------

Number of shares

2022 2021

'000 GBP '000

--------------------------------------------------------------- ------- ----------

Weighted average number of ordinary shares

for the purposes of basic EPS 31,170 31,170

--------------------------------------------------------------- ------- ----------

Weighted average number of ordinary shares

for the purposes of diluted EPS 31,170 31,519

--------------------------------------------------------------- ------- ----------

The diluted loss per share is considered to be the same as

the basic loss per share. Potential dilutive shares are not

treated as dilutive where they would result in a loss per share.

5. Notes to the cash flow statement

2022 2021

GBP'000 GBP'000

-------------------------------------------------- --------- ---------

(Loss) / profit before tax (624) 253

Adjustments for:

Depreciation of property, plant and equipment 57 142

Amortisation of intangible assets 37 6

Share-based payment expense 174 111

Finance costs - 11

Acquisition related expenses deferred amounts 6 -

Interest receivable (9) -

-------------------------------------------------- --------- ---------

Operating cash flows before movements in working

capital (359) 523

Increase in inventories (88) (75)

Decrease/(increase) in receivables 1,012 (2,285)

Increase in payables 912 5,782

-------------------------------------------------- --------- ---------

Cash generated by operations 1,477 3,945

Tax credit received less tax paid 191 -

Net cash from operating activities 1,668 3,945

-------------------------------------------------- --------- ---------

Reconciliation of liabilities arising from financing

activities

2022 2021

GBP'000 GBP'000

-------------------------------------- --------- ---------

Net Debt as 1 January - -

Debt acquired in business combination 133 -

Financing cash flows (133) -

-------------------------------------- --------- ---------

Net Debt as at 31 December - -

-------------------------------------- --------- ---------

Cash and cash equivalents

2022 2021

GBP'000 GBP'000

Cash and bank balances 8,322 6,810

------------------------ --------- ---------

Cash and cash equivalents comprise cash and short-term bank

deposits with an original maturity of three months or less. The

carrying amount of these assets is approximately equal to their

fair value.

6. Annual Report & Annual General Meeting

The Company announces its intention to hold its Annual General

Meeting ("AGM") on Wednesday 28 June 2023. Details of the AGM will

be communicated to shareholders via the Company's website and a

Regulatory Information Service as soon as they are finalised. This

notice will also include the date on which the notice of AGM and

the Annual Report will be posted to shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKBBNCBKDOPK

(END) Dow Jones Newswires

May 03, 2023 02:00 ET (06:00 GMT)

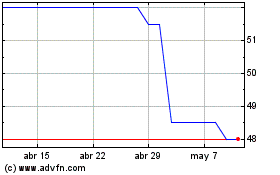

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De May 2023 a May 2024