Dukemount Capital PLC Notice of AGM (8372W)

14 Diciembre 2023 - 3:56AM

UK Regulatory

TIDMDKE

RNS Number : 8372W

Dukemount Capital PLC

14 December 2023

14 December 2023

Dukemount Capital Plc

("Dukemount" or the "Company")

Notice to shareholders for annual general meeting, further

advance under existing funding agreement, settlement to achieve a

reduction in existing debt and completion of Chesterfield

Conversion of debt

The board of directors, Dukemount Capital Plc, a SPAC (as

confirmed in the announcement of 12 September 2023), is pleased to

confirm the following:

-- A circular will be posted on Monday 18 December to hold the

annual general meeting of the Company on 12 January 2024. The

resolutions (the "Resolutions") at the annual general meeting will

be to, inter alia, restructure the share capital of the Company

given the current trading price being below the nominal value.

-- Through extensive discussions with the existing noteholders

(the "Investors") pursuant to the existing funding agreement (as

detailed in the announcement of 11 October 2022) (the "Existing

Funding"), the directors have executed a net advance of GBP40,000

to fund immediate capital requirements of the Company.

-- The Investors have agreed an irrevocable conditional

amendment to the Existing Funding as follows:

o The existing debt (inclusive of the further GBP40,000 advance)

will be reduced to GBP900,000 (being a decrease of over 20% of the

accrued balances).

o No interest or fees to accrue during the term (i.e. the

outstanding balance is frozen).

o All rights to receive warrants pursuant to the Existing

Funding are released and waived.

o 24 month repayment term from the date of the amendment being

effective

o Upon completion of a reverse takeover, the Company may elect

for either (a) the Existing Funding to be converted into equity at

the relevant placing price for the RTO or (b) the Existing Funding

will be repaid (i) 50% of the outstanding balance on completion,

(ii) 25% - 13 months from completion and (iii) 25% - 24 months from

completion.

The amendments are conditional on the passing of the Resolutions

and the Chesterfield Conversion below.

-- As previously announced, Chesterfield Capital Limited has

undertaken to convert the existing GBP500,000 debt at 0.0065 per

ordinary share in the Company (being 76,923,076 ordinary shares

when calculated prior to the reorganisation as detailed in the

Resolutions) (the "Chesterfield Conversion"). Chesterfield Capital

Limited has issued a subscription which is only conditional on the

passing of the Resolutions.

CEO Elect Paul Gazzard commented:

"The board of directors are working closely with its broker,

Peterhouse Capital, to consider all capital raising opportunities

and to review prospects with regards to an RTO. At present the

Company has no proceedable RTO opportunities, but we continue to

review those presented to the board and will continue to ensure the

market is kept up-to-date on progress. The additional funding from

the Investors ensures the Company is on track to finalise its

annual report for the 30 September 2023 year end and intends to

publish those within the required timetable. Further, the

restructure of the Existing Funding and the Chesterfield Conversion

simplifies considerably the historic liabilities of the Company,

something which the board believes will have a positive impact on

progressing a potential RTO. The circular for the annual general

meeting will be posted next week."

For further information, please visit www.dukemountcapitalplc.com or contact:

Dukemount Capital Plc : Email info@dukemountplc.com

CEO: Paul Gazzard

Non-Executive Director: Geoffery Dart

Broker Enquiries:

Peterhouse Capital Limited Tel: +44 (0) 207 469 0930

Lucy Williams/Duncan Vasey

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOATIBLTMTABMIJ

(END) Dow Jones Newswires

December 14, 2023 04:56 ET (09:56 GMT)

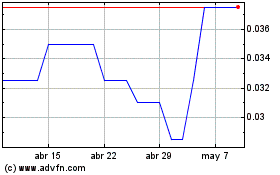

Dukemount Capital (LSE:DKE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Dukemount Capital (LSE:DKE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024