TIDMEAAS

RNS Number : 9115E

eEnergy Group PLC

16 March 2022

16 March 2022

eEnergy Group plc

("eEnergy" or "the Group")

Results for the six months ended 31 December 2021

eEnergy Group plc (AIM: EAAS), the digital energy services

company, is pleased to announce its interim results for the six

months ended 31 December 2021.

Financial Highlights for the six months ended 31 December

2021:

-- Revenue for the enlarged Group up 42% to GBP9.6 million (H1 FY21: GBP6.8 million).

-- Energy Management revenue increased to GBP4.8 million (H1

FY21: GBP0.2 million) through underlying annualised growth of 25%,

the inclusion of Beond for the full period and the acquisition of

UtilityTeam in September 2021.

-- Energy Efficiency revenue of GBP4.8 million was stable with

H2 FY21 but down 28% on H1 FY21 (GBP6.6 million), primarily as a

result of the catch up effect in H1 FY21 of projects delayed from

the first Covid lockdown.

-- Group gross margin increased in the period to 57.6 % (H1

FY21: 38.2%) due to the change in sales mix towards Energy

Management.

-- Adjusted EBITDA(1) up 117% to GBP0.8 million (H1 FY21: GBP0.4 million).

-- Profit before exceptional items(2) of GBP0.2 million (H1 FY21 GBP0.1 million).

-- Cash at bank GBP2.6 million (30 June 2021: GBP3.3 million)

and net debt (including IFRS 16 lease liabilities) of GBP1.1

million (30 June 2021: net cash GBP0.8 million).

Operational Highlights:

-- Successful integration of Beond and advanced integration of

UtilityTeam, both performing ahead of management's

expectations.

-- Increased stake in MY ZeERO from 37.5% to 51% following the

successful completion of specific development milestones.

-- Contracted forward revenue(3) increased 205% to GBP18.3

million (31 December 2020: GBP6.0 million).

-- Accelerating pipeline for Energy Efficiency projects - higher

value of investment grade proposals(4) issued in H1 FY22 than in

the whole of FY21.

-- Now ranked as a Top 5 Energy Management provider in the UK by Cornwall Insight.

-- Delivered the first integrated onsite solar generation and lighting replacement project

-- Secured and installed the first standalone energy data and

insights contract for a multi academy trust.

-- 108 LED lighting installations completed at schools and

businesses in the UK & Ireland in H1 FY22 (H1 FY21: 111).

-- 132 MY ZeERO eMeters installed and a further 260 installed or

awaiting installation at 28 February 2022.

Highlights post period end

-- Successfully refinanced all our secured debt with Silicon

Valley Bank in February 2022. The GBP5 million revolving credit

facility is at a significantly lower average cost of finance and

provides much more flexibility.

-- The Company is now able to provide its clients with onsite

solar generation and intends to add electric vehicle charging

solutions to its offering by the end of FY22.

Full year outlook

-- The Group has a growing pipeline of opportunities, which is

expected to generate incremental revenue in H2 FY22.

-- There are clearly risks outside of the Group's control,

including challenges to contracting new energy supply contracts in

the current market environment and timing of customer decisions on

Energy Efficiency contracts and installations . However, on

balance, and given the full period contribution from UtilityTeam

and the strength of the Group's pipeline of opportunities, the

Board expects to trade in line with the current market expectations

for FY22.

Harvey Sinclair, CEO of eEnergy, commented :

" eEnergy has made robust progress over the last six months,

having successfully integrated the teams at Beond and UtilityTeam,

both of which are performing well and ahead of our expectations.

Moreover, we are seeing strong momentum with our customers engaging

with our newly rolled outsmart metering and energy efficiency

as-a-service solutions.

Whilst the volatile market environment represents risks for our

business, the ongoing energy crisis and the resulting increase in

energy prices has provided an inflection point for our business.

Our customers recognise the commercial significance of reducing

energy wastage now more than ever. We are one of the only

businesses that enable customers to reduce their energy consumption

as well as generate their own energy without the need for capital

investment.

Additionally, the broader macro conditions and clear regulatory

drivers continue to be a tailwind for the business, and the Board

believes this provides the Group with improved organic structural

growth drivers. "

Investor Presentation

CEO Harvey Sinclair and CFO Ric Williams will provide a live

presentation relating to the interim results via the Investor Meet

Company platform on 16 March 2022 at 09:00am GMT.

The presentation is open to all existing and potential

shareholders. Questions can be submitted at any time during the

live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet eEnergy Group plc via:

https://www.investormeetcompany.com/eenergy-group-plc/register-investor

Note: (1) Adjusted EBITDA is Earnings before interest, tax,

depreciation and amortisation before exceptional items, which are

transaction-related items, incremental integration and

restructuring costs and share based payment expenses.

Note (2) Profit before exceptional items is the profit before

tax and before the exceptional items listed in Note 1.

Note (3) Contracted forward revenue is based upon our

expectations of energy consumption by our clients under contract

plus the revenue to be earned from energy efficiency contracts that

have been signed but not yet installed.

Note (4) An investment grade proposal is a written proposal

issued to an engaged client after we have completed an investment

grade audit of the client's site.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, as it forms part of UK

Domestic Law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement, this inside information

is now considered to be in the public domain. The person

responsible for arranging for the release of this announcement on

behalf of eEnergy is Ric Williams, Chief Financial Officer.

Contacts:

eEnergy Group plc Tel: +44 20 7078

9564

Harvey Sinclair, Chief Executive Officer info@eenergyplc.com

Ric Williams, Chief Financial Officer www.eenergyplc.com

Crispin Goldsmith, Chief Strategy & Commercial

Officer

Singer Capital Markets (Nominated Adviser Tel: +44 20 7496

and Joint Broker) 3000

Justin McKeegan/Mark Taylor/Asha Chotai (Corporate

Finance)

Tom Salvesen (Corporate Broking)

Turner Pope Investments (Joint Broker) Tel: +44 20 3657

0050

Andy Thacker/James Pope info@turnerpope.com

Tavistock (Financial PR and IR) Tel: +44 20 7920

3150

Jos Simson/Heather Armstrong/Katie Hopkins eEnergy@t avistock.co.uk

About eEnergy Group plc

eEnergy (AIM: EAAS) is a digital energy services company,

empowering organisations to achieve Net Zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making Net Zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through our

digital procurement platform and energy management services.

-- Tackle energy waste with granular data and insight on energy

use and dynamic energy management.

-- Reduce energy use with the right energy efficiency solutions without upfront cost.

-- Reach Net Zero with onsite renewable generation and EV charging.

eEnergy currently manages 5.3TWh of energy for 2,200 customers

across the public and private sectors.

eEnergy has been awarded The Green Economy Mark by London Stock

Exchange.

https://eenergyplc.com/

Chief Executive's Statement

The first half of our FY22 financial year has been a period in

which we have made significant steps in integrating the Group. We

have expanded our services and customer base and aligned our

broader strategy to become a leading integrated energy efficiency

and management business. The acquisition of UtilityTeam has brought

us a commercial edge to our Energy Management business, including

scale and a significant opportunity to cross-sell our products and

services to our growing customer base. Whilst H1 FY22 may have felt

like we were "treading water" in Energy Efficiency, the resumption

of face to face marketing to the education sector and the success

in establishing a broader set of channels to market means that our

pipeline of proposals and opportunities is at a record high.

Strategy

Our strategy since Admission has been to assemble, through

organic growth and acquisition, a balanced portfolio of energy and

carbon reduction solutions, to diversify the Group, improve its

quality of earnings and generate scale with a view to helping

schools and businesses achieve the Net Zero goals. eEnergy now has

the ability to offer customers a broad range of products and

services and expertise in energy management and efficiency and

intelligent measurement and analysis, cultivating a large and

relevant customer base to which the Group is cross-selling by

delivering its end-to-end offering. 44% of our Top 50 clients are

actively engaged in procuring significant additional services from

the Group.

With the acquisition and integration of UtilityTeam we have

established the foundation for how we support our clients in their

journey to Net Zero across the business. With this now complete, we

continue to build upon this base with an increased focus on channel

partners and relationships which means we can scale the business

more effectively and build relationships with customers who can

benefit from the breadth of our offering rather than just a single

solution.

We completed our first integrated onsite solar generation and

LED lighting project in H1 FY22 and we have proposals of

significant value that include onsite solar generation which we

hope to secure and deliver before the end of FY22. As energy prices

move inexorably higher we believe that the combination of being

able to install local solar generation alongside energy reduction

projects like LED, all on a capital free basis, is a compelling

proposition for the market. Onsite solar generation is relevant to

the vast majority of our clients and we have active engagement with

clients for projects worth over GBP7 million. We are also exploring

opportunities to ensure that we secure more of the value gained

through the installation of onsite solar generation, which may

include acquiring the right solar partner.

As previously disclosed, the Group also intends to add electric

vehicle charging solutions to its offering by the end of FY22. The

structural and regulatory growth drivers that the Group is exposed

to remain highly attractive and will support Management's growth

ambitions over the medium term.

Acquisition criteria

We have a clearly stated acquisition strategy with focused

criteria, including to:

-- building capability in renewables;

-- target high growth, strong and aligned leadership ideally with proprietary technologies; and

-- execute transactions that are earnings accretive and cash generative.

We will seek to target acquisitions based on maintainable EBITDA

multiples, with earnout and lock-ins for key management.

To date, the Group has utilised flexible acquisition structures,

involving a mix of consideration shares and cash. The Group intends

to continue to utilise such structures and where cash is paid using

available debt facilities, to limit Group net leverage to no more

than 2x EBITDA.

Energy Market conditions

We have seen extreme volatility in the UK and European energy

markets for a number of months, and more recently exacerbated by

the war in Ukraine. We have been advising our clients for some time

that higher energy prices are with us for the foreseeable future,

and that this only makes the savings achievable from implementing

energy efficiency measures that much greater. The volatility in the

market, including the risk of failure of some energy suppliers,

also emphasises the advantage we have from our technology and

consulting led Energy Management business, where customers are

increasingly looking for greater insight on consumption, efficiency

and risk management. However, the recent issues around security of

supply have meant that despite us having consultancy agreements in

place with our clients we have not always been able to lock in

their future energy supply. This is due to the effective closure of

the market with suppliers unwilling to price customers' demand in

the short term. Whilst we have seen some easing of these conditions

in the past few days, the market remains susceptible to change as

events in Ukraine trigger a broader political and economic

response.

Trading performance

Energy Management

Beond's first year

We acquired Beond in December 2020 to be the bedrock for our

Energy Management business and it has performed very well,

delivering Adjusted EBITDA 25% ahead of our acquisition base case

in the first year. This strong performance has been driven by

increased revenues as we have expanded the services our clients pay

for complemented by operating efficiencies in how we deliver those

services. In addition, we have delivered the automation of key data

collection and manipulation processes as well as our online

customer platform.

UtilityTeam

We completed the acquisition of UtilityTeam in September 2021

and trading to date has exceeded our expectations, although the

much larger size of UtilityTeam's key contracts brings positives

and negatives. The UtilityTeam contracts are typically longer and

larger than the more diversified portfolio of contracts in Beond

and the customers demand a broader range of services. However,

whilst we have good visibility of our pipeline and have not seen

any increase in customer churn, the disruption in the marketplace

we are currently seeing has resulted in a delay in signing some

larger contracts which, in turn, has a bearing on the timing of

revenue as we recognise c20% of the contract value on signing.

MY ZeERO

Following the successful completion of specific development

milestones in October 2021 eEnergy increased its stake in MY ZeERO

from 37.5% to 51%. We signed and then installed our first

standalone monitoring and data insights as a service contract with

a multi academy trust in December 2021 and at 31 December 2021 had

132 eMeters installed. Client demand is strong and we have

installed or secured orders for another 260 eMeters as at 11 March

2022 and expect to have installed over 1,000 eMeters by the end of

June from a sales pipeline of c.GBP1.8 million.

Energy Efficiency

We provide schools, businesses and other organisations with the

right energy efficiency solutions (such as LED lighting) to reduce

their energy usage with no upfront cost as the client pays for our

solution over a fixed term (typically five - seven years) where the

regular payment is always less than the savings on their

energy.

Due to the difficult market conditions brought about by the

third national Covid lockdown in early 2021 the financial

performance of the Energy Efficiency business in H1 FY22 was stable

at the level we achieved in H2 FY21 but behind that seen in H1

FY21, a period that benefited significantly from the "catch up" of

projects from the first Covid lockdown into the summer of 2020.

Access to potential clients changed significantly in October and

November 2021 as we were able to engage in face-to-face marketing

at events and conferences, which is a key direct sales channel for

the education marketplace. As a result, we achieved our lead

generation targets for the whole of FY22 by Christmas and the

pipeline of proposals and opportunities at 31 December 2021 was at

a record high. Momentum has continued since the end of the calendar

year and the pipeline has grown further still. The focus is now on

completing the committed installations by the end of FY22 and

continuing to develop our pipeline of opportunities. Together with

securing projects through key channel partners, the success in

securing the first phase with a number of large multi academy

trusts gives us confidence in a significantly improved outcome for

H2 FY22.

In Ireland the impact of the Covid restrictions on our ability

to secure leads, convert opportunities and install projects

continued throughout 2021 and were more severe than in the UK, with

revenue falling 18% compared with H1 FY21. Having brought Ireland

into the unified management structure and with those Covid

restrictions starting to ease, we are now seeing the volume of

sales increasing in line with our expectations.

Management team and structure

The acquisition of UtilityTeam allowed us to further strengthen

the management structure and we welcomed Delvin Lane and Simon

Smith as Managing Directors for each of the Energy Management and

Energy Efficiency businesses respectively. Whilst focused on the

solutions each of these businesses deliver Delvin and Simon work

collaboratively to ensure that we are delivering integrated

solutions to our top 50 strategic clients, those who have the

greatest need for our end-to-end solutions.

Full Year Outlook

Our strategy is on track and the Group has a growing pipeline of

opportunities for the remainder of the financial year across both

our Energy Efficiency and Energy Management divisions. Our new

business targets are well covered and we have issued more Energy

Efficiency proposals in H1 FY22 than in the whole of FY21.

Our contracted forward revenues (based on current expected

consumption for Energy Management clients), as at 31 December 2021

of GBP18.3 million over five years (up 205% from 31 December 2020).

Of that GBP18.3 million, GBP5.3 million is expected to be

recognised as revenue in H2 FY22 and GBP6.5 million recognised in

FY23.

eEnergy continues to make significant strategic progress towards

its stated goal to provide a simple, end to end solution to

organisations and companies wanting an economic and effective path

to Net Zero emissions. We have grown our customer base, evolved our

service offering and have exposure to some of the largest

structural growth trends in the energy segment. Our focus on

cross-selling to our existing customers (with whom we are actively

engaged in over GBP17 million of opportunities) and cultivating new

customers across both divisions is creating new opportunities for

the Group to drive further profitable growth.

There are clearly risks that are outside of the control of the

Group, including the global consequences of continued war in

Ukraine and the timing of customer decisions on Energy Efficiency

contracting and installations but on balance, and given the full

period contribution from UtilityTeam and the strength of our

pipeline of opportunities, the Board expects to trade in-line with

market expectations for the current financial year.

Harvey Sinclair

Chief Executive Officer

16 March 2022

Note: (1) Profit before exceptional items is the profit before

tax excluding transaction-related items, incremental integration

and restructuring costs and share based payment expenses.

Chief Financial Officer's Statement

The financial performance of the Group for the interim period

has been broadly in line with our expectations. The acquisition of

UtilityTeam in September and the related Placing that we completed

has strengthened our overall financial position and has contributed

to the continued growth in revenue and profitability.

Financial position and liquidity

Our closing cash at the end of December 2021 was GBP2.6 million

(30 June 2021: GBP3.3 million) and our debt balances (GBP3.7

million at 31 December 2021, including IFRS 16 lease liabilities)

were predominantly long term in nature. In February 2022 we

completed the refinancing of all of our secured debt with Silicon

Valley Bank as part of a GBP5 million committed revolving credit

facility which provides more flexibility at a significantly lower

average cost of finance.

During H1 FY22 the impact of the shift from energy suppliers

paying commission income in advance to favouring paying in arrears

became more pronounced and was a particular factor in the reduction

to our period end cash balance. Whilst the working capital profile

has changed there is no reduction to the overall cash commission

that the Group receives over the life of the effected

contracts.

The Board seeks to take a prudent approach to working capital

management, with ongoing monitoring of our financial position and

scenario analysis to reflect downside risk cases that may arise

from potential disruption to the business, whether from the

consequences of the Covid-19 pandemic or the volatility in the

energy market. Having considered management's assessment of

potential scenarios, the Board is confident that the Group has

sufficient financial resources and headroom within its debt

facilities (including the ability to meet its debt covenants) for

the foreseeable future.

Financial overview

The overall 42% increase in revenue reflects a stronger than

expected performance in Energy Management as well as the trading to

date from the acquisition of UtilityTeam in September 2021 and

slightly weaker than expected revenue in Energy Efficiency due to

the drag on lead generation earlier in 2021.

Energy Management

-- Revenue for H1 FY22 was GBP4.8 million (H1 FY21: GBP0.2

million) reflecting strong annualised growth of 25% following the

acquisition of Beond in December 2020 and the contribution from

UtilityTeam from its acquisition in September 2021.

-- Contracted forward revenues of GBP17.0 million at 31 December

2021, up 250% (31 December 2020 GBP4.9 million).

-- Operating EBITDA margin for H1 FY22 was 29.8% (H1 FY21:

15.4%) as we improved pricing and operational efficiency across the

Energy Management business.

-- During H1 FY22 87% of all energy management contracts signed

by clients were for 100% renewable supply (FY21: 82%).

The Energy Management business has performed ahead of

management's expectations in terms of both revenue growth and the

rate at which the UtilityTeam business is being integrated into the

Group. In the first year within the Group Beond has increased its

average contract term by 27% and revenue per meter under management

by 37%.

The contracted future revenue has grown both organically (at 27%

pa) and as a result of bringing UtilityTeam into the Group and we

have already contracted x% of our expected FY23 revenues.

MY ZeERO

-- At 31 December 2021 we had 132 eMeters deployed.

-- We had a further 260 eMeters either installed or under

committed order at 11 March 2022, which represents Contracted

future revenue was GBP0.4 million.

We report the results of MY ZeERO within the Energy Management

business and see this as an integral part of the Group as allowing

customers to measure their energy consumption is at the heart of

the strategy.

Energy Efficiency

-- Total contract value secured in H1 FY22 was GBP4.9 million (H1 FY21: GBP6.9 million).

-- Contracted future revenue of GBP1.3 million at 31 December

2021 was 10% higher compared to 31 December 2020 (GBP1.2

million).

-- Revenue for H1 FY22 was GBP4.8 million, the same as for H2

FY21 but down from GBP6.6 million in H1 FY21, where we benefited

from the catch-up of projects delayed after the first Covid

lockdown.

-- Gross margin (after commission) has improved 440bps to 37.8%

compared the equivalent period of the prior year (H1 FY21: 33.4%;

FY21 34.4%).

-- The operating EBITDA margin declined 730bps to 5.8% (H1 FY21:

13.1%) as a result of the lower revenue in the period and the

investment in additional sales, marketing and operational delivery

resources.

-- Number of projects completed in H1 FY22 was 108 (H1 FY21: 111).

The Energy Efficiency business has been stable across the whole

of calendar 2021. Market conditions have remained challenging in

Ireland where the extent of Covid lockdowns have been more

restrictive than in the UK.

Gross margins after commission have continued to improve over

the period as a result of the strong relationships we have with our

key supply chain partners across the UK and Ireland.

Operating expenses have increased 13% to GBP1.5 million (H1

FY21: GBP1.3 million) as we have continued to invest in our sales

and marketing and operational delivery capability in order to

capture and deliver the volume and complexity of projects we are

installing.

Head office costs

Following the acquisition of Beond in December 2021 and to

reflect the growing scale of the Group's operations, we expanded

the head office management team to include our COO as well as

additional Group resources in marketing and finance. As a result

our central management costs increased to GBP0.9 million in H1 FY22

(H1 FY21: GBP0.5 million).

Working capital

As described in my year end report our two divisions operate to

a different working capital tempo. Within Energy Efficiency we

typically fund our projects with funding partners at the time of

installation and our funding partner takes the collection risk over

the term of the client contract. Due to the timing of the

completion of projects in December 2021 more than usual of our

contracts completed in the month were funded during 2022 which

accounts for cGBP0.5 million of the increase in Trade and other

receivables.

Within Energy Management we recognise a proportion of revenue

when the underlying energy supply contract is signed between our

client and the energy supplier. We also typically receive the

majority of our income in the form of commission based upon actual

consumption by our client. Historically the business has received

more cash in advance from suppliers than the revenue that has been

recognised and therefore recorded a deferred income balance.

However, in light of the ongoing volatility in the energy markets

we have seen a change in receipt of supplier commissions, with

energy suppliers increasingly favouring payments in arrears, rather

than offering up to 80% of the expected commission upfront. This

shift by suppliers away from upfront commission has accelerated

with the recently increased volatility in the market. This has

changed the working capital profile and delayed the collection of

cash (but not overall cash commissions to be received), for the

applicable contracts.

Borrowings

At acquisition in September 2021, UtilityTeam had a GBP1.45

million CBILS loan. Throughout the period we have made scheduled

repayments across our loans and the combined effect has resulted in

our borrowings increased GBP1.1 million between 30 June and 31

December 2021 to GBP2.9 million.

In February 2022 we successfully refinanced all of our secured

loans with a three year, GBP5 million rolling credit facility with

Silicon Valley Bank which has significantly reduced our blended

cost of finance and provides us with enhanced liquidity and more

flexible financing. With Silicon Valley Bank we have a strong

partner who is very supportive of our growth strategy.

Acquisitions

In September 2021 we completed the acquisition of UtilityTeam.

As described in note 9 of the interim financial report, we expect

to pay approximately GBP18.0 million (assuming the maximum Earn-out

consideration is payable) of which we have already paid GBP14.5

million. The first GBP1.5 million of the earn out consideration is

payable in cash with the balance is shares. UtilityTeam is being

integrated into our Energy Management business but we are already

seeing the benefits of having broadened the capability and reach

within the business.

Ric Williams

Chief Financial Officer

16 March 2022

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six month period ended 31 December 2021

Period to Period to Year to

31 December 31 December 30 June

2021 2020 2021

Note GBP'000 GBP'000 GBP'000

----- -------------- -------------- ----------

Continuing operations

Revenue from contracts with customers 9,592 6,767 13,596

Cost of sales (4,067) (4,428) (8,059)

------------------------------------------- ----- -------------- -------------- ----------

Gross profit 5,525 2,339 5,537

Operating expenses (5,911) (2,952) (4,955)

Included within operating expenses

are:

* Other exceptional items 4 1,193 985 248

-------------- -------------- ----------

Adjusted operating expenses (4,718) (2,213) (4,707)

-------------- -------------- ----------

Adjusted earnings before interest,

taxation, depreciation and amortisation 807 372 830

------------------------------------------- ----- -------------- -------------- ----------

Earnings before interest, taxation,

depreciation and amortisation (386) (613) 582

Depreciation and amortisation (401) (63) (333)

Finance costs (227) (212) (426)

Loss before taxation (1,014) (888) (177)

Income tax - - 205

------------------------------------------- ----- -------------- -------------- ----------

Profit (Loss) for the year from

continuing operations attributable

to the owners of the company (1,014) (888) 28

=========================================== ===== ============== ============== ==========

Attributable to:

Owners of the company (932) (888) 28

Non-controlling interest (82) - -

------------------------------------------- ----- -------------- -------------- ----------

(1,014) (888) 28

------------------------------------------- ----- -------------- -------------- ----------

Other comprehensive income -

items that may be reclassified

subsequently to profit and loss

Change in the fair value of other

current assets - 43 34

Translation of foreign operations 107 49 102

------------------------------------------- ----- -------------- -------------- ----------

Total other comprehensive profit

(loss) 107 92 136

------------------------------------------- ----- -------------- -------------- ----------

Total comprehensive profit (loss)

for the year (907) (796) 164

=========================================== ===== ============== ============== ==========

Total comprehensive profit (loss)

attributable to:

Owners of the company (825) (796) 164

Non-controlling interest (82) - -

------------------------------------------- ----- -------------- -------------- ----------

(1,003) (796) 164

------------------------------------------- ----- -------------- -------------- ----------

Basic and diluted loss per share

from continuing operations attributable

to owners of the company 5 (0.33)p (0.58)p 0.01p

------------------------------------------- ----- -------------- -------------- ----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2021

As at As at

31 December 30 June

2021 2021

Note GBP'000 GBP'000

----- -------------

NON-CURRENT ASSETS

Property, plant and equipment 296 80

Intangible assets 6 30,253 11,693

Right of use assets 622 610

Deferred Tax Asset 415 415

Investment in Associate - 155

Total non-current assets 31,586 12,953

------------------------------------------ ----- ------------- ---------

Other current assets 44 47

Inventories 742 371

Trade and other receivables 8,049 4,276

Financial assets at fair value through

profit or loss 140 140

Cash and cash equivalents 2,588 3,332

------------------------------------------ ----- ------------- ---------

Total current assets 11,563 8,166

------------------------------------------ ----- ------------- ---------

TOTAL ASSETS 43,149 21,119

------------------------------------------ ----- ------------- ---------

NON-CURRENT LIABILITIES

Lease liability 376 434

Borrowings 7 2,367 1,245

Deferred Tax Liability 1,576 415

Other non-current liabilities 300 468

Total non-current liabilities 4,619 2,562

CURRENT LIABILITIES

Trade and other payables 10,019 7,819

Deferred and contingent consideration 9 4,245 -

Lease liability 343 264

Borrowings 7 579 601

Total current liabilities 15,186 8,684

------------------------------------------ ----- ------------- ---------

TOTAL LIABILITIES 19,805 11,246

------------------------------------------ ----- ------------- ---------

NET ASSETS 23,344 9,873

========================================== ===== ============= =========

Equity attributable to owners of the

parent

Issued share capital 16,367 16,071

Share premium 47,167 33,014

Other reserves 771 601

Reverse acquisition reserve (35,246) (35,246)

Foreign currency translation reserve 94 (13)

Accumulated losses (5,486) (4,554)

------------------------------------------ ----- ------------- ---------

Total equity attributable to owners

of the parent 23,667 9,873

------------------------------------------ ----- ------------- ---------

Non-controlling interest (323) -

------------------------------------------ ----- ------------- ---------

Total equity 23,344 9,873

========================================== ===== ============= =========

CONSOLIDATED STATEMENTS OF CASHFLOWS

For the six month period ended 31 December 2021

Period Period Year to

to 31 December to 31 December 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

---------------- ---------------- ---------

Cash flow from operating activities

Operating profit (loss) - continuing

operations (1,014) (888) 28

Adjustments for:

Depreciation and amortisation 401 63 332

Finance cost (net) 127 131 311

Share issue to settle expenses - - 301

Share option charge 170 172 485

Share of loss in associate 30 - 34

Finance charge on lease liabilities 31 34 65

Foreign exchange movement 12 10 35

Gain on derecognition of contingent

consideration - - (1,444)

-------------------------------------------- ---------------- ---------------- ---------

Operating cashflow before working

capital movements (243) (478) 147

Decrease (increase) in trade and

other receivables 65 (1,652) (2,406)

(Decrease) increase in trade and

other payables (2,612) 1,344 2,760

(Increase) decrease in inventories (42) 10 (23)

Decrease (increase) in deferred

income (414) (140) (264)

Net cash outflow inflow from operating

activities (3,246) (916) 214

-------------------------------------------- ---------------- ---------------- ---------

Cash flow from investing activities

Cash acquired on acquisition of

business 2,800 1,218 1,218

Cash from exercise of options in

acquired business - 521 521

Cash paid to acquire subsidiaries (10,582) (2,395) (2,395)

Expenditure on intangible assets (457) - (217)

Purchase of property, plant and

equipment (117) (122) (134)

-------------------------------------------- ---------------- ---------------- ---------

Net cash (outflow) from investing

activities (8,356) (778) (1,007)

-------------------------------------------- ---------------- ---------------- ---------

Cash flows from financing activities

Interest (paid) received (97) (131) (319)

Repayment of lease liabilities (109) (41) (163)

Net proceeds from the issue of

shares 11,382 2,985 3,149

Proceeds from loans and borrowings - 299 294

Repayment of borrowings (333) - (314)

-------------------------------------------- ---------------- ---------------- ---------

Net cash inflow from financing activities 10,843 3,112 2,647

-------------------------------------------- ---------------- ---------------- ---------

Net increase in cash and cash equivalents (759) 1,418 1,854

Effect of exchange rates on cash 15 (73) -

Cash and cash equivalents at the

start of the period 3,332 1,478 1,478

Cash and cash equivalents at the

end of the period 2,588 2,823 3,332

============================================ ================ ================ =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period ended 31 December 2021

Reverse Foreign

Share Share Acqn. Other Currency Accum. Non Control Total

Capital Premium Reserve Reserves Reserve Losses Interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2021 16,071 33,014 (35,246) 601 (13) (4,554) - 9,873

Translation

of foreign

operations - - - - 107 - - 107

Loss for the ( 932

period - - - - - ) (82) (1,014)

---------------------- --------- --------- --------- ---------- ---------- -------- ------------ --------

Total comprehensive

loss for the ( 932

period - - - - 107 ) (82) (907)

------------

Shares issued

during the

period 296 14,771 - - - - - 15,067

Cost of share

issue - (618) - - - - - (618)

Share based

payments - - - 170 - - 170

Acquisition

of new entity - - - - - - (241) (241)

---------------------- --------- --------- --------- ---------- ---------- -------- ------------ --------

Total transactions

with owners 296 14,153 - 170 - - (241) 14,378

---------------------- --------- --------- --------- ---------- ---------- -------- ------------ --------

Balance at

31 December

2021 16,367 47,167 (35,246) 771 94 (5,486) (323) 23,344

====================== ========= ========= ========= ========== ========== ======== ============ ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period ended 31 December 2020

Reverse Foreign

Share Share Acqn. Other Currency Accum. Total

Capital Premium Reserve Reserves Reserve Losses Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2020 15,725 22,375 (35,246) 82 (115) (4,582) (1,761)

Translation of

foreign operations - - - - 49 - 49

Revaluation of

other assets - - - 43 - - 43

Loss for the

period - - - - - (888) (888)

------------------------- --------- --------- --------- ---------- ---------- -------- --------

Total comprehensive

loss for the

year attributable

to equity holders

of the parent - - - 43 49 (888) (796)

Shares issued

during the period 328 10,301 - - - - 10,629

Share based payments - - 172 - - 172

Cost of share

issue (227) - - - - (227)

------------------------- --------- --------- --------- ---------- ---------- -------- --------

Total transactions

with owners 328 10,074 - 172 - - 10,574

------------------------- --------- --------- --------- ---------- ---------- -------- --------

Balance at 31

December 2020 16,053 32,449 (35,246) 297 (66) (5,470) 8,017

========================= ========= ========= ========= ========== ========== ======== ========

SELECTED NOTES TO THE FINANCIAL INFORMATION

For the six month period ended 31 December 2021

1 Basis of preparation

The condensed consolidated interim financial statements of

eEnergy Group plc (the "Group") for the six month period ended 31

December 2021 have been prepared in accordance with Accounting

Standard IAS 34 Interim Financial Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 30 June 2021, which was prepared under UK adopted

international accounting standards (IFRS), and any public

announcements made by eEnergy Group plc during the interim

reporting period and since.

These condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 June 2021 prepared under IFRS have been filed

with the Registrar of Companies. The auditor's report on those

financial statements was unqualified and did not contain a

statement under Section 498(2) of the Companies Act 2006. These

condensed consolidated interim financial statements have not been

audited.

Basis of preparation - going concern

The interim financial statements have been prepared under the

going concern assumption, which presumes that the Group will be

able to meet its obligations as they fall due for the foreseeable

future.

At 31 December 2021 the Group had cash reserves of GBP2,588,000

(30 June 2021: GBP3,332,000; 31 December 2020: GBP2,823,000).

In assessing whether the going concern assumption is

appropriate, the Directors have taken into account all relevant

information about the current and future position of the Group and

Company, including the current level of resources and the ability

to trade within the terms and covenants of its loan facility over

the going concern period of at least 12 months from the date of

approval of the interim financial statements. The eEnergy group

meets its working capital requirements from its cash and cash

equivalents and its loan facilities, which are secured by a

debenture over its trading subsidiaries.

Having prepared budgets and cash flow forecasts covering the

going concern period which have been stress tested for the negative

impact of possible scenarios from volatile UK energy prices which

have been exacerbated by the current war in Ukraine, the Directors

believe the Group has sufficient resources to meet its obligations

for a period of at least 12 months from the date of approval of

these interim financial statements. Discretionary expenditure will

be curtailed, if necessary, in order to preserve cash for working

capital purposes and ensure compliance with covenants.

Taking these matters into consideration, the Directors consider

that the continued adoption of the going concern basis is

appropriate having prepared cash flow forecasts for the relevant

period. The interim financial statements do not reflect any

adjustments that would be required if they were to be prepared

other than on a going concern basis.

Accounting policies

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting

period.

New and amended standards adopted by the group

A number of amended standards became applicable for the current

reporting period. These amended standards do not have a material

impact on the Group, and the Group did not have to change its

accounting policies or make retrospective adjustments as a result

of adopting these standards.

3. SEGMENT REPORTING

The following information is given about the Group's reportable

segments:

The Chief Operating Decision Maker is the Board of Directors.

The Board reviews the Group's internal reporting in order to assess

performance of the Group. Management has determined the operating

segments based on the reports reviewed by the Board.

The Board considers that during the six month period ended 31

December 2021 and 31 December 2020, the Group operated in two

business segments, the Energy Management segment and the Energy

Efficiency segment, which predominantly comprised of LED lighting

solutions. With the strengthening of the management team following

the acquisition of UtilityTeam and the appointment of Managing

Directors to lead each of the operating segments the Board now

primarily reviews Energy Efficiency as a single segment whereas in

the prior year the Board reviewed the operations in the UK and

Ireland separately.

Energy Energy

Mgmt Efficiency Central Group

---------------------------------- -------- ------------ -------- ---------

2021 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- ------------ -------- ---------

Revenue - UK 4,832 3,333 - 8,165

Revenue - Ireland - 1,427 - 1,427

-------- ------------ -------- ---------

Revenue - Total 4,832 4,760 - 9,592

Cost of sales (1,107) (2,960) - (4,067)

-------- ------------ -------- ---------

Gross Profit 3,725 1,800 - 5,525

Operating expenses (2,284) (1,524) - (3,808)

-------- ------------ -------- ---------

Operating EBITDA 1,441 276 - 1,717

Central management costs - - (896) (896)

Adjusted EBITDA 1,441 276 (896) 821

Depreciation and amortisation (344) (56) (1) (401)

Finance and similar charges (38) (184) (19) (241)

-------- ------------ -------- ---------

Profit (loss) before exceptional

items 1,059 36 (916) 179

Exceptional items (139) (63) (991) (1,193)

-------- ------------ -------- ---------

Profit (loss) before tax 920 (27) (1,907) (1,014)

-------- ------------ -------- ---------

Taxation charge - - - -

-------- ------------ -------- ---------

Profit (loss) after tax 920 (27) (1,907) (1,014)

======== ============ ======== =========

Non-controlling interest (82) - - (82)

Profit (loss) attributable to

owners of the Company 1,002 (27) (1,907) (932)

======== ============ ======== =========

Net Assets

Non current assets - UK 23,269 3,326 4,385 30,980

Non current assets - Ireland - 606 - 606

Current assets 6,878 4,161 524 11,563

-------- ------------ -------- ---------

Assets - Total 30,147 8,093 4,909 43,149

Liabilities (8,891) (6,167) (4,747) (19,805)

--------

Net assets 21,256 1,926 162 23,344

======== ============ ======== =========

Energy Energy

Mgmt Efficiency Central Group

---------------------------------- -------- ------------ -------- ---------

2020 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- ------------ -------- ---------

Revenue - UK 162 4,881 - 5,043

Revenue - Ireland - 1,724 - 1,724

-------- ------------ -------- ---------

Revenue - Total 162 6,605 - 6,767

Cost of sales (28) (4,400) - (4,428)

-------- ------------ -------- ---------

Gross Profit 134 2,205 - 2,339

Operating expenses (109) (1,340) - (1,449)

-------- ------------ -------- ---------

Operating EBITDA 25 865 - 890

Central management costs - - (518) (518)

Adjusted EBITDA 25 865 (518) 372

Depreciation and amortisation (10) (46) (7) (63)

Finance and similar charges (6) (42) (164) (212)

-------- ------------ -------- ---------

Profit (loss) before exceptional

items 9 777 (689) 97

Exceptional items - - (985) (985)

-------- ------------ -------- ---------

Profit (loss) before and after

tax 9 777 (1,674) (888)

======== ============ ======== =========

Net Assets

Non current assets - UK 1,630 195 10,314 16,014

Non current assets - Ireland - 733 - 733

Current assets 1,615 3,854 1,408 6,877

-------- ------------ -------- ---------

Assets - Total 3,245 4,782 11,722 19,749

Liabilities (2,132) (6,968) (2,632) (11,732)

--------

Net assets (liabilities) 1,113 (2,186) 9,090 8,017

======== ============ ======== =========

4. EXCEPTIONAL ITEMS

Operating expenses include items that the Directors consider to

be exceptional by their nature. These items are:

Period to Period to Year to

31 December 31 December 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

--------------------------------- ------------- ------------- ---------

Acquisition related expenses 820 813 1,094

Changes to initial recognition

of contingent consideration - - (1,444)

Incremental restructuring and

integration costs 198 - 113

Share based payment expense 175 172 485

------------- ------------- ---------

Total exceptional expenses 1,193 985 248

------------- ------------- ---------

Acquisition expenses are the costs incurred in completing the

"Buy and Build" strategy associated with acquisitions and strategic

investments. The costs incurred in completing the acquisition of

UtilityTeam in September 21 are described in Note 8.

The share based payment charge reflects the non cash cost of the

Management Incentive Plan awards made on 7 July 2020 and the award

of options made to the senior management team on 7 December 2021

which are being amortised over their three year vesting period.

5. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share is

calculated by dividing the profit or loss for the year by the

weighted average number of ordinary shares in issue during the

year

Period to Year to 30 Period to

31 Dec 2021 June 2021 31 Dec 2020

------------------------------- ------------- ------------ -------------

(Loss) profit for the year

from continuing operations

attributable to owners of

the Company - GBP'000 (1,014) 28 (888)

Weighted number of ordinary

shares in issue 304,325,269 199,038,204 152,632,932

-------------------------------- ------------- ------------ -------------

Basic earnings per share

from continuing operations

- pence (0.36) 0.01 (0.58)

-------------------------------- ------------- ------------ -------------

There is no difference between the diluted loss per share and

the basic loss per share presented. Share options and warrants

could potentially dilute basic earnings per share in the future,

but were not included in the calculation of diluted earnings per

share as they are anti-dilutive for the periods presented.

6. INTANGIBLE ASSETS

Customer Trade

Goodwill Software relation-ships names Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------- --------- ---------------- --------- ---------

Cost

At 1 July 2021 9,803 642 824 555 11,824

Additions on acquisition 14,178 - 3,487 1,039 18,704

Additions in the

period - 244 - - 244

At 31 December

2021 23,981 886 4,311 1,594 30,772

========= ========= ================ ========= =========

Amortisation

At 1 July 2021 - 60 41 30 131

Amortisation in

the period - 182 143 63 388

At 31 December

2021 - 242 184 93 519

--------- --------- ---------------- --------- ---------

Net book value

at

30 June 2021 9,803 582 783 525 11,693

--------- --------- ---------------- --------- ---------

Net book value

at

31 December 2021 23,981 644 4,127 1,501 30,253

========= ========= ================ ========= =========

7. BORROWINGS

31 December 30 June 31 December

2021 2021 2020

GBP'000 GBP'000 GBP'000

------------- ------------ --------- ------------

Current

Borrowings 579 601 592

579 601 592

------------- ------------ --------- ------------

Non-current

Borrowings 2,367 1,245 1,629

2,367 1,245 1,629

------------- ------------ --------- ------------

The terms of the Borrowings are as disclosed in the 30 June 2021

financial statements except that at acquisition in September 2021

UtilityTeam had a CBILS Loan of GBP1,450,000. The CBILS loan was

interest free for the first twelve months and is then repaid in

instalments over the following five years. The interest rate on the

UtilityTeam CBILS loans is 1.28 % above base rate per annum. The

CBILS loan was secured over the assets of UtilityTeam.

In February 2022 the Group completed the refinancing of all of

its secured borrowings and agreed a GBP5m secured revolving credit

facility with Silicon Valley Bank.

...............................

Maturity of the borrowings as of 31 December 2021 are as

follows:

GBP'000

----------------------- --------

Current 579

Due between 1-2 years 1,602

Due between 2-5 years 750

Due beyond 5 years 15

------------------------ --------

2,946

----------------------- --------

8. RELATED PARTY TRANSACTIONS

Key management personnel are considered to the Board of

Directors. The amount payable to the Board of Directors for the six

months ended 31 December 2021 was GBP563,000 (H1 FY21:

GBP266,000).

9. BUSINESS COMBINATIONS

Acquisition of UtilityTeam Topco Limited and related Placing

On 17 September 2021 the Company completed the acquisition of

all of the share capital of UtilityTeam TopCo Limited ("UTT"). At

the same time the Company completed the Placing of 80 million

shares which were issued at 15 pence per share, which raised

GBP12.0 million for the Company. The Placing proceeds have been

primarily used to settle the initial cash consideration for the

acquisition of UTT.

UTT is a UK-based, top 20 energy consulting and procurement

business, whose services aim to reduce costs and support clients'

transition to Net Zero.

The initial consideration of GBP14.5 million was satisfied as

follows:

-- cash consideration of GBP9.5 million, payable on completion

with further cash consideration of GBP2 million, GBP1 million of

which was paid in October 2021 and the final GBP1 million in

January 2022.; and

-- the issue of 18.0 million Ordinary Shares, which had a fair

value of GBP3.0 million based on the closing share price on the day

prior to completion.

There is an adjustment to the value of the initial consideration

based upon the level of net working capital and debt in UTT at the

date of acquisition. Any reduction in the fair value of the net

assets acquired will result in lower consideration being paid and

lower goodwill arising on the acquisition.

Further earn-out consideration of up to a maximum of GBP5.1

million may be payable, based on a multiple of 7.0x UTT's EBITDA,

for the year ending 31 December 2021. The Company will pay GBP7 for

every GBP1 of EBITDA generated in excess of GBP2.3 million, up to a

maximum EBITDA of GBP3.0 million ("Earn-Out Consideration").

The Earn-Out Consideration would be satisfied as follows:

-- the first GBP1.5m of Earn-Out Consideration will be paid in cash; and

-- any balance, up to GBP3.6 million, will be satisfied by the

issue of new Ordinary Shares at a price that is the higher of 24p

and the 30 day volume weighted average price prior to 31 December

2021. Therefore a maximum of 15 million new Ordinary Shares may be

issued.

The initial estimate of the fair value of the assets acquired

and liabilities assumed of UTT at the date of acquisition based

upon the UTT consolida ted balance sheet at 17 September 2021 are

as follows:

GBP'000

------------------------------------------------------ ---------

Property, plant and equipment 180

Intangible assets 4,526

Right of use assets 135

Cash at bank 2,787

Inventory 27

Trade and other receivables 3,759

Trade and other payables (4,813)

Lease liability (141)

Deferred tax liability (1,161)

Loans and other borrowings (1,450)

---------

Total identifiable net assets acquired 3,849

Goodwill 13,935

------------------------------------------------------ ---------

Consideration

Initial consideration (recorded at the market value

of the shares issued) 14.539

Contingent consideration 3,245

Total consideration 17,784

------------------------------------------------------ ---------

The initial accounting for the acquisition of UTT is incomplete

as at the date of these interim financial statements given the

short period of time since the acquisition was completed.

10. EVENTS AFTER THE BALANCE SHEET DATE

Refinancing of all secured debt

In February 2022 the Group completed the refinancing of all of

its secured borrowings and agreed a GBP5m secured revolving credit

facility with Silicon Valley Bank.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GBGDXCGBDGDL

(END) Dow Jones Newswires

March 16, 2022 03:00 ET (07:00 GMT)

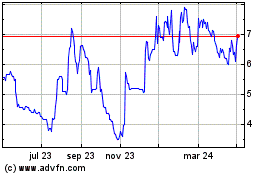

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

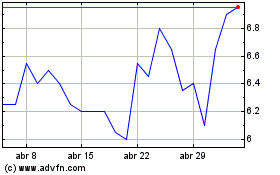

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

De May 2023 a May 2024