TIDMEAAS

RNS Number : 6900H

eEnergy Group PLC

25 November 2022

25 November 2022

eEnergy Group plc

("eEnergy" or "the Group")

Issue of secured bonds to raise GBP2,525,000 and issue of

Warrants

Proposed Director Appointment

eEnergy (AIM: EAAS), the net zero energy services provider,

announces that it has secured further debt finance of GBP2,525,000

(the "Subordinated Debt"), in order to provide additional funding

to the Group.

The Subordinated Debt has been structured as secured discounted

capital bonds ("Bonds") which are due for repayment on 24 May 2024

and 21 June 2024. GBP1 million of the Subordinated Debt is being

provided by each of, Hawk Investment Holdings Limited ("Hawk"), an

existing shareholder of eEnergy, and FFIH Limited (("FFIH"), with

the balance of GBP525,000 being provided by the directors of the

Company ("Directors").

FFIH is an investment company owned by John Foley and his wife.

John is a barrister and chartered accountant who has served on a

number of public and private company boards. He was CEO of

MacLellan Group plc, a UK facilities management provider, for 12

years until its sale in 2006 to Interserve plc for an enterprise

value of GBP130m. He was co founder of Premier Technical Services

Group Ltd (PTSG) a specialist provider of facilities services, and

was its Chairman from inception in 2007 until early November 2022

(he remains a Non-Executive Director). PTSG became a public listed

company in 2015 and was acquired by Macquarie Group Ltd in 2019 for

an enterprise value of approximately GBP300m which represented a

304% premium to the 2015 listing share price. He is also currently

Chairman of SEC Newgate Spa, the parent company of a global

strategic communications and advisory group and is also Chairman of

Servoca Plc, a provider of staffing solutions and outsourced

services.

As announced in the Company's preliminary results for the year

ended 30 June 2022 published concurrently with this announcement,

the Subordinated Debt will be used to fund additional Energy

Services working capital as a result of lengthened cash collection

cycles as well as funding the next phase of MY ZeERO stock-build,

other balance sheet liabilities and general working capital.

Issue of Warrants

In connection with the Subordinated Debt, the subscribers to the

Bonds will also be granted warrants to subscribe for, in aggregate

42,083,328 ordinary shares of the Company (the "Warrants"), on a

pro rata basis. The Warrants will have an exercise price of 6p and

will be exercisable for a period of 5 years from the date of

issue.

The Company intends to utilise its remaining share authorities

from its 2021 AGM to grant 32,791,216 Warrants immediately. The

remaining 9,292,112 Warrants will be issued to the subscribers to

the Bond (including the Directors) subject to obtaining shareholder

approval at the Company's next AGM, expected to be held in December

2022.

Details of the Subordinated Debt

Under the terms of the Bonds, Hawk, FFIH and the Directors are

subscribing in aggregate for GBP2,525,000 of the Bonds. The Bonds

are being issued at a 21.29% discount to their face value

(equivalent to a discount rate of 1.25% per month plus a 2%

repayment fee) and are due to be redeemed by the Company (through

the payment of in aggregate GBP3,207,754) on or before 24 May 2024

(in respect of amounts owed to Hawk and FFIH) and on or before 21

June 2024 (in respect of amounts owed to the Directors) (the

"Redemption Dates").

The Bonds being subscribed for by Hawk and FIFH will be issued

immediately on funds being received by the Company. The GBP525,000

of Bonds being issued to the Directors will be issued following the

AGM and the associated funds are expected to be received by the

Company on or around 21 December 2022.

The Bonds are secured on a second-charge basis behind Silicon

Valley Bank UK Limited ("SVB"), the Company's senior creditor. The

maturity of SVB's fully drawn GBP5.0 million revolving credit

facility provided to the Group has been shortened by 12 months to

12 February 2024, to maintain SVB's priority as senior creditor.

The security relating to the Hawk and FFIH loans will rank senior

to the Directors loans.

The Bond contains certain customary terms, including accelerated

payment in an event of default. The Bond can be repaid early at the

election of the Company without penalty. In the event that the

Subordinated Debt is not redeemed in whole on or before the

Redemption Date, then interest shall accrue thereon at the rate of

15% per annum above the prevailing base rate of the Bank of

England.

Security for the Bonds will be secured through a debenture held

on trust by a security trustee, which will be Derek Myers, a

Director participating in the Bond issue and Non-Executive Director

of the Company.

Proposed Director Appointment

Under the terms of the Bonds and until the Subordinated Debt

owed to Hawk and FFIH has been repaid in full, Hawk and FFIH

jointly have the right to appoint a Non-Executive Director to the

board of the Company, subject to satisfactory completion of

customary due diligence and approval by the Company's nominated

adviser. The Company intends to appoint John Foley as the Company's

Non-Executive Chair at the time of publication of the Group's

interim results for the six months to 31 December 2022.

It is expected that David Nicholls will remain on the Company's

board as a Non-Executive Director. Further announcements will be

made in due course.

Related Party Transaction

The Directors have subscribed for, in aggregate, GBP525,000

Bonds and are thereby being granted 8,749,996 Warrants in aggregate

(subject to shareholder approval at the AGM). The participation of

the Directors in the Bonds, and associated grant of Warrants,

constitutes a related party transaction under Rule 13 of the AIM

Rules.

As all of the Directors are participating in the transaction,

Singer Capital Markets Advisory LLP, acting in its capacity as the

Company's nominated adviser, having consulted with the Directors,

considers that the terms of the Directors participation in the

Bonds and the associated grant of Warrants are fair and reasonable

insofar as the Company's Shareholders are concerned.

Details of the subscriptions for the Bonds are set out

below:

Name Amount subscribed Number of Redemption

GBP Warrants amount

Hawk 1,000,000 16,666,666 1,270,400

------------------ ---------------------- ---------------------

FFIH 1,000,000 16,666,666 1,270,400

------------------ ---------------------- ---------------------

Nigel Burton 200,000 3,333,333 254,077

------------------ ---------------------- ---------------------

Crispin Goldsmith 25,000 416,666 31,760

------------------ ---------------------- ---------------------

Andrew Lawley 25,000 416,666 31,760

------------------ ---------------------- ---------------------

Derek Myers 200,000 3,333,333 254,077

------------------ ---------------------- ---------------------

David Nicholl 25,000 416,666 31,760

------------------ ---------------------- ---------------------

Harvey Sinclair 25,000 416,666 31,760

------------------ ---------------------- ---------------------

Gary Worby 25,000 416,666 31,760

------------------ ---------------------- ---------------------

2,252,000 42,083,328 3,207,754

------------------ ---------------------- ---------------------

Harvey Sinclair, CEO of eEnergy Group plc, commented : "As

announced in our preliminary results, today, eEnergy continues to

deliver significant year on year growth. As we win larger

contracts, we are seeing longer cash collection cycles and for this

reason we have secured a GBP2,525,000 facility with Hawk and John

Foley's FFIH investment vehicle, a new strategic investor, as well

as support from the Directors. The Board believes that John Foley

has an excellent track record in building high growth companies and

we look forward to his appointment to our Board."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018.

The person responsible for arranging the release of this

announcement on behalf of the Company is Crispin Goldsmith Chief

Financial Officer of the Company.

Contacts:

eEnergy Group plc Tel: +44 20 7078 9564

Harvey Sinclair, Chief Executive info@eenergyplc.com ; www.eenergyplc.com

Officer

Crispin Goldsmith, Chief Financial

Officer

Singer Capital Markets (Nominated Tel: +44 20 7496 3000

Adviser and Joint Broker)

Justin McKeegan, Asha Chotai,

James Maxwell (Corporate Finance)

Tom Salvesen (Corporate Broking)

Canaccord Genuity Limited (Joint Tel: +44 20 7523 8000

Broker)

Max Hartley, Tom Diehl, Gerel

Bastin (Corporate Broking)

Tavistock Tel: +44 207 920 3150

Jos Simson, Heather Armstrong, eEnergy@tavistock.co.uk

Katie Hopkins

About eEnergy Group plc

eEnergy (AIM: EAAS) is a net zero energy services provider,

empowering organisations to achieve net zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making net zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through the

Group's digital procurement platform and energy management

services.

-- Tackle energy waste with granular data and insight on energy

use and dynamic energy management.

-- Reduce energy use with the right energy efficiency solutions without upfront cost.

-- Reach net zero with onsite renewable generation and electric vehicle (EV) charging.

eEnergy is a Top 5 B2B energy company and has been awarded The

Green Economy Mark by London Stock Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IODFEMFWIEESEDF

(END) Dow Jones Newswires

November 25, 2022 12:40 ET (17:40 GMT)

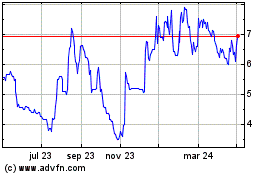

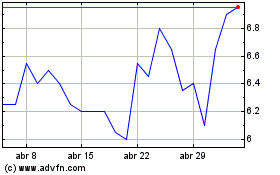

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Eenergy (LSE:EAAS)

Gráfica de Acción Histórica

De May 2023 a May 2024