TIDMEAH

RNS Number : 6720U

Eco Animal Health Group PLC

27 November 2023

27 November 2023

ECO Animal Health Group pc ("ECO", the "Company" or the

"Group")

(AIM: EAH)

Results for the six months ended 30 September 2023

HIGHLIGHTS

Financial

-- Group Revenue increased 9% to GBP38.0 million (H1 2022: GBP34.9 million)

o Revenues on a constant currency basis increased 15%

-- Gross margins 41% (H1 2022: 45%)

-- Adjusted EBITDA at GBP0.7 million (H1 2022: GBP1.7 million)

-- Loss per share of 1.93p (H1 2022: earnings per share: 1.96p)

-- Cash generated by operations increased to GBP4.8m (H1 2022: GBP3.0m)

-- Cash balances increased to GBP20.6m (30 September 2022 GBP12.9m)

Operational

-- Revenue in China and Japan increased by 14% to GBP9.7 million (H1 2022: GBP8.5 million)

-- Revenue in USA and Canada increased by 26% to GBP8.2 million (H1 2022: GBP6.5 million)

-- US FDA and Veterinary Drugs Directorate in Canada approval

received for use of Aivlosin (R) in pregnant and lactating sows

-- Successful recent Capital Markets Day highlighted significant

potential unrecognised future value in R&D pipeline

-- ESG - 'A' rating by Integrum ESG

David Hallas, Chief Executive Officer of ECO Animal Health Group

plc, commented : "I am very pleased to see continuing revenue

growth, despite currencies headwinds for a large part of this first

half. Adjusting for the currency effect underlying growth in

revenues increased by 15%. We expect gross margins to improve in

the second half due to sales mix and improvements in Cost of Goods.

We have strong visibility over second half revenue. The Board looks

forward with cautious optimism to reporting the full year numbers

in line with market expectations .

I was particularly proud to showcase, at our recent Capital

Markets Day, some of the great results we are seeing in our R&D

programme. We plan to make further disclosure as our projects

progress; the intention being to build shareholder knowledge and

confidence around our future potential".

Forward-Looking Statements

This announcement contains certain forward-looking statements.

The forward-looking statements reflect the knowledge and

information available to the Company and Group during preparation

and up to the publication of this announcement. By their very

nature, these statements depend upon circumstances and relate to

events that may occur in the future and thereby involving a degree

of uncertainty. Therefore, nothing in this announcement should be

construed as a profit forecast by the Company or Group.

Contacts

ECO Animal Health Group plc

David Hallas (Chief Executive Officer)

Christopher Wilks (Chief Financial Officer) 020 8447 8899

IFC Advisory

Graham Herring

Zach Cohen 020 3934 6630

Singer Capital Markets (Nominated Adviser

& Joint Broker)

Philip Davies

Sam Butcher 020 7496 3000

Investec (Joint Broker)

Gary Clarence

Carlo Spingardi

Lydia Zychowska 020 7597 5970

Equity Development

Hannah Crowe

Matt Evans 020 7065 2692

CHAIRMAN AND CHIEF EXECUTIVE'S COMBINED STATEMENT

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

The Board is pleased to present the results for the Group for

the six months ended 30 September 2023 ("H1 2023"). During the

first half of the financial year, the Group experienced positive

global sales momentum and despite currency headwinds our results

show good revenue growth. The Group expects that the typical

pattern of demand will result in a stronger second half to our

year. The Group's revenue since September 2023, current order books

and run rate of sales from the Group's stocking locations provides

90% coverage of the projected second half revenue (94% of full year

consensus market forecasts*). Phasing and mix of revenues,

inventory usage and costs all support the forward view of gross

margins. We invested further in our promising R&D pipeline and

we continued to grow our commercial footprint in anticipation of

the introduction of new products. The Board is also proud to have

been awarded an 'A' rating for ESG - the highest grade possible -

by Integrum ESG, higher than some 300 companies ranked in our

sub-sector. This highlights our continuing/ efforts to improve our

impact on not only the environment but also the communities we work

with.

* The Board understands that current consensus figures for FY23

are GBP88.3m of revenue and GBP7.7m Adjusted EBITDA

Financial Performance

Group revenue was 9% higher in H1 2023 at GBP38.0 million (H1

2022: GBP34.9 million). China and Japan revenue of GBP9.7 million

represented 26% of Group revenue (H1 2022: 24%). On a constant

currency basis the Group's revenue in H1 2023 was GBP40.1 million;

an increase of 15% compared with H1 2022. The principal currency

effects were from a weaker US Dollar and Chinese RMB compared with

Sterling during the period.

Excluding China and Japan, revenue from other markets grew by

7%, in aggregate, to GBP28.3 million (H1 2022: GBP26.4

million).

The gross margin in H1 2023 was 41% (H1 2022: 45%). A

combination of foreign exchange effects and cost of purchases of

the active pharmaceutical ingredient ("API"), as well as certain

increased costs of manufacture outside of China have impacted the

gross margins. In addition, depreciation of the company's factory

equipment in China was charged to Cost of Sales in the period (in

2022, during the factory rebuild, depreciation was charged to

administrative costs). It is expected that the revenue and API

effects will in part reverse in H2 2023. The Gross margin movement

may be analysed as follows:

%

Gross margin in the six months ended 30 September

2022 45.3

F/x impact on revenue (3.5)

F/x impact on cost of sales 0.9

Impact of API inventory sales lag (1.1)

China depreciation charged to cost of sales (0.5)

Other increased cost of manufacture (0.3)

------

Gross margin in the six months ended 30 September

2023 40.8

------

Administrative expenses excluding foreign exchange gains at

GBP14.2 million were 13% higher than the comparative period last

year (H2 2022: GBP12.6 million). This arose in the main from

increased personnel costs offset in part by savings in legal, audit

and professional.

Research and development ("R&D") expenses shown in the

income statement together with the amounts capitalised were in

aggregate a cash investment of GBP3.6 million (H1 2022: GBP4.2

million). This represented 9.0% of revenue generated in the period

(H1 2022: 12.0%).

Earnings before interest, tax, depreciation, amortisation and

impairment, share based payments and foreign exchange movements

("Adjusted EBITDA") were GBP0.7 million (H1 2022: GBP1.7 million).

This reduction arose as a direct consequence of the higher revenue

offset by lower gross margin and increased personnel costs.

Cash generated from operations was GBP4.8 million (H1 2022:

GBP3.0 million). Continuing close management of working capital -

in particular inventories and receivables - has resulted in a cash

balance of GBP20.6 million which is significantly greater than at

30 September 2022 and comparable to the level at 31 March 2023.

Cash balances at 30 September 2023 can be analysed as follows:

At 30 September

2023 2022

(GBP'm) (GBP'm)

Held in UK 6.1 2.8

Held in non-China subsidiaries 2.9 2.0

Held in China 100% owned subsidiary 1.5 4.1

Held in China 51% owned subsidiary 10.1 4.0

20.6 12.9

--------- ---------

The Group repatriates cash from China by annual dividend

declaration; this is subject to withholding taxes of 5% and is paid

according to the relevant shareholdings. On a day--to--day basis,

the Board considers the cash held in the Group's joint venture

subsidiary in China to be unavailable to the Group outside of

China; accordingly, cash management and funds available for

investment in R&D is based upon the cash balances outside of

China.

During July 2023, two dividends totalling GBP3.4 million were

received from China.

The Group's committed banking facilities remain at GBP15.0

million, being a GBP5.0 million overdraft facility and a GBP10

million revolving credit facility. These facilities expire on 30

June 2026 and were undrawn as at 30 September 2023.

Basic loss per share in the six months ended 30 September 2023

was 1.93p (H1 2022: EPS 1.96p). The prior period EPS benefited from

the exchange rate gain reported in the period of GBP2.6 million in

the six months ended 30 September 2022.

Business Performance

The geographical analysis of the Group's revenue in the six

months ended 30 September 2023 compared to the prior period in 2022

and the full year ended 31 March 2023 was as follows:

Revenue Summary 6 months ended 30 September Year ended

H1 23 vs 31 March

2023 2022 H1 22 2023

(GBP'm) (GBP'm) % Change (GBP'm)

China and Japan 9.7 8.5 14% 26.4

North American (USA and Canada) 8.2 6.5 26% 15.2

South and Southeast Asia 7.8 7.4 5% 16.8

Latin America 7.7 7.9 (3%) 18.1

Europe 3.4 2.9 17% 6.0

Rest of World and UK 1.2 1.7 (29%) 2.8

Total Group 38.0 34.9 9% 85.3

--------------------------------- -------------- -------------- --------- -----------

Group revenue increased by 9% to GBP38.0 million (H1 2022:

GBP34.9 million). As stated earlier, on a constant currency basis

the increase in revenue was 15% in H1 2023 compared with H1 2022.

The main components of this revenue improvement were from China and

the USA. As noted in the Group's FY23 Annual Report the strong

trading in the final quarter ended 31 March 2023 carried over into

the spring and early summer months; this demand for Aivlosin (R)

was driven by disease incidence, in particular Porcine Reproductive

and Respiratory Syndrome ("PRRS") virus. Similarly, the strength in

the USA market was associated with prevalence of disease and strong

key account relationships. The improvement in European revenue was

offset by a phasing of revenues derived from North African

markets.

Aivlosin(R) continues to gain market share from other longer

established branded antimicrobials. The growth seen in Southeast

Asia during the last four or five years has continued during 2023.

The poor poultry market in India in recent years has recovered with

revenue increasing to GBP2.9 million (H1 2022: GBP2.2 million).

Thailand remained the largest single market for the Group's

products in this region with revenue increasing to GBP3.6 million

(H1 2022: GBP3.5 million), supported with good sales into

Bangladesh, Pakistan, Malaysia and Vietnam of GBP1.2 million (H1

2022: GBP1.6 million). Revenue in Latin America decreased 3% to

GBP7.7 million (H1 2022: GBP7.9 million), with Brazil representing

the largest market at GBP4.2 million (H1 2022: GBP4.2 million).

Brazil's exports of pork to China continued during the period

providing strong demand for Aivlosin (R) . Mexico revenue in H1

2023 was GBP0.3 million higher than the equivalent period last year

and the remaining counties in Latin America were broadly consistent

year on year. Revenue derived from Europe was GBP0.5 million higher

than H1 2022. Within the continent, Spain remained the largest

single market with revenues of GBP0.8 million in the six months

ended 30 September 2023 (H1 2022: GBP1.0 million).

Accelerated growth through R&D investment

Work on the Group's promising pipeline of new products has

continued at pace during the first half of this financial year with

GBP3.6 million (H1 2022: GBP4.2 million) spent during the period.

We held a Capital Markets Day ("CMD") on 9 November 2023 during

which a great deal of detail was provided on the Group's pair of

Mycoplasma vaccines for poultry, the Group's novel injectable

antimicrobial, the Group's very promising PRRS virus vaccine and

combination PCV2/MHyo vaccine for swine and the Group's approach to

a vaccine for necrotic enteritis in poultry. These latter three

projects employ highly novel monoclonal technology approaches and

promise to deliver significant technological disruption to the

prevention of these diseases. We highlighted some very significant

efficacy results which describe statistically significant immunity

to disease challenge when compared with control groups

incorporating placebo, untreated and treated with commercially

available existing products. The presentations at the CMD concluded

with an assessment of the revenue and profit contribution potential

in the R&D portfolio as well as a description of the net

present value and internal rate of return of the projects when

assessed over their product life cycle.

The Board considers the R&D portfolio to be rich in

opportunity and investment in this programme to be in shareholders'

best interests. These new products are complementary to our

extremely successful existing Aivlosin (R) based business,

addressing the same markets, producers, distributors and disease

complexes. It is envisaged that as revenue and profits begin to be

generated from these new product introductions the resulting

cashflow will be applied in a progressive way to dividend

distribution further enhancing shareholder value.

Strategy

Following the refresh of the Group's strategy in the Autumn of

2022, a year later the leadership team once again reviewed the

Group's direction and priorities. This resulted in an endorsement

of the vision and values of the Group. The embodiment of these

values is in the "3 C's" - these being Curiosity, Commitment and

Collaboration. Furthermore, the focus on delivering the class

leading products promised by the R&D effort was reinforced as

the primary opportunity to deliver shareholder value. Specific

actions arising involve prioritising projects with a balance of net

present value, risk, proximity to market and size of funding

requirement. In addition, key actions have been taken in relation

to building the operational capabilities and manufacturing

collaborations to fulfil the commercial needs of the new

products.

The Group is open to and will pursue further collaboration

including technical partnering, licensing and M&A activity.

People

The Board acknowledges the value that our people relationships

bring to the business. Whether it is current team members who

describe the 3C's in their everyday, prospective members of staff

for whom the 3C's resonate, customers, R&D partners commercial

partners or shareholders we understand the value of engagement and

the additive effect of a team working collectively. Engagement

surveys and environment, social and governance initiatives have

continued to enshrine these values. The Board extends its sincere

gratitude to all our people, customers, partners and collaborators

as we seek to maximise shareholder and stakeholder value.

Outlook

The Group expects that the historically observed increased

demand for Aivlosin (R) associated with the Northern Hemisphere

winter will once again result in a stronger second half to our

year. 94% of the market consensus revenue* is covered by

year-to-date revenue, order books and run rate from the Group's

stocking locations. Additionally, the first half currency headwinds

have normalised and the phasing and mix of revenues, inventory

usage and costs all support the forward profitability view. The

Board will continue during the remainder of this financial year to

invest in our extremely exciting new product pipeline.

The Board looks forward with cautious optimism to reporting the

full year numbers in line with market expectations*.

* The Board understands that current consensus figures for FY23

are GBP88.3m of revenue and GBP7.7m Adjusted EBITDA

Dr Andrew Jones David Hallas

Non-executive Chairman Chief Executive Officer

CONSOLIDATED INCOME STATEMENT

Six months Six months Year

to 30.09.23 to 30.09.22 ended

(unaudited) (unaudited) 31.03.23

(audited)

Notes GBP000's GBP000's GBP000's

Revenue 6 38,009 34,859 85,311

Cost of sales (22,508) (19,063) (46,935)

------------- ------------- -----------

Gross profit 15,501 15,796 38,376

40.8% 45.3% 45.0%

Other income 29 242 357

Research and development expenses (2,098) (2,923) (5,920)

Administrative expenses (14,016) (10,032) (27,866)

------------- ------------- -----------

(Loss)/profit from operating activities (584) 3,083 4,947

Finance income 76 42 104

Finance costs (166) (137) (656)

------------- ------------- -----------

Net finance cost (90) (95) (552)

Share of profit of associate 47 51 45

------------- ------------- -----------

47 51 45

(Loss)/profit before income tax (626) 3,039 4,440

Income tax charge 8 (580) (929) (1,349)

------------- ------------- -----------

(Loss)/profit for the period (1,206) 2,110 3,091

============= ============= ===========

(Loss)/profit attributable to:

Owners of the parent Company (1,307) 1,324 1,008

Non-controlling interest 101 785 2,083

------------- ------------- -----------

(Loss)/profit for the period (1,037) 2,110 3,091

============= ============= ===========

(Loss)/earnings per share (pence) 7 (1.93) 1.96 1.49

============= ============= ===========

(1 . 93

Diluted (loss)/earnings per share (pence) 7 ) 1.95 1.47

============= ============= ===========

Adjusted EBITDA (Non-GAAP measure) 6 705 1,670 7,235

============= ============= ===========

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Six months Six months Year

to 30.09.23 to 30.09.22 ended

(unaudited) (unaudited) 31.03.23

(audited)

GBP000's GBP000's GBP000's

(Loss)/profit for the period (1,206) 2,110 2,064

Other comprehensive income/(loss):

Items that may be reclassified to profit

or loss:

Foreign currency translation differences (1,285) 276 (586)

Items that will not be reclassified to profit

or loss:

Remeasurement of defined benefit pension

schemes - - 100

------------- ------------- -----------

Other comprehensive (loss)/income for the

year (1,285) 276 (486)

------------- ------------- -----------

Total comprehensive (loss)/income for the

year (2,491) 2,386 1,578

Attributable to:

Owners of the parent Company (2,070) 1,506 (229)

Non-controlling interest (421) 880 1,807

------------- ------------- -----------

(2,491) 2,386 1,578

============= ============= ===========

CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Share Share Revaluation Other Foreign Retained Total Non-controlling Total

Capital Premium Reserve Reserves Exchange Earnings Interest Equity

Reserve

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Balance as at

31

March 2022 3,381 63,319 657 106 2,188 12,413 82,064 12,284 94,348

Profit for the

year - - - - - 1,008 1,008 2,083 3,091

Other comprehensive income:

Foreign

currency

movement - - - - (310) - (310) (276) (586)

Actuarial

gains

on pension

scheme assets - - - - - 100 100 - 100

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Total

comprehensive

income for

the year - - - - (310) 1,108 798 1,807 2,605

--------- --------- ------------ --------- --------- --------- --------- ----------------

Transactions with owners:

Share-based

payments - - - - - 408 408 - 408

Dividends - - - - - - - (1,810) (1,810)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Transactions

with

owners - - - - - 408 408 (1,810) (1,402)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Balance as at

31

March 2023 3,381 63,319 657 106 1,878 13,929 83,270 12,281 95,551

========= ========= ============ ========= ========= ========= ========= ================ =========

Loss for the

period - - - - - (1,307) (1,307) 101 (1,206)

Other comprehensive income:

Foreign

currency

movement - - - - (763) - (763) (522) (1,285)

Total

comprehensive

loss for the

period - - - - (763) (1,307) (2,070) (421) (2,491)

--------- --------- ------------ --------- --------- --------- --------- ----------------

Transactions with owners:

Issue of

shares

in the year 1 - - - - - 1 - 1

Share-based

payments - - - - - 320 320 - 320

Dividends - - - - - - - (2,814) (2,814)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Transactions

with

owners 1 - - - - 320 321 (2,814) (2,493)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Balance at 30

September

2023 3,382 63,319 657 106 1,115 12,942 81,521 9,046 90,567

========= ========= ============ ========= ========= ========= ========= ================ =========

CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Share Share Revaluation Other Foreign Retained Total Non-controlling Total

Capital Premium Reserve Reserves Exchange Earnings Interest Equity

Reserve

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Balance as at

31

March 2021 3,379 63,258 656 106 1,092 13,410 81,901 13,414 95,315

Lossfor the

year - - - - - (686) (686) (19) (705)

Other

comprehensive

income:

Foreign

currency

movement - - - - 1,096 - 1,096 1,099 2,195

Deferred tax

on

revaluation

of freehold

property - - 1 - - - 1 - 1

Actuarial

gains on

pension

scheme assets - - - - - 24 24 - 24

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Total

comprehensive

income for

the year - - 1 - 1,096 (662) 435 1,080 1,515

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Transactions

with

owners:

Issue of

shares in

the year 2 61 - - - - 63 - 63

Share-based

payments - - - - - 342 342 - 342

Dividends - - - - - (677) (677) (2,210) (2,887)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Transactions

with

owners 2 61 - - - (335) (272) (2,210) (2,482)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Balance as at

31

March 2022 3,381 63,319 657 106 2,188 12,413 82,064 12,284 94,348

========= ========= ============ ========= ========= ========= ========= ================ =========

Profit for the

period - - - - - 1,325 1,325 785 2,110

Other

comprehensive

income:

Foreign

currency

movement - - - - 181 - 181 95 276

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Total

comprehensive

income for

the period - - - - 181 1,325 1,506 880 2,386

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Transactions

with

owners:

Share-based

payments - - - - - 175 175 - 175

Dividends - - - - - - - (1,810) (1,810)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Transactions

with

owners - - - - - 175 175 (1,810) (1,635)

--------- --------- ------------ --------- --------- --------- --------- ---------------- ---------

Balance as at

30

September

2022 3,381 63,319 657 106 2,369 13,913 83,745 11,354 95,099

========= ========= ============ ========= ========= ========= ========= ================ =========

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Group

As at 30.09.23 As at 30.09.22 As at 31.03.23

(unaudited) (unaudited) (audited)

Notes GBP000's GBP000's GBP000's

Non-current assets

Intangible assets 9 36,639 35,058 35,636

Property, plant and equipment 5,834 4,835 6,097

Investment property - 227 0

Right-of-use assets 3,857 1,635 4,282

Investments 274 264 252

Deferred tax assets 579 523 559

--------------- --------------- ---------------

Total non-current assets 47,183 42,542 46,826

Current assets

Inventories 19,497 32,853 22,409

Trade and other receivables 25,748 24,832 26,850

Income tax recoverable 1,647 1,598 2,947

Other taxes and social security 461 801 394

Cash and cash equivalents 20,577 12,883 21,658

Assets held for sale 230 - 230

--------------- --------------- ---------------

Total current assets 68,160 72,967 74,489

--------------- --------------- ---------------

TOTAL ASSETS 115,343 115,509 121,315

Current Liabilities

Trade and other payables (15,020) (13,242) (14,523)

Provisions (5,301) (4,512) (5,178)

Income tax payable (116) (351) (1,017)

Other taxes and social security payable (151) (481) (516)

Lease liabilities (934) (97) (884)

Dividends (50) (50) (50)

--------------- --------------- ---------------

Total current liabilities (21,572) (18,733) (22,168)

--------------- --------------- ---------------

Net current assets 46,588 54,234 52,321

--------------- --------------- ---------------

Total assets less current liabilities 93,771 96,776 99,147

Non-current liabilities

Lease liabilities (3,204) (1,677) (3,596)

--------------- --------------- ---------------

TOTAL ASSETS LESS TOTAL LIABILITIES 90,567 95,099 95,551

=============== =============== ===============

EQUITY

Issued share capital 3,382 3,381 3,381

Share premium account 63,319 63,319 63,319

Revaluation reserve 657 657 657

Other reserves 106 106 106

Foreign exchange reserve 1,115 2,369 1,878

Retained earnings 12,942 13,913 13,929

--------------- --------------- ---------------

Shareholders' funds 81,521 83,745 83,270

Non-controlling interests 9,046 11,354 12,281

--------------- --------------- ---------------

TOTAL EQUITY 90,567 95,099 95,551

=============== =============== ===============

Consolidated Cash Flow Statement

Group

Six months Six months Year

to 30.09.23 to 30.09.22 ended

(unaudited) (unaudited) 31.03.23

(audited)

GBP000's GBP000's GBP000's

Cash flows from operating activities

(Loss)/profit before income tax (627) 3,039 4,440

Adjustment for:

Finance income (76) (42) (104)

Finance cost 166 137 656

Foreign exchange (gain)/loss (219) (2,573) (468)

Depreciation 452 162 812

Amortisation of right-of-use assets 203 196 452

Revaluation of investment property - - (3)

Amortisation of intangible assets 533 546 1,087

Share of associate's results (47) (51) (45)

Share based payment charge 320 175 408

------------- ------------- -----------

Operating cash flows before movements

in working capital 705 1,589 7,235

Change in inventories 2,535 (1,671) 7,776

Change in receivables 2,349 4,153 (1,843)

Change in payables (793) (1,593) 3,802

Change in provisions and pensions 16 502 1,439

------------- ------------- -----------

Cash generated from operations 4,812 2,980 18,409

Finance costs (6) (71) (451)

Income tax (135) (1,039) (2,052)

------------- ------------- -----------

Net cash from operating activities 4,671 1,870 15,906

Cash flows from investing activities

Acquisition of property, plant and equipment (386) (1,255) (3,562)

Purchase of intangibles (1,536) (1,300) (2,419)

Finance income 76 42 104

------------- ------------- -----------

Net cash (used in)/from investing activities (1,846) (2,513) (5,877)

Cash flows from financing activities

Proceeds from issue of share capital 1 - -

Interest paid on lease liabilities (160) (67) (205)

Principal paid on lease liabilities (112) (202) (387)

Dividends paid (2,813) (1,810) (1,810)

------------- ------------- -----------

Net cash (used in)/from financing activities (3,084) (2,079) (2,402)

Net (decrease)/increase in cash and

cash equivalents (259) (2,722) 7,627

Foreign exchange movements (822) 1,291 (283)

Balance at the beginning of the period 21,658 14,314 14,314

------------- ------------- -----------

Balance at the end of the period 20,577 12,883 21,658

============= ============= ===========

NOTES TO THE PRELIMINARY RESULTS FOR THE SIX MONTHS TO 30

SEPTEMBER 2023

1. General information

ECO Animal Health Group plc ("the Company") and its subsidiaries

(together "the Group") manufacture and supply animal health

products globally.

The Company is traded on the AIM market of the London Stock

Exchange and is incorporated and domiciled in the UK. The address

of its registered office is The Grange, 100 High Street, Southgate,

Lond on, N14 6BN.

2. Summary of the Group's significant accounting policies

2.1 Basis of preparation

The financial information for the period to 30 September 2023

does not constitute statutory accounts as defined by Section 435 of

the Companies Act 2006. It has been prepared in accordance with the

accounting policies set out in, and is consistent with, the audited

financial statements for year ended 31 March 2023.

This Interim Statement has not been audited or reviewed by the

Group's auditors.

2.2 Statement of compliance

This Interim Statement is prepared in accordance with IAS 34

"Interim Financial Reporting". Accordingly, whilst the Interim

Statement has been prepared in accordance with IFRS, and the

primary statements follow the format of the annual financial

statements, only selected notes are included - those that provide

an explanation of events and transactions that are significant to

an understanding of the changes in financial position and

performance of the Group since the last annual reporting date. IAS

34 states a presumption that anyone who reads the Group's Interim

Statement will also have access to its most recent annual report.

Accordingly, annual disclosures are not repeated in this Interim

Statement.

3. Changes to significant accounting policies and other restatements

The principal accounting policies which are adopted by the Group

in the preparation of its financial statements are set out in in

the consolidated financial statements of the Group for the year

ended 31 March 2023. These policies have been consistently applied

to all prior years. The Group's accounting policies have been

consistently applied in accordance with IFRS continued into the six

months ended 30 September 2023.

As set out in the consolidated financial statements of the Group

for the year ended 31 March 2023, new standards and amendments came

into effect during the financial year. These standards and

amendments do not have a material impact.

For the March 2023 Annual Report and Accounts, the Group

reviewed the accounting for share incentive awards made to

employees of subsidiary companies and concluded that the previous

approach to recording the transaction in the balance sheet of the

parent company should be by increasing the value of the investment

in subsidiary, rather than recording it as an intercompany

receivable. Accordingly, the prior year balance sheets of the

Parent company have been restated to show this presentation. There

is no impact or effect on the consolidated financial

statements.

Full details are given in the Annual Report and Accounts for the

year ended 31 March 2023, and there is no financial effect on the

interim consolidated financial statements.

4. Revenue is derived from the Group's animal pharmaceutical businesses.

5. Principal risks and uncertainties

The principal risks and uncertainties relating to the Group were

set out on pages 10-13 of the Group's Annual Report and Accounts

for the year ended 31 March 2023. The key exposures are to foreign

currency exchange rates, potential delays in obtaining marketing

authorisations, single sources of supply for some raw materials,

disease impact on growth, trade debtor recovery and recession in

major regions of the world leading to reduced demand for the

Group's products have remained unchanged since the year end.

6. Segment information

Management has determined the operating segments based on the

reports reviewed by the Board to make strategic decisions. The

Board considers the business from a geographical perspective.

Geographically, management considers the performance in the

Corporate/UK, China and Japan, North America, South and South East

Asia, Latin America, Europe and the Rest of the World. Revenues are

geographically allocated by the destination of customer. The

performance of these geographical segments is measured using

Earnings before Interest, Tax, Depreciation and Amortisation

("Adjusted EBITDA**"), adjusted to exclude share-based payments,

revaluation, impairment and personnel related litigation matters.

Adjusted EBITDA is a non-GAAP measure used by the management to

assess the underlying business performance.

Corporate China North S & SE Latin Europe Rest Total

/U.K. & Japan America Asia America of World

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Six months to 30.09.23

(unaudited)

Sale of goods 503 9,705 8,193 7,746 7,722 3,481 562 37,912

Royalties - - - - - - 97 97

---------- --------- --------- --------- --------- --------- ---------- ---------

Revenue from external

customers 503 9,705 8,193 7,746 7,722 3,481 659 38,009

---------- --------- --------- --------- --------- --------- ---------- ---------

Adjusted EBITDA** (8,363) 1,948 3,267 2,591 763 364 354 925

Six months to 30.09.22

(unaudited)

Sale of goods 756 8,507 6,465 7,460 7,868 2,894 834 34,784

Royalties - - - - - - 75 75

---------- --------- --------- --------- --------- --------- ---------- ---------

Revenue from external

customers 755 8,507 6,465 7,460 7,868 2,894 909 34,859

---------- --------- --------- --------- --------- --------- ---------- ---------

Adjusted EBITDA** (6,448) 2,657 2,195 2,972 1,318 1,091 458 4,243

Year ended 31 March

2023

Sale of goods 1,303 26,374 15,172 16,759 18,107 6,073 1,338 85,126

Royalties - - - - - - 185 185

---------- --------- --------- --------- --------- --------- ---------- ---------

Revenue from external

customers 1,303 26,374 15,172 16,759 18,107 6,073 1,523 85,311

---------- --------- --------- --------- --------- --------- ---------- ---------

Adjusted EBITDA** (19,101) 9,340 5,463 6,767 3,059 1,486 689 7,703

A reconciliation of adjusted EBITDA for reportable segments to

profit from operating activities is provided as follows:

Six months Six months Year ended

to 30.09.23 to 30.09.22 31.03.23

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

Adjusted EBITDA for reportable

segments 925 4,243 7,703

Depreciation (452) (240) (812)

Amortisation of right-of-use assets (203) (197) (452)

Revaluation of investment property - - 3

Amortisation (533) (546) (1,087)

Share-based payment charges (320) (175) (408)

------------- ------------- -----------

(Loss)/profit from operating activities (583) 3,085 4,948

------------- ------------- -----------

Foreign exchange movement (220) (2,573) (468)

------------- ------------- -----------

Adjusted EBITDA for the Group 705 1,670 7,235

============= ============= ===========

7. (Loss)/earnings per share

The calculation of basic earnings per share is based on the

post-tax profit for the year divided by the weighted average number

of shares in issue during the year.

Six months to 30.09.23 Six months to 30.09.22 Year ended 31.03.23

(unaudited) (unaudited) (audited)

Earnings Weighted Per Earnings Weighted Per Earnings Weighted Per

average share average share average share

number amount number amount number amount

of of of shares

shares shares

GBP000's 000's pence GBP000's 000's pence GBP000's 000's pence

(Loss)/earnings

attributable to

ordinary

shareholders

on continuing

operations

after tax (1,307) 67,722 (1.93) 1,324 67,722 1.96 1,008 67,722 1.49

Dilutive effect

of share

options - - - - 349 - - 918 -

--------- --------- -------- --------- --------- -------- --------- ---------- --------

Diluted

(loss)/earnings

per share (1,307) 67,722 (1.93) 1,324 68,071 1.95 1,008 68,640 1.47

========= ========= ======== ========= ========= ======== ========= ========== ========

The diluted EPS figure reflects the impact of historic grants of

share options and is calculated by reference to the number of

options granted for which the average share price for the year was

in excess of the option exercise price. As the Group's result for

the six months ended 30 September 2023 was loss, there was no

dilutive effect on the earnings per share in this period.

8. Taxation

The effective rate of the tax charge in the six months to 30

September 2023 is 93%, which is higher than the effective rate in

the six months to 30 September 2022 of 31%. This reflects

withholding taxes on dividends received during the period and the

impact on the tax charge of finalising prior year tax

computations.

9. Intangible assets

Group Goodwill Distribution Drug registrations, Total

rights patents and license

costs

GBP000's GBP000's GBP000's GBP000's

Cost

At 31 March 2022 17,930 407 23,292 41,629

Additions - - 1,300 1,300

--------- ------------- --------------------- ---------

At 30 September 2022 17,930 407 24,592 42,929

Additions - - 1,119 1,119

--------- ------------- --------------------- ---------

At 31 March 2023 17,930 407 25,711 44,048

Additions - - 1,536 1,536

--------- ------------- --------------------- ---------

At 30 September 2023 17,930 407 27,247 45,584

========= ============= ===================== =========

Amortisation

At 31 March 2022 - (158) (7,167) (7,325)

Charge for the period - (10) (536) (546)

--------- ------------- --------------------- ---------

At 30 September 2022 - (168) (7,703) (7,871)

Charge for the period - (10) (531) (541)

--------- ------------- --------------------- ---------

At 31 March 2023 - (178) (8,234) (8,412)

Charge for the period - (10) (523) (533)

--------- ------------- --------------------- ---------

At 30 September 2023 - (188) (8,757) (8,945)

========= ============= ===================== =========

Net Book Value

At 30 September 2023 17,930 219 18,490 36,639

========= ============= ===================== =========

At 31 March 2023 17,930 229 17,477 35,636

========= ============= ===================== =========

At 30 September 2022 17,930 239 16,889 35,058

========= ============= ===================== =========

At 31 March 2022 17,930 249 16,125 34,304

========= ============= ===================== =========

The amortisation and impairment charges are included within

administrative expenses in the income statement.

The Group continuously reviews the status of its research and

development activity, paying close attention to the likelihood of

technical success and the commercial viability of development

projects. In the period to September 2023 there were no indications

that any development projects for which costs have previously been

capitalised were unlikely to achieve technical success or

commercial viability.

10. Related party transactions

Interest and management charges from Parents to the other Group

companies

During the period Zhejiang ECO Animal Health Ltd paid dividends

to ECO Animal Health Ltd of GBP449,600 (RMB 3,916,015).

During the period Zhejiang ECO Biok Animal Health Products

Limited paid dividends of GBP225,029 (RMB 1,960,000) to ECO Animal

Health Group plc (H1 FY2023: GBP144,828) and GBP2,702,641 (RMB

23,540,000) to ECO Animal Health Limited (H1 FY2023:

GBP1,739,409).

This financial information was approved by the board on 26

November 2023.

This interim statement is available on the Group's website.

DIRECTORS AND OFFICERS Andrew Jones (Non-Executive Chairman)

David Hallas (Chief Executive)

Chris Wilks (Chief Financial Officer)

Tracey James (Non-Executive Director)

Frank Armstrong (Non-Executive Director)

REGISTERED OFFICE The Grange, 100 High Street, Southgate, Lond

on, N14 6BN

Tel: 020 8447 8899

COMPANY NUMBER 01818170

INFORMATION AT www.ecoanimalhealth.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BFBPTMTJTBIJ

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

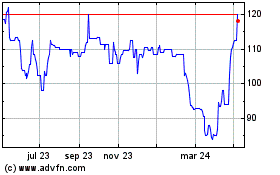

Eco Animal Health (LSE:EAH)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

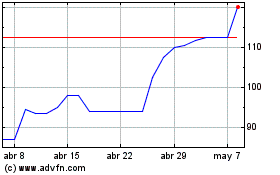

Eco Animal Health (LSE:EAH)

Gráfica de Acción Histórica

De May 2023 a May 2024