TIDMEBQ

RNS Number : 4878G

Ebiquity PLC

30 March 2022

30 March 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION, DISTRIBUTION OR

FORWARDING, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO

OR FROM THE UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND THE

REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN WHICH

SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 596/2014 AS IT FORMS PART OF UK DOMESTIC

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMED

("MAR").

Ebiquity Plc

Proposed Acquisition of Media Management, LLC.

Ebiquity plc ("Ebiquity" or the "Company"), a world leader in

media investment analysis, is pleased to announce the proposed

acquisition by Ebiquity Inc., the Company's US subsidiary, of Media

Management, LLC. ("MML"), a US-focused media audit specialist, for

an initial consideration of GBP6.1 million(1) with a deferred

consideration element payable in 2025 (the "MML Acquisition").

Acquisition Highlights

-- MML is a US media audit company providing clients with

transparency and accountability of their media investments, and

agency performance validation using its proprietary Circle Audit(R)

technology

-- The MML Acquisition accelerates the scaling of Ebiquity in

the world's largest advertising market, and increases its presence

with large US corporates

-- MML's automation practices and combination of the two

businesses will improve operating efficiencies and drive realisable

cost synergies across the enlarged business

-- In the financial year to 31 December 2021, MML reported

revenue of GBP5.4 million and operating profit of GBP0.7

milion(2)

-- Initial consideration of GBP6.1 million(1) payable in cash on completion of the acquisition

o c.GBP5.1 million(1) (84% of initial consideration) in cash

funded from existing cash resources

o c.GBP1.0 million(1) (16% of initial consideration) in cash

applied by the MML Vendors (as defined below) to subscribe for

1,737,261 new Ordinary Shares of Ebiquity (the "MML Shares"). The

MML Shares will be subject to an 18-month lock-in and an ongoing

orderly market agreement

-- Deferred consideration payable in 2025

o Based on 1.0x of 2024 reported adjusted earnings before

interest and tax of the combined Ebiquity US and MML businesses

expected to be at least GBP3.0 million(3)

o 80% payable directly in cash to the MML Vendors; 20% in cash

to be applied by the MML Vendors to subscribe for new Ordinary

Shares of Ebiquity and they will be subject to the same lock-in and

orderly market provisions as the MML Shares

-- Completion of the MML Acquisition is conditional on the

admission of MML Shares to trading on AIM expected on or around 4

April 2022

Overview of MML

MML is a US-based media audit company providing clients with

transparency and accountability of their media investments, and

agency performance validation, founded in St Louis, Missouri in

1995 by Thomas Bridge. MML uses a proprietary circle audit

technology that enables it to analyse 100% of its clients' "media

buy" data from all major "media buy" management platforms. MML has

a 40-person team centred in St Louis and distributed across the US.

The company has a high-quality client roster that includes Geico,

GM, AT&T, AstraZeneca and Samsung with average client tenure of

11 years. The founder and current chief executive officer of MML,

Thomas Bridge (the "Founder"), will remain with the business and

join Ebiquity's North American management team.

In the financial year ended 31 December 2021, MML's revenue grew

c.29% year-on-year to GBP5.4 million and it made an improved

operating profit of GBP0.7 million with operating profit margin of

13.4 %(2) . As at 31 December 2021, MML had gross assets of GBP1.8

million(2) .

Acquisition rationale

The Board believes that there is a strong strategic and

financial rationale for the MML Acquisition. The acquisition of MML

and its complementary service offering would add scale to

Ebiquity's business in the US, the world's largest advertising

market. MML's client roster of blue-chip American corporates will

create significant cross-sell opportunities in the US for the

enlarged group. MML's strong automation practices will improve

operating efficiencies and drive realisable cost synergies.

The Ebiquity Group's business in the US would also be

immediately scaled with revenue of GBP10.7 million in the financial

year to 31 December 2021 on a pro forma basis(4) .

The MML integration will be managed by Ebiquity's US management

team headed by Paul Williamson (MD of Ebiquity's current North

American business) and Thomas Bridge (founder and current CEO of

MML).

Consideration

The acquisition is being effected by an agreement dated 29 March

2022 between Ebiquity, Ebiquity Inc. (the Company's US subsidiary),

MML, Bridge Media Services Inc. (held by the Founder and his

closely associated persons, together with Bridge Media Services

Inc., the "MML Vendors") and the MML Vendors (the "MML Acquisition

Agreement").

The initial consideration element for the MML Acquisition is

GBP6.1 million(1) payable in cash on completion. Of the GBP6.1m(1)

initial consideration, the 16% (c.GBP1.0 million(1) ) of the cash

has been applied by the MML Vendors to subscribe for 1,737,261 new

Ordinary Shares of Ebiquity which has been calculated (rounded down

to the nearest whole number) by reference to the middle market

quotations for the Ordinary Shares as shown by the AIM Appendix of

the Daily Official List of the London Stock Exchange for the five

Business Days prior to the date of this Announcement.

Under the MML Acquisition Agreement, the MML Vendors will hold

1,737,261 MML Shares following the completion of the MML

Acquisition.

The deferred consideration element for the MML Acquisition will

be payable in 2025 based on 1.0x of reported 2024 adjusted earnings

before interest and tax of the combined Ebiquity US and MML

businesses which is expected to be at least GBP3.0 million(3)

payable in cash of which the MML Vendors will apply 20% to

subscribe for Ordinary Shares (the "Earn-Out Shares", and together

with the MML Shares, the "New Shares") which will be calculated

(rounded down to the nearest whole number) by reference to the

middle market quotations for the Ordinary Shares as shown by the

AIM Appendix of the Daily Official List of the London Stock

Exchange for the five Business Days prior to the date the deferred

consideration is agreed between the parties. The Company expects to

have sufficient cash headroom in 2025 to satisfy the deferred cash

consideration for MML.

Under the MML Acquisition Agreement, the MML Vendors have

undertaken, save in limited circumstances, not to dispose of any of

their interests in the New Shares at any time prior to the 18-month

anniversary of the date of their issue. In addition, in order to

ensure an orderly market in the Ordinary Shares, the MML Vendors

have further undertaken they would not, save in limited

circumstances, deal or otherwise dispose of any such interests in

the New Shares other than through Panmure Gordon (or such other

broker appointed by the Company from time to time).

The MML Acquisition has been financed through the Company's

existing cash resources and the MML Shares will be issued under

existing Shareholder authorities. The MML Acquisition will complete

conditional on admission of MML Shares to trading on AIM.

Admission of MML Shares

Application will be made to London Stock Exchange plc for the

MML Shares to be admitted to trading on AIM. It is expected that

admission of the MML Shares will take place at 8.00 am on or around

4 April 2022 ( the "Admission").

The MML Shares will, when issued, rank equally in all respects

with the existing Ordinary Shares including the right to receive

dividends and other distributions declared following Admission.

Nick Waters, Chief Executive Officer of Ebiquity, said:

"This represents an exciting move for us to scale our North

American business. MML brings a team of experienced and highly

skilled media specialists, complementary capabilities, an

outstanding patented technology platform in Circle Audit, and a

roster of high-quality blue chip American clients. The combination

of Ebiquity and MML unlocks strong potential for the business, and

significantly advances and scales our business in the US, the

world's largest advertising market."

Thomas Bridge, Founder and current Chief Executive Officer of

MML, said:

"MML is excited to join the Ebiquity family, expanding our

coverage domestically & internationally for our clients. This

step further reinforces MML's commitment to our team and our

clients in continuing our work in driving third-party media

accountability."

Notes

1 MML initial consideration of US$8.0m; US$ / GBP exchange rate

assumed rate of US$1.3157.

2 Financial year to 31 December 2021; FX of $1.375; operating

profit calculated on a normalised basis adjusted for owner managed

costs including the salary, benefits and bonus of the founders and

other non-trading expenses.

3 MML deferred consideration expected to be at least US$4.0m;

US$ / GBP exchange rate assumed of US$1.3157.

4 Pro forma financials have been prepared for illustrative

purposes only and by their nature address a hypothetical situation

and, therefore, do not represent the Company's actual financial

performance. It is assumed that the acquisition has taken place on

1 January 2021.

Market abuse regulation

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/201 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

("MAR"). Upon the publication of this announcement via a Regulatory

Information Service this inside information is now considered to be

in the public domain.

The person responsible for arranging release of this

announcement on behalf of the Company is Alan Newman, Chief

Financial Officer and Chief Operating Officer of the Company.

Ebiquity plc +44 20 7650 9600

Nick Waters, CEO

Alan Newman, CFO & COO

Camarco

+44 7990 653

Ben Woodford 341

+44 7733 124

Geoffrey Pelham-Lane 226

Panmure Gordon (Financial Adviser, Nomad and

Broker) +44 20 7886 2500

Alina Vaskina / Harriette Johnson / Dougie

McLeod (Corporate Advisory)

Charles Leigh-Pemberton / Sam Elder (Corporate

Broking)

About Ebiquity plc

Ebiquity plc (LSE AIM: EBQ) is a world leader in media

investment analysis. It harnesses the power of data to provide

independent, fact-based advice, enabling brand owners to perfect

media investment decisions and improve business outcomes. Ebiquity

is able to provide independent, unbiased advice and solutions to

brands because we have no commercial interest in any part of the

media supply chain.

We are a data-driven solutions company helping brand owners

drive efficiency and effectiveness from their media spend,

eliminating wastage and creating value. We provide analysis and

solutions through five Service Lines: Media management, Media

performance, Marketing effectiveness, Technology advisory, Contract

compliance.

Ebiquity's clients are served by more than 500 media specialists

operating from 19 offices covering 80% of the global advertising

market.

The Company has the most comprehensive, independent view of

today's global media market, analysing US$55bn of media spend from

75 markets annually, including trillions of digital media

impressions. Our Contract Compliance division, FirmDecisions,

audits US$40bn of contract value annually.

As a result, more than 70 of the world's top 100 advertisers

today choose Ebiquity as their trusted independent media

advisor.

For further information, please visit: www.ebiquity.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQWPURCWUPPUUU

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

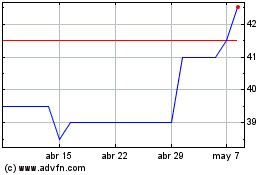

Ebiquity (LSE:EBQ)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ebiquity (LSE:EBQ)

Gráfica de Acción Histórica

De May 2023 a May 2024