TIDMECHO

RNS Number : 2316O

Echo Energy PLC

29 September 2023

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under The Market Abuse Regulation (EU 596/2014) pursuant

to the Market Abuse (Amendment) (EU Exit) Regulations 2018. Upon

the publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

29 September 2023

Echo Energy plc

("Echo Energy", "Echo" or the "Company")

Interim Results 2023

Echo Energy PLC is pleased to announce its Interim Results for

the period ended 30 June 2023.

Chairman's and Chief Executive Officer's Statement

In the 2022 Annual Report, released at the same time as this

2023 Interim Report, the following statement was made.

"Echo Energy, similar to many companies in the oil and gas

sector, faced exceptional challenges during recent years, with the

global pandemic impacting all aspects of the Company's operations

and finances in Argentina. The Company emerged from the COVID-19

period (during which the assets were sub economic) with a large

creditor position, 100%+ per annum inflation in Argentina and

Argentine currency exchange controls, which have prevented funds

being withdrawn from the country without significant penalties. As

a result of these factors, the raising of additional equity for an

Argentine business was challenging and the Company took the

decision in November 2022 to partially sell its Santa Cruz Sur

portfolio.

This partial sale enabled to the Company to:

-- Address its near-term funding challenges by providing

near-term cash, enabling the Company to transfer to buyers the

significant in-country creditors which had built up during the

COVID-19 period and providing access to funding for the Santa Cruz

assets.

-- Benefit from continued exposure (both directly through the

retained 5% working interest, the contingent payments, the further

5% option and the indirect holding in the Operator) to a

well-funded Santa Cruz portfolio, with the concessions likely to be

extended as a result of the provision of guarantee.

The Company, now with significantly reduced creditors and a

heavily reduced cost base, sits with a 5% interest in a producing

Santa Cruz Sur portfolio and an equity position in the operator

InterOil Exploration and Production ASA. In addition to the

divestment, the Company successfully completed a restructuring of

its legacy debt position, converting the majority of previously

outstanding debt into equity, substantially improving the balance

sheet and providing the additional flexibility to best manage the

financial requirements going forward. The Board see significant

opportunities at this point in the economic cycle to secure new

energy assets at attractive valuations and is currently exploring a

number of these opportunities. "

In addition, the directors draw attention to the Accounting

Policy notes regarding Going Concern, Estimates and the previous

audit.

James Parsons Martin Hull

Chairman Chief Executive

Officer

For further information, please contact:

Echo Energy C avendish Securities

Martin Hull, Chief Executive Officer (Nominated Adviser)

via Vigo Consulting Adrian Hadden

Ben Jeynes

+44 (0) 20 7397 8900

Vigo Consulting (PR Advisor) Zeus plc (Corporate Broker)

Patrick d'Ancona Simon Johnson

Finlay Thomson + 44 (0) 203 829 5000

Kendall Hill

+44 (0) 20 7390 0230

Financial Statements

Consolidated Statement of Comprehensive Income

Period ended 30 June 2023

Unaudited Unaudited Audited

1 January 2023 1 January 20222 Year to

to 30 June to 30 June 2022 31 December

Notes 2023 US $ 2022

US $ US $

----------------------------------- -------- ---------------- ----------------- --------------

Continuing operations

Revenue 3 - 6,230,288 86

Cost of sales 4 - (7,256,796) -

----------------------------------- -------- ---------------- ----------------- --------------

Gross (loss)/profit - (1,026,508) 86

Exploration expenses - (143,545) -

Administrative expenses (857,722) (1,125,073) (2,951,806)

Operating loss (857,722) (2,295,126) (2,951,720)

Financial income 5 175,311 2,161,898 1,618,844

Financial expense 6 (77,263) (1,834,643) (2,981,409)

Loss before tax (759,654) (1,967,871) (4,314,285)

Taxation 8 - 62,477

----------------------------------- -------- ---------------- ----------------- --------------

Loss from continuing operations (759,654) (1,967,871) (4,382,427)

Loss after taxation for

the year from discontinued

operations 10 (5,818,517) - (5,204,409)

Gain on sale of discontinued 17,115,930 - -

operations

Profit/(loss) for the

period 10,537,759 (1,967,871) (9,586,836)

Other comprehensive income:

Exchange difference on - 26,834 -

translating foreign operations

----------------------------------- -------- ---------------- ----------------- --------------

Total comprehensive profit/(loss)

for the period 10,537,759 (1,941,036) (9,586,836)

----------------------------------- -------- ---------------- ----------------- --------------

Profit/(loss) attributable

to: Owners of the parent 10,537,759 (1,941,036) (9,586,836)

----------------------------------- -------- ---------------- ----------------- --------------

Total comprehensive profit/(loss)

attributable to: Owners

of the parent 10,537,759 (1,941,036) (9,586,836)

----------------------------------- -------- ---------------- ----------------- --------------

Profit/(loss) per share

(cents) 9

Basic 0.19 (0.14) (0.50)

----------------------------------- -------- ---------------- ----------------- --------------

Diluted 0.19 (0.14) (0.50)

----------------------------------- -------- ---------------- ----------------- --------------

Profit/(loss) per share

(cents) for continuing

operations

Basic 0.19 (0.14) (0.27)

----------------------------------- -------- ---------------- ----------------- --------------

Diluted 0.19 (0.14) (0.27)

----------------------------------- -------- ---------------- ----------------- --------------

The notes form an integral part of these financial

statements.

Consolidated Statement of Financial Position

Period ended 30 June 2023

Unaudited Unaudited Audited

1 January 1 January Year to

2023 2022 31 December

Notes to 30 June to 30 June 2022

2023 2022 US $

US $ US $

--------------------------------- -------- -------------- -------------------------- --------------

Non-current assets

Property, plant and equipment 11 2,299 2,668,770 2,299

Other intangibles 12 - 6,662,805 -

Available-for-sale financial

assets 13 555,562 - -

557,861 9,331,575 2,299

Current Assets

Inventories - 1,415,225 -

Other receivables 349,590 3,566,742 769,551

Cash and cash equivalents 14 994,504 1,314,969 1,132,616

--------------------------------- -------- -------------- -------------------------- --------------

1,344,094 6,296,936 1,902,166

Assets of group held for

resale 10 - 18,739,291

--------------------------------- -------- -------------- -------------------------- --------------

Total assets 1,901,955 15,648,511 20,643,756

--------------------------------- -------- -------------- -------------------------- --------------

Current Liabilities

Trade and other payables (1,661,557) (19,511,235) (1,329,991)

(1,661,557) (19,511,235) (16,023,500)

Liabilities of disposal

group held for resale - - (29,620,264)

--------------------------------- -------- -------------- -------------------------- --------------

Non-current liabilities

Loans due in over one year 17 (5,341,036) (28,031,316) (5,463,301)

Provisions - (3,039,911) -

--------------------------------- -------- -------------- -------------------------- --------------

Total Liabilities (7,002,593) (50,582,462) (36,413,556)

--------------------------------- -------- -------------- -------------------------- --------------

Net Liabilities (5,100,638) (34,953,951) (15,769,800)

--------------------------------- -------- -------------- -------------------------- --------------

Equity attributable to

equity holders of the parent

Share capital 15 19,893,385 7,686,151 19,795,863

Shares not issued - - 97,523

Share premium 16 83,790,504 64,884,556 83,790,504

Capital contribution reserve 7,212,492 - 7,212,492

Warrant reserve 260,201 12,589,970 1,433,428

Share option reserve 644,560 1,522,499 644,560

Foreign currency translation

reserve (3,481,041) (3,504,752) (3,481,041)

Retained earnings (113,420,740) (118,132,375) (125,263,129)

--------------------------------- -------- -------------- -------------------------- --------------

Total Equity (5,100,638) (34,953,951) (15,769,800)

--------------------------------- -------- -------------- -------------------------- --------------

The notes form an integral part of these financial

statements.

Consolidated Statement of Changes in Equity

Period ended 30 June 2023

Foreign

Capital Share currency

Retained Share Shares Share contribution Warrant option translation

earnings capital to be premium reserve reserve reserve reserve Total

US $ US $ issued US $ US$ US $ US $ US $ equity

US$ US $

---------------------- ---------------- ------------- --------- ----------- -------------- ------------ ---------- ------------ -------------

1 January 2023 (125,263,129) 19,795,863 97,523 83,790,504 7,212,492 1,433,428 644,560 (3,481,041) (15,769,800)

Loss for the period (759,654) - - - - - - - (759,654)

Discontinued

operations (5,818,517) - - - - - - - (5,818,517)

Profit on sale of

discontinued

business 17,115,930 - - - - - - - 17,115,930

Total comprehensive

loss for the period 10,048,159 - - - - - - - 10,048,159

Warrants lapsed 1,071,987 - - - - (1,071,987) - - -

Warrants exercised 101,239 - - - - (101,239) - - -

Share issue 97,523 (97,523) - - - - - -

30 June 2023 (113,420,740) 19,893,385 - 83,790,504 7,212,492 260,201 644,560 (3,481,041) (5,100,638)

1 January 2022 (116,164,504) 7,209,086 64,977,243 -- 12,177,786 1,522,499 (3,531,587) (33,809,477)

Loss for the period (1,967,871) - - - - - - - (1,967,871)

Exchange Reserve - - - - - - - 26,835 26,835

---------------------- ---------------- ------------- --------- ----------- -------------- ------------ ---------- ------------ -------------

Total comprehensive

loss for the period (1,967,871) - - - - - - 26,835 (1,941,036)

Warrants issued - 433,696 - 400,735 - - - - 834,431

Share issue - - - (412,184) - 412,184 - - -

Transaction costs - 43,369 (81,238) -- - - - (37,869)

30 June 2022 (118,132,375) 7,686,152 - 64,884,556 - 12,589,970 1,522,499 (3,504,752) (34,953,951)

---------------------- ---------------- ------------- --------- ----------- -------------- ------------ ---------- ------------ -------------

Consolidated Statement of Changes in Equity (continued)

Period ended 30 June 2023

Foreign

Capital Share currency

Retained Share Shares Share contribution Warrant option translation

earnings capital to be premium reserve reserve reserve reserve Total

US $ US $ issued US $ US$ US $ US $ US $ equity

US$ US $

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

1 January 2022 (116,164,504) 7,209,086 - 64,977,243 12,177,786 1,522,499 (3,531,587) (33,809,477)

Loss for the

period (4,382,425) - - - - - - (4,382,425)

Discontinued

operations (5,204,409) - - - - (5,204,409)

Exchange

Reserve - - - - - - 50,546 50,546

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

Total

comprehensive

loss for the

period (9,586,834) - - - - - - 50,546 (9,536,288)

New shares

issued - 12,586,777 - 7,521,415 - - - - 20,108,192

Capital

contribution

on debt - -

restructuring - - - -- 7,212,492 -- - 7,212,492

Cash received

for shares

not issued - - 97,523 - - - - - 97,523

Warrants

lapsed - - - 11,291,846 (11,291,846) - - -

Share options

lapsed 1,035,696 - - - - - (1,035,696) - -

Share based

payments - - - - 157,757 - 157,757

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

31 December

2022 (125,263,129) 19,795,863 97,523 83,790,504 7,212,492 1,433,428 644,560 (3,481,041) (15,769,800)

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

The notes form an integral part of these financial

statements.

Consolidated Statement of Cash Flows

Period ended 30 June 2023

Unaudited Unaudited

1 January 1 January Year to

2023 2022 31 December

to 30 June to 30 June 2022

2023 2022 US $

US $ US $

--------------------------------------- ------------ --------------- --------------

Cash flows from operating activities

Profit/(loss) from continuing

operations (759,654) (1,967,871) (4,382,425)

Loss from discontinued operations (5,204,409)

(759,654) (1,967,871) (9,586,834)

Adjustments for:

Depreciation and depletion of

property, plant and equipment - 8,449 16,537

Depreciation and depletion of

intangible assets - 503,706 1,419,193

Impairment of intangible assets

and goodwill - - 506.818

Share-based payments - - 157,757

Sale of interest in joint venture (555,562) - -

for non-cash consideration

Financial income - (2,161,898) -

Financial expense 77,263 1,834,643 2,980,994

Exchange difference (141,286) (171,072) (1,582,441)

(1,379,239) 13,828 3,498,858

Increase)/decrease in inventory - (50,000) 863,196

Decrease in other receivables 259,128 657,790 978,758

Increase in trade and other payables (150,932) 1,371,642 2,150,092

--------------------------------------- ------------ --------------- --------------

108,196 1,979,432 3,992,046

Net cash used in operating activities (1,271,043) 25,389 (2,095,912)

Cash flows from investing activities

Purchase of intangible assets - (34,604) (61,233)

Purchase of property, plant and

equipment - (2,813) (217,578)

Sale of interests in joint venture 1,133,172

--------------------------------------- ------------ --------------- --------------

Net cash used in investing activities 1,133,172 (37,417) (278,811)

Cash flows from financing activities

Interest received - 26 -

Bank fees and other finance cost - (42,276) -

Issue of share capital - 834,430 2,714,574

Share issue costs - (37,867) -

Net cash from financing activities - 754,313 2,714,574

--------------------------------------- ------------ --------------- --------------

Net (decrease)/increase in cash

and cash equivalents (137,871) 742,286 339,853

Cash and cash equivalents at

the beginning of the period 1,132,375 742,339 742,339

--------------------------------------- ------------ --------------- --------------

Foreign exchange gains/(losses)

on cash and cash equivalents - (169,655) 50,447

--------------------------------------- ------------ --------------- --------------

Cash and cash equivalents at

the end of the period 994,504 1,314,969 1,132,375

--------------------------------------- ------------ --------------- --------------

The notes form an integral part of these financial

statements.

Notes to the Financial Statements

Period ended 30 June 2023

1. Accounting Policies

General Information

These financial statements are for Echo Energy plc ("the

Company") and subsidiary undertakings ("the Group"). The Company is

registered, and domiciled, in England and Wales and incorporated

under the Companies Act 2006.

Basis of Preparation

The condensed and consolidated interim financial statements for

the period from 1 January 2023 to 30 June 2023 and have been

prepared in accordance with International Accounting Standards

("IAS") 34 Interim Financial Reporting, and on the going concern

basis. They are in accordance with the accounting policies set out

in the statutory accounts for the year ended 31 December 2022 and

are expected to be applied for the year ending 31 December

2023.

The comparatives shown are for the period 1 January 2022 to 30

June 2022, and for the year ended 31 December 2022, and do not

constitute statutory accounts, as defined in section 435 of the

Companies Act 2006, but are based on the statutory financial

statements for the year ended 31 December 2022.

A copy of the Company's statutory accounts for the year ended 31

December 2022 is being delivered to the Registrar of Companies; the

accounts will very soon be available to download from the Company

website at www.echoenergyplc.com .

Going Concern

The financial information has been prepared assuming the Group

will continue as a going concern. Under the going concern

assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations.

The consolidated statement of financial position at 31 December

2022 showed a negative net asset position. Moreover, after

persistent difficulties, the board made the difficult decision in

late 2022 to divest of its operating assets in Argentina. This

decision came to fruition in June 2023 when, apart from a small 5%

retention holding, Echo Energy sold its interest in the SCS assets

to its joint venture partner and obtained a full, 100%, indemnity

against any future costs arising from those SCS operations.

The cash received from that sale was sufficient to partly, but

not fully, pay down backlog creditors. Further, the delay in

publishing the December 2022 Annual Report gave rise to an

automatic suspension of the trading in the company's shares on AIM,

preventing any equity fund raising until the Annual Report is

published and the suspension lifted.

Nevertheless, the directors have held positive discussions with

potential financial intermediaries with a view to raise additional

funding and also are in advanced negotiations to acquire a number

of assets including outside South America to replace the SCS

assets.

Going Concern

Consequently, the directors consider the going concern

assumption continues to be appropriate although there remain

material uncertainties as to;

1. Successfully raising sufficient funds.

2. Finding an appropriate investment within a suitable timescale

3. That investment being sufficiently cash-positive to fund the Group going forwards.

Estimates

The preparation of the interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing this condensed interim financial information, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those applied to consolidated financial statements

for the year ended 31 December 2022. The key sources of uncertainty

in estimates that have a significant risk of causing material

adjustment to the carrying amounts of assets and liabilities,

within the next financial year, are the Group's going concern

assessment.

Previous Audit

For reasons set out therein, the auditors did not express an

opinion in their report on the accounts for the year ended 31

December 2022.

In addition to the December 2022 balance sheet forming the

starting point for these accounts to 30 June 2023, similar

difficulties have manifested themselves in obtaining information

relating to the operations in Argentina for the preparation of the

interim accounts to June 2023. As a result certain figures

contained herein are necessarily based on estimates

Accordingly, the directors have taken a prudent view in

evaluating certain figures, including but not limited to the assets

and liabilities retained in Argentina, particularly trade debtors

and tax assets and liabilities, following the completion of the

sale of the majority of its interests there.

Revenue Recognition

Revenue comprises the invoice value of goods and services

supplied by the Group, net of value added taxes and trade

discounts. Revenue is recognised in the case of oil and gas sales

when goods are delivered and title has passed to the customer. This

generally occurs when the product is physically transferred into a

pipeline or vessel. Echo recognised revenue in accordance with IFRS

15. We have a contractual arrangement with our joint venture

partner who markets gas and crude oil on our behalf. Gas is

transferred via a metred pipeline into the regional gas

transportation system, which is part of the national transportation

system, control of the gas is transferred at the point at which the

gas enters this network, this is the point at which gas revenue is

recognised. Gas prices vary from month to month based on seasonal

demand from customer segments and production in the market as a

whole. Our partner agrees pricing with their portfolio of gas

clients based on agreed pricing mechanisms in multiple contracts.

Some pricing is regulated by government such as domestic supply.

Echo receive a monthly average of gas prices attained. Oil

shipments are priced in advance of a cargo and revenue is

recognised at the point at which cargoes are loaded onto a shipping

vessel at terminal.

2. Business Segments

The Group has adopted IFRS 8 Operating Segments. Per IFRS 8,

operating segments are regularly reviewed and used by the board of

directors being the chief operating decision maker for strategic

decision-making and resources allocation, in order to allocate

resources to the segment and assess its performance.

At the balance sheet date, there is only one business segment,

being the company, its activity disclosed in within continuing

operations.

Activity in Argentina, being the Santa Cruz Sur operations, are

set out within discontinued operations within note 10.

Activity within the group's Bolivian subsidiary is

immaterial.

3. R evenue

Unaudited Unaudited Audited

1 January 1 January Year to

2023 2022 31 December

to 30 June to 30 June 2022

2023 2022 US $

US $ US $

Oil revenue - 2,514,419 -

Gas revenue - 3,715,668 -

Other income - 201 86

Total Revenue - 6,230,288 86

--------------- ------------- ------------ -------------

Revenue for December 2022 and 2023 all derives from discontinued

operations held for resale and is shown in Note 10. At June 2022,

those operations had not been discontinued.

4. Cost of Sales

Unaudited Unaudited Audited

1 January 1 January Year to

2023 2022 31 December

to 30 June to 30 June 2022

2023 2022 US $

US $ US $

Production costs - 5,870,851 -

Selling and distribution - 928,235 -

costs

Movement in stock of crude - (50,000) -

oil

Depletion - 507,710 -

Total Costs - 7,256,796 -

--------------------------- ------------ ------------ -------------

Revenue for December 2022 and 2023 all derives from discontinued

operations held for resale and is shown in Note 10. At June 2022,

those operations had not been discontinued.

5. Finance Income

Unaudited Unaudited Audited

1 January 1 January Year to

2023 2022 31 December

to 30 June to 30 June 2022

2023 2022 US $

US $ US $

---------------------------- ------------ ------------ -------------

Interest income - 340 622

Net foreign exchange gains 175,331 2,161,558 1,618,222

Total 175,331 2,161,898 1,618,884

---------------------------- ------------ ------------ -------------

6. Financial Expense

Unaudited Unaudited Audited

period to period to Year to

30 June 30 June 2022 31 December

2023 US$ 2022

US $ US $

------------------------------------ ----------- -------------- -------------

Interest payable - 227 415

Net foreign exchange losses - 432,660 -

Unwinding of discount on

long term loan 77,263 1,272,735 2,598,746

Amortisation of loan fees - 86,745 234,101

Bank fees and overseas transaction - 42,276 -

taxes

------------------------------------ ----------- -------------- -------------

Total 77,263 1,834,643 8,993,432

------------------------------------ ----------- -------------- -------------

7. Taxation

The Group has tax losses available to be carried forward in

certain subsidiaries and the parent company. Due to uncertainty

around timing of the Group's projects, management have not

considered it appropriate to anticipate an asset value for them. No

tax charge has arisen during the six-month period to 30 June 2023,

or in the six-month period to June 2022, or the year to 31 December

2022.

8. Loss Per Share

The calculation of basic and diluted loss per share at 30 June

2023 was based on the loss attributable to ordinary shareholders.

The weighted average number of ordinary shares outstanding during

the period ended 30 June 2023 and the effect of the potentially

dilutive ordinary shares to be issued are shown below.

Period to Period to Year to

30 June 30 June 31 December

2023 2022 2022

----------------------------------- -------------- -------------- --------------

Net profit/(loss) for the year

(US $) 10,537,759 (1,967,871) (9,586,834)

----------------------------------- -------------- -------------- --------------

Basic weighted average ordinary

shares in issue during the

period 5,527,427,674 1,440,666,214 1,909,205,746

----------------------------------- -------------- -------------- --------------

Diluted weighted average ordinary

shares in issue during the

period 5,527,427,674 1,440,666,214 1,909,205,746

----------------------------------- -------------- -------------- --------------

Loss per share (cents)

Basic 0.19 (0.14) (0.27)

----------------------------------- -------------- -------------- --------------

Diluted 0.19 (0.14) (0.27)

----------------------------------- -------------- -------------- --------------

9. Discontinued Operations

In November 2022 the company committed to selling virtually all

of its interest in the Santa Cruz oil and gas operations in

Argentina to its joint-venture partner Interoil. A term of the sale

was for Echo to relinquish any management and accounting in respect

of the joint venture, instead receiving a profit share in

proportion to the remaining 5% holding in the joint venture,

effectively as investment income.

The sale was completed on 26 June 2023, satisfied by GBP825,000

in cash, shares to the value of GBP400,000 in Interoil and

GBP150,000 investment in Echo Energy PLC shares by Interoil. At 31

December 2022 the Argentinian operations were classified as a

disposal group held for sale and as discontinued operations.

The results of the Argentinian operations for the period are

presented below

Period to Period to Year to

30 June 2023 30 June 2022 31 December

US $ US$ 2022

US $

----------------------------------- -------------- -------------- --------------

Oil and gas revenue 3,632,389 - 14,114,331

----------------------------------- -------------- -------------- --------------

Cost of sales -

Production costs (7,912,008) - (16,933,985)

Depletion - - (1,419,193)

----------------------------------- -------------- -------------- --------------

Total cost of sales (7,912,008) - (18,353,178)

----------------------------------- -------------- -------------- --------------

Gross loss - (15,147,779)

Exploration expenses - - (287,919)

Impairment of plant and equipment - - (506,818)

Administrative expenses (490,245) - (578,011)

Operating loss from discontinued

activities (4,769,864) - (5,611,595)

Finance revenue - -

Finance expense `(4,157,561) - (788,847)

Foreign exchange gain 3,413,143 - 1,208,083

----------------------------------- -------------- -------------- --------------

Loss for the period before

taxation from discontinued

operations (5,818,517) - (5,192,359)

Deferred tax asset write-off - - (12,050)

----------------------------------- -------------- -------------- --------------

Loss for the period after

taxation from discontinued

operations (5,818,517) - (5,204,409)

----------------------------------- -------------- -------------- --------------

The major classes of assets and liabilities of the Argentinian

operations classified as held for sale as at 31 December 2022 were

as follows

As at

31 December

2022

US $

------------------------------- -------------

Property, plant and equipment 2,658,382

Intangible assets 5,267,129

Inventories 716,794

Joint venture receivables 9,729,937

Other receivables 279,012

Prepayments 87,916

Cash 121

--------------------------------- -------------

Assets of disposal group

held for sale 18,739,291

--------------------------------- -------------

Liabilities

Trade and other payables (14,095)

Joint venture payables 26,594,448

Provisions 3,039,911

--------------------------------- -------------

Liabilities of disposal group

held for sale 29,620,264

--------------------------------- -------------

Net liabilities (10,880,794)

--------------------------------- -------------

10. Property, Plant and Equipment

PPE - O&G Fixtures

Properties & Fittings Total

US $ US $ US $

------------------ ------------- ------------- ------------

30 JUNE 2023

Cost

1 January 2023 - 98,210 98,210

Additions - - -

Disposals - - -

------------------ ------------- ------------- ------------

30 June 2023 - 98,210 98,210

------------------ ------------- ------------- ------------

Depreciation

1 January 2023 - 95,911 95,911

Charge for the - - -

period

Disposals - - -

------------------ ------------- ------------- ------------

30 June 2023 - 95,911 95,911

------------------ ------------- ------------- ------------

Carrying amount

30 June 2023 - 2,299 2,299

------------------ ------------- ------------- ------------

30 JUNE 2022

Cost

1 January 2022 2,873,147 95,397 2,968,544

Additions - 2,813 2,813

Disposals - - -

------------------ ------------- ------------- ------------

30 June 2022 2,873,147 98,210 2,971,357

------------------ ------------- ------------- ------------

Depreciation

1 January 2022 202,718 91,421 294,139

Charge for the

period 4,004 4,445 8,449

Disposals - - -

------------------ ------------- ------------- ------------

30 June 2022 206,722 95,866 302,588

------------------ ------------- ------------- ------------

Carrying amount

30 June 2021 2,666,425 2,344 2,668,769

------------------ ------------- ------------- ------------

31 DECEMBER

2022

Cost

1 January 2022 2,873,147 95,397 2,968,544

Additions - 2,813 2,813

Reclassification

of assets of

disposal group

held for sale

(note 10) (2,873,147) (1,858) (2,873,147)

------------------ ------------- ------------- ------------

31 December 2022 - 98,210 98,210

------------------ ------------- ------------- ------------

Depreciation

1 January 2021 202,718 91,421 294,139

Charge for the

year 12,047 4,490 16,337

Reclassification

of assets of

disposal group

held for sale

(note 10) (214,765) - (214,765)

------------------ ------------- ------------- ------------

31 December 2022 - 95,911 95,911

------------------ ------------- ------------- ------------

Carrying amount

31 December 2022 - 2,299 2,299

------------------ ------------- ------------- ------------

31 December 2021 2,541,980 3,976 2,674,405

------------------ ------------- ------------- ------------

11. Intangible Assets

Argentina

Exploration & Evaluation

US $

------------------------------ --------------------------

30 June 2023

Cost

1 January 2023 -

Additions -

Disposals -

30 June 2023 -

------------------------------ --------------------------

Impairment

1 January 2023 -

Depletion -

Depreciation decommissioning -

assets

Impairment charge for -

the period

30 June 2023 -

------------------------------ --------------------------

Carrying amount

30 June 2023 -

------------------------------ --------------------------

30 JUNE 2022

Cost

1 January 2022 10,875,022

Additions 34,604

Disposals -

------------------------------ --------------------------

30 June 2022 10,909,626

------------------------------ --------------------------

Impairment

1 January 2022 3,743,115

Depletion 443,706

Depreciation decommissioning

assets 60,000

Impairment charge for -

the period

------------------------------ --------------------------

30 June 2021 4,246,821

------------------------------ --------------------------

Carrying amount

30 June 2022 6,662,805

------------------------------ --------------------------

30 June 2021 7,773,210

------------------------------ --------------------------

31 DECEMBER 2022

Cost

1 January 2022 10,875,022

Additions 61,233

Reclassification of

assets of disposal

group held for sale

(note 10) (10,429,437)

31 December 2022 506,818

------------------------------ --------------------------

Impairment

1 January 2022 3,743,115

Disposals -

Depletion 1,419,193

Impairment charge for

the year 506,818

Reclassification of

assets of disposal

group held for sale

(note 10) (5,162,308)

31 December 2022 506,818

------------------------------ --------------------------

Carrying amount

31 December 2022 -

------------------------------ --------------------------

31 December 2021 7,131,907

------------------------------ --------------------------

12 . AVAILABLE-FOR-SALE FINANCIAL ASSETS.

The company retains a passive 5% minority stake in the joint

venture in Argentina, the valuation being based on the achieved

price on the sale of the majority, discounted to reflect the

minority status. The company intends to hold this investment for

the medium-to-long term.

13 . Cash and Cash Equivalents

Unaudited Unaudited Audited

At 30 June At 30 June 31 December

2023 2022 2022

US $ US $ US $

------------------------------------- ------------ ------------ -------------

Cash held by joint venture partners - 54,604 -

Cash and cash equivalents 994,504 1,260,365 1,132,616

------------------------------------- ------------ ------------ -------------

Total 994,504 1,314,969 1,132,616

------------------------------------- ------------ ------------ -------------

14. Share Capital

Unaudited

At 30 Unaudited Audited

June 2023 At 30 June 31 December

2022 2022

US $ US $ US $

--------------------------------------------- ----------- ------------- --------------

Issued, Called Up and Fully Paid

5,560,618,550.32c (June 2022: 1,452,491,345

0.32c) ordinary shares

1 January 19,795,863 7,209,086 7,209,086

Equity shares issued 97,523 477,065 12,586,777

--------------------------------------------- ----------- ------------- --------------

30 June / 31 December 19,893,385 7,686,151 19,795,863

--------------------------------------------- ----------- ------------- --------------

The holders of 0.32c (0.25p) ordinary shares are entitled to

receive dividends from time to time and are entitled to one vote

per share at meetings of the Company.

During the six-month period to 30 June 2023, 97,523 shares were

issued.

15. Share Premium Account

Unaudited Unaudited Audited

At 30 June At 30 June 31 December

2023 2022 2022

US$ US $ US $

------------------------------------ ------------ ------------ -------------

1 January 83,790,504 64,977,243 64,977,243

Premium arising on issue of equity

shares/warrants - 400,735 7,521,415

Warrants Issued - (412,184) 11,291,846

Transaction costs - (81,238) -

------------ ------------ -------------

30 June 83,790,504 64,884,556 83,790,504

------------------------------------ ------------ ------------ -------------

16. Loans (due over 1 year)

Unaudited

Unaudited At 30 June Audited

At 30 June 2022 31 December

2023 2022

------------------------ ---------------- ----------------- ------------- -------------- --------------

Five-year secured

bonds (4,000,154) (20,909,700) (4,170,086)

Additional net

funding - (5,871,466) (6,059,126)

Other loans (1,340,882) (1,250,150) (1,293,215)

------------------------ ---------------- ----------------- ------------- -------------- --------------

Total (5,341,036) (28,031,316) (5,463,301)

------------------------ ---------------- ----------------- ------------- -------------- --------------

Amortised Repayment

Balance as finance charges of Exchange

at less cash principle adjustments 30 June

31 December interest US $ 2022

2022 paid US$ US$

US $ US $

------------------------ ---------------- ----------------- ------------- -------------- --------------

EUR 20 million five-year

secured bonds 4,170,086 44,188 - (214,120) 4,000,154

Other loans 1,293,215 33,075 - 14,592 1,340,882

Total 5,463,301 77,263 (199,528) 5,341,036

------------------------ ---------------- ----------------- ------------- -------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LLMITMTITBPJ

(END) Dow Jones Newswires

September 29, 2023 11:50 ET (15:50 GMT)

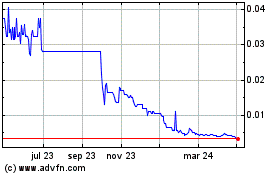

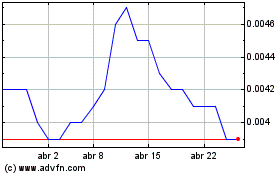

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Echo Energy (LSE:ECHO)

Gráfica de Acción Histórica

De May 2023 a May 2024