TIDMECO

RNS Number : 0633R

Eco (Atlantic) Oil and Gas Ltd.

27 February 2023

27 February 2023

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

Unaudited Results for the three and nine months ended 31

December 2023

Corporate and Operational Update

Eco (Atlantic) Oil & Gas Ltd. (AIM: ECO, TSX -- V: EOG) ,

the oil and gas exploration company focused on the offshore

Atlantic Margins, is pleased to announce its results for the three

and nine months ended 31 December 2022, and to provide a corporate

and operational update.

Highlights:

Financials (as at 31 December 2022)

-- The Company had cash and cash equivalents of US$14.5 million

and no debt as at 31 December 2022.

-- The Company had total assets of US$68.0 million, total

liabilities of US$17.8 million and total equity of US$50.1 million

as at 31 December 2022.

Operations:

South Africa

Block 2B

-- In November 2022, the JV Partners submitted a Production

Right Application to the Petroleum Agency of SouthAfrica ("PASA"),

based on the existing oil discovery of AJ-1 and potential future

operations.

-- Following the drilling of the Gazania-1 well in November

2022, further analysis of the well data is being undertaken to

determine next steps on the Block.

-- Eco and its JV partners continue to believe that Block 2B

contains considerable hydrocarbon resources and further updates

will be made in due course on how the JV partners will look to

deliver value from the licence for the benefit of all

stakeholders.

Block 3B/4B

-- In December 2022, Eco received regulatory approval from the

Department of Mineral Resources and Energy ("DMRE") of South Africa

and Petroleum Agency South Africa ("PASA") in respect of its

acquisition of an additional 6.25% participating interest in the

Block (the "Acquisition"), giving Eco an overall interest of

26.25%.

-- As the final instalment of the share consideration due in

respect of the Acquisition, Eco is issuing an additional 1,666,666

common shares to the Lunn Family Trust, the Vendor (the "Final

Consideration Shares").

-- The Company and its JV partners are progressing plans to

conduct a two-well campaign on Block 3B/4B and in addition continue

to progress the collaborative farm-out process, up to 55% gross

working interest in the Block, with various potential parties.

-- The JV Partners have selected a leading South African

environmental consulting firm to conduct a comprehensive

Environmental and Social Impact Assessment (ESIA) process

commencing in March 2023 in preparation for permitting and drilling

activity on the Block.

-- Africa Oil Corp. the Operator of the Block is preparing a new

51-101 Competent Person's Report following the completion of the 3D

data reprocessing and targets and leads identification.

Namibia

-- Namibia witnessed some of the largest oil exploration

discoveries in the world in 2022 and with significant exploration

activity set to continue this year, the Company believes that its

highly strategic acreage in-country will remain of considerable

interest to operators looking to enter the region.

-- Eco continues to explore possible farm out opportunities with

its four licences in the region and will update investors on

developments accordingly.

Guyana

-- Eco and its JV partners on the Orinduik Block, offshore

Guyana, continue to work towards identifying the optimal drilling

target and Eco plans to drill at least one well into a light oil

Cretaceous target in the next 12-18 months.

-- With an excess of 11 billion barrels of oil discovered in

Guyana to date, the region has become one of the most prolific

hydrocarbon basins in the world. Eco continues to work towards

unlocking the potential of the Orinduik Block as fast as

practically possible.

Gil Holzman, President and Chief Executive Officer of Eco

Atlantic, commented:

"We have had a busy start to the year, and I am pleased to

report substantial progress across a number of fronts in our

exciting exploration portfolio.

Following our drilling campaign on Block 2B, offshore South

Africa, in Q4 2022, we continue to analyse the well data obtained

from the Gazania-1 well. We remain of the view that considerable

untapped potential remains in the asset and we are working with our

partners on the Block to plan our next steps, in order to deliver

value for all stakeholders.

Significant progress continues to be made on Block 3B/4B,

offshore South Africa, with a number of workstreams progressing

well. As we have said previously, we are conducting a farm out

process on the licence and we are looking ahead to commencing a two

well drilling program once ESIA is completed and permits

obtained.

Both Guyana and Namibia continue to yield sizeable discoveries,

and we are seeing unprecedented levels of interest for exploration

assets in these regions. As such, we continue to progress our

highly strategic acreage positions in both Guyana and Namibia and

we look forward to updating the market on our farm out program in

Namibia and our plans for a drilling campaign in Guyana as soon as

practically possible.

We remain excited about the potential for 2023 and we look

forward to keeping all stakeholders updated throughout the course

of the year."

Admission of the Common Shares

Application has been made for admission of the Final

Consideration Shares, which will rank pari passu with existing

Common Shares, to trading on AIM ("Admission"). It is expected that

Admission will become effective, and trading will commence on or

around 8.00 a.m. on 3 March 2023 .

Following Admission of the Consideration Shares, the enlarged

issued share capital of the Company will be 367,348,680 Common

Shares. The above figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company.

The Company's unaudited financial results for the three and nine

months ended 31 December 2022, together with Management's

Discussion and Analysis as at 31 December 2022, are available to

download on the Company's website at www.ecooilandgas.com and on

Sedar at www.sedar.com .

The following are the Company's Balance Sheet, Income

Statements, Cash Flow Statement and selected notes from the annual

Financial Statements. All amounts are in US Dollars, unless

otherwise stated.

Balance Sheet

December 31, March 31,

------------------------------------------------

2022 2022

------------------------------------------------ --------------------------- -------------------

(Unaudited) (Audited)

--------------------------- -------------------

Assets

Current Assets

Cash and cash equivalents 14,461,888 3,438,834

Short-term investments 55,266 52,618

Government receivable 42,468 27,487

Amounts owing by license partners, 4,279,350 -

net

Accounts receivable and prepaid

expenses 788,597 257,911

Assets held for sale - 2,061,734

------------------------------------------------ --------------------------- -------------------

Total Current Assets 19,627,569 5,838,584

------------------------------------------------ --------------------------- -------------------

Non- Current Assets

Investment in associate 9,000,254 9,277,162

Petroleum and natural gas licenses 39,351,990 30,753,034

------------------------------------------------ --------------------------- -------------------

Total Non-Current Assets 48,352,244 40,030,196

------------------------------------------------ --------------------------- -------------------

Total Assets 67,979,813 45,868,780

------------------------------------------------ --------------------------- -------------------

Liabilities

Current Liabilities

Accounts payable and accrued liabilities 17,003,778 1,931,823

Current liabilities related to assets

held for sale - 473,254

Warrant liability 838,789 3,241,762

------------------------------------------------

Total Current Liabilities 17,842,567 5,646,839

Total Liabilities 17,842,567 5,646,839

------------------------------------------------ --------------------------- -------------------

Equity

Share capital 121,570,983 63,141,609

Shares to be issued - 20,766,996

Restricted Share Units reserve 433,153 267,669

Warrants 14,778,272 7,806,000

Stock options 2,560,023 958,056

Foreign currency translation reserve (1,846,026) (1,309,727)

Accumulated deficit (87,359,159) (51,408,662)

------------------------------------------------ --------------------------- -------------------

Total Equity 50,137,246 40,221,941

------------------------------------------------ --------------------------- -------------------

Total Liabilities and Equity 67,979,813 45,868,780

------------------------------------------------ --------------------------- -------------------

Income Statement

Three months ended Nine months ended

December 31, December 31,

------------------------------------------- ----------------------------------------------

2022 2021 2022 2021

--------------------- -------------------- --------------------- -----------------------

Unaudited Unaudited

------------------------------------------- ----------------------------------------------

Revenue

Interest

income 36,731 - 93,183 8,435

--------------------- -------------------- --------------------- -----------------------

36,731 - 93,183 8,435

Operating

expenses

:

Compensation

costs 217,192 116,651 697,106 526,738

Professional

fees 131,188 79,763 591,767 261,262

Operating costs,

net 19,880,507 179,885 32,921,918 597,703

General and

administrative

costs 120,692 121,569 728,846 430,926

Share-based

compensation 484,125 2,373 2,236,011 14,083

Foreign exchange

loss (333,104) (12,235) 642,117 40,987

--------------------- -----------------------

Total

operating

expenses 20,500,600 488,006 37,817,765 1,871,699

--------------------- -------------------- --------------------- -----------------------

Operating loss (20,463,869) (488,006) (37,724,582) (1,863,264)

Fair value

change

in warrant

liability 556,277 1,236,827 2,402,973 1,874,016

Share of losses

of

company

accounted

for at equity (92,303) - (276,908) -

--------------------- -------------------- --------------------- -----------------------

Net profit

(loss)

for the period

from

continuing

operations (19,999,895) 748,821 (35,598,517) 10,752

Gain (loss) from

discontinued

operations,

after-tax 546,343 (512,778) (351,980) (1,000,969)

Net profit

(loss)

for the period (19,453,552) 236,043 (35,950,497) (990,217)

Foreign currency

translation

adjustment 16,803 35,160 (536,299) 26,925

Comprehensive

profit

(loss) for the

period (19,436,749) 271,203 (36,486,796) (963,292)

--------------------- -------------------- --------------------- -----------------------

Basic and

diluted

net loss per

share

attributable to

equity

holders of the

parent (0.055) (0.002) (0.104) (0.005)

===================== ==================== ===================== =======================

Weighted

average

number of

ordinary

shares used in

computing

basic and

diluted

net loss per

share 365,355,650 199,893,636 344,158,567 194,041,560

===================== ==================== ===================== =======================

Cash Flow Statement

Nine months ended

December 31,

---------------------------------------------

2022 2021

(Unaudited) (Unaudited)

---------------------- ---------------------

Cash flow from operating activities

Net loss from continuing operations (35,598,517) 10,752

Net loss from discontinued operations (351,980) (1,000,969)

Items not affecting cash:

Share-based compensation 2,236,012 14,083

Depreciation and amortization - 57,187

Accrued interest - 8,535

Revaluation of warrant liability (2,402,973) (1,874,016)

Share of losses of companies accounted for 276,908 -

at equity

Changes in non--cash working capital:

Government receivable (14,981) 12,444

Accounts payable and accrued liabilities 15,243,249 145,697

Accounts receivable and prepaid expenses 7,969,314 (59,781)

Reallocation to discontinued operations cashflows (171,294) -

Advance from and amounts owing to license

partners (12,878,306) (298,337)

---------------------------------------------------- ---------------------- ---------------------

(25,692,568) (2,984,405)

---------------------------------------------------- ---------------------- ---------------------

Net change in non-cash working capital items (458,842) -

relating to discontinued operations

Cash flow from investing activities

Investment in associate - (10,000,000)

Short-term investments (2,648) 1,500,022

---------------------------------------------------- ---------------------

(2,648) (8,499,978)

---------------------------------------------------- ---------------------- ---------------------

Cash flow from investing activities - discontinued 2,047,322 -

operations

Cash flow from financing activities

Proceeds from private placements, net 35,666,089 -

Issuance of shares - 4,793,789

Exercise of stock options - 71,388

35,666,089 4,865,177

---------------------------------------------------- ---------------------- ---------------------

Increase (decrease) in cash and cash equivalents 11,559,353 (6,619,206)

Foreign exchange differences (536,299) 46,000

Cash and cash equivalents, beginning of period 3,438,834 11,807,309

---------------------------------------------------- ---------------------- ---------------------

Cash and cash equivalents, end of period 14,461,888 5,234,103

---------------------------------------------------- ---------------------- ---------------------

Supplementary disclosure of cash flow information:

Significant non-cash transactions

Issuance of shares in respect of farm out 8,500,000 -

agreement

---------------------------------------------------- ---------------------- ---------------------

8,500,000 -

---------------------------------------------------- ---------------------- ---------------------

Notes to the Financial Statements

Basis of Preparation

The Condensed Interim Consolidated financial statements of the

Company have been prepared on a historical cost basis with the

exception of certain financial instruments that are measured at

fair value. Historical cost is generally based on the fair value of

the consideration given in exchange for assets.

**S**

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0)

20 8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Head of Corporate Sustainability +44(0)781 729 5070

Strand Hanson (Financial & Nominated Adviser) +44 (0) 20 7409 3494

James Harris

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

Matthew Armitt

Detlir Elezi

Echelon Capital (Financial Adviser N.

America Markets)

Ryan Mooney +1 (403) 606 4852

Simon Akit +1 (416) 8497776

Celicourt (PR) +44 (0) 20 8434 2754

Mark Antelme

Jimmy Lea

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

Notes to editors:

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM-quoted Atlantic Margin-focused

oil & gas exploration company with offshore license interests

in Guyana, Namibia, and South Africa. Eco aims to deliver material

value for its stakeholders through its role in the energy

transition to explore for low carbon intensity oil and gas in

stable emerging markets close to infrastructure.

Offshore Guyana in the proven Guyana-Suriname Basin, the Company

holds a 15% Working Interest in the 1,800 km(2) Orinduik Block

Operated by Tullow Oil. In Namibia, the Company holds Operatorship

and an 85% Working Interest in four offshore Petroleum Licences:

PELs: 97, 98, 99, and 100, representing a combined area of 28,593

km(2) in the Walvis Basin.

Offshore South Africa, Eco is Operator and holds a 50% working

interest in Block 2B and a 26.25% Working Interest in Block 3B/4B

operated by Africa Oil Corp., totalling some 20,643km (2) .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTBCGDDRGDDGXL

(END) Dow Jones Newswires

February 27, 2023 02:00 ET (07:00 GMT)

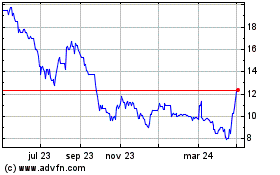

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

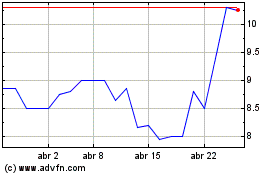

Eco (atlantic) Oil & Gas (LSE:ECO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024