TIDMEDEN

RNS Number : 2360B

Eden Research plc

30 September 2022

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

30 September 2022

Eden Research plc ("Eden" or "the Company")

Half Yearly Report

Eden Research plc (AIM: EDEN), the AIM-quoted company focused on

sustainable biopesticides and plastic-free formulation technology

for use in the global crop protection, animal health and consumer

products industries, announces its interim results for the six

months ended 30 June 2022.

Financial highlights

-- Revenue for the period of GBP1.04m (H1 2021: GBP0.79m), an increase of c. 32%

-- Product sales of GBP1.01m (H1 2021: GBP0.66m), an increase of c. 53%

-- Operating loss for the period of GBP1.3m (H1 2021: GBP1.8m)

-- Cash and cash equivalents of GBP1.9m (H1 2021: GBP5.8m)

-- Cash and cash equivalents at 31 August 2022 of GBP2.4m

following a tax refund and receipts from half-year end trade

debtors

-- On track to meet 2022 product sales revenue guidance of GBP1.4m

Business highlights

Expanding regulatory approvals in key territories, including the

US, and leveraging of high-value commercial agreements

-- Materially increased Eden's global addressable market with

label extensions and new regulatory approvals, most notably the

addition of the US following EPA approval, post-period end

o Other notable approvals included Mevalone(R) label extensions

in Italy (sold under the brand "3logy(R)", by Sipcam-Oxon)

-- Eden's new insecticide product heading towards

commercialisation with extensive registration and commercial

evaluation field trials ongoing in 2022

-- Commercialisation of the seed treatment product developed as

part of the Corteva project remains on track with commercial launch

possible in advance of the 2024 growing season (subject to

regulatory approvals)

-- Robust sales of Eden's products indicating that demand is returning to pre-pandemic levels

-- New distribution arrangements in key territories expected by year-end

Corporate highlights

New team additions reflecting Eden's next phase of growth and

ambition to capitalise on the abundance of new opportunities

-- Appointment of Richard Horsman as Non-Executive Director,

with effect from 1 September 2022. Richard brings over 25 years of

AIM and Main Market experience to the team

-- New Development Team Lead and Formulation Team members recruited

-- Strengthening of the Commercial Team underway

Lykele van der Broek, Chairman of Eden Research, commented:

"We reached the mid-part of 2022 on a firm footing, expanding

our regulatory approvals in key regions, advancing our strategic

partnerships with major industry players, and delivering robust

sales of our products, indicating a return to pre-pandemic demand

levels.

The authorisation of Cedroz(TM) and Mevalone(R) and their

associated active ingredients in the US after the period end has

been a particular highlight for us. As the Environmental Protection

Agency ("EPA") continues to ban a number of commonly used

conventional chemical pesticide products in recent years, US-based

farmers are in need of viable alternatives to keep up with the

growing demand for food. The approval of our biopesticide products,

which are based on naturally occurring substances, provide this

alternative, without compromising efficacy, yield or production

costs.

This development opens up significant revenue and growth

opportunities for us, with our total addressable market in the

region of $500 million. We now turn our attention to state level

approvals, focusing on California and Florida in the first

instance, which we expect to see in the coming months, followed by

the start of meaningful sales in 2023.

This year so far has also seen us continue to successfully

develop new product ranges, including our insecticide offering,

which has produced good field trial results to date in both our own

hands, and in the hands of potential commercial partners. Our

partnership to develop our seed treatment product with Corteva also

goes from strength to strength and we look forward to successfully

commercialising this offering as quickly as possible, subject to

regulatory clearance.

Despite ongoing macro-economic challenges, we are pleased with

the progress that has been made during the year so far. With our

new board and team additions, we are confident that we have the

talent and capabilities to capitalise on the significant and

growing market opportunity available for Eden across the globe. I

look forward to reporting further progress in the coming months as

we continue to work towards our strategic and financial goals."

For further information contact:

Eden Research plc www.edenresearch.com

Sean Smith

Alex Abrey 01285 359 555

Cenkos Securities plc (Nominated advisor

and broker)

Giles Balleny / Max Gould (corporate

finance)

Michael Johnson (sales) 020 7397 8900

Hawthorn Advisors (Financial PR)

Victoria Ainsworth eden@hawthornadvisors.com

Stephen Atkinson

Chief Executive Officer's Statement

The first of half of 2022 has represented a period of progress

for Eden, and I am delighted to say we are beginning to see the

fruits of our commercial efforts with stronger sales.

Executing on our strategic objectives

At our recent AGM, we laid out four key strategic areas that we

are pursuing to take the Company forward into its next phase of

growth:

-- Diversification of our product portfolio, geographic

presence, target markets, and product uses

-- Enhancing our research, development and operations, and

self-reliance, through the expansion of our in-house capabilities,

optimising our supply chains, and reducing our time to market

-- Growth through new partnerships and collaborations with major

global and regional partners, as well as regulatory clearance in

new countries, crops, and diseases

-- Team expansion with added capacity in key strategic areas such as development and commercial

Eden has been delivering against these objectives in the

following ways:

1. Widening our global market opportunities

We are excited to be able to report federal approval from the

EPA received after the period end for distribution of our flagship

products, Mevalone(R) and Cedroz(TM), alongside our three

associated active ingredients, in one of the largest agricultural

markets in the world. This has been the result of over four years

of effort by our experienced regulatory and commercial teams who

worked tirelessly to ensure that Eden addressed the EPA's extensive

and evolving list of strict requirements. We are the first British

crop protection company to receive such approval for a

biopesticide, and we are, by far, the smallest company to achieve

the ambitious goal of registering three active ingredients and two

formulated products at once, thereby opening up one of the world's

most important markets for agricultural inputs.

Eden's naturally derived products represent a compelling

proposition for American farmers looking to navigate the

increasingly restrictive landscape of regulations whilst still

maintaining or increasing food production in a sustainable way. We

estimate this one addressable market alone to be worth in excess of

$500 million per annum. The next step in the process will be to

focus on local regulatory approval in the key states of California

and Florida, where many of the country's high-value crops are

grown. We expect these regulatory processes to be relatively short,

as we target the 2023 growing season.

Eden also received a label extension for Mevalone(R) in Italy

which is sold under the brand name "3logy(R)" by our commercial

partner Sipcam Oxon. This label extension has allowed Eden and

Sipcam to target two new fungal pathogens and add a wide range of

new crop types to the label. We estimate that this expansion of the

label for 3logy adds thousands of hectares of high-value crops to

our addressable market.

We are currently hard at work to further optimise our

distribution network, and we anticipate announcing new partnerships

in the coming months; all aimed at adding new territories or

expanding our market access in existing countries.

2. Expanding our product line and applicable uses

Our product development pipeline continues to progress. Examples

include our forthcoming insecticide product which we have been

conducting extensive field trials on this year. We are now at the

stage of receiving trial results and, in the meantime, we have sent

our product to a long list of third parties, including several

industry leaders, to undertake field trials of their own. We look

forward to sharing the outcome of these field trials in due course

as we prepare for registration and commercialisation.

In addition, field trials this growing season on our seed

treatment product, developed for commercialisation by Corteva, have

so far proven successful. We are looking to move forward with the

regulatory process in key markets as swiftly as possible. Our

aspiration is to launch this important new product in time for the

2024 growing season, although the process is subject to regulatory

approval by the relevant authorities across our targeted

geographies.

We are continually assessing applicable use of our biopesticide

products across crops outside our existing remit such as cannabis,

as well as the use of our proprietary technologies in the consumer

products and animal health industries.

3. New team additions to drive next phase of growth

Post-period, we welcomed Richard Horsman as a new Non-Executive

Director. Richard possesses an abundance of industry, commercial

and corporate acumen and expertise which will help drive Eden

through our next phase of growth. This not only applies to

maximising the potential of our existing opportunities, but also in

driving new opportunities that share synergies with our core

business.

Strong revenue and sales performance against year-end

guidance

Revenues for the first half of the year increased by

approximately 32% to GBP1.04m compared to GBP0.79m for H1 2021.

The focus for the business remains to grow revenue through

product sales which will ultimately provide a sustainable,

consistent source of income for the Company. Product sales

increased by approximately 53% to GBP1.01m compared to GBP0.66m for

H1 2021.

Earnings improved against H1 2021 with overall loss before tax

of GBP1.3m (H1 2021: GBP1.8m loss), but were flat against H1 2021

Adjusted EBITDA (i.e. EBITDA excluding Share Based Payments) with a

loss of GBP0.8m (H1 2021: GBP0.8m loss).

The cash position at half-year was GBP1.9m (H1 2021: GBP5.8m)

and GBP2.4m at 31 August 2022 following a tax refund and receipts

from half-year end trade debtors.

Our cash generation is supported by the material progress made

along various development lines, as well as the growing number of

additional commercial agreements and regulatory approvals in new

territories.

We continue to aggressively manage our cash position and always

aim to achieve operational efficiencies. Much of the work that has

been brought in-house was previously contracted to third parties,

and so many of our internal costs have offset what were previously

larger third-party expenditures. By bringing certain strategic

capabilities in-house, we have also been able to significantly

reduce development time whilst building internal know-how and

strengthening our strategic capabilities in support of future

growth.

Dividend

At present, there is currently no near-term plan to pay a

dividend. However, the Board continues to review the company's

dividend policy.

Maintaining a cautious approach against a promising outlook

The commercial foundations for the remainder of the year have

been set in place by the interim period and we remain on track to

meet full year product sales revenue market expectations of GBP1.4

million. As ever, we continue to monitor conditions of the current

growing season and any impact this may have on our product sales.

Generally dry weather conditions across the south of Europe have,

once again, reduced demand for botryticides and certain other

agrochemicals. Ultimately this can result in higher-than-desired

inventory levels.

Whilst it is premature to assess what impact this will have on

the post-season selling period, we are monitoring this situation

closely as we are with various supply chain-related issues,

including increasing raw material prices. The well-known potential

impact of weather in the short-term, and climate change in the

longer term, further highlights the need to expand our product

range and the diseases and pests that we target in order to achieve

a diversification of risks across the product portfolio. We have

made good progress in this area in the last five years, and we will

continue to focus upon these efforts as a matter of priority.

On behalf of the Company, I'd like to thank our staff for their

outstanding efforts so far this year as well as our shareholders

for their continued interest and support.

Sean Smith

Chief Executive Officer

29 September 2022

Eden Research plc - Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2022

Six

Six months Year ended

months ended 31 December

ended 30 30 June 2021

June 2022 2021 GBP GBP

GBP unaudited unaudited audited

Revenue (note 16) 1,040,036 785,294 1,228,580

--------------- ------------ -------------

Cost of sales (626,342) (403,570) (667,343)

--------------- ------------ -------------

Gross profit 413,694 381,724 561,237

--------------- ------------ -------------

Administrative expenses (1,295,770) (1,272,825) (2,694,290)

Amortisation of intangible assets (246,325) (316,536) (434,630)

Share based payments (note 15) (152,135) (544,028) (640,597)

--------------- ------------ -------------

Operating loss (1,280,536) (1,751,665) (3,208,280)

28 82 98

Investment revenues (9,868) (18,320) (32,074)

Finance costs (33,351) (54,847) (97,247)

Foreign exchange gains/(losses)

Share of loss of equity accounted

investee, net of tax (note 10) (9,849) (9,199) (58,177)

--------------- ------------ -------------

Loss before taxation (1,333,576) (1,833,949) (3,395,680)

Income tax income 345,424 261,020 618,137

--------------- ------------ -------------

Loss for the financial period (988,152) (1,572,929) (2,777,543)

Attributable to:

Equity holder of the company (997,630) (1,583,887) (2,788,973)

Non-controlling interest 9,478 10,958 11,430

--------------- ------------ -------------

Other Comprehensive Income net

of tax - - -

Total Comprehensive Income (988,152) (1,572,929) (2,777,543)

Earnings per share (note 7)

Basic (pence per share) (0.26) (0.42) (0.73)

Eden Research plc - Consolidated Statement of Financial Position

as at 30 June 2022

30 June

2022 30 June 2021 31 Dec 2021

GBP GBP GBP

unaudited unaudited audited

NON-CURRENT ASSETS

Intangible assets (note 9) 8,330,644 7,315,305 7,919,780

Property, plant & equipment

(note 12) 222,712 259,484 232,278

Right of Use assets (note 13) 339,179 373,968 372,787

Investments in associate (note

10) 351,839 410,666 361,688

9,244,374 8,359,423 8,886,533

CURRENT ASSETS

Inventories 459,424 264,797 521,351

Trade and other receivables 1,564,652 1,495,898 886,587

Taxation 918,009 546,128 903,245

Cash and cash equivalents 1,852,019 5,748,840 3,829,369

4,794,104 7,770,555 6,140,552

CURRENT LIABILITIES

Trade and other payables 1,638,945 1,705,285 1,711,518

Lease liabilities 114,478 94,415 99,924

1,753,423 1,924,912 1,811,442

NET CURRENT ASSETS 3,040,681 5,845,643 4,329,110

NON-CURRENT LIABILITIES

Trade and other payables - 125,212 87,740

Lease liabilities 247,742 305,016 298,428

247,742 430,228 386,168

NET ASSETS 12,037,313 13,900,050 12,829,475

EQUITY

Called up share capital 3,803,402 3,803,402 3,803,402

Share premium account 39,308,529 39,308,529 39,308,529

Warrant reserve 769,773 876,764 937,505

Merger reserve 10,209,673 10,209,673 10,209,673

Retained earnings (42,094,661) (40,328,965) (41,460,753)

Non-controlling interest 40,597 30,647 31,119

TOTAL EQUITY 12,037,313 13,900,050 12,829,475

Eden Research plc - Consolidated Statement of Changes in Equity

as at 30 June 2022

Non-control-ling

interest

Share Share Merger Warrant Retained

capital premium reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP

Six months

ended 30 June

2022

Balance at

1 January 2022

(audited) 3,803,402 39,308,529 10,209,673 937,505 (41,460,753) 31,119 12,829,475

Loss and total

comprehensive

income - - - - (997,630) 9,478 (988,152)

Transactions

with owners

- Xinova write

off - - - - 43,855 - 43,855

- Options granted - - - 152,135 - - 152,135

- Options

exercised/lapsed - - - (319,867) 319,867 - -

---------- ----------- ----------- ---------- ------------- ----------------- ------------

Transactions

with owners - - - (167,732) 363,722 - 195,990

---------- ----------- ----------- ---------- ------------- ----------------- ------------

Balance at

30 June 2022

(unaudited) 3,803,402 39,308,529 10,209,673 769,773 (42,094,661) 40,597 12,037,313

---------- ----------- ----------- ---------- ------------- ----------------- ------------

Six months

ended 30 June

2021

Balance at 1

January 2021

(audited) 3,803,402 39,308,529 10,209,673 429,915 (38,842,259) 19,689 14,928,949

Loss and total

comprehensive

income - - - - (1,583,887) 10,958 (1,572,929)

Transactions

with owners

- Xinova write

off - - - - - - -

- Options granted - - - 544,028 - - 544,028

- Options

exercised/lapsed - - - (97,179) 97,179 - -

---------- ----------- ----------- ---------- ------------- ----------------- ------------

Transactions

with owners - - - 446,849 97,179 - 544,028

---------- ----------- ----------- ---------- ------------- ----------------- ------------

Balance at 30

June 2021

(unaudited) 3,803,402 39,308,529 10,209,673 876,764 (40,328,965) 30,647 13,900,050

---------- ----------- ----------- ---------- ------------- ----------------- ------------

Eden Research plc - Consolidated Statement of cash flows for the

six months ended 30 June 2022

Six months Six months

Year ended

ended ended 31

30 June December

30 June 2022 2021 2021

GBP GBP GBP

unaudited unaudited audited

Cash flows from operating

activities

Cash outflow from operations

(note 8) (1,528,470) (420,027) (1,586,582)

Interest on lease liabilities (9,868) (18,320) (32,074)

Tax refunded 330,660 - -

Net cash used in operating

activities (1,207,678) (438,347) (1,618,656)

Cash flows from investing

activities

Purchase of intangible assets (657,189) (902,356) (1,624,927)

Purchase of property, plant

and equipment (21,790) (98,458) (101,269)

Interest received 28 82 98

------------- ------------ ------------

Net cash used in investing

activities (678,951) (1,000,732) (1,726,098)

------------- ------------ ------------

Cash flows from financing

activities

Payment of lease liabilities (57,370) (43,737) (90,387)

Net cash used in financing

activities (57,370) (43,737) (90,387)

------------- ------------ ------------

(Decrease)/increase in cash

and cash equivalents (1,943,999) (1,482,816) (3,435,141)

Cash and cash equivalents

at

beginning of period 3,829,369 7,286,503 7,286,503

Effect of exchange rate fluctuations

on cash held (33,351) (54,847) (21,993)

------------- ------------ ------------

Cash and cash equivalents

at

end of period 1,852,019 5,748,840 3,829,369

============= ============ ============

Cash and cash equivalents comprise bank account balances.

Notes to the Interim Results

1. Reporting Entity

Eden Research plc is a public limited company incorporated in

the United Kingdom under the Companies Act 2006. The Company is

domiciled in the United Kingdom and is quoted on the Alternative

Investment Market (AIM).

These condensed consolidated interim financial statements

('Interims') as at and for the six months ended 30 June 2022

comprise the Company and its Subsidiaries (together referred to as

'the Group'). The principal activities of the Group are the

development and commercialisation of encapsulation, terpenes and

environmentally friendly technologies to provide naturally

occurring solutions for the global agrochemicals, animal health,

and consumer product industries.

2. Basis of Preparation

These Interims have been prepared in accordance with IAS 34

'Interim Financial Reporting', and should be read in conjunction

with the Group's last annual consolidated financial statements as

at and for the year ended 31 December 2021 which were approved by

the Board of Directors on 30 May 2022 and have been delivered to

the Registrar of Companies. The report of the auditors on those

financial statements was unqualified, did not contain an emphasis

of matter paragraph and did not contain any statement under section

498 of the Companies Act 2006.

The Interims do not include all of the information required for

a complete set of financial statements prepared under UK-adopted

International Accounting Standards and do not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. However, selected explanatory notes are included to explain

events and transactions that are significant to an understanding of

the changes in the Group's financial position and performance since

the last annual financial statements.

Comparative information in the Interims as at and for the year

ended 31 December 2021 has been taken from the published audited

financial statements as at and for the year ended 31 December 2021.

All other periods presented are unaudited.

The Board of Directors and the Audit Committee approved the

interims on 29 September 2022.

3. Going Concern

The directors have, at the time of approving the Interims, a

reasonable expectation that the Group has adequate resources to

continue in operational existence for at least 12 months from the

approval of the financial statements. Thus, the Interim financial

statements have been prepared on a going concern basis which

contemplates the realisation of assets and the settlement of

liabilities in the ordinary course of business.

The Group has reported a loss for the first half of the year

after taxation of GBP988,152 (H1 2021: GBP1,572,929). Net current

assets at that date amounted to GBP3,040,681 (H1 2021:

GBP5,845,643). Cash at that date amounted to GBP1,852,019 (H1 2021:

GBP5,748,840). The Group is reliant on its existing cash balance to

fund its working capital.

The Directors have prepared budgets and projected cash flow

forecasts, based on forecast sales provided by Eden's distributors

where available, for a period of at least 12 months from the date

of approval of the Interims and they consider that the Company will

be able to operate with the cash resources that are available to it

for this period.

The forecasts adopted include only revenue derived from existing

contracts. They do not include potential upside from on-going

discussions and negotiations with other parties not yet contracted,

as well as other 'blue sky' opportunities.

The impact of COVID-19 has been considered in the forecasts. The

Group has not been significantly impacted by the pandemic although

it has led to some delays in product development processes and

limited promotional activity. The forecasts reflect this with the

development expenditure timing based on the latest experience with

regulatory authorities and sales volumes on the latest

distributors' information which reflects their post-COVID-19

demand.

In addition, the Group has relatively low fixed running costs

and, while mitigating actions are not forecast to be required to

support the going concern basis, the Directors have previously

demonstrated its ability to delay certain other costs, such as

Research and Development expenditure, in the event of unforeseen

cash constraints and are willing and able to delay costs in the

forecast period should the need arise.

Consequently, the directors are confident that the company will

have sufficient funds to continue to meet its liabilities as they

fall due for at least 12 months from the date of approval of the

financial statements and therefore have prepared the financial

statements on a going concern basis

4. Adoption of new and revised standards and changes in accounting policies

These condensed consolidated Interims have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 December 2021, except for

the application of the following standard at 1 January 2022:

-- Amendments to IFRS 3, IAS 16, IAS 37 and the 2018-2020 IFRS Annual Improvements cycle

The adoption of these new standards would not result in any

material changes to the Interims.

The accounting policies have been applied consistently for the

purposes of preparation of these condensed Interims.

5. Principal risks and uncertainties

The Company's prime risk is the on-going commercialisation of

its intellectual property, which involves testing of the Company's

products, obtaining regulatory approvals and reaching a

commercially beneficial arrangement for each product to be taken to

market. This is measured by comparing actual results with forecasts

that have been agreed by the Company's Board of Directors.

The Company's credit risk is primarily attributable to its trade

receivables. Credit risk is managed by running credit checks on

customers and by monitoring payments against contractual

agreements.

The Company monitors cash flow as part of its day-to-day control

procedures. The Board considers cash flow projections at its

meetings and ensures that the Company has sufficient cash resources

to meet its on-going cash flow requirements.

Due to the nature of the business, there is inherent risk of

infringement of Eden's intellectual property rights by third

parties. The risk of infringement is managed by taking (and acting

on) the relevant legal advice as and when required.

There is also inherent uncertainty surrounding the regulatory

approval of products in terms of both timing and outcome. This risk

is managed by retaining appropriately experienced staff and

contracting with expert consultants as needed.

6. COVID-19 and Ukraine

COVID-19

As restrictions significantly eased in the first part of 2022,

operationally things are returning to normal.

Commercially, there has been some negative impact on the sales

of our products due to the on-going reduction in demand for wine

grapes, a knock-on effect of the substantive closure of the

hospitality industry.

The Company has not seen a significant change on its toll

manufacturing operations, though supply of some raw materials

continues to be somewhat delayed.

Regulatory authorities were working at reduced capacity, which

has impacted on-going product approval applications that we have

around the world, though it is still difficult at this stage to

assess what, if any, commercial and financial impact there may

be.

The Company has been careful to manage its cost-base and cash

position given the general uncertainties that currently exist due

to the global COVID-19 pandemic.

Ukraine

Eden does not currently have any business activities in Russia

or Ukraine and, as such, does not expect any immediate, direct

impact on its business.

The knock-on effect of the conflict on other countries is yet to

be understood, though we do not envisage significant disruption to

the current business in the short term.

7. Earnings per share

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2021 2021

2022 Pence unaudited Pence

Pence unaudited audited

(Loss)/profit per ordinary share

(pence) - basic (0.26) (0.42) (0.73)

================= ================= =============

Loss per share - basic has been calculated on the net basis on

the loss after tax of GBP988,152 (30 June 2021: GBP 1,572,929 , 31

December 2021: GBP2,777,543) using the weighted average number of

ordinary shares in issue of 380,340,229 (30 June 2021: 380,340,229,

31 December 2021: 380,340,229).

Diluted earnings per share has not been presented as the Group

is currently loss making and as a result, any additional equity

instruments have the effect of being anti-dilutive.

8. Reconciliation of loss before income tax to cash used by operations

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

unaudited unaudited audited

(Loss)/profit after tax (988,152) (1,572,929) (2,777,543)

Adjustments for:

Share of associate's losses 9,849 9,199 58,177

Amortisation charges 246,325 316,536 434,630

Share based payment charge 152,135 544,028 640,597

Xinova loan balance written 43,855 - -

off

Depreciation of property,

plant and equipment and right

of use assets 88,159 75,601 155,341

Finance costs 9,868 18,320 122,311

Foreign exchange currency

losses 33,351 54,847 21,993

Finance income (28) (82) (98)

Tax credit (345,424) (261,020) (618,137)

Movements in working capital:

(Increase)/decrease in trade

and other receivables (678,066) 185,518 509,721

(Decrease)/ Increase in trade

and other payables (162,269) 250,330 163,355

Decrease/(increase) in inventory 61,927 (40,375) (296,929)

------------ ------------ --------------

Cash used by operations (1,528,470) (420,027) (1,586,582)

============ ============ ==============

9. Intangible assets

Intellectual Licences Development Total

property and trademarks Costs

GBP GBP GBP GBP

COST

At 1 January 2021 9,316,281 448,896 6,624,406 16,389,583

Additions - - 902,356 902,356

------------- ---------------- ------------ -----------

At 30 June 2021 9,316,281 448,896 7,526,762 17,291,939

Additions 91,405 7,788 623,378 722,571

------------- ---------------- ------------ -----------

At 31 December

2021 9,407,686 456,684 8,150,140 18,014,510

Additions - - 657,189 657,189

------------- ---------------- ------------ -----------

At 30 June 2022 9,407,686 456,684 8,807,329 18,671,699

============= ================ ============ ===========

AMORTISATION

At 1 January 2021 6,716,681 448,896 2,494,523 9,660,100

Charge for the

period 109,974 - 206,562 316,536

------------- ---------------- ------------ -----------

At 30 June 2021 6,826,655 448,896 2,701,085 9,976,636

Charge for the

period 109,974 - 8,120 118,094

------------- ---------------- ------------ -----------

At 31 December

2021 6,936,629 448,896 2,709,205 10,094,730

Charge for the

period 105,174 648 140,503 246,325

------------- ---------------- ------------ -----------

At 30 June 2022 7,041,803 449,544 2,849,708 10,341,055

============= ================ ============ ===========

CARRYING AMOUNT

At 30 June 2022 2,365,883 7,140 5,957,621 8,330,644

============= ================ ============ ===========

At 31 December

2021 2,471,057 7,788 5,440,935 7,919,780

============= ================ ============ ===========

At 30 June 2021 2,489,626 - 4,825,679 7,315,305

============= ================ ============ ===========

10. Investment in associate

Six months Six months Year ended

ended ended

30 June 2022 30 June 2021 31 December

2021

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Percentage ownership interest

and proportion of voting rights 29.90% 29.90% 29.90%

GBP GBP GBP

Non-current assets 409,425 440,601 440,601

Current assets 310,173 333,532 287,576

Non-current liabilities (98,806) (98,806) (98,806)

Current liabilities (269,026) (253,558) (269,026)

Net assets (100%) 351,766 421,769 360,345

Company's share of net assets 105,178 149,437 107,743

Separable intangible assets 133,533 148,101 140,817

Goodwill 412,649 412,649 412,649

Impairment of investment in

associate (299,521) (299,521) (299,521)

Carrying amount of interest

in associate 351,839 410,666 361,688

Revenue 255,912 270,970 361,307

Profit/(loss) from continuing

operations (8,579) (6,406) (145,849)

Post tax profit from discontinued - - -

operations

100% of total post-tax profits (8,579) (6,406) (145,849)

29.9% of total post-tax profits (2,565) (1,915) (43,609)

Amortisation of separable intangible

assets (7,284) (7,284) (14,568)

Company's share of loss including

amortisation of separable intangible

asset (9,849) (9,199) (58,177)

11. Subsidiaries

Details of the company's subsidiaries at 30 June 2022 are as follows:

Name of undertaking Country of Ownership Voting power Nature of business

incorporation interest (%) held (%)

TerpeneTech Republic of 50.00 50.00 Sale of biocide

Limited Ireland products

Eden Research Republic of 100.00 100.00 Dormant

Europe Limited Ireland

TerpeneTech Limited ("TerpeneTech (Ireland))", whose registered office is

108 Q House, Furze Road, Sandyford, Dublin, Ireland, was incorporated on

15 January 2019 and is jointly owned by both Eden Research Plc and TerpeneTech

(UK), the company's associate.

Eden has the right to appoint a director as chairperson who will have a

casting vote, enabling the Group to exercise control over the Board of Directors

in the absence of an equivalent right for TerpeneTech (UK). Eden owns 500

ordinary shares in TerpeneTech (Ireland).

Eden Research Europe Limited, whose registered office is 108 Q House, Furze

Road, Sandyford, Dublin, Ireland, was incorporated on 18 November 2020 and

is wholly owned by both Eden Research plc.

Non-controlling interests

The following table summarises the information relating to the

Group's subsidiary with material non-controlling interest, before

intra-group eliminations:

30 June 30 June 31 Dec

2022 2021 2021

GBP GBP GBP

unaudited unaudited audited

NCI percentage 50% 50% 50%

Non-current assets 99,563 112,835 106,199

Current assets - - -

Non-current liabilities - - -

Current liabilities (18,371) (55,542) (43,962)

Net assets 81,192 61,293 62,237

---------- ---------- ---------

Carrying amount of NCI -

Revenue 25,591 28,551 36,131

Profit/(loss) 18,955 21,915 22,859

OCI - - -

Total comprehensive income 18,955 21,915 22,859

---------- ---------- ---------

Cash flows from operating activities - - -

Cash flows from investment activities - - -

Cash flows from financing activities - - -

Net increase/(decrease) in cash

and cash equivalents - - -

---------- ---------- ---------

Dividends paid to non-controlling

interests - - -

---------- ---------- ---------

12. Property, plant and equipment

Land

and buildings Total

GBP GBP

COST

At 1 January 2021 200,758 200,758

Additions 98,458 98,458

--------------- ---------

At 30 June 2021 299,216 299,216

Additions - owned 2,811 2,811

--------------- ---------

At 31 December 2021 302,027 302,027

Additions 21,790 21,790

--------------- ---------

At 30 June 2022 323,817 323,817

=============== =========

AMORTISATION

At 1 January 2021 12,693 12,693

Charge for the period 27,039 27,039

--------------- ---------

At 30 June 2021 39,732 39,732

Charge for the period 30,017 30,017

--------------- ---------

At 31 December 2021 69,749 69,749

Charge for the period 31,356 31,356

--------------- ---------

At 30 June 2022 101,105 101,105

=============== =========

CARRYING AMOUNT

At 30 June 2022 222,712 222,712

=============== =========

At 31 December 2021 232,278 232,278

=============== =========

At 30 June 2021 259,484 259,484

=============== =========

13. Right of use assets

Land and

buildings Vehicles Total

GBP GBP GBP

COST

At 1 January 2021 417,521 35,865 453,386

Additions - 27,920 27,920

----------- ----------- ---------

At 30 June 2021 417,521 63,785 481,306

Additions 26,256 22,288 48,544

----------- ----------- ---------

At 31 December 2021 443,777 86,073 529,850

Additions - 23,194 23,194

Disposals - (35,865) (35,865)

----------- ----------- ---------

At 30 June 2022 443,777 73,402 517,179

=========== =========== =========

AMORTISATION

At 1 January 2021 36,361 22,415 58,776

Charge for the period 41,752 6,810 48,562

----------- ----------- ---------

At 30 June 2021 78,113 29,225 107,338

Charge for the period 41,752 7,973 49,725

At 31 December 2021 119,865 37,198 157,063

Charge for the period 45,438 11,364 56,802

Eliminated on disposal - (35,865) (35,865)

----------- ----------- ---------

At 30 June 2022 165,303 12,697 178,000

=========== =========== =========

CARRYING AMOUNT

At 30 June 2022 278,474 60,705 339,179

=========== =========== =========

At 31 December 2021 323,912 48,875 372,787

=========== =========== =========

At 30 June 2021 339,408 34,560 373,968

=========== =========== =========

14. Trade and other receivables

30 June 31 December

30 June 2022 2021 2021

GBP GBP GBP

Trade receivables 1,166,042 780,215 693,948

VAT recoverable 231,407 164,026 104,760

Other receivables 66,410 319,259 65,957

Prepayments and accrued

income 100,793 232,398 21,922

1,564,652 1,495,898 886,587

Trade receivables disclosed above are measured at amortised cost.

The Directors consider that the carrying amount of trade and

other receivables approximates their fair value.

15. Share based payments

Long-Term Incentive Plan ("LTIP")

Since September 2017 Eden has operated an option scheme for

executive directors, senior management and certain employees under

an LTIP which allows for certain qualifying grants to be HMRC

approved. Details on options issued in prior periods can be found

in the annual report for the year ended 31 December 2021.

2022 Award

Options

Number of share Weighted average

options exercise price (pence)

30 Jun 30 Jun 30 Jun 30 Jun

2022 2021 2022 2021

Outstanding at 1 January 18,680,0044 5,891,111 7 -

Granted during the period 2,006,939 10,500,000 6 6

Exercised during the period - - - -

Lapsed during the period - (5,891,111) - -

----------- ----------- -------------------- ------

Exercisable at 30 June 20,686,943 10,500,000 7 -

=========== =========== ==================== ======

The following information is relevant in the determination of

the fair value of options granted during the period under the LTIP

Replacement Award.

Grant date 30/06/2022

Number of awards 2,006,939

------------------

Share price GBP0.04 - GBP0.05

------------------

Exercise price GBP0.01 - GBP0.06

------------------

Expected dividend yield -%

------------------

Expected volatility 63%

------------------

Risk free rate 0.95%

------------------

Vesting period One year

------------------

Expected Life (from date of grant) 3 years

------------------

The exercise price of options outstanding at the end of the period

ranged between 1p and 10p (H1 2021: 6p) and their weighted average

contractual life was 2.1 years (H1 2021: 1.5 years).

The share-based payment charge for the period, in respect of options,

was GBP152,135 (H1 2021: GBP544,028), GBP119,083 of which related

to options granted in 2021 and GBP33,052 of which related to options

granted in the period.

Warrants

Number of share Weighted average

options exercise price (pence)

30 Jun 30 Jun 30 Jun 30 Jun

2022 2021 2022 2021

Outstanding at 1 January 2,989,865 2,989,865 19 19

Granted during the period - - - -

Exercised during the period - - - -

Lapsed during the period (400,000) - 25 -

------------ ------------ ---------- -------------

Exercisable at 30 June 2,589,865 2,989,865 15 15

============ ============ ========== =============

The exercise price of warrants outstanding at the end of the period

ranged between 12p and 30p (H1 2021: 12p and 30p) and their weighted

average contractual life was 0.0 years (H1 2021: 1.0 year.) None

of the warrants have vesting conditions.

The share-based payment charge for the period, in respect of warrants,

was GBPnil (H1 2021: GBPnil). The weighted average fair value of

each warrant granted during the period was GBPnil (2020: GBPnil).

Xinova liability

In September 2015, the Company entered into a Collaboration and

Licence agreement with Invention Development Management Company LLC

(part of Intellectual Ventures, now called Xinova LLC). As part of

this agreement, upon successful completion of a number of different

tasks, Xinova became entitled to a payment which is calculated

using a percentage (initially 3.17%, reduced to 1.6% following the

fundraise in March 2020) of the fully diluted equity value, reduced

by cash and cash equivalents, of the Company on the date on which

payment becomes due which is expected to be 30 September 2025. This

has been accounted for as a cash-settled share-based payment under

IFRS 2.

An amount of GBP67,462, being the estimated fair value of the

liability due to Xinova, was recognised during 2016 and included as

a non-current liability. It is not believed that the value of the

services provided by Xinova can be reliably measured, and so this

amount was calculated based on the Company's market capitalisation

at 31 December 2016, adjusted to reflect the percentage of work

completed by Xinova at that date based on a pre-determined schedule

of tasks.

At 31 December 2021, an amount of GBP87,704 (30 June 2021:

GBP125,212) was owed to Xinova and is shown as non-current other

liabilities.

During the period, Eden was informed that Xinova had begun to

wind down its operations.

As a consequence, Eden began communications with an agent acting

on behalf of Xinova to effect the wind down in respect of the

liability owed to Xinova by Eden.

On 22 April 2022, Eden signed a 'full and final' settlement

agreement with Xinova which resulted in Eden paying an amount of

GBP43,855, which represented a c. 50% discount to the liability of

GBP87,740 as at 31 December 2021, in line with the then existing

contract.

16. Segmental Reporting

IFRS 8 requires operating segments to be reported in a manner

consistent with the internal reporting provided to the chief

operating decision-maker. The chief operating decision-maker, who

is responsible for the resource allocati on and assessing

performance of the operating segments has been identified as the

Executive Directors as they are primarily responsible for the

allocation of the resources to segments and the assessment of

performance of the segments.

The Executive Directors monitor and then assess the performance

of segments based on product type and geographical area using a

measure of adjusted EBITDA. This is the result of the segment after

excluding the share-based payment charges, other operating income

and the amortisation of intangibles. These items, together with

interest income and expense are not allocated to a specific

segment.

The segmental information for the six months ended 30 June 2022

is as follows:

Agrochemicals Consumer Animal Total

products health

-------------- ---------- -------- -----------

Revenue GBP GBP GBP GBP

-------------- ---------- -------- -----------

Milestone payments - - - -

-------------- ---------- -------- -----------

R & D charges - 3,232 - 3,232

-------------- ---------- -------- -----------

Royalties - 25,591 - 25,591

-------------- ---------- -------- -----------

Product sales 1,011,213 - - 1,011,213

-------------- ---------- -------- -----------

Total revenue 1,011,213 28,823 - 1,040,036

-------------- ---------- -------- -----------

EBITDA (822,740) 28,823 - (793,917)

-------------- ---------- -------- -----------

Share Based Payments (152,135) - - (152,135)

-------------- ---------- -------- -----------

Adjusted EBITDA (974,875) 28,823 - (946,052)

-------------- ---------- -------- -----------

Amortisation (239,689) (6,636) - (246,325)

-------------- ---------- -------- -----------

Depreciation (88,159) - - (88,159)

-------------- ---------- -------- -----------

Finance costs, foreign exchange

and investment revenues (43,191) - - (43,191)

-------------- ---------- -------- -----------

Income Tax 345,424 - - 345,424

-------------- ---------- -------- -----------

Share of Associate's loss - (9,849) - (9,849)

-------------- ---------- -------- -----------

(Loss)/Profit for the Year (1,000,490) 12,338 - (988,152)

-------------- ---------- -------- -----------

Total Assets 13,931,631 99,563 - 14,038,478

-------------- ---------- -------- -----------

Total assets includes:

-------------- ---------- -------- -----------

Additions to Non-Current

Assets 702,173 - - 702,173

-------------- ---------- -------- -----------

Total Liabilities 1,982,793 18,371 - 2,001,164

-------------- ---------- -------- -----------

The segmental information for the six months ended 30 June 2021

is as follows:

Agrochemicals Consumer Animal Total

products health

-------------- ---------- -------- ------------

Revenue GBP GBP GBP GBP

-------------- ---------- -------- ------------

Milestone payments 95,025 - - 95,025

-------------- ---------- -------- ------------

R & D charges - 3,218 - 3,218

-------------- ---------- -------- ------------

Royalties - 28,551 - 28,551

-------------- ---------- -------- ------------

Product sales 658,500 - - 658,500

-------------- ---------- -------- ------------

Total revenue 753,525 31,769 - 785,294

-------------- ---------- -------- ------------

EBITDA (843,969) 28,551 - (815,418)

-------------- ---------- -------- ------------

Share Based Payments (544,028) - - (544,028)

-------------- ---------- -------- ------------

Adjusted EBITDA (1,387,997) 28,551 - (1,359,446)

-------------- ---------- -------- ------------

Amortisation (309,900) (6,636) - (316,536)

-------------- ---------- -------- ------------

Depreciation (75,601) - - (75,601)

-------------- ---------- -------- ------------

Finance costs, foreign exchange

and investment revenues (73,167) - - (73,167)

-------------- ---------- -------- ------------

Income Tax 261,020 - - 261,020

-------------- ---------- -------- ------------

Share of Associate's loss - (9,199) - (9,199)

-------------- ---------- -------- ------------

(Loss)/Profit for the Year (1,585,645) 12,716 - (1,572,929)

-------------- ---------- -------- ------------

Total Assets 16,017,143 112,835 - 16,129,978

-------------- ---------- -------- ------------

Total assets includes:

-------------- ---------- -------- ------------

Additions to Non-Current

Assets 1,028,734 - - 1,028,734

-------------- ---------- -------- ------------

Total Liabilities 2,303,598 51,542 - 2,355,140

-------------- ---------- -------- ------------

The segmental information for the year ended 31 December 2021 is

as follows:

Agrochemicals Consumer Animal Total

products health

-------------- ---------- -------- ------------

Revenue GBP GBP GBP GBP

-------------- ---------- -------- ------------

Milestone payments 5,250 - - 5,250

-------------- ---------- -------- ------------

R & D charges - 7,760 - 7,760

-------------- ---------- -------- ------------

Royalties 57,170 36,131 - 93,301

-------------- ---------- -------- ------------

Product sales 1,122,269 - - 1,122,269

-------------- ---------- -------- ------------

Total revenue 1,184,689 43,891 - 1,228,580

-------------- ---------- -------- ------------

Adjusted EBITDA (2,021,602) 43,891 - (1,977,711)

-------------- ---------- -------- ------------

Share Based Payments (640,597) - - (640,597)

-------------- ---------- -------- ------------

EBITDA (2,662,199) 43,891 - (2,618,308)

-------------- ---------- -------- ------------

Amortisation (421,358) (13,272) - (434,630)

-------------- ---------- -------- ------------

Depreciation (155,342) - - (155,342)

-------------- ---------- -------- ------------

Finance costs, foreign exchange

and investment revenues (129,223) - - (129,223)

-------------- ---------- -------- ------------

Impairment of investment - - - -

in associate

-------------- ---------- -------- ------------

Income Tax 618,137 - - 618,137

-------------- ---------- -------- ------------

Share of Associate's loss - (58,177) - (58,177)

-------------- ---------- -------- ------------

(Loss)/Profit for the Year (2,749,985) (27,558) - (2,777,543)

-------------- ---------- -------- ------------

Total Assets 15,004,888 22,197 - 15,027,085

-------------- ---------- -------- ------------

Total assets includes:

-------------- ---------- -------- ------------

Additions to Non-Current

Assets 1,802,660 - - 1,802,660

-------------- ---------- -------- ------------

Total Liabilities 2,153,649 43,961 - 2,197,610

-------------- ---------- -------- ------------

Geographical Reporting

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

GBP GBP GBP

UK 28,823 31,769 83,891

Europe 1,011,213 753,525 1,144,689

----------- ----------- -------------

1,040,036 785,294 1,228,580

=========== =========== =============

The revenue derived from Milestone Payments relates to

agreements which cover a number of countries both in the EU and the

rest of the world.

All of the non-current assets are in the UK.

Notes to Editors:

Eden Research is the only UK-listed company focused on

biopesticides for sustainable agriculture. It develops and supplies

innovative biopesticide products and natural microencapsulation

technologies to the global crop protection, animal health and

consumer products industries.

Eden's products are formulated with terpene active ingredients,

based on natural plant defence metabolites. To date, they have been

primarily used on high-value fruits and vegetables, improving crop

yields and marketability, with equal or better performance when

compared with conventional pesticides. Eden has two products

currently on the market:

Based on plant-derived active ingredients, Mevalone (R) is a

foliar biofungicide which initially targets a key disease affecting

grapes and other high-value fruit and vegetable crops. It is a

useful tool in crop defence programmes and is aligned with the

requirements of integrated pest management programmes. It is

approved for sale in a number of key countries whilst Eden and its

partners pursue regulatory clearance in new territories thereby

growing Eden's addressable market globally.

Cedroz (TM) is a bio-nematicide that targets free living

nematodes which are parasitic worms that affect a wide range of

high-value fruit and vegetable crops globally. Cedroz is registered

for sale on two continents and Eden's commercial collaborator,

Eastman Chemical, is pursuing registration and commercialisation of

this important new product in numerous countries globally.

Eden's Sustaine (R) encapsulation technology is used to harness

the biocidal efficacy of naturally occurring chemicals produced by

plants (terpenes) and can also be used with both natural and

synthetic compounds to enhance their performance and ease-of-use.

Sustaine microcapsules are naturally-derived, plastic-free,

biodegradable micro-spheres derived from yeast. It is one of the

only viable, proven and immediately registerable solutions to the

microplastics problem in formulations requiring encapsulation.

Eden was admitted to trading on AIM on 11 May 2012 and trades

under the symbol EDEN. It was awarded the London Stock Exchange

Green Economy Mark in January 2021, which recognises London-listed

companies that derive over 50% of their total annual revenue from

products and services that contribute to the global green economy.

Eden derives 100% of its total annual revenues from sustainable

products and services.

For more information about Eden, please visit: www.edenresearch.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LLMFTMTBTBIT

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

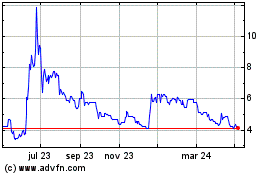

Eden Research (LSE:EDEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

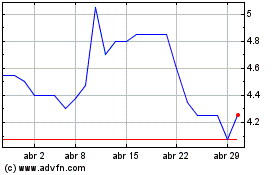

Eden Research (LSE:EDEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024