Edenville Energy PLC Rukwa Operational Update & Corporate Update (7529F)

09 Noviembre 2022 - 1:00AM

UK Regulatory

TIDMEDL

RNS Number : 7529F

Edenville Energy PLC

09 November 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018.

9 November 2022

EDENVILLE ENERGY PLC

("Edenville" or the "Company")

Rukwa Operational Update

And

Corporate Update

Edenville Energy Plc (AIM: EDL) is pleased to provide an update

on operations at its Rukwa Coal Project ("Rukwa") in Tanzania.

Following the recommencement of production at Rukwa, as

announced on 11 October 2022, the Company is pleased to report the

works undertaken to upgrade the wash plant have yielded positive

results, with the wash plant regularly running at the targeted

base-case output of c.100 tonnes per day, which, if sustained and

assuming increases in working time on the ground as referred to

below, achieves the Company's initial target of 4,000 tonnes per

month. However, the period did witness interruptions to production

as components for the excavator, used to extract run of mine

("ROM") coal for delivery to the wash plant, were damaged. These

components have subsequently been replaced and operations are

currently back at the c.100 tonnes per day level of washed coal

output. Management continues to expand the inventory of spare parts

at site to minimise future downtime.

As noted, the performance of the wash plant has been encouraging

and the Company's view remains that a sustained output of 100

tonnes per day, and higher, is achievable. The simplest way for

future increases to be achieved will be to increase daily

production hours from the current eight-hour shifts for five and a

half days per week. The opportunities for longer 12 hour or even

double shifts (16 hour) and seven days per week production are

being examined, including seeking to ensure that on the ground

machinery is capable of meeting the targeted output on an ongoing

basis. In addition, the Company has taken possession of two new

trucks in recent days, which will be used to transport ROM coal

from the coal face site to the wash plant, accelerating the process

and ROM capacity substantially to avoid downtime at the wash

plant.

The quality of ROM coal also has a significant impact on the

output from the wash plant. The specifications of the wash plant,

as a new piece of plant, indicate the output of washed coal should

be approximately 35% of the tonnage inputted. This 35% output is

not achievable by default and is dependent on the quality of coal

inputted and the efficiency of the plant.

To further improve on output to meet and subsequently exceed the

targeted 4,000 tonnes per month yield (assuming no further

interruptions), the Company has engaged the services of Alan

Golding, a competent coal geologist who has many years' experience

in coal mining throughout Africa. Mr Golding has visited the Rukwa

project site and started the process of evaluating the best

location for the next ROM extraction. His efforts have thus far

also uncovered a potentially significant coal seam, previously

unrecognised, which if proven could enable the production of

additional coal for several years to augment or replace current

production if the quality of coal is higher.

If this materialises it has the potential to improve the quality

of the ROM coal and the efficiency of the wash plant over time.

Further work is still required to assess the extent, attractiveness

and viability of this coal seam, however initial reports appear

encouraging.

Demand for Rukwa coal remains strong and all of the washed coal

production from 7 October 2022 to 7 November 2022, being 1,480

tonnes, was sold at prices ranging from US$40 to US$45 per tonne,

with coal fines of 200 tonnes selling at up to US$20 per tonne.

With our current stock pile of fines in excess of 60,000 tonnes the

Company is pleased to have now identified potential customers for

fines and will now look to monetise over time both ongoing

production of fines and the stockpile.

The Company has identified a new long-term customer who is

willing to enter into a contract with the Company for a minimum of

3,000 tonnes per month of washed coal at a price in excess of US$50

per tonne, subject to the Company establishing a stable production

level. Accordingly, the Company expects to increase cashflows as it

reaches higher levels of sustained output. Whilst the rainy season

in Tanzania is expected to have an impact on production capacity,

the Company is taking steps to minimise the disruption by

establishing ROM stockpiles over the next two months, which can be

used if and when necessary. Moreover, the Company is now better

positioned to withstand the impact compared to previous years

following investment in infrastructure and equipment.

Arrangement with contract miner

The Company has been advised that due to the need to undertake a

tender process for the engagement of a local contract mine

operator, the Company has temporarily suspended the previously

announced arrangement with the local operator, as announced on 16

August 2022. This will now enable the Company to receive all of the

proceeds of coal sales, until such time as a tendering process has

been concluded in the coming weeks. The Company has ensured there

is sufficient operational expertise at site during this period.

Update on Dispute with Upendo Group Ltd

In addition, Edenville is advised that the courts in Tanzania

will address in the next few weeks the Company's claim for the

reversal of the transfer of Upendo Group Ltd.'s 10% economic

interest in the local joint venture, which holds the licences

governing the Rukwa project, to a 10% direct holding on the

principal production licence. A further update will be provided in

due course.

For further information please contact:

Edenville Energy Plc Via IFC Advisory

Nick Von Schirnding - Chairman

Noel Lyons - CEO

Strand Hanson Limited +44 (0) 20 7409 3494

(Financial and Nominated Adviser)

James Harris

Rory Murphy

Tavira Securities Limited +44 (0) 20 7100 5100

(Broker)

Oliver Stansfield

Jonathan Evans

IFC Advisory Limited +44 (0) 20 3934 6630

(Financial PR and IR)

Tim Metcalfe

Florence Chandler

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFFFFLLELTIIF

(END) Dow Jones Newswires

November 09, 2022 02:00 ET (07:00 GMT)

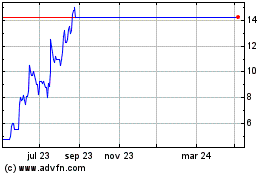

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024