TIDMENQ

RNS Number : 5244U

EnQuest PLC

02 August 2022

EnQuest PLC, 02 August 2022

Operations update

Strong production and cash generation, supporting

deleveraging

EnQuest Chief Executive, Amjad Bseisu, said :

"We have made a good start to the year, delivering production of

49,726 Boepd and generating $332 million in free cash flows ($474

million pre-hedging) that have enabled us to significantly reduce

net debt to c.$880 million at the end of June, resulting in a net

debt to EBITDA ratio of around 1.0x, and representing a significant

step towards our 0.5x target.

" Performance has been strong at Kraken and in Malaysia, where

we have seen the positive impact of our well workover programme.

Our drilling and workover programmes are underway at both Magnus

and PM8/Seligi to deliver production in the second half, offset by

our maintenance shutdowns at Magnus and Kraken.

"We remain on track to deliver our operational targets and, in

the prevailing price environment, are focused on driving an

accelerated debt reduction programme.

"EnQuest has a long track record of investment in the North Sea.

We remain focused on continuing to improve performance and extend

the lives of assets within our portfolio, delivering value to all

of our stakeholders as we increase production, reduce emissions and

support energy security."

Operating performance

-- Average net Group production in the six months to end June

2022 was 49,726 Boepd, an 8% increase over the same period last

year, driven by strong production efficiency across the portfolio;

full year guidance remains unchanged

-- Kraken delivered average gross production of 27,698 Boepd,

above the top end of full year guidance of 22,000 to 26,000 Boepd;

planned shutdown on track for the third quarter

-- Infill drilling campaigns have commenced at Magnus and

PM8/Seligi

-- Well work campaigns at Magnus and PM8/Seligi are progressing

well, with two wells returned to service and three well workovers

completed, respectively

-- Excellent progress in reducing absolute Scope 1 and 2

emissions, with CO2 equivalent emissions reduced by 16.8% from the

2020 baseline; since 2018, UK Scope 1 and 2 emissions have reduced

by 42.6%

Liquidity and net debt

-- Net debt of c.$880 million at 30 June 2022 is down c.$342

million, inclusive of c.$10 million of foreign exchange movement,

from 31 December 2021, driven by strong free cash flow

generation

-- At the end of June, $115 million remained outstanding on the

Group's senior secured debt facility ('RBL') following accelerated

repayments totalling $300 million in the six months to end June

2022

-- EnQuest's net debt to EBITDA ratio as at 30 June 2022 is

around 1.0x, down from 1.6x at the end of 2021.

-- EnQuest has executed $14.4 million (1.7%) of buy backs of the

2023 7% high yield bonds

-- For the period July to December 2022, the Group has hedged

c.3.4 MMbbls of oil with an average floor price of c.$60/bbl and an

average ceiling price of $79/bbl. For 2023, the Group has hedged a

total of approximately c.3.5 MMbbls with an average floor price of

c.$57/bbl and an average ceiling price of c.$77/bbl

Guidance unchanged

-- 2022 net production guidance of between 44,000 and 51,000

Boepd

-- Kraken gross production still expected to be between 22,000

Boepd and 26,000 Boepd (15,500 Boepd to 18,500 Boepd net)

-- Operating expenditure is expected to be approximately $430

million

-- Cash capital expenditure is expected to be around $165

million

-- Abandonment expense is expected to total approximately $75

million

Board change

-- As previously announced, on 24 March 2022 Jonathan Swinney

notified the Board of his intention to step down from the Board as

Chief Financial Officer ('CFO') and Executive Director. Following a

successful period of transition, Jonathan will step down from the

Board on 15 August 2022 and Salman Malik will join the Board as CFO

on the same day.

Production details

Average daily production For the For the

on a net working period to period to

interest basis 30 June 2022 30 June 2021

-------------------------- -------------- --------------

(Boepd) (Boepd)

UK Upstream

- Magnus 12,754 13,847

- Kraken 19,527 23,690

- Golden Eagle(1) 7,060 -

- Other Upstream

(2) 4,081 3,504

-------------- --------------

UK Upstream 43,422 41,041

UK Decommissioning -

(3) 337 337

-------------- --------------

Total UK 43,422 41,378

Total Malaysia 6,304 4,809

-------------- --------------

Total EnQuest 49,726 46,187

-------------- --------------

(1) Golden Eagle completion date was 22 October 2021

(2) Other Upstream: Scolty/Crathes, Greater Kittiwake Area and

Alba

(3) UK Decommissioning: the Dons

Magnus

Average production for the first six months of 2022 was 12,754

Boepd, impacted by a pump and well integrity failure in June . T he

2022 well work campaign is underway, with the North West Magnus

well expected online in the coming weeks. The long-term plan to

enhance production and mitigate risk of future well failures is

progressing, with two wells successfully returned to service in the

first half of 2022 and with further well work planned in the second

half of the year .

Preparations are underway for the three week shutdown planned in

the third quarter, with the key workscope being a compressor

overhaul.

Kraken

During the first half of 2022, average gross production was

27,698 Boepd, which is above the top end of full year guidance of

22,000 to 26,000 Boepd. The floating, production, storage and

offloading vessel continues to deliver top quartile performance,

with production efficiency of 92% and water injection efficiency of

95%.

The Group continues to assess optimisation opportunities for the

planned shutdown scheduled in the third quarter of 2022.

Golden Eagle

Year to date June production was 7,060 Boepd. Production

efficiency remains strong at 95%, partially offset by gas lift

maintenance and natural decline. The joint venture has approved a

two infill well drilling campaign to commence in the fourth quarter

of 2022, with first oil expected in the first quarter of 2023.

Other upstream assets

Production for the first six months of 2022 averaged 4,081

Boepd. This was driven by uptime of 92% at the Greater Kittiwake

Area, and the continued positive impact of work completed in the

first quarter to optimise gas lift delivery pressure.

Alba continues to perform in line with Group expectations.

EnQuest is working with its partners to progress field

development studies for Bressay and the Bentley team is focused on

re-evaluation of the existing subsurface data.

UK Decommissioning

Heather and Thistle plug and abandonment ('P&A') campaigns

are progressing well with six wells completed at Heather and nine

wells completed at Thistle. The Group remains on track to complete

the P&A of 16 wells at each installation in 2022.

The tender processes for heavy lift vessels for Heather and

Thistle topsides and jacket removals has concluded. Contracts to

complete those scopes, which are scheduled for 2024 and 2025

respectively, are expected to be awarded in the second half of

2022.

At the Dons, subsea infrastructure removal within the 500-metre

zone is progressing as expected, with two phases completed during

the first half of the year, and the final phase scheduled for

completion in August.

Infrastructure and New Energy

The Sullom Voe Terminal and its related infrastructure continues

to maintain safe and reliable performance, with 100% export service

availability during the first half of 2022. In June, the terminal

also reached the milestone of 12 months without any recordable HSE

incidents.

EnQuest continues to develop cost-effective and efficient plans

to transform the terminal and prepare and repurpose the site to

progress global scale decarbonisation opportunities, including

carbon capture and storage, electrification and green hydrogen.

EnQuest continues to work collaboratively with potential partners

and key stakeholders to progress these opportunities.

Furthermore, EnQuest has conducted initial phases of feasibility

and economic screening work in respect of a carbon storage concept.

The Group expects to make an application in respect of carbon

capture and storage ('CCS') licence areas accessible from EnQuest's

existing infrastructure in the forthcoming North Sea Transition

Authority ('NSTA') UK offshore CCS licensing round.

The Group has continued to make excellent progress in reducing

its absolute Scope 1 and 2 emissions during the first half of 2022,

with CO2 equivalent emissions reduced by 16.8% from the 2020

baseline, reflecting operational improvements and increased

workforce awareness driving lower flaring, fuel gas and diesel

usage. Since 2018, UK Scope 1 and 2 emissions have reduced by

42.6%, which is significantly ahead of the UK Government's North

Sea Transition Deal target of achieving a 10% reduction in Scope 1

and 2 CO2 equivalent emissions by 2025 and is close to the 50%

reduction targeted by 2030.

Malaysian operations

For the first six months of 2022, average production in Malaysia

was 6,304 Boepd, representing a 31% increase over the same period

last year, following reinstatement of the riser pipeline during the

first quarter of 2022 and three workovers, on budget and ahead of

schedule. The fourth well workover is in progress with completion

anticipated in July.

Following the mobilisation and installation of the drilling rig

at the Seligi-C satellite platform, and the drilling of a pilot

hole during June, the infill drilling campaign has commenced with

the first horizontal well due onstream imminently.

Develeraging

The Group generated strong free cash flows during the first half

of 2022, resulting in net debt of c.$880 million at 30 June 2022,

down c.$342 million since the end of 2021. This reduction was

driven by accelerated repayments totalling $300 million on the

Group's RBL facility, with drawings at $115 million at 30 June

2022, significantly ahead of the required amortisation schedule.

EnQuest's net debt to EBITDA ratio at 30 June 2022 was c.1.0x.

In line with EnQuest's continued focus on deleveraging, during

July, the Group has bought back and cancelled $14.4 million of its

2023 7% high yield bonds, leaving $813 million outstanding. The

Group may, from time to time, purchase its outstanding notes in

open-market purchases and/or privately negotiated transactions and

upon such terms and at such prices as it may determine. The Group

will evaluate any such transactions in light of then-existing

market conditions, taking into account the Group's current

liquidity and prospects for future access to capital. The amounts

involved in any such transactions, individually or in the

aggregate, may be material.

2022 outlook

The Group remains on track to achieve net production between

44,000 and 51,000 Boepd, with a significant well work and drilling

campaign underway across the portfolio, partially offset by natural

declines and planned maintenance shutdowns at Magnus and Kraken in

the third quarter.

Full year expectations for operating, cash capital and

abandonment expenditures remain unchanged from the Group's original

guidance at approximately $430 million, $165 million and $75

million, respectively. EnQuest remains focused on cost discipline

and has been proactive in engagement with its global supply chain

to mitigate the impacts of cost inflation within the current

year.

Following the enactment of the Energy Profits Levy, EnQuest

remains committed to investment in the North Sea and is reviewing

future capital expenditure programmes in light of the additional

investment allowances available under the levy.

EnQuest hedged a total of c.8.7 MMbbls for 2022 predominantly

using costless collars, with an average floor price of c.$63/bbl

and an average ceiling price of c.$77/bbl. For the period July to

December 2022, c.3.4 MMbbls of production remains hedged with an

average floor price of c.$60/bbl and an average ceiling price of

c.$79/bbl.

Cash flows in the second half of the year will be affected by

planned maintenance shutdowns, phasing of work programmes and the

impact of the Energy Profits Levy.

The Group continues to explore options to refinance its high

yield bond ahead of maturity in October 2023.

EnQuest expects to announce its 2022 half year results in

September 2022.

Ends

For further information please contact:

EnQuest PLC Tel: +44 (0)20 7925

4900

Amjad Bseisu (Chief Executive)

Jonathan Swinney (Chief Financial Officer)

Ian Wood (Head of Communications & Investor

Relations)

Craig Baxter (Senior Investor Relations &

Communications Manager)

Tulchan Communications Tel: +44 (0)20 7353

4200

Martin Robinson

Martin Pengelley

Harry Cameron

Notes to editors

ENQUEST

EnQuest is providing creative solutions through the energy

transition. As an independent production and development company

with operations in the UK North Sea and Malaysia, the Group's

strategic vision is to be the operator of choice for maturing and

underdeveloped hydrocarbon assets by focusing on operational

excellence, differential capability, value enhancement and

financial discipline.

EnQuest PLC trades on both the London Stock Exchange and the

NASDAQ OMX Stockholm.

Please visit our website www.enquest.com for more information on

our global operations.

Forward-looking statements: This announcement may contain

certain forward-looking statements with respect to EnQuest's

expectations and plans, strategy, management's objectives, future

performance, production, reserves, costs, revenues and other trend

information. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon

circumstances that may occur in the future. There are a number of

factors which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. The statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Nothing in this announcement should

be construed as a profit forecast. Past share performance cannot be

relied upon as a guide to future performance.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUPUMURUPPGMG

(END) Dow Jones Newswires

August 02, 2022 02:00 ET (06:00 GMT)

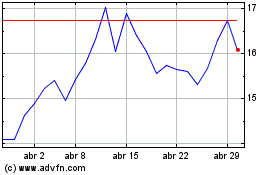

Enquest (LSE:ENQ)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Enquest (LSE:ENQ)

Gráfica de Acción Histórica

De May 2023 a May 2024