TIDMEQT

RNS Number : 9153N

EQTEC PLC

28 September 2023

28 September 2023

EQTEC plc

("EQTEC", the "Company" or the "Group")

Interim results for the six months ended 30 June 2023

EQTEC plc (AIM: EQT), a global technology innovator powering

distributed, decarbonised, new energy infrastructure through its

waste-to-value solutions for hydrogen, biofuels and energy

generation announces its unaudited, interim results for the six

months ended 30 June 2023 ("H1 2023"), with post-period

progress.

Financial highlights

-- Revenue and other operating income: EUR0.145 million (H1 2022: EUR2.98 million)

-- Gross profit EUR0.036 million (H1 2022: EUR0.24 million)

-- EBITDA loss before significant and non-recurring items:

EUR1.92 million (H1 2022: EUR1.97 million)

-- Capital raise of GBP3.5 million (EUR4.05 million) through the placing of new shares

-- Reprofiling of existing loan facilities including the

conversion of existing debt into equity and settlement of strategic

supplier fees in new Ordinary Shares

Financial performance over the first half of 2023 declined

relative to previous periods as the Company makes a strategic shift

away from development of high-risk, legacy projects, toward focus

as a pure-play technology provider on pre-funded, risk-mitigated

projects owned and driven by credible infrastructure owners and

investors.

The Company views its H1 2023 financial underperformance as a

consequence of this transition, whilst it refocuses a majority of

its business development and engineering efforts on steady,

reliable revenues from higher-probability client projects.

As engineering work now underway across a number of client

projects completes in 2023 and early 2024, the Company anticipates

further, greater revenues from equipment sales, other engineering

services and licensing & maintenance support services, as well

as additional revenue from front-end engineering on new client

projects.

Business strategy and strategic investment

The Company announced its business strategy of moving out of

project development and into pure-play technology licensing and

innovation with its 2021 interim results and reaffirmed this

strategy in its 2021 and 2022 annual reports, at successive, annual

general meetings (the "AGMs") and in other public communications.

The Company's strategy emphasises: (1) continuously developing and

leveraging its IP-rich engineering and innovation capabilities; (2)

de-risking its portfolio by occupying a narrow segment of the value

chain, collaborating with the world's best value chain partners;

and (3) driving higher margins through licensing its IP for use by

owner-operators, deploying its engineering and design capabilities

to get its IP deployed into more places, for the best-suited

business models.

Despite the Company's well-publicised strategic focus, over the

past six months and particularly over the past week, the Company's

market valuation has declined dramatically. The Board regularly

reviews the apparent disconnect between the market's valuation of

the Company and the intrinsic value of its patented and proprietary

technology, its pipeline, its partners and its prospects for

integrating its technology into the right projects, as its business

strategy gains traction.

In response, the Board is conducting a review of available

options for required investment, with a particular focus on

long-term, strategic investors of sufficient scale and resources to

support the Company's growth and execution of its strategic vision.

To facilitate engagement with prospective investors, the Company

has, together with its advisors, including a major investment bank

announced by the Company in February 2023, established a 10-year

business plan built around its declared strategy.

Ian Pearson, Chairman of EQTEC, commented:

"The Board is committed to the Company's business strategy and

its leadership as it negotiates a difficult transition out of

EQTEC's project development past into its future business model as

a leading technology innovation business. To add momentum behind

execution of its strategy, the Company requires the sort of funding

that only one or more strategic investors can bring. It is

imperative that we respond to the AIM market's valuation of the

Company by finding investors of scale that understand and believe

in EQTEC's direction and full potential."

David Palumbo, CEO of EQTEC, commented:

"We remain committed to transitioning EQTEC from a broad-based

project developer, exposed to a wide range of commercial and

delivery risks, into a technology licensor and innovator focused on

what we do best. We forecast that 2023 would be a pivotal year in

that transition, and now we can begin to see its impact: an

increasing number of pre-funded projects held by larger, better

funded clients and co-delivered with a more reliable cadre of

partners. At the same time, and even after avoiding EUR18 million

in costs last year, we are having to make hard choices about making

good on completion of legacy projects or leaving them behind.

Either way, the impact of managing through the legacy work is

painful in financial terms, as our revenue and profit figures

indicate. But it is also temporary. The engineering work we are

undertaking now on the renewed portfolio will gradually convert to

equipment sales and paid fees for engineering, licensing &

maintenance support. As we strictly qualify, select and contract

new work, we expect increasingly smooth revenues across a busy

portfolio of client-led projects. The second half of 2023 is

focused on steady progression of our transition, including further

clean-up of legacy challenges and growing the depth and breadth of

our engagement with leading partners investing and building new

energy infrastructure in Europe and beyond."

Commercial and operational highlights, including post period

-- Italy Market Development Centre ("MDC"): The Group's

reference plant in Tuscany, Italy was commissioned, made

operational and handed over to Italian operating company EQTEC

Italia MDC Srl; the Group also carried out site visits with

prospective customers including large, European owner-operators.

Post period, the Group, which owns c. 20% of the operating company,

announced bank refinance of the plant worth EUR2.9 million, subject

to specified performance improvements due to be made by the end of

2023.

-- Biogaz Gardanne feasibility: The Group was awarded

feasibility work funded by the France government toward a potential

waste-to-renewable natural gas ("RNG") facility at the site of a

former coal-fired power station, with Wood as the prospective

methanation technology partner. Post period, the Company announced

successful completion of steam-oxygen gasification tests at its

R&D facility at the Université de Lorraine in Epinal, France

("UL"), as part of the Gardanne feasibility work. More broadly, the

tests confirmed that similar results to those achieved with EQTEC

steam-oxygen gasification technology at the UL facility can be

directly applied at commercial scale, for production of advanced

biofuels. The Group later announced completion of feasibility work

and progress toward paid engineering work, supported by the French

government and with emerging prospects for private-sector

investment.

-- Limoges project: In partnership with French utility company

Idex, the Group was awarded a project by the Limoges Métropole for

a waste-to-RNG facility; the project is due to order paid

engineering work from EQTEC in late 2023 or early 2024, with Wood

as prospective methanation technology partner.

-- Colibrì projects: The Company announced a collaboration

framework agreement with Poseidon LNG Hub Srl of Italy toward

deployment of EQTEC technology in Italy for clean, waste-to-RNG

plants, starting with a portfolio of four projects in northern

Italy backed by a consortium including Linde plc, Wood, Alfa Laval

AB and Chemprod Srl.

-- France MDC: Post period, the Company announced the sale to

Idex of 95% of the share capital of Grande-Combe SAS, the project

company for the France MDC and the second project for the

partnership; the Group also announced that it and Idex had signed a

contract for front-end engineering design ("FEED") work expected to

start immediately and complete within 2023, with the Group expected

to receive revenues of EUR440,000 for engineering services.

However, subsequent rescheduling of the completion of FEED work to

December 2023 is expected to result in recognition of such revenues

being delayed to early 2024. The Group also confirmed that it

anticipates by early 2025 invoicing the project for a total of

EUR15 million for engineering services, equipment, commissioning

and licensing.

Current trading and outlook

The Company is accelerating its transition toward its target

business model of technology licensor and innovator, by recovering

or releasing legacy projects, qualifying and pursuing new

opportunities in target markets, continuing its programme of

applied research and trials for client projects at the Université

de Lorraine and driving operational and organisational changes to

the Group itself.

The Company's transition efforts in 2023 have focused on four

legacy projects, driving to re-establish value, recover cash or

exit them.

-- At the North Fork project in California, USA, the Company and

its fellow NFCP shareholders, with the support of the project's

bondholder, have replaced the project manager and are in the

process of exiting the lead contractor for the project. The change

follows restructuring of the project achieved through the

pre-packaged Chapter 11 bankruptcy announced by the Company in

October 2022 and a concerted push by shareholders and bondholder

for accelerated completion of construction, toward commissioning

and live operation of the intended 2.0 MWe forestry waste-to-power

and biochar plant. Additionally, NFCP has cancelled its contract

with the prospective operations and maintenance provider,

transitioning North Fork Community Power LLC ("NFCP") from simply a

shareholding entity to a full, operating company. NFCP has

appointed a highly experienced project management and consultancy

company to drive project progress and to support its ramp-up of the

operational capability.

-- At the Deeside project in Flintshire, UK, the Company

announced on 20 September 2023 that it had issued a legal claim

against project development partner Logik Developments Limited

("Logik Developments") and its wholly owned subsidiary Logik WTE

Limited (collectively, "Logik") in connection with payments made by

the Group and due to the Group, and for breach of the share

purchase agreement between Logik Developments and Deeside WTV,

EQTEC's wholly owned project company. The claim outlined a number

of payments due to the Group for reimbursement of loans made by the

Group to Logik, for reimbursement of direct payments made by the

Group on Logik's behalf and for work undertaken by EQTEC on behalf

of Logik, originally in Logik's scope of work. The total amounts

claimed by the Group total c. GBP4 million.

-- EQTEC commenced commissioning work in Larissa, Greece at the

0.5 MWe plant owned and to be operated by Agrigas Energy SA.

However, the Company is owed outstanding fees of EUR400,000 and is

unwilling to progress with completion of commissioning until these

are paid. The Company is actively working with project EPC ewerGy

GmbH to recover fees and proceed with commissioning.

-- The Company announced on 20 September 2023 that it would

cease activity on its Billingham project in Teesside, UK, given the

difficulties and costs past and future with developing the project

through to financial close. Recent withdrawals of private wire

offtaker candidates for the prospective plant, combined with the

decision by the grid connection provider to cancel the project's

grid connection, made it unfeasible for the Company to prioritise

the project against its emerging portfolio of work in France, Italy

and elsewhere.

The Company has sought to limit its priority activities to a

focused set of opportunities and projects as outlined above.

However, it has also kept in touch with emerging opportunities in

its go-to-markets and especially in France, Croatia, Ireland and

USA.

-- In France, the Group has engaged with one of Europe's largest

utility companies for provision of tailored solutions for

industrial clients. The utility is designing, deploying and

operating on-premise solutions for its industrial clients and sees

a range of opportunities for EQTEC's syngas technology as part of

its offering.

-- In Croatia, the Group continues to engage investors interested in funding the Croatia MDC in Belišće, Croatia toward full operation. The Group had intended to see the plant recommissioned by the end of 2023, but the prospective investors requested operational data from Italia MDC over an extended period of stable operations, thus pushing out the original schedule for Croatia MDC. As soon as EQTEC Italia MDC Srl is able to provide sufficient data, the Company anticipates proceeding toward full funding of the Belišće plant.

-- In Ireland, the Company announced on 25 July 2023 a

collaboration framework agreement with Irish development and

project management company Domi Ost Limited, for deployment of

EQTEC solutions into Ireland, especially for RNG, hydrogen or other

advanced applications such as ethanol or methanol. The Company

confirmed that the parties have identified four projects for joint

pursuit, one of which is now under active development.

-- In the USA, the Company is looking beyond California,

carefully qualifying opportunities that it could support with its

limited and Europe-based capability. It is in discussions with two

large owner-operators with interest in decarbonisation and new

energy infrastructure. Additionally, and with a view to longer-term

development of local engineering capability to support the US

market, the Company is in discussions with two top-tier, R1

research universities toward establishment of R&D facilities on

their premises, based on EQTEC technology.

The Group continued its programme of applied research and trials

for client projects with the Energy from Biomass and Wastes team,

part of the Laboratoire d'Etudes et de Recherche sur le Matériau

Bois at UL. In July 2023, the Group announced success with

steam-oxygen gasification trials for advanced applications such as

RNG, hydrogen and other biofuels. In October 2023, the Group will

carry out additional trials in support of at least one client

seeking to convert refused-derived fuel ("RDF") from municipal

solid waste into power or biofuels.

Finally, and in support of redoubling its efforts in an

efficient and effective way toward accelerating its transition out

of legacy work and into target business, the Company is making

targeted operational and organisational changes:

-- The Company and CFO Nauman Babar have come to mutual

agreement for his transition out of the business before the end of

2023. Mr Babar is departing in light of family considerations that

require him to relocate outside the UK. The Board has commenced a

search for Mr Babar's replacement, and he has committed to support

the Company with orderly handover of his responsibilities. Mr.

Babar's replacement will be announced in due course.

-- Executive Directors have proposed, and the Board of Directors

has agreed that, in recognition of 2023 revenue underperformance

and the near-term requirement for cash preservation in the Company,

the short-term incentive bonus programme ("STI") and the long-term

incentive share options programme ("LTIP") for all Executive

Directors shall be suspended until further notice.

-- On 04 April 2023, the Executive Directors agreed that 24% of

their remuneration payable in 2023 could be satisfied, at the

discretion of the Company's remuneration committee, by the issue of

new Ordinary Shares. The Executive Directors have now agreed to

waive completely their entitlement to receive 24% of their

remuneration payable in 2023.

The principal, unaudited, condensed and consolidated financial

statements for the six months ended 30 June 2023 are set out

below:

EQTEC plc and Group

Unaudited, condensed, consolidated statement of profit or

loss

for the six months ended 30 June 2023

Notes 6 months 6 months

ended ended

30 June 2023 30 June 2022

EUR EUR

Revenue 6 145,293 2,981,006

Cost of sales (109,528) (2,742,168)

Gross profit 35,765 238,838

Operating income/(expenses)

Administrative expenses (2,124,280) (2,464,310)

Impairment of project costs - (1,872)

Other income 52,914 -

Other gains 7 182,833 -

Foreign currency (losses)/gains (68,897) 253,214

Operating loss (1,921,665) (1,974,130)

Share of loss from equity accounted

investments (102,996) (7,322)

Gains from sales to equity accounted

investments deferred - (83,504)

Gain/(loss) on revaluation of equity

accounted investment 16,726 (488)

Change in fair value of investments (6,822) (249,120)

Finance income 39,451 233,953

Finance costs (449,300) (199,751)

Loss before taxation 6 (2,424,606) (2,280,362)

Income tax 8 - -

LOSS FOR THE FINANCIAL PERIOD (2,424,606) (2,280,362)

Loss/(Profit) attributable to:

Owners of the company (2,424,594) (2,280,379)

Non-controlling interest (12) 17

(2,424,606) (2,280,362)

6 months 6 months

ended ended

30 June 2023 30 June 2022

EUR per share EUR per share

Basic loss per share:

From continuing operations 9 (0.0002) (0.0003)

From continuing and discontinued

operations 9 (0.0002) (0.0003)

Diluted loss per share:

From continuing operations 9 (0.0002) (0.0003)

From continuing and discontinued

operations 9 (0.0002) (0.0003)

EQTEC plc and Group

Unaudited, condensed, consolidated statement of other

comprehensive income

for the six months ended 30 June 2023

6 months 6 months

ended ended

30 June 2023 30 June 2022

EUR EUR

Loss for the financial period (2,424,606) (2,280,362)

Other comprehensive income/(loss)

Items that may be reclassified subsequently to profit or loss

Exchange differences arising on retranslation

of foreign operations 229,958 (235,360)

229,958 (235,360)

Total comprehensive loss for the

financial period (2,194,648) (2,515,722)

Attributable to:

Owners of the company (2,126,160) (2,574,813)

Non-controlling interests (68,488) 59,091

(2,194,648) (2,515,722)

EQTEC plc and Group

Unaudited, condensed, consolidated statement of financial

position

at 30 June 2023

Notes 30 June 2023 31 December

2022

ASSETS EUR EUR

Non-current assets

Property, plant and equipment 10 537,187 133,053

Intangible assets 11 17,515,929 17,578,231

Investments accounted for using the

equity method 12 7,758,573 7,619,514

Financial assets 3,838,754 3,728,434

Other financial investments 174,866 171,186

Total non-current assets 29,825,309 29,230,418

Current assets

Development costs 13 7,138,705 6,033,543

Loans receivable from project development 13 5,597,403 5,446,087

Trade and other receivables 14 7,083,640 7,221,046

Cash and cash equivalents 1,041,525 1,693,116

Total current assets 20,861,273 20,393,792

Total assets 50,686,582 49,624,210

EQUITY AND LIABILITIES EUR EUR

Equity

Share capital 15 28,906,359 26,799,584

Share premium 89,806,447 87,203,372

Other reserves 2,694,125 2,694,125

Accumulated deficit (79,432,079) (77,305,919)

Equity attributable to the owners

of the company 41,974,852 39,391,162

Non-controlling interests (2,327,011) (2,258,523)

Total equity 39,647,841 37,132,639

Non-current liabilities

Borrowings 2,281,341 1,064,598

Lease liabilities 17 370,163 -

Total non-current liabilities 2,651,504 1,064,598

Current liabilities

Trade and other payables 18 5,711,017 6,264,404

Borrowings 16 2,583,243 5,106,038

Lease liabilities 17 92,977 56,531

Total current liabilities 8,387,237 11,426,973

Total equity and liabilities 50,686,582 49,624,210

EQTEC plc and Group

Unaudited, condensed, consolidated statement of changes in

equity

for the six months ended 30 June 2023 and the six months ended

30 June 2022

Equity

attributable

to owners

Share Share Other Accumulated of the Non-controlling

Capital premium reserves deficit company interests Total

EUR EUR EUR EUR EUR EUR EUR

Balance at 1

January

2022 25,977,130 83,610,562 2,353,868 (66,177,072) 45,764,488 (2,384,189) 43,380,299

Transactions

with

owners - - - - - - -

Loss for the

financial

period - - - (2,280,379) (2,280,379) 17 (2,280,362)

Unrealised

foreign

exchange

gains/(losses) - - - (294,434) (294,434) 59,074 (235,360)

Total

comprehensive

loss for the

financial

period - - - (2,574,813) (2,574,813) 59,091 (2,515,722)

Balance at 30

June

2022 25,977,130 83,610,562 2,353,868 (68,751,885) 43,189,675 (2,325,098) 40,864,577

Balance at 1

January

2023 26,799,584 87,203,372 2,694,125 (77,305,919) 39,391,162 (2,258,523) 37,132,639

Issue of

ordinary

shares 1,596,560 2,399,413 - - 3,995,973 - 3,995,973

Issue of

ordinary

shares in lieu

of

debt 510,215 621,674 - - 1,131,889 - 1,131,889

Share issue

costs - (418,012) - - (418,012) - (418,012)

Transactions

with

owners 2,106,775 2,603,075 - - 4,709,850 - 4,709,850

Loss/(profit)

for

the financial

period - - - (2,424,594) (2,424,594) (12) (2,424,606)

Unrealised

foreign

exchange

losses - - - 298,434 298,434 (68,476) 229,958

Total

comprehensive

loss for the

financial

period - - - (2,126,160) (2,126,160) (68,488) (2,194,648)

Balance at 30

June

2023 28,906,359 89,806,447 2,694,125 (79,432,079) 41,974,852 (2,327,011) 39,647,841

EQTEC plc and Group

Unaudited, condensed, consolidated statement of cash flows

for the six months ended 30 June 2023

Notes 6 months 6 months

ended ended

30 June 30 June

2023 2022

EUR EUR

Cash flows from operating activities

Loss for the financial period (2,424,606) (2,280,362)

Adjustments for:

Depreciation of property, plant

and equipment 92,823 117,055

Amortisation of intangible assets 62,301 62,301

Share of loss from equity accounted

investments 102,996 7,322

Gains from sales to equity accounted

investments deferred - 83,504

(Gain)/loss on revaluation of equity

accounted investment (16,726) 488

Change in fair value of investments 6,822 249,120

(Gain)/(loss) on debt for equity

swap (182,833) -

Unrealised foreign exchange movements 332,389 (468,471)

Operating cash flows before working

capital changes (2,026,834) (2,229,043)

(Increase)/decrease in:

Development costs (1,105,162) (1,444,134)

Trade and other receivables 102,061 (1,296,294)

Decrease in Trade and other payables (652,009) (186,641)

Cash used in operating activities

- continuing operations (3,681,944) (5,156,112)

Income taxes repaid 22,746 -

Finance income (39,451) (233,953)

Finance costs 449,300 199,751

Cash used in operating activities (3,249,349) (5,190,314)

Cash flows from investing activities

Additions to property, plant and

equipment (7,482) (26,465)

Additions to other investments (5,665) -

Deposit paid on land purchase - (593,799)

Investment in related undertakings - (356,279)

Loans advanced to equity accounted

investments (225,250) (2,715,253)

Loans repaid by equity accounted

investments 33,200

Other advances to equity accounted

investments (2,000) -

Loans advanced to project development

undertakings - (781,483)

Cash used in investing activities (207,197) (4,473,279)

Cash flows from financing activities

Proceeds from borrowings and lease

liabilities 906,540 5,981,262

Repayment of borrowings and lease

liabilities (2,006,943) (212,847)

Proceeds from issue of ordinary

shares 4,051,609 -

Share issue costs (247,173) -

Loan issue costs (9,097) (328,769)

Interest paid (2,101) (608)

Net cash generated from financing

activities 2,692,835 5,439,038

Net (decrease)/ increase in cash

and cash equivalents (763,711) (4,224,555)

Cash and cash equivalents at the

beginning of the financial period 1,693,116 6,446,217

Cash and cash equivalents at the

end of the financial period 929,405 2,221,662

EQTEC plc and Group

Notes to the unaudited, condensed, consolidated financial

statements

for the six months ended 30 June 2023

1. GENERAL INFORMATION

The unaudited interim condensed consolidated financial

statements of EQTEC plc ("the Company") and its subsidiaries ("the

Group") for the six months ended 30 June 2023 were authorised for

issue in accordance with a resolution of the directors on 27

September 2023.

EQTEC plc ("the Company") is a company domiciled in Ireland. The

Company's registered office is at Building 1000, City Gate, Mahon,

Cork T12 W7CV, Ireland. The Company's shares are quoted on the AIM

market of the London Stock Exchange plc.

The Group is a waste-to-value group, which uses its proven

proprietary Advanced Gasification Technology to generate safe,

green energy from nearly 60 different kinds of feedstock such as

municipal, agricultural and industrial waste, biomass, and

plastics. The Group collaborates with waste operators, developers,

technologists, EPC contractors and capital providers to build

sustainable waste elimination and green energy infrastructure.

Our income currently comes from the following streams:

gasification technology sales including software, engineering &

design and other related services; maintenance income from

operating plants; and we receive development fees from projects

where we invest development capital. In the future we expect to

receive potential revenue from licensing opportunities and revenue

from live operations where EQTEC has an equity stake in a

plant.

2. BASIS OF PREPERATION

The unaudited interim condensed consolidated financial

statements are for the six months ended 30 June 2023 and are

presented in Euro, which is the functional currency of the parent

company. They have been prepared on a going concern basis in

accordance with International Accounting Standard (IAS) 34 Interim

Financial Reporting.

The annual financial statements of the group are prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the EU. The condensed set of financial statements has

been prepared applying the accounting policies and presentation

that were applied in the preparation of the Company's published

consolidated financial statements for the financial year ended 31

December 2022, except for the adoption of new standards effective

as of 1 January 2023. The Group has not early adopted any other

standard, interpretation or amendment that has been issued but is

not yet effective.

The financial information contained in this interim statement,

which is unaudited, does not constitute statutory accounts as

defined by the Companies Act, 2014. The interim condensed

consolidated financial statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

financial statements for the financial year ended 31 December 2022.

The financial statements of the Group were prepared in accordance

with IFRSs as adopted by the European Union and can be found on the

Group's website at www.eqtec.com .

The financial information for the six months ended 30 June 2023

and the comparative financial information for the six months ended

30 June 2022 have not been audited or reviewed by the Company's

auditors pursuant to guidance issued by the Auditing Practices

Board. The comparative figures for the financial year ended 31

December 2022 are not the Group's statutory accounts for that

financial year. Those accounts have been reported on by the

Company's auditor and will be delivered to the Company's

Registration Office in due course. The audit report on those

statutory accounts was unqualified.

The Group incurred a loss on continuing operations of

EUR2,424,606 (1H 2022: EUR2,280,362) during the six-month period

ended 30 June 2023 and had net current assets of EUR12,474,036 (31

December 2022: EUR8,966,819) and net assets of EUR39,647,841 (31

December 2022: EUR37,132,639) at 30 June 2023.

Going concern and future funding

These unaudited interim condensed consolidated financial

statements have been prepared on a going-concern basis, which

assumes the Company will have sufficient funds available to enable

it to trade for not less than twelve months from the date of

announcing these unaudited interim condensed consolidated financial

statements.

The management team has prepared financial forecasts to estimate

the likely cash requirements of the Company over the next twelve

months from the date of announcing these unaudited interim

condensed consolidated financial statements. These forecasts show

that the Company will require additional external debt or equity

funding going into the second half of 2024 to be able to continue

as a going concern.

The directors have assessed that there is a reasonable prospect

that the funding required for the Company to continue as a going

concern will be secured and therefore have prepared the unaudited

interim condensed consolidated financial statements on a

going-concern basis. In the event that additional funding is not

secured, the Company would not be a going concern and as a

consequence there is a material uncertainty relating to the

Company's ability to continue as a going concern.

The unaudited interim condensed consolidated financial

statements do not include any adjustments that would arise if the

Company were unable to continue as a going concern.

3. BASIS OF CONSOLIDATION

The unaudited interim condensed consolidated financial

statements include the financial statements of the Group and all

subsidiaries. The financial period ends of all entities in the

Group are coterminous.

4. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies used in preparing the

unaudited interim condensed consolidated financial information are

consistent with those disclosed in the Annual Report and Accounts

of EQTEC plc for the financial year ended 31 December 2022, except

for the amendment to the development assets policy and the adoption

of new standards and interpretations and revisions of existing

standards as of 1 January 2023 noted below:

New/revised standards and interpretations adopted in 2023

The following amendments to existing standards and

interpretations were effective in the period to 30 June 2023, but

were either not applicable or did not have any material effect on

the Group:

-- IFRS 17: Insurance Contracts;

-- Amendments to IAS 12: Income Taxes - International Tax Reform - Pillar Two Model Rules;

-- Amendments to IAS 12: Income Taxes - Deferred Taxes related

to Assets and Liabilities arising from a Single Transaction;

-- Amendments to IAS 8: Accounting Polices, Changes in

Accounting Estimates and Errors-Definition of Accounting Estimates;

and

-- Amendments to IAS 1: Presentation of Financial Statements and

IFRS Practice Statement 2 Making Materiality Judgements -

Disclosure of Accounting Policies.

The directors do not expect the adoption of the above amendments

and interpretations to have a material effect on the interim

condensed financial statements in the period of initial

application.

5. ESTIMATES

The preparation of the interim condensed consolidated financial

statements requires management to make judgements, estimates and

assumptions that affect the application of policies and reported

amounts of certain assets, liabilities, revenues and expenses

together with disclosure of contingent assets and liabilities.

Estimates and underlying assumptions are reviewed on an on-going

basis. Revisions of accounting estimates are recognised in the

period in which the estimate is revised.

The judgements, estimations and assumptions applied in the

interim financial statements, including the key sources of

estimation uncertainty, were the same as those applied in the

Group's last annual financial statements for the financial year

ended 31 December 2022.

6. SEGMENT INFORMATION

Information reported to the chief operating decision maker for

the purposes of resource allocation and assessment of segment

performance focuses on the products and services sold to customers.

The Group's reportable segments under IFRS 8 Operating Segments are

as follows:

Technology Sales: Being the sale of Gasification Technology and

associated Engineering and Design Services; and

Power Generation: Being the development and operation of

renewable energy electricity and heat generating plants.

The chief operating decision maker is the Chief Executive

Officer. Information regarding the Group's current reportable

segment is presented below. The following is an analysis of the

Group's revenue and results from continuing operations by

reportable segment:

Segment Revenue Segment Profit/(Loss)

6 months ended 6 months ended

30 June 30 June 30 June 30 June

2023 2022 2023 2022

EUR EUR EUR EUR

Technology Sales 145,293 2,981,006 (781,496) (536,346)

Power Generation - - (99) (63)

Total from continuing

operations 145,293 2,981,006 (781,595) (536,409)

Central administration costs and directors'

salaries (1,306,920) (1,689,063)

Impairment of project costs - (1,872)

Other income 52,914

Other gains and losses 182,833 -

Foreign currency (losses)/gains (68,897) 253,214

Share of loss of equity accounted investments (102,996) (7,322)

Gains from sales to equity accounted

investments deferred - (83,504)

Gain/(loss) on revaluation of equity

accounted investment 16,726 (488)

Change in fair value of investments (6,822) (249,120)

Finance income 39,451 233,953

Finance costs (449,300) (199,751)

Loss before taxation (continuing operations) (2,424,606) (2,280,362)

Revenue reported above represents revenue generated from

associated undertakings and external customers. Inter-segment sales

for the financial period amounted to EURNil (2022: EURNil).

Included in revenues in the Technology Sales Segment are revenues

of EURNil (2022: EUR2,550,000) which arose from sales to associate

undertakings and joint ventures of EQTEC plc.

Segment profit or loss represents the profit or loss earned by

each segment without allocation of central administration costs and

directors' salaries, other operating income, share of losses of

jointly controlled entities, investment revenue and finance costs.

This is the measure reported to the chief operating decision maker

for the purposes of resource allocation and assessment of segment

performance.

Other segment information: Depreciation and Additions to non-current

amortisation assets

6 months ended 6 months ended

30 June 30 June 30 June 30 June

2023 2022 2023 2022

EUR EUR EUR EUR

Technology sales 57,429 61,794 496,612 26,465

Power Generation - - - -

Head Office 97,695 117,563 - -

155,124 179,357 496,612 26,465

The Group operates in four principal geographical areas:

Republic of Ireland (country of domicile), the European Union,

United States and the United Kingdom. The Group's revenue from

continuing operations from external customers and information about

its non-current assets* by geographical location are detailed

below:

Revenue from Associates Non-current assets*

and External Customers

6 months 6 months

ended ended As at As at

30 June 30 June 30 June 31 December

2023 2022 2023 2022

EUR EUR EUR EUR

Republic of Ireland - - - -

European Union 145,293 2,981,006 2,769,657 2,392,776

United States - - - -

United Kingdom - - - 35,049

145,293 2,981,006 2,769,657 2,427,825

*Non-current assets excluding goodwill, financial instruments,

deferred tax and investment in jointly controlled entities and

associates.

The management information provided to the chief operating

decision maker does not include an analysis by reportable segment

of assets and liabilities and accordingly no analysis by reportable

segment of total assets or total liabilities is disclosed.

7. OTHER GAINS AND LOSSES

6 months ended 6 months ended

30 June 2023 30 June 2022

EUR EUR

Gain on debt for equity swap 182,833 -

During the financial period, the Group extinguished some of its

borrowings by issuing equity instruments. In accordance with IFRIC

19 Extinguishing Financial Liabilities with Equity Instruments, the

gain recognised on these transactions was EUR182,833 (H1 2022:

EURNil).

8. INCOME TAX

6 months ended 6 months ended

30 June 2023 30 June 2022

EUR EUR

Income tax expense comprises:

Current tax expense - -

Deferred tax credit - -

Adjustment for prior financial - -

periods

Tax expense - -

An income tax charge does not arise for the six months ended 30

June 2023 or 30 June 2022 as the effective tax rate applicable to

expected total annual earnings is Nil as the Group has sufficient

tax losses coming forward to offset against any taxable profits. A

deferred tax asset as not been recognised for the losses coming

forward.

9. LOSS PER SHARE

6 months ended 6 months ended

30 June 2023 30 June 2022

EUR per share EUR per share

Basic loss per share

From continuing operations (0.0002) (0.0003)

From discontinued operations - -

Total basic loss per share (0.0002) (0.0003)

Diluted loss per share

From continuing operations (0.0002) (0.0003)

From discontinued operations - -

Total diluted loss per share (0.0002) (0.0003)

The loss and weighted average number of ordinary shares used in

the calculation of the basic and diluted loss per share are as

follows:

6 months 6 months

ended ended

30 June 2023 30 June 2022

EUR EUR

Loss for period attributable to

equity holders of the parent (2,424,594) (2,280,379)

Profit for the period from discontinued

operations used in the calculation

of basic earnings per share from

discontinued operations - -

Losses used in the calculation of

basic loss per share from continuing

operations (2,424,594) (2,280,379)

No. No.

Weighted average number of ordinary

shares for

the purposes of basic loss per share 10,474,682,261 8,599,024,945

Weighted average number of ordinary

shares for

the purposes of diluted loss per

share 10,474,682,261 8,599,024,945

Dilutive and anti-dilutive potential ordinary shares

The following potential ordinary shares were excluded in the

diluted earnings per share calculation as they were

anti-dilutive.

30 June 2023 30 June 2022

Share warrants in issue 2,053,846,832 462,472,488

Share options in issue 67,304,542 67,304,542

Convertible loans 276,698,306 93,457,944

LTIP Shares in issue 374,779,879 23,045,003

Total anti-dilutive shares 2,772,629,559 646,279,977

10. PROPERTY, PLANT AND EQUIPMENT

During the six-month period ended 30 June 2023, the Group

acquired property, plant and equipment to the value of EUR489,130

financed by new leases (H1 2022 - EURNil) and EUR7,482 financed by

cash. (H1 2022: EUR26,465).

11. INTANGIBLE ASSETS

Included are the following amounts relating to goodwill in

intangible assets:

Goodwill Patents Total Goodwill Patents Total

30-Jun-23 30-Jun-23 30-Jun-23 31-Dec-22 31-Dec-22 31-Dec-22

Cost EUR EUR EUR EUR EUR EUR

At start and

at end of

the

financial

period 16,710,497 2,492,059 19,202,556 16,710,497 2,492,059 19,202,556

Amortisation and impairment

At start of

the

financial

period 1,427,038 197,287 1,624,325 1,427,038 72,685 1,499,723

Amortisation

for the

period 62,300 62,300 124,602 124,602

Impairment - -

losses

At end of the

financial

period 1,427,038 259,587 1,686,625 1,427,038 197,287 1,624,325

Carrying value

At start and

at end of

the

financial

period 15,283,459 2,232,470 17,515,929 15,283,459 2,294,772 17,578,231

12. INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD

Investments accounted for using the equity method are made up as

follows:

30 June 2023 31 December

2022

EUR EUR

Investment in associate undertakings 4,399,974 4,263,604

Investment in joint ventures 3,358,599 3,355,910

7,758,573 7,619,514

The carrying amount of equity-accounted investments has changed

as follows in the six months to June 2023:

Associate Joint

Undertakings Ventures

6 months 6 months

ended ended

30 June 2023 30 June 2023

EUR EUR

Beginning of the period 4,263,604 3,355,910

Loans advanced in period 218,750 6,500

Loans repaid in period (32,000) (1,200)

Interest accrued on loans in period 31,597 -

Share of loss on equity-accounted

investments in period (99,241) (3,755)

Gain on revaluation of equity accounted 16,726 -

investment

Exchange differences 538 1,144

4,399,974 3,358,599

13. DEVELOPMENT ASSETS

30 June 31 December

2023 2022

EUR EUR

Costs associated with project development

Loan receivable from project development

undertakings 7,138,705 6,033,543

* Convertible loans 2,908,147 2,824,572

* Other loans 2,689,256 2,621,515

5,597,403 5,446,087

The Group uses its expertise in engineering, project management,

permitting, planning and financing to develop waste to value

projects. Once the projects reach a certain level of maturity,

third party investors are allowed invest in the project SPV. The

Group charges a premium to the project SPV for the development

services over and above the costs incurred in developing the

project.

Costs associated with project development, including loans

advanced to project undertakings (together "Total Project Costs")

comprise expenses associated with engineering, project management,

permitting, planning, financing and other services, incurred in

furthering the development of a project towards financial close.

Total Project Costs set out above represent the cost of delivery of

project development services and are transferred to cost of sales

when the project SPV is invoiced by the Group for project

development work.

Included in loans receivable from project development

undertakings is an amount of EUR450,000 which is receivable, along

with accrued interest, 18 months from the date of drawdown.

Interest is charged at 15% per annum. At 30 June 2023, the loan is

valued at EUR605,177 (31 December 2022: EUR597,329).

Included in loans receivable is an amount of GBP2,500,000 (31

December 2022: GBP2,500,000) arising from development service fees

to Shankley Biogas Limited which has been converted into a

convertible loan note secured by a fixed and floating charge on the

assets and business of Shankley Biogas Limited. The loan note,

which is interest-free, is due to be paid to the company following

sale of, or investment into Shankley Biogas Limited by any third

party. At 30 June 2023, the loan is valued at EUR2,908,147 (31

December 2022: EUR2,824,572).

The remaining loans receivables were issued with no interest and

no fixed repayment date.

14. TRADE AND OTHER RECEIVABLES

Included in trade and other receivables is an amount of

EUR884,077 (31 December 2022: EUR858,670) being a deposit towards

the purchase of land on which the proposed up to 25 MWe Billingham

waste gasification and power plant at Haverton Hill, Billingham,

UK, will be constructed.

15. EQUITY

During the 6-month period ended 30 June 2023, 2,106,774,908

shares (6 months ended 30 June 2022: Nil shares) were issued as

follows:

Amounts of shares 6 months 6 months

ended ended

30 June 30 June

2023 2022

Ordinary Shares of EUR0.001 each

issued and fully paid

Beginning of the period 9,421,479,112 8,599,024,945

Issued in lieu of borrowings and 510,214,516 -

settlement of payables

Share issue for cash - public and 1,596,560,373 -

private placement

Total Ordinary shares of EUR0.001

each authorised, issued and fully

paid at the end of the period 11,528,254,001 8,599,024,945

16. BORROWINGS

During the six months ended 30 June 2023, the following occurred

in relation to debt securities:

Altair Facility

On 21 March 2023, it was announced that Altair Group Investments

Limited ("Altair"), the largest shareholder of the Company, has

agreed to subscribe for GBP1.5 million pursuant to the Placing

announced on that date. In addition, the Company has an existing

GBP2 million loan facility with Altair, as announced on 9 December

2022 (the "Altair Facility"). The Company and Altair entered into

an agreement through which Altair's participation in the Placing

will be applied towards reducing the outstanding amount of GBP1.8

million under the Altair Facility and to increase the maximum

amount of such facility to GBP3.5 million, with GBP1.7 million

remaining available for drawdown following the Altair Placing and

intended repayment (the "Facility Extension"). All other terms of

the Altair Facility remain unchanged.

Lenders' Facility

On 21 March 2023, the Company announced that the Company had an

existing GBP10 million loan facility with Riverfort Global

Opportunities PCC Limited and YA II PN Limited (the "Lenders" and

the "Lenders Facility"). As at 21 March 2023, the outstanding

balance of the Lenders Facility is GBP5,137,500. The Lenders

agreed, conditional upon admission of the placing shares pursuant

to the GBP3.5 million placing as announced on 21 March 2023, to

convert GBP887,500 of the current outstanding loan balance into

403,409,091 units at the placing price comprising 403,409,091 new

Ordinary Shares ("Lender Shares") and 201,704,540 share purchase

warrants on the same terms as the Warrants.

The Lenders have also agreed to reprofile the monthly repayment

schedule of the Lenders' Facility for the period until 31 December

2024, with repayments starting on 30 June 2023. A one-off reprofile

fee of 3% of the Lenders' Facility will be added to the outstanding

balance. Following the reprofile, the outstanding balance of the

Lenders' Facility will be GBP4.25 million and a fixed-interest

monthly coupon of GBP31,875 will be payable when repayments

commence.

The Lenders will also receive warrants over 965,909,091 Ordinary

Shares as part of the debt reprofile, exercisable for a period of

two years from the date of grant at a 100 percent premium over the

Placing Price ("Lender Warrants"). However, the Lender Warrants

will be exercisable only once the mid-market closing price of the

Ordinary Shares is equal to or exceeds 0.55 pence at the time of

exercise.

17. LEASES

Lease liabilities are presented in the statement of financial

position as follows:

30 June 31 December

2023 2022

EUR EUR

Current 92,977 56,531

Non-current 370,163 -

463,140 56,531

The Group has a lease for its offices in Iberia, Spain and

London, United Kingdom. The lease liabilities are secured by the

related underlying asset. Further minimum lease payments at 30 June

2023 were as follows:

Minimum lease payments due

Within 1-2 2-3 3-4 4-5 After Total

1 year years years years years 5 years

EUR EUR EUR EUR EUR EUR EUR

30 June 2023

Lease payments 105,600 105,600 105,600 105,600 74,800 - 497,200

Finance charges (12,623) (9,795) (6,881) (3,878) (883) - (34,060)

Net Present

Values 92,977 95,805 98,719 102,722 73,917 - 463,140

31 December

2022

Lease payments 56,849 - - - - - 56,849

Finance charges (318) - - - - - (318)

Net Present

Values 56,531 - - - - - 56,531

18. TRADE AND OTHER PAYABLES

Included in trade and other payables at 30 June 2023 is an

amount of EUR2,559,169 (GBP2,200,000) (31 December 2022:

EUR2,485,623 (GBP2,200,000)) relating to consideration payable

under the share purchase contract to acquire Logik WTE Limited.

19. RELATED PARTY TRANSACTIONS

The Group's related parties include Altair Group Investment

Limited ("Altair"), who at 30 June 2023 held 15.91% of the shares

in the Company, the associate and joint venture companies and key

management.

Transactions with Altair

During the six-month period ended 30 June 2023, Altair advanced

EUR906,540 (H1 2022: EURNil) by way of borrowings and was repaid

EUR1,707,919 (H1 2022: EURNil) with respect to these loans.

Interest payable to Altair for the six-month period ended 30 June

2023 amounted to EUR42,295 (H1 2022: EURNil). Included in

borrowings, net of amortisation costs, at 31 December 2022 is an

amount of EUR372,130 (31 December 2022: EUR1,064,598) due to Altair

from the Group

Transactions with associate undertakings and joint ventures

The following aggregated transactions were made with associate

undertakings and joint ventures in the six months ended 30 June

2023:

6 months 6 months ended

ended 30 June 2022

30 June 2023

Loans to associated undertakings EUR EUR

and joint ventures

Beginning of the financial period 5,174,551 3,621,307

Loans advanced in period 225,250 2,715,253

Loans repaid in period (33,200) -

Reclassified as equity (254,470) -

Interest accrued on loans in period 31,597 186,251

Exchange differences 2,450 203,103

At end of the financial period 5,146,178 6,725,914

6 months 6 months ended

ended 30 June 2022

30 June 2023

Sales of goods and services EUR EUR

Technology sales - 2,550,000

Other income 52,913 -

30 June 2023 31 December

2022

Period-end balances EUR EUR

Included in trade receivables 5,113,553 4,243,628

Re-charge of costs 31,482 27,508

Transactions with key management

Key management of the Group are the members of EQTEC plc's board

of directors. There have been no non-remuneration transactions with

key management in the six months ended 30 June 2023.

20. EVENTS AFTER THE BALANCE SHEET DATE

Sale of subsidiary

On 12 July 2023, the Company announced that it had agreed with

French infrastructure owner and utility company Idex to the sale of

95% of the share capital of its 100% subsidiary, Grande-Combe SAS

("Grande-Combe"), the project company for the Company's France

Market Development Centre ("MDC") and the project to construct and

commission it ("France MDC"). Idex's acquisition of Grande-Combe

from the Company has been formalised through execution of a

share-purchase agreement (the "SPA") and a shareholders' agreement

(together with the SPA, the "Agreement"). Under the terms of the

Agreement, Idex acquires the project for construction and

commissioning of France MDC and EQTEC remains the integrator and

licensor of core technology, also retaining the right to utilise

France MDC as an MDC.

The main elements of the Agreement are as follows:

-- Under the SPA, Idex acquires 95% of the share capital in

Grande-Combe, with the Company retaining a 5% carried interest;

EQTEC's carried interest requires no financial investment by

EQTEC;

-- In respect of the acquired share capital, the Company

receives a fixed consideration of EUR750,000, payable at completion

of the transaction (the "Fixed Consideration");

-- In addition to the Fixed Consideration, the Company is

eligible to receive additional payments up to full commissioning of

the France MDC, subject to achieving performance milestones and for

a combined total of up to EUR750,000;

-- In addition, under the Agreement, EQTEC will receive fees for

engineering services, equipment, commissioning and licensing over

the period Q4 2023 - Q1 2025, estimated to amount in total c. EUR15

million; and

-- Under the Agreement, the Company is entitled to utilise

France MDC for one prospective client visit per month, with more

visits possible under specific terms.

Discontinuation of Billingham Project

On 20 September 2023, the Company announced its intention to

cease activity on its Billingham project at Haverton Hill,

Teesside, UK (the "Project"). The Company's decision comes amidst

challenging market conditions in the UK and following recent

setbacks with the project that make it increasingly inappropriate

for the Company to prioritise the Project against opportunities

elsewhere. Given its investments into development of the Project in

recent years and the likelihood the Company will be unable to

recover all of them, the Company anticipates writing some of them

off. At 30 June 2023, the total costs capitalised in the Project

amounted to EUR4,721,316.

Legal claim against Logik Developments Limited and Logik WTE

Limited re: Deeside

On 20 September 2023, the Company initiated legal proceedings in

the London Circuit Commercial Court of the Business and Property

Courts of England and Wales by submitting a Particulars of Claim

against Logik Developments Limited and Logik WTE Limited. The Claim

outlines the case against Logik for failure to pay for the services

rendered, costs incurred and loans made by EQTEC plc and its

subsidiaries to Logik and for breach of the share purchase

agreement between the two parties originally executed on 07

December 2020 and amended several times since that date (the

"SPA"). The amounts claimed by the Group total c. GBP4 million.

In relation to the Deeside project, as at 30 June 2023 the full

consideration of EUR3,838,754 (or GBP3,454,878) (31 December 2022:

EUR3,728,434 (or GBP3,300,000)) has been recognised as an

Investment in Related Undertakings and the balance of consideration

payable of EUR2,559,169 (GBP2,303,252) (31 December 2022:

EUR2,485,623 (GBP2,200,000)) has been recognised as a liability in

Other Payables. In addition, the total costs capitalised in

relation to the Project amounted to EUR3,548,873 of which

EUR1,464,794 was classified as Development Costs and EUR2,084,079

as Loans Receivable from Project Development Undertakings.

21. APPROVAL OF FINANCIAL STATEMENTS

The condensed consolidated financial statements for the six

months ended 30 June 2023, which comply with IAS 34, were approved

by the Board of Directors on 27 September 2023.

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014, as it

forms part of United Kingdom domestic law by virtue of the European

Union (Withdrawal) Act 2018, as amended, and has been announced in

accordance with the Company's obligations under Article 17 of that

Regulation.

ENQUIRIES

EQTEC plc

David Palumbo / Nauman Babar +44 20 3883 7009

Strand Hanson - Nomad & Financial

Adviser

James Harris / Richard Johnson +44 20 7409 3494

Panmure Gordon - Broker

John Prior / Hugh Rich +44 20 7886 2500

Instinctif - Media & investor relations EQTEC@instinctif.com

enquiries +44 791 717 8920 / +44 788

Guy Scarborough / Tim Field 788 4794

About EQTEC plc

As one of the world's most experienced gasification technology

and engineering companies, with a growing track record of

delivering operational and commercial success for transforming

waste-to-energy through best-in-class technology innovation,

engineering and project development, EQTEC brings together design

innovation, project delivery discipline and solid commercial

experience to add momentum to the global energy transition. EQTEC's

proven, proprietary and patented technology is at the centre of

clean energy projects, sourcing local waste, championing local

businesses, creating local jobs and supporting the transition to

localised, decentralised and resilient energy systems.

EQTEC designs, supplies and builds advanced gasification

facilities in the UK, EU and US, with highly efficient equipment

that is modular and scalable from 1MW to 30MW. EQTEC's versatile

solutions process over 50 varieties of feedstock, including

forestry wood waste, vegetation and other agricultural waste from

farmers, industrial waste and sludge from factories and municipal

waste, all with no hazardous or toxic emissions. EQTEC's solutions

produce a pure, high-quality synthesis gas ("syngas") that can be

used for the widest range of applications, including the generation

of electricity and heat, production of synthetic natural gas

(through methanation) or biofuels (through Fischer-Tropsch,

gas-to-liquid processing) and reforming of hydrogen.

EQTEC's technology integration capabilities enable the Group to

lead collaborative ecosystems of qualified partners and to build

sustainable waste reduction and green energy infrastructure around

the world.

The Company is quoted on AIM (ticker: EQT) and the London Stock

Exchange has awarded EQTEC the Green Economy Mark, which recognises

listed companies with 50% or more of revenues from

environmental/green solutions.

Further information on the Company can be found at www.eqtec.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFVLARIDFIV

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

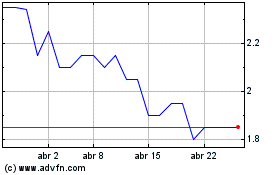

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De May 2023 a May 2024