TIDMEQT

RNS Number : 5246U

EQTEC PLC

24 November 2023

24 November 2023

EQTEC plc

("EQTEC", the "Company" or the "Group")

Notice of Extraordinary General Meeting (the "EGM")

Proposed Capital Reorganisation and Share Consolidation

EQTEC plc (AIM: EQT), a global technology innovator powering

distributed, decarbonised, new energy infrastructure through its

waste-to-value solutions for hydrogen, biofuels, and energy

generation, announces that, further to its announcement on 20

November 2023 (the "Announcement"), a circular (the "Circular") is

being sent to shareholders today.

The Circular contains a notice of EGM to approve the capital

reorganisation proposed by the Company in the Announcement (the

"Capital Reorganisation"). The EGM will be held at the offices of

Philip Lee LLP, Connaught House, One Burlington Road, Dublin 4, D04

C5Y6, Ireland at 12.00 noon on Monday, 18 December 2023.

A copy of the Circular and a notice of the EGM (the "Notice")

will be available on the Company's website: www.eqtec.com later

today.

Extracts from the Circular and defined terms are set out

below.

ENQUIRIES

EQTEC plc

David Palumbo / Jeffrey Vander Linden +44 20 3883 7009

Strand Hanson - Nomad & Financial Adviser

James Harris / Richard Johnson +44 20 7409 3494

-----------------

Global Investment Strategy UK Ltd - Broker

Samantha Esqulant +44 20 7048 9045

-----------------

Fortified Securities - Broker

Guy Wheatley +44 20 3411 7773

-----------------

Panmure Gordon - Broker

John Prior / Hugh Rich +44 20 7886 2500

-----------------

Introduction

The purpose of this document is to provide details regarding the

Capital Reorganisation and explain why the Board believes this is

in the best interests of EQTEC plc and its shareholders.

The Capital Reorganisation is conditional on, among other

things, the passing of the Resolutions by Shareholders at the

Extraordinary General Meeting, which is scheduled to take place at

12:00 noon on 18 December 2023. The formal Notice of Extraordinary

General Meeting is set out at the end of this document (together

with a set of explanatory notes) and a form of proxy is also

enclosed for you to complete, sign and return.

The Board considers that the Capital Reorganisation is in the

best interests of the Shareholders taken as a whole and unanimously

recommends that Shareholders vote in favour of the Resolutions to

be proposed at the Extraordinary General Meeting. Failure to

approve the proposed Resolutions may constitute an event of default

under certain facilities included in the refinancing announced on

20 November 2023 following which (as with the case of other

standard events of default) the lenders of such facilities may

declare all outstanding amounts immediately due and payable.

Background and reasons for the Capital Reorganisation

The Company has previously announced its business strategy of

moving out of project development and into pure-play technology

licensing and innovation. The Company's strategy emphasises: (1)

continuously developing and leveraging its IP-rich engineering and

innovation capabilities; (2) de-risking its portfolio by occupying

a narrow segment of the value chain, collaborating with the world's

best value chain partners; and (3) driving higher margins through

licensing its IP for use by owner-operators, deploying its

engineering and design capabilities to get its IP deployed into

more places, for the best-suited business models.

In its recent 2023 Interim Results the Board announced it is

conducting a review of available options for required investment,

with a particular focus on long-term, strategic investors of

sufficient scale and resources to support the Company's growth and

execution of its strategic vision. To facilitate engagement with

prospective investors, the Company has, together with its advisors,

including a major investment bank announced by the Company in

February 2023, established a 10-year business plan built around its

declared strategy.

On 20 November 2023 the Company announced a proposed financial

restructuring, in collaboration with its existing funders and

certain key shareholders, to enable the Company to transition to

revenue-led growth and regain momentum with execution of its

business strategy. Certain aspects of the refinancing are subject

to Shareholders passing resolutions to provide the Company with

authority to issue new Ordinary Shares and the implementation of a

share capital reorganisation. As a condition subsequent to part of

the refinancing announced on 20 November 2023, the Company must

hold the EGM by 3 January 2024 to seek approval from its

Shareholders to implement a share capital reorganisation to reduce

the nominal value of its Ordinary Shares and to refresh the

Company's authority to allot shares.

Shareholder approval is therefore being sought for a

reorganisation of the Company's share capital, comprising the

subdivision, consolidation and a part redesignation of the existing

Ordinary Shares. Each Shareholder's proportionate interest in the

issued Ordinary Shares of the Company (save for rounding to avoid

fractional entitlements) will remain unchanged as a result of the

Capital Reorganisation.

The Capital Reorganisation is proposed in order to achieve a

higher market price for the Consolidated Ordinary Shares to a more

appropriate range for the Company. The Board believes that the

Capital Reorganisation will improve the marketability of the

Ordinary Shares by way of a higher share price and hopes to reduce

volatility in the Company's share price by narrowing the spread of

its bid and offer price. In addition, if the Capital Reorganisation

was not implemented, the Company is prohibited from allotting

shares at a discount to their nominal value, and this is addressed

by the Capital Reorganisation.

The authorised share capital of the Company is EUR213,200,000

divided into 25,761,091,094 Ordinary Shares of EUR0.001 each,

10,000,000,000 Deferred Convertible A Ordinary Shares of EUR0.01

each, 75,140,494 Deferred B Ordinary Shares of EUR0.099 each and

200,000,000 Deferred Ordinary Shares of EUR0.40 each.

As at the date of this document, the Company has 14,783,204,492

Ordinary Shares in issue, with a closing mid-market price of

0.0425p per Ordinary Share (as at 20 November 2023, being the

latest practicable Business Day prior to the date of this

document).

The Capital Reorganisation will involve the following three

inter-conditional steps: (1) the subdivision of existing Ordinary

Shares; (2) the consolidation of the resulting Ordinary Shares; and

(3) the redesignation of certain of the remaining Ordinary

Shares.

(1) Ordinary Share Subdivision

The current nominal value of each of the existing Ordinary

Shares is EUR0.001. Pursuant to the proposed subdivision, each

existing Ordinary Share would be subdivided into 10 Ordinary Shares

of EUR0.0001, from the time at which the Resolution in respect of

the subdivision becomes effective (which will be immediately prior

to the Ordinary Share Consolidation and Redesignation).

(2) Ordinary Share Consolidation

Immediately after the subdivision of the Ordinary Shares every

1,000 (one thousand) subdivided Ordinary Shares of EUR0.0001 each

will be consolidated into 10 (ten) Ordinary Shares of EUR0.01

each

(3) Redesignation

Immediately after the Ordinary Share Consolidation 9 (nine) out

of every 10 Ordinary Shares of EUR0.01 each will be redesignated

into 9 (nine) deferred C ordinary shares of EUR0.01 each ("2023

Deferred Shares").

Shareholders should note that, except for the increase in

nominal value of each Ordinary Share, the voting and dividend

rights attaching to the New Ordinary Shares arising on the Capital

Reorganisation will be identical in all respects to those attaching

to the existing Ordinary Shares at the date of this document. The

2023 Deferred Shares will have no economic value and will carry the

rights as set out in the Amended Articles and as summarised

below.

If the Capital Reorganisation is approved, the New Ordinary

Shares will be admitted to trading on AIM on 19 December 2023.

No new share certificates representing the New Ordinary Shares

will be sent to Shareholders who hold Existing Ordinary Shares in

certificated form. Accordingly, share certificates for the Existing

Ordinary Shares will remain valid, and will only be replaced by

share certificates for New Ordinary Shares when the old share

certificates are surrendered for cancellation following the

transfer, transmission or other disposal of New Ordinary

Shares.

Shareholders who hold their Existing Ordinary Shares in

uncertificated form through CREST should expect to see the security

description updated, in order to reflect their holding in New

Ordinary Shares.

Following the Share Consolidation, the Company's new SEDOL code

will be BLF9HQ3 and its new ISIN code will be IE000955MAJ1.

The 2023 Deferred Shares created will be effectively valueless

as they will not carry any rights to vote or dividend rights. In

addition, holders of 2023 Deferred Shares will not be entitled to a

payment on a return of capital or on a winding up of the Company.

The 2023 Deferred Shares will not be traded on AIM or listed and

will not be transferable other than as specified in the Amended

Articles.

No share certificates will be issued in respect of the 2023

Deferred Shares, nor will CREST accounts of Shareholders be

credited in respect of any entitlement to 2023 Deferred Shares.

In connection with the Capital Reorganisation, the Company is

also required to amend the Existing Articles to reflect the amended

authorised share capital of the Company and include the specific

rights and restrictions attaching to the 2023 Deferred Shares, as

set out above.

Application will be made in accordance with the AIM Rules for

the New Ordinary Shares arising from the Capital Reorganisation to

be admitted to trading on AIM, subject to Shareholders passing

Resolutions at the EGM. It is expected that if such Resolutions are

passed, Admission in respect of such New Ordinary Shares will

become effective and that dealings in those New Ordinary Shares

will commence on 19 December 2023.

No Shareholder will be entitled to a fraction of a new Ordinary

Share or 2023 Deferred Share. Instead, their entitlement will be

rounded down to the nearest whole number of New Ordinary Shares and

Deferred Shares. Remaining fractional entitlements to New Ordinary

Shares and Deferred Shares will be aggregated and sold on behalf,

and for the benefit of, the Company. As a result of the Ordinary

Share Consolidation existing shareholdings will effectively be

divided by 100. If a Shareholder holds fewer than 100 Existing

Ordinary Shares at the Record Date, then the rounding down process

will result in that Shareholder being entitled to zero New Ordinary

Shares and as a result of the Capital Reorganisation they will

cease to hold any Ordinary Shares.

Extraordinary General Meeting

Set out at the end of this document is a notice convening the

Extraordinary General Meeting to be held on 18 December 2023 at

12.00 a.m. in the offices of Philip Lee LLP, Connaught House, One

Burlington Road, Dublin 4, D04 C5Y6 , Ireland at which the

Resolutions will be proposed.

Shareholders wishing to vote but who are unable to attend the

Extraordinary General Meeting in person, are urged to appoint the

Chairman of the meeting as their proxy, in accordance with the

relevant instructions on the form of proxy, and to submit their

form of proxy so as to be received as soon as possible and by no

later than 12:00 a.m. on 16 December 2023. This will ensure that

your vote will be counted even if you are unable to attend in

person.

Resolutions

A summary of the resolutions to be proposed at the Extraordinary

General Meeting is set out below. Please note that this is not the

full text of the Resolutions and you should read this section in

conjunction with the Resolutions contained in the formal notice at

the end of this document (together with the explanatory notes set

out at the end of such notice).

The following resolutions, which are all inter dependent, will

be proposed at the Extraordinary General Meeting:-

Resolution 1 , which will be proposed as an ordinary resolution

seeks shareholder authority to approve the Sub-division.

Resolution 2 , which will be proposed as an ordinary resolution,

seeks shareholder authority to approve the Ordinary Share

Consolidation.

Resolution 3 , which will be proposed as a special resolution,

seeks shareholder authority to approve the Redesignation.

Resolution 4 , which will be proposed as a special resolution,

in order to give effect to the foregoing, seeks shareholder

authority to adopt as the memorandum and articles of association of

the Company the draft memorandum and articles of association

produced to the meeting and initialled by the Chairman of the

meeting for the purposes of identification.

Resolution 5 , which will be proposed as an ordinary resolution,

to authorise the Directors to issue Ordinary Shares up to an

aggregate nominal value equal to EUR4,500,000. This authority shall

expire at the close of business on the date of the next AGM of the

Company unless previously renewed, varied or revoked by the

Company.

As a special resolution, Resolution 3 and 4 require votes in

favour representing 75 per cent. or more of the votes cast (in

person or by proxy) at the Extraordinary General Meeting in order

to be passed.

Action to be taken by Shareholders

A form of proxy for use at the Extraordinary General Meeting is

enclosed. Whether or not you intend to be present at the

Extraordinary General Meeting, you are requested to complete, sign

and return the form of proxy in accordance with the instructions

thereon.

For Shareholders whose name appears on the register of members

of the Company (being those who hold their shares in certificated

form), your proxy may be submitted by post, and returning it to the

Company's Registrar Link Registrars Limited at P.O. Box 7117,

Dublin 2, Ireland (if delivered by post) or at Link Registrars

Limited, Suite 149, The Capel Building, Mary's Abbey, Dublin 7, D07

DP79, Ireland (if delivered by hand) so as to arrive no later than

12.00 noon on 16 December 2023. The return of the form of proxy

will not prevent you from attending the Extraordinary General

Meeting and voting in person should you wish to do so.

Persons who hold their interests in ordinary shares as Belgian

law rights through the Euroclear system or as CDIs should consult

with their custodian, stockbroker or other intermediary at the

earliest opportunity for further information on the processes and

timelines for submitting proxy votes for the EGM through the

respective systems. For voting services offered by custodians

holding Irish corporate securities directly with Euroclear Bank

SA/NV ("Euroclear Bank"), please contact your custodian.

To be effective, all proxy voting instructions (whether

submitted directly or through the EB System or CREST) together with

any power of attorney or other authority under which it is

executed, or a notarially certified copy thereof, must be received

by the Company's Registrars, no later than 12.00 noon. on 16

December 2023. However, persons holding through the EB System or

CREST will also need to comply with any additional voting deadlines

imposed by the respective service offerings. All relevant persons

are recommended to consult with their stockbroker or other

intermediary at the earliest opportunity.

Board Recommendations

The Directors consider that all the proposals to be considered

at the Extraordinary General Meeting are in the best interests of

the Company and its shareholders as a whole and are most likely to

promote the success of the Company. Failure to approve the proposed

Resolutions may constitute an event of default under certain

facilities included in the refinancing announced on 20 November

2023 following which (as with the case of other standard events of

default) the lenders of such facilities may declare all outstanding

amounts immediately due and payable. Accordingly, the Directors

unanimously recommend that you vote in favour of the Resolutions to

be proposed at the Extraordinary General Meeting as they intend to

do in respect of their own beneficial holdings currently amounting

to approximately 3.05 per cent. of the issued share capital of the

Company.

The results of the voting on all Resolutions will be announced

via a Regulatory Information Service and published on our website

as soon as practicable following the conclusion of the

Extraordinary General Meeting.

DEFINITIONS

In this document and in the Form of Proxy the following

expressions have the following meanings.

"AIM" the AIM market of the London Stock

Exchange;

"AIM Rules" the rules for AIM companies and

their nominated advisers issued

by the London Stock Exchange governing

the admission to and the operation

of AIM;

"Articles of Association" the articles of association of the

or "Articles" Company as amended from time to

time and filed with the Registrar

of Companies;

"Amended Articles" the articles of association of the

Company as amended following the

passing of Resolutions 1 and 2 at

the EGM to approve the Capital Reorganisation;

"Business Day" a day (other than Saturdays, Sundays,

public holidays or bank holidays)

"Capital Reorganisation" on which banks are generally open

for normal business in Ireland;

the reorganisation of the Company's

share capital in the matter proposed

in section 2 of the Chairman's Letter

and effected by Resolutions 1-3;

"Circular" or "Document" this document dated 24 November

2023 containing information about

the Capital Reorganisation, the

Resolutions and the Notice of Extraordinary

General Meeting

"Company" or "EQTEC" EQTEC plc;

"Companies Act" the Companies Act 2014 of Ireland

as amended;

"2008 Deferred Shares" the Deferred Convertible A Ordinary

Shares of EUR0.01 each in the Company

having the rights set out in the

Existing Articles;

"2013 Deferred Shares" the Deferred Ordinary Shares of

EUR0.40 each in the Company having

the rights set out in the Existing

Articles;

"2017 Deferred Shares" the Deferred B Ordinary Shares of

EUR0.099 each in the Company having

the rights set out in the Existing

Articles;

"2023 Deferred Shares" the Deferred C Ordinary Shares of

EUR0.10 each in the Company arising

from the Capital Reorganisation

and having the rights set out in

the Amended Articles;

"Existing Articles" the articles of association of the

Company as at the date of this document;

"Existing Ordinary Shares" the 14,783,204,492ordinary shares

of EUR0.001 each in the capital

of the Company in issue as at the

date of this document (being the

entire issued ordinary share capital

of the Company);

"Extraordinary General the extraordinary general meeting

Meeting" or "EGM" of the Company convened for 18 December

2023 to approve the Resolutions;

"EUI" Euroclear UK & International Limited,

the operator of the CREST System;

"Form of Proxy" means the form of proxy for use

at the General Meeting which accompanies

this document;

"GBP" the lawful currency of the United

Kingdom;

"Group" or "EQTEC Group" the Company and its subsidiary undertakings;

"Ireland" Ireland, excluding for the avoidance

of doubt, Northern Ireland;

"Link" or "Registrars" Link Registrars Limited, the Company's

registrars, who have their registered

office at Suite 149, The Capel Building,

Mary's Abbey, Dublin 7, D07 DP79,

Ireland;

"London Stock Exchange" London Stock Exchange plc;

"New Ordinary Shares" the new ordinary shares of nominal

value EUR0.01 each in the capital

of the Company to be created pursuant

to the Capital Reorganisation;

"Ordinary Share Consolidation" following the Subdivision, the consolidation

of the Ordinary Shares of EUR0.0001

each, into Ordinary Shares of EUR0.01

each, as described in section 2

of the Chairman's Letter and effected

by Resolution 2.

"Ordinary Shares" the ordinary shares of EUR0.001

each in the capital of the Company

or, as the context requires, ordinary

shares of EUR0.0001 each in the

capital of the Company or, as the

context requires, ordinary shares

of EUR0.01 each in the Capital of

the Company where Ordinary Shares

are in issue or to be issued, post

the Capital Reorganisation.

"Record Date" 6.00 p.m. on 18 December 2023 or

such other date as the Directors

may determine, being the date by

reference to which the Ordinary

Share Consolidation is calculated;

"Redesignation" following the Subdivision and the

Ordinary Share Consolidation the

redesignation of 9 (nine) out of

every 10 Ordinary Shares of EUR0.01

each into 9 (nine) 2023 Deferred

Shares, as described in section

2 of the Chairman's Letter and effected

by Resolution 3;

"Resolutions" the shareholder resolutions to be

voted upon by Shareholders at the

EGM;

"Restricted Jurisdiction" the United States, Australia, Canada,

Japan, New Zealand and the Republic

of South Africa and any other jurisdiction

in which it would be unlawful to

distribute the document and would

be required to be approved by a

regulatory body;

"Sub-division" means the subdivision of the Ordinary

Shares as described in Section 2

of the Chairman's Letter and effected

by Resolution 1;

"Shareholders" holders of shares (of any class)

in the capital of the Company;

"UK" or "United Kingdom" the United Kingdom of Great Britain

and Northern Ireland; and

"UK Listing Authority" the Financial Conduct Authority

or "UKLA" acting in its capacity as the competent

authority for the purposes of Part

VI of the Financial Services and

Markets Act 2000.

SHARE CONSOLIDATION STATISTICS

Number of Existing Ordinary Shares 14,783,204,492

Number of New Ordinary Shares to be in issue

immediately following completion of the Capital

Reorganisation 147,832,044

Number of 2023 Deferred Shares to be in issue

immediately following completion of the Capital

Reorganisation 1,330,488,404

New ISIN Code following the Share Consolidation IE000955MAJ1

New SEDOL Code following the Share Consolidation BLF9HQ3

TIDM EQT

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Date of this Document and Form of 24 November 2023

Proxy

Latest time and date for receipt 12.00 a.m. on 16 December

of Forms of Proxy 2023

Extraordinary General Meeting 12.00 a.m. on 18 December

2023

Announcement of the Results of the 18 December 2023

Extraordinary General Meeting

Record date for Ordinary Share Consolidation 6.00p.m. on 18 December2023

Admission effective and dealings start of business on 19

commence in the New Ordinary Shares December 2023

and Credit of Euroclear Bank Participant

Accounts and CREST Member accounts

(where applicable)

Note

(1) Unless otherwise stated, all references in this document are

to Dublin time. The dates given are based on the Directors

expectations and may be subject to change. Any change to the

timetable will be notified to the London Stock Exchange and to the

market via a regulatory announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGNKNBNOBDDBDB

(END) Dow Jones Newswires

November 24, 2023 02:00 ET (07:00 GMT)

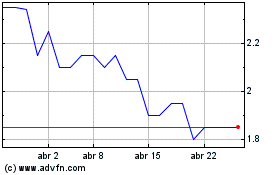

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De May 2023 a May 2024