TIDMEST

RNS Number : 2229O

East Star Resources PLC

29 September 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

29 September 2023

East Star Resources Plc

("East Star" or the "Company")

Half Year Report for the Six Months Ended 30 June 2023

East Star Resources Plc (LSE:EST), which is defining mineral

resources in Kazakhstan for the energy revolution, is pleased to

present its half year report for the six month period ended 30 June

2023.

Projects Highlights

Copper-Zinc-Lead - Rudny Altai VMS Belt

-- Announced on 25 January 2023 the identification of a

substantial copper-zinc-lead-deposit located within the 100% owned

RA3 licence (the "Verkhuba Deposit")

o An independent JORC-compliant Exploration Target of 19-23 Mt

at 1.4-1.9% CuEq for the Verkhuba Deposit was announced on 21 March

2023, defined by 97 drill holes comprising 42,178 m of historical

diamond drilling

o Conducted extensive geological traverse over project area in

preparation for drilling, mapping more than 70 historical collar

locations

-- Post period-end, in August 2023, East Star commenced diamond

core drilling, focusing primarily on the Verkhuba Deposit

-- Announced on 20 September 2023 encouraging observations with

visual core inspection combined with X-ray fluorescence ("XRF")

readings confirming presence of copper and zinc mineralisation in

the first four holes at Verkhuba

o Copper mineralisation identified in all holes with multiple

massive sulphide intervals recognised

o Drilling identified large thicknesses of disseminated copper

mineralisation, not previously acknowledged or assayed in

historical drilling

-- Core is being prepared for multi-element assay including

copper, zinc, and precious metals (gold/silver)

Rare Earths - East Kostanay

-- Announced on 3 April 2023 assay results from drilling in

November 2022 which demonstrated high grade intersections across

the entire tested area and broad intersections in every drill hole,

validating historical data and providing a strong indication of an

REE deposit of consequential size and grade

-- Sequential leach test results announced on 16 June 2023

demonstrated that a majority of REEs had been liberated from

primary minerals during the weathering process

-- Planning low-cost assessment of additional test work to

identify if an economic process to leach rare earth elements from

the weathered material is possible

Gold - Chu-Ili Orogenic Gold Belt

-- Assay results from 2022 drilling on Apmintas Licence

announced on 13 February 2023 demonstrated:

o Anomalous gold mineralisation in all three target areas with

potential economic grades in the Eshkilitau II and Southern Shabdar

targets

o Eshkilitau II has potential for a mineralised system with a

strike of >1 km along a fault zone with significant regional

exploration upside potential from >10km of strike

o Analysis ongoing to determine next steps

-- Assay results from 2022 drilling on Dalny Licence announced

on 26 April 2023 confirmed a gold bearing mineralised system with

shallow intersections of potentially economic grades and widths

o Analysis ongoing to determine next steps

Sandy Barblett, Non-Executive Chairman, commented:

"In early January 2023 East Star identified a substantial

copper-zinc-lead deposit defined from extensive historical

drilling. Since then, we have wasted no time in preparing for and

undertaking our first copper drilling programme, primarily focusing

on this deposit. Together with a number of exciting

heli-electromagnetic and other targets, the Company's Rudny Altai

prospects are potential game-changers for our Company in a prolific

copper region with established infrastructure. We look forward in

due course to receiving results of the first assays, from what is

evidently a strongly mineralised system.

"In addition, field and desktop work continues on other

prospects across the VMS licences. A review by one of the world's

most prominent VMS experts, Dr Bruce Gemmell, highlights our

licences as being "highly prospective for the discovery of new VMS

deposits." This was further validated by a field visit from VMS

expert, Dr Carl Brauhart, in August 2023, which confirmed our

analysis that felsic volcanic rocks are abundant across the

tenements with almost all field observations being consistent with

a deep marine environment suitable for the establishment of VMS

deposits.

"In parallel, East Star has continued to evaluate data from our

rare earths and gold projects to determine the next steps in

exploration."

For further information visit the Company's website at

www.eaststarplc.com , or contact:

East Star Resources Plc

Alex Walker, Chief Executive Officer

Tel: +44 (0)20 7390 0234 (via Vigo Consulting)

Peterhouse Capital Limited (Corporate Broker)

Duncan Vasey / Lucy Williams

Tel: +44 (0) 20 7469 0930

Vigo Consulting (Investor Relations)

Ben Simons / Peter Jacob

Tel: +44 (0)20 7390 0234

About East Star Resources Plc

East Star Resources is focused on the discovery and development

of strategic minerals required for the energy revolution. With an

initial nine licences covering 1,321.5 km(2) in three mineral rich

districts of Kazakhstan, East Star is undertaking an intensive

exploration programme, applying modern geophysics to discover

minerals in levels that were not previously explored. The Company

also intends to further expand its licence portfolio in Kazakhstan.

East Star's management are based permanently on the ground,

supported by local expertise, and joint ventures with the state

mining company.

Follow us on social media:

LinkedIn:

https://www.linkedin.com/company/east-star-resources/

Twitter: https://twitter.com/EastStar_PLC

Subscribe to our email alert service to be notified whenever

East Star releases news:

www.eaststarplc.com/newsalerts

The person who arranged for the release of this announcement was

Alex Walker, CEO of the Company.

CHAIRMAN'S STATEMENT

Introduction

The first half of 2023 (the "Period") has seen intense

operational activity. In early January 2023, East Star identified a

substantial copper-zinc-lead deposit defined from extensive

historical drilling. Since then, we have wasted no time in

preparing for and undertaking our first copper drilling campaign,

primarily focusing on this deposit. Together with a number of

exciting heli-electromagnetic ("HEM") and other targets, the

Company's Rudny Altai prospects are potential game-changers in a

prolific copper region with established infrastructure, providing a

potential route to a low-CAPEX development.

In parallel, East Star has continued work to evaluate data from

our rare earths and gold projects to determine the next steps in

exploration.

Review of Operations

Copper-Zinc-Lead - Rudny Altai VMS Belt

On 25 January 2023, East Star announced the identification of a

substantial copper-zinc-lead deposit ("Cu-Zn-Pb") located within

our 100% owned RA3 licence, centrally located in the world-class

Rudny Altai VMS belt. The newly identified polymetallic deposit

known as the Verkhuba Deposit is within the greater Verkhuba Ore

District on East Star's licences which includes a number of other

high priority HEM anomalies.

The next step in anticipation of drilling was to commission

leading resource advisors AMC Consultants to determine an

independent JORC-compliant Exploration Target for the Verkhuba

Deposit. On 21 March 2023, we published AMC Consultants'

Exploration Target of 19-23 Mt at 1.0-1.4% Cu and 1.0-1.4% Zn

(1.4-1.9% CuEq), which is defined by 97 drill holes comprising

42,178 m of historical diamond drilling, reviewed by East Star over

the preceding 12 months.

Shortly after the Period, in July 2023, we began to prepare the

site for an initial drilling programme. Our field teams undertook

an extensive geological traverse over the project area, mapping

more than 70 historical collar locations as well as a number of

copper outcrops. On 10 July 2023, we announced we had contracted

Everest Sondaj LLP, a Turkish-owned and locally operated drilling

contractor with extensive experience in drilling oriented diamond

core in mountainous areas, to execute our drilling programme.

During August 2023, we commenced diamond core drilling at the

Verkuba Deposit. This initial programme was aimed, amongst other

things, at twinning existing boreholes with identified strong

copper mineralisation, as well as testing the potential of gold and

silver mineralisation which was not assayed for in historical

drilling but is known to be present in metallurgical samples taken

from within the deposit.

On 20 September 2023, we were pleased to announce encouraging

observations from visual inspection and logging of core, with much

of the drilling correlating with anticipated mineralised zones from

the historical data. Broad zones of disseminated sulphides with

consistent copper and zinc readings by XRF, along with zones of

chalcopyrite-rich massive sulphides, leaves very little doubt we

are in a strongly mineralised system. Core is currently being

prepared for assay which will provide the data we need to model

these results against the historical drill holes which will

hopefully form the basis of a JORC compliant resource.'

In addition, field and desktop work continues on other prospects

across the Rudny Altai VMS licences. A review by one of the world's

most prominent VMS experts, Dr Bruce Gemmell, highlights our

licences as being "highly prospective for the discovery of new VMS

deposits." This was further validated by a field visit from VMS

expert, Dr Carl Brauhart, in August 2023, which confirmed our

analysis that felsic volcanic rocks are abundant across the

tenements with almost all field observations being consistent with

a deep marine environment suitable for the establishment of VMS

deposits.

Rare Earths - East Kostanay

On 3 April 2023, we announced assay results from initial

drilling to test the Talairyk project for Rare Earth Element

("REE") concentrations. The results demonstrated high grade

intersections across the entire tested area and broad intersections

in every drill hole, validating historical data and providing a

strong indication of an REE deposit of consequential size and

grade. Samples analysed reported Total Rare Earth Oxides with an

average grade of 934.4 ppm with the highest-grade result of 2m at

6,127 ppm TREO.

Eight samples were sent for five-stage sequential leach test

work to provide an initial indication as to the leachability of the

REEs from the clays. The test work was conducted by the School of

Applied Sciences at University of Brighton, UK and the results were

announced on 16 June 2023. Sequential leach testing clearly

demonstrated that a majority of REEs were liberated from primary

minerals during the weathering process and were now associated with

other mineral phases. Our understanding of the minerology and

potential for economic extraction of REEs from the Talairyk deposit

has grown significantly and, while not definitive, it will allow us

to plan a low-cost assessment of what additional test work is

required to identify if an economic process to leach rare earth

elements from the weathered material is possible. We are consulting

with metallurgical specialists in this regard to assess the next

phase of testing.

Gold - Chu-Ili Orogenic Gold Belt

On 13 February 2023, we announced results from diamond core

drilling undertaken in 2022 on the Apmintas Licence. The results

demonstrated gold bearing systems in all three target areas.

Eshkilitau II showed potential for an extensive mineralised system

with a strike of more than 1 km along a fault zone. High-grade

intersections at Southern Shabdar (32.15 g/t Au) and Eshkilitau

(14.01 g/t Au) demonstrated the existence of high-grade zones

within the mineralised systems while gold occurrences mapped over

10 km of the Eshkilitau trend demonstrated the exploration upside

within the region.

On 26 April 2023, we announced results from diamond core

drilling in 2022 on the Dalny Licence, with results from the

Alatagyl northern area indicating a gold bearing mineralised system

with shallow intersections of potentially economic grades and

widths.

We are undertaking a review of all the drill results against the

historical data to expand our knowledge of the mineralisation

system on these licences and determine the scope of follow-up

exploration.

Key East Star Financial Indicators

-- Cash and cash equivalents at 30 June 2023 were GBP765,000

-- Loss before taxation for the Period was GBP260,000

-- The Group held net assets at 30 June 2023 of GBP3,494,000

Summary

We are eagerly awaiting the assays from the drilling at the

Verkhuba Copper Deposit from what is evidently a strongly

mineralised system. Further understanding and advancing the

opportunity at Verkhuba and other attractive targets is clearly our

number one priority in the coming months given the scale and

proximity of the opportunity. A maiden JORC-compliant resource,

which we hope to obtain in due course, will move us a step closer

towards our objective of a low CAPEX, low OPEX development with

nearby processing options.

I would like to pay tribute to Alex Walker and his in-country

team for the tremendous progress made during the Period. We thank

all shareholders for their continued support and look forward to

updating you again in due course.

Sandy Barblett

Non-Executive Chairman

29 September 2023

EAST STAR RESOURCES PLC - CONDENSED CONSOLIDATED INTERIM

FINANCIAL STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTH PERIODING 30 JUNE 2023

Unaudited Unaudited

Period ending Period ending

30 June 31 May

2023 2022

Note GBP'000 GBP'000

--------------------------------------------------------- ----- ------------------------- -------------------------

Continuing Operations

--------------------------------------------------------- ----- ------------------------- -------------------------

Administrative expenses 5 (260) (399)

Operating loss (260) (399)

--------------------------------------------------------- ----- ------------------------- -------------------------

Finance Income - (93)

Reverse acquisition expense - (1,626)

Loss before taxation (260) (2,118)

--------------------------------------------------------- ----- ------------------------- -------------------------

Other comprehensive income (60) 91

Total comprehensive loss for the period attributable to

shareholders from continuing operations (320) (2,027)

--------------------------------------------------------- ----- ------------------------- -------------------------

Basic & dilutive earnings per share - (GBP pence) 6 (0.143) (1.435)

--------------------------------------------------------- ----- ------------------------- -------------------------

The notes form an integral part of the Condensed Consolidated

Interim Financial Statements.

EAST STAR RESOURCES PLC - CONDENSED CONSOLIDATED INTERIM

FINANCIAL STATEMENTS

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

Unaudited Unaudited Audited

As At As At As At

30 June 31 May 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Exploration assets 7 2,543 - 2,268

Earn in advance (financial asset) 57 - 57

Property, plant and equipment 19 26 25

Intangibles - 1,039 -

TOTAL NON-CURRENT ASSETS 2,619 1,065 2,350

----------------------------------- ----- ------------------ ------------------- ----------------------------

CURRENT ASSETS

Cash and cash equivalents 765 3,205 1,456

Trade and other receivables 180 327 133

TOTAL CURRENT ASSETS 945 3,532 1,589

----------------------------------- ----- ------------------ ------------------- ----------------------------

TOTAL ASSETS 3,564 4,597 3,939

----------------------------------- ----- ------------------ ------------------- ----------------------------

CURRENT LIABILITIES

Trade and other payables 70 50 127

TOTAL CURRENT LIABILITIES 70 50 127

----------------------------------- ----- ------------------ ------------------- ----------------------------

TOTAL LIABILITIES 70 50 127

----------------------------------- ----- ------------------ ------------------- ----------------------------

NET ASSETS 3,494 4,547 3,812

----------------------------------- ----- ------------------ ------------------- ----------------------------

EQUITY

Share capital 9 1,823 1,823 1,823

Share premium 9 5,891 5,905 5,891

Share based payment reserve 10 270 106 268

Share capital to be issued 3,750 3,750 3,750

Foreign exchange reserve 6 93 66

Reverse acquisition reserve (4,795) (4,932) (4,795)

Retained earnings (3,451) (2,198) (3,191)

Non controlling interest (0.03) (0.03) -

TOTAL EQUITY 3,494 4,547 3,812

=================================== ===== ================== =================== ============================

The notes form an integral part of the Condensed Consolidated

Interim Financial Statements.

The Condensed Consolidated Financial Statements were approved

and authorised by the Board of Directors on 29 September 2023

Sandy Barblett

Non-Executive Chairman

EAST STAR RESOURCES PLC - CONDENSED CONSOLIDATED INTERIM

FINANCIAL STATEMENTS

STATEMENT OF CHANGES IN EQUITY

FOR THE 6 MONTH PERIODING 30 JUNE 2023

Share Share Equity SBP Foreign Reverse Share Retained Total

Capital Premium reserve reserve exchange acquisition Capital Earnings Equity

reserve reserve to

issue

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Balance at

31 December

2021 53 132 31 - (4) - - (86) 126

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Loss for

period - - - - - - - (3,105) (3,105)

Other

comprehensive

income - - - - 70 - - - 70

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Total

comprehensive

expense for

year - - - - 70 - - (3,105) (3,035)

Transactions

with owners

in own

capacity

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Recognition

of PLC equity

at

acquisition

date 695 1,501 - 24 - 1,257 - - 3,477

Remove share

capital of

DVK (53) (132) (31) - - 216 - - -

Issue of

shares

for

acquisition

of subsidiary 504 2,014 - - - (6,268) 3,750 - -

Issue of

shares

for placing 624 2,494 - - - - - - 3,118

Share issue

costs - (118) - - - - - - (118)

Broker

warrants

issued - - - 132 - - - - 132

Employee

options

issued - - - 112 - - - - 112

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Transactions

with owners

in own

capacity 1,770 5,759 (31) 268 - (4,795) 3,750 - 6,721

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Balance at

31 December

2022 1,823 5,891 - 268 66 (4,795) 3,750 (3,191) 3,812

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Loss for

period - - - - - - - (260) (260)

Other

comprehensive

income - - - - (60) - - - (60)

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Total

comprehensive

income for

period - - - - (60) - - (260) (320)

Transactions

with owners

in own

capacity

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Employee

options

issued - - - 2 - - - - 2

Transactions

with owners

in own

capacity - - - 2 - - - - 2

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

Balance at

30 June 2023 1,823 5,891 - 270 6 (4,795) 3,750 (3,451) 3,494

--------------- -------- --------- --------- --------- --------- ------------ -------- --------- --------

EAST STAR RESOURCES PLC - CONDENSED CONSOLIDATED INTERIM

FINANCIAL STATEMENTS

STATEMENT OF CASHFLOWS

FOR THE 6 MONTH PERIODING 30 JUNE 2023

Unaudited Unaudited

6 month period ended 6 month period ended

30 June 31 May

2023 2022

GBP'000 GBP'000

Cash flow from operating activities

Loss before taxation for the period (320) (2,027)

Adjustments for:

Share based payment on reverse acquisition - 1,626

Depreciation 7 -

Share based payments 2 82

Foreign exchange 54 35

Listing expenses settled in shares - 18

Changes in working capital:

Decrease / (increase) in trade and other receivables (102) 346

Increase / (decrease) in trade and other payables (46) (158)

Net cash outflow from operating activities (405) (78)

Cash flows from investing activities

Investment in fixed assets (1) (0.8)

Spend on exploration assets (275) (1,039)

Net cash flow from investing activities (276) (1,040)

------------------------------------------------------ --------------------- ---------------------

Cash flows from financing activities

Proceeds from Issue of Shares - 3,100

Share Issue Costs - (105)

Net cash flow from financing activities - 2,995

------------------------------------------------------ --------------------- ---------------------

Net increase in cash and cash equivalents (681) 1,877

Cash and cash equivalents at beginning of the period 1,456 1,353

Foreign exchange impact on cash (10) (25)

Cash and cash equivalents at end of the period 765 3,205

------------------------------------------------------ --------------------- ---------------------

EAST STAR RESOURCES PLC - CONDENSED CONSOLIDATED INTERIM

FINANCIAL STATEMENTS

NOTES TO THE FINANCIAL STATEMENTS

FOR THE 6 MONTH PERIODING 30 JUNE 2023

1. General information

East Star Resources Plc was incorporated under the Companies Act

2006 on 17 November 2020 in England and Wales under the name Cawmed

Resources Limited and remains domiciled there with Registered

Number 13025608. The Company subsequently changed its name to East

Star Resources Limited on 27 January 2021 and on 3rd March 2021

re-registered as a plc. The following condensed consolidated

interim financial statements are consolidated to include the

Company and all its subsidiaries ("the Group").

The address of its registered office is Eccleston Yards, 25

Eccleston Place, London SW1W 9NF, United Kingdom.

The principal activity of the Group is to explore opportunities

in the natural resources sector specifically in relation to gold

and copper extraction. In prior periods the Company successfully

completed the acquisition of Discovery Ventures Kazakhstan ("DVK"),

a Kazakhstan based subsidiary which jointly holds multiple

exploration licenses. During this period the Group has under taken

significant exploration activities across these licenses and

regularly reported to the market on the immense potential of the

area.

2. Accounting policies

IAS 8 requires that management shall use its judgement in

developing and applying accounting policies that result in

information which is relevant to the economic decision-making needs

of users, that are reliable, free from bias, prudent, complete and

represent faithfully the financial position, financial performance

and cash flows of the entity.

2.1 Basis of preparation

The condensed consolidated interim financial statements

("interim financial statements") have been prepared in accordance

with International Accounting Standard 34 "Interim Financial

Reporting" (IAS 34). The interim financial statements have been

prepared on the historical cost basis, except for assets and

liabilities measured at fair value through profit and loss. The

Directors have decided not to present parent company standalone

financial statements as they do not add to the understandability of

the position of the Group.

The functional currency for each entity in the Group is

determined as the currency of the primary economic environment in

which it operates. The functional currency of the Company's

subsidiaries is the Kazakhstan Tenge. The presentational currency

of the Group is Pounds Sterling as this is the functional currency

of the parent entity and also the currency in which equity

fundraising has been facilitated. Amounts have been rounded to the

nearest GBP'000.

The interim financial statements have not been audited and do

not constitute statutory accounts within the meaning of section 434

of the Companies Act 2006. The figures have been prepared using

applicable accounting policies and practices consistent with those

adopted in the audited annual financial statements for the year

ended 31 December 2022.

The interim financial statements are for the six months to 30

June 2023, being six months from the financial year end for the

Group being 31 December 2022. The interim financial statements do

not include all the information and disclosures required in the

annual financial statements and should be read in conjunction with

the Group's annual audited financial statements for the period

ended 31 December 2022. The Group has prepared the interim

financial statements using reverse acquisition methodology and

therefore has presented the comparatives for the accounting

acquirer (legal subsidiary - DVK). As per IAS 34 the comparative

data for the comparable year-to-date period has been presented as

well as the year-to-date figures for the immediately preceding

financial year being 31 December 2022.

Due to the Parent Company changing accounting reference dates

from 31 November to 31 December comparable interims periods are not

strictly identical. However as there is no seasonal affects to the

business and the periods are of equal length the Directors do not

see any issue in presenting the comparative period. The Group is in

its relative infancy also and is yet to establish a consistent

business cycle so the usefulness of comparability is limited.

The business is not considered to be seasonal in nature.

New standards, amendments and interpretations adopted by the

Group

During the current period the Group adopted all the new and

revised standards, amendments and interpretations that are relevant

to its operations and are effective for accounting periods

beginning on 1 January 2023. This adoption did not have a material

effect on the accounting policies of the Group.

New standards, amendments and interpretations not yet adopted by

the Group.

The standards and interpretations that are relevant to the

Group, issued, but not yet effective, up to the date of these

interim Financial Statements have been evaluated by the Directors

and they do not consider that there will be a material impact of

transition on the financial statements.

2.2 Going concern

The Directors have assessed the Group's ability to adopt the

going concern basis of accounting and consider the adoption to be

appropriate in the preparation of the interim financial statements.

Currently the Group has cash and cash equivalents of GBP765k and

its only major committed expenditure relates to minimum spend

commitments on licenses which equates to around GBP260,000 until

the Group's next reporting date. This combined with a current

average cash burn rate across the Group of around GBP30,000/month

supports the fact that the Group will not have any liquidity issues

in the near future.

Management have prepared in depth budgets and cash flow analysis

to support their assumptions and hence are confident in the

adoption of the going concern basis for the Group.

2.3 Risks and uncertainties

The Directors continuously assess and monitor the key risks of

the business. The business has not materially changed since the end

of the last period and hence risks pertaining to the business

remain materially similar. Overall the Board feels that the team

and risk mitigation factors that are in place are sufficient to

reasonably deal with any risks that may arise.

3. Critical accounting estimates and judgements

In the application of the Group's accounting policies, the

Directors are required to make judgements, estimates and

assumptions about the carrying amount of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods. The areas involving a higher degree of judgement or

complexity, or areas where assumptions and estimates are

significant to the financial statements, are disclosed below:

Recoverable value of exploration assets - Note 7

Costs capitalised in respect of the Group's mining assets are

required to be assessed for impairment under the provisions of IFRS

6. Such an estimate requires the Group to exercise judgement in

respect of the indicators of impairment and also in respect of

inputs used in the models which are used to support the carrying

value of the assets. Such inputs include estimates of mineral

reserves, production profiles, commodity prices, capital

expenditure, inflation rates, and pre-tax discount rates that

reflect current market assessments of (a) the time value of money;

and (b) the risks specific to the asset for which the future cash

flow estimates have not been adjusted. The Directors concluded that

there was no impairment as at 31 December 2022 and circumstances

have not changed since then to indicate that there would be any

impairment at 30 June 2023.

4. Segment reporting

The Group manages its operations in two segments, being

exploration activities in Kazakhstan and corporate functions in the

United Kingdom. The results of these segments are regularly

reviewed by the board as a basis for the allocation of resources,

in conjunction with individual investment appraisals, and to assess

their performance.

Contributions per segment to loss before taxation are detailed

below:

United Kingdom Kazakhstan Total

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- --------------- ----------- --------

Administrative expenses (205) (55) (260)

Operating loss from continued operations per reportable segment (205) (55) (260)

Reportable segment assets 891 2,673 3,564

Reportable segment liabilities (16) (55) (70)

Total 875 2,619 3,494

=============== =========== ========

5. Administrative expenses

United Kingdom Kazakhstan Total

2023 GBP'000 GBP'000 GBP'000

Consultancy expense (41) (94) (135)

Professional fees (53) - (53)

Administrative expenses (61) (3) (64)

Salary expense (44) - (44)

Foreign Exchange (6) 42 36

(205) (55) (260)

--------------- ------------- ---------------

6. Earnings per share

The calculation for basic and diluted earnings per ordinary

share is based on the total comprehensive loss after income tax

attributable to equity shareholders for the period and is as

follows:

Unaudited Unaudited Audited

6 month period ended 6 month period ended Year

30 June 31 May ended 31 December

2023 2022 2022

Net loss for the period attributable to ordinary

equity holders for continuing operations

(GBP'000) (260) (2,027) (3,105)

Weighted average number of ordinary shares in

issue 182,250,164 141,193,801 180,843,292

--------------------------------------------------- --------------------- --------------------- -------------------

Basic and diluted earnings per share for

continuing operations (pence) (0.143) (1.435) (1.72)

--------------------------------------------------- --------------------- --------------------- -------------------

There is no difference between the diluted loss per share and

the basic loss per share presented. Share options and warrants

could potentially dilute basic earnings per share in the future but

were not included in the calculation of diluted earnings per share

as they are anti-dilutive for the period presented. See note 23 for

further details.

7. Exploration & evaluation assets

GBP'000

----------------------------------------- --------

Opening balance - 1 January 2023 2,268

Exploration expenditure across licenses 275

As at 30 June 2023 2,543

----------------------------------------- --------

Exploration and evaluation assets relate specifically to mining

licenses held in the Kazakhstan based subsidiaries. The Group holds

a total of 8 licenses plus one jointly through a farm in

arrangement with Phoenix Mining Ltd across 3 mineral districts

being specifically the Chu-Ili belt, East Kostanay region and Rudny

Altai belt. The majority of investment in the assets has been

across the Chu-Ili and Rudny held licenses to date.

8. Investment in subsidiaries

Country of

Name Business Activity Incorporation Registered Address Percentage Holding

----------------------- --------------------- ------------------------ ----------------------- -------------------

bld. 12/1, VP 32, 3rd

floor, IHUB

coworking, D. Konayev

Street, Yessil

district, Astana

Discovery Ventures city,

Kazakhstan Limited Mineral exploration Kazakhstan Z05H9B0, Kazakhstan 100%

bld. 12/1, VP 32, 3rd

floor, IHUB

coworking, D. Konayev

Street, Yessil

district, Astana

city,

Chu Ili Resources ltd* Mineral exploration Kazakhstan Z05H9B0, Kazakhstan 80%

bld. 12/1, VP 32, 3rd

floor, IHUB

coworking, D. Konayev

Street, Yessil

district, Astana

city,

Rudny Resources ltd* Mineral exploration Kazakhstan Z05H9B0, Kazakhstan 80%

----------------------- --------------------- ------------------------ ----------------------- -------------------

*Subsidiaries held indirectly through Discovery Ventures

Kazakhstan

9. Share capital and share premium

Ordinary Shares Share Capital Share Premium Total

# GBP'000 GBP'000 GBP'000

---------------- -------------- -------------- --------

As at 31 December 2022 182,250,164 1,823 5,891 7,714

As at 30 June 2023 182,250,164 1,823 5,891 7,714

---------------- -------------- -------------- --------

10. Share based payments reserve

The following options over ordinary shares have been granted by

the Group and are outstanding at period end:

GBP'000

---------------------------------- --------

Opening balance - 1 January 2023 268

Employee options 2

As at 30 June 2023 270

---------------------------------- --------

Warrants

As at 30 June 2023

----------------------------------------------

Number of

Weighted average exercise price warrants

----------------------------------- -------------------------------- ------------

Brought forward at 1 January 2023 5p 14,813,505

Granted in period 5p -

Vested in period 5p -

Lapsed in period 5p (6,000,000)

Outstanding at 30 June 2023 5p 8,813,505

----------------------------------- -------------------------------- ------------

Exercisable at 30 June 2023 5p 8,813,505

=================================== ================================ ============

Options

As at 30 June 2023

---------------------------------------------

Number of

Weighted average exercise price warrants

----------------------------------- -------------------------------- -----------

Brought forward at 1 January 2023 5p 11,250,000

Granted in period(1) 5p 4,432,326

Vested in period 5p -

Cancelled in period (181,159)

Outstanding at 30 June 2023 5p 15,501,167

----------------------------------- -------------------------------- -----------

Exercisable at 30 June 2023 5p 11,250,000

=================================== ================================ ===========

(1) On 1 March 2023, 4,432,326 employee options were granted in

relation to the Long Term Incentive Plan implemented. These options

have an exercise price of GBP0.043 and expire 10 years from the

grant date.

The option vesting details are listed below:

Vesting Event Trigger for Vesting Number of options vested on date of vesting

1 50% of the Shares under Option shall Vest on the first 50% of options issued

anniversary of the Date of Grant;

-------------------------------------------------------- --------------------------------------------

2 25% of the Shares under Option shall Vest on the second 25% of options issued

anniversary of the Date of Grant;

and

-------------------------------------------------------- --------------------------------------------

3 the remaining number of the Shares under Option shall 25% of options issued

Vest on the third anniversary of the

Date of Grant.

-------------------------------------------------------- --------------------------------------------

12. Related party transactions

Equity issued to Directors & Director related entities

As a result of the Long Term Incentive Plan implemented during

the Period the Directors and following employees were issued

options as below:

Name Role Options

Alex Walker Director 2,898,511

---------- ----------

Anthony Eastman Director 289,855

---------- ----------

David Minchin Director 289,855

---------- ----------

Sandy Barblett Director 289,855

---------- ----------

Akmaral Niyazova Employee 181,159

---------- ----------

Saltanat Mukasheva Employee 181,159

---------- ----------

Zhanara Ismuratova Employee 181,159

---------- ----------

Ruslan Balykbayev Employee 120,773

---------- ----------

Provision of services

During the period, GBP30,241 was paid to Orana Corporate LLP for

the provision of administrative and corporate accounting services

of which GBP6,030 remains owing at 30 June 2023. Anthony Eastman is

a Director of the Company and a partner of Orana Corporate LLP.

Other than these there were no other related party

transactions.

13. Events subsequent to period end

There were no material events subsequent to period end that

require disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BXGDCUDDDGXC

(END) Dow Jones Newswires

September 29, 2023 09:28 ET (13:28 GMT)

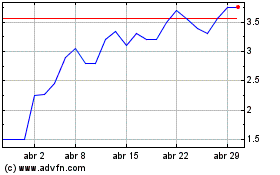

East Star Resources (LSE:EST)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

East Star Resources (LSE:EST)

Gráfica de Acción Histórica

De May 2023 a May 2024