TIDMFDEV

RNS Number : 1884N

Frontier Developments PLC

19 January 2023

Frontier Developments plc

FY23 Interim Results

Frontier Developments plc (AIM: FDEV, 'Frontier', the 'Company',

or the 'Group'), a leading developer and publisher of video games

based in Cambridge, UK, publishes its unaudited interim results for

the 6 months to 30 November 2022 ('H1 FY23').

Financial Headlines

H1 FY23 H1 FY22 FY22

(6 months to (6 months to (12 months

30 November 2022) 30 November to 31 May 2022)

2021)

Revenue GBP57.1m GBP49.1m GBP114.0m

----------------------- ----------------- ---------------------

Operating profit/(loss) GBP6.9m (GBP1.3m) GBP1.5m

----------------------- ----------------- ---------------------

EBITDA* GBP19.1m GBP14.1m GBP41.1m

----------------------- ----------------- ---------------------

Adjusted EBITDA** (GBP0.6m) (GBP0.9m) GBP6.7m

----------------------- ----------------- ---------------------

EPS (basic) 17.2p (4.2p) 24.6p

----------------------- ----------------- ---------------------

Net cash balance at GBP42.6m GBP33.6m GBP38.7m

period end

----------------------- ----------------- ---------------------

*Earnings before interest, tax, depreciation and

amortisation.

** Adjusted EBITDA is earnings before interest, tax,

depreciation and amortisation charges related to game developments

and Frontier's game technology, less investments in game

developments and Frontier's game technology, and excluding

share-based payment charges and other non-cash items.

-- Revenue increased by 16% over the comparative period to

GBP57.1 million (H1 FY22: 49.1 million) through the release of

F1(R) Manager 2022 in August 2022, ongoing sales of the current

portfolio and new PDLC (paid-downloadable content) for existing

games

-- Gross profit margin of 63% was consistent with the

comparative period (H1 FY22: 63%), underpinned by the continued

contribution from the existing portfolio

-- Net R&D expenses reduced by GBP2.5 million to GBP16.1

million (H1 FY22: GBP18.6 million) mainly as a result of the full

amortisation of Elite Dangerous: Odyssey during FY22

-- Operating profit rebounded to GBP6.9 million (H1 FY22: a loss

of GBP1.3 million) through a combination of a higher revenue and

lower R&D costs

-- Adjusted EBITDA, a measure of cash profit, remained as a

small net outflow (an outflow of GBP0.6 million versus an outflow

of GBP0.9 million in H1 FY22), reflecting continued investment in

future titles and support for existing games

-- Net cash balance was GBP42.6 million at 30 November 2022 (31

May 2022: GBP38.7 million). Net cash grew by GBP3.9 million during

the period despite an GBP8.8 million cash outflow in November 2022

for the acquisition of Complex Games

Operational & Strategic Headlines

-- Frontier's develop, launch and nurture strategy continues to

deliver material annual revenue from each game over many years

o As expected, the strongest performers in FY23 to date from our

existing portfolio are Jurassic World Evolution 2 and Planet Zoo ,

which continue to be supported with free updates and multiple PDLC

packs

o Jurassic World Evolution 2 , which released in November 2021,

delivered GBP73 million in its first 14 months (to 31 December

2022), which is 96% of the revenue achieved by 2018's Jurassic

World Evolution in its first 14 months (GBP76 million)

o Planet Zoo, launched in November 2019, continues to contribute

strong annual sales, with revenue in CY2022 at 82% of the revenue

recorded in CY2021

o As reported in the trading update on 9 January 2023, sales

performance during key price promotions in December 2022 (after the

reported period) fell below expectations, with some evidence of

increased player price sensitivity adversely impacting sales across

the portfolio

-- F1(R) Manager 2022 , the first annual title in a major new

sports franchise for Frontier, was released at the end of August

2022;

o Player engagement at release in August 2022 and during the

initial period after release was strong, and broadly in-line with

original expectations

o Over 600,000 units have been sold to date across PC, Xbox and

PlayStation, including both digital and physical unit sales on

console

o Metacritic ratings are between 74 and 80 across the three

platforms

o Unfortunately, sales performance during key holiday season

price promotions (after the reported period) fell materially below

original expectations, as reported in the trading update on 9

January 2023, potentially due in part to increased player price

sensitivity related to worsening economic conditions

o F1(R) Manager 2022 remains a good first game in an important

new annual franchise for Frontier

o We will continue to enhance the F1(R) Manager franchise over

the coming years on the solid foundations provided by the first

game

-- We are assessing our strategy for Frontier Foundry, our games

label for third-party publishing;

o Foundry has supported eight different games to date, with six

released games and two titles launching in the next few months

o Given our mixed financial success to date and in the context

of increased competition in the third-party publishing market, we

are assessing our strategy for Foundry. In particular, we are

focussing on return on investment

o Whilst we remain committed to, and excited by, the titles

currently in development for release in FY23, we currently do not

have any Foundry titles scheduled for release in FY24, although we

will continue to earn revenue from titles released prior to

FY24

o The assessment of the strategy for Foundry is expected to

complete by the end of May 2023

Current Trading and Outlook

Following a lower sales performance in December than expected,

and the ongoing assessment of Foundry, the Board reset its

financial expectations for FY23 and FY24 in a trading update on 9

January 2023.

The outturn over the five remaining months of this financial

year is dependent on a number of variables, including the timing

and contribution from the scheduled Foundry releases and the

macro-economic environment. The Board believes it is still possible

to surpass last year's record revenue performance of GBP114

million, particularly if one of the upcoming Foundry titles is a

conspicuous success. However, given the number of variables and the

more challenging economic outlook, the Board have set a minimum

expectation of delivering revenue of not less than GBP100 million

in FY23.

The Board's expectation for revenue for FY23 of GBP100 million

to GBP114 million, would deliver an IFRS operating profit in the

range GBP2 million to GBP10 million.

The Board has set its expectations for FY24 revenue growth at 5%

above the eventual revenue outcome for FY23, in light of current

market and portfolio uncertainties, and the absence of new titles

from Foundry releasing in FY24.

FY24 will benefit from the release of our Warhammer Age of

Sigmar real-time strategy game and F1(R) Manager 2023.

For FY25 we have two new game releases planned, with F1(R)

Manager 2024 plus an own-IP creative management simulation

game.

Jonny Watts, Frontier's CEO, said

"I would like to thank our teams for their hard work and

dedication during a busy 2022 for Frontier. During the first half

of the financial year our game portfolio performed largely in line

with expectations. However, the key December trading period was

below expectations and we believe this was partly due to increased

player price sensitivity.

As we look forward, there are important lessons we have learned

for the F1(R) Manager franchise, including making the game more

accessible and engaging to a wider audience. I am confident that we

have delivered a good first game to build upon.

We have announced a review of Frontier Foundry, which we expect

to complete by the end of the financial year, as a result of the

financial challenges and competition for that third-party

publishing business model. We continue to look forward to the

releases of Deliver us Mars and The Great War: Western Front in the

next few months. They offer upside potential but we are being

cautious given our experience of the market in December.

Our Warhammer Age of Sigmar real-time strategy game remains on

track for release in FY24 and I look forward to sharing more

details in due course.

Overall we believe our core strategy remains sound. We have a

strong portfolio of good games and a large and talented team of

people. We will continue to work together to navigate our

challenges and deliver on our opportunities."

There will be a call for analysts and institutional investors at

9:30a.m. today. To register please contact

frontier@tulchangroup.com

Enquiries :

Frontier Developments +44 (0)1223 394 300

Jonny Watts, CEO

Alex Bevis, CFO

Liberum - Nomad and Joint Broker +44 (0)20 3100 2000

Neil Patel / Cameron Duncan

Jefferies - Joint Broker +44 (0)20 7029 8000

Philip Noblet / William Brown

Tulchan Communications +44 (0)20 7353 4200

Matt Low / Mark Burgess / Alex Dart

About Frontier Developments plc

Frontier is a leading independent developer and publisher of

videogames founded in 1994 by David Braben, co-author of the iconic

Elite game. Based in Cambridge, Frontier uses its proprietary COBRA

game development technology to create innovative genre-leading

games, primarily for personal computers and videogame consoles. As

well as self-publishing internally developed games, Frontier also

publishes games developed by carefully selected partner studios

under its Frontier Foundry games label.

Frontier's LEI number: 213800B9LGPWUAZ9GX18.

www.frontier.co.uk

Interim Results Statement

REVENUE

Total revenue in H1 FY23 grew to GBP57.1 million, 16% ahead of

the comparative period (H1 FY22: GBP49.1 million). Two-thirds of

revenue in the period was generated by existing games which had

been released before June 2022, with one-third of revenue coming

from new games released in the period, namely F1 (R) Manager 2022

and Foundry title Stranded: Alien Dawn .

Ongoing material revenue contributions from the genre-leading

games in the existing portfolio shows the strength of Frontier's

develop, launch and nurture strategy. As expected, the strongest

performers in the period from the existing portfolio were Jurassic

World Evolution 2 and Planet Zoo , which were both supported with

free updates and multiple PDLC packs. During 2022, Jurassic World

Evolution 2 benefitted from two large expansions inspired by the

content and themes from the June 2022 release of the Jurassic World

Dominion film, with the Jurassic World Evolution 2: Dominion Biosyn

Expansion in June 2022 (H1 FY23) and the Jurassic World Evolution

2: Dominion Malta Expansion in December 2022 (H2 FY23). Across the

whole portfolio, PDLC accounted for 30% of total revenue in H1 FY23

(H1 FY22: 25%).

COSTS AND PROFITABILITY

Gross profit grew to GBP36.1 million in the period (H1 FY22:

GBP30.8 million) through the increased level of sales, with the

gross profit margin percentage maintained at 63% (H1 FY22: 63%) as

a result of the strong performance of the existing portfolio.

Frontier's gross margin percentage tends to vary between periods

based on the revenue mix of own-IP games, licenced-IP games and

Foundry titles.

Gross research and development expenses in the period increased

by 16% to GBP25.9 million (H1 FY22: GBP22.2 million). The increase

was driven by the continued rise in people costs to support

Frontier's development plans, including headcount growth. Partly

offsetting the increased investment in internal people costs, was a

planned reduction in outsourced development costs. Significant

outsource costs were incurred during the development of F1 (R)

Manager 2022 , mainly during FY22, to deliver the large number of

assets required for the twenty-two circuits which featured during

the 2022 F1 (R) season. The Group will continue to benefit from

this initial investment, as the majority of those assets will be

utilised in future F1 (R) Manager titles.

Capitalisation of development costs on game developments and

Frontier's game technology accounted for GBP18.4 million in the

period (H1 FY22: GBP15.8 million). The percentage of gross research

and development costs which were capitalised was maintained at 71%

(H1 FY22: 71%). Providing free updates and content post-release is

an important element of Frontier's nurturing strategy, generating

return on investment. Development costs for free updates and

content are expensed as they are incurred, with only development

cost for chargeable content being capitalised. During H1 FY23, free

updates and content were developed and released for Jurassic World

Evolution 2, Planet Zoo, and Elite Dangerous , often alongside

chargeable content. Frontier's normal expectations for

capitalisation is 70-90% of gross development spending.

R&D amortisation charges related to previously capitalised

game developments and Frontier's game technology reduced to GBP8.6

million (H1 FY22: GBP12.2 million). Charges in H1 FY22 included a

full six months of amortisation for major expansion Elite

Dangerous: Odyssey (a May 2021 release) which temporarily boosted

amortisation charges. Elite Dangerous: Odyssey was eventually fully

amortised in FY22, with additional charges being recorded in H2

FY22.

As a result of the lower level of amortisation charges in H1

FY23 versus the comparative period, net research and development

expenses as recorded in the Income Statement fell by 14% to GBP16.1

million (H1 FY22: GBP18.6 million), being gross spend of GBP25.9

million, less capitalised costs of GBP18.4 million, plus

amortisation charges of GBP8.6 million.

Sales and marketing expenses in the period reduced slightly to

GBP6.9 million (H1 FY22: GBP7.5 million), with administrative

expenses increasing slightly to GBP6.3 million in the period (H1

FY22: GBP6.0 million), partly related to professional costs for the

acquisition of Complex Games in November 2022.

With higher revenue and lower R&D costs, operating profit

rebounded to a profit of GBP6.9 million in the period versus a

GBP1.3 million operating loss in H1 FY22.

Adjusted EBITDA, a measure of cash profit, remained as a small

net outflow in the period (an outflow of GBP0.6 million versus an

outflow of GBP0.9 million in H1 FY22), as Frontier continues to

invest strongly in future titles whilst supporting existing

games.

A net zero corporation tax charge was recorded in the Income

Statement for the period (H1 FY22: GBPnil), since for the full

financial year enhanced deductions from the Video Game Tax Relief

scheme are expected to offset any tax charges on profits. The Group

expects to provide additional corporation tax disclosures in the

FY23 financial statements.

A profit after tax of GBP6.7 million was recorded in the period

(H1 FY22: loss of GBP1.7 million). Basic earnings per share was

17.2 pence (H1 FY22: loss per share of 4.2 pence).

BALANCE SHEET AND CASH FLOW

The Group continues to benefit from a strong balance sheet, with

cash balances of GBP42.6 million at 30 November 2022 (31 May 2022:

GBP38.7 million; 30 November 2021: GBP33.6 million). The

acquisition of Complex Games in November 2022 resulted in a net

cash outflow of GBP8.8 million. Excluding that outflow, cash would

have increased by GBP12.7 million during H1 FY23. That increase in

cash came mainly from working capital movements and tax; cash

balances were boosted by a GBP9 million net working capital inflow,

as high levels of receivables as at 31 May 2022 unwound, and GBP4

million was received from HMRC for Video Game Tax relief claims

relating to FY21. Adjusted EBITDA, a measure of cash profitability,

was a small net outflow (GBP0.6 million) in H1 HY23 as Frontier

continues to invest strongly in new titles whilst supporting

existing games.

CONSOLIDATED INCOME STATEMENT

FOR THE PERIODED 30 NOVEMBER 2022

6 months to 6 months to 12 months

30 November 30 November to 31 May

2022 2021 2022

Notes GBP'000 GBP'000 GBP'000

----------------------------------- ------ ------------- ------------- -----------

Revenue 6 57,118 49,116 114,032

Cost of sales (20,984) (18,326) (40,420)

----------------------------------- ------ ------------- ------------- -----------

Gross profit 36,134 30,790 73,612

Research and development expenses 12 (16,052) (18,593) (46,179)

Sales and marketing expenses (6,893) (7,503) (12,339)

Administrative expenses (6,333) (6,037) (13,558)

----------------------------------- ------ ------------- ------------- -----------

Operating profit/(loss) 6,856 (1,343) 1,536

Net finance costs (137) (310) (592)

----------------------------------- ------ ------------- ------------- -----------

Profit/(loss) before tax 6,719 (1,653) 944

Income tax - - 8,684

----------------------------------- ------ ------------- ------------- -----------

Profit/(loss) for the period

attributable to shareholders 6,719 (1,653) 9,628

----------------------------------- ------ ------------- ------------- -----------

Earnings per share

Basic earnings per share 7 17.2p (4.2p) 24.6p

Diluted earnings per share 7 16.5p (4.2p) 23.7p

All the activities of the Group are classified as continuing.

The accompanying accounting policies and notes form part of this financial information.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 NOVEMBER 2022

6 months to 6 months to 12 months

to

30 November 30 November 31 May 2022

2022 2021

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------ ------------ ------------

Profit/(loss) for the period 6,719 (1,653) 9,628

Other comprehensive income

Items that will be reclassified subsequently

to profit or loss:

Exchange differences on translation

of foreign operations 23 (12) (19)

---------------------------------------------- ------------ ------------ ------------

Total comprehensive income/(loss) for

the period attributable to the equity

holders of the parent 6,742 (1,665) 9,609

---------------------------------------------- ------------ ------------ ------------

The accompanying accounting policies and notes form part of this

financial information.

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

AS AT 30 NOVEMBER 2022

(REGISTERED COMPANY NO: 02892559)

30 November 30 November

Notes 2022 2021 31 May 2022

GBP'000 GBP'000 GBP'000

------------------------------- -------- --------------- -------------- --------------

Non-current assets

Intangible assets 8 79,012 73,508 70,833

Property, plant and equipment 9 6,171 6,967 6,640

Goodwill 11 10,385 - -

Right-of-use asset 18,673 20,296 19,484

Deferred tax asset 1,349 384 1,348

Total non-current assets 115,590 101,155 98,305

------------------------------- -------- --------------- -------------- --------------

Current assets

Trade and other receivables 11,191 27,845 24,705

Current tax asset 4,094 2,511 7,867

Cash and cash equivalents 42,639 33,561 38,699

------------------------------- -------- --------------- -------------- --------------

Total current assets 57,924 63,917 71,271

------------------------------- -------- --------------- -------------- --------------

Total assets 173,514 165,072 169,576

------------------------------- -------- --------------- -------------- --------------

Current liabilities

Trade and other payables (18,430) (20,167) (21,797)

Lease liability (1,483) (1,440) (1,461)

Deferred income (2,769) (1,327) (2,466)

Total current liabilities (22,682) (22,934) (25,724)

------------------------------- -------- --------------- -------------- --------------

Net current assets 35,242 40,983 45,547

------------------------------- -------- --------------- -------------- --------------

Non-current liabilities

Provisions (63) (49) (56)

Lease liability (18,525) (20,008) (19,278)

Other payables (5,547) (8,825) (6,148)

Total non-current liabilities (24,135) (28,882) (25,482)

------------------------------- -------- --------------- -------------- --------------

Total liabilities (46,817) (51,816) (51,206)

------------------------------- -------- --------------- -------------- --------------

Net assets 126,697 113,256 118,370

------------------------------- -------- --------------- -------------- --------------

Equity

Share capital 10 197 197 197

Share premium account 36,468 36,368 36,468

Equity reserve (11,998) (8,635) (12,769)

Foreign exchange reserve 5 (11) (18)

Retained earnings 102,025 85,337 94,492

------------------------------- -------- --------------- -------------- --------------

Total equity 126,697 113,256 118,370

------------------------------- -------- --------------- -------------- --------------

The accompanying accounting policies and notes form part of this

financial information.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 NOVEMBER 2022

Foreign

Share Share premium Equity exchange Retained Total

capital account reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 May 2021 197 36,079 (9,351) 1 86,228 113,154

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

Loss for the period - - - - (1,653) (1,653)

Other comprehensive income:

Exchange differences on

translation

of foreign operations - - - (12) - (12)

Total comprehensive loss

for

the period - - - (12) (1,653) (1,665)

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

Issue of share capital net

of expenses - 289 - - - 289

Share-based payment charges - - 1,175 - - 1,175

Share-based payment

transfer

relating to option

exercises

and lapses - - (762) - 762 -

Employee Benefit Trust net

cash inflows from option

exercises - - 303 - - 303

Transactions with owners - 289 716 - 762 1,767

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

At 30 November 2021 197 36,368 (8,635) (11) 85,337 113,256

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

Profit for the period - - - - 11,281 11,281

Other comprehensive income:

Exchange differences on

translation

of foreign operations - - - (7) - (7)

Total comprehensive income

for the period - - - (7) 11,281 11,274

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

Issue of share capital net

of expenses - 100 - - - 100

Share-based payment charges - - 1,277 - - 1,277

Share-based payment

transfer

relating to option

exercises

and lapses - - (614) - 614 -

Employee Benefit Trust cash

outflows from share

purchases - - (5,000) - - (5,000)

Employee Benefit Trust net

cash inflows from option

exercises - - 203 - - 203

Deferred tax movements

posted

directly to reserves - - - - (2,740) (2,740)

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

Transactions with owners - 100 (4,134) - (2,126) (6,160)

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

At 31 May 2022 197 36,468 (12,769) (18) 94,492 118,370

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

Profit for the period - - - - 6,719 6,719

Other comprehensive income:

Exchange differences on

translation

of foreign operations - - - 23 - 23

Total comprehensive income

for the period - - - 23 6,719 6,742

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

Share-based payment charges - - 1,305 - - 1,305

Share-based payment

transfer

relating to option

exercises

and lapses - - (814) - 814 -

Employee Benefit Trust net

cash inflows from option

exercises - - 280 - - 280

Transactions with owners - - 771 - 814 1,585

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

At 30 November 2022 197 36,468 (11,998) 5 102,025 126,697

---------------------------- -------------- --------------- --------------- --------------- ---------- ---------

The accompanying accounting policies and notes form part of this

financial information.

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE PERIODED 30 NOVEMBER 2022

6 months to 6 months to 12 months

30 November 30 November to

2022 2021 31 May 2022

GBP'000 GBP'000 GBP'000

------------------------------------------------- ------------- ------------- ---------------

Profit before taxation 6,719 (1,653) 944

Adjustments for:

Depreciation and amortisation 12,289 15,481 32,199

Impairment of intangible assets - - 7,398

Movement in unrealised exchange (gains)/losses

on forward contracts (817) 1,224 474

Share-based payment expenses 1,305 1,175 2,452

Interest received (166) (14) (57)

Payment of interest element of lease

liabilities 303 325 649

Research and Development Expenditure

Credit (RDEC) - - (375)

Working capital changes:

Change in trade and other receivables 15,451 (14,105) (10,964)

Change in trade and other payables (6,228) 2,929 4,465

Change in provisions 7 7 15

------------------------------------------------- ------------- ------------- ---------------

Cash generated from operations 28,863 5,369 37,200

Taxes received 4,021 3,957 3,956

Net cash flows from operating activities 32,884 9,326 41,156

------------------------------------------------- ------------- ------------- ---------------

Investing activities

Purchase of property, plant and equipment (645) (1,779) (2,500)

Expenditure on intangible assets (18,895) (15,969) (36,243)

Acquisition of subsidiaries (net of (8,847) - -

cash acquired)

Interest received 166 14 57

Net cash flows used in investing activities (28,221) (17,734) (38,686)

------------------------------------------------- ------------- ------------- ---------------

Financing activities

Proceeds from issue of share capital - 289 389

Employee Benefit Trust cash outflows

from share purchases - - (5,000)

Employee Benefit Trust cash inflows

from option exercises 280 303 506

Payment of principal element of lease

liabilities (731) (709) (1,419)

Payment of interest element of lease

liabilities (303) (325) (649)

Net cash flows used in financing activities (754) (442) (6,173)

------------------------------------------------- ------------- ------------- ---------------

Net change in cash and cash equivalents

from continuing operations 3,909 (8,850) (3,703)

Cash and cash equivalents at beginning

of period 38,699 42,423 42,423

Exchange differences on cash and cash

equivalents 31 (12) (21)

Cash and cash equivalents at end of

period 42,639 33,561 38,699

------------------------------------------------- ------------- ------------- ---------------

The accompanying accounting policies and notes form part

of this financial information.

NOTES TO THE FINANCIAL INFORMATION

1. CORPORATE INFORMATION

Frontier Developments plc (the 'Company') and its subsidiaries

(together, the 'Group') develops and publishes video games for the

interactive entertainment sector. The Company is a public limited

company and is incorporated and domiciled in the United

Kingdom.

The address of its registered office is 26 Science Park, Milton

Road, Cambridge CB4 0FP.

The Group's operations are based in the UK, with subsidiaries

based in Canada and the US.

2. BASIS OF PREPARATION AND STATEMENT OF COMPLIANCE

Basis of preparation

The consolidated interim financial statements have been prepared

in accordance with International Accounting Standard 34 'Interim

Financial Reporting' (IAS 34), as issued by the International

Accounting Standards Board (IASB) and as adopted by the UK, and the

disclosure requirements of the Listing Rules.

The consolidated interim financial statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006, and have not been audited or reviewed by the

Company's auditors.

The consolidated interim financial statements should be read in

conjunction with the financial statements for the year ended 31 May

2022.

Statutory accounts for the year ended 31 May 2022 were approved

by the Board of Directors on 21 September 2022 and delivered to the

Registrar of Companies. The Auditor's Report was unqualified, did

not contain an emphasis of matter paragraph and did not contain any

statement under section 498 of the Companies Act 2006.

The financial information has been prepared under the historical

cost convention except for financial instruments held at fair

value. The financial information is presented in Sterling, the

presentation and functional currency for the Group and Company. All

values are rounded to the nearest thousand pounds (GBP'000) except

when otherwise indicated.

Going concern basis

The Group's forecasts and projections, taking account of current

cash resources and reasonably possible changes in trading

performance, support the conclusion that there is a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future, a period of not

less than 12 months from the date of approval of these financial

statements. The Group therefore continues to adopt the going

concern basis in preparing its financial statements.

3. ACCOUNTING POLICIES

Except for the application for UK-adopted international

accounting standards, for which there are no material differences

from International Financial Reporting Standards as issued by the

IASB and adopted by the EU when applied to the Group, the

consolidated interim financial statements have been prepared in

accordance with the accounting policies adopted in the Group's most

recent annual financial statements for the year ended 31 May

2022.

4. ACCOUNTING ESTIMATES AND KEY JUDGEMENTS

When preparing the interim financial statements, management

undertakes a number of judgements, estimates and assumptions about

recognition and measurements of assets, liabilities, income and

expenses. The actual results may differ from these estimates.

The judgements, estimates and assumptions applied in the interim

financial statements, including the key sources of estimation

uncertainty, were the same as those applied in the Group's last

annual financial statements for the year ended 31 May 2022.

5. SIGNIFICANT EVENTS AND TRANSACTIONS

There were no significant events or transactions in the interim

period (1 June 2022 to 30 November 2022) which were not included

within the interim financial statements. There have been no

significant events or transactions during the period from the end

of the interim period to the day preceding the date of this report

(1 December 2022 to 18 January 2023).

6. SEGMENT INFORMATION

The Group identifies operating segments based on internal

management reporting that is regularly reviewed by the chief

operating decision maker and reported to the Board. The chief

operating decision maker is the Chief Executive Officer.

Management information is reported as one operating segment,

being revenue from publishing games and revenue from other streams

such as royalties and licensing.

The Group does not provide any information on the geographical

location of sales as the majority of revenue is through third-party

distribution platforms which are responsible for the sales data of

consumers. The cost to develop this information internally would be

excessive.

The majority of the Group's non-current assets are held within

the UK.

All material revenue is categorised as either publishing revenue

or other revenue.

The Group typically satisfies its performance obligations at the

point that the product becomes available to the customer.

Other revenue mainly related to royalty income in H1 FY23, H1

FY22 and FY22.

6 months to 6 months to 12 months

30 November 30 November to 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------- ------------- -----------

Publishing revenue 56,971 48,893 113,555

Other revenue 147 223 477

------------------------------------------- ------------- ------------- -----------

Total revenue 57,118 49,116 114,032

------------------------------------------- ------------- ------------- -----------

Cost of sales (20,984) (18,326) (40,420)

------------------------------------------- ------------- ------------- -----------

Gross profit 36,134 30,790 73,612

------------------------------------------- ------------- ------------- -----------

Research and development expenses (16,052) (18,593) (46,179)

Sales and marketing expenses (6,893) (7,503) (12,339)

Administrative expenses (6,333) (6,037) (13,558)

------------------------------------------- ------------- ------------- -----------

Operating profit/(loss) 6,856 (1,343) 1,536

------------------------------------------- ------------- ------------- -----------

Net finance costs (137) (310) (592)

------------------------------------------- ------------- ------------- -----------

Profit/(loss) before tax 6,719 (1,653) 944

------------------------------------------- ------------- ------------- -----------

Income tax - - 8,684

------------------------------------------- ------------- ------------- -----------

Profit/(loss) for the period attributable

to shareholders 6,719 (1,653) 9,628

------------------------------------------- ------------- ------------- -----------

7. EARNINGS PER SHARE

The calculation of the basic earnings per share is based on the

profit/(loss) attributable to the shareholders of Frontier

Developments plc divided by the weighted average number of shares

in issue during the period.

6 months 6 months to 12 months

to 30 November 30 November to 31 May

2022 2021 2022

-------------------------------------------- ---------------- ---------------- ----------------

Profit/(loss) attributable to shareholders

(GBP'000) 6,719 (1,653) 9,628

Weighted average number of shares 39,018,948 39,162,921 39,172,987

-------------------------------------------- ---------------- ---------------- ----------------

Basic earnings per share (p) 17.2 (4.2) 24.6

-------------------------------------------- ---------------- ---------------- ----------------

The calculation of the diluted earnings per share is based on the profit/(loss)

attributable to the shareholders of Frontier Developments plc divided

by the weighted average number of shares in issue during the period

as adjusted for the dilutive effect of share options.

6 months 6 months 12 months

to 30 November to 30 November to 31 May

2022 2021 2022

-------------------------------------------- ---------------- ---------------- --------------

Profit/(loss) attributable to shareholders

(GBP'000) 6,719 (1,653) 9,628

Diluted weighted average number of

shares 40,598,671 39,162,921 40,606,756

-------------------------------------------- ---------------- ---------------- --------------

Diluted earnings per share (p) 16.5 (4.2) 23.7

-------------------------------------------- ---------------- ---------------- --------------

The reconciliation of the average number of Ordinary Shares used for

basic and diluted earnings per share is as follows:

------------------------------------------------------------------------------------------------

6 months 6 months 12 months

to 30 November to 30 November to

2022 2021 31 May 2022

-------------------------------------------- ---------------- ---------------- --------------

Weighted average number of shares 39,018,948 39,162,921 39,172,987

Dilutive effect of share options 1,579,723 - 1,433,769

-------------------------------------------- ---------------- ---------------- --------------

Diluted average number of shares 40,598,671 39,162,921 40,606,756

-------------------------------------------- ---------------- ---------------- --------------

The dilutive effect of share options is nil for the 6 months to

30 November 2021 because a loss was recorded for that period.

8. INTANGIBLE ASSETS

Game technology Game developments Third-party

GBP'000 GBP'000 software IP licences Total

GBP'000 GBP'000 GBP'000

------------------------------- ---------------- ------------------ ------------ -------------- ----------

Cost

At 31 May 2021 17,009 97,119 2,060 11,185 127,373

Additions 1,254 14,557 158 - 15,969

At 30 November 2021 18,263 111,676 2,218 11,185 143,342

Additions 1,470 17,939 172 - 19,581

Disposals - (222) - - (222)

------------------------------- ---------------- ------------------ ------------ -------------- ----------

At 31 May 2022 19,733 129,393 2,390 11,185 162,701

Additions 1,643 16,786 106 - 18,535

On acquisition - - 62 - 62

------------------------------- ---------------- ------------------ ------------ -------------- ----------

At 30 November 2022 21,376 146,179 2,558 11,185 181,298

------------------------------- ---------------- ------------------ ------------ -------------- ----------

Amortisation and impairment

At 31 May 2021 7,058 46,434 1,227 1,336 56,055

Amortisation charges 1,058 11,115 229 1,377 13,779

------------------------------- ---------------- ------------------ ------------ -------------- ----------

At 30 November 2021 8,116 57,549 1,456 2,713 69,834

Amortisation charges 1,057 13,245 195 361 14,858

Impairment charge - 7,398 - - 7,398

Disposals - (222) - - (222)

------------------------------- ---------------- ------------------ ------------ -------------- ----------

At 31 May 2022 9,173 77,970 1,651 3,074 91,868

Amortisation charges 1,512 7,293 210 1,341 10,356

On acquisition - - 62 - 62

------------------------------- ---------------- ------------------ ------------ -------------- ----------

At 30 November 2022 10,685 85,263 1,923 4,415 102,286

------------------------------- ---------------- ------------------ ------------ -------------- ----------

Net book value

Net book value at 30 November

2022 10,691 60,916 635 6,770 79,012

------------------------------- ---------------- ------------------ ------------ -------------- ----------

Net book value at 31 May

2022 10,560 51,423 739 8,111 70,833

------------------------------- ---------------- ------------------ ------------ -------------- ----------

Net book value at 30 November

2021 10,147 54,127 762 8,472 73,508

------------------------------- ---------------- ------------------ ------------ -------------- ----------

Net book value at 31 May

2021 9,951 50,685 833 9,849 71,318

------------------------------- ---------------- ------------------ ------------ -------------- ----------

9. PROPERTY, PLANT AND EQUIPMENT

Fixtures Computer Leasehold Total

and fittings equipment improvements

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- -------------- ----------- -------------- --------

Cost

At 31 May 2021 863 4,156 5,358 10,377

Additions - 1,779 - 1,779

------------------------------- -------------- ----------- -------------- --------

At 30 November 2021 863 5,935 5,358 12,156

Additions 5 716 - 721

------------------------------- -------------- ----------- -------------- --------

At 31 May 2022 868 6,651 5,358 12,877

Additions - 606 39 645

On acquisition 12 98 53 163

------------------------------- -------------- ----------- -------------- --------

At 30 November 2022 880 7,355 5,450 13,685

------------------------------- -------------- ----------- -------------- --------

Depreciation

At 31 May 2021 546 2,737 1,016 4,299

Charge for the period 75 648 167 890

------------------------------- -------------- ----------- -------------- --------

At 30 November 2021 621 3,385 1,183 5,189

Charge for the period 75 805 168 1,048

------------------------------- -------------- ----------- -------------- --------

At 31 May 2022 696 4,190 1,351 6,237

Charge for the period 75 878 168 1,121

On acquisition 5 98 53 156

------------------------------- -------------- ----------- -------------- --------

At 30 November 2022 776 5,166 1,572 7,514

------------------------------- -------------- ----------- -------------- --------

Net book value

Net book value at 30 November

2022 104 2,189 3,878 6,171

-------------------------------

Net book value at 31 May 2022 172 2,461 4,007 6,640

------------------------------- -------------- ----------- -------------- --------

Net book value at 30 November

2021 242 2,550 4,175 6,967

------------------------------- -------------- ----------- -------------- --------

Net book value at 31 May 2021 317 1,419 4,342 6,078

------------------------------- -------------- ----------- -------------- --------

10. SHARE CAPITAL

Number Nominal Value

GBP

------------------------------------------------ ----------- --------------

At 1 June 2021 39,343,604 196,718

------------------------------------------------ ----------- --------------

Shares issued on option exercises and warrants 49,651 248

------------------------------------------------ ----------- --------------

At 30 November 2021 39,393,255 196,966

------------------------------------------------ ----------- --------------

Shares issued on option exercises and warrants 30,094 151

------------------------------------------------ ----------- --------------

At 31 May 2022 39,423,349 197,117

------------------------------------------------ ----------- --------------

Shares issued on option exercises and warrants - -

------------------------------------------------ ----------- --------------

At 30 November 2022 39,423,349 197,117

------------------------------------------------ ----------- --------------

11. ACQUISITION OF COMPLEX GAMES INC

On 1 November 2022, Frontier Developments plc acquired

experienced game development studio Complex Games Inc ('Complex')

following a successful collaboration with the development and

launch of Warhammer 40,000: Chaos Gate - Daemonhunters.

Frontier acquired 100% of the share capital in Complex for an

upfront cash consideration of CAD$13 million (GBPGBP8.3 million)

and conditional deferred cash consideration of up to CAD$5.16

million (GBPGBP3.3 million), which is payable subject to Complex

meeting certain operational milestones during the period to 31

December 2023.

In addition, the four employee shareholders - the two founders

and the two studio principals - will participate in a profit-share

earn-out of up to CAD$11.76 million (GBPGBP7.5 million) payable

over 5 years.

Acquisition accounting in the H1 FY23 financial results is

provisional, due to the short time since the acquisition of Complex

and the date of the interim financial statements. The assessment of

the fair value of the assets acquired is subject to change, since

the purchase price allocation review is still in progress. It is

expected that this work will be completed by 31 May 2023 to enable

the acquisition accounting to be finalised in the full year FY23

financial results.

In the H1 FY23 financial results, a provisional fair value of

the assets of Complex as at 1 November 2022 of CAD$2.0 million

(GBPGBP1.3 million) has been applied. After adjusting the total of

the upfront consideration (CAD$13 million, GBPGBP8.3 million) and

deferred consideration (CAD$5.16 million, GBPGBP3.3 million) for

the net position on cash and working capital, the total

consideration accounted for was CAD$18.4 million (GBPGBP11.7

million). This has resulted in a provisional goodwill balance of

GBPGBP10.4 million, which is included on the Consolidated Statement

of Financial Position in the interim financial statements.

12. KEY PERFORMANCE INDICATORS - NON-STATUTORY MEASURES

In addition to measures of financial performance derived from

IFRS reported results - revenue, operating profit, operating profit

margin percentage, earnings per share and net cash balance -

Frontier publishes, and provides commentary on, financial

performance measurements derived from non-statutory calculations.

Frontier believes these supplementary measures, when read in

conjunction with the measures derived directly from statutory

financial reporting, provide a better understanding of Frontier's

overall financial performance.

EBITDA

EBITDA, being earnings before tax, interest, depreciation and

amortisation, is commonly used by investors when assessing the

financial performance of companies. It attempts to arrive at a

'cash profit' figure by adjusting operating profit for non-cash

depreciation and amortisation charges. In Frontier's case, EBITDA

does not provide a clear picture of the Group's cash profitability,

as it adds back amortisation charges relating to game developments,

but without deducting the investment costs for those developments,

resulting in a profit measure which does not take into account any

of the costs associated with developing games. Since EBITDA is a

commonly used financial performance measure, it has been included

below for the benefit of readers of the accounts who may value that

measure of performance.

6 months to 12 months

30 November 6 months to to

2022 30 November 2021 31 May 2022

GBP'000 GBP'000 GBP'000

------------------------------- ------------- ------------------ -------------

Operating profit/(loss) 6,856 (1,343) 1,536

Depreciation and amortisation 12,291 15,481 32,199

Impairment of intangible

assets - - 7,398

EBITDA 19,147 14,138 41,133

------------------------------- ------------- ------------------ -------------

Adjusted EBITDA

Frontier also discloses an Adjusted EBITDA measure which, in the

Company's view, provides a better representation of 'cash profit'

than EBITDA. Adjusted EBITDA for Frontier is defined as earnings

before interest, tax, depreciation and amortisation charges related

to game developments and Frontier's game technology, less

investments in game developments and Frontier's game technology,

and excluding share-based payment charges and other non-cash items.

This effectively provides the cash profit figure that would have

been achieved if Frontier expensed all game development investment

as it was incurred, rather than capitalising those costs and

amortising them over several years.

6 months

to 6 months to 12 months

30 November 30 November to 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

--------------------------------------------- -------------- ------------- ------------------------

Operating profit/(loss) 6,856 (1,343) 1,536

Add back non-cash intangible asset

amortisation charges for game developments

and Frontier's game technology 8,589 12,173 26,475

Add back non-cash intangible asset

impairment charge for game developments - - 7,398

Deduct capitalised investment costs

in game developments and Frontier's

game technology (18,429) (15,811) (35,220)

Add back non-cash depreciation charges 1,934 1,702 3,562

Add back non-cash movements in unrealised

exchange (gains)/losses on forward

contracts (817) 1,224 474

Add back non-cash share-based payment

expenses 1,305 1,175 2,452

Adjusted EBITDA (562) (880) 6,677

--------------------------------------------- -------------- ------------- ------------------------

Research and development (R&D) expenses

Research and development (R&D) expenses recorded in

Frontier's Income Statement are arrived at after capitalising game

development costs and after recording amortisation charges for

games which have been released. Similar to the principles of the

Adjusted EBITDA measure showing financial performance as if all

game development investments were expensed as incurred, Frontier

provides commentary on the difference between gross R&D

expenses (before capitalisation/amortisation) and net R&D

expenses (after capitalisation/amortisation). The net R&D

expenses figure aligns with the R&D expenses recorded in the

Income Statement, whereas the gross R&D expenses figure

provides a better representation of 'cash spend' on R&D

activities.

6 months 6 months

to to 12 months

30 November 30 November to

2022 2021 31 May 2022

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------------- ------------- -------------

Gross R&D expenses 25,892 22,231 47,526

Capitalised investment costs in

game developments and Frontier's

game technology (18,429) (15,811) (35,220)

Amortisation charges for game developments

and Frontier's game technology 8,589 12,173 26,475

Impairment of intangible assets - - 7,398

Net R&D expenses 16,052 18,593 46,179

-------------------------------------------- --------------- ------------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BPMPTMTBBBLJ

(END) Dow Jones Newswires

January 19, 2023 02:00 ET (07:00 GMT)

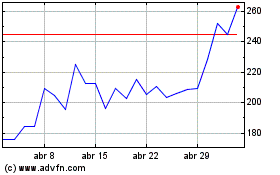

Frontier Developments (LSE:FDEV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Frontier Developments (LSE:FDEV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024