TIDMGLV

RNS Number : 3767M

Glenveagh Properties plc

14 September 2023

14 September 2023

Glenveagh Properties plc

Interim Results 2023

Glenveagh Properties plc ("Glenveagh" or the "Group") a leading

Irish homebuilder announces its Interim Results for the period

ended 30 June 2023.

Financial Highlights

Six Months to 30 Six Months to 30 Change

June 2023 June 2022

------------------------------- ------------------------------ ------------------------------- --------------------

Revenue EUR'm 171.6 200.0 -14%

------------------------------- ------------------------------ ------------------------------- --------------------

* Suburban 109.7 88.9 +23%

------------------------------- ------------------------------ ------------------------------- --------------------

* Urban 61.9 111.1 -44%

------------------------------- ------------------------------ ------------------------------- --------------------

Gross profit EUR'm 27.9 32.9 -15%

------------------------------- ------------------------------ ------------------------------- --------------------

* Suburban 20.5 15.4 +33%

------------------------------- ------------------------------ ------------------------------- --------------------

* Urban 7.5 17.5 -57%

------------------------------- ------------------------------ ------------------------------- --------------------

Gross margin 16.3% 16.5% -20 bps

------------------------------- ------------------------------ ------------------------------- --------------------

* Suburban 18.7% 17.3% +140 bps

------------------------------- ------------------------------ ------------------------------- --------------------

* Urban 12.1% 15.8% -370 bps

------------------------------- ------------------------------ ------------------------------- --------------------

Profit before tax

EUR'm 1.4 13.0 -89%

------------------------------- ------------------------------ ------------------------------- --------------------

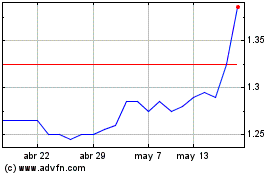

Earnings Per Share

(cent) 0.21 1.32 -84%

------------------------------- ------------------------------ ------------------------------- --------------------

30 June 2023 30 June 2022

------------------------------- ------------------------------ ------------------------------- --------------------

Land EUR'm 447.0 513.0 -13%

------------------------------- ------------------------------ ------------------------------- --------------------

Work in Progress

EUR'm 317.6 291.9 +9%

------------------------------- ------------------------------ ------------------------------- --------------------

Operating cash flow

EUR'm (93.2) (17.5)

------------------------------- ------------------------------ ------------------------------- --------------------

Net Debt EUR'm 182.2 97.5 +EUR85m

------------------------------- ------------------------------ ------------------------------- --------------------

Total Equity EUR'm 637.2 707.2 -10%

------------------------------- ------------------------------ ------------------------------- --------------------

Suburban

Completions 333 257 +30%

------------------------------- ------------------------------ ------------------------------- --------------------

Suburban: Closed &

forward order book

- units(1) 1,782 1,831 -3%

------------------------------- ------------------------------ ------------------------------- --------------------

Suburban: Closed &

forward order book

- EUR'm(1) 563.1 588.1 -4%

------------------------------- ------------------------------ ------------------------------- --------------------

Group: Closed &

forward order book

- EUR'm(1) 1136.7 989.8 +15%

------------------------------- ------------------------------ ------------------------------- --------------------

(1) As at 11 September 2023. Prior year data disclosed

as at 9 September 2022

Trading Summary

-- We reiterate our FY 2023 guidance, anticipating an EPS outturn of 7.5-8.0 cents

-- The Group performed to expectation in H1 2023 and increased

suburban margin, secured approvals for both of its Partnerships

sites, and benefitted from strong planning momentum. Profitability

was impacted primarily by lower urban revenues, reflecting a higher

H1 2022 comparative that included approximately EUR63m from the

disposal of the East Road site, along with increased financing

costs

-- The Group has been granted permissions for approximately

4,000 units so far this year, some 700 of which are currently in

post-grant appeal periods

-- Our strategy of supply chain integration, combined with our

scale and long-term supply chain commitments, enabled us to

mitigate build cost inflation to a 4-5% level in H1 2023

-- In June we launched NUA, the innovative manufacturing and new

technology arm of the Group. NUA will lead innovation in modern

methods of construction in the Irish market. Significant investment

here is now largely completed and the business will have the

capacity to deliver over 2,000 units in FY 2024 from our three

off-site manufacturing facilities in Carlow, Arklow, and

Dundalk

-- Our share buyback programme, initiated on 6 January 2023, was

completed on 2 August 2023. Approximately EUR63 million was

returned to shareholders, bringing overall returns to over EUR300

million since May 2021

-- Strong progress was also made to further integrate

sustainability throughout the business, alongside the launch of our

Net Zero transition plan in March 2023

-- All suburban units capable of closing in FY 2023 are now

sold, signed or reserved. Further improvement in the suburban

margin is expected in FY 2023 to approximately 19%

-- Approximately EUR120m of revenue will be recognised in FY

2023 from the Group's Urban business segment

-- We anticipate making further efficiencies in our land

investment and expect land value to approach EUR400 million by 31

December 2023, with further efficiencies anticipated in FY 2024.

Work in progress (WIP) at year end is expected to increase on FY

2022 levels, to reflect ongoing developments in our urban

portfolio. Net debt is expected to reach 10-15% of net assets at

year end

Outlook

-- We continue to see a very positive long-term demand outlook

for the Irish residential housing market. Strong private demand is

underpinned by a robust economic environment, a fast-growing

population and supportive demand-side initiatives from the

Government

-- New opportunities are emerging to partner with multiple State

agencies as part of the Government's recent supply-side housing

initiatives. Significant additional funding has been proposed for

the Land Development Agency (LDA). In addition, one of our urban

schemes of over 250 units has been approved under the Croí Cónaithe

programme and this is expected to commence in Q4. Our scale,

operational capability and established expertise in partnership and

urban development models, leaves us ideally positioned to

participate in such initiatives. These have the potential to

generate significant incremental revenue and profits for the Group

over the medium term

-- The improved planning momentum means that the Group has

planning permission for all of its expected deliveries in FY 2024.

Based on planning lodgements year to date and anticipated in the

rest of this year, over 70% of our current landbank will be fully

planned and available for development by the end of FY 2024

-- We are currently active on 24 suburban and urban sites,

including all of our large suburban sites required for FY 2024

delivery

-- In our Partnerships business segment, enabling works have now

commenced on both our Ballymastone and Oscar Traynor Road sites and

we expect to deliver revenue of over EUR100 million in FY 2024,

with an anticipated gross margin of approximately 15%

-- A very healthy land portfolio and forward order book,

combined with strong planning momentum and robust operational and

manufacturing capability, gives the Group increasing confidence in

its capacity to generate strong revenue and profit growth across

its Suburban, Urban and Partnerships business segments in FY 2024.

We are comfortable with current consensus EPS expectations for FY

2024 of approximately 17 cents

-- We continue to remain focused on enhancing capital efficiency

and cash generation across the business, with a renewed focus on

investment in urban development activity in particular. Once our

capital allocation priorities are satisfied, we will continue to

return any excess cash identified to shareholders. This will

underpin the delivery of long-term operational growth and optimal

returns for shareholders, with our Return on Equity target of 15%

in 2024 our key capital metric

CEO Stephen Garvey commented:

"We began the year with three clear objectives - to grow our

portfolio of planned sites, to advance our Partnerships business,

and to transform our manufacturing business.

While planning delays proved challenging at the start to the

year, we have seen a strong upturn in permissions granted through

2023 and are on track to have over 70% of our current landbank

fully planned and available by the end of FY 2024.

We began 2023 with no planning achieved in our Partnerships

segment, to now being commenced on two of the largest such sites in

the country. We are proving that public and private entities can

work successfully together to deliver sustainable mixed tenure

developments.

Partnerships are how substantial housing volume can be delivered

effectively across all tenures. I encourage the Government to focus

on this area as a vehicle to address the housing crisis.

The continued reform of planning policy and system, as well as

the Government's demand and supply side initiatives, are showing

positive results too.

NUA is now at scale to deliver in 2024. This business gives us

an excellent platform for delivering greater volumes of

sustainable, high-quality, energy-efficient new homes using modern

methods of construction.

The outlook across Glenveagh's businesses is favourable and the

opportunities are compelling. We are ideally placed to serve what

continues to be strong private demand, in addition to working

constructively with State agencies on supply-side initiatives.

Accelerating the provision of new housing is critical to help

sustain economic strength and to accommodate our young and

fast-growing population."

Results Presentation

A webcast presentation of the results for analysts and

institutional investors will take place at 8.30am on 14 September

2023. The presentation slides will be available on the Investor

Relations section on www.glenveagh.ie from 7.00am on 14 September

2023.

This presentation can also be accessed live from the Investor

Relations section on www.glenveagh.ie or alternatively via

conference call.

Conference call: Click here to register for conference call

Audio webcast: Click here for webcast

Registration and access details are also available at

www.glenveagh.ie/corporate/investor-centre/investors-events

For further information please contact:

Investors: Media:

Glenveagh Properties plc Gordon MRM

Michael Rice (CFO) Ray Gordon 087 241 7373

Jack Gorman (Head of IR and Corporate David Clerkin 087 830 1779

Affairs) glenveagh@gordonmrm.ie

investors@glenveagh.ie

----------------------------

Note to Editors

Glenveagh Properties plc, listed on Euronext Dublin and the

London Stock Exchange, is a leading Irish homebuilder.

Supported by innovation and supply chain integration, Glenveagh

are committed to opening access to sustainable high-quality homes

to as many people as possible in flourishing communities across

Ireland. We are focused on three core markets - suburban housing,

urban apartments and partnerships with local authorities and state

agencies.

www.glenveagh.ie

Forward-looking statements

This announcement does not constitute or form any part of an

invitation to underwrite, subscribe for or otherwise acquire or

dispose of any shares of Glenveagh Properties plc ("Glenveagh" or

"the Group").

This announcement contains statements that are, or may be deemed

to be, forward-looking statements. Forward-looking statements

include, but are not limited to, information concerning the Group's

possible or assumed future results of operations, plans and

expectations regarding demand outlook, business strategies,

financing plans, competitive position, potential growth

opportunities, potential operating performance improvements,

expectations regarding inflation, macroeconomic uncertainty,

geopolitical tensions, weather patterns, the effects of competition

and the effects of future legislation or regulations.

Forward-looking statements include all statements that are not

historical facts and can be identified by the use of

forward-looking terminology such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "ensure", "arrive", "achieve", "develop" or

"believe" (or the negatives thereof) or other variations thereon or

comparable terminology. Forward-looking statements are prospective

in nature and are based on current expectations of the Group about

future events, and involve risks and uncertainties because they

relate to events and depend on circumstances that will occur in the

future. Although Glenveagh believes that current expectations and

assumptions with respect to these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to be correct. Due to various risks and uncertainties, actual

events or results or actual performance of the Group may differ

materially from those reflected or contemplated in such

forward-looking statements. You are cautioned not to place undue

reliance on any forward-looking statements.

These forward-looking statements are made as of the date of this

document. Glenveagh expressly disclaims any obligation to update

these forward-looking statements other than as required by law.

The forward-looking statements in this announcement do not

constitute reports or statements published in compliance with any

of Regulations 6 to 8 of the Transparency (Directive 2004/109/EC)

Regulations 2007 (as amended).

GLENVEAGH PROPERTIES PLC: BUSINESS AND FINANCIAL REVIEW

1. BUSINESS REVIEW

i. Group Sales

a. Overview

The Group had total revenue of EUR171.6 million (H1 2022:

EUR200.0 million), relating to the completion of 333 suburban units

(H1 2022: 257) in the period and revenue recognised from the

significant monetisation of Urban assets.

b. Suburban

The Group reported suburban revenue of EUR109.7 million, an

increase of 23% reflecting the Group's strong operational

performance in a market that continues to benefit from very strong

underlying demand.

In H1 2023, 333 suburban units were closed. This represented a

30% increase on the 257 units closed in H1 2022. Multiple sites are

now set up to deliver over 100 units per annum which allows the

business to generate enhanced operational efficiencies, that in

turn underpins faster profit generation and improvements in the

Group's Return on Equity.

ASP in H1 2023 was approximately EUR324k (H1 2022: EUR332k). A

mid-single digit increase in underlying House Price Inflation

("HPI") was more than offset by a change in both the product and

site mix in the period, reflecting our commitment to delivering

homes that are affordable for our customers.

Underlying market demand for new homes continued to be very

strong in H1 2023, driven by a robust economic environment, a

fast-growing population and supportive demand-side initiatives from

the Government.

In H1 2023, the Group delivered approximately 140 units

(approximately 40% of our suburban units) as part of these

Government support initiatives to provide social and affordable

housing.

On 1 January 2023 the scope of the First Home Scheme was

significantly extended to an additional cohort of buyers by

increasing the price ceilings that apply in 30 of Ireland's 31

local authority areas. A further upward adjustment was made to the

price ceiling in three local authorities on 1 July 2023. These

changes will provide more first-time buyers with enhanced access to

new housing developments. The scheme is designed to bridge the gap

between a first-time buyer's deposit and mortgage and the price of

the new home, providing up to 30% of the price of the home and

supporting affordability for first-time buyers, a key target market

for Glenveagh.

Customer affordability was further supported by the change in

the Central Bank of Ireland's macroprudential rules, announced in

October 2022 and effective from 1 January 2023. This increased

borrowing capacity materially among the first-time buyer cohort, up

to 4x income compared to a 3.5x limit previously.

c. Urban

We continue to make strong progress in our Urban business

segment, with a particular focus this year on building out the

significant projects that are already underway. All projects are on

track for delivery in FY 2023 and FY 2024 and are detailed in the

following table.

Urban assets Transaction H1 2023 H2 2023 FY 2024

Type revenue (EURm) revenue revenue

(EURm)* (EURm)*

Premier Inn

hotel Forward fund 13 3 -

-------------- ---------------- --------- ---------

Citywest Forward fund 24 13 10

-------------- ---------------- --------- ---------

Castleknock Forward fund 23 19 6

-------------- ---------------- --------- ---------

Marina Village Forward sale - 17 -

-------------- ---------------- --------- ---------

Cluain Mhuire Forward sale - - 70

-------------- ---------------- --------- ---------

* approximate revenue that is anticipated to be delivered in H2

2023 and FY 2024

The residual asset in the Docklands portfolio is the office

development of approximately 100,000sqft which is being constructed

in conjunction with the Premier Inn hotel. Notwithstanding a

challenging commercial office environment, the office development

is already attracting interest from high calibre clients due to its

location, pricing and impressive sustainability credentials.

Completion is anticipated in FY 2024.

The Group is also in negotiations with State agencies on a

number of its urban developments for prospective delivery from FY

2024 and beyond , including t he Croí Cónaithe programme which is

being advanced to activate the owner occupier apartment market. One

of our urban schemes of over 250 units has been approved under the

Croí Cónaithe programme and this is expected to commence in Q4.

d. Partnerships

Significant progress has been made by the Group in its

Partnerships business segment this year, leaving the business

ideally placed to deliver on its target to deliver revenue and

profits from this segment from FY 2024.

Both Ballymastone and Oscar Traynor Road received final planning

permissions and enabling works have commenced on both sites.

The Group expects to deliver revenue of over EUR100 million from

these two sites in FY 2024 , with an anticipated gross margin of

approximately 15%.

In addition, new resources and funding are now being provided by

the Government for supply-side housing initiatives, the most

significant recent initiative of which is proposed further funding

to the LDA.

Our scale, operational capability and established expertise in

partnership models leave us ideally positioned to advance such

opportunities as they relate to both our Urban and Partnerships

segments. These have the potential to generate significant

incremental revenue and profits for the Group over the medium

term.

ii. Forward Order Book

The continued strength of the Irish market is demonstrated

through our strong performance to date in 2023 and forward order

book, which total EUR1.14 billion. The forward order book in the

suburban business of EUR563.1 million, comprising 1,782 units,

gives good visibility on deliveries in FY 2023 and early FY 2024.

In addition, the forward order book includes revenue in FY 2023 and

FY 2024 to be recognised from the five executed transactions within

the Urban business segment, as well as the contracted element of

the Partnerships business segment.

Strong reservation rates in our Suburban business segment is

evidence of the strong underlying market demand that is supported

by the resilience of the domestic economy and by the updated

Housing for All initiatives and the change to the Central Bank of

Ireland's macroprudential rules that both became effective in

January 2023. Customer demand is further strengthened by the

continued undersupply across the market of high-quality, affordable

housing in Ireland.

We are currently active on 24 suburban and urban sites,

including all of our large suburban sites required for FY 2024

delivery.

iii. Planning Progress and Policy

The Group has made significant progress in what has been an

improving planning environment in FY 2023, increasing confidence on

unit delivery in FY 2024 and beyond. Additional resourcing has been

provided to An Bord Pleanála and the efficiency of its applications

processing is improving.

So far in 2023, we have lodged planning applications for

approximately 2,400 units. The Large-Scale Residential (LRD)

process is functioning well to date and the Group has lodged

several applications under this process, with several successful

grants already received within or ahead of guided timelines.

In our FY 2022 Results Statement we noted that the Group was

also exploring the option to re-lodge its four outstanding

Strategic Housing Development (SHD) applications, totalling 1,100

suburban units, into the LRD system. Three of these applications

subsequently received approval and the remaining application (for

approximately 170 units) is expected to be re-lodged into the LRD

system.

In FY 2023 to date, the Group has been granted permissions for

approximately 4,000 units across over twenty applications, some 700

of which are currently in post-grant appeal periods.

Overall, the Group is strongly positioned for longer term

growth. The Group has planning permission for all of its expected

deliveries in FY 2024. The improved planning momentum, combined

with our planning applications lodged so far this year and

anticipated for the remainder of 2023, mean that over 70% of our

current landbank will be fully planned and available for

development by the end of FY 2024.

We were encouraged by the Government's Draft Sustainable and

Compact Guidelines for Planning Authorities released in August

2023. Its effective implementation can help ensure medium density

residential schemes are more viable for developers and more

affordable for purchasers. We are also assessing how changes in

density requirements may impact the provision of apartments in

specific locations.

The Draft Planning & Development Bill 2022 was published in

January 2023 and following extensive review and consultation, new

legislation is expected before Government imminently.

The review of the National Planning Framework is underway and we

would urge that this review accurately reflects present and future

population requirements, supports viability and be designed for the

types of homes that the country wants and needs.

Solving the housing crisis effectively will also require

appropriate resourcing across all aspects of the design, planning

and development lifecycle. Providing ample resourcing to planning

bodies, local authorities and utility companies in the near term is

critical for the sustainable delivery of increased housing

supply.

iv. Development Land Portfolio Management

Given the Group's strong land portfolio, the business continues

to take a disciplined and strategic approach to land acquisitions

and remains focused on managing to a 4-5 year land portfolio at

scale.

A key strategic priority for the business has been to reduce the

net investment in land and improve capital efficiency and, in line

with this priority, the Group's land portfolio was EUR447.0 million

at 30 June 2023 (31 December 2022: EUR458.5 million). This

reduction was primarily driven by the movements in the suburban

portfolio, and we anticipate driving more efficiencies from the

landbank in the second half of the year.

The Group's land portfolio comprises approximately 14,800 units

with an average plot cost of approximately EUR30k. By number of

units, the Suburban segment accounts for 71% of the portfolio, with

the remainder comprising Urban segment (15)% and Partnerships

segment (14%). Approximately 70% of the overall portfolio is

located in the Greater Dublin Area.

The Group spent or has contracted to spend a total of

approximately EUR14.4 million on three land sites in H1 2023. These

three sites have the capacity to deliver up to 600 new homes in

sustainable communities.

The Group is focused on prioritising structured land

transactions which will enable more efficient standardisation of

the suburban portfolio as well as maintaining an efficient balance

sheet. The Group is sale agreed on three subject-to-planning deal

structures capable of delivering 450 homes. In addition, the Group

is sale agreed on two sites adjacent to an active construction

site, which will allow the Group to maximise construction and

operational efficiencies in this location by adding a further 160

homes. These five sites were sourced through the Group's Land

Campaign and are expected to complete in the second half of the

year.

A Residential Zoned Land Tax is being introduced in FY 2024,

replacing the current Vacant Site Levy, aimed at incentivising

landowners to use inactive zoned land for housing. This will be a

positive development in that it will provide additional land

investment opportunities for the Group. The Group is also actively

managing and reviewing its existing portfolio to determine the

extent of any relevant tax liability that it may incur.

v. Input Cost Inflation

The construction sector continues to face ongoing supply chain

constraints and volatile commodity prices that continue to impact

input cost price inflation. The Group has several strategies to

mitigate the impact of this inflationary environment. It

collaborates with supply chain partners to secure sustainable,

competitive pricing while maintaining supply security. It uses its

scale and purchasing power to negotiate competitive terms and

pricing, while the Group's supply chain integration strategy also

provides greater control over input costs. In April 2023 the

Government announced that development levies will be removed for a

limited time, a measure that is expected to mitigate against cost

pressures across the industry.

These mitigation strategies enabled us to manage build cost

inflation to a 4-5% level in H1 2023. As levels of house price

inflation in the new homes market were at similar levels, the

overall impact on margin was broadly neutral.

vi. Supply Chain Integration - NUA

In June we launched NUA, the innovative manufacturing and new

technology arm of the business that operates from our three

off-site manufacturing facilities in Carlow town, Arklow,

Co.Wicklow and Dundalk, Co.Louth. The sites are strategically

located to service all our sites effectively as a nationwide home

builder. At scale, NUA will have capacity to deliver over 2,000

units per year.

Significant investment is now largely completed so the focus is

on maximising the value from NUA and building the capability to

deliver our own housing requirements.

This innovation in offsite manufacturing will become

increasingly important as standardised house types become a much

larger component of our output in coming years, as the proportion

of Glenveagh designed planning units increases in the overall

portfolio. Standardising process and product across the business

will support an improved margin and return profile for the Group

overall. It will also enable the Group to meet its ambition to

incorporate high-density and standardised house types into the

manufacturing and delivery process.

vii. Sustainability Agenda Progress

The Group has placed environmental and social issues at the

heart of its Building Better strategy and has integrated

sustainability and business priorities into one overarching

strategy. Our progress and performance is underpinned by strong

governance structures with the Environmental and Social

Responsibility Committee in place at Board level.

The key milestone in H1 2023 was the launch of the Group's Net

Zero Transition Plan in March 2023, outlining its near-term and

long-term GHG emissions reduction targets for scopes 1, 2 and 3.

These targets call for a 46% absolute reduction in Scopes 1 & 2

by 2031 and a 55% reduction in Scope 3 emissions intensity

(tCO2e/100sqm) by 2031, using 2021 as the baseline year. Longer

term net zero targets have been set for scopes 1,2&3 by 2050.

All targets have been submitted to the Science Based Targets

initiative (SBTi) for validation.

One of the first actions to be considered in the Net Zero

Transition Plan focuses on transitioning sites to renewable fuel.

We have begun to switch our onsite power generators and plant

machinery to renewable fuel, namely Hydrotreated Vegetable Oil

(HVO).

The Group has also started to implement its Equity, Diversity

& Inclusion (ED&I) strategy, Building a Better Workplace,

that was launched in December 2022. In H1 2023 we once again

attained the Investors in Diversity Silver mark and have achieved

an overall result of 'Building Momentum'.

Our supply chain is critical to the actions that we take so we

were proud to become a founding partner of the Supply Chain

Sustainability School in Ireland in H1 2023. This will support the

development and enhancement of sustainability skills and knowledge

in the supply chain.

In February 2023 the Group agreed a new sustainability linked

finance facility that incorporates four specific sustainability Key

Performance Indicators ("KPIs") in line with those already set out

above.

For the remainder of FY 2023 the Group's main sustainability

focus will be on implementing actions to support our Net Zero

Transition Plan, developing our biodiversity and circular economy

strategies, and continuing our preparation to disclose under the

Corporate Sustainability Reporting Directive.

We have also continued to maintain and improve our ESG ratings.

Our Sustainalytics rating improved from 19.3 to 16.4 and is denoted

as 'Low-risk'. Our CDP rating is B and our MSCI rating is AA.

2. FINANCIAL REVIEW

i. Group Performance

Total group revenue was EUR172 million (H1 2022: EUR200 million

) from two main income streams:

-- EUR110 million in our suburban business, which predominantly

relates to our 333 suburban units closed in the period

-- EUR62 million from our urban business, comprising development

revenue from our forward funds of the Premier Inn hotel in

Castleforbes and our apartment developments in Citywest and

Castleknock

Glenveagh's suburban revenue of EUR110 million represents

significant growth for the primary segment of the business and

equates to a 23% increase in revenue versus H1 2022. The Group

delivered 333 units in the period at an Average Selling Price

("ASP") of approximately EUR324k (H1 2022: EUR332k). The reduction

in ASP reflects a combination of solid HPI, which is offset by

changes in the product and site mix in the period.

All suburban units capable of closing in FY 2023 are now sold,

signed or reserved. The progress made to date in 2023 demonstrates

the strong underlying demand for suburban housing, supported by the

updated initiatives from the Government and the Central Bank of

Ireland.

The Group's gross profit for the first half amounted to EUR27.9

million (H1 2022: EUR32.9 million ) with an overall gross margin of

16.3% (H1 2022: 16.5%).

Suburban gross margins improved to 18.7% (H1 2022: 17.3%) as the

business continues to benefit from enhanced operational

efficiencies and we remain confident of a full year suburban margin

of approximately 19%.

Urban gross margin was 12.1% in H1 2023 (H1 2022: 15.8%). This

margin is consistent with our expectations and has reduced from the

prior period due to the profit from the sale of our East Road site

for EUR63m in H1 2022.

Our operating profit for the six month period was EUR8.8 million

(H1 2022: EUR16.0 million ). The Group's central costs for the

period were EUR17.9 million (H1 2022: EUR15.9 million ), which

along with EUR1.2 million (H1 2022: EUR1.0 million ) of

depreciation and amortisation gives total administrative expenses

of EUR19.1 million (H1 2022: EUR16.9 million ).

Net finance costs for the first half increased significantly to

EUR7.5 million (H1 2022: EUR3.0 million ), primarily impacted by a

one-off release of EUR1.8m associated with our previous financing

facility, increased interest rates, and higher average debt

levels.

Overall, the Group delivered an earnings per share of 0.21 cent

(H1 2022: 1.32 cent).

ii. Balance Sheet and Cash Flow

Consistent with prior periods, the business has invested capital

in the first half of 2023 which will unwind and deliver revenue in

H2 2023 and into FY 2024. On that basis, our inventory at period

end was EUR764.6 million (31 December 2022: EUR685.7 million).

Our land efficiency strategy continues to reduce our net

investment in land with EUR447.0 million of land inventory at 30

June 2023 (31 December 2022: EUR458.5 million ). We believe that

further reductions can be made in this regard, while still

supporting the significant growth the business has projected in the

coming years and we expect to reduce land inventory further towards

EUR400 million by year end.

The Group has continued to invest in work in progress in line

with the growth strategy of the business with a period end balance

of EUR317.6 million (31 December 2022: EUR227.2 million ). The

increase year on year relates to our investment in the urban

business, namely our forward sold developments in Cluain Mhuire,

Dublin and Marina Village, Greystones and the ongoing construction

of the office development in the Dublin Docklands.

The total work in progress in the urban business at 30 June 2023

is EUR78 million with all ongoing developments due to close in H2

2023 or 2024. The remaining work in progress across the business of

approximately EUR240 million is lower year on year, reflecting

continued efficiencies and enhanced capital management on our key

suburban sites.

The business has increased its investment in Property, Plant

& Equipment during the first half of the year, resulting from

our continued focus on innovation and our supply chain initiatives,

with specific investment in our manufacturing facility in Carlow.

This investment is now largely complete with the focus turning to

maximising the value and efficiencies from these facilities.

At 30 June 2023 the reduced equity figure reflected the fourth

share buyback programme which was conducted through the period and

which totalled approximately EUR59 million. In H1 2023, a total of

60.6 million shares were repurchased and subsequently cancelled.

This buyback programme is now complete, having returned

approximately EUR63 million to shareholders and bringing total

shareholder returns to over EUR300m since May 2021.

Net debt at period end increased to EUR182 million (31 December

2022: EUR14 million) reflecting the WIP investment in the suburban

units due to close in H2 and the ongoing urban developments, which

are due to close later in the year and in FY 2024. We continue to

anticipate that net debt will reach 10-15% of net assets by the end

of FY 2023.

Though from a relatively low base, the Group made progress in

increasing Return on Equity to 6.6% from 5.8% in H1 2022.

iii. Group Financing

In February 2023, the Group finalised a new five-year

sustainability linked finance facility of EUR350 million,

consisting of a EUR100 million term component and a revolving

credit facility of EUR250 million, which is a direct replacement of

our previous EUR250 million debt facility. This new facility is

with our existing banking syndicate, at interest rates consistent

with those of the previous facility and includes financial and

sustainability covenants that better reflect the current strategy

and growth ambitions of the business.

This facility will ensure that the business has the appropriate

financial structure to support the operational growth of the

business over the next five years, while also ensuring the business

can maximise its Return on Equity for shareholders.

Statement of Directors' responsibilities in respect of the

condensed consolidated interim financial statements for the half

year ended 30 June 2023

The Directors are responsible for preparing the half-yearly

financial report in accordance with the Transparency (Directive

2004/109/EC) Regulations 2007 ("Transparency Directive"), and the

Transparency Rules of the Central Bank of Ireland.

In preparing the condensed set of consolidated financial

statements included within the half-yearly financial report, the

directors are required to:

- prepare and present the condensed set of consolidated

financial statements in accordance with IAS 34 Interim Financial

Reporting as adopted by the EU, and the Transparency Directive and

the Transparency Rules of the Central Bank of Ireland;

- ensure the condensed set of consolidated financial statements has adequate disclosures;

- select and apply appropriate accounting policies;

- make accounting estimates that are reasonable in the circumstances; and

- assess the Entity's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern and

using the going concern basis of accounting unless the directors

either intend to liquidate the Entity or to cease operations, or

have no realistic alternative but to do so.

The directors are responsible for designing, implementing and

maintaining such internal controls as they determine is necessary

to enable the preparation of the condensed set of consolidated

financial statements that is free from material misstatement

whether due to fraud or error.

We confirm that to the best of our knowledge:

(1) the condensed set of consolidated financial statements

included within the half-yearly financial report of Glenveagh

Properties plc for the six months ended 30 June 2023 ("the interim

financial information") which comprises the condensed consolidated

statement of profit or loss and other comprehensive income, the

condensed consolidated balance sheet, the condensed consolidated

statement of changes in equity, the condensed consolidated

statement of cash flows and the related explanatory notes, have

been presented and prepared in accordance with IAS 34 Interim

Financial Reporting as adopted by the EU, the Transparency

Directive and Transparency Rules of the Central Bank of

Ireland.

(2) The interim financial information presented, as required by

the Transparency Directive, includes:

a. an indication of important events that have occurred during

the first 6 months of the financial year, and their impact on the

condensed set of consolidated financial statements;

b. a description of the principal risks and uncertainties for

the remaining 6 months of the financial year

c. related parties' transactions that have taken place in the

first 6 months of the current financial year and that have

materially affected the financial position or the performance of

the enterprise during that period; and

d. any changes in the related parties' transactions described in

the last annual report that could have a material effect on the

financial position or performance of the enterprise in the first 6

months of the current financial year.

The directors are responsible for the maintenance and integrity

of the corporate and financial information included on the Entity's

website. Legislation in the Republic of Ireland governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

On behalf of the Board

Stephen Garvey Michael Rice 13 September 2023

Director Director

Independent auditor's review report on the condensed

consolidated interim financial statements to the members of

Glenveagh Properties PLC

Conclusion

We have been engaged by the Entity to review the Entity's

condensed set of consolidated financial statements in the

half-yearly financial report for the six months ended 30 June 2023

which comprises the condensed consolidated statement of profit or

loss and other comprehensive income, the condensed consolidated

balance sheet, the condensed consolidated statement of changes in

equity, the condensed consolidated statement of cash flows and a

summary of significant accounting policies and other explanatory

notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of consolidated

financial statements in the half-yearly financial report for the

six months ended 30 June 2023 is not prepared, in all material

respects in accordance with International Accounting Standard 34

Interim Financial Reporting ("IAS 34") as adopted by the EU and the

Transparency (Directive 2004/109/EC) Regulations 2007

("Transparency Directive"), and the Central Bank (Investment Market

Conduct) Rules 2019 ("Transparency Rules of the Central Bank of

Ireland).

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (Ireland) 2410 Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity ("ISRE (Ireland) 2410") issued for use in Ireland. A review

of interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (Ireland)

and consequently does not enable us to obtain assurance that we

would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We read the other information contained in the half-yearly

financial report to identify material inconsistencies with the

information in the condensed set of consolidated financial

statements and to identify any information that is apparently

materially incorrect based on, or materially inconsistent with, the

knowledge acquired by us in the course of performing the review. If

we become aware of any apparent material misstatements or

inconsistencies we consider the implications for our report.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention that causes us to believe that the directors have

inappropriately adopted the going concern basis of accounting, or

that the directors have identified material uncertainties relating

to going concern that have not been appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (Ireland) 2410. However, future events or

conditions may cause the Entity to cease to continue as a going

concern, and the above conclusions are not a guarantee that the

Entity will continue in operation.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Transparency Directive and the Transparency Rules of the

Central Bank of Ireland.

The directors are responsible for preparing the condensed set of

consolidated financial statements included in the half-yearly

financial report in accordance with IAS 34 as adopted by the

EU.

As disclosed in note 1, the annual financial statements of the

Entity for the year ended 31 December 2022 are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU.

In preparing the condensed set of consolidated financial

statements, the directors are responsible for assessing the

Entity's ability to continue as a going concern, disclosing, as

applicable, matters related to going concern and using the going

concern basis of accounting unless the directors either intend to

liquidate the Entity or to cease operations, or have no realistic

alternative but to do so.

Our responsibility

Our responsibility is to express to the Entity a conclusion on

the condensed set of consolidated financial statements in the

half-yearly financial report based on our review.

Our conclusion, including our conclusions relating to going

concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion section of

this report.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the Entity in accordance with the

terms of our engagement to assist the Entity in meeting the

requirements of the Transparency Directive and the Transparency

Rules of the Central Bank of Ireland. Our review has been

undertaken so that we might state to the Entity those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the Entity for our

review work, for this report, or for the conclusions we have

reached.

KPMG 13 September 2023

Chartered Accountants

1 Stokes Place

St. Stephen's Green

Dublin, Ireland

Glenveagh Properties PLC

Condensed consolidated statement of profit or loss and other

comprehensive income

for the six months ended 30 June 2023

Note 30 June 30 June

2023 2022

EUR'000 EUR'000

Revenue 8 171,581 200,007

Cost of sales (143,647) (167,143)

Gross profit 27,934 32,864

Administrative expenses (19,088) (16,871)

Operating profit 8,846 15,993

Finance expense (7,462) (3,037)

Profit before tax 1,384 12,956

Income tax 10 (129) (3,385)

Profit after tax 1,255 9,571

Items that are or may be reclassified

subsequently to profit or loss:

Fair value movement on cashflow

hedges 870 -

Cashflow hedges reclassified to 5 -

profit or loss

Total other comprehensive income 875 -

Total comprehensive profit for

the period

attributable of the owners of

the Company 2,130 9,571

Basic earnings per share (cents) 0.21 1.32

Diluted earnings per share (cents) 0.21 1.31

Glenveagh Properties PLC

Condensed consolidated balance sheet

as at 30 June 2023

30 June 31 December

Note 2023 2022

Assets EUR'000 EUR'000

Non-current assets

Goodwill 5,697 5,697

Property, plant and equipment 12 60,858 51,750

Intangible assets 1,730 1,770

Derivative contracts 875 -

Deferred tax asset 10 1,360 619

70,520 59,836

Current assets

Inventory 11 764,661 685,751

Trade and other receivables 69,410 58,671

Income tax receivable 2,913 -

Restricted cash 458 458

Cash and cash equivalents 61,747 71,085

899,189 815,965

Total assets 969,709 875,801

Equity

Share capital 13 663 719

Share premium 13 179,578 179,416

Undenominated capital 396 335

Retained earnings 407,649 465,680

Cashflow hedge reserve 875 -

Share-based payment reserve 48,010 46,968

Total equity 637,171 693,118

Liabilities

Non-current liabilities

Loans and borrowings 14 237,410 71,221

Lease liabilities 3,967 4,216

Trade and other payables 3,500 3,500

244,877 78,937

Current liabilities

Trade and other payables 84,670 93,234

Income tax payable - 565

Derivative contracts interest 5 -

Loans and borrowings 14 2,175 9,419

Lease liabilities 811 528

87,661 103,746

Total liabilities 332,538 182,683

Total liabilities and equity 969,709 875,801

Glenveagh Properties PLC

Condensed consolidated statement of changes in equity

for the six months ended 30 June 2023

Share Capital

----------------------

Share-based

Ordinary Deferred Undenominated Share payment Cashflow Retained Total

shares Shares capital premium reserve hedge reserve earnings equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance as at 1

January

2023 638 81 335 179,416 46,968 - 465,680 693,118

Total

comprehensive

profit for the

year

Income for the

year - - - - - - 1,255 1,255

Fair value

movement on

cashflow hedges - - - - - 870 - 870

Cashflow hedges

reclassified

to profit and

loss - - - - - 5 - 5

Other - - - - - - - -

comprehensive

income

- - - - - 875 1,255 2,130

Transactions with

owners

of the Company

Equity-settled

share-based

payments - - - - 1,042 - - 1,042

Exercise of

options 5 - - 162 - - - 167

Purchase of own

shares

(Note 13) (61) - 61 - - - (59,286) (59,286)

(56) - 61 162 1,042 - (59,286) (58,077)

Balance as at 30

June

2023 582 81 396 179,578 48,010 875 407,649 637,171

Glenveagh Properties PLC

Condensed consolidated statement of changes in equity

for the six months ended 30 June 2022

Share Capital

--------------------------------------

Share-based

Ordinary Founder Undenominated Treasury Share payment Retained Total

shares shares capital shares premium reserve earnings equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Balance as at 1

January

2022 771 181 100 - 179,310 45,251 558,468 784,081

Total comprehensive

profit

for the period

Profit for the period - - - - - - 9,571 9,571

Other comprehensive - - - - - - - -

income

- - - - - - 9,571 9,571

Transactions with

owners

of the Company

Equity-settled

share-based

payments - - - - - 975 - 975

Purchase of own shares

(Note 13) (73) - 73 - - - (87,477) (87,477)

(73) - 73 - - 975 (87,477) (86,502)

Balance as at 30 June

2022 698 181 173 - 179,310 46,226 480,562 707,150

Glenveagh Properties PLC

Condensed consolidated statement of cash flows

for the six months ended 30 June 2023

30 June 30 June

2023 2022

Note EUR'000 EUR'000

Cash flows from operating activities

Profit for the period 1,255 9,571

Adjustments for :

Depreciation and amortisation 1,324 1,018

Finance costs 7,462 3,037

Profit on sale of property, plant

and equipment (216) (38)

Equity-settled share-based payment

expense 9 1,042 975

Tax expense 10 129 3,385

10,996 17,948

Changes in :

Inventories (71,076) (36,895)

Trade and other receivables (17,600) (8,328)

Trade and other payables (8,294) 16,552

Cash used in operating activities (85,974) (10,723)

Interest paid (2,790) (2,625)

Tax paid (4,479) (4,167)

Net cash used in operating activities (93,243) (17,515)

Cash flows from investing activities

Acquisition of property, plant and

equipment 12 (11,825) (12,995)

Acquisition of intangible assets (115) (357)

Transfer from restricted cash 15 - 25,000

Proceeds from the sale of property,

plant and equipment 954 9

Net cash (used in) / from investing

activities (10,986) 11,657

Cash flows from financing activities

Proceeds from borrowings 250,001 90,000

Repayment of loans and borrowings (92,500) (5,000)

Transaction costs related to loans

and borrowings (3,535) -

Purchase of own shares (59,061) (87,029)

Proceeds from exercise of share options 167 -

Payment of lease liabilities (181) (384)

Net cash from / (used in) financing

activities 94,891 (2,413)

Net decrease in cash and cash equivalents

in the

period (9,338) (8,271)

Cash and cash equivalents at the

beginning of the period 71,085 116,176

Cash and cash equivalents at the

end of the period 61,747 107,905

Glenveagh Properties PLC

Notes to the condensed consolidated interim financial

statements

1 Reporting entity

Glenveagh Properties PLC ("the Company") is domiciled in the

Republic of Ireland. The Company's registered office is Block C,

Maynooth Business Campus, Maynooth, Co. Kildare, W23 F854. These

condensed consolidated interim financial statements comprise the

Company and its subsidiaries (together referred to as "the Group")

and cover the six month period ended 30 June 2023 ("the period").

The Group's principal activities are the construction and sale of

residential houses and apartments for the private buyer, local

authorities and institutional investors. The condensed consolidated

interim financial statements for the six months ended 30 June 2023

are unaudited and does not constitute statutory financial

statements as defined in the Companies Act 2014. A copy of the

financial statements for the financial year ended 31 December 2022

are available on the Company's website (https://glenveagh.ie/) and

will be filed with the Companies Registration Office. The auditor's

report accompanying those financial statements was unqualified.

2 Statement of compliance

The condensed consolidated interim financial statements have

been prepared in accordance with IAS 34 Interim Financial Reporting

as adopted by the EU and should be read in conjunction with the

Group's last annual consolidated financial statements as at and for

the financial year ended 31 December 2022 ("last annual financial

statements") which have been prepared in accordance with IFRS as

adopted by the EU. The interim financial statements do not include

all of the information required for a complete set of IFRS

financial statements. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Group's financial position

and performance since the last annual financial statements. The

accounting policies adopted are consistent with those of the

previous accounting period. As disclosed in note 5, during the

period the Group has transacted derivative contracts relating to an

interest rate swap to manage the interest rate risk arising from

floating rate borrowings.

3 Functional and presentation currency

These consolidated financial statements are presented in Euro

which is the Company's functional currency. All amounts have been

rounded to the nearest thousand unless otherwise indicated.

4 Use of judgements and estimates

In preparing these interim financial statements, management has

made judgements and estimates that effect the application of

accounting policies and the reported amounts of assets and

liabilities, income and expense. No individual judgment or estimate

is deemed to have a significant impact upon the financial

statements apart from those supporting the assessment of the

carrying value of the Group's inventories as described below.

Critical accounting judgements

Management applies the Group's accounting policies when making

critical accounting judgements, of which no individual judgement is

deemed to have a significant impact upon the financial

statements.

Key sources of estimation uncertainty

The key source of significant estimation uncertainty impacting

these financial statements involves assessing the carrying value of

inventories as detailed below.

(a) Carrying value of work-in-progress, estimation of costs to

complete and impact on profit recognition

The Group holds inventories stated at the lower of cost and net

realisable value. Such inventories include land and development

rights, work-in-progress and completed units.

As residential development is largely speculative by nature, not

all inventories are covered by forward sales contracts.

Furthermore, due to the nature of the Group's activity and, in

particular the scale of its developments and the length of the

development cycle, the Group has to allocate site-wide development

costs between units being built and/or completed in the current

year and those for future years. It also has to forecast the costs

to complete on such developments. These estimates impact

management's assessment of the net realisable value of the Group's

inventory balance and also determine the extent of profit or loss

that should be recognised in respect of each development in each

reporting period.

In making such assessments and allocations, there is a degree of

inherent estimation uncertainty. The Group has established internal

controls designed to effectively assess and centrally review

inventory carrying values and ensure the appropriateness of the

estimates made. These assessments and allocations evolve over the

life of the development in line with the risk profile, and

accordingly the margin recognised reflects these evolving

assessments, particularly in relation to the Group's long-term

developments. The impact of sustainability and other macroeconomic

factors have been considered in the Group's assessment of the

carrying value of its inventories at 30 June 2023, particularly

with regard to the potential implications for future selling

prices, development expenditure and construction programming.

Management has considered a number of scenarios on each of its

active developments and the consequential impact on future

profitability based on current facts and circumstances together

with any implications for future projects in undertaking its net

realisable value calculations.

5 New significant accounting policies

Standards issued but not yet effective

A number of new standards and amendments to standards are

effective for annual periods beginning after 1 January 2023 and

earlier application is permitted.

- IAS 8 Accounting policies, changes in accounting estimates and

errors: Definition of accounting estimates and errors

(amendment)

- IAS 1 Presentation of financial statements: Amendments to IAS

1 presentation of financial statements and IFRS practice statement

2 making materiality judgements (amendment)

- IFRS 17 Insurance contracts - amendments to IFRS 17 insurance contracts (amendment)

- IFRS 17 Insurance contracts - initial application of IFRS 17

and IFRS 9 - Comparative information (amendment)

- IAS 12 Income taxes - Deferred tax related to assets and

liabilities arising from a single transaction (amendment)

- IAS 7 Statement of Cash Flows and IFRS 7 Financial

Instruments: Disclosures: Supplier Finance Arrangements (amendment)

(not yet effective)

- IAS 12 Income taxes: International Tax Reform - Pillar Two Model Rules (amendment)

- IAS 1 Presentation of Financial Statements:

o Classification of Liabilities as Current or Non-current Date

(amendment) (not yet effective)

o Classification of Liabilities as Current or Non-current -

Deferral of Effective Date (amendment) (not yet effective)

o Non-current Liabilities with Covenants (amendment) (not yet

effective)

- IFRS 16 Leases: Lease Liability in a Sale and Leaseback (amendment) (not yet effective)

Derivatives and hedging

The Group has transacted derivatives relating to an interest

rate swap to manage the interest rate risk arising from floating

rate borrowings. Derivatives are initially recognised at fair value

on the date a derivative contract is entered into, and they are

subsequently remeasured to their fair value at the end of each

reporting period. The accounting for subsequent changes in fair

value depends on whether the derivative is designated as a hedging

instrument and, if so, the nature of the item being hedged.

The group designates certain derivatives as hedges of a

particular risk associated with the cash flows of recognised assets

and liabilities and highly probable forecast transactions (cash

flow hedges).

Changes in the fair value of derivative hedging instruments

designated as cash flow hedges are recognised in other

comprehensive income to the extent that the hedge is effective. The

gain or loss relating to the ineffective portion is recognised

immediately in profit or loss.

Amounts accumulated in other comprehensive income are

reclassified to profit or loss in the same periods that the hedged

items affect profit or loss. The reclassified gain or loss relating

to the effective portion of interest rate swaps hedging variable

rate borrowings is recognised in profit or loss within finance

income or costs respectively.

If the hedging instrument no longer meets the criteria for hedge

accounting, expires or is sold, terminated or exercised, then hedge

accounting is discontinued prospectively. The cumulative gain or

loss previously recognised in other comprehensive income remains

there until the forecast transaction occurs, unless the hedged

transaction is no longer expected to occur, in which case the

cumulative

gain or loss that was previously recognised in other

comprehensive income is transferred to profit and loss.

At inception of the hedge relationship, the group documents the

economic relationship between hedging instruments and hedged items,

including whether changes in the cash flows of the hedging

instruments are expected to offset changes in the cash flows of

hedged items. The group documents its risk management objective and

strategy for undertaking its hedge transactions.

The full fair value of a hedging derivative is classified as a

non-current asset or liability when the remaining maturity of the

hedged item is more than 12 months; it is classified as a current

asset or liability when the remaining maturity of the hedged item

is less than 12 months.

There have been no other changes to significant accounting

policies during the period to 30 June 2023.

6 Going concern

The Group has recorded a profit before tax of EUR1.4 million

(2022: EUR12.9 million). The Group has an unrestricted cash balance

of EUR36.7 million (31 December 2022: EUR82.9 million) exclusive of

the minimum cash balance of EUR25.0 million which the Group is

required to maintain under the terms of its debt facilities. The

Group has committed undrawn funds available of EUR60.0 million (31

December 2022: EUR30.0 million).

Management has prepared a detailed cash flow forecast in order

to assess the Group's ability to continue as a going concern for at

least a period of twelve months from the signing of these interim

financial statements. The preparation of this forecast considered

the principal risks facing the Group, including those risks that

could threaten the Group's business model, future performance,

solvency or liquidity over the forecast period.

The Group is forecasting compliance with all covenant

requirements under the current facilities including the interest

cover covenant which is based on earnings before interest, tax,

depreciation and amortisation (EBITDA) excluding any non-cash

impairment charges or reversals. Total debt must not exceed

adjusted EBITDA by a minimum of 4 times, this is calculated on both

a forward and trailing twelve-month basis. Other assumptions within

the forecast include the Group's expected selling prices and sales

strategies as well as its investment in work in progress which

reflect updated development programmes.

The Directors confirm that they believe the Group has the

appropriate working capital management strategy, operational

flexibility and resources in place to continue in operational

existence for the foreseeable future and has accordingly prepared

the condensed consolidated interim financial statements on a going

concern basis.

7 Segmental information

Segmental financial results

30 June 30 June

2023 2022

EUR'000 EUR'000

Revenue

Suburban 109,651 88,946

Urban 61,930 111,061

Partnerships - -

Revenue for reportable segments 171,581 200,007

30 June 30 June

2023 2022

EUR'000 EUR'000

Operating profit / (loss)

Suburban 13,477 9,327

Urban 6,076 16,776

Partnerships (739) (581)

Operating profit for reportable

segments 18,814 25,522

Reconciliation to results for

the period

Segment results - operating profit 18,814 25,522

Finance expense (7,462) (3,037)

Directors' remuneration (1,064) (1,208)

Corporate function payroll costs (2,874) (2,523)

Depreciation and amortisation (1,170) (1,018)

Professional fees (1,057) (2,129)

Share-based payment expense (1,042) (975)

Profit on sale of property, plant

and equipment 216 38

Other corporate costs (2,977) (1,714)

Profit before tax 1,384 12,956

Segment assets and liabilities

30 June 2023 31 December 2022

Suburban Urban Partnerships Total Suburban Urban Partnerships Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Segment assets 651,199 178,277 9,266 838,742 590,321 153,018 6,452 749,791

Reconciliation to

Consolidated

Balance Sheet

Deferred tax asset 1,360 620

Derivative contracts 875 -

Trade and other receivables 1,484 785

Cash and cash equivalents 61,747 71,085

Income tax receivable 2,913 -

Property, plant and equip

ment 60,858 51,750

Intangible assets 1,730 1,770

969,709 875,801

Segment liabilities 61,829 16,894 269 78,992 69,138 9,876 159 79,173

Reconciliation to

Consolidated

Balance Sheet

Trade and other payables 9,179 17,561

Loans and Borrowings 239,585 80,640

Derivative contracts 5 -

Lease liabilities 4,777 4,744

Income tax payable - 565

332,538 182,683

8 Revenue

30 June 30 June

2022 2021

EUR'000 EUR'000

Suburban

Core 109,651 86,336

Non-core - 2,610

109,651 88,946

Urban

Core 58,870 109,960

Non-core 3,060 1,101

61,930 111,061

Total Revenue 171,581 200,007

As in the prior year, the Group expects significantly more

closing activity (and consequently increased revenue) in the second

half of the financial year as a result of the seasonality that

currently exists within the Group's development cycle.

Core suburban product relates to affordable starter homes for

first time buyers. Core urban product relates primarily to

apartments suitable for institutional investors. Non-core suburban

and urban product relates to high-end, private developments and

sites. Non-core suburban and urban cost of sales is mostly

attributable to land and development expenditure costs for high

end, private developments and sites.

Urban core revenue includes income from the sale of land and

development revenue from construction contracts that are recognised

over time by reference to the stage of completion of the contract

with the customer. Development revenue recognised in the period

related to the development of the sites at Barn Oaks Apartments,

Castleforbes and Carpenterstown and amounted to EUR58.9 million (30

June 2022: EUR30.5 million) with EUR34.9 million (31 December 2022:

EUR32.1 million) outstanding in contract receivables at the period

end. The payment terms for these contracts are between 30 and 90

days.

9 Share-based payment arrangements

(a) Description and reconciliation of options outstanding

Number of Number of

Options Options

2023 2022

LTIP options in issue at 1 January 13,022,830 10,583,334

Granted during the period 5,515,311 4,568,698

Forfeited during the period (381,427) (163)

Lapsed during the period (1,067,076) -

Exercised during the period (3,226,235) (1,309,820)

LTIP options in issue at 30 June 13,863,403 13,842,049

Exercisable at 30 June 388,859 1,015,962

SAYE - reconciliation of options outstanding

Number of Number

Options of

2023 Options

2022

SAYE in issue at 1 January 755,220 964,740

Forfeited during the period (1,167) -

Lapsed during the period (720) -

Exercised during the period (270,333) -

SAYE options in issue at 30 June 483,000 964,740

Exercisable at 30 June 48,000 2,520

The options outstanding at 30 June 2023 had an exercise price

EUR0.001 (2022: EUR0.001) and a weighted-average contractual life

of 7 years (2022: 7 years).

(b) Measurement of fair values

The EPS and ROE related performance conditions are non-market

conditions and do not impact the fair value of the EPS or ROE based

awards at grant date which is equivalent to the share price at

grant date. The inputs used in measuring fair value at grant date

were as follows:

2023 2022

Fair value at grant

date EUR1.12 EUR1.16

Share price at grant

date EUR1.12 EUR1.16

The exercise price of all options granted under the LTIP to date

is EUR0.001 and all options have a 7- year contractual life.

(c) Expense recognised in profit or loss

The Group recognised an expense of EUR1.0 million (2022: EUR1.0

million) in the consolidated statement of profit or loss in respect

of options granted under the LTIP and SAYE arrangements.

10 Income tax

30 June 30 June

2023 2022

EUR'000 EUR'000

Current tax charge for the period 750 3,507

Deferred tax credit for the period (621) (122)

Total income tax charge 129 3,385

Movement in deferred Balance Balance

tax balances at

at 1 January Prior period Recognised 30 June

in

2023 remeasurement the period 2023

EUR'000 EUR'000 EUR'000 EUR'000

Expenses deductible in

future periods 619 120 621 1,360

The expenses deductible in future periods arise in Ireland and

have no expiry date. Based on profitability achieved in the period,

the continued forecast profitability in the Group's strategic plan

and the sensitivities that have been applied therein, management

has considered it probable that future profits will be available

against which the above losses can be recovered and, therefore, the

related deferred tax asset can be realised.

Global minimum tax

To address concerns about uneven profit distribution and tax

contributions of large multinational corporations, various

agreements have been reached at a global level, including an

agreement by over 135 jurisdictions to introduce a global minimum

tax rate of 15%. In December 2022, the Organisation for Economic

Co-operation and Development ("OCED") released a draft legislative

framework that is expected to be used by individual jurisdictions

that signed the agreement to amend their local tax laws. Once

changes to the tax laws in any jurisdiction in which the Group

operates are enacted or substantively enacted, the Group may be

subject to the top-up tax. Currently, the Group operates solely in

the Republic of Ireland, based on current criteria there is no

current tax impact in the period ended 30 June 2023 (six months

ended 30 June 2022: EURNil).

11 Inventory 30 June 31 December

2023 2022

EUR'000 EUR'000

Land 443,806 455,280

Development expenditure work in progress 317,624 227,240

Development rights 3,231 3,231

764,661 685,751

(i) Employment cost capitalised

EUR7.0 million of employment costs incurred in the period have

been capitalised in inventory (June 2022: EUR6.7million).

12 Property, plant and equipment

During the period, the Group recognised total additions to

property, plant and equipment of EUR11.8 million (six months ended

30 June 2022: EUR13.3 million) which included expenditure on land

and buildings of EUR8.5 million (six months ended 30 June 2022:

EUR9.0 million), with EUR3.3 million (six months ended 30 June

2022: EUR4.3 million) invested in plant and machinery, fixtures and

fittings and computer equipment. Depreciation recognised in the

period was EUR2.3 million (six months ended 30 June 2022: EUR1.9

million). Net disposals of plant and machinery in the period of

EUR0.6m (six months ended 30 June 2022: EUR0.1 million).

During the period, the Group entered into new lease agreements

for the use of motor vehicles EUR0.2 million (six months ended 30

June 2022: EURNil).

13 Share capital and share premium

(a) Authorised share capital

As at 30 June 2023 and 31 December 2022 Number of

shares EUR'000

Ordinary shares of EUR0.001 each 1,000,000,000 1,000

Deferred shares of EUR0.001 each 200,000,000 200

1,200,000,000 1,200

(b) Issued and fully paid share capital and share premium

As at 30 June 2023 Number of Share capital Share premium

shares EUR'000 EUR'000

Ordinary shares of EUR0.001 each 581,075,456 582 179,578

Deferred shares of EUR0.001 each 81,453,077 81 -

662,528,533 663 179,578

As at 31 December 2022 Number of Share capital Share premium

shares EUR'000 EUR'000

Ordinary shares of EUR0.001 each 638,131,722 638 179,416

Deferred shares of EUR0.001 each 81,453,077 81 -

719,584,799 719 179,416

On 6 January 2023, a fourth share buyback programme commenced to

repurchase up to 10% of the Group's issued share capital such that

the maximum number of shares which can be repurchased under this

buyback is 63,813,172. As at 30 June 2023 the total number of