TIDMHICL

RNS Number : 5270X

HICL Infrastructure PLC

21 December 2023

21 December 2023

HICL Infrastructure PLC

"HICL" or "the Company" and, together with its subsidiaries,

"the Group", the London-listed infrastructure investment company

managed by InfraRed Capital Partners Limited ("InfraRed" or "the

Investment Manager".

HICL acquires additional stake in French toll road for c.

GBP20m, bringing total interest to 24%

-- Additional 3.1% interest acquired in A63 Motorway for c. GBP20m on highly accretive terms

-- Total return and yield significantly in excess of the bar set by alternative uses of capital

-- Continued focus on disciplined balance sheet management, with live disposal activity

The Board is pleased to announce that HICL has agreed to acquire

a further 3.1% interest in the A63 Motorway concession (the "A63")

in France for c. GBP20m from a co-shareholder. Completion is

expected in early 2024, subject to customary third-party

consents.

The asset is a 40-year toll-road concession to design, upgrade,

finance, operate and maintain a 104km section of the existing A63

between Salles and Saint-Geours-de-Maremne, in southwest France.

The A63 benefits from its strategic positioning as an important

trans-European transport corridor, which has resulted in

historically resilient traffic performance. HICL first invested in

the A63 in 2017, and InfraRed's management of the asset dates back

to 2011. Following this incremental investment, HICL will hold a

24% interest in the asset.

In line with the Board's disciplined approach to capital

allocation, this acquisition was carefully evaluated against

alternative uses of capital, including the repurchase of the

Company's shares. The Board is satisfied that the expected return

and yield from this incremental investment are significantly in

excess of the relevant hurdles and presents a unique opportunity to

increase HICL's investment in a high-performing quality asset.

The acquisition will be funded from the proceeds of the recently

announced disposals. Once the announced disposals have completed,

HICL's revolving credit facility ("RCF") is forecast to be c.

GBP135m drawn. The Company continues to benefit from live disposal

activity as part of HICL's active approach to enhancing portfolio

composition through asset rotation.

Mike Bane, Chair of HICL, said:

"This attractive incremental investment for HICL aligns with the

Board's strict capital allocation framework. It provides greater

accretion than alternative uses of capital and the investment has a

well-understood risk profile. Highly disciplined balance sheet

management remains a priority for the Board, including the

reduction of RCF drawings over time."

Edward Hunt, Head of Core Income Funds at InfraRed, said:

"We are pleased to have increased HICL's stake in this

high-quality European transport link, which InfraRed has

successfully managed for over ten years. While the bar for

acquisitions remains high, incremental investments such as this

demonstrate the attractive risk and reward dynamic that can be

captured by nimble investors in the current market in specific

circumstances."

-ends-

Enquiries

InfraRed Capital Partners Limited +44 (0) 20 7484 1800 / info@hicl.com

Edward Hunt

Helen Price

Mohammed Zaheer

Brunswick +44 (0) 20 7404 5959 / hicl@brunswickgroup.com

Sofie Brewis

Investec Bank plc +44(0) 20 7597 4952

David Yovichic

RBC Capital Markets +44 (0) 20 7653 4000

Matthew Coakes

Elizabeth Evans

Aztec Financial Services (UK) Limited +44(0) 203 818 0246

Chris Copperwaite

Sarah Felmingham

HICL Infrastructure PLC

HICL Infrastructure PLC ("HICL") is a long-term investor in

infrastructure assets which are predominantly operational and

yielding steady returns. It was the first infrastructure investment

company to be listed on the London Stock Exchange.

With a current portfolio of over 100 infrastructure investments,

HICL is seeking further suitable opportunities in core

infrastructure, which are inherently positioned at the lower end of

the risk spectrum.

Further details can be found on the HICL website www.hicl.com

.

Investment Manager (InfraRed Capital Partners)

The Investment Manager to HICL is InfraRed Capital Partners

Limited ("InfraRed") which has successfully invested in

infrastructure projects since 1997. InfraRed is a leading

international investment manager, operating worldwide from offices

in London, New York, Seoul and Sydney and managing equity capital

in multiple private and listed funds, primarily for institutional

investors across the globe. InfraRed is authorised and regulated by

the Financial Conduct Authority.

The infrastructure investment team at InfraRed consists of over

100 investment professionals, all with an infrastructure investment

background and a broad range of relevant skills, including private

equity, structured finance, construction, renewable energy and

facilities management.

InfraRed implements best-in-class practices to underpin asset

management and investment decisions, promotes ethical behaviour and

has established community engagement initiatives to support good

causes in the wider community. InfraRed is a signatory of the

Principles of Responsible Investment.

Further details can be found on InfraRed's website www.ircp.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAXAEADNDFFA

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

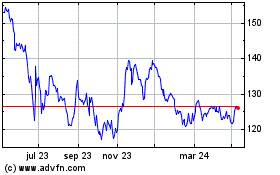

Hicl Infrastructure (LSE:HICL)

Gráfica de Acción Histórica

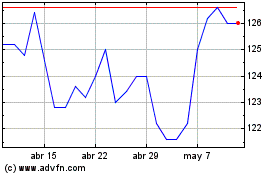

De Mar 2024 a Abr 2024

Hicl Infrastructure (LSE:HICL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024