TIDMHMI

RNS Number : 1953N

Harvest Minerals Limited

21 September 2023

21 September 2023

Harvest Minerals Limited

("Harvest" or the "Company")

Interim Results

Harvest Minerals Limited, the AIM listed fertiliser producer,

announces its interim results for the six months ended 30 June

2023.

RESULTS

The loss after tax recorded in the Condensed Consolidated

Statement of Comprehensive Income for the half-year ended 30 June

2023 was $1,645,945 (Half year to 30 June 2022: $883,556) which is

attributable to lower demand and lower pricing for the Company's

product in the period.

Net cash outflow from operating activities in the Condensed

Consolidated Statement of Cashflows for the half year ended 30 June

2023 was $2,634,226 (Half year to 30 June 2022: net cash inflow

$693,207). Please refer to note 5 in the financial statements for

further detail on reconciling the net loss to net cash inflows from

operating activities.

REVIEW OF OPERATIONS

Arapua Fertiliser Project

During the half-year ended 30 June 2023, Harvest sold 7,280

tonnes of its organic fertiliser, KP Fértil(R), representing a 74%

decrease over the 28,104 tonnes sold in the same period of 2022.

While historically the majority of Harvest's annual sales have been

achieved in the second half of the year, sales to date in 2023 have

remained below internal expectations. This is attributable to a

reduction in volume demand by farmers who are less incentivised to

boost production whilst crop prices are low and energy prices are

high. Accordingly, the Company's 2023 full year invoiced sales

target is now 70,000 tonnes of KP Fértil(R). Furthermore, the

impact on Harvest's financial results has been exacerbated by a

reduction in the price of its product, which it has lowered to

follow the market and try to encourage farmers to recommence

buying.

Short-term visibility remains low for the Company due to

numerous national and international geopolitical and macroeconomic

challenges, which are affecting the Company's business. However,

Harvest remains optimistic about the medium and long-term future,

with megatrends such as a growing world population likely to

accelerate the increased use of fertilisers. Another trend likely

to boost interest in organic products such as KP Fértil(R) is the

increased focus on organic farming initiatives to reverse the loss

of biodiversity and support Brazil's climate change strategies and

objectives.

With its team of 12 associates/agronomists split into two

regional teams, supported by a third-party network comprising of 20

resales centres, Harvest continues to advance its marketing

initiatives to offer its product for coffee, sugarcane, and other

crops, targeting a cross section of producers and resellers. It is

also maintaining its R&D efforts at its development farm next

to the mine where testwork is ongoing to demonstrate the continued

superiority of KP Fértil(R) and expand its client base.

As and when the market improves, the Company is positioned to

support higher sales volumes and rebuild profitability at its low

cost and high margin Arapua operation. In order to reduce the

Company's cash burn rate, the Directors agreed to temporarily pause

drawing their remuneration due from the Company during Q2 2023

until such point as the Company is in a better position to pay.

Sergi Potash Project & Mandacaru Phosphate Project

Given the scale of activity currently being undertaken at

Arapua, the Company did not materially advance either its Sergi

Potash Project or its Mandacaru Phosphate Project during the

half-year to 30 June 2023.

Brian McMaster

Executive Chairman

21 September 2023

Competent Person Statement

The technical information in this report is based on complied

and reviewed data by Mr Paulo Brito BSc(geol), MAusIMM, MAIG. Mr

Brito is a consulting geologist for Harvest Minerals Limited and is

a Member of AusIMM - The Minerals Institute, as well as a Member of

Australian Institute of Geoscientists. Mr Brito has sufficient

experience which is relevant to the style of mineralisation and

type of deposit under consideration and to the activity which is

being undertaken to qualify as a Competent Person as defined in the

2012 Edition of the "Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves". Mr Brito also meets

the requirements of a qualified person under the AIM Note for

Mining, Oil and Gas Companies and consents to the inclusion in this

report of the matters based on his information in the form and

context in which it appears. Mr Brito accepts responsibility for

the accuracy of the statements disclosed in this report.

Condensed Consolidated Statement of Comprehensive Income

for the half-year ended 30 June 2023

Consolidated

6 months ended 6 months ended

30 June

Notes 2023 30 June

$ 2022

$

--------------- ---------------

Revenue from fertiliser sales 3 931,608 2,735,590

Cost of goods sold 4 (707,044) (1,153,441)

--------------- ---------------

Gross profit 224,564 1,582,149

--------------- ---------------

Interest income 18,592 9,857

Other income - 513

Gain on sale of motor vehicle 15,171 8,185

Foreign exchange gain/(loss) (1,919) (54,401)

Accounting fees (91,734) (61,876)

Audit and tax fees (85,942) (19,255)

Advertising fees (196,790) (146,877)

Consultants' fees (76,689) (52,383)

Directors' fees (395,391) (390,705)

Depreciation (38,985) (4,685)

Legal fees (8,036) (6,423)

Wages & Salaries (309,161) (427,713)

Interest expense (80,217) (44,808)

Public company costs (103,082) (117,474)

Travel expenses (126,437) (306,748)

Impairment exploration expense - (491,500)

Other expenses (352,786) (359,412)

--------------- ---------------

Loss from continuing operations before

income tax (1,608,842) (883,556)

Income tax expense (37,103) -

Loss from continuing operations after

income tax 5 (1,645,945) (883,556)

Other comprehensive income

Item that may be reclassified subsequently

to profit or loss

Foreign currency translation 1,040,306 964,215

Other comprehensive income for the

half-year 1,040,306 964,215

---------------

Total comprehensive income/(loss)

for the half-year (605,639) 80,659

---------------

Loss per share

Basic and diluted loss per share (cents

per share) (0.87) (0.48)

Condensed Consolidated Statement of Financial Position

as at 30 June 2023

Consolidated

Notes 30 June 31 December

2023 2022

$ $

------------ -------------

Assets

Current Assets

Cash and cash equivalents 5 423,982 2,723,509

Trade and other receivables 6 710,944 514,724

Inventories 7 1,396,515 195,882

------------ -------------

Total Current Assets 2,531,441 3,434,115

------------ -------------

Non-Current Assets

Trade and other receivables 477,406 320,025

Investments 321,069 -

Plant and equipment 8 3,728,703 2,891,499

Mine properties 9 4,644,548 4,055,486

Deferred exploration and evaluation

expenditure 54,045 48,118

Total Non-Current Assets 9,225,771 7,315,128

------------ -------------

Total Assets 11,757,212 10,749,243

------------ -------------

Current Liabilities

Trade and other payables 10 533,982 513,389

Borrowings 11 511,748 53,270

Total Current Liabilities 1,045,730 566,659

------------ -------------

Non-Current Liabilities

Provision for rehabilitation 308,304 276,435

Borrowings 11 1,295,075 192,407

------------ -------------

Total Non-Current Liabilities 1,603,379 468,842

Total Liabilities 2,649,109 1,035,501

------------ -------------

Net Assets 9,108,103 9,713,742

============ =============

Equity

Contributed equity 12 43,328,219 43,328,219

Reserves 2,002,717 962,411

Accumulated losses (36,222,833) (34,576,888)

------------ -------------

Total Equity 9,108,103 9,713,742

============ =============

Condensed Consolidated Statement of Changes in Equity

for the half-year ended 30 June 2023

Notes Contributed Accumulated Foreign currency

Consolidated equity losses translation Option reserve Total

$ $ reserve $ $

$

Balance as at 1

January 2023 12 43,328,219 (34,576,888) (2,578,637) 3,541,048 9,713,742

-------------- -------------- -------------------- ----------------- ------------

Total comprehensive

gain for the

half-year

Loss for the

half-year 30 June

2023 - (1,645,945) - - (1,645,945)

Other comprehensive

income - - 1,040,306 - 1,040,306

-------------- -------------- -------------------- ----------------- ------------

Total comprehensive

income for the

half-year - (1,645,945) 1,040,306 - (605,639)

-------------- -------------- -------------------- ----------------- ------------

Balance at 30 June

2023 43,328,219 (36,222,833) (1,538,331) 3,541,048 9,108,103

============== ============== ==================== ================= ============

Balance as at 1

January 2022 43,328,219 (34,774,685) (3,482,302) 3,541,048 8,612,280

-------------- -------------- -------------------- ----------------- ------------

Total comprehensive

loss for the

half-year

Loss for the

half-year 30 June

2022 - (883,556) - - (883,556)

Other comprehensive

income - - 964,215 - 964,215

-------------- -------------- -------------------- ----------------- ------------

Total comprehensive

loss for the

half-year - (883,556) 964,215 - 80,659

-------------- -------------- -------------------- ----------------- ------------

Balance at 30 June

2022 12 43,328,219 (35,658,241) (2,518,087) 3,541,048 8,692,939

============== ============== ==================== ================= ============

Condensed Consolidated Statement of Cash Flows

for the half-year ended 30 June 2023

Consolidated

6 months ended 6 months ended

30 June 30 June

2023 2022

$ $

--------------- ---------------

Cash flows from operating activities

Receipts from customers 962,276 2,999,821

Payments to suppliers and employees (3,534,877) (2,271,663)

Interest received 18,592 9,857

Interest paid (80,217) (44,808)

Net cash outflow / inflow from operating

activities 5 (2,634,226) 693,207

--------------- ---------------

Cash flows from investing activities

Purchase of plant and equipment (638,218) (941,621)

Payments for mine properties (204,683) (351,413)

Payments for exploration and evaluation

expenditure - (37,063)

Proceeds from sale of motor vehicle 60,536 8,185

Payments for investments - loan collateral (306,732) -

---------------

Net cash outflow from investing activities (1,089,097) (1,321,912)

--------------- ---------------

Cash flows from financing activities

Proceeds from borrowings 1,436,381 1,274,816

Repayment of borrowings (106,222) (29,637)

Net cash inflow from financing activities 1,330,159 1,245,179

--------------- ---------------

Net (decrease) / increase in cash and

cash equivalents (2,393,164) 616,474

Cash and cash equivalents at beginning

of period 2,723,509 1,708,001

Effect of exchange rate fluctuations

on cash held 93,637 89,564

Cash and cash equivalents at the end

of the period 5 423,982 2,414,039

=============== ===============

Notes to the Condensed Consolidated Financial Statements

for the half-year ended 30 June 2023

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

Corporate Information

This general purpose half-year financial report of Harvest

Minerals Limited (the "Company") and its subsidiaries (the "Group")

for the half-year ended 30 June 2023 was authorised for issue in

accordance with a resolution of the Directors on 21 September

2023.

Harvest Minerals Limited is a company limited by shares

incorporated in Australia whose shares are publicly traded on the

AIM market of the London Stock Exchange.

The nature of the operations and principal activities of the

Group are described in the Directors' Report.

Basis of Preparation

This financial report for the half-year ended 30 June 2023 has

been prepared in accordance with the requirements of the

Corporations Act 2001, applicable accounting standards including

AASB 134 Interim Financial Reporting, Accounting Interpretations,

and other authoritative pronouncements of the Australian Accounting

Standards Board ("AASB"). Compliance with AASB 134 ensures

compliance with IAS 134 "Interim Financial Reporting". The Group is

a for profit entity for financial reporting purposes under

Australian Accounting Standards.

These half-year financial statements do not include all notes of

the type normally included within the annual financial statements

and therefore cannot be expected to provide as full an

understanding of the financial performance, financial position and

financing and investing activities of the group as the full

financial statements.

It is recommended that the half-year financial statements be

read in conjunction with the annual report for the year ended 31

December 2022 and considered together with any public announcements

made by Harvest Minerals Limited during the half-year ended 30 June

2023 in accordance with the continuous disclosure obligations of

the AIM market.

For the purpose of preparing the interim report, the half-year

has been treated as a discrete reporting period. The accounting

policies and methods of computation adopted are consistent with

those of the previous financial year and corresponding interim

reporting period. These accounting policies are consistent with

Australian Accounting Standards and with International Financial

Reporting Standards.

New and amending Accounting Standards and Interpretations

In the half-year ended 30 June 2023, the Directors have reviewed

all of the new and revised Standards and Interpretations issued by

the AASB that are relevant to the Group's operations and effective

for current reporting periods beginning on or after 1 January 2023.

The Directors have also reviewed all new Standards and

Interpretations that have been issued but are not yet effective for

the half-year ended 30 June 2023. As a result of this review the

Directors have determined that there is no impact, material or

otherwise, of the new and revised Standards and Interpretations on

the Group's business and, therefore, no change is necessary to the

Group accounting policies.

New and amended accounting standards and interpretations have

been published but are not mandatory. The Group has decided against

early adoptions of these standards and has determined the potential

impact on the financial statements from the adoption of these

standards and interpretations is not material to the Group.

Going concern

For the half-year ended 30 June 2023 the Group recorded a loss

after tax of $1,645,945 (Half-year to 30 June 2022: $883,556) and

had net cash outflows from operating and investing activities of

$3,723,323 (Half-year to 30 June 2022: $628,705). These conditions

indicate a material uncertainty that may cast doubt about the

Group's ability to continue as a going concern and, therefore, that

it may be unable to realise its assets and discharge its

liabilities in the normal course of business. In the absence of an

improvement in sales volumes and pricing, the ability of the Group

to continue as a going concern will be dependent on securing

additional funding and/or from asset sales in order for the Group

to continue to fund its operational activities in the longer

term.

The half-year financial report has been prepared on the basis

that the Group is a going concern, which contemplates the

continuity of normal business activity, realisation of assets and

settlement of liabilities in the normal course of business for the

following reasons:

-- Management have considered the future capital requirements of

the entity and will consider all funding options as required,

including asset sales;

-- The level of the Group's expenditure can be managed;

-- The Directors agreed to temporarily pause drawing their

remuneration due from the Company during Q2 2023 until such point

as the Company is in a better position to pay;

-- The Group has historically demonstrated its ability to raise

funds to satisfy its immediate cash requirements.

As at the date of this report, the Board and Management believe

there are sufficient funds to meet the Group's working capital

requirements in the near term and that sufficient funds will become

available, through certain of the above actions, if and when

needed, to finance the operations of the Group in the longer term.

Should the Group not be able to continue as a going concern, it may

be required to realise its assets and discharge its liabilities

other than in the ordinary course of business, and at amounts that

differ from those stated in the half-year financial report. The

half-year financial report does not include any adjustments

relating to the recoverability and classification of recorded asset

amounts or liabilities that might be necessary should the Group not

continue as a going concern.

Significant Accounting Policies

Deferred Exploration and Evaluation Expenditure

Exploration and evaluation expenditure incurred by or on behalf

of the Group is accumulated separately for each area of interest.

Such expenditure comprises net direct costs and an appropriate

portion of related overhead expenditure but does not include

general overheads or administrative expenditure not having a

specific nexus with a particular area of interest.

Each area of interest is limited to a size related to a known or

probable mineral resource capable of supporting a mining operation.

Exploration and evaluation expenditure for each area of interest is

carried forward as an asset provided that one of the following

conditions is met:

-- such costs are expected to be recouped through successful

development and exploitation of the area of interest or,

alternatively, by its sale; or

-- exploration and evaluation activities in the area of interest

have not yet reached a stage which permits a reasonable assessment

of the existence or otherwise of economically recoverable reserves,

and active and significant operations in relation to the area are

continuing.

Expenditure which fails to meet the conditions outlined above is

written off. Furthermore, the directors regularly review the

carrying value of exploration and evaluation expenditure and make

write downs if the values are not expected to be recoverable.

Identifiable exploration assets acquired are recognised as

assets at their cost of acquisition, as determined by the

requirements of AASB 6 Exploration for and Evaluation of Mineral

Resources. Exploration assets acquired are reassessed on a regular

basis and these costs are carried forward provided that at least

one of the conditions referred to in AASB 6 is met.

Exploration and evaluation expenditure incurred subsequent to

acquisition in respect of an exploration asset acquired is

accounted for in accordance with the policy outlined above for

exploration expenditure incurred by or on behalf of the entity.

Acquired exploration assets are not written down below

acquisition cost until such time as the acquisition cost is not

expected to be recovered. When an area of interest is abandoned,

any expenditure carried forward in respect of that area is written

off. Expenditure is not carried forward in respect of any area of

interest/mineral resource unless the Group's rights of tenure to

that area of interest are current.

Mine Properties

Mine properties represent the accumulation of all exploration,

evaluation and development expenditure incurred in respect of areas

of interest in which mining has commenced or is in the process of

commencing. When further development expenditure is incurred in

respect of mine property after the commencement of production, such

expenditure is carried forward as part of the mine property only

when substantial future economic benefits are thereby established,

otherwise such expenditure is classified as part of the cost of

production.

Amortisation is provided on a unit of production basis which

results in a write off of the cost proportional to the depletion of

the proven and probable mineral reserves.

The net carrying value of each area of interest is reviewed

regularly and to the extent to which this value exceeds its

recoverable amount, the excess is either fully provided against or

written off in the financial year in which this is determined.

The Group provides for environmental restoration and

rehabilitation at site which includes any costs to dismantle and

remove certain items of plant and equipment. The cost of an item

includes the initial estimate of the costs of dismantling and

removing the item and restoring the site on which it is located,

the obligation for which an entity incurs when an item is acquired

or as a consequence of having used the item during that period.

This asset is depreciated on the basis of the current estimate of

the useful life of the asset. In accordance with AASB 137

Provisions, Contingent Liabilities and Contingent Assets the Group

is also required to recognise as a provision the best estimate of

the present value of expenditure required to settle this

obligation. The present value of estimated future cash flows is

measured using a current market discount rate.

Stripping costs

Costs associated with material stripping activity, which is the

process of removing mine waste materials to gain access to the

mineral deposits underneath, during the production phase of surface

mining are accounted for as either inventory or a non-current asset

(non-current asset is also referred to as a 'stripping activity

asset').

To the extent that the benefit from the stripping activity is

realised in the form of inventory produced, the Group accounts for

the costs of that stripping activity in accordance with the

principles of AASB 102 Inventories. To the extent the benefit is

improved access to ore, the Group recognises these costs as a

non-current asset provided that:

-- it is probable that the future economic benefit (improved

access to the ore body) associated with the stripping activity will

flow to the Group;

-- the Group can identify the component of the ore body for which access has been improved; and

-- the costs relating to the stripping activity associated with

that component can be measured reliably.

Stripping activity assets are initially measured at cost, being

the accumulation of costs directly incurred to perform the

stripping activity that improves access to the identified component

of ore plus an allocation of directly attributable overhead costs.

In addition, stripping activity assets are accounted for as an

addition to, or as an enhancement to, an existing asset.

Accordingly, the nature of the existing asset determines:

-- whether the Group classifies the stripping activity asset as tangible or intangible; and

-- the basis on which the stripping activity asset is measured

subsequent to initial recognition.

In circumstances where the costs of the stripping activity asset

and the inventory produced are not separately identifiable, the

Group allocates the production stripping costs between the

inventory produced and the stripping activity asset by using an

allocation basis that is based on volume of waste extracted

compared with expected volume, for a given volume of ore

production.

Borrowings

Borrowings are initially recognised at fair value, net of

transaction costs incurred. Borrowings are subsequently measured at

amortised cost. Any difference between the proceeds (net of

transaction costs) and the redemption amount is recognised in

profit or loss over the period of the borrowing using the effective

interest method. Fees paid on the establishment of loan facilities

are recognised as transaction costs of the loan to the extent that

it is probable that some or all of the facility will be drawn down.

In this case, the fee is deferred until the draw down occurs. To

the extent there is no evidence that it is probable that some or

all of the facility will be drawn down, the fee is capitalised as a

prepayment for liquidity services and amortised over the period of

the facility to which it relates.

Revenue

Revenue arises mainly from the sale of fertiliser. The Group

generates revenue in Brazil. To determine whether to recognise

revenue, the Group follows a 5-step process:

1. Identifying the contract with a customer

2. Identifying the performance obligations

3. Determining the transaction price

4. Allocating the transaction price to the performance obligations

5. Recognising revenue when/as performance obligation(s) are satisfied.

The revenue and profits recognised in any period are based on

the delivery of performance obligations and an assessment of when

control is transferred to the customer.

In determining the amount of revenue and profits to record, and

related statement of financial position items (such as contract

fulfilment assets, capitalisation of costs to obtain a contract,

trade receivables, accrued income and deferred income) to recognise

in the period, management is required to form a number of key

judgements and assumptions. This includes an assessment of the

costs the Group incurs to deliver the contractual commitments and

whether such costs should be expensed as incurred or

capitalised.

Revenue is recognised either when the performance obligation in

the contract has been performed, so 'point in time' recognition or

'over time' as control of the performance obligation is transferred

to the customer. For contracts with multiple components to be

delivered such as fertiliser, management applies judgement to

consider whether those promised goods and services are (i) distinct

- to be accounted for as separate performance obligations; (ii) not

distinct - to be combined with other promised goods or services

until a bundle is identified that is distinct or (iii) part of a

series of distinct goods and services that are substantially the

same and have the same pattern of transfer to the customer.

Transaction price

At contract inception the total transaction price is estimated,

being the amount to which the Group expects to be entitled and has

rights to under the present contract. The transaction price does

not include estimates of consideration resulting from change orders

for additional goods and services unless these are agreed. Once the

total transaction price is determined, the Group allocates this to

the identified performance obligations in proportion to their

relative stand-alone selling prices and recognises revenue when (or

as) those performance obligations are satisfied.

For each performance obligation, the Group determines if revenue

will be recognised over time or at a point in time. Where the Group

recognises revenue over time for long term contracts, this is in

general due to the Group performing and the customer simultaneously

receiving and consuming the benefits provided over the life of the

contract.

For each performance obligation to be recognised over time, the

Group applies a revenue recognition method that faithfully depicts

the Group's performance in transferring control of the goods or

services to the customer. This decision requires assessment of the

real nature of the goods or services that the Group has promised to

transfer to the customer. The Group applies the relevant output or

input method consistently to similar performance obligations in

other contracts.

When using the output method the Group recognises revenue on the

basis of direct measurements of the value to the customer of the

goods and services transferred to date relative to the remaining

goods and services under the contract. Where the output method is

used, in particular for long term service contracts where the

series guidance is applied, the Group often uses a method of time

elapsed which requires minimal estimation. Certain long term

contracts use output methods based upon estimation of number of

users, level of service activity or fees collected.

If performance obligations in a contract do not meet the over

time criteria, the Group recognises revenue at a point in time.

This may be at the point of physical delivery of goods and

acceptance by a customer or when the customer obtains control of an

asset or service in a contract with customer-specified acceptance

criteria.

Disaggregation of revenue

The Group disaggregates revenue from contracts with customers by

contract type, which includes only fertiliser as management

believes this best depicts how the nature, amount, timing and

uncertainty of the Group's revenue and cash flows.

Performance obligations

Performance obligations categorised within this revenue type

include the debtor taking ownership of the fertiliser product.

Inventories

Inventories are valued at the lower of cost and net realisable

value.

Costs incurred in bringing each product to its present location

and condition is accounted for as follows:

-- Raw materials - purchase cost; and

-- Finished goods - cost of direct materials and labour and an

appropriate proportion of variable and fixed overheads based on

normal operating capacity.

Net realisable value is the estimated selling price in the

ordinary course of business, less estimated costs of completion and

the estimated costs necessary to make the sale.

Provisions

Provisions are recognised when the Group has a present

obligation (legal or constructive) as a result of a past event, it

is probable that an outflow of resources embodying economic

benefits will be required to settle the obligation and a reliable

estimate can be made of the amount of the obligation.

Where the Group expects some, or all, of a provision to be

reimbursed, for example under an insurance contract, the

reimbursement is recognised as a separate asset but only when the

reimbursement is virtually certain. The expense relating to any

provision is presented in the statement of comprehensive income net

of any reimbursement.

If the effect of the time value of money is material, provisions

are determined by discounting the expected future cash flows at a

pre-tax rate that reflects current market assessments of the time

value of money, and where appropriate, the risks specific to the

liability. Where discounting is used, the increase in the provision

due to the passage of time is recognised as a finance cost.

NOTE 2: SEGMENT REPORTING

For management purposes, the Group is organised into one main

operating segment, which involves mining exploration, processing

and sale of fertiliser. All of the Group's activities are

interrelated, and discrete financial information is reported to the

Board (Chief Operating Decision Maker) as a single segment. No

revenue is derived from a single external customer.

Accordingly, all significant operating decisions are based upon

analysis of the Group as one segment. The financial results from

this segment are equivalent to the financial statements of the

Group as a whole. Revenue earned by the Group is generated in

Brazil and all of the Group's non-current assets reside in

Brazil.

The following table present revenue and loss information and

certain asset and liability information regarding business segments

for the half year ended 30 June 2023.

Continuing operations

Australia Brazil Consolidated

30 June 2023 $ $ $

Segment revenue - 931,608 931,608

Segment profit/(loss) before income

tax expense (642,854) (965,988) (1,608,842)

30 June 2023

Segment assets 367,324 11,389,888 11,757,212

---------- ----------- -------------

Segment liabilities 220,861 2,428,248 2,649,109

---------- ----------- -------------

Additions to non-current assets - 945,953 945,953

---------- ----------- -------------

Continuing operations

Australia Brazil Consolidated

30 June 2022 $ $ $

Segment revenue - 2,735,590 2,735,590

Segment loss before income tax expense (656,104) (227,452) (883,556)

30 June 2022

Segment assets 822,413 10,317,216 11,139,629

---------- ----------- -------------

Segment liabilities 342,633 2,104,057 2,446,690

---------- ----------- -------------

Additions to non-current assets - 1,330,097 1,330,097

---------- ----------- -------------

NOTE 3: REVENUE FROM CONTRACTS WITH CUSTOMERS

The Group derives its revenue from the sale of goods at a point

in time in the major category of Fertiliser.

Consolidated

6 months

to 6 months to

30 June 30 June

2023 2022

$ $

Fertiliser sales 931,608 2,735,590

Total revenue 931,608 2,735,590

--------- ----------

NOTE 4: COST OF GOODS SOLD

Consolidated

6 months

6 months to to

30 June 30 June

2023 2022

$ $

Mine operating costs 383,059 492,617

Royalty expense 36,546 108,430

Rehabilitation expense 7,911 216,272

Depreciation 152,717 146,931

Amortisation 126,811 189,191

Total cost of goods sold 707,044 1,153,441

---------- -------------

NOTE 5: CASH AND CASH EQUIVALENTS

Consolidated

Reconciliation of Cash and Cash Equivalents 30 June 31 December

2023 2022

Cash comprises: $ $

Cash at bank 423,982 2,723,509

423,982 2,723,509

------------ --------------

Consolidated

Reconciliation of operating loss after tax 6 months 6 months

to the cash flows from operations to to

30 June 30 June

2023 2022

$ $

Loss from ordinary activities after tax (1,645,945) (883,556)

Non cash items

Depreciation charge 191,702 151,616

Amortisation charge 126,811 189,191

Rehabilitation charge 7,911 216,272

Impairment of exploration and evaluation expenditure - 491,500

Gain on disposal of motor vehicle (15,171) (8,185)

Foreign exchange gain 1,919 54,401

Change in assets and liabilities

(Increase) / Decrease in trade and other receivables (121,413) 174,834

(Increase) / Decrease in inventories (1,200,633) (287,163)

Increase / (Decrease) in trade and other payables

and provisions 20,593 594,297

Net cash outflow from operating activities (2,634,226) 693,207

------------ --------------

NOTE 6: TRADE AND OTHER RECEIVABLES

Consolidated

30 June 31 December

2023 2022

$ $

Trade Debtors(1) 1,819,386 1,606,440

Expected credit losses (1,398,945) (1,260,749)

Prepayments 31,925 -

Cash advances 203,366 161,762

GST receivable 7,170 7,271

Other tax receivables 48,042 -

Total trade and other receivables 710,944 514,724

----------- ------------

(i) Classification of trade receivables

Trade debtors, other debtors and goods and services tax are

receivable on varying collection terms. Due to the short-term

nature of these receivables, their carrying value is assumed to

approximate their fair value. Some debtors are given industry

standard longer payment terms which may cross over more than one

accounting period. These trade terms are widely used in the

agricultural market in Brazil and are considered industry

norms.

(ii) Impairment of trade receivables

The group applies the simplified approach to measuring expected

credit losses which uses a lifetime expected loss allowance for all

trade receivables and contract assets. To measure the expected

credit losses, trade receivables have been grouped based on shared

credit risk characteristics and the days past due. The historical

loss rates are adjusted to reflect current and forward information

on macroeconomic factors affecting the ability of the customers to

settle the receivables. Trade receivables are written off where

there is no reasonable expectation of recovery. Indicators that

there is no reasonable expectation of recovery include, amongst

others, the failure of a debtor to engage in a repayment plan with

the group, and a failure to make contractual payments for a period

of greater than 120 days past due.

NOTE 7: INVENTORIES

Consolidated

30 June 31 December

2023 2022

$ $

Raw materials - 9,298

Finished goods 1,396,515 186,584

---------- -----------

1,396,515 195,882

---------- -----------

NOTE 8: PLANT AND EQUIPMENT

Consolidated

12 months

6 months to to

30 June 31 December

2023 2022

$ $

At beginning of the period 2,891,499 1,111,314

Additions for the period 741,270 2,035,861

Disposals for the period (45,365) (10,874)

Depreciation charge for the period (191,702) (418,649)

Net exchange difference on translation 333,001 173,847

Balance at the end of the period 3,728,703 2,891,499

---------- -----------------

NOTE 9: MINE PROPERTIES

Consolidated

12 months

6 months to to

30 June 31 December

2023 2022

$ $

At beginning of the period 4,055,486 3,691,160

Additions for the period 204,683 -

Rehabilitation obligation - 259,928

Amortisation charge for the period (126,811) (354,282)

Net exchange difference on translation 511,190 458,680

Balance at the end of the period 4,644,548 4,055,486

---------- -----------------

NOTE 10: TRADE AND OTHER PAYABLES

Consolidated

30 June 31 December

2023 2022

$ $

Trade payables 220,333 242,706

Accruals 276,391 176,895

Other payables 37,258 93,788

--------------- -----------

533,982 513,389

--------------- -----------

Trade creditors, other creditors and goods and services tax are

non-interest bearing and generally payable on 60 day terms. Due to

the short term nature of these payables, their carrying value is

assumed to approximate their fair value.

NOTE 11: BORROWINGS

Consolidated

30 June 31 December

2023 2022

$ $

Current

Secured Loans payable 511,748 53,270

511,748 53,270

-------- ------------

Non-current

Secured Loans payable 1,295,075 192,407

1,295,075 192,407

---------- --------

In March 2023, the Group secured a further $R5,000,000 loan with

BDMG for purchase of equipment and machinery. The loan is repayable

over a two year period with repayments commencing in April 2024 and

secured against $R1,000,000 in cash as collateral. As at 30 June

2023, the Group recorded $1,806,823 (31 December 2022: $245,677) of

secured loans as a payable.

NOTE 12: CONTRIBUTED EQUITY

30 June 31 December

2023 2022

$ $

Contributed equity

Ordinary shares fully paid 43,328,219 43,328,219

---------- ----------

6 months to 12 months year ended

30 June 2023 31 December 2022

No. $ No. $

Movements in ordinary shares on issue

Opening balance 189,169,217 43,328,219 185,835,884 43,328,219

Shares to be issued as part an acquisition(1) - - 3,333,333 -

Closing balance 189,169,217 43,328,219 189,169,217 43,328,219

----------- ---------- ----------- ----------

(1) On 29 November 2021, the Company entered into an agreement

to acquire 100% of the ordinary shares of BF Mineração Ltda for

cash and shares. On 6 July 2022, the Company announced the issuance

of 3,333,333 shares related to the agreement to acquire 100% of the

ordinary shares of BF Mineração Ltda for the Miriri Phosphate

Project.

NOTE 13: DIVIDENDS

No dividends have been paid or provided for during the half-year

(half-year to 30 June 2022: $nil).

NOTE 14: CONTINGENT LIABILITIES AND COMMITMENTS

There has been no material change in contingent liabilities or

commitments since the last annual reporting date.

NOTE 15: FINANCIAL INSTRUMENTS

The Group has a number of financial instruments which are not

measured at fair value in the statement of financial position.

The Directors consider that the carrying amounts of current

receivables, current payables and current borrowings are considered

to be a reasonable approximation of their fair values.

NOTE 16: SUBSEQUENT EVENTS

As announced to AIM on 14 August 2023, the Group has revised its

2023 sales target from 120,000 tonnes to 70,000 tonnes.

There have been no other known significant events subsequent to

the end of the period that require disclosure in this report.

ENDS

Harvest Minerals Brian McMaster (Chairman) Tel: +44 (0) 203 940

Limited 6625

Strand Hanson Limited Ritchie Balmer Tel: +44 (0) 20 7409

Nominated & Financial James Spinney 3494

Adviser

Tavira Securities Jonathan Evans Tel: +44 (0) 20 3 192

Broker 1733

St Brides Partners Ana Ribeiro harvest@stbridespartners.co.uk

Ltd Isabel de Salis

Financial PR

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GLGDCRDDDGXB

(END) Dow Jones Newswires

September 21, 2023 02:32 ET (06:32 GMT)

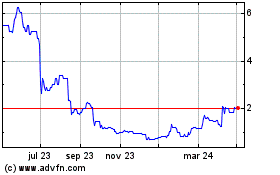

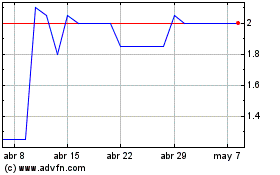

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Harvest Minerals (LSE:HMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024