TIDMINX

RNS Number : 3632D

i-nexus Global PLC

21 June 2023

THIS ANNOUNCEMENT, INCLUDING THE APPIX, AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM THE UNITED STATES, CANADA, JAPAN, RUSSIA, THE REPUBLIC

OF SOUTH AFRICA, AUSTRALIA, NEW ZEALAND OR ANY OTHER JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION. PLEASE SEE THE IMPORTANT NOTICES

AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN I-NEXUS GLOBAL PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT

OF ITS DISTRIBUTION, SHALL FORM THE BASIS OF, OR BE RELIED ON IN

CONNECTION WITH ANY INVESTMENT DECISION IN RESPECT OF I-NEXUS

GLOBAL PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 as retained as part of UK

law by virtue of the European Union (Withdrawal) Act 2018 as

amended ("MAR"). . Upon the publication of this Announcement, this

inside information is now considered to be in the public

domain.

i-Nexus Global PLC

("i-Nexus", the "Company" or the "Group")

Proposed issue of GBP0.5 million of Fixed Rate Unsecured

Convertible Loan Notes; and

Extension of 2020 and 2021 Convertible Loan Notes

The Company announces that it is proposing to raise in aggregate

GBP0.5 million (before expenses) by way of the issue of GBP0.5

million of Fixed Rate Unsecured Convertible Redeemable Loan Notes

("2023 Convertible Loan Notes") (the "Proposed Transaction"). The

2023 Convertible Loan Notes will be unlisted and non-transferable

and no offer or invitation is being made to shareholders more

generally to purchase, acquire or subscribe for any of the

Convertible Loan Notes in conjunction with the Proposed

Transaction.

Furthermore, the Company also announces today that it has agreed

with the holders of both the 2020 Convertible Loan Notes and the

2021 Convertible Loan Notes (having passed the necessary written

resolutions) to extend the nal redemption dates from 4 November

2024 to 4 November 2025 in respect of the 2020 Convertible Loan

Notes and from 29 September 2024 to 29 September 2025 in respect of

the 2021 Convertible Loan Notes. Other than the final redemption

dates, the terms of the 2020 Convertible Loan Notes and the 2021

Convertible Loan Notes, as previously announced, remain

unchanged.

Highlights

-- Proposed issue of GBP0.5 million of Fixed Rate Unsecured Convertible Redeemable Loan Notes

-- The net proceeds of the issue of the 2023 Convertible Loan

Notes of GBP0.5 million will provide much needed additional working

capital to allow the emerging sales and pipeline momentum to be re

ected within operating results and cash ow and will be applied

entirely towards meeting the Company's ongoing working capital

requirements.

-- The Convertible Loan Notes are unsecured and

non-transferrable and no application will be made for their

admission to trading on any recognised securities exchange.

-- The holders will have the right to convert the Convertible

Loan Notes they hold into ordinary shares of GBP0.10 each in the

capital of the Company ("Ordinary Shares") at a price of 10 pence

per Ordinary Share (the "Conversion Price") at any time on or prior

to 7 July 2025.

-- The Conversion Price represents a premium of approximately

166.7 per cent. to the closing middle market price of 3.75 pence

per Ordinary Share on 20 June 2023, being the latest practicable

trading day prior to the publication of this Announcement.

-- Richard Cunningham, the Non-Executive Chairman, has agreed to

participate in the Proposed Transaction and has agreed to subscribe

for the 2023 Convertible Loan Notes following the passing of the

resolutions by Shareholders at a general meeting of the Company

("General Meeting") ("Resolutions") as proposed in a circular,

which will shortly be despatched to Shareholders ("Circular").

-- The Directors other than Richard Cunningham (the "Independent

Board") are strongly of the belief that the issue of the 2023

Convertible Loan Notes is the best available option for securing

further investment in the near term, having regard to the

desirability of demonstrating increased funding headroom and

exibility within a limited timeframe.

-- The Proposed Transaction is conditional on the passing of the

Resolutions by Shareholders at the General Meeting, including a

special resolution which will give the Directors the required

authority to disapply statutory pre-emption rights in respect of

the potential future issue of new Ordinary Shares upon conversion

of the 2023 Convertible Loan Notes.

Simon Crowther, CEO of Solution, commented:

" Having made good progress on increasing our sales pipeline,

adding new logos and expanding the use of our software within

existing customers, we felt that the time was right to provide the

business with a cash buffer to enable a greater focus on the

execution of the strategy. We are once again very grateful for the

support of our investors in providing us with this funding and look

forward to continued steady progress in the months ahead. These

growing proof points of success underline our confidence in our

offering and ability to play a leadership role in the maturing

market for strategy execution ."

Capitalised terms used but not defined in this announcement

shall have the meanings set out in the Circular.

1. Introduction

On 28 April 2023, the Company issued its interim results, which

included a statement that the Board was considering the available

options at its disposal in order to strengthen the Group's cash

position.

The Company announces today that it has concluded this review

and is proposing to raise in aggregate GBP0.5 million (before

expenses) by way of the issue of 2023 Convertible Loan Notes to the

Investors. The 2023 Convertible Loan Notes will be unlisted and

non-transferable, and no offer or invitation is being made to

Shareholders more generally to purchase, acquire, or subscribe for

any of the 2023 Convertible Loan Notes in conjunction with the

issue of the 2023 Convertible Loan Notes. The Company completed

previous issues of convertible loan notes in November 2020 and

September 2021 and the 2023 Convertible Loan Notes now proposed to

be issued carry substantially equivalent terms to those previously

issued.

The Company also announces today that it has agreed with the

holders of both the 2020 Convertible Loan Notes and the 2021

Convertible Loan Notes (having passed the necessary written

resolutions) to extend the nal redemption dates from 4 November

2024 to 4 November 2025 in respect of the 2020 Convertible Loan

Notes and from 29 September 2024 to 29 September 2025 in respect of

the 2021 Convertible Loan Notes (both referred to as the

Extensions). Other than the nal redemption dates, the terms of the

2020 Convertible Loan Notes and the 2021 Convertible Loans Notes,

as previously announced, remain unchanged.

Richard Cunningham, the Non-Executive Chairman and Herald, both

of whom hold 2020 Convertible Loan Notes and 2021 Convertible Loan

Notes and both of whom signed the written resolutions agreeing to

the Extensions, have also agreed to participate in the issue of the

2023 Convertible Loan Notes and, subject to the passing of the

Resolutions by Shareholders at the General Meeting, will subscribe

for 2023 Convertible Loan Notes. Both Richard Cunningham and

Herald's agreement to the Extensions and their participation in the

issue of the 2023 Convertible Loan Notes (referred to as the

Proposed Transactions) are related party transactions for the

purposes of Rule 13 of the AIM Rules and, as a result, Richard

Cunningham has not been involved in the decisions taken by the

Board to proceed with the Proposed Transactions and, for the

purposes of the Proposed Transactions, David Firth is the Company's

Independent Non-Executive Director and is issuing this letter to

the Company's Shareholders.

As further explained under paragraph 2 below, the Independent

Board is strongly of the belief that the issue of the 2023

Convertible Loan Notes is the best available option for securing

further investment in the near term, having regard to the

desirability of demonstrating increased funding headroom and

exibility within a limited timeframe.

The issue of the 2023 Convertible Loan Notes is conditional on

the passing of the Resolutions by Shareholders at the General

Meeting, including a special resolution which will give the

Directors the required authority to disapply statutory pre-emption

rights in respect of the potential future issue of new Ordinary

Shares upon conversion of the 2023 Convertible Loan Notes.

The purpose of the Circular is to outline the reasons for, and

provide further information on, the Proposed Transactions and to

explain why the Independent Board believes this to be in the best

interests of the Company and its Shareholders as a whole.

In the Circular, you will nd a notice of the General Meeting at

which the Resolutions will be proposed to approve the issue of the

2023 Convertible Loan Notes. The General Meeting is expected to be

convened for 11.00 a.m. on 7 July 2023 at Saffery Champness, 71

Queen Victoria Street, London, EC4V 4BE.

Your attention is also drawn to the summary of the key terms of

the Convertible Loan Notes in the Appendix of this

announcement.

The Independent Board strongly believes that the Proposed

Transactions are in the best interests of the Company and its

Shareholders as a whole. The Independent Board also stresses that

it is very important that Shareholders vote in favour of the

Resolutions proposed at the General Meeting, as those Directors who

hold Ordinary Shares intend to do. The Independent Board believes

that if the Resolutions are not passed at the General Meeting and

so the issue of the 2023 Convertible Loan Notes does not proceed,

then in the absence of available alternative sources of funding, it

is likely that the Company will be required to employ mitigating

actions to ensure it continues to operate within the cash resources

currently available to it. This would increase the liquidity risk

posed should any customer delay payment and would constrain

management's ability to focus their efforts on more strategic areas

of the business.

2.Background to and reasons for the Proposed Transactions

The Company saw an improvement in new business generation in

FY22, securing a record nine new customers alongside a considerable

improvement in renewal rates with existing customers. As a result

of this positive progress, the Board took the decision within the

second half of the financial year to accelerate a select number of

essential investments, both in its existing employee base to

preserve retention and in additional resources needed for

operational delivery. While this increased the Company's recurring

cost base and subsequently reduced cash reserves, these investments

ensured the successful delivery and deployment of the new logos,

several of which have since extended their use of the i-nexus

software highlighting the speed of value being derived from the

product alongside the increased market need for digitalised

strategy solutions.

These extensions, combined with the delivery of a further five

new logos during H1 of FY23, saw the Company's MRR grow by 25 per

cent. to GBP281,000 on an annualised basis for the 12-month period

to 31 March 2023. Following the conclusion of this essential

investment plan in early FY23, there are no further plans to

increase the cost base of the Company until such time as revenue

growth delivers a position of at least Adjusted EBITDA breakeven,

with the strategic objective to build a cash buffer thereafter.

Pipeline activity and in particular the number of prospects that

are undertaking trials or pilots continues to be encouraging,

providing confidence in continued revenue growth with an

increasingly remote or hybrid workforce across multiple industries

driving the need for scalable, robust, digital strategy execution

tools.

Nevertheless, prior to the Company achieving a position of at

least Adjusted EBITDA breakeven, the seasonality of customer

renewals means that continued careful cash management is required

as the Company approaches the end of its financial year, a

forecasted cash low point, increasing the risk posed should any

customer delay payment. Were delays to arise, the Company would

need to implement potentially operationally harmful mitigating

actions.

The Company's Outlook statement within the Interim Results,

released on 28 April 2023, stated that whilst the business has

clear visibility of its cash runway, the Board recognised that the

continued efforts in managing our cash resources required

consideration of the available options at its disposal in order to

strengthen the Group's cash position. The Board is mindful of

ensuring suf cient liquidity within the business should a downside

scenario emerge in order to relieve pressure at the end of the FY23

nancial year, and provide the management team with the ability to

focus their efforts on more strategic areas of the business such as

delivering on its pipeline opportunities and realising the growing

expansion opportunities within its customer base, without the need

to employ potentially operationally harmful mitigating actions.

The Independent Board have concluded that, in view of the

continued challenges in the Group's current and near term forecast

cash position, that it is desirable to create additional working

capital headroom and that the issue of the 2023 Convertible Loan

Notes is the best available option for securing such investment

within a limited timeframe.

The Independent Board also concluded that the Extensions would

similarly assist the Group with its working capital headroom in the

near future and would enable the Group to focus its efforts on

delivering on its pipeline opportunities and realising the growing

expansion opportunities within its customer base.

3. Current Trading & Prospects

At the time of its Interim Results, the Company stated that it

was on track to deliver improved double-digit net MRR growth in

FY23, capitalising on the increased opportunities within its

installed user base and strong prospect pipeline. Subsequent to

this announcement, whilst the current expectation is that this

statement will hold true, new revenue delivery during Q3 has

moderated against forecast levels with most H2 new business and

expansion opportunities now anticipated to land during Q4.

Consequently, the delays experienced by the Company in realising

these opportunities increases the pressure on cash flow,

particularly as the Company approaches the forecasted low point at

the end of the financial year, and highlights the essential need

for the management team to focus their efforts on strategic areas

of the business.

4.The 2023 Convertible Loan Notes

The Company has entered into the Convertible Loan Note

Instrument pursuant to which the Company has created 2023

Convertible Loan Notes of an aggregate principal amount of GBP0.5

million. The issue of the 2023 Convertible Loan Notes is

conditional only upon the passing of the Resolutions at the

proposed General Meeting.

The 2023 Convertible Loan Notes are unsecured and

non-transferrable, and no application will be made for their

admission to trading on any recognised securities exchange.

The Convertible Loan Note Instrument gives the holders of the

2023 Convertible Loan Notes the right to convert the 2023

Convertible Loan Notes they hold into Ordinary Shares at a price of

10 pence per Ordinary Share, equal to the nominal value of each

Ordinary Share (which represents a premium of approximately 166.7

per cent. to the closing middle market price of 3.75 pence per

Ordinary Share on 20 June 2023, being the latest practicable

trading day prior to the date of this announcement) at any time on

or prior to 7 July 2025.

Further details of the key terms and conditions attaching to the

2023 Convertible Loan Notes are set out in the Appendix of this

announcement.

The Investors have entered into irrevocable undertakings with

the Company whereby each Investor has agreed irrevocably and, save

only for the passing of the Resolutions at the General Meeting,

unconditionally to subscribe for an aggregate amount of GBP500,000

of 2023 Convertible Loan Notes:

Subscriber Aggregate Issue Price

Herald GBP420,000

Richard Cunningham GBP30,000

Financiere de l'Audiovisuel GBP30,000

Siobhan Adele Robinson GBP20,000

Total GBP500,000

Upon the passing of the proposed Resolutions, the Company shall

issue the 2023 Convertible Loan Notes to the Investors and execute

and deliver certificates in respect of the 2023 Convertible Loan

Notes in the aggregate amounts finally subscribed for.

Following publication of the Circular, a copy of the draft

Convertible Loan Note Instrument will be available for inspection

at the Company's registered office until the time and date of the

General Meeting.

5. Related Party Transactions

Richard Cunningham is a Director of the Company and its

Non-Executive Chairman, whilst Herald is currently, prior to the

issue of the 2023 Convertible Loan Notes and as at the date of this

announcement, interested in (in aggregate) 4,031,490 Ordinary

Shares, representing approximately 13.6 per cent. of the existing

Ordinary Share capital of the Company, and is therefore regarded as

a "Substantial Shareholder" for the purposes of the AIM Rules. Both

Richard Cunningham and Herald agreed to the Extensions and Richard

Cunningham has agreed to subscribe for 2023 Convertible Loan Notes

with an aggregate par value of GBP30,000 and Herald has agreed to

subscribe for 2023 Convertible Loan Notes with an aggregate par

value of GBP420,000. Richard Cunningham and Herald's respective

participations in the Proposed Transactions constitute related

party transactions under Rule 13 of the AIM Rules.

The Independent Board considers, having consulted with Singer

Capital Markets, that the terms of Richard Cunningham's and

Herald's respective participations in the Proposed Transaction are

fair and reasonable in so far as Shareholders are concerned.

Herald's participation in the issue of the 2023 Convertible Loan

Notes along with their participation in the 2020 Convertible Loan

Notes and 2021 Convertible Loan Notes, would, if the total number

of shares in issue remain the same, represent a fully diluted

holding in excess of 29.9 per cent. should all of the loan notes

they hold and the accrued interest thereon under all of the

convertible loan note instruments be converted. However, contained

in each of the convertible loan notes instruments pertaining to the

2020 Convertible Loan Notes, 2021 Convertible Loan Notes and 2023

Convertible Loan Notes, there is a contractual provision that

neither Herald nor the Company can invoke a conversion of such

number of loan notes held by Herald (or individuals or entities

acting in concert with Herald) that could result in Herald's

interest in the Company (including individuals or entities acting

in concert with Herald) exceeding 29.9 per cent. of total voting

rights.

6. Effect of the issue of the 2023 Convertible Loan Notes and

Use of Proceeds

After taking into account the receipt of the expected net

proceeds from the issue of the 2023 Convertible Loan Notes of

GBP0.43 million, the Directors are of the opinion that the Group

has sufficient working capital for its present requirements, that

is for at least 12 months from the date of this document. In

reaching this conclusion the Directors have modelled a downside

scenario under which they assume, inter alia, a material decrease

in monthly recurring revenues during the FY24 financial year, an

increase in churn and reduced renewals and an increase in working

capital requirements as a result of delays to receipt of client

funds. Under this downside scenario the net proceeds would still

provide the business with sufficient working capital headroom to

continue to operate. Under this scenario, no measures were applied

to the Group's existing cost base despite a number of potential

mitigating actions being available through the discretionary nature

of certain costs incurred. Whilst the internal modelling

demonstrates continuing cash headroom, the Company's viability in

the longer term remains critically dependent on its ability to

capitalize on current positive momentum by securing a modest level

of new sales to existing and potential customers. In the event the

net proceeds are received and in the unlikely scenario the business

trades to a downside case modelled by management over a twelve

month period and beyond, the then management would have to employ

mitigating actions available to ensure the business remains

solvent.

7. Potential Dilutive Effect Resulting From The Proposed

Transaction

The 2023 Convertible Loan Notes are capable of being converted

into new Ordinary Shares at a price of 10 pence per Ordinary Share.

In the circumstances whereby all of the principal amounts of the

2023 Convertible Loan Notes are converted and all of the rolled-up

interest attributable to the 2023 Convertible Loan Notes is also

converted on the same basis they will upon full conversion

represent an increase in the issued ordinary share capital of the

Company (assuming there has not been any other share issuance in

the meantime) of approximately 19.6 per cent.

The previous issue of convertible loan notes pursuant to the

2020 Convertible Loan Notes and 2021 Convertible Loan Notes are

also capable of being converted into new Ordinary Shares at a price

of 10 pence per Ordinary Share. In the circumstances whereby all of

the principal amounts of the previous issue of convertible loan

notes are converted and all of the rolled-up interest attributable

to such notes is also converted on the same basis they will upon

full conversion represent an increase in the issued ordinary share

capital of the Company (assuming there has not been any other share

issuance in the meantime) of approximately 91.7 per cent.

Accordingly, when the effect of the issue of the 2023

Convertible Loan Notes is added to the effect of the previous issue

of convertible loan notes pursuant to the 2020 Convertible Loan

Notes and 2021 Convertible Loan Notes, then the maximum number of

new Ordinary Shares issued to satisfy full conversion of all

tranches of convertible loan notes, including rolled-up interest,

would represent an increase in the issued ordinary share capital of

the Company of approximately 111.4 per cent., and so existing

Shareholders would experience aggregate dilution of approximately

52.7 per cent. As well as dilution there is the potential that

convertible loan notes that are converted into Ordinary Shares may

be sold in the market impacting the Company's share price.

8. General Meeting

The Company will shortly dispatch the Circular to Shareholders

convening a General Meeting of the Company at which the Resolutions

summarised below will be proposed:

Resolution one - authority to allot securities

Resolution one is proposed as an ordinary resolution. This means

that, for the Resolution to be passed, more than 50 per cent. of

the votes cast must be in favour of the Resolution. Resolution one

grants the Directors authority to allot Ordinary Shares, or grant

rights to subscribe for or convert any security into Ordinary

Shares, up to an aggregate nominal value of GBP580,000. This will

enable the Directors to issue the 2023 Convertible Loan Notes to

the Investors and any further subscribers. The authority granted by

this resolution shall expire on 8 July 2025.

Resolution two - disapplication of pre-emption rights

Resolution two is proposed as a special resolution. This means

that, for the Resolution to be passed, at least 75 per cent. of the

votes cast must be in favour of the Resolution. Resolution two

shall disapply the statutory pre-emption provisions set out in the

Companies Act in respect of the allotment of Ordinary Shares, or

granting of rights to subscribe for or convert any security into

Ordinary Shares, up to an aggregate nominal value of GBP580,000.

This disapplication shall expire on 8 July 2025.

Resolution two is conditional on Resolution one being passed so

that, if Resolution one is not passed, neither of the Resolutions

will become effective and the issue of 2023 Convertible Loan Notes

will not be implemented.

9. Irrevocable Undertakings

Each of the Directors and each of the Investors have given an

irrevocable undertaking to vote in favour of the Resolutions in

respect of their own beneficial holdings (and that of their

associates) of Ordinary Shares, together totalling 10,914,595,

representing in aggregate 36.9 per cent. of the issued Ordinary

Shares.

10. Importance Of The Vote

IT IS VERY IMPORTANT that Shareholders vote in favour of the

Resolutions at the General Meeting. The Independent Board believes

that if the Resolutions are not passed at the General Meeting and

so the issue of the 2023 Convertible Loan Notes does not proceed

and in the absence of available alternative sources of funding, it

is likely that the Company will require to operate with careful

cash management processes in the short term, increasing the

liquidity risk posed should any customer delay payment and

constraining management's ability to focus their efforts on more

strategic areas of the business.

11. Recommendation

The Independent Board strongly believes that the issue of the

2023 Convertible Loan Notes is in the best interests of the Company

and its Shareholders as a whole. Accordingly, the Independent Board

recommend that Shareholders vote in favour of the Resolutions to be

proposed at the General Meeting as those members of the Board (and

their associates) intend to do in respect of their entire

beneficial holdings of 2,071,575 Ordinary Shares representing 7.01

per cent. of the current issued Ordinary Share capital.

The person responsible for arranging the release of this

Announcement on behalf of the Company is Drew Whibley, Chief

Financial Officer.

For further information please contact:

i-nexus Global plc Via: Alma PR

Simon Crowther, CEO

Drew Whibley, CFO

Singer Capital Markets (Nominated Tel: +44 (0)207 496

Adviser and Broker) 3000

Sandy Fraser

Alex Bond

Jake Humphrey

Alma PR Tel: +44 (0)203 405

Caroline Forde 0205

Important Notices

Singer Capital Markets Advisory LLP (Singer Capital Markets),

which is authorised and regulated in the United Kingdom by the

Financial Conduct Authority, is acting for the Company and no one

else in connection with the Proposed Transactions and will not be

responsible to any person other than the Company for providing the

regulatory and legal protections afforded to clients of Singer

Capital Markets nor for providing advice in relation to the

contents of this announcement or any matter, transaction or

arrangement referred to in it. Singer Capital Markets has not

authorised the contents of, or any part of, this announcement and

no liability whatsoever is accepted by Singer Capital Markets for

the accuracy of information or opinion contained in this

announcement or for the omission of any information.

A copy of the Circular will be available on the website of

i-nexus Global plc at (http://www.i-nexus.com).

Forward-Looking Statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements" which reflect the Directors'

current views, interpretations, beliefs or expectations with

respect to the financial performance, business strategy and plans

and objectives of management for future operations of the Group.

These statements include forward-looking statements with respect to

the Group and the sector and industry in which the business

currently operates. Statements which include the words "believes",

"estimates", "plans", "projects", "anticipates", "expects",

"intends", "may", "aims", "targets", "will", "should" or, "future",

"opportunity", "potential" or, in each case, their negatives, and

similar statements of a future or forward- looking nature identify

forward-looking statements. These forward-looking statements

include matters that are not historical facts. They appear in a

number of places throughout this announcement. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this announcement are based on

certain factors and assumptions, including the Directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. While the Directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by law or by the AIM Rules, the Company undertakes no

obligation to publicly release the results of any revisions to any

forward-looking statements in this announcement that may occur due

to any change in the Directors' expectations or to reflect events

or circumstances after the date of this announcement.

APPIX

SUMMARY TERMS OF THE CONVERTIBLE LOAN NOTE

The key terms and conditions of the Convertible Loan Note

Instrument are as follows:

a) The issue of the 2023 Convertible Loan Notes is conditional

only on the passing of the Resolutions at the General Meeting.

There are no other conditions to the issue of the 2023 Convertible

Loan Notes.

b) The aggregate nominal value of the 2023 Convertible Loan

Notes is GBP500,000 and there is a minimum subscription amount of

GBP2,500 by an Investor for 2023 Convertible Loan Notes.

c) The 2023 Convertible Loan Notes are unsecured and

non-transferrable and no application will be made for their

admission to trading on any recognised securities exchange.

d) The Investors have irrevocably agreed to subscribe for the

amount of the 2023 Convertible Loan Notes as set out against their

names in Part I of the Circular immediately upon the passing of the

Resolutions at the General Meeting.

e) Following the issue of the 2023 Convertible Loan Notes, the

Investors may issue a conversion notice before the date on which

the 2023 Convertible Loan Notes are to be redeemed (see h below)

notifying the Company that they wish to convert part or all of

their 2023 Convertible Loan Notes into Ordinary Shares at a

conversion price of 10 pence per Ordinary Share.

f) The Investors may convert the 2023 Convertible Loan Notes

they hold, in whole or in part, at their sole discretion, provided

that the conversion will not result in a holder of 2023 Convertible

Loan Notes, together with any persons acting in concert with them,

being interested in Ordinary Shares carrying in aggregate more than

29.9 per cent. of the voting rights of the Company and, in the

event of any election to convert being made following an offer that

is made to all holders of Ordinary Shares in the Company to acquire

such number of Ordinary Shares that would give an offeror (and

those acting in concert with them) to cast more than 50 per cent.

of the votes, then this limitation shall continue to apply, but any

2023 Convertible Loan Notes held in excess of 29.9 per cent. on

conversion can be redeemed at the higher of their par value and the

highest offer price made by the offeror during an offer period.

g) The Company is entitled at any time following the date which

is 12 months after the date of issue of the 2023 Convertible Loan

Notes to require the Investors to convert, in whole or in part,

their 2023 Convertible Loan Notes on a pro-rata basis into Ordinary

Shares at the conversion price of 10 pence per Ordinary Share,

provided the closing bid price of an Ordinary Share as shown in the

Daily Official List of the London Stock Exchange for a period of at

least 60 consecutive days is equal to or exceeds GBP0.79 per

Ordinary Share.

h) Any 2023 Convertible Loan Notes not converted shall be redeemed on 7 July 2025.

i) Interest shall accrue on the 2023 Convertible Loan Notes at a

fixed rate of 8 per cent. per annum and shall roll up, but shall

not be compounded, and all accrued interest that is outstanding

shall be payable in full on the date the 2023 Convertible Loan

Notes are redeemed or, alternatively, the Investors may choose to

convert the rolled up interest into Ordinary Shares at the same

conversion price of 10 pence per Ordinary Share.

j) In the event that the Company is in default of any payment

obligation under the Convertible Loan Note Instrument, default

interest shall accrue (compounded quarterly) at the higher of 10

per cent. per annum and the base rate for the time being of

Barclays Bank plc.

a. The Convertible Loan Note Instrument sets out certain events

of default, on the occurrence of which the holders of 2023

Convertible Loan Notes may, in their sole discretion, require

immediate repayment of the amounts due to them in respect of the

2023 Convertible Loan Notes. These include:

b. the Company failing to make any payment due under the

Convertible Loan Note Instrument within seven days of such payment

becoming due;

c. material breach by the Company of the Convertible Loan Note

Instrument which is not cured within 30 days;

d. a breach of warranty given by the Company pursuant to the Convertible Loan Note Instrument;

e. the Company ceasing or threatening to cease or becoming

unable to pay its debts as they become due or ceasing to carry on

all or substantially all of its business;

f. an encumbrancer taking possession or a receiver,

administrative receiver, administrator or similar of cer being

appointed in respect of the whole or any substantial part of

the

g. Company's undertaking, property or assets; or

h. the Company initiating or consenting to bankruptcy, insolvency or composition proceedings.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFSIRLIIFIV

(END) Dow Jones Newswires

June 21, 2023 02:00 ET (06:00 GMT)

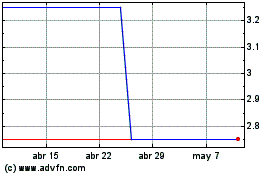

I-nexus Global (LSE:INX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

I-nexus Global (LSE:INX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024