TIDMJLP

RNS Number : 7633P

Jubilee Metals Group PLC

11 October 2023

Jubilee Metals Group PLC

Registration number (4459850)

AltX share code: JBL

AIM share code: JLP

ISIN: GB0031852162

("Jubilee" or "the Company" or "the Group")

Dissemination of a Regulatory Announcement that contains inside

information according to UK Market Abuse Regulations. Not for

release, publication or distribution in whole or in part in, into

or from any jurisdiction where to do so would constitute a

violation of the relevant laws or regulations of such

jurisdiction.

Audited Results for the year ended 30 June 2023

Notice of Annual General Meeting

Integrated Annual Report

Jubilee Metals Group PLC (AIM: JLP/Altx: JBL), a diversified

leader in metals processing with operations in Africa, is pleased

to announce its audited results for the year ended 30 June 2023

("FY2023"). Today, Jubilee is also publishing, its Integrated

Annual Report.

Jubilee has delivered a strong operational performance which has

assisted in buffering some of the challenging market conditions,

brought on by a fast-depreciating PGM basket price and

infrastructural challenges in both operating jurisdictions. The

operational performance served to demonstrate Jubilee's ability to

challenge industry norms by breaking through technical barriers and

implementing solutions that extract value from materials and ore

sources that were previously regarded by others as waste or too

complex.

Key milestones and achievements for the year

-- Record production figures across our PGM, chrome and copper

operations with 42 433 PGM oz (exceeding guidance and up 2%

year-on-year) 1 289 890 chrome concentrate tonnes (up 7%) and 2 923

copper tonnes (up 29%).

-- Successfully implemented an investment programme of GBP36

million (FY2022: GBP58 million) equivalent to US$44 million

(FY2022: US$70 million) to diversify and expand our operations in

chrome, PGM, copper and cobalt.

-- Commissioned a state-of-the-art expanded PGM processing

facility, designed to process PGM tailings and ores, previously

regarded as waste. This versatile facility boasts an annual

production capacity of 44 000 oz of PGMs.

-- Further expanded the chrome operational footprint through the

implementation of a long-term chrome ROM offtake agreement offering

increased chrome margins capable of offsetting the lower PGM

margins.

-- In South Africa, to address the infrastructure challenges, we

initiated the installation of backup power units at our chrome

facilities and managed stock levels to ensure continuous

operations.

-- In Zambia, we achieved significant advancements by

formulating breakthrough process flow sheets for the treatment of

mixed and transitional copper reefs as part of our 14 000 tonnes

per annum Southern copper strategy. These breakthroughs form part

of the process flowsheet upgrade at Roan currently underway.

-- The upgraded flowsheet offers significant lower capital

expansion opportunities within Zambia.

-- The technical team is in the process of innovating a copper

waste leach circuit for the treatment of copper and cobalt

tailings, as part of our Northern Refining copper strategy. The

development phase has commenced with upscaled continuous pilot runs

to confirm the encouraging results achieved to date.

-- Effectively addressed the infrastructure issues associated

with the new Roan Concentrator. A modern water infrastructure

system was completed in December 2022, followed by an enhanced

power infrastructure finalised in February 2023.

Financial highlights

-- Revenue from operations increased by 1% to GBP142 million

(FY2022: GBP140 million) equating to US$171 million (FY2022: US$186

million) with growth in US$ chrome revenue predominately offsetting

the market driven decrease in PGM revenue.

-- Gross profit was lower at GBP31 million (FY2022: GBP45

million) equivalent to US$38 million (FY2022: US$60 million)

impacted mainly by:

o Lower average PGM basket prices year-on-year decreasing by 22% to US$1 262 (FY2022: US$1 615)

o Increase of 11% in US$ operating cost per PGM oz driven mainly

by the increase in power and logistic costs

o Initial decrease during H1 FY2023 in chrome margins mainly due

to power constraints which was addressed through the roll-out of

back-up power systems

o Decrease in copper revenue per tonne of 19% to US$7 451 (FY2022: US$9 210)

o Continued expected growth of the chrome operations offering

the potential to offset lower PGM margins

-- EBITDA decreased to GBP24.8 million (FY2022: GBP36.8million)

or US$29.8 million (FY2022: US$48.9 million).

-- Cash from operating activities was supported by increased

contribution from operational expansions and remained strong at

GBP31 million (FY2022: GBP35 million) equivalent to US$37 million

(FY2022:US$42 million).

-- The Group's earnings per share decreased by 35% to 0.48 pence

(FY2022: 0.73 pence), as a result of the weighted average number of

shares increasing by 9% to 2 687.7 million shares (FY2022: 2 455.5

million shares) predominately due to the exercise of warrants

during the financial year and earnings attributable to owners of

the parent decreasing by 28% to GBP12.9 million (FY2022: GBP18.0

million) or US$15.5 million (FY2022: US$24.0million).

-- Group cash and cash equivalents at 30 June 2023 of

GBP12.5million (FY2022: GBP16 million) or US$15.9 million (FY2022

US$19.5 million).

-- A robust net cash position supporting the Group's current

assets to cover total liabilities by 103% (FY2022: 131%).

-- The Group's equity reduced marginally to GBP205 million

(FY2022: GBP207 million), predominately due to the profit after

taxation off-set by the movement in the foreign currency

translation reserve as a result of the weakening ZAR and ZMW

against the pound during the period under review. The Group

continues to maintain a strong equity ratio of 68% (FY2022:

71%).

Project and operational highlights

South Africa

-- In FY2023, our South African operations achieved 177 days

without any Lost Time Injuries (LTIs), compared to 162 days in

FY2022. This translates to a consistent LTIFR rate of 1.5,

mirroring our previous year's performance.

o The company was saddened by the loss of life suffered by a

service provider to our operations earlier in the year.

-- PGM oz sold increased by 2% to 42 433 oz (FY2022: 41 586 oz),

exceeding full year guidance of 38 000 oz.

-- Chrome tonnes sold increased by 4% to 1 275 287 tonnes

(FY2022: 1 222 452 tonnes) exceeding full year guidance of 1 200

000 tonnes.

-- Net cost per PGM oz net of chrome credits of US$508

(FY2022:US$408), remaining firmly as one of the lowest cost

producers of PGMs.

-- South African operations have reached stable production

meeting the market guidance and offering significant growth

opportunities.

-- On 6 June 2023, we proudly announced a significant, long-term

processing partnership. This collaboration increases our chrome ore

processing capacity by 360 000 tonnes annually offering the

potential to produce an additional 160 000 tonnes of chrome

concentrate per annum at improved margins together with an

associated feed to our PGM operations of 10 000 PGM ounces. The

move into higher margin chrome offtakes offers Jubilee:

o The opportunity to obtain greater exposure to the chrome price

and achieve higher margins compared with the existing fixed price

chrome tolling agreements;

o The option to further expand the partnership to expand the

processing capacity to 720 000 tonnes per annum of chrome ore;

o The opportunity of additional expansion opportunities

leveraging Jubilee's proven chrome efficiency capability, setting a

target annualised chrome concentrate production rate of 2 million

tonnes (60% expansion) over the next two years further

strengthening Jubilee's position as one of the largest chrome

producers globally.

Zambia

-- Zambian operations sustained a robust safety performance,

achieving 122 LTI free days (FY2022: 185 LTI free days), and

commensurately realising a reduction in the LTIFR to 2.4 (FY2022:

2.9).

-- Successfully mitigated power and water disruptions by

completing a new, privately-owned water infrastructure in December

2022 and augmenting the power infrastructure in February 2023.

-- Copper production improved by 29% to 2 923 tonnes (FY2022: 2

269 tonnes), marginally below the Group's revised guidance of 3 000

tonnes primarily due to previously announced power and water

disruptions in Zambia, impacting the ramp-up of the Roan

Concentrator.

-- Decision taken to further upgrade the Roan concentrator to

implement new technical advances and address lessons learnt in the

processing of weathered and transitional copper ores. The expansion

and upgrade of Roan has commenced and is expected to be completed

during Q2 FY 2024.

-- Jubilee successfully developed a breakthrough process flow

sheet for the treatment of mixed and transitional copper reefs as

part of our 14 000 tonnes per annum Southern copper strategy.

-- This modular flowsheet development offers the potential to

unlock numerous transitional copper ore opportunities in Zambia at

a significantly reduced capital investment per opportunity.

-- The Northern Copper Strategy continues to progress with the

development phase entering upscaled continuous pilot trials to

confirm results achieved to date. If successful, Jubilee believes

this would solve the technical barrier to unlock the recovery of

copper and cobalt from the vast quantity of copper tailings at

surface in Zambia.

Financial highlights

South Africa

-- Net revenue from our South African operations for FY2023

increased to GBP125 million (FY2022: GBP121million) up 3% from

FY2022, equivalent to US$151 million (FY2022: US$162 million).

-- Gross profit from South African operations for FY2023 reached

GBP27 million (US$32 million) down 30% from FY2022 maintaining a

healthy of 21% despite a 22% decline in the PGM US$ revenue per oz

and external operating cost drivers of power and logistics.

-- Chrome earnings margin of 12% (FY2022:13%) despite a rise in

operating costs of 10% to GBP56/t (FY2022: GBP51/t). Operating

costs in US$ terms remained consistent year-on-year.

-- PGM cost per oz US$508 (FY2022: US$408) net of chrome credits

driven higher mainly by cost of power and reliance on back-up

power.

Zambia

-- Net revenue from Zambian operations decreased by 8% driven by

sifter market prices to GBP17 million (FY2022: GBP18 million)

equivalent to US$20 million (FY2022: US$24 million) for the

year.

-- Gross profit from Zambian operations decreased by 35% to GBP5

million (FY2022: GBP8 million) and in US$ terms US$ 7.5 million

(FY2022: US$10 million) for the year.

-- Copper unit cost per tonne down 2% to US$5 281 (FY2022: US$5 386).

-- Total capital investment to date to deliver the integrated

Southern Copper Refining Strategy of GBP63 million (US$74 million)

which includes the integrated Sable Copper and Cobalt Refinery and

the Roan Concentrator.

Prospects for FY2024

SOUTH AFRICA

-- FY2024 offers the potential for growth in earnings as it

benefits from the expansion drive into high margin chrome

operations at a time when the market is experiencing strong demand

for chrome products:

o An additional 60 000 tonnes of higher margin chrome

concentrate is targeted for the first 6 months of FY2024 (150 000

tonnes over the full period) reaching an additional 15 000 tonnes

per month at stable production.

o The production of chrome forms a critical part of the South

African business' profitability and cost competitiveness. Jubilee

will continue to expand its chrome operational footprint on

attractive, market-linked terms during the period.

-- The Company confirms its guidance of achieving 1.45 million

tonnes of chrome concentrate for FY 2024.

-- The Company will seek to incrementally expand its PGM

production footprint to match the growing demand from the expansion

of the chrome operations.

-- Considering the prevailing PGM basket prices, the Company has

opted to prioritise enhancing the efficiency of existing PGM

capacity. We are also assessing potential Joint Ventures to

accommodate additional PGM feed materials, which presents a

cost-effective PGM expansion option for the Group. As part of this

decision the construction of a new PGM facility in the eastern limb

of South Africa has been placed under review.

-- The Company confirms its guidance of 42 000 PGM ounces for FY2024.

Zambia

-- The Southern Copper strategy targets the processing of

weathered and transitional copper reefs traditionally discarded as

waste.

o Jubilee developed breakthrough modular circuit designs

targeting the recovery of copper from these reefs;

o Modular circuit design offers potential for rapid deployment

based on learnings from the South African operations;

o Modules range from 15 000 to 50 000 tonnes per month

processing capacity at lower capital of US$2.5 million for a 15 000

tonnes per month module;

o Modules targeted as part of Roan upgrade with two further

modules considered under current long term offtake agreements being

negotiated.

-- The Company confirms its guidance of 5 850 tonnes of copper

for FY 2024 which is impacted by the upgrade at Project Roan.

-- As part of the development of the Northern Copper strategy,

upscaled continuous process trials have commenced to both confirm

the results achieved to date as well as the process flow sheet

assumptions. The continuous trials will run over an extended period

of approximately 10 weeks to ensure the accuracy of the

results.

Leon Coetzer, CEO, commented: "I am pleased to report another

year of significant growth at Jubilee in which we have demonstrated

our ability to navigate through some challenging infrastructure

conditions. The company successfully countered the sharp drop in

the PGM basket price by expanding its chrome operations into

higher-margin offtake agreements, resulting in a robust net cash

position and strong cash generation. Investments in power

infrastructure in South Africa and Zambia were crucial in

addressing power outages and stabilizing supply, while a new

private water infrastructure investment resolved disruptions issues

at the Roan operations.

"This year-on-year improved production performance reflects the

company's ongoing investment strategy in expansion opportunities,

with a belief in continued positive results in the short and medium

term. The organisation remains committed to challenging itself to

improve operational efficiencies, embodying what they refer to as

the "Jubilee Way."

"In South Africa, our operations continue maintain its status as

one of the lowest cost PGM producers and our commitment to safety

is evident with 177 days without any Lost Time Injuries. New

processing partnerships announced in the year are expected to

significantly enhance margins and processing capacities. Jubilee is

also poised for growth in Zambia, investing further in our new

copper division including upgrading our Roan Concentrator to boost

copper output. Technical breakthroughs from the development centre

offer substantial near-term growth opportunities in Zambia.

"In conclusion, the success of Jubilee can be attributed to the

unwavering dedication of our employees, strategic investments, and

agility in addressing challenges. The company remains committed to

delivering value to stakeholders and strengthening our market

position, and I continue to have every confidence our investments

will generate significant returns for shareholders in the short and

long term."

GROUP KEY PERFORMANCE INDICATORS

% change FY2022 FY2023 FY2023 FY2022 % change

Unit GROUP KEY UNITS Unit

OF PRODUCTION

PGM ounces sold

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

(5%) 35 318 33 376 Oz * Inyoni Oz 33 376 35 318 (5%)

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

44% 6 268 9 057 Oz * Third party JV Oz 9 057 6 268 44%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Total PGM ounces

2% 41 586 42 433 Oz sold Oz 42 433 41 586 2%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Copper tonnes

29% 2 604 2 923 Tonne sold Tonne 2 923 2 604 29%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

UNIT REVENUE

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Revenue per PGM

(22%) 1 615 1 262 $/oz ounce GBP/oz 1 048 1 215 (14%)

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Revenue per copper GBP

(19%) 9 210 7 451 $/t tonne /t 6 187 7 047 (12%)

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

UNIT COSTS

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Net cost per PGM

ounce (after

by-product GBP

24% 408 508 $/oz credits chrome) /oz 422 305 38%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Net cost per copper

tonne (after

by-product GBP

(2%) 5 386 5 281 $/t credits cobalt) /t 4 385 4 165 5%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

UNIT EARNINGS

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Net earnings per GBP

(38%) 1 207 754 $/oz PGM ounce /oz 627 910 (31%)

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Net earnings per GBP

(43%) 3 824 2 171 $/t copper tonne /t 1 802 2 882 (37%)

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

GROUP KEY FINANCIAL

INDICATORS

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

37 643 37 443 47 409 30 993

(1%) 497 796 US$ Capital spend GBP 212 020 53%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Cashflow from

41 276 37 336 operating 31 006 31 005

(10%) 419 216 US$ activities GBP 607 195 0%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

186 387 170 901 141 928 140 006

(8%) 702 624 US$ Revenue GBP 672 986 1%

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

48 955 29 841 24 782 36 773

(39%) 819 994 US$ EBITDA GBP 880 653 (33%)

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Tangible net asset

value per ordinary

(2%) 5.90 5.77 US cent share (pence) pence 4.56 4.86 (6%)

------------------ ------------------ -------------- --------------------- ------- -------- -------- ---------

Audit Opinion

The auditor's report on the annual financial statements of the

Group was unqualified and did not contain any statements under

section 498(2) or (3) of the Companies Act 2006.

Notice of Annual General Meeting and availability of the Group's

Annual Financial Statements

The Company also hereby gives notice of its 2023 Annual General

Meeting ("AGM"), which will be held on 3 November 2023 at 11:00 am

UK time at the offices of Fladgate LLP, 16 Great Queen Street,

London, WC2B 5DG, to transact the business as stated in the notice

of AGM. The Group's Annual Report for the year ended 30 June 2023,

along with the Notice of AGM, have been posted to the website,

www.jubileemetalsgroup.com .

Salient Dates:

Shareholders on the register who are entitled 29 September 2023

to receive the notice of AGM (SA)

Notice of AGM posted to shareholders 11 October 2023

Last date to trade in order to be eligible 27 October 2023

to participate in and vote at the AGM (SA)

Record Date for the purposes of determining

which shareholders are entitled to participate 1 November 2023

in and vote at the AGM (UK)

Record date for purpose of determining which 1 November 2023

shareholders are entitled to participate and

vote at the AGM (SA)

Latest time and date for receipt of CREST

Proxy Instruction and other uncertificated 11:00 am (UK time) 1 November

instructions (UK) 2023

Latest time and date for receipt of dematerialised 1 pm (SA time) 1 November

holding instruction and other uncertified 2023

instructions (SA)

Annual General Meeting 11:00 a.m. (UK time) 03

November 2023

Results of the Annual General Meeting released 03 November 2023

on RNS and SENS

---------------------------------------------------- --------------------------------

Integrated Annual Report

The Integrated Annual Report for the year ended 30 June 2023 is

also available on the Company's website today at

www.jubileemetalsgroup.com. Physical copies of the Annual Report

will be posted to shareholders who have elected to receive

them.

11 October 2023

For further information visit www.jubileemetalsgroup.com or contact:

Jubilee Metals Group PLC Tel: +27 (0) 11 465 1913

Leon Coetzer

PR & IR Adviser - Tavistock Tel: +44 (0) 20 7920 3150

Jos Simson/ Gareth Tredway

Nominated Adviser - SPARK Advisory Tel: +44 (0) 20 3368 3555

Partners Limited

Andrew Emmott/ James Keeshan

Joint Broker - Berenberg Tel: +44 (0) 20 3207 7800

Matthew Armitt/ Jennifer Lee/ Detlir

Elezi

Joint Broker - WHIreland Tel: +44 (0) 20 7220 1670/

Harry Ansell/ Katy Mitchell +44 (0) 113 394 6618

JSE Sponsor - Questco Corporate Advisory Tel: +27 (0) 11 011 9207

Pty Ltd

Alison McLaren

GROUP ANNUAL FINANCIAL STATEMENTS FOR THE YEARED 30 JUNE

2023

Group statements of financial position at 30 June 2023

Figures in Pound Sterling 2023 2022

Assets

Non-current assets

Property, plant and equipment 88 696 783 69 875 918

Intangible assets 79 883 128 78 466 341

Other financial assets 14 138 325 15 283 501

Inventories 13 505 677 12 506 751

Deferred tax 5 930 084 4 345 508

----------------------------------------------- ----------- -----------

202 153 997 180 478 019

------------------------------------------------ ----------- -----------

Current assets

Other financial assets 338 077 701 808

Inventories 35 664 792 27 736 150

Tax assets 695 422 990 746

Trade and other receivables 29 680 525 48 820 613

Contract assets 19 009 089 18 875 946

Cash and cash equivalents 12 596 183 16 017 944

----------------------------------------------- ----------- -----------

97 984 088 113 143 207

------------------------------------------------ ----------- -----------

Total assets 300 138 085 293 621 226

------------------------------------------------ ----------- -----------

Equity and liabilities

Equity attributable to equity holders of parent

Share capital and share premium 3161 119 978 155 538 672

Reserves 2 608 390 23 503 904

Accumulated profit 37 716 975 24 803 165

----------------------------------------------- ----------- -----------

201 445 343 203 845 741

Non-controlling interest 3 212 940 3 710 249

----------------------------------------------- ----------- -----------

204 658 283 207 555 990

------------------------------------------------ ----------- -----------

Liabilities

Non-current liabilities

Other financial liabilities 2 803 434 2 803 434

Lease liabilities 24 144 359 665

Deferred tax liability 13 852 052 18 221 132

Provisions 937 613 929 398

----------------------------------------------- ----------- -----------

17 617 243 22 313 629

------------------------------------------------ ----------- -----------

Current liabilities

Other financial liabilities - 1 035

Trade and other payables 59 639 629 52 632 003

Revolving credit facility 14 171 100 8 471 028

Current tax liabilities 4 051 830 2 647 541

----------------------------------------------- ----------- -----------

77 862 559 63 751 607

------------------------------------------------ ----------- -----------

Total liabilities 95 479 802 86 065 236

------------------------------------------------ ----------- -----------

Total equity and liabilities 300 138 085 293 621 226

------------------------------------------------ ----------- -----------

Group statements of comprehensive income for the year ended 30

June 2023

Figures in Pound Sterling 2023 2022

-------------------------------------------- ------------- ------------

Revenue 141 928 672 140 006 986

Cost of sales (110 537 605) (94 669 908)

-------------------------------------------- ------------- ------------

Gross profit 31 391 067 45 337 078

Operating expenses (15 873 028) (19 693 753)

-------------------------------------------- ------------- ------------

Operating profit 15 518 039 25 643 325

Investment revenue 1 614 824 1 400 599

Fair value adjustments 313 241 913 929

Finance costs (5 164 668) (1 445 307)

Share of loss from associate - (6 505)

-------------------------------------------- ------------- ------------

Profit before taxation 12 281 436 26 506 041

Taxation 688 109 (8 133 615)

-------------------------------------------- ------------- ------------

Profit for the year 12 969 545 18 372 426

------------------------------------------------ ------------- ------------

Profit for the year attributable to:

Owners of the parent 12 913 810 18 037 001

Non-controlling interest 55 735 335 425

-------------------------------------------- ------------- ------------

12 969 545 18 372 426

------------------------------------------------ ------------- ------------

Earnings per share (pence) 2 0.48 0.73

Diluted earnings per share (pence) 2 0.47 0.70

Reconciliation of other comprehensive

income:

Profit for the year 12 969 545 18 372 426

Other comprehensive income:

Exchange differences on translation foreign

operations (20 866 371) 16 810 787

Taxation related to components of other

comprehensive income - (168 048)

Total comprehensive income (7 896 826) 35 015 165

------------------------------------------------ ------------- --------------

Total comprehensive income attributable

to:

Owners of the parent (7 399 517) 34 467 442

Non-controlling interest (497 309) 547 723

-------------------------------------------- ------------- --------------

(7 896 826) 35 015 165

------------------------------------------------ ------------- --------------

Group statements of changes in equity as at 30 June 2023

Share Total

capital Foreign Share- (Accumulated attributable

and currency based Convertible Loss)/ to equity

Figures in Pound share Translation Merger payment notes Total retained holders of Total

Sterling premium reserve reserve reserve reserve reserves earnings the Company NCI equity

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

Group

Balance at 30 120 013 (19 482 23 184 2 707 133 380 3 162 136 542

June 2021 188 063) 000 928 203 040 6 612 905 6 753 964 054 526 582

Changes in equity

Profit for the

year - - - - - - 18 037 001 18 037 001 547 723 18 584 724

Other

comprehensive 16 430

income - 407 - - - 16 430 407 - 16 430 407 - 16 430 407

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

Total

comprehensive

income 16 430

for the year - 407 - - - 16 430 407 18 037 001 34 467 408 547 723 35 015 131

Issue of share

capital

net of costs 35 129 124 - - - - - - 35 129 124 - 35 129 124

Share warrants

expired 20 026 - - (20 026) - (20 026) - - - -

Share warrants

issued - - - 22 500 - 22 500 - 22 500 - 22 500

Share options

exercised/lapsed 173 294 - - (185 494) - (185 494) 12 200 - - -

Share options

issued - - - 846 652 - 846 652 - 846 652 - 846 652

Transfer between

reserves 203 040 - - - (203 040) (203 040) - -

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

16 430

Total changes 35 525 484 407 - 663 632 (203 040) 16 890 999 18 049 201 70 465 683 547 723 71 013 406

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

Balance at 30 155 538 (3 051 23 184 3 371 23 503 203 845 3 710 207 555

June 2022 672 656) 000 560 - 904 24 803 165 740 249 988

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

Changes in equity

Profit for the 12 416

year - - - - - - 12 913 810 12 913 810 (497 309) 501

Other

comprehensive (20 313 (20 313 (20 313 (20 313

income - 293) - - - 293) - 293) - 293)

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

Total

comprehensive

income (20 313 (20 313 (7 896

for the year - 293) - - - 293) 12 913 810 (7 399 483) (497 309) 792)

Issue of share

capital

net of costs 4 563 360 - - - - - - 4 563 360 - 4 563 360

Share warrants

exercised 935 414 - - (935 414) - (935 414) - - - -

Share options

exercised/lapsed 82 532 - - (82 532) - (82 532) - - - -

Share options

issued - - - 435 725 - 435 725 - 435 725 - 435 725

(20 313 (20 895 (2 897

Total changes 5 581 306 293) - (582 221) - 514) 12 913 810 (2 400 398) (497 309) 707)

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

Balance at 30 161 119 (23 364 23 184 2 789 201 445 3 212 204 658

June 2023 978 949) 000 339 - 2 608 390 37 716 975 342 940 281

----------------- ------------ ----------------- ----------- ------------ ----------------- ------------ -------------------- ------------------ ---------- ------------

Note: 3

Group statements of cash flow as at 30 June 2023

Figures in Pound Sterling 2023 2022

Cash flows from operating

activities

Cash generated from operations 36 523 227 34 901 495

Interest income 1 614 824 1 400 599

Finance costs (5 164 668) (1 445 307)

Taxation paid (1 966 776) (3 851 592)

------------------------------------- -------------- ---------------

Net cash from operating activities 31 006 607 31 005 195

------------------------------------- -------------- ---------------

Cash flows from investing

activities

Purchase of property, plant

and equipment (33 782 332) (36 451 781)

Sale of property, plant and 28 236 -

equipment

Purchase of intangible assets (9 129 681) (15 662 685)

Purchase of non-current inventories (998 926) (12 506 751)

Net cash from investing activities (43 882 703) (64 621 217)

------------------------------------- -------------- ---------------

Cash flows from financing

activities

Net proceeds on share issues 4 563 360 35 129 124

Proceeds from revolving credit

facilities 5 700 072 4 631 802

Increase in loans to joint

ventures 39 644 (6 933 571)

Decrease in other financial

liabilities (1 035) (4 062 392)

Lease payments (335 521) (588 317)

------------------------------------- -------------- ---------------

Net cash from financing activities 9 966 520 28 176 646

------------------------------------- -------------- ---------------

Total cash movement for the

year (2 909 576) (5 439 376)

Total cash at the beginning

of the year 16 017 944 19 643 047

Effect of exchange rate movement

on cash balances (512 185) 1 814 272

------------------------------------- -------------- ---------------

Total cash at end of the year 12 596 183 16 017 944

------------------------------------- -------------- ---------------

Notes to the Group financial statements for the year ended 30

June 2023

1. Statement of accounting policies

Jubilee Metals Group PLC is a public company listed on AIM of

the LSE and Altx of the JSE, incorporated and existing under the

laws of England and Wales, having its registered office at 1st

Floor, 7/8 Kendrick Mews, London, SW7 3HG, United Kingdom.

The Group and Company results for the year ended 30 June 2023

have been prepared using the accounting policies applied by the

Company in its 30 June 2023 annual report, which are in accordance

with UK adopted International Financial Reporting Standards

("IFRS") and IFRC interpretations, in conformity with the

requirements of the Companies Act 2006. The financial statements

are presented in Pound Sterling.

2. Earnings per share

Figures in Sterling 2023 2022

============================================= ============= ===========

Earnings attributable to ordinary equity

holders of the parent (GBP) 12 913 810 18 037 001

============================================= ============= ===========

Weighted average number of shares for basic 2 455 458

earnings per share 2 687 683 403 009

Effect of dilutive potential ordinary shares

- Share options and warrants 45 560 690 123 943 501

============================================= ============= ===========

Diluted weighted average number of shares 2 579 401

for diluted earnings per share 2 733 244 093 510

============================================= ============= ===========

Basic earnings per share (pence) 0.48 0.73

Diluted basic earnings per share (pence) 0.47 0.70

--------------------------------------------- ------------- -----------

Total number of shares in issue at year 2 657 051

end 2 738 129 981 370

--------------------------------------------- ------------- -----------

Tangible net asset value (GBP) 124 775 155 136 618 835

--------------------------------------------- ------------- -----------

Tangible net asset value per share (pence) 4.56 4.84

============================================= ============= ===========

There have been no other transactions involving ordinary shares

or potential ordinary shares between the reporting date and the

date of authorisation of these financial statements. There were no

share transactions post year end to the date of this report that

could have impacted earnings per share had it occurred before year

end.

3. Share capital, share premium, options and warrants

Figures in Sterling 2023 2022

Authorised

The share capital of the Company is divided

into an unlimited number of ordinary shares

of GBP 0.01 each.

Issued share capital fully paid

Ordinary shares of 1 pence each 27 381 300 26 570 514

Share premium 133 738 678 128 968 158

============================================= =========== ===========

Total issued capital 161 119 978 155 538 672

============================================= =========== ===========

The Company issued the following ordinary shares during the

period and as at the date of this announcement:

Issue price

Date issued Number of shares (pence) Purpose

=============================== ================ =========== ========

Opening balance at 1 July 2022 2 657 051 370

07-Jul-22 25 000 6.12 Warrants

22-Jul-22 1 439 156 6.12 Warrants

01-Sep-22 8 509 713 6.12 Warrants

21-Sep-22 4 659 599 6.12 Warrants

21-Sep-22 2 500 000 3.38 Warrants

10-Nov-22 2 500 000 3.38 Warrants

24-Nov-22 4 659 599 6.12 Warrants

28-Nov-22 8 509 713 6.12 Warrants

21-Dec-22 5 000 000 3.38 Warrants

18-Jan-23 32 159 446 6.12 Warrants

23-Jan-23 366 385 0.06 Warrants

04-May-23 1 250 000 2.50 Options

04-May-23 1 000 000 4.00 Options

04-May-23 2 000 000 4.50 Options

04-May-23 3 500 000 5.50 Options

04-May-23 3 000 000 6.00 Options

------------------------------- ---------------- ----------- --------

2 738 129 981

------------------------------- ---------------- ----------- --------

During the year share transaction costs accounted for as a

deduction from the share premium account amounted to GBPNil (FY2022

GBP1 385 214 ). The company recognised a share-based payment

expense in the share premium account in an amount of GBP1 017 946 (

FY2022: GBP193 320) in accordance with section 610 (2) of the

United Kingdom Companies Act 2006. The charge relates to the issue

of new Jubilee shares in lieu of warrants exercised and the amount

was accounted for as a deduction from the share premium

account.

Warrants

At year-end and as the last practicable date, the Company had

the following warrants outstanding:

Issue Share price

Number of Price Expiry at issue date

Issue Date warrants (pence) date (pence)

================= ============== ========== ============ ==============

19 Nov 2019 7 818 750 4.00 19 Nov 2023 4.13

22 Jun 2020 750 000 3.40 22 Jun 2024 3.90

21 Jan 2021 4 036 431 13.00 21 Jan 2025 13.20

================= ============== ========== ============ ==============

12 605 181

================= ============== ========== ============ ==============

Reconciliation of the number of warrants

in issue 2023 2022

============================================= ============ ==============

Opening balance 86 267 125 86 267 125

Expired/exercised during the year (73 661 944) -

============================================= ============ ==============

Closing balance 12 605 181 86 267 125

============================================= ============ ==============

4. Segmental analysis

Following the strategic restructuring of Jubilee's business

model management presents the following segmental information:

-- PGM and Chrome - the processing of PGM and chrome containing materials;

-- Copper and Cobalt - the processing of Copper and Cobalt containing materials;

-- Other - administrative and corporate expenses

The Group's operations span five countries South Africa,

Australia, Mauritius, Zambia, and the United Kingdom. There is no

difference between the accounting policies applied in the segment

reporting and those applied in the Group financial statements.

Madagascar does not meet the qualitative threshold under IFRS 8

consequently no separate reporting is provided.

2023

PGM and Chrome Copper and

Figures in Pound Sterling Cobalt Other Total

------------------------------ --------------------- ----------- ------------- ---------------

Total assets 140 451 298 100 659 374 59 027 411 300 138 083

------------------------------ --------------------- ----------- ------------- ---------------

Total liabilities 55 925 242 33 248 577 6 305 986 95 479 805

------------------------------ --------------------- ----------- ------------- ---------------

Revenue 125 051 722 16 876 950 - 141 928 672

Gross profit 26 496 660 4 894 407 - 31 391 067

Depreciation and amortisation (6 826 254) (1 733 769) (391 577) (8 951 600)

Operating expenses (870 765) (3 212 716) (2 837 949) (6 921 430)

Operating profit 18 799 641 (52 078) (3 229 526) 15 518 037

Investment revenue 760 047 - 854 777 1 614 824

Fair value - - 313 241 313 241

Net finance costs (4 286 774) (877 893) - (5 164 667)

Profit before taxation 15 272 914 (929 971) (2 061 508) 12 281 435

------------------------------ --------------------- ----------- ------------- ---------------

Taxation (314 842) 1 133 699 (130 748) 688 109

------------------------------ --------------------- ----------- ------------- ---------------

Profit after taxation 14 958 072 203 728 (2 192 256) 12 969 544

------------------------------ --------------------- ----------- ------------- ---------------

2022

PGM and Chrome Copper and

Figures in Pound Sterling Cobalt Other Total

------------------------------ --------------------- ----------- ------------- ---------------

Total assets 130 862 228 101 905 479 60 853 519 293 621 226

------------------------------ --------------------- ----------- ------------- ---------------

Total liabilities 28 026 802 13 309 255 14 729 179 56 065 236

------------------------------ --------------------- ----------- ------------- ---------------

Revenue 121 655 367 18 351 619 - 140 006 986

Gross profit 37 832 751 7 504 327 - 45 337 078

Depreciation and amortisation (7 553 949) (1 387 261) (1 281 692) (10 222 902)

Operating expenses (4 770 379) (1 909 100) (2 791 372) (9 470 851)

Operating profit 25 508 423 4 207 966 (4 073 064) 25 643 325

Investment revenue 588 435 795 786 16 378 1 400 599

Fair value - 580 933 332 996 913 929

Net finance costs (827 726) (617 581) - (1 445 307)

Income from equity account

investments - - (6 505) (6 505)

------------------------------ --------------------- ----------- ------------- ---------------

Profit before taxation 25 269 132 4 967 104 (3 730 195) 26 506 041

------------------------------ --------------------- ----------- ------------- ---------------

Taxation (6 487 979) (535 544) - (8 133 615)

------------------------------ --------------------- ----------- ------------- ---------------

Profit after taxation 18 781 153 4 431 560 (3 730 195) 18 372 426

------------------------------ --------------------- ----------- ------------- ---------------

5. Going Concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Group's Integrated Annual Report. The Group

meets its day--to--day working capital requirements through cash

generated from operations and trade finance facilities.

The current global economic climate creates to some extent

uncertainty particularly over:

-- the trading price of metals; and

-- the exchange rate fluctuation between the US$ and the ZAR and

thus the consequence for the cost of the company's raw materials as

well as the price at which product can be sold.

The Group's forecasts and projections to 31 December 2024,

taking account of reasonably possible changes in trading

performance, commodity prices and currency fluctuations, indicates

that the Group should be able to operate within the level of its

current cash flow earnings forecasted for at least the next twelve

months from the date of approval of the financial statements.

The Group is adequately funded and has access to further

facilities, which together with contracts with several high-profile

customers strengthen the Group's ability to meet its day-to-day

working capital requirements and capital expenditure requirements.

Therefore, the directors believe that the Group is suitably funded

and placed to manage its business risks successfully despite

identified economic uncertainties.

The directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future, thus continuing to adopt the going concern

basis of accounting in preparing the annual financial

statements.

6. Events after the reporting period

The directors confirm that there have been no significant events

affecting the company since the end of the reporting period and up

to the date of approval of these financial statements that would

require adjustments to or disclosure in the financial

statements.

Annexure 1

Headline earnings per share

Accounting policy

Headline earnings per share ("HEPS") is calculated using the

weighted average number of shares in issue during the period under

review and is based on earnings attributable to ordinary

shareholders after excluding those items as required by Circular

1/2021 issued by the South African Institute of Chartered

Accountants (SAICA).

In compliance with paragraph 18.19 (c) of the JSE Listings

Requirements the table below represents the Group's Headline

earnings and a reconciliation of the Group's earnings reported and

headline earnings used in the calculation of headline earnings per

share:

Reconciliation of headline earnings per share

June 2023 June 2022

------------------ -------------------

Gross Net Gross Net

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------- -------- -------- -------- ---------

Earnings for the period attributable

to ordinary shareholders 12 914 - 18 037

Share of impairment loss from equity

accounted associate - - 6.5 5

Fair value adjustments (313) (313) (914) (914)

--------------------------------------------- -------- -------- -------- ---------

Headline earnings from continuing operations 12 601 17 128

--------------------------------------------- ------------------ -------------------

Weighted average number of shares in

issue ('000) 2 738 130 2 455 458

Diluted weighted average number of

shares in issue ('000) 2 733 244 2 579 402

Headline earnings per share from continuing

operations (pence) 0.46 0.70

Headline earnings per share from continuing

operations (ZAR cents) 9.84 14.11

Diluted headline earnings per share

from continuing operations (pence) 0.46 0.66

Diluted headline earnings per share

from continuing operations (ZAR cents) 9.86 13.43

Average conversion rate used for the

period under review GBP:ZAR 0.047 0.049

--------------------------------------------- -------- -------- -------- ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UAOVROWURARA

(END) Dow Jones Newswires

October 11, 2023 02:00 ET (06:00 GMT)

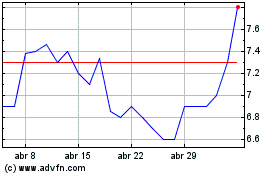

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De May 2023 a May 2024