TIDMJWNG

RNS Number : 5289X

Jaywing PLC

21 December 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

21 December 2023

Jaywing plc

("Jaywing" or "the Company")

Interim Results September 2023

Jaywing plc (AIM: JWNG), the Data Science and Marketing

business, with operations in the UK and Australia, today announces

its interim results for the six months ended 30 September 2023

("H1").

Financial highlights

6 months 6 months

to to

30 September 30 September

2023 2022 Change

GBP'000 GBP'000 %

-------------- -------------- -------

Revenue 11,107 11,161 (0.5%)

-------------- -------------- -------

Underlying Adjusted

EBITDA(1) 1,311 942 39.2%

-------------- -------------- -------

Loss after tax for the

period (1,688) (208)

-------------- --------------

Cash Generated from

Operations (123) (134)

-------------- --------------

Net Debt (excluding

IFRS 16) (2) (11,925) (10,381)

-------------- --------------

Reconciliation of Operating Profit with Adjusted EBITDA

6 months 6 months

to to

30 September 30 September

2023 2022

GBP'000 GBP'000

Operating (Loss)/Profit (537) 580

-------------- --------------

Add Back:

-------------- --------------

Depreciation 119 117

-------------- --------------

Depreciation of right

of use assets 313 310

-------------- --------------

Amortisation of intangibles 227 30

-------------- --------------

EBITDA 122 1,037

-------------- --------------

Restructuring charges 1,189 131

-------------- --------------

Acquisition & related

costs - 192

-------------- --------------

Legal income - (418)

-------------- --------------

Underlying Adjusted

EBITDA(1) 1,311 942

-------------- --------------

Underlying Adjusted

EBITDA margin 11.8% 8.4%

-------------- --------------

6 months to 6 months to Change Change %

30 September 30 September % at constant

2023 2022 exchange

GBP'000 GBP'000 rates*

%

Revenue

------------- ------------- ------ ------------

United Kingdom 7,690 8,426 (8.7%) (8.7%)

------------- ------------- ------ ------------

Australia 3,417 2,735 24.9% 36.7%

------------- ------------- ------ ------------

Group total 11,107 11,161 (0.5%) 2.4 %

------------- ------------- ------ ------------

Underlying Adjusted

EBITDA(1)

------------- ------------- ------ ------------

United Kingdom 810 801 1.1% 1.1%

------------- ------------- ------ ------------

Australia 501 141 255.3% 288.3 %

------------- ------------- ------ ------------

Group total 1,311 942 39.2% 44.1 %

------------- ------------- ------ ------------

(1) Underlying Adjusted EBITDA represents EBITDA before

restructuring charges arising from headcount reduction and other

cost saving actions taken in Q1 of FY24, acquisition and related

costs in FY23 and legal recoveries in FY23

(2) Including accrued interest

* At constant exchange rates applicable to the 6 months ended 30

September 2022

Operational Highlights

-- Underlying Adjusted Group EBITDA up by 39.2% at GBP1,311k, on 0.5% lower revenues

-- Australia ("AUS") underlying profitability improved with

Adjusted EBITDA up 255.3% due to strong AUS revenue growth.

-- AUD:GBP FX rate adversely impacted results. Under constant

exchange rates Group revenues were up by 2.4% and Group Adjusted

EBITDA up by 44.1%.

-- UK cost and efficiency improvements resulted in a 1.1%

increase in Adjusted EBITDA on an 8.7% reduction in revenue.

-- Encouraging new business pipeline

-- UK Marketing sector continues to be affected by current economic conditions.

-- Decision (our AI-based PPC automation tool) is performing

well with 12 clients now on Decision, including our first client in

Australia.

Commenting on the results, Andrew Fryatt, CEO of Jaywing plc,

said :

I am pleased to report a strong improvement in our

profitability, with Group underlying Adjusted EBITDA up 39% to

GBP1,311k on net revenues which were down by 0.5%. I am especially

pleased as we have found ourselves operating against a backdrop of

continuing challenging economic conditions and in a marketing

sector impacted by a widespread slowdown in client spend.

In the first quarter of this financial year we could see the

risk of a slowdown in UK revenues, and we took early action to

reduce our cost base to ensure that we were in the right shape for

the balance of the year. With the support of our employees we were

able to remove around 14% of UK headcount, resulting in a

significant improvement in UK profitability in the second quarter

of this financial year (July 23 to September 23). Following this

exercise, Group headcount is 245 across the UK and Australia.

Australia

Jaywing Australia has seen accelerating revenue growth since the

integration of our two businesses in Sydney. Revenue was up by 25%

in the first half (up by 37% at constant exchange rates), supported

by continuing new client wins. Additional business has been won

with OES and New Balance and we have recently opened a new notable

account with Crocs .

Jaywing Australia's' heritage was previously focused on

performance marketing and website design & build. Now, the

expanded proposition includes Creative and Data Science components,

partially supported out of the UK, building a more integrated

proposition for our clients.

Revenue gains have been delivered whilst maintaining tight

control of costs, and the momentum is expected to continue into the

second half of the financial year.

UK Risk Consulting sector

Early in the year we won a significant new contract for

modelling work with Virgin Media O2, and more recent wins include

model validation contracts with Hampshire Trust Bank and also with

ITV. Together these have driven a 23% growth in half year Risk

Consulting revenues and a 77% growth at contribution level.

The strength of our performance in Risk Consulting has sustained

profitability despite the slowdown in Marketing revenues in the UK,

and we have an encouraging pipeline of further Consulting

opportunities. Our risk consultants and analysts continue to

provide a fast-paced, flexible and high-quality service that

competes strongly in this sector.

UK Agency sector

The weakness of the UK marketing sector has been widely

reported, and we saw a delay in client commitments from April 2023

onwards. As mentioned above, we took decisive action in May 2023 to

ensure our UK Agency cost base was "right-sized" for subdued

revenues, and refocused our efforts on the growth areas of the

sector. We have reaped the benefits of this from July onwards, with

Q2 contribution stepping up markedly compared to a slow Q1, a

result of the restructuring, and currently building a promising

pipeline of new client opportunities.

Our focus on an integrated marketing proposition, using our data

science and creative resources to deliver demonstrably superior

results, continues to resonate with existing and potential clients.

The continued acceleration of the move towards digital has

reinforced the need to understand marketing effectiveness, and we

have been able to deliver both outstanding results and insight to

our clients. We have had 10 new clients commence billing in the

first half, including DUSK.com, Subaru Europe, and Lowell

Financial, and we have seen some clients returning and restarting

spend, including, for example HSBC.

Following the headcount reductions, UK Agency revenue per head

in the first half was up 9% to GBP42k.

We are continuing to build the client base for our suite of

award-winning AI-based tools, including Decision (our AI-based PPC

automation tool) and Archetype (our AI modelling tool that helps to

predict customer behaviour). In our Risk Consulting business, we

also have Echelon (our commercial scoring tool) and Horizon

(AI-based modelling software we use with our IFRS 9 clients).

Decision is used both as a standalone application and also as

part of an integrated solution, and monthly billings are now up 60%

year-on-year.

We continue to develop our automation and AI capabilities across

both our Agency and Risk Consulting divisions to enhance the

effectiveness of our client-focused solutions.

Net Debt and Cash Flow

Net debt increased by GBP1,544k to GBP11,925k as at 30 September

2023, due to the impact of the restructuring exercise, the funding

of the Midisi acquisition in 2022, and interest charges now

accruing at a higher rate.

Working capital continues to be closely managed with debtor days

for the Group dropping from 51 days at the year end, to 47

days.

People

Jaywing has an extraordinarily committed and collaborative group

of employees in both the UK and Australia, which is a key factor in

enabling us to work through this challenging period. I would like

to thank all our employees for their continuing contribution and

support.

Outlook

The actions taken to optimise our cost base, coupled with the

strong growth of Australia and our Risk Consulting business in the

UK, have helped us to offset the impact of the weaker UK Agency

sector in H1. Our new business pipeline and strengthened integrated

marketing proposition give us confidence for the second half,

although we remain cautious given the backdrop of ongoing economic

and geopolitical uncertainty.

Enquiries :

Jaywing plc

Christopher Hughes (CFO/Company Tel: 0333 370 6500

Secretary)

Spark Advisory Partners Limited

Matt Davis / James Keeshan Tel: 020 3368 3552

Consolidated statement of comprehensive income

Unaudited Unaudited Audited

Six months Six months year ended

ended ended 31 March

30 Sept 30 Sept 2022 2023

2023

Note GBP'000 GBP'000 GBP'000

Revenue 4 11,107 11,161 22,062

Other operating income 9 423 507

Operating expenses (11,653) (11,004) (33,909)

------------ -------------- ------------

Operating (Loss) /

Profit (537) 580 (11,340)

Finance costs (859 ) (372 ) (1,195)

(Loss) / Profit before

tax (1,396) 208 (12,535)

Tax charge (292) (416) (291)

------------ -------------- ------------

Loss after tax for

the period (1,688) (208) (12,826)

Loss for the period

is attributable to:

Owners of the parent (1,688 ) (208 ) (12,826)

------------ -------------- ------------

(1,688) (208) (12,826)

Other comprehensive

income

Items that will be

reclassified subsequently

to profit or loss

Exchange differences

on retranslation of

foreign operations 16 (68) (368)

------------ -------------- ------------

Total comprehensive

loss for the period (1,672 ) (276 ) (13,194)

------------ -------------- ------------

Total comprehensive

loss is attributable

to:

Owners of the parent (1,672) (276) (13,194)

------------ -------------- ------------

(1,672) (276) (13,194)

------------ -------------- ------------

Loss per share 5

Basic loss per share (1.81p) (0.22p) (13.73p)

Diluted loss per share (1.81p) (0.22p) (13.73p)

Consolidated balance sheet

Unaudited Unaudited Audited

30 Sept 30 Sept 31 March

2023 2022* 2023

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 6 3,647 4,010 4,023

Goodwill 10,602 21,705 10,602

Deferred tax asset 620 557 620

Other intangible assets 7 1,983 3,331 2,125

------------------ ----------------- -----------

16,852 29,603 17,370

------------------ ----------------- -----------

Current assets

Trade and other receivables 5,013 5,246 4,418

Contract assets 826 887 352

Cash and cash equivalents 211 490 1,089

6,050 6,623 5,859

------------------ ----------------- -----------

Total assets 22,902 36,226 23,229

------------------ ----------------- -----------

Liabilities

Current liabilities

Borrowings 8 12,136 10,871 11,435

Trade and other payables 6,321 6,839 5,810

Contract liabilities 959 788 983

Lease liabilities 394 486 380

Tax liabilities 185 25 20

Provisions 9 552 - -

------------------ ----------------- -----------

20,547 19,009 18,628

------------------ ----------------- -----------

Non-current liabilities

Lease liabilities 2,379 3,206 2,638

Provisions 9 570 - 570

Deferred tax liability 592 - 592

Trade and other payables 1,706 2,373 2,021

5,247 5,579 5,821

------------------ ----------------- -----------

Total liabilities 25,794 24,588 24,449

------------------ ----------------- -----------

Net (liabilities) / assets (2,892) 11,638 (1,220)

------------------ ----------------- -----------

Equity

Capital and reserves attributable

to equity holders of the

company

Share capital 10 34,992 34,992 34,992

Share premium 10,088 10,088 10,088

Capital redemption reserve 125 125 125

Shares purchased for treasury (25) (25) (25)

Foreign currency translation

reserve (234) 50 (250)

Retained earnings (47,838) (33,592) (46,150)

------------------ ----------------- -----------

Total equity (2,892) 11,638 (1,220)

------------------ ----------------- -----------

* The comparative information has been restated due to

misstatements in the prior period as discussed in the Annual Report

and Accounts for the year ended 31 March 2023

Consolidated cash flow statement

Unaudited Unaudited Audited

Six months Six months year ended

ended ended 31 March

30 Sept 30 Sept 2022 2023

2023

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Loss after tax for the period (1,688) (208) (12,826)

Adjustment for:

Impairment of goodwill - - 12,095

Depreciation of property, plant,

and equipment 119 117 245

Depreciation and impairment

of right of use assets 313 310 641

Amortisation of intangibles 227 30 320

Financial costs 859 372 1,195

Taxation expense 292 416 291

------------ -------------- ------------

Operating cash flow before

changes in working capital 122 1,037 1,961

Operating cash flow before

changes in working capital

(Increase)/Decrease in trade

and other receivables (1,139) 735 1,986

Increase/(Decrease) in trade

and other payables 894 (1,906) (2,654)

Cash generated from operations (123) (134) 1,293

Interest paid - (15) -

Tax paid (101) (44) (21)

------------ -------------- ------------

Net cash flow from operating

activities (224) (193) 1,272

Cash flows from investing activities

Payment of deferred and contingent

consideration (187) (668) (818)

Acquisition of subsidiary - (400) (400)

Capitalised development costs (85) - -

Acquisition of property, plant,

and equipment (56) (150) (483)

------------ -------------- ------------

Net cash outflow from investing

activities (328) (1,218) (1,701)

------------ -------------- ------------

Cash flows from financing activities

Increase in borrowings - 1,500 1,500

Repayment of Lease Liabilities

(IFRS 16) (326) (313) (696)

Net cash (outflow)/inflow from

financing activities (326) 1,187 804

Net decrease in cash, cash

equivalents and bank overdrafts (878) (224) 375

Cash and cash equivalents at

beginning of period 1,089 714 714

------------ -------------- ------------

Cash and cash equivalents at

end of period 211 490 1,089

------------ -------------- ------------

Cash and cash equivalents comprise:

Cash at bank and in hand 211 490 1,089

------------ -------------- ------------

Consolidated statement of changes in equity

Share Share Capital Treasury Foreign Retained Total

capital premium redemption Shares currency earnings* equity

account reserve translation

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- ------------ --------- ------------- ----------- ---------

Balance at 31 March

2022 34,992 10,088 125 (25) 118 (33,071) 12,227

(audited)

--------- --------- ------------ --------- ------------- ----------- ---------

Prior year adjustment

(audited) - - - - - (253) (253)

Restated balance at

31 March 2022 (audited) 34,992 10,088 125 (25) 118 (33,324) 11,974

Loss for the period - - - - - (12,826) (12,826)

Retranslation of foreign

currency - - - - (368) - (368)

--------- --------- ------------ --------- ------------- ----------- ---------

Total comprehensive

income for the period - - - - (368) (12,826) (13,194)

--------- --------- ------------ --------- ------------- ----------- ---------

Balance at 31 March

2023 (audited) 34,992 10,088 125 (25) (250) (46,150) (1,220)

--------- --------- ------------ --------- ------------- ----------- ---------

Loss for the period - - - - - (1,688) (1,688)

Retranslation of foreign

currency - - - - 16 - 16

--------- --------- ------------ --------- ------------- ----------- ---------

Total comprehensive

income for the period - - - - 16 (1,688) (1,672)

--------- --------- ------------ --------- ------------- ----------- ---------

Balance at 30 September

2023 (unaudited) 34,992 10,088 125 (25) (234) (47,838) (2,892)

--------- --------- ------------ --------- ------------- ----------- ---------

* The comparative information has been restated due to

misstatements in the prior period as discussed in the Annual Report

and Accounts for the year ended 31 March 2023

1. General Information

Jaywing plc (the "Company") is incorporated and domiciled in the

United Kingdom. The Company is listed on the AIM market of the

London Stock Exchange. The registered address is Albert Works,

Sidney Street, Sheffield,

S1 4RG.

The interim financial information was approved for issue on 30

November 2023.

2. Basis of preparation

The consolidated interim financial statements for the six months

ended 30 September 2023, which are unaudited, have been prepared in

accordance with applicable accounting standards and under the

historical cost convention except for certain financial instruments

that are carried at fair value.

The financial information for the year ended 31 March 2023 set

out in this interim report does not constitute statutory accounts

as defined in Section 434 of the Companies Act 2006. The Group's

statutory financial statements for the year ended 31 March 2023

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain statements under Section 498 (2) or Section 498 (3) of the

Companies Act 2006.

The consolidated interim financial information should be read in

conjunction with the annual financial statements for the year ended

31 March 2023, which have been p repared and approved by the

Directors in accordance with UK-adopted International accounting

standards in conformity with the Companies Act 2006. The

Consolidated Financial Statements have been prepared under the

historical cost convention, except for revaluation of any assets

and liabilities carried at fair value.

The Board continually assesses and monitors the key risks of the

business. The Board continues to consider the Group's profit and

cash flow plans for at least the next 12 months and runs forecasts

and downside stress test scenarios. These risks have not

significantly changed from those set out in the Company's Annual

Report for the period ended 31 March 2023.

Based on the Group's cash flow forecasts and projections, the

Directors are satisfied that the Group has adequate resources to

continue in operational existence for the foreseeable future. In

considering their position the Directors have also had regard to

letters of support in respect of the secured debt received from

each of the holders of that debt. The Group has continued to adopt

the going concern basis of accounting in preparing these interim

financial statements.

3. Accounting policies

The principal accounting policies of Jaywing plc and its

subsidiaries ("the Group") are consistent with those set out in the

Group's 2023 annual report and financial statements other than the

new policies included below.

There were no new relevant Standards or Interpretations to be

adopted for the six months ended 30 September 2023.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual

earnings.

3.1 Provisions

A provision is recognised in the balance sheet when the Group

has a present legal or constructive obligation as a result of a

past event, and it is probable that an outflow of economic benefits

will be required to settle the obligation. If the effect is

material, provisions are determined by discounting the expected

future cash flows at a pre-tax rate that reflects current market

assessments of the time value of money and, where appropriate, the

risks specific to the liability.

3.2 Share-based payment transactions

The fair value of the CSOP & LTIP options have been taken as

the market price as at the grant date. The charge to profit or loss

takes account of the estimated number of shares that will vest.

Where the options do not have any market conditions attached, the

number expected to vest is reassessed at each reporting period. All

share-based remuneration is equity-settled. Provision is made for

National Insurance when the Group is committed to settle this

liability. The charge to profit or loss takes account of the

options expected to vest, is deemed to arise over the vesting

period, and is discounted.

4. Segment information

The Group reported its operations based on location of business

(United Kingdom & Australia).

Revenue, Contribution and Adjusted EBITDA by operating

segments

Unaudited Unaudited

six months six months

ended 30 ended

Sept 2023 30 Sept 2022

GBP'000 GBP'000

Revenue

United Kingdom 7,690 8,426

Australia 3,417 2,735

----------- -------------

11,107 11,161

----------- -------------

Contribution (1)

United Kingdom 2,595 3,012

Australia 1,178 792

----- -----

3,773 3,804

----- -----

Underlying Adjusted EBITDA (2)

United Kingdom 810 801

Australia 501 141

----- ---

1,311 942

----- ---

(1) Contribution is defined as Revenue less Direct Costs

comprise staff and other costs directly attributable to the

revenues of the respective operating segments.

(2) Underlying Adjusted EBITDA represents Earnings Before

Interest Tax, Depreciation & Amortisation ('EBITDA') before

restructuring costs, acquisition and related costs and legal

recoveries.

5. Loss per share

Unaudited Unaudited Audited

Six months Six months year

ended ended ended

30 Sept 30 Sept 31 March

2023 2022 2023

Pence Pence per Pence per

per share share Share

Basic loss per share (1.81p) (0.22p) (13.73p)

Diluted loss per share (1.81p) (0.22p) (13.73p)

6. Property, plant and equipment

Unaudited Unaudited Audited

30 Sept 30 Sept 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Buildings 3,085 3,462 3,325

Leasehold improvements 202 216 147

Office equipment 360 332 551

---------- ---------- ----------

3,647 4,010 4,023

---------- ---------- ----------

7. Other intangible assets

Unaudited Unaudited Audited

30 Sept 30 Sept 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Development costs 97 39 29

Intellectual property 1,886 3,292 2,099

---------- ---------- ----------

1,983 3,331 2,125

---------- ---------- ----------

8. Borrowings

Unaudited Unaudited Audited

30 Sept 30 Sept 31 March

2023 2022* 2023

Summary GBP'000 GBP'000 GBP'000

Borrowings 12,136 10,871 11,435

---------- ---------- ----------

12,136 10,871 11,435

---------- ---------- ----------

Borrowings are repayable

as follows:

Within 1 year

Borrowings 12,136 10,871 11,435

---------- ---------- ----------

Total due within 1 year 12,136 10,871 11,435

In more than one year but - - -

less than two years

Total amount due 12,136 10,871 11,435

---------- ---------- ----------

Average interest rates at % % %

the balance sheet date were:

Term loan 9.77 5.60 8.57

* The comparative information has been restated due to

misstatements in the prior period as discussed in the Annual Report

and Accounts for the year ended 31 March 2023

As the loans are at variable market rates their carrying amount

is equivalent to their fair value.

The borrowings are repayable on demand and interest is

calculated at 3-month LIBOR plus a margin. Borrowings includes

accrued interest.

The borrowings are secured by charges over all the assets of

Jaywing and guarantees and charges over all the assets of the

various subsidiaries (Jaywing UK Limited, Alphanumeric Limited,

Gasbox Limited, Jaywing Central Limited, Jaywing Innovation

limited, Bloom Media (UK) Limited, Epiphany Solutions Limited,

Jaywing Pty Limited, Frank Digital Pty Limited).

Cash and

Reconciliation of net debt** cash equivalents Borrowings Net debt

GBP'000 GBP'000 GBP'000

30 September 2023 (Unaudited)* 211 (12,136) (11,925)

31 March 2023 (Audited)* 1,089 (11,435) (10,346)

30 September 2022 (Unaudited) 490 (10,871) (10,381)

------------------ ----------- ---------

* The comparative information has been restated due to

misstatements in the prior period as discussed in the Annual Report

and Accounts for the year ended 31 March 2023

**Excluding lease liabilities and deferred consideration

9. Provisions (unaudited)

Unaudited Unaudited Audited

30 Sept 30 Sept 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Due in less than one year:

Restructuring provision 552 - -

---------- ---------- ----------

Due in greater than one

year:

Dilapidations provision 570 - 570

---------- ---------- ----------

The dilapidations provision of GBP570k has been recognised

across the three offices in the UK and Australia. The dilapidations

provision will be settled at the end of the lease period for the

three offices, which is greater than one year for all.

The restructuring provision of GBP552k has been recognised for

the constructive obligation of expenditure confirmed as part of the

current year UK headcount reduction process.

10. Share capital (unaudited)

Allotted, issued and fully paid

45p deferred 5p ordinary

shares shares

Number Number GBP'000

Issued share capital at 31

March 2023 and 30 September

2023 and 30 September 2022 67,378,520 93,432,217 34,992

--------------- -------------- ----------

11. Related party transactions (unaudited)

There were no other significant changes in the nature and size

of related party transactions for the period from those disclosed

in the Annual Report for the year ended 31 March 2023.

12. Employee benefits (unaudited)

On 13 April 2023, the Company granted 1,142,000 LTIP (Long Term

Incentive Plan) share options to Andrew Fryatt (CEO) and 4,640,000

CSOP (Company Share Option Plan) options to certain senior

employees of the Group. The total number of Shares that can be

acquired pursuant to options granted under the LTIP and CSOP

amounts to 5,782,000 Shares.

LTIP Options

The LTIP Options granted to Andrew Fryatt are subject to a

minimum vesting price of 10.0 pence per Share and an exercise price

of 5.0 pence per Share. The performance period for LTIP Options

granted under the LTIP will typically be four years commencing from

the date of grant of the relevant LTIP Option. However, in the case

of Andrew Fryatt, in recognition of his service to the Company

since March 2020, 50% of the LTIP Options will vest and be

exercisable on or after the second anniversary of the date of

grant, subject to and to the extent that the performance conditions

are met.

Except in the event of a change of control of the Company and in

certain 'good leaver' scenarios, LTIP Options may only be exercised

after the expiry of the performance period and to the extent that

the relevant performance criterion is met. Shares acquired on

exercise of LTIP Options shall be subject to a two-year holding

period, during which time they cannot be sold, except in certain

circumstances including, but not limited to, the sale of Shares to

meet any tax liabilities arising upon exercise of the LTIP

Options.

Charge to the statement of comprehensive income

Under IFRS 2, the Group is required to recognise an expense in

the financial statements. The expense is apportioned over the

vesting period based upon the number of options which are expected

to vest and the fair value of those options at the date of

grant.

Based on the market conditions at grant date, we have assessed

the fair value of these options to be GBPnil at the interim date.

This will be monitored across the vesting period and will be

updated accordingly, at subsequent reporting dates.

CSOP Options

The market value CSOP Options were granted over a total of

4,640,000 Shares with an exercise price of 5.0 pence per Share. The

vesting period of the CSOP Options shall be three years from the

date of grant. Except in the event of a change of control of the

Company and in certain 'good leaver' scenarios, no CSOP Options may

be exercised prior to the expiry of the vesting period. Shares

acquired on exercise of the CSOP Options shall be subject to a

holding period of one year, during which time they cannot be sold,

except in certain circumstances including, but not limited to, the

sale of Shares to cover the exercise price payable upon exercise of

the CSOP Options. No performance conditions attach to the exercise

of the CSOP Options.

Ch arge to the statement of comprehensive income

Under IFRS 2, the Group is required to recognise an expense in

the financial statements. The expense is apportioned over the

vesting period based upon the number of options which are expected

to vest and the fair value of those options at the date of grant.

Due to their being no performance conditions attached to the

options, all of these are expected to vest.

Based on the fair value of 4.5 pence per share, the calculated

charge for the period to Sep-23 is GBP32k. Due to the amount being

immaterial we have not included this in our interim results.

13. Post balance sheet event (unaudited)

There are no post balance sheet events that require

disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZMZZNGVGFZM

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

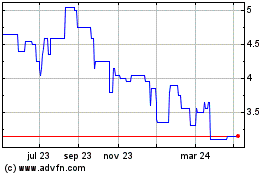

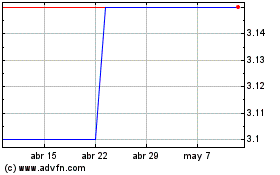

Jaywing (LSE:JWNG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Jaywing (LSE:JWNG)

Gráfica de Acción Histórica

De May 2023 a May 2024