TIDMPIRI

RNS Number : 7379N

Pires Investments PLC

27 September 2023

27 September 2023

Pires Investments PLC

("Pires" or the "Company")

Unaudited interim results for the six months ended 30 June

2023

Pires Investments plc (AIM: PIRI), the investment company

focused on next-generation technology, is pleased to announce its

unaudited interim results for the six-month period ended 30 June

2023.

Highlights

Company highlights

-- Net asset value ("NAV") of GBP7,310,000 as at the period end

(31 December 2022: GBP7,822,000), equating to a decrease of 6.5%

since 31 December 2022, albeit against the background of a

difficult technology market.

-- NAV per share as at the period end was 4 pence (31 December

2022: 4.28 pence) and so Pires is now trading at a 67.5% discount

to its NAV.

-- Loss of GBP512,000 during the period (six months ended 30

June 2022: profit before taxation of GBP992,000).

-- Two-year debt funding facility amounting to GBP1.235 million

announced on 22 December 2022, just prior to the start of the

period, to provide funding for further investment and a bridge to

the sale of portfolio companies.

Portfolio highlights

-- Investment made in Sure Valley Ventures ("SVV")'s new venture

capital fund, SVV3, alongside Enterprise Ireland.

-- Smarttech247, since achieving a listing on AIM in late 2022,

is continuing to grow revenue and customers.

-- A number of the portfolio companies have, and are continuing

to, successfully raise new funding against a difficult funding

background.

-- SVV1 actively focused on realising material cash returns from

its portfolio given that it is now in its investment realisation

phase.

-- SVV2, with the British Business Bank as a cornerstone

investor, is actively looking to make further investments.

Nicholas Lee, Director of Pires, commented:

" Pires invests in next generation technology with a focus on Al

either directly, or indirectly through its investment in three

funds managed by SVV and its investment in Sure Ventures plc.

The first half of 2023 has continued to be a difficult time for

small-cap listed companies and for those companies with a

technology focus. However, notwithstanding this market backdrop,

Pires has been able to broadly maintain the value of its portfolio

and a number of the Company's investments have also continued to

make good progress during the period. In particular:

- Smarttech247, as a quoted company, has continued to grow

revenue and EBITDA and is winning new contracts. Its shares are

trading at an 8% premium to its IPO price as of 26 September

2023

- Cameramatics has raised EUR3 million in new funding at an

increasing valuation. It has also won new clients in the UK and US

including customers such as Maritime Transport, one of the UK's

largest privately owned transport companies.

- Nova Leah, a leader in cyber security for connected medical

devices, raised EUR1 million in Q2 2023 at an increasing

valuation.

- Getvisibility is growing rapidly, with a number of new channel

partners being onboarded during the period.

- LandVault, a large metaverse builder, successfully raised an

additional US$3 million after extending its Series B funding round

in April 2023. It is also steadily building its pipeline.

On 23 February 2023, Pires announced that it had agreed to

invest in SVV's new venture capital fund, SVV3, alongside

Enterprise Ireland, the fund's cornerstone investor that committed

50% or EUR15 million to the fund.

Going forward, t he Company has a clear and proven strategy of

investing in next-generation technology with a focus on AI and

realising returns from its investments which, it is continuing to

implement. Furthermore, SVV1 has now entered its realisation phase

and we are looking forward to further increases in the value of the

portfolio companies and subsequent exits, which are expected to

generate cash returns to the Company. The directors believe the

portfolio of investments remains well-poised to achieve significant

growth to deliver value to Pires and its shareholders."

Investment overview

Summary

The Company's principal investment portfolio categories are

summarised below:

Category Cost or Cost or

valuation valuation

at 30 June at 31 December

2023 2022

GBP000s GBP000s

------------ ----------------

Investment in Sure Valley

Ventures 5,217 5,219

------------ ----------------

Direct investments 2,901 2,901

------------ ----------------

Cash/other listed securities 670 856

------------ ----------------

Total 8,789 8,976

------------ ----------------

Investment in Sure Valley Ventures

Pires has exposure to the SVV funds via:

- a 13% direct investment in SVV1

- a 21.9% holding in Sure Ventures plc, the principal

investments of which comprise a 25.9% interest in SVV1 and a

holding in VividQ

- a 5.9% interest in SVV2, alongside the British Business Bank

- 16.7% interest in SVV3, alongside Enterprise Ireland

Pires therefore has aggregate direct and indirect interests in

SVV1 of circa 19% and in SVV2 of 7.2%.

1. Sure Valley Ventures Fund ("SVV1")

SVV1 is SVV's first fund which has completed its new investment

phase and has now entered its realisation phase. It has already

achieved three realisations/liquidity events to date, including the

recent listing of Smarttech247, with more expected in the future.

During the period, one of the portfolio companies, Buymie, was

disposed of and the value of the investment written off

accordingly. The impact of this on the fund was offset by valuation

gains achieved by other investments.

Within the SVV1 portfolio, highlights during the period

include:

GetVisibility

GetVisibility is a cybersecurity company focusing on data

visibility and control and uses state-of-the-art artificial

intelligence ("AI") to classify and secure unstructured

information. The company has continued to grow, with a number of

new channel partners being onboarded, leading to an increase in its

number of enterprise customers.

Pires also has a direct interest in GetVisibility and, an

additional indirect interest through SV plc.

LandVault

LandVault, a large metaverse builder, successfully raised an

additional US$3 million after extending its Series B funding round

in April 2023. This strategic funding was raised from Web3 focused

investors including, The Sandbox, The Gemini Frontier Fund, HodICo

and hedge fund Kingsway Capital. The proceeds of the fundraise are

set to assist in its global expansion, further investment in

innovative technologies and development in the building of an open

protocol, Matera, to make the metaverse experience more

accessible.

Smarttech247

Smarttech247 Group plc ("Smarttech247") (AIM: S247) is an

established global artificial intelligence-based cybersecurity

business, specialising in automated managed detection and response.

It has a successful track record of revenue growth and

profitability and is positioned at the intersection of three major

cyber security growth markets: security threat incidents, growth of

cloud adoption and proliferation of cyber security data generation

that needs to be integrated.

On 15 December 2022, the company's shares were admitted to

trading on the London Stock Exchange's AIM market raising gross

proceeds of GBP3.7 million through a placing at a price of 29.66

pence per new ordinary share. Smarttech247's share price as at 26

September 2023 was 32 pence per share, representing approximately

an 8% increase since listing and a significant uplift compared to

the level at which the investment was initially made. Recent full

year and interim results of Smarttech247, along with some new

contract wins have reinforced the company's growth trajectory.

ENGAGE XR

ENGAGE XR Holdings plc ("ENGAGE XR") (AIM: EXR) is a virtual

reality ("VR") technology company focused on becoming a leading

global provider of virtual communications solutions through its

proprietary software platform, ENGAGE. ENGAGE provides users with a

platform for creating, sharing and delivering VR content for

education, training and online events through its three solutions:

Virtual Campus, Virtual Office, and Virtual Events.

In Q4 2022, the company announced the launch of ENGAGE Link, a

new metaverse platform designed for corporations, professionals,

education organisations and event organisers. The company has seen

encouraging engagement with enterprise customers for this new

platform and was able to successfully demonstrate its capabilities

to a global audience in April 2023, with the hosting of ENGAGE XR's

first VR concert titled "Eat Sleep VR Repeat" starring Norman Cook,

AKA Fatboy Slim.

In January 2023, the company announced its first AI-powered

employee, Athena, who can answer questions, take voice commands and

complete tasks within its metaverse program. In February 2023, the

company raised EUR10.5 million by way of a placing which included a

subscription by HTC for GBP0.58 million.

For the 12 months ended 31 December 2022, the company achieved

revenue of EUR3.9 million, an increase of approximately 62% in this

period. The Group's cash position at 30 April 2023 was EUR10.3

million. In June 2023, Lenovo's new VR headset was released. Lenovo

is a channel partner for ENGAGE XR and so this is expected to

provide a new route to market for the company. In September 2023,

the company published its 2023 interim results which showed

continued revenue growth of 18% over the same period in 2022.

Cameramatics

Cameramatics offers a cloud based, SaaS solution to fleet

managers, enabling companies to deal with the increasing demands

around driver shortages, driver retention, rising fuel costs,

insurance costs, emission output and driver safety protocols. Its

in-house developed smart technologies, smart vision systems, AI

safety technologies, fleet safety/risk management tools and data

software solutions have been achieving strong results for

customers.

In Q1 2023, the company raised EUR3 million from existing

investors to assist with funding growth. The company is expanding

into new geographies, with good traction being gained in the US and

new clients being won including customers such as Maritime

Transport, one of the UK's largest privately owned transport

companies.

As at the period end, SVV1 had a portfolio of 14 investee

companies at different stages of development, spanning a range of

sectors. The portfolio provides Pires with exposure to a number of

key, cutting-edge and rapidly growing technology sectors. Further

details of the portfolio companies and recent developments are set

out below:

Artificial intelligence

Ambisense Provides an artificial intelligence platform

(Ambisense Limited) to deliver environmental risk assessment to allow

real-time gas and environmental monitoring using

both loT and sensor solutions. The company has

already been awarded a number of major contracts

and has a substantial pipeline of opportunities.

----------------------------------------------------------

EveryAngle An artificial intelligence platform that uses

machine learning to provide enterprises, such

as large retailers, with line of business solutions

to reduce fraud, churn and waste using machine

vision.

----------------------------------------------------------

Security

----------------------------------------------------------

Nova Leah An artificial intelligence cyber-security risk

(Nova Leah Limited) assessment and protection platform for connected

medical devices.

connected medical devices.

----------------------------------------------------------

Getvisibility An artificial intelligence security company addressing

(Visibility Blockchain the substantial problem faced by corporations

Limited) in storing, sorting, accessing and protecting

data.

----------------------------------------------------------

PreCog An artificial intelligence security solution

(Polience Limited) platform company that provides data intelligence

to combat crime, terrorism and protect vulnerable

people. Customers include leading law enforcement

and security agencies, and transport infrastructure

groups.

----------------------------------------------------------

Smarttech247 An established global artificial intelligence-based

cybersecurity business, specialising in automated

managed detection and response. The company is

listed on AIM.

(Smarttech247

Group PLC)

----------------------------------------------------------

Immersive Technologies

----------------------------------------------------------

Engage XR A developer of virtual reality and immersive

(Engage XR Holdings experiences with a specific focus on education

plc) and enterprise learning and development. The

company is listed on AIM, has over 100 commercial

customers and is rapidly growing revenue and

margins.

----------------------------------------------------------

LandVault (Formerly A platform enabling the monetisation of interactive

Admix) programmatic brand placements in, for example,

video games and other AR/VR applications. The

company is rapidly growing revenues and numbers

of active users.

(WAM Group Limited)

----------------------------------------------------------

Warducks An AR/VR game development studio which has produced

(Warducks Limited) leading VR games and will soon launch a new AR

game, Edge of Earth.

----------------------------------------------------------

Vivid Q A deep tech software company which has developed

(Vivid Q Limited) a framework for real-time 3D holographic displays

for use in heads-up displays and AR headsets

and glasses.

----------------------------------------------------------

Volograms An artificial intelligence deep learning company

(Volograms Limited) that uses Al to create 3D augmented reality from

2D photos and videos. The company has launched

a consumer AR Camera app called Volu and has

pro user and enterprise versions in development.

----------------------------------------------------------

Virtex A company building a platform for the next-generation

(Virtex Limited) of live, immersive entertainment within the virtual

reality gaming and esports industries. It is

developing its new stadium app.

----------------------------------------------------------

Internet of things

----------------------------------------------------------

CameraMatics An artificial intelligence platform enabling

(MySafe Drive transport fleet managers to reduce risk, increase

Limited) driver safety and comply with growing industry

governance and compliance. The company is expanding

into new geographies, with good traction being

gained in the US and new clients being won including

customers such as Maritime Transport, one of

the UK's largest privately owned transport companies.

----------------------------------------------------------

Wia Provides a platform solution for smart buildings.

(WIA Technologies Its platform provides full device and application

Limited) management, security, data capture and storage,

analysis and control.

----------------------------------------------------------

2. Sure Valley Ventures UK Software Technology Fund ("SVV2")

In March 2022, the Company invested in a second SVV fund, the

Sure Valley Ventures UK Software Technology Fund. The principal

investor in SVV2 is the British Business Bank ("BBB") an investment

arm of the UK Government. The first close of this fund amounted to

GBP85 million, with the BBB investing up to GBP50 million and other

investors ("Private Investors"), including Pires, investing up to

GBP35 million over the 10 year life of the fund.

SVV2 is managed by the same SVV team which, to date, has been

highly successful in achieving a number of cash realisations from,

and upward revaluations of, companies in the SVV1 portfolio. The

profit share arrangements within SVV2 are designed to encourage the

involvement of private investors alongside the BBB, meaning that

Pires and the other private investors would expect to receive a

significantly enhanced share of the total return generated by the

fund compared to industry standard.

SVV2 made two investments in 2022 which are described below:

RetÌnÍZE RETiniZE Limited is an award-winning creative-tech

Limited company based in Belfast, Northern Ireland The

company is developing an innovative software

product called Animotive that is harnessing the

latest VR and Generative Al technologies to transform

the 3D animation production process.

Jaid Jaid is a rapidly growing platform that uses

Al as a Service (AIaaS) solution to help businesses

reduce costs, improve efficiency and make data-driven

decisions, including client service automation,

sales automation, payment exception processing

and claims administration processing.

----------------------------------------------------------

Whilst further investments for this fund are being reviewed, the

funding requirement is expected to be relatively limited in the

short-term and will be met from existing cash resources and/or

realisations from SVV1.

3. Sure Valley Ventures III Limited Partnership ("SVV3")

On 23 February 2023, Pires announced that it had agreed to

invest in SVV's new venture capital fund, SVV3, alongside

Enterprise Ireland, the fund's cornerstone investor that committed

50% or EUR15 million to the fund. SVV3 plans to invest in circa 15

high-growth Al software companies in sectors such as Enterprise,

Immersive Technologies and Cybersecurity across the Republic of

Ireland.

Whilst new investments for this fund are being reviewed, the

funding requirement is expected to be relatively limited in the

short-term and will be met from existing cash resources and/or

realisations from SVV1.

4. Sure Ventures plc ("SV plc")

SV plc (LSE: SURE) is a London-listed venture capital fund which

invests in early-stage software companies in the rapidly growing

technology areas of Augmented Reality, Virtual Reality, Internet of

Things and artificial intelligence. As at 30 June 2023, Pires had a

21.9% shareholding in SV plc whose principal investment is a 25.9%

interest in SVV1 and a commitment to SVV2. Pires therefore has an

aggregate (direct and indirect) interest in SVV1 of around 19%,

which comprises its original direct 13% interest in SVV1 and an

indirect interest of 5.7%, through its 21.9% shareholding in SV

plc. SV plc also has direct shareholdings in VividQ and Let's

Explore Group, although this shareholding has subsequently been

sold.

Direct investments

GetVisibility

GetVisibility is a cybersecurity company focusing on data

visibility and control. It uses state-of-the-art artificial

intelligence ("AI") to classify and secure unstructured

information. The company has continued to grow rapidly, with a

significant number of new channel partners being onboarded, leading

to a substantial increase in its number of enterprise

customers.

Pires also has indirect interests in GetVisibility through SVV1

and SV plc.

Emergent Entertainment Ltd ("Emergent")

Emergent a next-generation entertainment company focused on

bringing audiences and storytellers together by harnessing emerging

technologies.

During the period, Emergent signed an LOI to secure development

funding to develop a new game and is also in discussions on other

projects. The launch of the VR game, Peaky Blinders, was positively

received and further work is underway to increase sales. The

company has agreed terms with a massive multiplayer role-playing

game developer to fast track the development of its Web3 game,

Resurgence, which is expected to reduce development times by 12

months. The management team is also working on various initiatives

to reduce the company's cost base and it expects 2023 revenues to

be significantly ahead of the previous year.

Low6 Limited ("Low6")

Low6 is a leader in sports gaming technology that powers

franchises with their own branded gaming experiences to engage and

monetise their digital fanbases.

During the period, Low6 has continued to win new clients

including Olybet, Better Collective and BetRivers and has expanded

and increased revenue with existing clients. The company has

contracted approximately US$7 million in revenue since 1 July 2022

and revenues are expected to continue to grow in the remainder of

the year as the Premier League gets going in August and the North

America sports kick off in September. In late April 2023, the

company raised GBP800,000 from its largest shareholders as a bridge

to EBIDTDA breakeven which was achieved in July 2023. The

management team continues to work on cost reduction with the

majority of the legacy debt attributed to the pool betting

operation having been negotiated down and/or cleared now.

PreCog

PreCog is a security solution platform company that provides

data intelligence to combat crime, terrorism and protect vulnerable

people. Its customers include leading law enforcement and security

agencies, and transport infrastructure groups. The company has

continued to develop its product offering and, in particular, it

has developed an "off the shelf product" which is expected to

minimise manufacturing risk. The company operates in an exciting

security sector with significant potential demand for its products

expected going forward.

Key financial indicators

The key unaudited performance indicators are set out below:

Performance indicator 30 June 2023 31 December Change

2022

-------------------------------- ------------- ----------- ------

GBP000s GBP000s -

Loss attributable GBP(512) GBP(366) -

Net asset value GBP 7,310 GBP 7,822

Net asset value - fully diluted

per share 4.00p 4.28p

For this period, operating costs have been reduced and portfolio

valuations have remained relatively flat. However, the

strengthening of the GBP against the EUR and financing costs have

contributed to a resulting loss for the period.

As previously stated, we do not believe that the Company's net

asset value fairly represents its financial potential, given the

scope for significant valuation uplift for the companies within the

portfolio. This is clearly demonstrated by a series of gains, both

realised and unrealised, that have been achieved to date from its

investment portfolio. Furthermore, realisations that are achieved

within the SVV portfolio result in cash distributions to the

Company and are not retained within the fund thereby delivering a

real cash return to the Company.

Outlook

Overall, we remain encouraged by the progress made to date by

our investee companies and the outlook for the respective sectors

in which they operate.

We expect that in the coming months we will see some additional

realisations or liquidity events from the investment portfolio.

Furthermore, it is important to note that, as previously mentioned,

the SVV1 fund has now substantially completed its deployment phase

and so is moving towards a realisation phase which is expected to

generate further cash inflows for the Company.

In summary, we believe that our investment strategy in the

technology sector has already proven successful. Furthermore, our

portfolio is also very much AI focused and so should be attractive

to investors wanting exposure to this exciting and fast-moving

sector.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged the

release of this information is Nicholas Lee, Director of the

Company.

Enquiries:

Pires Investments plc

Nicholas Lee, Director Tel: +44 (0) 20 3368 8961

Nominated Adviser

Cairn Financial Advisers LLP Tel: +44 (0) 20 7213 0880

Liam Murray/Ludovico Lazzaretti

Broker

Peterhouse Capital Limited Tel: +44 (0) 20 7469 0935

Lucy Williams/Duncan Vasey

Notes to Editors

About Pires Investments plc

Pires Investments plc (AIM: PIRI) is a company providing

investors with access to a portfolio of next-generation technology

businesses with significant growth potential and focus on AI.

The Company is building an investment portfolio of high-tech

businesses across areas such as Artificial Intelligence, Internet

of Things, Cyber Security, Machine Learning, Immersive Technologies

and Big Data, which the Board believes demonstrate evidence of

traction and the potential for exponential growth, due to

increasing global demand for development in these sectors.

For further information, visit: https://piresinvestments.com/

.

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2023

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30-Jun 30-Jun 31-Dec

2023 2022 2022

Continuing activities GBP000s GBP000s GBP000s

Notes

Revenue

Investment income - - -

Other income 2 - -

Total revenue 2 - -

Gains on investments held

at fair value through profit

or loss (251) 1,422 420

Operating expenses (215) (430) (786)

---------- ---------- -----------

Operating (loss)/profit

from continuing activities (464) 992 (366)

(Loss)/profit before taxation

from continuing activities (464) 992 (366)

Financing cost (48) - -

Tax - - -

(Loss)/profit for the period

from continuing activities (512) 992 (366)

---------- ---------- -----------

(Loss)/profit for the period

and total comprehensive

income attributable to equity

holders of the Company (512) 992 (366)

========== ========== ===========

Basic (loss)/profit per

share 3

Equity holders

Basic and fully diluted (0.28)p 0.58p (0.20)p

UNAUDITED STATEMENT OF FINANCIAL POSITION

As at 30 June 2023

Unaudited Unaudited Audited

As at As at As at

30-Jun 30-Jun 31-Dec

2023 2022 2022

GBP000s GBP000s GBP000s

Notes

CURRENT ASSETS

Investments 8,124 8,810 8,129

Trade and other

receivables 11 9 373

Cash and cash equivalents 665 588 847

---------- ---------- ---------

TOTAL CURRENT ASSETS 8,800 9,407 9,349

---------- ---------- ---------

TOTAL ASSETS 8,800 9,407 9,349

========== ========== =========

EQUITY

Called up share

capital 457 416 457

Shares to be issued - 10 -

Share premium account 8,778 8,176 8,778

Share premium account - 155 -

for shares to be

issued

Retained earnings (13,920) (12,050) (13,408)

Capital redemption

reserve 11,995 11,995 11,995

---------- ---------- ---------

TOTAL EQUITY 4 7,310 8,702 7,822

NON-CURRENT LIABILITIES

Loan Notes 1,235 - 1,235

CURRENT LIABILITIES

Trade creditors

and other liabilities 255 705 292

---------- ---------- ---------

TOTAL LIABILITIES

AND CURRENT LIABILITIES 1,490 705 1,527

TOTAL EQUITY AND

LIABILITIES 8,800 9,407 9,349

========== ========== =========

UNAUDITED CASH FLOW STATEMENT

For the six months ended 30 June 2023

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30-Jun 30-Jun 31-Dec

2023 2022 2022

GBP000s GBP000s GBP000s

Cash flows from operating

activities - (Loss)/profit

for the period (512) 992 (366)

Realised (gain) on disposal

of investments - (14) (14)

Fair value movement in

investments 251 (1,408) (406)

Interest income (2) - -

Financing cost 48 - -

Decrease/(increase) in

receivables 362 (1) (365)

(Decrease)/increase in

payables (37) 530 117

Net cash absorbed by

operating activities 110 99 (1,034)

Cash flows from investing

activities

Payments to acquire investments (246) (440) (760)

Proceeds of sale of investments - 68 66

Net cash from investing

activities (246) (372) (694)

Cash flows from financing

activities

Interest received 2 - -

Financing cost (48) - -

Net proceeds from shares

issued or to be issued - 487 966

Issue of loan notes - - 1,235

Net cash from financing

activities (46) 487 2,201

Net (decrease)/increase

in cash and cash equivalents

during the period (182) 214 473

Cash and cash equivalents

at beginning of the period 847 374 374

Cash and cash equivalents

at end of the period 665 588 847

Notes to the Unaudited Interim Report

1. GENERAL INFORMATION

Pires Investments plc (the "Company") is a company domiciled in

England whose registered office address is 9(th) Floor, 107

Cheapside, London EC2V 6DN. The condensed interim financial

statements of the Company for the six months ended 30 June 2023 is

that of the Company only.

The condensed interim financial statements do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006.

The financial information for the year ended 31 December 2022

has been extracted from the statutory accounts for that period

which were prepared in accordance with International Financial

Reporting Standards ("IFRS"). The auditors' report on the statutory

accounts was unqualified. A copy of those financial statements has

been filed with the Registrar of Companies.

The financial information for the six months ended 30 June 2022

and 30 June 2023 were also prepared in accordance with IFRS.

The condensed interim financial statements do not include all of

the information required for full annual financial statements.

The condensed interim financial statements were authorised for

issue on 26 September 2023.

2. BASIS OF ACCOUNTING

The financial statements are unaudited and have been prepared on

the historical cost basis in accordance with International

Financial Reporting Standards as adopted by the EU ("IFRS") using

the same accounting policies and methods of computation as were

used in the annual financial statements for the year ended 31

December 2022. As permitted, the interim report has been prepared

in accordance with the AIM Rules for Companies and is not compliant

in all respects with IAS 34 Interim Financial Statements. The

condensed interim financial statements do not include all the

information required for full annual financial statements and hence

cannot be construed as in full compliance with IFRS.

3. (LOSS)/PROFIT PER SHARE

The calculation of the basic profit per share is based on the

following data:

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30-Jun 30-Jun 31-Dec

2023 2022 2022

GBP000s GBP000s GBP000s

(Loss)/profit on continuing activities

after tax (512) 992 (366)

Basic and fully diluted

Basic and fully diluted earnings per share have been computed

based on the following data:

Number of

shares

Weighted average number of ordinary

shares for the period 182,956,642 159,463,671 171,274,697

Basic earnings per share from

continuing activities (p) (0.28) 0.6 (0.20)

There were no dilutive instruments that would give rise to diluted

earnings per share.

4. STATEMENT OF CHANGES IN EQUITY

Share Capital Shares Share Premium Capital Retained Earnings Total

to be issued Redemption

Reserve

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

At 1 January

2022 396 - 7,874 11,995 (13,042) 7,223

Issue of shares

(net of costs) 20 165 302 - 487

Profit for the

6 months ended

30 June 2022 - - - - 992 992

-------------

At 30 June

2022 416 165 8,176 11,995 (12,050) 8,702

Issue of shares

(net of costs) 41 (165) 602 - - 478

Loss for the

6 months ended

31 December

2022 - - - (1,358) (1,358)

-------------

At 31 December

2022 457 - 8,778 11,995 (13,408) 7,882

Loss for the

6 months ended

30 June 2023 - - - - (512) (512)

-------------

At 30 June

2023 457 - 8,778 11,995 (13,920) 7,310

============= ------------- ============= =========== ================= =======

5. DISTRIBUTION OF INTERIM REPORT

Copies of the Interim Report for the six months ended 30 June

2023 are available on the Company's website,

www.piresinvestments.com .

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SESFMMEDSEDU

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

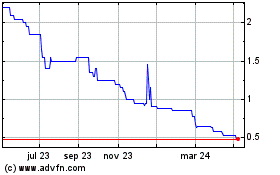

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

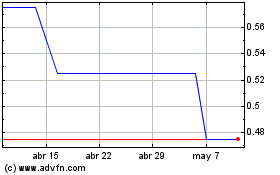

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De May 2023 a May 2024