Quarterly Review (1758427)

26 Octubre 2023 - 6:48AM

UK Regulatory

M&G Credit Income Investment Trust plc (MGCI)

Quarterly Review

26-Oct-2023 / 12:48 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

M&G CREDIT INCOME INVESTMENT TRUST PLC

(the "Company")

LEI: 549300E9W63X1E5A3N24

Quarterly Review

The Company announces that its quarterly review as at 30 September 2023 is now available, a summary of which is

provided below. The full quarterly review is available on the Company's website at:

https://www.mandg.com/dam/investments/common/gb/en/documents/funds-literature/credit-income-investment-trust/

mandg_credit-income-investment-trust_quarterly-review_gb_eng.pdf

Market Review

The third quarter was characterised by a shift in financial markets toward an acceptance that central banks would keep

interest rates elevated for a prolonged period. This saw government bond yields hit fresh multi-year highs while

investors pulled back from risk assets. The period had started on a positive footing as a notable deceleration in

inflation in Europe and the US saw soft landing expectations drive a strong rally in risk assets, supported by lots of

good news all round from an economic standpoint. As the period progressed however, the early summer optimism lost

momentum as concerns grew over a new era of higher interest rates and central banks' determination to bring inflation

under control with restrictive policies weighed heavily. In the US, fiscal positioning and growing debt levels, not to

mention a credit downgrade by ratings agency Fitch, dented investor appetite for US Treasuries, which contributed to

the significant climb higher in yields. Eurozone and UK government bonds sold off also, although the latter proved

slightly more resilient, outperforming other core sovereign debt over the period. UK corporate bonds were stronger over

the quarter compared to the previous period and versus regional rivals (US and Europe), boosted by broadly flat

government bond yields and some tightening of credit spreads.

With rates likely to stay 'high for longer', attention focused on the potential lagged effects of rate rises on

economic activity. The US economy remained resilient in the period, with GDP data showing growth at an annual rate of

2.1% for the second quarter, partly as wage growth supported consumer spending. The UK economy expanded 0.2% in the

second quarter from the previous quarter and retail sales rose in August. Revised data showed that the UK economy was

now bigger than its pre-pandemic size, and having long been identified as the worst performing economy among G7

countries since the Covid-19 pandemic, also showed that the UK had actually outperformed both Germany and France over

the same period. There were fresh signs of frailty in the Euro-area economy as a succession of weak economic data

releases pointed to a slowdown in activity, leading to concerns that the single-currency bloc could be heading for

recession.

Manager Commentary

Pleasingly the Company delivered another quarter of strongly positive performance. The Company's NAV total return in Q3

was +3.10% which outperformed comparative fixed income indices such as the ICE BofA Sterling Corporate and

Collateralised Index (+2.22%) and the ICE BofA High Yield Index (+1.72%). Performance was driven by a relatively equal

combination of income and capital gains. Our short position in UK 10 year gilt futures continued to mitigate against

the negative effect of rising interest rates, allowing returns to capture the positive contribution of a tightening in

portfolio credit spreads over the quarter. Our strategy of combining higher yielding private assets alongside a smaller

allocation to mainly investment grade, public credit whilst maintaining low duration has proved to be very successful

over the past 12 months, with the Company's 1-year NAV total return 10.35% as at the end of September.

It was a relatively quiet quarter for portfolio activity and although we are reluctant to chase yield at current credit

spread levels, we did continue to add risk selectively. Senior unsecured positions in financial bonds have performed

well for us recently and we took the opportunity to add similar positions in Virgin Money in the secondary market and

Principality at new issue. Following recent private asset repayments, we invested GBP4m into the daily dealing M&G Senior

Asset Backed Credit Fund. The fund invests in a diversified pool of investment grade ABS, predominantly in senior

tranches with 80% or more expected to be of a credit rating of at least AA- or higher. The current average credit

rating of the portfolio is AAA and it returns at present approximately SONIA+150bps. We will use the fund as a

cash-park vehicle while we wait for attractively priced public and private opportunities to arise. In September we

completed the secondary market purchase of two tranches (GBP1.3m) in a public securitisation which was issued by Telereal

in 2008 to fund the sale and leaseback transaction of British Telecom telephone exchanges. The B7 and C1 notes were

purchased at 90 and 91 respectively giving all-in yields of more than 10% for BBB risk. We also sold our bonds from

public high yield borrower Oriflame, with the outlook becoming particularly negative and the turnaround story looking

increasingly difficult to execute.

Outlook

Despite the disinflationary progress seen over the third quarter, a straight line return to a 2% inflation target seems

improbable and recent notable increases in oil and natural gas prices have already resulted in upside surprises in UK

and US CPI data. If the last two months are any indication of future inflation, core US CPI will likely end the year

well above the Fed's target, necessitating interest rates to remain in restrictive territory as they look to wrestle

stubborn inflation back under control. Labour force pressure, strikes and wage growth have been established as

prominent features of the macro landscape in the short term and will complicate the job of policymakers as they attempt

to prevent inflation from becoming embedded. That said, the lagged effect from rate hiking cycles is starting to be

felt in the real economy and lending conditions in both the US and Europe have tightened considerably in the second

half of the year and are in line with levels historically only observed around recessions.

High debt accompanied by high interest rates is an unhealthy dynamic that will ramp up stress within the economy. While

policy rates remain elevated, the inherent risk is that something, somewhere in the financial system will break. So far

issuers in corporate debt markets have been fairly well insulated from the rise in interest rates with many having

termed out debt maturities at lower interest rates in previous years. However, if central banks do as they have been

signalling and keep interest rates higher for longer, the inflection point is fast approaching when many issuers are

forced to refinance large debt piles at significantly higher coupons and defaults will almost certainly increase over

the next two years.

With Europe still reeling from Russia's invasion of Ukraine, a dramatic escalation in geopolitical tensions in the

Middle East has added another layer of complexity to an already uncertain economic outlook. It is too early to say what

impact the Israeli-Palestinian conflict will have on global supply chains and energy prices, with much depending on how

much the war escalates between the two countries and whether it spreads out into a broader regional conflict. Should

the situation develop and involve other global players and allies, the potential human and economic cost would have

significant ramifications on a global scale.

We remain cautious on adding risk at current credit spread levels but we are positioned to move quickly should market

volatility present opportunities, supported by the Company's undrawn GBP25m credit facility. Economic indicators are

showing a deterioration in financial conditions although we are yet to really see this reflected in credit market

pricing except at the riskiest end of the spectrum. Under current market conditions we will continue to look to rotate

out of lower yielding public bonds and into private credit as and when new transactions become available, capturing the

illiquidity premium which has been re-established over the course of the year.

Link Company Matters Limited

Company Secretary

26 October 2023

- ENDS -

The content of the Company's web-pages and the content of any website or pages which may be accessed through hyperlinks

on the Company's web-pages, other than the content of the Update referred to above, is neither incorporated into nor

forms part of the above announcement.

=----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BFYYL325, GB00BFYYT831

Category Code: MSCL

TIDM: MGCI

LEI Code: 549300E9W63X1E5A3N24

Sequence No.: 280848

EQS News ID: 1758427

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1758427&application_name=news

(END) Dow Jones Newswires

October 26, 2023 07:48 ET (11:48 GMT)

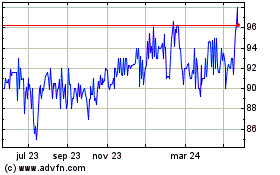

M&g Credit Income Invest... (LSE:MGCI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

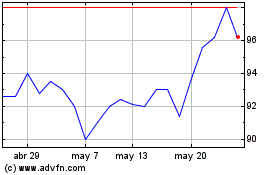

M&g Credit Income Invest... (LSE:MGCI)

Gráfica de Acción Histórica

De May 2023 a May 2024