TIDMMIN

RNS Number : 6409H

Minoan Group PLC

31 July 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

31 July 2023

Interim Results Announcement

Minoan Group Plc

(the "Group" or the "Company" or "Minoan")

Minoan Group Plc, the AIM listed resort development company

presents its unaudited interim results for the six months ended 30

April 2023.

KEY POINTS

-- Discussions with the Public Welfare Ecclesiastical Foundation

Panagia Akrotiriani ("the Foundation") in relation to the Master

contract continue and remain in line with the published

timeline.

-- The detailed environmental study for the Masterplan which

follows the Presidential Decree is making good progress.

-- Commercial discussions and other negotiations relating to the

Project continue with further NDAs expected in the coming

period.

-- The Loss for the period was almost halved compared to the

same period last year to GBP286,000 (2021/22: GBP542,000).

Christopher Egleton, Chairman of Minoan, said:

"In April of this year, the Company laid out the key milestones

and timeline that it expects for the conclusion of the Project. The

Company continues to follow this and George Mergos and I very much

look forward to updating Shareholders with progress in the near

future."

The Company's unaudited interim results for the six months ended

30 April 2023 can be viewed on Minoan's website,

www.minoangroup.com , with effect from 31 July 2023.

For further information visit www.minoangroup.com or

contact:

Minoan Group Plc

Christopher Egleton christopher.egleton@minoangroup.com

George Mergos georgios.mergos@minoangroup.com

W H Ireland Limited 020 7220 1666

Antonio Bossi

Peterhouse Capital Limited 020 7469 0930

Duncan Vasey

Chairman's Statement

Introduction

I am pleased to present the unaudited interim results for Minoan

Group Plc for the six months to 30 April 2023.

During the period, Loyalward Limited, the Group's wholly owned

subsidiary and owner of the Project, under the leadership of George

Mergos, continued to make good progress with the Itanos Gaia

Project in Crete (the "Project").

Discussions with the Public Welfare Ecclesiastical Foundation

Panagia Akrotiriani (the "Foundation") are proceeding well with a

number of meetings having taken place in the period and

subsequently. These discussions are on a practical basis and the

Company remains confident that they can be concluded in the coming

months.

Alongside these discussions, work is being undertaken on the

detailed environmental study for the Masterplan which follows the

requirements arising from the Presidential Decree. I look forward

to be able to announce the conclusion of this in due course.

As I reported in April, the discussions with the Foundation are

not impeding progress on the Project itself, as we are moving

forward based on the existing contractual documentation. This has

enabled the management team to proceed with certainty and to

undertake the Commercial and other negotiations relating to the

Project. The Board expects further Non Disclosure Agreements to be

signed in the coming period.

Financial Review

The Board is pleased to note the reduction in the loss for the

six months period to 30 April 2023. The loss before taxation was

GBP286,000 compared to GBP542,000 in the same period last year. The

Company continues to focus on the key activities necessary to drive

the Project forward.

Total assets at 30 April 2023 totalled GBP51,475,000 (2021:

GBP50,907,000).

Outlook

In April of this year, the Company laid out the key milestones

and timeline that it expects for the conclusion of the Project. The

Company continues to follow this and George Mergos and I very much

look forward to updating Shareholders with progress in the near

future.

Christopher W Egleton

Chairman

31 July 2023

Unaudited Consolidated Statement of Comprehensive Income

Six months ended 30 April 2023

6 months ended 6 months ended Year ended

30.04.23 30.04.22 31.10.22

GBP'000 GBP'000 GBP'000

Revenue - - -

Cost of sales - - -

-------------- -------------- -----------

Gross profit - - -

Operating expenses (220) (264) (541)

Operating loss (220) (264) (541)

Finance costs (66) (278) (524)

Loss before taxation (286) (542) (1,065)

Taxation - - -

-------------- -------------- -----------

Loss for period attributable

to equity holders of the Company (286) (542) (1,065)

-------------- -------------- -----------

Loss per share attributable to

equity holders of the Company:

Basic and diluted (0.04)p (0.09)p (0.16)p

Unaudited Consolidated Statement of Changes in Equity

Six months ended 30 April 2023

Share Share Merger Warrant Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP000 GBP'000 GBP'000

Balance at 1 November

2022 20,321 36,583 9,349 2,619 (26,183) 42,689

Loss for the period - - - - (286) (286)

Issue of ordinary shares 27 - - - - 27

Share based payments - - - - - -

-------- -------- -------- -------- --------- --------

Balance at 30 April 2023 20,348 36,583 9,349 2,619 (26,469) 42,430

-------- -------- -------- -------- --------- --------

Six months ended 30 April 2022

Share Share Merger Warrant Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP000 GBP'000 GBP'000

Balance at 1 November

2021 19,021 36,583 9,349 2,571 (25,118) 42,406

Loss for the period - - - - (542) (542)

Issue of ordinary shares 150 - - - - 150

Share based payments - - - 47 - 47

Balance at 30 April 2022 19,171 36,583 9,349 2,618 (25,660) 42,061

-------- -------- -------- -------- --------- --------

Year ended 31 October 2022

Share Share Merger Warrant Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP000 GBP'000 GBP'000

Balance at 1 November

2021 19,021 36,583 9,349 2,571 (25,118) 42,406

Loss for the year - - - - (1,065) (1,065)

Issue of ordinary shares 1,300 - - - - 1,300

Share based payments - - - 48 - 48

Balance at 31 October

2022 20,321 36,583 9,349 2,619 (26,183) 42,689

-------- -------- -------- -------- --------- --------

Unaudited Consolidated Statement of Financial Position as at 30

April 2023

As at 30.04.23 As at 30.04.22 As at 31.10.22

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 3,583 3,583 3,583

Property, plant and equipment 157 157 157

Total non-current assets 3,740 3,740 3,740

---------------- ---------------- --------------

Current assets

Inventories 47,561 47,004 47,388

Receivables 159 158 167

Cash and cash equivalents 15 5 130

---------------- ---------------- --------------

Total current assets 47,735 47,167 47,685

---------------- ---------------- --------------

Total assets 51,475 50,907 51,425

---------------- ---------------- --------------

Equity

Share capital 20,348 19,171 20,321

Share premium account 36,583 36,583 36,583

Merger reserve account 9,349 9,349 9,349

Warrant reserve 2,619 2,618 2,619

Retained earnings (26,469) (25,660) (26,183)

---------------- ---------------- --------------

Total equity 42,430 42,061 42,689

---------------- ---------------- --------------

Liabilities

Current liabilities 9,045 8,846 8,736

Total equity and liabilities 51,475 50,907 51,425

---------------- ---------------- --------------

Unaudited Consolidated Cash Flow Statement

Six months ended 30 April 2023

6 months ended 6 months ended Year ended

30.04.23 30.04.22 31.10.22

GBP'000 GBP'000 GBP'000

Loss before taxation (286) (542) (1,065)

Finance costs 66 278 524

Increase in inventories (173) (246) (630)

Decrease in receivables 8 4 5

Increase in current liabilities 234 418 370

--------------------------- --------------------------- -----------------------

Net cash (outflow) from operations (151) (88) (806)

Finance costs (66) (231) (476)

--------------------------- --------------------------- -----------------------

Net cash used in operating

activities (217) (319) (1,282)

--------------------------- --------------------------- -----------------------

Cash flows from investing

activities

Purchase of property, plant -

and equipment - -

Purchase of intangible assets - - -

--------------------------- --------------------------- -----------------------

Net cash used in investing -

activities - -

--------------------------- --------------------------- -----------------------

Cash flows from financing

activities

Net proceeds from the issue

of ordinary shares 27 150 1,300

Net loans received / (repaid) 75 154 92

--------------------------- --------------------------- -----------------------

102 304 1,392

--------------------------- --------------------------- -----------------------

Net (decrease) / increase

in cash (115) (15) 110

Cash at beginning of period 130 20 20

--------------------------- --------------------------- -----------------------

Cash at end of period 15 5 130

--------------------------- --------------------------- -----------------------

Notes to the Unaudited Financial Statements

Six months ended 30 April 2023

1. General information

The Company is a public limited company incorporated in England

and Wales. The Company's principal activity in the period under

review was that of a holding and management company of a Group

involved in the design, creation, development and management of

environmentally friendly luxury hotels and resorts plus the

provision of general management services.

2. Basis of preparation

The interim financial statements are unaudited and do not

constitute statutory accounts as defined in Section 434(3) of the

Companies Act 2006. A copy of the audited Report and Financial

Statements for the year ended 31 October 2021 has been delivered to

the Registrar of Companies. The auditor's report on these accounts

was unqualified and did not contain statements under s498(2) to

s498(4) of the Companies Act 2006.

These interim financial statements for the six months ended 30

April 2023 comprise an Unaudited Consolidated Statement of Profit

and Loss and Other Comprehensive Income, Unaudited Consolidated

Statement of Changes in Equity, Unaudited Consolidated Statement of

Financial Position and Unaudited Consolidated Cash Flow Statement

plus relevant notes.

The interim financial statements are prepared in accordance with

EU adopted International Financial Reporting Standards ("IFRS") and

the International Financial Reporting Interpretations Committee

("IFRIC") interpretations and the Companies Act 2006 applicable to

companies reporting under IFRS.

The principal accounting policies adopted in the preparation of

the interim financial statements are consistent with those adopted

in the Report and Financial Statements for the year ended 31

October 2022.

Going concern

The directors have considered the financial and commercial

position of the Group in relation to its Project in Crete (the

"Project"). In particular, the directors have reviewed the matters

referred to below.

Following the unanimous approval of a Plenum of the Greek

Council of State, the highest court in Greece, the Presidential

Decree granting land use approval for the Project was issued on 11

March 2016 and was published in the Government Gazette. The

planning rules for the Project are now enshrined in law. The

appeals lodged against the Presidential Decree have been rejected

by the Greek Supreme Court. Accordingly, the directors consider

that they will conclude further Project joint venture agreements in

the near term.

In addition to specific Project related matters as noted above,

and as has been the case in the past, the Group continues to need

to raise capital in order to meet its existing finance and working

capital requirements. While the directors consider that any

necessary funds will be raised as required, the ability of the

Company to raise these funds is, by its nature, uncertain.

Having taken these matters into account, the directors consider

that the going concern basis of preparation of the financial

statements is appropriate.

Notes to the Unaudited Financial Statements (continued)

Six months ended 30 April 2023

3. Loss per share attributable to equity holders of the

Company

Earnings per share are calculated by dividing the earnings

attributable to the equity holders of a company by the weighted

average number of ordinary shares in issue during the period.

Diluted earnings per share are

calculated by adjusting basic earnings per share to assume the

conversion of all dilutive potential ordinary shares. There are no

dilutive instruments in issue, therefore the basic loss per share

and diluted loss per share are the same. The weighted average

number of shares used in calculating basic and diluted loss per

share for the six months ended 30 April 2023 was 733,131,124. (Six

months ended 30 April 2022: 612,627,502; Year ended 31 October

2022: 647,900,567).

4. Share based payments charge

In accordance with IAS 32, the Share based payments charge in

respect of warrants finance charges has been included in Finance

costs in the Unaudited Consolidated Statement of Comprehensive

Income.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDDFIIVIV

(END) Dow Jones Newswires

July 31, 2023 02:00 ET (06:00 GMT)

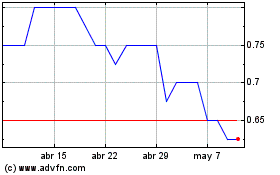

Minoan (LSE:MIN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Minoan (LSE:MIN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024