TIDMMPL

RNS Number : 1601C

Mercantile Ports & Logistics Ltd

08 June 2023

THIS ANNOUNCEMENT (THE "ANNOUNCEMENT") AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE

OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO THE UNITED STATES OF AMERICA, ITS STATES, TERRITORIES AND

POSSESSIONS ("UNITED STATES"), AUSTRALIA, CANADA, JAPAN, SINGAPORE,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE PROHIBITED BY

ANY APPLICABLE LAW.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE

OR THE SOLICITATION TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY

SECURITIES.

THE COMMUNICATION OF THIS ANNOUNCEMENT AND ANY OTHER DOCUMENTS

OR MATERIALS RELATING TO THE RETAIL OFFER AS A FINANCIAL PROMOTION

IS ONLY BEING MADE TO, AND MAY ONLY BE ACTED UPON BY, THOSE PERSONS

IN THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND

("UNITED KINGDOM" OR "UK") FALLING WITHIN ARTICLE 43 OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005, AS AMED ("FPO") (WHICH INCLUDES AN EXISTING SHAREHOLDER OF

MERCANTILE PORTS & LOGISTICS LIMITED). ANY INVESTMENT OR

INVESTMENT ACTIVITY TO WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE

ONLY TO SUCH PERSONS AND WILL BE ENGAGED IN ONLY BY SUCH

PERSONS.

8 June 2023

Mercantile Ports & Logistics Limited

("MPL" or the "Company" and, together with its subsidiaries, the

"Group")

Retail Offer to raise gross proceeds of up to GBP1.20

million

Mercantile Ports & Logistics Limited (AIM: MPL), which is

operating and continuing to develop a port and logistics facility

in Navi Mumbai, Maharashtra, India, is pleased to announce a

proposed retail offer via the BookBuild platform (the "Retail

Offer") to raise gross proceeds of up to GBP1.20 million (before

expenses) through the issue of new ordinary shares of no par value

in the Company ("Ordinary Shares"). Under the Retail Offer, up to

40,000,000 new Ordinary Shares (the "Retail Shares") will be made

available at a price equal to 3 pence per share ("Issue

Price").

In addition to the Retail Offer and as announced earlier today,

the Company is also proposing a placing of new Ordinary Shares (the

"Placing Shares") to raise a minimum of GBP3.00 million (before

expenses) (the "Placing") and a subscription by certain existing

and new investors of new Ordinary Shares (the "Subscription

Shares", and together with the Retail Shares and the Placing

Shares, the "New Ordinary Shares") to raise GBP5.85 million (before

expenses) (the "Subscription", and together with the Retail Offer

and the Placing, the "Equity Fundraising"), in each case at the

Issue Price. A separate announcement has been made regarding the

Placing and its terms. For the avoidance of doubt, the Retail Offer

is not part of the Placing or the Subscription. The Issue Price

represents a discount of approximately 29.4% to the closing

mid-market price per Ordinary Share of 4.25 pence on 7 June 2023,

being the latest practicable date before this Announcement.

Net proceeds from the Equity Fundraising will enable the Group

to strengthen the balance sheet and to provide working capital for

the Group. The Company is in advanced discussions to refinance its

existing debt facilities, and the net proceeds from the Equity

Fundraising will assist the Company in such discussions.

Completion of the Equity Fundraising is conditional, inter alia,

upon approval of the shareholders of the Company (the

"Shareholders") at the general meeting of the Shareholders to be

held on or around 27 June 2023 (the " General Meeting ") and on the

New Ordinary Shares being admitted ("Admission") to trading on AIM,

being the market of that name operated by London Stock Exchange plc

(the "London Stock Exchange") ("AIM"). It is expected that

Admission of the New Ordinary Shares will become effective and that

dealings will commence at 8.00 a.m. on 28 June 2023.

The Retail Offer is not part of the Placing or the Subscription.

Completion of the Retail Offer is conditional, inter alia, upon the

Equity Fundraising being or becoming wholly unconditional, however

completion of the Equity Fundraising is not conditional on the

completion of the Retail Offer.

Expected timetable in relation to the Retail Offer

Event Date and time

Retail Offer opens 4.35 p.m. on 8 June

2023

Latest time and date for receipt of commitments under 4.30 p.m. on 12 June

the Retail Offer 2023

Results of the Retail Offer announced 13 June 2023

General Meeting 11.00 a.m. on 27 June

2023

Announcement of results of the General Meeting 27 June 2023

Expected date when Admission is effective and unconditional 8.00 a.m. on 28 June

dealings in the New Ordinary Shares on AIM commence 2023

Expected date for crediting of the New Ordinary Shares 28 June 2023

in uncertificated form to CREST members' accounts

References to times in this Announcement are to London time

unless otherwise stated.

The times and dates set out in the expected timetable of

principal events above and mentioned throughout this Announcement

may be adjusted by the Company in which event the Company will make

an appropriate announcement to a Regulatory Information Service

giving details of any revised dates and the details of the new

times and dates will be notified to the London Stock Exchange and,

where appropriate, Shareholders. Shareholders may not receive any

further written communication.

Dealing codes

ISIN for Ordinary Shares GG00BKSH7R87

SEDOL for Ordinary Shares BKSH7R8

LEI 213800UT113BW8VXV311

TIDM MPL

Retail Offer

The Company values its retail Shareholder base and believes that

it is appropriate to provide eligible retail Shareholders in the

United Kingdom the opportunity to participate in the Retail Offer.

The Retail Offer will allow eligible retail Shareholders to

participate in the Retail Offer by subscribing for Retail Shares,

through eligible financial intermediaries, at the Issue Price via

the BookBuild platform.

The Company is therefore making the Retail Offer available in

the United Kingdom through the financial intermediaries which will

be listed, subject to certain access restrictions, on the following

website:

https://www.bookbuild.live/deals/DX72E1/authorised-intermediaries

Cenkos Securities plc ("Cenkos Securities") will be acting as

coordinator in relation to the Retail Offer (the "Retail Offer

Coordinator").

Existing retail Shareholders can contact their intermediary to

participate in the Retail Offer, assuming they are eligible to do

so. In order to participate in the Retail Offer, each intermediary

must be on-boarded onto the BookBuild platform, have an active

trading account with the Retail Offer Coordinator and have been

approved by the Retail Offer Coordinator as an intermediary in

respect the Retail Offer. Each intermediary must also agree to the

final terms and the Retail Offer terms and conditions, which

regulate, inter alia, the conduct of the Retail Offer on market

standard terms and provide for the payment of commission to any

intermediary that elects to receive a commission and/or fee (to the

extent permitted by the FCA Handbook Rules) from the Retail Offer

Coordinator (on behalf of the Company).

Any expenses incurred by any intermediary are for its own

account. Eligible retail Shareholders who wish to participate in

the Retail Offer should confirm separately with any intermediary

whether there are any commissions, fees or expenses that will be

applied by such intermediary in connection with any application

made through that intermediary pursuant to the Retail Offer.

The Retail Offer will be open to eligible Shareholders in the

United Kingdom at 4.35 p.m. on 8 June 2023 on the following

website:

https://www.bookbuild.live/deals/DX72E1/authorised-intermediaries .

The Retail Offer is expected to close by no later than 4.30 p.m. on

12 June 2023. Eligible retail Shareholders should note that

intermediaries may have earlier closing times. The Retail Offer may

close early if it is oversubscribed.

If any intermediary has any questions about how to participate

in the Retail Offer on behalf of existing Shareholders, please

contact BookBuild at support@bookbuild.live .

The Retail Offer the subject of this announcement is and will,

at all times, only be made to, directed at and may only be acted

upon by those persons who are, Shareholders. To be eligible to

participate in the Retail Offer, applicants must meet the following

criteria before they can submit an order for Retail Shares: (i) be

a customer of one of the participating intermediaries listed on the

above website; (ii) be resident in the United Kingdom and (iii) be

a Shareholder (which may include individuals aged 18 years or over,

companies and other bodies corporate, partnerships, trusts,

associations and other unincorporated organisations and includes

persons who hold their Ordinary Shares directly or indirectly

through a participating intermediary). For the avoidance of doubt,

persons who only hold CFDs, Spreadbets and/or similar derivative

instruments in relation to Ordinary Shares are not eligible to

participate in the Retail Offer.

The Company reserves the right to scale back any order at its

discretion. The Company reserves the right to reject any

application under the Retail Offer without giving any reason for

such rejection.

It is vital to note that once an application for Retail Shares

has been made and accepted via an intermediary, it cannot be

withdrawn.

The Retail Shares will be issued free of all liens, charges and

encumbrances and will, when issued and fully paid, rank pari passu

in all respects with the existing Ordinary Shares, including the

right to receive all dividends and other distributions declared,

made or paid after the date of their issue.

The Retail Offer is an offer to subscribe for transferable

securities, the terms of which ensure that the Company is exempt

from the requirement to issue a prospectus under Regulation (EU)

2017/1129 as it forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018 (the "UK Prospectus Regulation"). The

aggregate total consideration for the Retail Offer will not exceed

EUR8 million (or the equivalent in Pounds Sterling) and therefore

the exemption from the requirement to publish a prospectus, set out

in section 86(1) Financial Services and Markets Act 2000, as

amended ("FSMA"), will apply.

The Retail Offer is not being made into any jurisdiction other

than the United Kingdom or to US Persons (as defined in Regulation

S of the US Securities Act 1933, as amended).

No offering document, prospectus or admission document has been

or will be prepared or submitted to be approved by the UK Financial

Conduct Authority (the "FCA") or any other authority in relation to

the Retail Offer, and eligible retail Shareholders' commitments

will be made solely on the basis of the information contained in

this Announcement and information that has been published by or on

behalf of the Company prior to the date of this Announcement by

notification to an RIS in accordance with the FCA's Disclosure

Guidance and Transparency Rules and the Market Abuse Regulation (EU

Regulation No. 596/2014) as it forms part of United Kingdom law by

virtue of the European Union (Withdrawal) Act 2018 (as

amended).

There is a minimum subscription of GBP250 per retail Shareholder

under the terms of the Retail Offer which is open to eligible

retail Shareholders in the United Kingdom subscribing via the

intermediaries, which will be listed, subject to certain access

restrictions, on the following website:

https://www.bookbuild.live/deals/DX72E1/authorised-intermediaries

There is no maximum application amount to apply in the Retail

Offer, except that the aggregate total consideration for the Retail

Offer shall not exceed GBP1.20 million. The terms and conditions on

which eligible retail Shareholders subscribe will be provided by

the relevant financial intermediaries including relevant commission

or fee charges.

Eligible retail Shareholders should make their own

investigations into the merits of an investment in the Company.

Nothing in this Announcement amounts to a recommendation to invest

in the Company or amounts to investment, taxation or legal

advice.

It should be noted that a subscription for Retail Shares and

investment in the Company carries a number of risks. Eligible

retail Shareholders should take independent advice from a person

experienced in advising on investment in securities such as the

Retail Shares if they are in any doubt.

An investment in the Company will place capital at risk. The

value of investments, and any income, can go down as well as up, so

investors could get back less than the amount invested. Returns may

increase or decrease as a result of currency fluctuations.

Neither past performance nor any forecasts should be considered

a reliable indicator of future results.

For further information, please visit www.mercpl.com or

contact:

MPL C/O SEC Newgate

+44 (0) 20 3757 6880

Cenkos Securities plc Stephen Keys

(Nomad and Broker) +44 (0) 20 7397 8900

------------------------------

BookBuild Paul Brotherhood/ Marc Downes

support@bookbuild.live

------------------------------

This Announcement should be read in its entirety. In particular

the information in the "Important Notice" section of the

Announcement should be read and understood.

IMPORTANT NOTICE

The Retail Offer is only open to eligible retail Shareholders in

the United Kingdom who fall within Article 43 of the FPO (which

includes an existing Shareholder).

The content of this Announcement has been prepared by, and is

the sole responsibility of, the Company.

This Announcement and the information contained herein is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in or into the United States of America

(including its territories and possessions, any states in of the

United States and the District of Columbia). This Announcement is

not an offer of securities for sale into the United States. The

Retail Shares referred to herein have not been and will not be

registered under the Securities Act and may not be offered or sold

in the United States, or to or for the account or benefit of any US

person (within the meaning of the Securities Act). No public

offering of Retail Shares is being made in the United States. The

Retail Offer Shares are being offered and sold outside the United

States in "offshore transactions", as defined in, and in compliance

with, Regulation S under the Securities Act. In addition, the

Company has not been, and will not be, registered under the US

Investment Company Act of 1940, as amended.

This Announcement, and the information contained herein is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in or into or from the United States, Canada,

Australia, Singapore, Japan or the Republic of South Africa, or any

other jurisdiction where to do so might constitute a violation of

the relevant laws or regulations of such jurisdiction (the

"Restricted Jurisdictions").

This Announcement does not constitute or form part of an offer

to sell or issue or a solicitation of an offer to buy, subscribe

for or otherwise acquire any securities in any jurisdiction

including, without limitation, the Restricted Jurisdictions or any

other jurisdiction in which such offer or solicitation would be

unlawful. This Announcement and the information contained in it is

not for publication or distribution, directly or indirectly, to

persons in a Restricted Jurisdiction, unless permitted pursuant to

an exemption under the relevant local law or regulation in any such

jurisdiction. No public offer of the securities referred to herein

is being made in any such jurisdiction.

The distribution of this Announcement may be restricted by law

in certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

This Announcement has not been approved by the London Stock

Exchange or any other securities exchange.

No prospectus or offering document will be made available in

connection with the matters contained in this Announcement and no

such prospectus is required (in accordance with the EU Prospectus

Regulation or the UK Prospectus Regulation) to be published.

Certain statements in this Announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "could", "intend",

"estimate", "expect" and words of similar meaning, include all

matters that are not historical facts. These forward-looking

statements involve risks, assumptions and uncertainties that could

cause the actual results of operations, financial condition,

liquidity and dividend policy and the development of the industries

in which the Group's businesses operate to differ materially from

the impression created by the forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties and other factors that

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. Given

those risks and uncertainties, prospective investors are cautioned

not to place undue reliance on forward-looking statements.

Forward-looking statements speak only as of the date of such

statements and, except as required by the FCA, the London Stock

Exchange or applicable law, neither the Company nor Cenkos

Securities undertake any obligation to update or revise publicly

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Any indication in this Announcement of the price at which the

Ordinary Shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Group.

Cenkos Securities, which is authorised and regulated in the

United Kingdom by the FCA, is acting for the Company and for no one

else in connection with the transactions or arrangements described

in this Announcement and will not be responsible to anyone other

than the Company for providing the protections afforded to clients

of Cenkos Securities or for providing advice in relation to the

transactions or arrangements described in this Announcement, or any

other matters referred to in this Announcement.

The information in this announcement is for background purposes

only and does not purport to be full or complete. No representation

or warranty, express or implied, is or will be made as to, or in

relation to, and no responsibility or liability is or will be

accepted by or on behalf of the Company, Cenkos Securities, or by

their affiliates or their respective agents, directors, officers

and employees as to, or in relation to, the accuracy or

completeness of this Announcement (or whether any information has

been omitted from the Announcement) or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed. Cenkos Securities and its affiliates,

accordingly disclaim all and any liability whether arising in tort,

contract or otherwise which they might otherwise be found to have

in respect of this announcement or its contents or otherwise

arising in connection therewith.

The Retail Shares to be issued pursuant to the Retail Offer will

not be admitted to trading on any stock exchange other than to

trading on AIM, being the market of that name operated by the

London Stock Exchange.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Retail Shares have been subject to a product approval

process, which has determined that such Retail Shares are: (a)

compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties, each as defined in Chapter 3 of the FCA

Handbook Conduct of Business Sourcebook ("COBS"); and (b) eligible

for distribution through all permitted distribution channels (the

"UK Target Market Assessment"). Notwithstanding the UK Target

Market Assessment, distributors should note that: the price of the

Retail Shares may decline and investors could lose all or part of

their investment; the Retail Shares offer no guaranteed income and

no capital protection; and an investment in the Retail Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The UK Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Retail Offer.

For the avoidance of doubt, the UK Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of COBS 9A and COBS 10A, respectively; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase or take any other action whatsoever with respect to the

Retail Shares. Each distributor is responsible for undertaking its

own UK target market assessment in respect of the Retail Shares and

determining appropriate distribution channels.

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Retail Shares have been subject to a product approval process,

which has determined that such Retail Shares are: (i) compatible

with an end target market of retail investors and investors who

meet the criteria of professional clients and eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the "Target Market Assessment"). Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Retail Shares may decline and investors could lose all or

part of their investment; the Retail Shares offer no guaranteed

income and no capital protection; and an investment in the Retail

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Retail Offer.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Cenkos Securities will only procure investors who meet

the criteria of professional clients and eligible

counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Retail Shares. Each

distributor is responsible for undertaking its own target market

assessment in respect of the Retail Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOESSLFIAEDSEEM

(END) Dow Jones Newswires

June 08, 2023 11:35 ET (15:35 GMT)

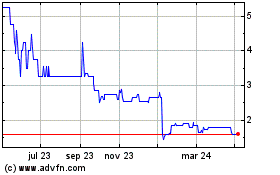

Mercantile Ports & Logis... (LSE:MPL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

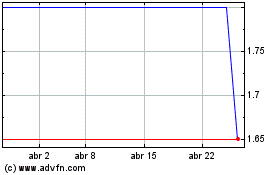

Mercantile Ports & Logis... (LSE:MPL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024