PensionBee Group plc 1H 2023 Results Announcement (5773G)

20 Julio 2023 - 1:00AM

UK Regulatory

TIDMPBEE

RNS Number : 5773G

PensionBee Group plc

20 July 2023

PensionBee Group plc

Incorporated in England and Wales

Registration Number: 13172844

LEI: 2138008663P5FHPGZV74

ISIN: GB00BNDRLN84

20 July 2023

PensionBee Group plc

Trading Update for the six months ended 30 June 2023

Continued strong growth across all key metrics

On track to achieve ongoing Adjusted EBITDA profitability by end of 2023

PensionBee Group plc ('PensionBee' or the 'Company'), a leading online pension provider, today

announces a trading update for the six months ended 30 June 2023.

Highlights

-- Strong continued customer growth, with Invested Customers having increased by 33% year on

year to 211,000 (June 2022: 159,000).

-- Assets under Administration increased by 38% year on year to GBP3,704m (June 2022: GBP2,676m),

underpinned by strong Net Inflows from new and existing customers.

-- Successful launch of LifeSearch partnership with initial positive customer demand.

-- Commitment to continuous product innovation and outstanding customer service contributed to

a sustained high Customer Retention Rate of c.97%.

-- LTM Revenue increased by 30% to GBP20m (June 2022: GBP16m) and first half Revenue increased

by 32% to GBP11m (June 2022: GBP8m).

-- Adjusted EBITDA of GBP(8)m (June 2022: GBP(15)m), reflecting continued progress towards profitability.

-- On track to achieve ongoing Adjusted EBITDA profitability by the end of 2023 and profitability

for the full year 2024.

PensionBee delivered strong growth across all of its key performance indicators in the first

half of the year, with Assets under Administration ('AUA') increasing by 38% to GBP3,704m.

The Company has seen excellent momentum in the growth of the customer base, adding approximately

30,000 new Invested Customers in the first half of the year, taking the overall Invested Customer

base to 211,000. This demonstrates the continued success of its data-led, multi-channel customer

acquisition approach and highlights the clear demand for its customer-focused proposition.

Revenue for the first half of the year grew by 32% year on year to GBP11m as a result of strong

Net Inflows from new and existing customers, with LTM Revenue increasing by 30% to GBP20m.

The Company's sustained high Customer Retention Rate and AUA Retention Rate, both c.97%, have

continued to drive recurring revenue.

Continued Advancement of Strategic Goals

Sustained marketing investment of GBP7m across the last two quarters has supported brand building

and customer acquisition. PensionBee expects to continue investing in its brand awareness

through the renewal of its partnership with Brentford FC, becoming the left sleeve sponsor

of the Men's first team and the 'front of shirt' sponsor for the B team, Academy and Women's

team. The Company has continued to apply its data-driven, multi-channel approach to successfully

reach new customers, bringing educational initiatives to customers through roadshows, podcasts

and new channels such as TikTok. The Cost per Invested Customer has continued to demonstrate

a downward trajectory, in line with expectations, given the depth of the Company's marketing

capability in efficient customer acquisition.

PensionBee has continued to innovate and adapt its products to suit the evolving needs of

its customers and to support customer engagement. It has added free informative content and

helpful tools, including a state pension age calculator. The in-app offering has been enhanced

via the launch of in-app content delivering helpful insights to mobile app users to increase

their transfer and saving rates. The Company has also launched a successful partnership with

LifeSearch, helping customers to obtain a range of insurance products and critical illness

cover which enable them to continue to save for a happy retirement even in the event of unforeseen

circumstances, with initial positive customer demand. The Company's focus on delivering outstanding

customer service has been evidenced through the maintenance of its Excellent Trustpilot rating

and rapid response times on the phone and live chat.

The Company has continued to invest in the scalability of its technology platform through

a focus on internal automation, efficiency, security and pension transfer improvements to

support productivity, as demonstrated by a 12% improvement in productivity(1) over the first

half of the year. The Company will continue to explore and adopt artificial intelligence tooling

within its departments, using it for initial content generation, project research and coding

problem resolution. It is increasingly integrating its data platform within daily product

management operations to ensure its multidisciplinary development teams remain productive

and impactful.

Outlook

The Board remains confident in PensionBee's potential for continued growth and profitability,

due to its ability to attract new customers that generate growth in recurring revenue through

its scalable technology platform.

The Company is pleased to reiterate the guidance previously provided at the time of the 2022

full year results. Its strong cash balance of GBP14m leaves it well-placed to pursue a c.2%

market share target of the substantial GBP700bn UK transferable pensions market over the next

5-10 years, resulting in a long-term potential revenue opportunity of approximately GBP150m.

The Company remains on track to further reduce Cost per Invested Customer, expecting to achieve

ongoing Adjusted EBITDA profitability by the end of 2023 and profitability for the full year

2024. PensionBee expects to achieve long-term EBITDA margins in excess of 50%, driven by the

scalability of its technology platform. This is supported by the Company's continued positive

momentum in its trading performance and growth in key metrics such as customer growth and

AUA.

Analyst and Investor Presentation

There will be a presentation for analysts and investors this morning at 8:30am via webcast.

Please contact press@pensionbee.com if you would like to attend.

Romi Savova, CEO of PensionBee, commented:

"We are delighted to report a successful first half of 2023 as we pursue our mission to make

pensions simple so that everyone can look forward to a happy retirement. We have continued

growing our Assets Under Administration and Revenue by acquiring new customers and helping

our existing customers to save more in their pensions.

We are preparing the Company for the achievement of ongoing Adjusted EBITDA profitability

in the second half of the year by consistently focusing on our productivity and harnessing

the scalability of our technology platform. We have continued to invest effectively in our

marketing initiatives, maintaining our household brand name status. We are proud to have launched

additional helpful features, such as in-app content and life insurance, to help our customers

navigate a testing economic environment. The market opportunity for PensionBee is vast and

our strong cash balance leaves us well-positioned to continue capturing market share."

Financial Summary

As at Period End

Jun-2022 Jun-2023 YoY change

--------- --------- -----------

AUA (GBPm)(2) 2,676 3,704 38%

--------- -----------

AUA Retention Rate (% of AUA)(3) >95% >95% Stable

--------- -----------

Invested Customers (thousands)(4) 159 211 33%

--------- -----------

Customer Retention Rate (% of IC)(5) >95% >95% Stable

--------- -----------

Cost per Invested Customer (GBP)(6) 260 247 (5)%

--------- --------- -----------

Realised Revenue Margin (% of AUA)(7) 0.63% 0.65% +1 bps

--------- --------- -----------

For the Trailing 12-month Period Ending

Jun-2022 Jun-2023 YoY change

------------- ------------ ---------------

LTM Revenue 16 20 30%

------------- ------------ ---------------

LTM Adjusted EBITDA (24) (13) (47)%

------------ ---------------

LTM Adjusted EBITDA Margin (152)% (62)% 90ppt*

------------ ---------------

For the 6 month Period Ending

Jun-2022 Jun-2023 YoY change

---------- --------- -----------

Revenue (GBPm)(8) 8 11 32%

---------- --------- -----------

Adjusted EBITDA (GBPm)(9) (15) (8) (47)%

--------- -----------

Adjusted EBITDA Margin (% of Revenue)(10) (181)% (73)% 108ppt*

--------- -----------

For the 6 month Period Ending

Jun-2022 Jun-2023 YoY change

---------- --------- -----------

Opening AUA (GBPm)(2) 2,587 3,025 17%

--------- -----------

Gross Inflows (GBPm) 579 612 6%

--------- -----------

Gross Outflows (GBPm) (98) (143) 47%

--------- -----------

Net Inflows (GBPm) 481 469 (3)%

--------- -----------

Market Growth and Other (GBPm) (392) 210 n/a

--------- -----------

Closing AUA (GBPm)(2) 2,676 3,704 38%

--------- -----------

Notes

* ppt is the absolute change in percentage.

1 Invested Customers per Staff Member calculated using LTM average for total workforce. Management

information as at 30 June 2023.

----------------------------------------------------------------------------------------------------

2 Assets under Administration ('AUA') is the total invested value of pension assets within PensionBee

Invested Customers' pensions. It measures the new inflows less the outflows and records a

change in the market value of the assets. AUA is a measurement of the growth of the business

and is the primary driver of Revenue.

----------------------------------------------------------------------------------------------------

3 AUA Retention measures the percentage of retained PensionBee AUA from Transfer Outs over the

average of the trailing twelve months. High AUA retention provides more certainty of future

Revenue. This measure can also be used to monitor customer satisfaction.

----------------------------------------------------------------------------------------------------

4 Invested Customers ('IC') means those customers who have transferred pension assets or made

contributions into one of PensionBee's investment plans.

----------------------------------------------------------------------------------------------------

5 Customer Retention Rate measures the percentage of retained PensionBee Invested Customers

over the average of the trailing twelve months. High customer retention provides more certainty

of future Revenue. This measure can also be used to monitor customer satisfaction.

----------------------------------------------------------------------------------------------------

6 Cost per Invested Customer ('CPIC') means the cumulative advertising and marketing costs incurred

since PensionBee commenced trading up until the relevant point in time divided by the cumulative

number of Invested Customers at that point in time. This measure monitors cost discipline

of customer acquisition. PensionBee's desired CPIC threshold is GBP200-GBP250.

----------------------------------------------------------------------------------------------------

7 Realised Revenue Margin is calculated by using the last twelve months of Recurring Revenue

over the average quarterly AUA held in PensionBee's investment plans over the period.

----------------------------------------------------------------------------------------------------

8 Revenue means the income generated from the asset base of PensionBee's customers, essentially

annual management fees charged on the AUA, together with a minor revenue contribution from

other services.

----------------------------------------------------------------------------------------------------

9 Adjusted EBITDA is the profit or loss for the period before taxation, finance costs, depreciation,

share based compensation and transaction costs.

----------------------------------------------------------------------------------------------------

10 Adjusted EBITDA Margin means Adjusted EBITDA as a percentage of Revenue for the relevant period.

----------------------------------------------------------------------------------------------------

Contacts

PensionBee press@pensionbee.com

Rachael Oku

Laura Dunn-Sims

About PensionBee

PensionBee is a leading online pension provider, making pension management easy for its customers

while they save for a happy retirement.

PensionBee helps its customers combine their old pension pots, make flexible contributions,

invest in line with their goals and values and make withdrawals from the age of 55 (increasing

to 57 in 2028). PensionBee offers a range of investment plans, including fossil fuel free

options, from some of the world's largest asset managers.

Operating in the GBP1 trillion market of Defined Contribution pension assets, PensionBee has

grown rapidly through its direct-to-consumer marketing activities, creating a household brand

name for the mass market.

The Company has GBP3.7 billion in Assets Under Administration and 211,000 Invested Customers

as at 30 June 2023. PensionBee has consistently maintained a Customer Retention Rate in excess

of 95% and an Excellent Trustpilot rating, reflecting its commitment to outstanding customer

service.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUGAMUPWGMB

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

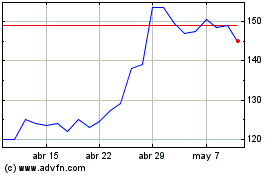

Pensionbee (LSE:PBEE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pensionbee (LSE:PBEE)

Gráfica de Acción Histórica

De May 2023 a May 2024