TIDMPMP

RNS Number : 3810M

Portmeirion Group PLC

14 September 2023

14 September 2023

PORTMEIRION GROUP PLC

('the Group')

Interim results for the six months ended 30 June 2023

H1 results reflect previously stated US retailer destocking

H2 started in line with expectations with a strong Christmas

order book

Portmeirion Group PLC, the owner, designer, manufacturer and

omni-channel retailer of leading homeware brands in global markets,

is pleased to announce its results for the six months ended 30 June

2023.

Financial summary

H1 2023 H1 2022 FY 2022

GBPm GBPm GBPm

Revenue 44.1 45.5 110.8

-------- -------- --------

Headline profit before tax(1) 0.0 2.0 8.0

-------- -------- --------

(Loss)/profit before tax (0.1) 1.0 7.0

-------- -------- --------

Headline EBITDA(1) 2.8 4.3 13.2

-------- -------- --------

EBITDA 2.7 3.3 12.1

-------- -------- --------

Headline basic (loss) / earnings

per share(1) (0.12p) 12.00p 46.59p

-------- -------- --------

Basic (loss) / earnings per share (0.82p) 5.72p 40.39p

-------- -------- --------

Dividends proposed and paid per share

in respect of the period 3.50p 3.50p 15.50p

-------- -------- --------

Financial

-- H1 Group revenue of GBP44.1 million, a decrease of 3% compared

to the record prior year sales (H1 2022: GBP45.5 million);

as previously stated this is reflective of increased caution

on ordering from US customers, in particular the destocking

by retailer customers.

-- Headline profit before tax(1) was GBP0.0 million (H1 2022:

GBP2.0 million).

-- H1 headline operating profit margin(1) of 1.6% was impacted

by the fall in revenue (H1 2022: 4.3%) and gross margin reduction.

-- H1 gross margin impacted by peak inflation in stock due to

container freight rates which are expected to subside through

H2 2023 and 2024.

-- Solid growth in the UK, South Korea and rest of world markets.

-- Headline basic loss per share(1) of 0.12p (H1 2022: earnings

per share of 12.00p).

-- Interim dividend declared of 3.50p per share (H1 2022: 3.50p).

-- Strong balance sheet maintained with like-for-like inventory

reduction of 5% since FY 2022 and further reduction expected

in H2 2023.

-- Net debt is GBP15.0 million but we expect this to reduce below

FY 2022 levels (FY 2022: GBP10.1 million) by year end as working

capital unwinds and we maintain significant headroom within

current borrowing facilities.

(1) Headline profit before tax, headline EBITDA, headline

operating margin and headline basic earnings per share excludes

exceptional items - see note 3.

Operational summary

-- Improved productivity in Stoke-on-Trent ceramic factory maintained

through ongoing automation programme.

-- Spode brand continues to grow, with further benefit expected

in H2 from new collaboration with Kit Kemp Design Studio and

further new product development in Spode Christmas Tree range.

-- Rest of world ceramic sales continue to grow, diversification

being a key part of our long term growth strategy, with further

growth expected in H2.

-- Home fragrance division benefits from adding AromaWorks London

brand with sales growth and factory now operating at a more

efficient level. We expect growth and improved profitability

in H2.

-- Launch of new sustainability strategy 'Crafting a Better Future'

demonstrates the Group's commitment to becoming a more sustainable

business. In H1 we were pleased to reduce gas and electricity

usage by 6% compared to the prior year.

Current Trading & Outlook

-- H2 has started in line with our expectations and we have a

strong Christmas order book, which is ahead of the same period

last year.

-- We expect FY sales and profit to be in line with consensus

market expectations which were revised in July as a result

of North American retailer destocking.

-- We remain committed to our long term ambition of rebuilding

operating margins.

Mike Raybould, Chief Executive , commented :

"As previously indicated, the Group has seen reduced order flow

in H1 2023 across our North American market. This has been

particularly noticeable amongst retail customers reducing stock

levels. However we are confident that in the past few years we have

made lasting market share gains in the US and have further

incremental product listings agreed across key US department store

chains for H2 2023. Together with new product launches we therefore

expect that sales in our US and Canadian markets will stabilise and

return to growth in due course.

We are successfully controlling overheads despite the

significant inflationary environment and will continue to target

further global synergies in our cost base over the next 12 months.

Alongside ongoing improved factory productivity in our Stoke site

and as global container shipping rates return to historical levels,

we remain confident of delivering our medium and long term

operating margin growth targets.

We have made great strides on both operational and commercial

fronts in the last few years and our brands continue to resonate

well with consumers around the world."

Portmeirion Group PLC:

Mike Raybould, Chief Executive +44 (0) 1782 mraybould@portmeiriongroup.com

743 443

David Sproston, Group Finance +44 (0) 1782 dsproston@portmeiriongroup.com

Director 743 443

Hudson Sandler:

Dan de Belder +44 (0) 207 796 portmeirion@hudsonsandler.com

4133

Nick Moore

Emily Brooker

Shore Capital:

(Nominated Adviser and Joint +44 (0) 207 408

Broker): 4090

Patrick Castle Corporate Advisory

Lucy Bowden Corporate Broking

Malachy McEntyre

Singer Capital Markets +44 (0) 207

(Joint Broker): 496 3000

Peter Steel Investment Banking

Asha Chotai

NOTES TO EDITOR:

Portmeirion Group PLC is a leading, omni-channel British

ceramics manufacturer and retailer of leading homeware brands.

Based in Stoke-on-Trent, United Kingdom, the Group owns six

unrivalled heritage and contemporary brands, with 750+ years of

collective heritage; Portmeirion, Spode, Royal Worcester,

Pimpernel, Wax Lyrical and Nambé.

The Group serves markets across the world, with global demand

driven by diversified international markets including the key

geographies of the US, UK and South Korea.

Portmeirion Group has a proven capital-light, well developed and

self-funded growth strategy focused on building a wider customer

base and growing the sales footprint of its brands, through:

-- Building and growing international sales markets

-- Developing online sales channels in core markets

-- Designing and launching new product to widen appeal and take market share

-- Leveraging brands and extensive product ranges

Interim Review

Financial highlights

Revenue was GBP44.1 million for the first six months of the

year, a decrease of 3% over the record prior year sales (H1 2022:

GBP45.5 million).

Our operating performance was negatively impacted by the sales

reduction; headline operating profit(1) was GBP0.7 million (H1

2022: GBP2.0 million). This left the Group's operating margin at

1.6% for the first half of the year (H1 2022: 4.3%).

Due to the reduced operating margin performance and increased

interest costs, headline profit before tax(1) was GBPnil (H1 2022:

GBP2.0 million).

Headline basic loss per share(1) was 0.12p (H1 2022: earnings

per share of 12.00p).

(1) Headline profit before tax, headline operating profit and

headline earnings per share excludes exceptional items (see note

3).

Operational overview

The Group's largest sales market, North America (the US and

Canada), accounted for 33% of total Group revenue. Sales were 13%

behind the first half of 2022 at GBP14.4 million (H1 2022: GBP16.7

million) as major retailers undertook aggressive destocking ahead

of anticipated fears of a slowdown in consumer spending. Where we

have retailer sales out data to the end consumer, this evidences

that demand remains robust and we therefore believe our diversified

range of products and sizeable online penetration will result in an

improved trading performance once this destocking exercise is

complete.

Our second largest market is the UK, which accounted for 27% of

total Group sales. Sales were slightly ahead of prior year at

GBP11.7 million (H1 2022: GBP11.5 million) as we benefitted from

additional sales from the AromaWorks London brand that the Group

acquired in August 2022. We are closely monitoring the impact of

inflationary pressures on consumer spending but currently this

market is performing in line with our expectations.

In South Korea, our third largest market accounting for 32% of

total Group revenue, sales grew by 7% to GBP14.3 million (H1 2022:

GBP13.4 million) as we continued our strategy of increasing online

exposure of our brands and diversifying our ranges. We have

introduced new ranges in this market but expect both the increasing

impact of inflation and currency movement to impact consumer

sentiment in the short term.

In our rest of world markets, sales were down 4% over the same

period in 2022 at GBP3.7 million (H1 2022: GBP3.8 million). The

prior year included some Q1 sales to Russia/Eastern Europe and some

loss-making home fragrance contracts which we have since

discontinued; excluding these, underlying ceramic sales were 10%

ahead of the prior year as part of our long-term strategy.

We continue to invest in new products for our customers around

the world, and are pleased with the initial performance of a number

of new ranges including the new Spode collaboration with the Kit

Kemp Design Studio.

Balance sheet

The Group ended the first half of 2023 with net debt of GBP15.0

million at 30 June 2023; this compares to net debt of GBP6.8

million at 30 June 2022 and net debt of GBP10.1 million at 31

December 2022. In addition to the cash balance of GBP1.5 million

and bank borrowings of GBP16.4 million, the Group also has

unutilised bank facilities of GBP10.1 million. The increase in net

debt since 30 June 2022 is largely driven by working capital

movements, with higher receivables due to customer mix and lower

payables due to reduced inventory purchasing. We expect both of

these movements to unwind in H2.

Our stock balance at 30 June 2023 was GBP42.1 million compared

to GBP42.6 million at 30 June 2022 and GBP41.1 million at 31

December 2022. Excluding the impact of AromaWorks London inventory

(brand acquired in August 2022) and seasonal shipping timing, we

have reduced inventory from both June 2022 and December 2022 on a

like-for-like basis by 5%. We have a number of initiatives in the

second half of 2023 which should see further reductions in

inventory and an improved net debt position by 31 December 2023

compared to the prior year end.

Dividend

The Board is committed to a dividend policy which ensures we

retain and invest enough capital in our business to drive long-term

growth in our brands and maintain a prudent and sustainable level

of dividend cover.

Despite the short term challenges in the Group's trading

performance, we expect to generate cash in the current financial

year and with our medium term expectations for profit and cash

generation, the Board is declaring an interim dividend of 3.50p per

share (2022: 3.50p). The interim dividend will be paid on 15

December 2023. The ex-dividend date will be 16 November 2023 with a

record date of 17 November 2023.

The cover for dividends paid and proposed for 2022 was 3.0

times. We remain of a view that a dividend cover level of

approximately 3.0 times is in the long-term interest of the Group

and shareholders.

Environmental, Social and Governance (ESG)

In May 2023, the Group launched a new sustainability strategy

and roadmap entitled 'Crafting a Better Future' which outlines the

Group's commitment to becoming a more sustainable business. The

launch represents the next level of ambition for the Group - to

ensure that we continue to reduce our impact on the environment and

support our colleagues and communities.

We continue to drive our progress on reducing our energy

consumption and in H1 reduced gas and electricity usage by 6%

compared to the prior year.

Further details on our ESG commitments and integration within

the Group can be found on our website, www.portmeiriongroup.com,

and in the Section 172(1) statement - Engaging with key

stakeholders, Our commitment to ESG and the Corporate Governance

Statements in our Annual Report and Accounts.

Corporate governance

The Group is a committed member of the Quoted Companies Alliance

("QCA") and has chosen to apply the QCA Corporate Governance Code,

complying with its principles throughout the period. Further

details can be found on our website at

www.portmeiriongroup.com/investors.

The Board keeps its composition and performance under review to

ensure that we have the appropriate skills and experience in place

to deliver our strategy. In June 2023, the Group announced that

Jeremy Wilson had been appointed as a Non-executive Director.

Group Strategy

Our homeware brands have a combined history of more than 750

years and are much loved around the world.

We remain focused on our strategic goal of growing the sales

footprint of the business over the next 3-5 years. We plan to do

that by continuing to develop our key heritage ranges through

product extensions and developing new sales channels to reach new

customers, whilst at the same time increasing our market share in

contemporary and giftware homewares through launching beautifully

designed new products and leveraging these new ranges across our

existing global sales infrastructure.

Our strategy remains to return operating margins back to

historical levels with a medium-term target of reaching 10%.

Further detail on executing our growth strategy

1. Geography - building and growing sales markets outside of our

three core markets of North America, UK and South Korea

Rest of World ceramic sales markets (excluding Russia/Eastern

Europe) grew by 10% in H1 2023. Our products are sold in more than

80 countries around the world. Our three core markets of North

America, UK and South Korea accounted for 92% of Group sales in H1

2023.

We continue to see a significant opportunity to grow the

contribution from sales outside of core markets over the next 3-5

years.

2. Online - further developing online sales channels in our core

markets reaching more potential customers on more occasions

In our core UK and US markets, sales through all online channels

accounted for 48% of sales (H1 2022: 52%, FY 2022: 51%). In

addition, we continued to build our online presence in

international markets including South Korea.

For our own websites, our customer lists continue to grow and

are now 10% larger than twelve months ago. This has allowed us to

reduce investment in traffic acquisition spend and drive an

improved operating margin performance for our online sales.

3. Designing and launching new products - widening the appeal

with our existing customer base and taking market share

Sales from new product launches in H1 2023 accounted for in

excess of 10% of the Group's total sales, with a strong roadmap of

new launches for the next 18 months.

We expect to see further strengthening of this KPI due to our

investment in this area.

4. Leveraging our brands

We continue to invest in our six global brands and work on

leveraging the strength of our brands outside of their current core

markets.

Our Spode brand has grown again in H1 2023 and we expect further

benefits in H2 2023 from the new collaboration with Kit Kemp Design

Studio.

Returning our operating margin to 12.5% in the long term

1. Improving productivity in our UK factories through investment

in automation to reduce manual handling

We continue to invest in our UK factories and have a number of

new automation investments being installed over the remainder of

2023 which will reduce manual handling and increase our pieces

output per labour hour.

Productivity in our UK ceramic factory was maintained in H1 2023

despite a small reduction in output as we balance inventory

levels.

2. Leveraging our fixed cost base as we grow top line sales

We still see a significant opportunity to grow our sales

footprint over the next 3-5 years which will enable us to leverage

our spare factory capacity and improve capabilities in our UK

factories and our existing sales and distribution infrastructure

around the world.

3. Improving the profitability of our home fragrance division back to pre-Covid levels

Wax Lyrical, our home fragrance division, had a positive H1 2023

with both an improved sales and profit performance.

In 2022 we purchased the AromaWorks London brand and have now

absorbed the manufacturing of all of its product ranges within the

existing capacity at our Wax Lyrical factory in Cumbria, UK. This

has driven better recovery of fixed overheads and we expect the

home fragrance division to return to profitability for the full

year.

Outlook

We are cognisant of the ongoing challenges facing consumers

around the world with significant inflationary cost pressures and

rising interest rates. Whilst in the short term this will continue

to impact consumer spending decisions, we expect demand for our

brands to remain robust. We expect retailer customer stock levels

to stabilise after a period of destocking during the first

half.

The second half of the year has started in line with our

expectations and we have strong advance order books for our key

Christmas ranges which are ahead of last year and provide us with

good visibility of H2 sales. We will also continue to mitigate

economic pressures by bringing new products to the market. We

expect FY sales and profit to be in line with consensus market

expectations which were revised in July as a result of North

American retailer destocking.

Despite short term pressures, we remain confident in our medium

and long term ambitions to grow our sales and operating margins. We

have taken market share in key markets in recent years,

particularly in the US - and together, with the ongoing work to

increase productivity through investments in our factories, will

drive much improved levels of profitability in the medium term.

Dick Steele Mike Raybould

Non-executive Chairman Chief Executive

Consolidated Income Statement

Unaudited

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

Revenue 2 44,122 45,467 110,820

Operating costs (43,408) (43,510) (102,154)

----------------------------------- ------ ------------ ------------ -------------

Headline operating profit(1) 714 1,957 8,666

Exceptional items 3

- restructuring costs (124) (1,006) (958)

- acquisition costs - - (76)

----------------------------------- ------ ------------ ------------ -------------

Operating profit 590 951 7,632

Interest income - - 29

Finance costs 4 (703) (212) (956)

Other income - 265 265

Headline profit before tax(1) 11 2,010 8,004

Exceptional items 3

- restructuring costs (124) (1,006) (958)

- acquisition costs - - (76)

----------------------------------- ------ ------------ ------------ -------------

(Loss)/profit before tax (113) 1,004 6,970

Tax 5 - (218) (1,415)

----------------------------------- ------ ------------ ------------ -------------

(Loss)/profit for the period

attributable to equity holders (113) 786 5,555

----------------------------------- ------

Earnings per share 7

Basic (0.82p) 5.72p 40.39p

Diluted (0.82p) 5.70p 40.35p

Headline earnings per share(1) 7

Basic (0.12p) 12.00p 46.59p

Diluted (0.12p) 11.97p 46.54p

Dividends proposed and paid per

share 6 3.50p 3.50p 15.50p

----------------------------------- ------ ------------ ------------ -------------

All the above figures relate to continuing operations.

(1) Headline operating profit is statutory operating profit of

GBP590,000 (H1 2022: GBP951,000) add exceptional items of

GBP124,000 (H1 2022: GBP1,006,000). Headline profit before tax is

statutory loss before tax of GBP113,000 (H1 2022: profit before tax

of GBP1,004,000), add exceptional items of GBP124,000 (H1 2022:

GBP1,006,000).

Consolidated Statement of Comprehensive Income

Unaudited

Six months

to 30 Six months Year to

June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Loss)/profit for the period (113) 786 5,555

--------------------------------------------- ----------- ------------- --------------

Items that will not be reclassified

subsequently to profit or loss:

Remeasurement of net defined benefit

pension scheme asset - - (1,517)

Deferred tax relating to items that will

not be reclassified subsequently to profit

or loss - - 380

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translation of

foreign operations (1,050) 2,082 2,466

--------------------------------------------- ----------- ------------- --------------

Other comprehensive income for the period (1,050) 2,082 1,329

--------------------------------------------- ----------- ------------- --------------

Total comprehensive income for the period

attributable to equity holders (1,163) 2,868 6,884

--------------------------------------------- ----------- ------------- --------------

Consolidated Balance Sheet

Unaudited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 9,467 8,978 9,416

Intangible assets 9,119 7,176 8,581

Property, plant and equipment 16,640 16,326 16,842

Right-of-use assets 5,820 6,366 5,869

Pension scheme surplus 617 1,360 317

Total non-current assets 41,663 40,206 41,025

-------------------------------- ----------- ----------- --------------

Current assets

Inventories 42,100 42,597 41,117

Trade and other receivables 17,319 13,998 19,887

Current income tax asset 121 649 792

Cash and cash equivalents 1,460 3,189 1,681

Total current assets 61,000 60,433 63,477

-------------------------------- ----------- ----------- --------------

Total assets 102,663 100,639 104,502

-------------------------------- ----------- ----------- --------------

Current liabilities

Trade and other payables (12,938) (18,188) (16,469)

Borrowings (14,436) (6,044) (8,789)

Lease liabilities (1,239) (1,842) (1,696)

Total current liabilities (28,613) (26,074) (26,954)

-------------------------------- ----------- ----------- --------------

Non-current liabilities

Deferred tax liability (3,213) (2,562) (3,230)

Borrowings (2,000) (3,977) (2,981)

Lease liabilities (5,058) (4,967) (4,654)

Total non-current liabilities (10,271) (11,506) (10,865)

-------------------------------- ----------- ----------- --------------

Total liabilities (38,884) (37,580) (37,819)

-------------------------------- ----------- ----------- --------------

Net assets 63,779 63,059 66,683

-------------------------------- ----------- ----------- --------------

Equity

Called up share capital 710 710 710

Share premium account 18,344 18,344 18,344

Investment in own shares (3,108) (3,124) (3,108)

Share-based payment reserve 58 160 148

Translation reserve 2,602 3,268 3,652

Retained earnings 45,173 43,701 46,937

-------------------------------- ----------- ----------- --------------

Total equity 63,779 63,059 66,683

-------------------------------- ----------- ----------- --------------

Consolidated Statement of Changes in Equity

Unaudited

Share-based

Share Investment payment

Share premium in own reserve Translation Retained

capital account shares GBP'000 reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2022 710 18,344 (3,124) 128 1,186 44,703 61,947

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

Profit for the

period - - - - - 786 786

Other comprehensive

income for the

period - - - - 2,082 - 2,082

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

Total comprehensive

income for the

period - - - - 2,082 786 2,868

Increase in

share-based

payment reserve - - - 32 - - 32

Dividends paid - - - - - (1,788) (1,788)

At 30 June

2022 710 18,344 (3,124) 160 3,268 43,701 63,059

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

Profit for the

period - - - - - 4,769 4,769

Other comprehensive

income for the

period - - - - 384 (1,137) (753)

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

Total comprehensive

income for the

period - - - - 384 3,632 4,016

Dividends paid - - - - - (481) (481)

Increase in

share-based

payment reserve - - - 59 - - 59

Transfer on

exercise or

lapse of options - - - (71) - 71 -

Shares issued

under employee

share schemes - - 16 - - (16) -

Deferred tax

on share-based

payment - - - - - 30 30

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

At 31 December

2022 710 18,344 (3,108) 148 3,652 46,937 66,683

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

Loss for the

period - - - - - (113) (113)

Other comprehensive

income for the

period - - - - (1,050) - (1,050)

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

Total comprehensive

income for the

period - - - - (1,050) (113) (1,163)

Decrease in

share-based

payment reserve - - - (90) - - (90)

Dividends paid - - - - - (1,651) (1,651)

At 30 June

2023 710 18,344 (3,108) 58 2,602 45,173 63,779

--------------------- ---------- ---------- ------------- ------------ -------------- ----------- ----------

Consolidated Statement of Cash Flows

Unaudited

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Operating profit 590 951 7,632

Adjustments for :

Depreciation of property, plant and equipment 686 895 1,810

Depreciation of right-of-use assets 988 1,008 1,881

Amortisation of intangible assets 434 408 813

Charge for share-based payments (90) 32 91

Exchange gain/(loss) 618 (193) (559)

Loss on disposal of tangible fixed assets - 269 251

----------------------------------------------- ------------ ------------- -------------

Operating cash flows before movements

in working capital 3,226 3,370 11,919

----------------------------------------------- ------------ ------------- -------------

Increase in inventories (2,052) (11,388) (9,869)

Decrease in receivables 2,104 6,100 239

(Decrease)/increase in payables (3,275) 754 (643)

----------------------------------------------- ------------ ------------- -------------

Cash generated from/(used by) operations 3 (1,164) 1,646

----------------------------------------------- ------------ ------------- -------------

Contributions to defined benefit pension

scheme (300) (450) (900)

Interest paid (596) (114) (686)

Income taxes paid 587 (179) (300)

----------------------------------------------- ------------ ------------- -------------

Net cash outflow from operating activities (306) (1,907) (240)

----------------------------------------------- ------------ ------------- -------------

Investing activities

Interest received - - 5

Purchase of property, plant and equipment (753) (2,663) (4,093)

Purchase of intangible assets (1,007) (491) (1,933)

Other income - 265 265

Acquisition of subsidiary - - (821)

Net cash outflow from investing activities (1,760) (2,889) (6,577)

----------------------------------------------- ------------ ------------- -------------

Financing activities

Dividends paid (1,651) (1,788) (2,269)

Principal elements of lease payments (1,086) (1,057) (1,864)

Drawdown of short term borrowings 11,916 4,060 6,803

Repayments of borrowings (7,250) (1,000) (2,000)

----------------------------------------------- ------------ ------------- -------------

Net cash inflow from financing activities 1,929 215 670

----------------------------------------------- ------------ ------------- -------------

Net decrease in cash and cash equivalents (137) (4,581) (6,147)

Cash and cash equivalents at beginning of

period 1,681 7,616 7,616

Effect of foreign exchange rate changes (84) 154 212

-------------------------------------------- ------ -------- --------

Cash and cash equivalents at end of period 1,460 3,189 1,681

-------------------------------------------- ------ -------- --------

Notes to the Interim Financial Information

1. Basis of preparation

The financial information included in the interim results

announcement for the six months to 30 June 2023 was approved by the

Board on 13 September 2023.

The interim financial information for the six months to 30 June

2023 has not been audited or reviewed and does not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006. The Company's statutory accounts for the year

ended 31 December 2022 were prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006.

The interim financial information has been prepared in

accordance with IFRS on the historical cost basis, except that some

derivative financial instruments are stated at their fair value.

The same accounting policies, presentation and methods of

computation are followed in the interim financial statements as

were applied in the Group's last audited financial statements for

the year ended 31 December 2022.

Statutory accounts for the year ended 31 December 2022 have been

delivered to the Registrar of Companies.

Going concern

The Directors, having made suitable enquiries and analysis of

the accounts, consider that the Group has adequate resources to

continue in business for the foreseeable future. In making this

assessment, the Directors have considered the Group's current

trading performance and available banking facilities with

appropriate headroom in facilities and financial covenants.

There remains ongoing challenges in our sales markets around the

world caused by the negative impact of the cost of living crisis,

but the Group remains well-diversified with adequate funding

headroom available.

The Group has also produced a sensitivity analysis to its cash

flow forecast based upon possible downside scenarios. We have

modelled a 10% sales reduction to assess the potential negative

impact of a significant downturn in trading performance. This

demonstrated the Group still has sufficient headroom within

borrowing facilities and loan covenants.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and expense.

Actual results may differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those detailed on pages 80-81 of the

Group's 2022 Financial Statements.

Notes to the Interim Financial Information

Continued

2. Segmental analysis

The following tables provide an analysis of the Group's revenue

by operating segment and geographical market, irrespective of the

origin of the products:

Six months Six months Year to

to 30 June to 30 June 31 December

Operating segment 2023 2022 2022

GBP'000 GBP'000 GBP'000

UK 29,547 27,567 59,753

North America 14,575 17,900 51,067

44,122 45,467 110,820

--------------------- ------------ ------------ -------------

Six months Six months Year to

to 30 June to 30 June 31 December

Geographical market 2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom 11,703 11,531 28,255

North America 14,422 16,659 48,944

South Korea 14,333 13,443 26,656

Rest of the World 3,664 3,834 6,965

----------------------- ------------ ------------ -------------

44,122 45,467 110,820

----------------------- ------------ ------------ -------------

3. Exceptional items

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Restructuring costs 124 1,006 958

Acquisition costs - - 76

----------------------- ------------ ------------ -------------

124 1,006 1,034

----------------------- ------------ ------------ -------------

Exceptional costs relate to a restructuring exercise undertaken

within the Group. All of these costs are exceptional in nature and

non-recurring.

4. Finance costs

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Interest paid 596 121 686

Interest on lease liabilities 107 91 270

703 212 956

------------------------------- ------------ ------------ -------------

Notes to the Interim Financial Information

Continued

5. Taxation

Tax for the interim period is charged at 0% (year to 31 December

2022: 20%) due to a loss being incurred during the period. The

expected weighted average annual corporation tax rate for the year

is 23%.

6. Dividend

An interim dividend of 3.50p (2022: 3.50p) per ordinary share

will be paid on 15 December 2023 to shareholders on the register on

17 November 2023. During the period a final dividend of 12.00p

(2022: 13.00p) per ordinary share was paid in respect of the

previous financial year.

7. Earnings per share

Six months

to 30 Six months Year to

June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Earnings

Earnings for the purpose of basic

and diluted earnings per share, being

profit for the period attributable

to equity holders (113) 786 5,555

---------------------------------------- ----------- ------------ -------------

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Number of shares

Weighted average number of shares

for the purpose of basic earnings

per share 13,759,282 13,750,919 13,753,233

Weighted average dilutive effect

of conditional share awards 13,658 33,507 14,773

-------------------------------------- ------------- ------------- -------------

Weighted average number of shares

for the purpose of diluted earnings

per share 13,772,940 13,784,426 13,768,006

-------------------------------------- ------------- ------------- -------------

The calculation of basic and diluted headline earnings per share

is based on the following data:

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Profit for the period attributable

to equity holders (113) 786 5,555

Add back/(deduct):

Exceptional items 124 1,006 1,034

Tax effect of exceptional items (28) (142) (182)

Headline earnings (17) 1,650 6,407

------------------------------------ ------------ ------------ -------------

Notes to the Interim Financial Information

Continued

8. Reconciliation of earnings before interest, tax, depreciation and amortisation (EBITDA)

Headline EBITDA

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Headline operating profit 714 1,957 8,666

Add back:

Depreciation 1,674 1,903 3,691

Amortisation 434 408 813

Headline earnings before interest,

tax, depreciation and amortisation 2,822 4,268 13,170

------------------------------------- ------------ ------------ -------------

Statutory EBITDA

Six months Six months Year to

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Operating profit 590 951 7,632

Add back:

Depreciation 1,674 1,903 3,691

Amortisation 434 408 813

Earnings before interest, tax, depreciation

and amortisation 2,698 3,262 12,136

--------------------------------------------- ------------ ------------ -------------

9. Retirement benefit schemes

Defined benefit scheme

The defined benefit obligation as at 30 June 2023 is calculated

on a year-to-date basis, using the latest actuarial valuation as at

31 December 2022 adjusted for payments to the scheme in line with

the Schedule of Contributions.

There have been no significant market fluctuations and

significant one-off events, such as plan amendments, curtailments

and settlements that have resulted in an adjustment to the

actuarially determined pension cost since the end of the prior

financial year.

The Group has made contributions of GBP300,000 to the scheme

during the period.

10. Related party transactions

The Group's related parties are as disclosed in the Report and

Accounts for the year ended 31 December 2022. There were no

material differences in related parties or related party

transactions in the six months ended 30 June 2023 except for

transactions with key management personnel.

The most significant of these was on 2 May 2023, under The

Portmeirion Group 2022 Approved and Unapproved Share Option Plans,

when 50,000, 35,000, 35,000, 35,000 and 15,000 share options awards

were granted to M Raybould, M Knapper, W Robedee, D Sproston and M

MacDonald respectively at an option price of GBP4.69 per share when

the market price was GBP4.69 per share.

In addition, on 2 May 2023, under The Portmeirion Group 2018

Deferred Incentive Share Option Plan, 5,275, 2,686, 3,864 and 2,087

share option awards were granted to M Raybould, M Knapper, W

Robedee and D Sproston respectively at a total exercise price of

GBP1 per individual when the market price was GBP4.69 per

share.

11. Post balance sheet events

There were no post balance sheet events.

12. Availability of document

A copy of the interim results will shortly be available on the

Company website at www.portmeiriongroup.com.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKNBDDBKBFCD

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

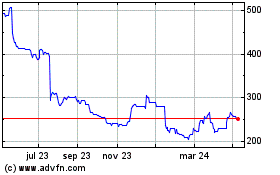

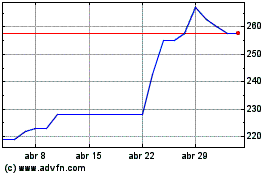

Portmeirion (LSE:PMP)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Portmeirion (LSE:PMP)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024