TIDMPRV

RNS Number : 6238E

Porvair PLC

03 July 2023

For immediate release 3 July 2023

Porvair plc

Interim results for the six months ended 31 May 2023

Porvair plc ("Porvair" or "the Group"), the specialist

filtration, laboratory and environmental technology group,

announces its interim results for the six months ended 31 May 2023

("H1 2023" or the "period").

Highlights:

-- Revenue 10% higher at GBP90.6 million (2022: GBP82.3

million), 5% higher on a constant currency basis*.

-- Operating profit 16% higher at GBP11.7 million (2022: GBP10.1 million).

-- Adjusted operating profit* 17% higher at GBP12.2 million (2022: GBP10.4 million).

-- Profit before tax 18% higher at GBP11.2 million (2022: GBP9.5 million).

-- Adjusted profit before tax* 20% higher at GBP11.8 million (2022: GBP9.8 million).

-- Basic earnings per share 20% higher at 19.3 pence (2022: 16.1 pence).

-- Adjusted basic earnings per share* 22% higher at 20.3 pence (2022: 16.6 pence).

-- Cash at GBP19.7 million (31 May 2022: GBP12.2 million; 30

November 2022: GBP18.3 million) after investing GBP2.9 million

(2022: GBP2.3 million) in capital expenditure and acquisitions.

-- Interim dividend increased 0.1 pence per share to 2.0 pence (2022: 1.9 pence).

Commenting on the results and outlook, Ben Stocks, Chief

Executive, said:

"This is a record set of results for the half-year and shows the

Group performing well overall, despite inconsistency of demand

across markets served. Aerospace, petrochemical and water quality

markets are having a strong year. As expected at the time of the

results announcement in January, orders in industrial and

laboratory consumable segments have been lower as they go through a

de-stocking cycle and lead-times return to more normal levels.

"Looking ahead, while noting that inconsistent order patterns

pose risks to forecasting, the Board expects the Group's full year

result to be ahead of that for 2022. The aggregate Group order

book, which has been at record levels for much of 2023, remains

high. Porvair's long-term earnings record is supported by

established global trends: tightening environmental regulations;

growth in analytical science; the need for clean water;

carbon-efficient transportation; the replacement of plastic and

steel with aluminium; and the drive for manufacturing process

quality and efficiency. The Board expects the momentum of this

strong start to 2023 will carry through to a satisfactory

conclusion to the year and views the longer-term with

confidence."

*See notes 1, 2 and 3 for definitions and reconciliations.

For further information please contact:

Porvair plc 01553 765 500

Ben Stocks, Chief Executive

James Mills, Group Finance Director

Buchanan Communications 020 7466 5000

Charles Ryland / Simon Compton / Jack

Devoy

An analyst briefing will take place at 9:30 a.m. on Monday 3

July 2023, please contact Buchanan for details.

An audiocast of the meeting and the presentation will

subsequently be made available at www.porvair.com .

Operating review

The Group has begun 2023 with a record set of results,

delivering 10% revenue growth (5% constant currency) which with

improved margins has generated 17% adjusted operating profit growth

(around 11% constant currency). Cash generation was as expected,

leaving cash reserves of GBP19.7 million at 31 May 2023.

Beneath the headlines, trading has been mixed across segments.

Stronger demand in aerospace and petrochemical markets is

supporting both the Metal Melt and Aerospace & Industrial

divisions; and new products, along with steady demand for water

quality assurance, are responsible for the growth in Seal

Analytical. This is balanced by the anticipated de-stocking in

laboratory and industrial consumable markets with supply chain

issues now mainly resolved. Inflation in wages and services remains

a concern but raw material cost pressure is less acute than was the

case twelve months ago.

The Group order book was at record levels for most of the

period, and remains high at the start of the second half, but again

the detail on a market-by-market basis is more nuanced. Lead times

which were stretched in 2022 have started to return to more normal

levels in 2023 and while this is advantageous in terms of customer

service, and will benefit inventory turns in the second half, it

makes near-term forecasting in these markets difficult.

The Group continues its consistent investment programme. In

addition to the Ratiolab acquisition which we hope to close in the

second half, investments have been made in productivity and margin

enhancements.

Financial summary

H1 2023 H1 2022 Growth

GBPm GBPm %

-------- -------- -------

Revenue 90.6 82.3 10

-------- -------- -------

Operating profit 11.7 10.1 16

-------- -------- -------

Adjusted operating profit* 12.2 10.4 17

-------- -------- -------

Profit before tax 11.2 9.5 18

-------- -------- -------

Adjusted profit before tax* 11.8 9.8 20

-------- -------- -------

Pence Pence

Earnings per share 19.3 16.1 20

-------- -------- -------

Adjusted earnings per share* 20.3 16.6 22

-------- -------- -------

GBPm GBPm

Cash generated from operations 8.2 7.2

-------- --------

Net cash (excluding lease liabilities) 19.7 12.2

-------- --------

*See notes 1, 2 and 3 for definitions and reconciliations.

Strategy and purpose

Porvair's strategy and purpose has remained consistent for over

19 years, a period that now encompasses two recessions and a

pandemic. This longer-term growth record gives the Board confidence

in the Group's capabilities and is the basis for capital allocation

and planning decisions.

The Group's record for growth, cash generation and investment

is:

5 years 10 years 15 years

CAGR* CAGR* CAGR*

-------- --------- ---------

Revenue growth 8% 9% 9%

Earnings per share growth 10% 12% 12%

Adjusted earnings per share growth 13% 13% 12%

-------- --------- ---------

GBPm GBPm GBPm

-------- --------- ---------

Cash from operations 94.1 158.3 194.9

Investment in acquisitions and capital

expenditure 40.8 81.5 97.0

-------- --------- ---------

* Compound annual growth rate

Strategic statement and business model

Porvair's strategic purpose is the development of specialist

filtration, laboratory and environmental technology businesses for

the benefit of all stakeholders. Principal measures of success

include consistent earnings growth and selected ESG measures. The

Group publishes a full ESG report at the time of the annual Final

Results.

The Group is positioned to benefit from global trends:

tightening environmental regulations; growth in analytical science;

the need for clean water; carbon-efficient transportation; the

replacement of plastic and steel by aluminium; and the drive for

manufacturing process quality and efficiency.

Porvair businesses have certain key characteristics in

common:

-- Specialist design, engineering or commercial skills are required;

-- Product use and replacement is mandated by regulation,

quality accreditation or a maintenance cycle; and

-- Products are typically designed into a system that will have

a long life-cycle and must perform to a given specification.

Orders are won by offering the best technical solutions or

commercial service at an acceptable cost. Technical expertise is

necessary in all markets served. New products are often adaptations

of existing designs with attributes validated in our own test and

measurement laboratories. Experience in specific markets and

applications is valuable in building customer confidence. Domain

knowledge is important, as is deciding where to direct

resources.

This leads the Group to:

1. Focus on markets with long-term growth potential;

2. Look for applications where product use is mandated and replacement demand is regular;

3. Make new product development a core business activity;

4. Establish geographic presence where end-markets require; and

5. Invest in both organic and acquired growth.

Therefore:

-- We focus on three operating segments: Aerospace &

Industrial; Laboratory; and Metal Melt Quality. All have clear

long-term growth drivers;

-- Our products typically reduce emissions or protect complex

downstream systems and, as a result, are replaced regularly. A high

proportion of our annual revenue is from repeat orders;

-- Through a focus on new product development, we aim to

generate growth rates in excess of the underlying market. Where

possible, we build intellectual property around our product

developments;

-- Our geographic presence follows the markets we serve. In the

last twelve months: 51% of revenue was in the Americas; 18% in

Asia; 20% in Continental Europe; 10% in the UK; and 1% in Africa.

The Group has plants in the US, UK, Germany, the Netherlands and

China. In the last twelve months: 56% of revenue was manufactured

in the US; 27% in the UK; 14% in Continental Europe; and 3% in

China; and

-- We aim to meet dividend and investment needs from free cash

flow and modest borrowing facilities. In recent years we have

expanded manufacturing capacity in the UK, Germany, US and China,

and made several acquisitions. All investments are subject to a

hurdle rate analysis based on strategic and financial

priorities.

Environmental, Social and Governance ('ESG')

The Board understands that responsible business development is

essential for creating long-term value for stakeholders. Most of

the products made by Porvair are used to the benefit of the

environment. Our water analysis equipment measures contamination

levels in water. Industrial filters are typically needed to reduce

emissions or improve efficiency. Aerospace filters improve safety

and reliability. Nuclear filters confine fissile materials. Metal

Melt Quality filters reduce waste and help improve the strength to

weight ratio of metal components.

A full ESG report was published in February 2023 setting

out:

-- Porvair's ESG management framework, goals and TCFD reporting;

-- How climate change and a net zero carbon future might affect markets served by the Group;

-- ESG metrics and results; and

-- How the Group has acted for the benefits of its stakeholders in 2022.

This ESG report will be updated in February 2024.

Divisional review

Aerospace & Industrial

H1 2023 H1 2022 Growth

GBPm GBPm %

-------- -------- -------

Revenue 36.5 30.7 19

-------- -------- -------

Operating profit 5.1 2.9 76

-------- -------- -------

Adjusted operating profit* 5.4 3.1 74

-------- -------- -------

*See notes 1 and 2 for definitions and reconciliations.

The Aerospace & Industrial division designs and manufactures

a wide range of specialist filtration products, demand for which is

driven by customers seeking better engineered, cleaner, safer or

more efficient operations. Differentiation is achieved through

design engineering; the development of intellectual property;

quality accreditations; and technical customer service.

Revenue in the period increased by 19%. Better aerospace orders

supported an increase in output and margins benefitted from

productivity investments made in recent years. Royal Dahlman, based

in Holland and mainly serving the petrochemical market with

emissions control filters, is having a much better year supported

by orders through our Indian engineering team. In the US,

industrial consumable demand is lower, notably in microelectronics

where de-stocking is affecting near-term demand. Acquired in March,

HRW expands the machining and product design skills of our facility

in Idaho, and this will help to support microelectronic margins

over the balance of the year.

Laboratory

H1 2023 H1 2022 Growth

GBPm GBPm %

-------- -------- -------

Revenue 29.1 30.8 (6)

-------- -------- -------

Operating profit 4.7 5.9 (20)

-------- -------- -------

Adjusted operating profit* 4.9 6.1 (20)

-------- -------- -------

*See notes 1 and 2 for definitions and reconciliations.

The Laboratory division has two operating businesses: Porvair

Sciences (including JGF Finneran and Kbio) and Seal Analytical.

-- Porvair Sciences manufactures laboratory filters, small

instruments and associated consumables. Differentiation is achieved

through proprietary manufacturing capabilities; filtration media;

and technical customer service.

-- Seal Analytical is a leading supplier of instruments and

consumables for environmental laboratories, for which demand is

driven by water quality regulations. Differentiation is achieved

through consistent new product development and technical customer

service.

After several years of robust growth, revenues in the Laboratory

division fell 6% in the period.

Seal Analytical had another strong half, supported by demand for

both their new AQ700 instrument and associated automation devices.

De-stocking of laboratory consumables from the second quarter

affected Porvair Sciences, where lead-times have now fallen to more

normal levels. This helps levels of customer service and inventory

turns, but challenges manufacturing efficiency. In the plants

affected, cost-reduction programmes have been undertaken to balance

changing order patterns.

As outlined in the results announcement in January , the Board

anticipated this de-stocking cycle and does not see any fundamental

changes in the underlying growth drivers of the Laboratory

division, in which investment continues. The acquisition of

Ratiolab was announced in May, subject to regulatory approval.

Ratiolab GmbH, located outside Frankfurt, distributes a wide range

of laboratory consumables in Europe and the Middle East, offering

technical customer service to a wide range of customers, only some

of which are already served by the Group. Ratiolab Kft., located

close to Budapest, manufactures laboratory consumables in a modern

and well-invested facility, the freehold of which is included in

the acquisition. Ratiolab has annual external revenues of around

EUR12 million. The transaction is expected to be earnings neutral

(after acquisition costs) in 2023, and earnings accretive

thereafter.

The Board believes Ratiolab will fit well into the Group's

Laboratory division, offering a complementary product range and

adding European manufacturing capabilities, injection moulding

expertise, new routes to market and additional engineering and

customer service capabilities.

Metal Melt Quality

H1 2023 H1 2022 Growth

GBPm GBPm %

-------- -------- -------

Revenue 24.9 20.8 20

-------- -------- -------

Operating profit 3.7 2.8 32

-------- -------- -------

Adjusted operating profit* 3.7 2.8 32

-------- -------- -------

*See notes 1 and 2 for definitions and reconciliations.

The Metal Melt Quality division manufactures filters for molten

aluminium, ductile iron and nickel-cobalt alloys. It has a

well-differentiated product range based on patented products and a

promising new product pipeline.

Revenue grew by 20%, helped by further recovery of

aerospace-related filters; the switch from plastic to recyclable

aluminium in beverage packaging; and the higher proportion of

aluminium used in electric and hybrid vehicles. Margins at 15%

remain ahead of their 10% - 12% target level.

The satellite manufacturing plant in China has had a strong

start to the year. Covid restrictions were lifted at the start of

the period enabling staff to return to work consistently. An

increasing proportion of the filters made in China for the Chinese

market are for higher-grade metal alloys where filtration

efficiency is more important.

Alternative performance measures - profit

H1 2023 H1 2022 Growth

GBPm GBPm %

-------- -------- -------

Adjusted operating profit 12.2 10.4 17

-------- -------- -------

Adjusted profit before tax 11.8 9.8 20

-------- -------- -------

Adjusted profit after tax 9.3 7.6 22

-------- -------- -------

The Group presents alternative performance measures to enable a

better understanding of its trading performance (see note 1).

Adjusted operating profit and adjusted profit before tax exclude

items that are considered significant and where treatment as an

adjusting item provides a more consistent assessment of the Group's

trading. Adjusting items comprise a GBP0.4 million charge (2022:

GBP0.3 million) for the amortisation of acquired intangible assets,

together with a GBP0.2 million charge (2022: GBPnil) for costs

incurred in relation to the acquisition of both HRW and Ratiolab

(see note 9).

Finance costs

The Group incurred a net interest charge of GBP0.4 million

(2022: GBP0.6 million) which consisted of the finance cost on the

pension deficit, lease liability interest, and the unwind of

discounted provisions and other payables. The Group also incurred

undrawn commitment fees on the Group's banking facilities, though

there were largely offset by interest receivable on deposits.

Tax

The Group tax charge was GBP2.4 million (2022: GBP2.1 million),

including the tax effect of adjusting items (see note 1). The

adjusted income tax expense was GBP2.4 million (2022: GBP2.2

million), with the effective rate of income tax on adjusted profit

before tax at 21% (2022: 22%).

Earnings per share and dividends

The basic earnings per share for the period was 19.3 pence

(2022: 16.1 pence). Adjusted earnings per share was 20.3 pence

(2022: 16.6 pence).

The Board has declared an interim dividend of 2.0 pence (2022:

1.9 pence) per share.

Investment

In the last five years, GBP 40.8 million has been invested in

acquisitions and capital expenditure. In the first half of 2023,

the Group invested GBP0.7 million on the HRW acquisition and GBP2.2

million on capital expenditure (2022: GBP2.3 million).

Cash flow, cash and net debt

Cash generated from operations in the six months to 31 May 2023

was GBP 8.2 million (2022: GBP7.2 million). The Group normally sees

an outflow of working capital in the first half of the year.

Working capital increased by GBP5.0 million (2022: GBP4.9 million)

in the period.

Net cash at 31 May 2023 was GBP19.7 million (31 May 2022:

GBP12.2 million; 30 November 2022: GBP18.3 million). Lease

liabilities were GBP 11.0 million (31 May 2022: GBP11.5 million; 30

November 2022: GBP11.5 million).

Provisions and contingent liabilities

The Group has GBP4.4 million (31 May 2022: GBP4.5 million; 30

November 2022: GBP4.0 million) of provisions for dilapidations and

performance warranties.

The Group has outstanding performance bonds with customers at 31

May 2023 of $nil (31 May 2022: $2.5 million; 30 November 2022: $1.0

million) and EUR0.2 million (31 May 2022: EUR0.4 million; 30

November 2022: EUR0.3 million).

Return on capital employed

The Group's return on capital employed was 16% (2022: 13%).

Excluding the impact of goodwill and retirement benefit

obligations, the return on operating capital employed was 37%

(2022: 33%).

Outlook

This is a record set of results for the half-year and shows the

Group performing well overall, despite inconsistency of demand

across markets served. Aerospace, petrochemical and water quality

markets are having a strong year. As expected at the time of the

results announcement in January, orders in industrial and

laboratory consumable segments have been lower as they go through a

de-stocking cycle and lead-times return to more normal levels.

Looking ahead, while noting that inconsistent order patterns

pose risks to forecasting, the Board expects the Group's full year

result to be ahead of that for 2022. The aggregate Group order

book, which has been at record levels for much of 2023, remains

high. Porvair's long-term earnings record is supported by

established global trends: tightening environmental regulations;

growth in analytical science; the need for clean water;

carbon-efficient transportation; the replacement of plastic and

steel with aluminium; and the drive for manufacturing process

quality and efficiency. The Board expects the momentum of this

strong start to 2023 will carry through to a satisfactory

conclusion to the year and views the longer-term with

confidence.

Ben Stocks

Group Chief Executive

30 June 2023

Related parties

Other than remuneration of key management personnel, there were

no related party transactions in the six months ended 31 May 2023

(2022: none).

Principal risks

Each division considers strategic, operational and financial

risks and identifies actions to mitigate those risks. These risk

profiles are reviewed by the Board and updated at least annually.

Further details of the Group's risk profile analysis can be found

in the Strategic Report section of the Annual Report & Accounts

for the year ended 30 November 2022.

Certain elements of the Group's order position can change

quickly in the face of changing economic circumstances. The Metal

Melt Quality division, Laboratory division and general industrial

filtration within the Aerospace & Industrial division all have

relatively short lead times and order cycles and, therefore,

revenue is subject to fluctuations which could have a material

effect on the Group's results for the balance of 2023.

Forward-looking statements

Certain statements in this interim financial information are

forward-looking. Although the Group believes that the expectations

reflected in these forward-looking statements are reasonable, it

can give no assurance that these expectations will prove to be

correct. Because these statements involve risks and uncertainties,

actual results may differ materially from those expressed or

implied by these forward-looking statements.

We undertake no obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Condensed consolidated income statement

For the six months ended 31 May

Six months ended

31 May

----------------------

2023 2022

Note Unaudited Unaudited

Continuing operations GBP'000 GBP'000

---------- ----------

Revenue 1,2 90,552 82,280

Cost of sales (59,924) (55,018)

---------- ----------

Gross profit 30,628 27,262

Other operating expenses (18,975) (17,185)

---------------------------------------------- ----- ---------- ----------

Adjusted operating profit 1,2 12,226 10,412

Adjustments:

Amortisation of acquired intangible assets (370) (335)

Other acquisition-related costs (203) -

Operating profit 1,2 11,653 10,077

Finance costs (437) (566)

Profit before tax 11,216 9,511

---------------------------------------------- ----- ---------- ----------

Adjusted income tax expense (2,449) (2,202)

Adjustments:

Tax effect of adjustments to operating

profit 1 82 67

---------------------------------------------- ----- ---------- ----------

Income tax expense (2,367) (2,135)

---------- ----------

Profit for the period 8,849 7,376

Earnings per share (basic) 3 19.3p 16.1p

Earnings per share (diluted) 3 19.3p 16.1p

Adjusted earnings per share (basic) 3 20.3p 16.6p

Adjusted earnings per share (diluted) 3 20.3p 16.6p

Condensed consolidated statement of comprehensive income

For the six months ended 31 May

Six months ended

31 May

----------------------------

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

-----------

Profit for the period 8,849 7,376

----------- ---------

Other comprehensive income/(expense)

Items that will not be reclassified

to profit and loss:

Actuarial gain in defined benefit pension plans

net of tax 750 3,037

----------- ---------

Items that may be subsequently reclassified to

profit and loss:

Exchange (loss)/gain on translation of foreign

subsidiaries (2,751) 3,329

----------- ---------

Total other comprehensive (expense)/income for

the period (2,001) 6,366

----------- ---------

Total comprehensive income for the

period 6,848 13,742

----------- ---------

The accompanying notes are an integral part of this interim

financial information.

Condensed consolidated balance sheet

As at 31 May

As at 30

As at 31 May November

------------------------ ----------

2023 2022 2022

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------- ----------- ----------

Non-current assets

Property, plant and equipment 24,710 22,705 24,311

Right-of-use assets 9,614 10,207 10,144

Goodwill and other intangible

assets 76,470 75,630 77,900

Deferred tax asset 740 342 1,046

----------- ----------- ----------

111,534 108,884 113,401

----------- ----------- ----------

Current assets

Inventories 32,803 28,266 30,973

Trade and other receivables 26,278 28,109 24,471

Derivative financial instruments 335 - 554

Cash and cash equivalents 19,678 15,988 18,297

----------- ----------- ----------

79,094 72,363 74,295

----------- ----------- ----------

Current liabilities

Trade and other payables (28,664) (28,478) (27,881)

Current tax liabilities (572) (1,246) (309)

Lease liabilities (2,046) (2,097) (2,156)

Derivative financial instruments - (269) (319)

Provisions 5 (4,028) (4,177) (3,692)

----------- ----------- ----------

(35,310) (36,267) (34,357)

----------- ----------- ----------

Net current assets 43,784 36,096 39,938

----------- ----------- ----------

Non-current liabilities

Borrowings - (3,754) -

Deferred tax liability (2,698) (2,472) (2,811)

Retirement benefit obligations (6,759) (7,102) (9,816)

Other payables - (900) -

Lease liabilities (8,968) (9,395) (9,316)

Provisions 5 (345) (312) (328)

----------

(18,770) (23,935) (22,271)

----------- ----------- ----------

Net assets 136,548 121,045 131,068

----------- ----------- ----------

Capital and reserves

Share capital 927 924 927

Share premium account 37,778 37,078 37,626

Cumulative translation reserve 12,702 10,986 15,453

Retained earnings 85,141 72,057 77,062

----------- ----------- ----------

Equity attributable to owners of

the parent 136,548 121,045 131,068

----------- ----------- ----------

The interim financial information was approved by the Board of

Directors on 30 June 2023 and was signed on its behalf by:

Ben Stocks James Mills

Group Chief Executive Group Finance Director

The accompanying notes are an integral part of this interim

financial information.

Condensed consolidated cash flow statement

For the six months ended 31 May

Six months ended 31

May

--------------------------------

2023 Unaudited 2022 Unaudited

Note

GBP'000 GBP'000

--------------- ---------------

Cash flows from operating activities

Cash generated from operations 7 8,211 7,239

Interest paid (154) (194)

Tax paid (2,057) (1,400)

--------------- ---------------

Net cash generated from operating

activities 6,000 5,645

--------------- ---------------

Cash flows from investing activities

Interest received 39 -

Acquisition of subsidiaries (678) -

Purchase of property, plant and equipment (2,221) (2,310)

Purchase of intangible assets (30) (43)

Proceeds from sale of property, plant

and equipment - 16

Net cash used in investing activities (2,890) (2,337)

--------------- ---------------

Cash flows from financing activities

Proceeds from issue of ordinary shares 152 -

Purchase of Employee Benefit Trust

shares (372) (406)

Decrease in borrowings 8 - (1,350)

Repayment of lease liabilities (1,259) (1,208)

Net cash used in financing activities (1,479) (2,964)

--------------- ---------------

Net increase in cash and cash equivalents 8 1,631 344

Effects of exchange rate changes (250) 202

--------------- ---------------

1,381 546

Cash and cash equivalents at the beginning

of the period 18,297 15,442

--------------- ---------------

Cash and cash equivalents at the end

of the period 19,678 15,988

--------------- ---------------

The accompanying notes are an integral part of this interim

financial information.

Condensed consolidated statement of changes in equity

For the six months ended 31 May (unaudited)

Share Cumulative

Share premium translation Retained Total

capital account reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- --------- ------------- ----------- ----------

At 1 December 2021 924 37,078 7,657 63,287 108,946

---------- --------- ------------- ----------- ----------

Profit for the period - - - 7,376 7,376

Other comprehensive income - - 3,329 3,037 6,366

Total comprehensive income

for the period - - 3,329 10,413 13,742

---------- --------- ------------- ----------- ----------

Purchase of own shares (held

in trust) - - - (406) (406)

Share-based payments (net

of tax) - - - 369 369

Dividends - - - (1,606) (1,606)

---------- --------- ------------- ----------- ----------

At 31 May 2022 924 37,078 10,986 72,057 121,045

---------- --------- ------------- ----------- ----------

At 1 December 2022 927 37,626 15,453 77,062 131,068

---- ------- ---------- -------- --------

Profit for the period - - - 8,849 8,849

Other comprehensive (expense)/income - - (2,751) 750 (2,001)

Total comprehensive (expense)/income

for the period - - (2,751) 9,599 6,848

---- ------- ---------- -------- --------

Purchase of own shares (held

in trust) - - - (372) (372)

Issue of ordinary share capital - 152 - - 152

Share-based payments (net

of tax) - - - 597 597

Dividends - - - (1,745) (1,745)

---- ------- ---------- -------- --------

At 31 May 2023 927 37,778 12,702 85,141 136,548

---- ------- ---------- -------- --------

The accompanying notes are an integral part of this interim

financial information.

Notes to the condensed interim consolidated financial

information

1. Alternative performance measures

Alternative performance measures are used by the Directors and

management to monitor business performance internally and exclude

certain cash and non-cash items which they believe are not

reflective of the normal course of business of the Group. The

Directors believe that disclosing such non-IFRS measures enables a

reader to isolate and evaluate the impact of such items on results

and allows for a fuller understanding of performance from year to

year. Alternative performance measures may not be directly

comparable with other similarly titled measures used by other

companies.

Alternative revenue measures (unaudited)

Six months ended

31 May

2023 2022 Growth

Aerospace & Industrial GBP'000 GBP'000 %

--------- -------- -------

Revenue at constant currency 34,503 29,971 15

Exchange 2,037 714

--------- --------

Revenue as reported 36,540 30,685 19

--------- -------- -------

Laboratory

Revenue at constant currency 26,964 29,840 (10)

Exchange 2,163 935

--------- -------- -------

Revenue as reported 29,127 30,775 (5)

--------- -------- -------

Metal Melt Quality

Revenue at constant currency 21,655 19,355 12

Exchange 3,230 1,465

--------- -------- -------

Revenue as reported 24,885 20,820 20

--------- -------- -------

Group

Revenue at constant currency 83,122 79,166 5

Exchange 7,430 3,114

--------- -------- -------

Revenue as reported 90,552 82,280 10

--------- -------- -------

Revenue at constant currency is derived from translating

overseas subsidiaries results at budgeted fixed exchange rates. In

2023 and 2022, the rates used were $1.40:GBP1 and EUR1.20:GBP1,

compared with actual rates of $1.22:GBP1 (2022: $1.31:GBP1) and

EUR1.14:GBP1 (2022: EUR1.19:GBP1).

A reconciliation of the Group's adjusted performance measures to

the reported IFRS measures is presented below:

H1 2023 H1 2022

Adjusted Adjustments Reported Adjusted Adjustments Reported

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- ------------ --------- --------- ------------ ---------

Operating profit 12,226 (573) 11,653 10,412 (335) 10,077

Finance costs (437) - (437) (566) - (566)

--------- ------------ --------- --------- ------------ ---------

Profit before

tax 11,789 (573) 11,216 9,846 (335) 9,511

Income tax expense (2,449) 82 (2,367) (2,202) 67 (2,135)

Profit for the

period 9,340 (491) 8,849 7,644 (268) 7,376

--------- ------------ --------- --------- ------------ ---------

An analysis of adjusting items is given below:

2023 2022

Affecting operating profit: GBP'000 GBP'000

----------- --------

Amortisation of acquired intangible assets (370) (335)

Other acquisition-related costs (203) -

(573) (335)

----------- --------

Affecting tax:

Tax effect of adjustments to operating profit 82 67

Total adjusting items (491) (268)

----------- --------

Adjusted operating profit excludes:

-- The amortisation of intangible assets arising on acquisition

of businesses of GBP0.4 million (2022: GBP0.3 million); and

-- Other acquisition-related costs of GBP0.2 million (2022:

GBPnil) in relation to the HRW acquisition and the planned

acquisition of Ratiolab (see note 9).

2. Segmental information

The chief operating decision maker has been identified as the

Board of Directors. The Board of Directors has instructed the

Group's internal reporting to be based around differences in

products and services, in order to assess performance and allocate

resources. The key profit measure used to assess the performance of

each reportable segment is adjusted operating profit/(loss).

Management has determined the operating segments based on this

reporting.

As at 31 May 2023, the Group is organised on a worldwide basis

into three operating segments:

1) Aerospace & Industrial - principally serving the aviation, and energy and industrial markets;

2) Laboratory - principally serving the bioscience and

environmental laboratory instrument and consumables market; and

3) Metal Melt Quality - principally serving the global

aluminium, North American Free Trade Agreement (NAFTA) iron foundry

and super-alloys markets.

Other Group operations' costs, assets and liabilities are

included in the "Central" division. Central costs mainly comprise

Group corporate costs, including new business development costs,

some research and development costs and general financial costs.

Central assets and liabilities mainly comprise Group retirement

benefit obligations, tax assets and liabilities, cash and

borrowings.

The segment results for the period ended 31 May 2023 are as

follows:

2023 - Unaudited

Aerospace Metal

& Industrial Laboratory Melt Quality Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------- --------------- ---------- ---------

Total segment revenue 36,553 30,076 24,885 - 91,514

Inter-segment revenue (13) (949) - - (962)

--------------- ------------- --------------- ---------- ---------

Revenue 36,540 29,127 24,885 - 90,552

--------------- ------------- --------------- ---------- ---------

Adjusted operating

profit/(loss) 5,359 4,898 3,715 (1,746) 12,226

Amortisation of

acquired intangible

assets (217) (153) - - (370)

Other acquisition-related

costs - - - (203) (203)

--------------------------- --------------- ------------- --------------- ---------- ---------

Operating profit/(loss) 5,142 4,745 3,715 (1,949) 11,653

Finance costs - - - (437) (437)

---------------

Profit/(loss)

before tax 5,142 4,745 3,715 (2,386) 11,216

--------------- ------------- --------------- ---------- ---------

The segment results for the period ended 31 May 2022 are as

follows:

2022 - Unaudited

Aerospace Metal

& Industrial Laboratory Melt Quality Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------- --------------- ---------- ---------

Total segment revenue 30,769 31,797 20,820 - 83,386

Inter-segment revenue (84) (1,022) - - (1,106)

--------------- ------------- --------------- ---------- ---------

Revenue 30,685 30,775 20,820 - 82,280

--------------- ------------- --------------- ---------- ---------

Adjusted operating

profit/(loss) 3,091 6,064 2,782 (1,525) 10,412

Amortisation of

acquired intangible

assets (182) (153) - - (335)

Operating profit/(loss) 2,909 5,911 2,782 (1,525) 10,077

Finance costs - - - (566) (566)

--------------- ------------- --------------- ---------- ---------

Profit/(loss) before

tax 2,909 5,911 2,782 (2,091) 9,511

--------------- ------------- --------------- ---------- ---------

The segment assets and liabilities at 31 May 2023 are as

follows:

At 31 May 2023 -

Unaudited Aerospace Metal

& Industrial Laboratory Melt Quality Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------- --------------- ---------- ---------

Segmental assets 70,099 64,762 34,099 1,990 170,950

Cash and cash equivalents - - - 19,678 19,678

--------------- ------------- --------------- ---------- ---------

Total assets 70,099 64,762 34,099 21,668 190,628

--------------- ------------- --------------- ---------- ---------

Segmental liabilities (20,488) (13,498) (6,587) (6,748) (47,321)

Retirement benefit

obligations - - - (6,759) (6,759)

Total liabilities (20,488) (13,498) (6,587) (13,507) (54,080)

--------------- ------------- --------------- ---------- ---------

The segment assets and liabilities at 31 May 2022 are as

follows:

At 31 May 2022 -

Unaudited Aerospace Metal

& Industrial Laboratory Melt Quality Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------- --------------- ---------- ----------

Segmental assets 77,124 57,114 30,777 244 165,259

Cash and cash

equivalents - - - 15,988 15,988

--------------- ------------ --------------- ------------ -----------

Total assets 77,124 57,114 30,777 16,232 181,247

--------------- ------------ --------------- ------------ -----------

Segmental liabilities (20,481) (15,358) (7,015) (6,492) (49,346)

Retirement benefit

obligations - - - (7,102) (7,102)

Borrowings - - - (3,754) (3,754)

--------------- ------------ --------------- ------------ -----------

Total liabilities (20,481) (15,358) (7,015) (17,348) (60,202)

--------------- ------------ --------------- ------------ -----------

The segment assets and liabilities at 30 November 2022 are as

follows:

At 30 November 2022

- Audited Aerospace Metal

& Industrial Laboratory Melt Quality Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------- --------------- ---------- ---------

Segmental assets 68,033 63,324 36,063 1,979 169,399

Cash and cash equivalents - - - 18,297 18,297

--------------- ------------- --------------- ---------- ---------

Total assets 68,033 63,324 36,063 20,276 187,696

--------------- ------------- --------------- ---------- ---------

Segmental liabilities (21,640) (13,168) (6,893) (5,111) (46,812)

Retirement benefit

obligations - - - (9,816) (9,816)

Total liabilities (21,640) (13,168) (6,893) (14,927) (56,628)

--------------- ------------- --------------- ---------- ---------

Geographical analysis

Six months ended 31 May

--------------------------------------------------------

2023 2022

Unaudited Unaudited

Revenue By destination By origin By destination By origin

GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------- --------------- ----------

United Kingdom 8,975 24,018 8,735 25,794

Continental Europe 18,475 14,054 18,961 10,146

United States of America 43,250 49,701 37,171 43,961

Other NAFTA 2,204 - 1,734 -

South America 1,448 - 987 -

Asia 15,395 2,779 13,558 2,379

Africa 805 - 1,134 -

--------------- ---------- --------------- ----------

90,552 90,552 82,280 82,280

--------------- ---------- --------------- ----------

3. Earnings per share (EPS)

Six months ended 31 May

------------------------------------------------------------------------

2023 2022

Unaudited Unaudited

As reported Earnings Weighted Per Earnings Weighted Per share

average share average

number of number Pence

GBP'000 shares Pence GBP'000 of shares

--------- ------------ ------- ----------- ------------ ----------

Profit for the

period - attributable

to owners of the

parent 8,849 7,376

Shares in issue 46,343,604 46,201,685

Shares owned by

the Employee Benefit

Trust (410,009) (289,162)

Basic EPS 8,849 45,933,595 19.3 7,376 45,912,523 16.1

Dilutive share

options outstanding - 18,087 - - 42,640 -

--------- ------------ ------- ----------- ------------ ----------

Diluted EPS 8,849 45,951,682 19.3 7,376 45,955,163 16.1

--------- ------------ ------- ----------- ------------ ----------

In addition to the above, the Group also calculates an earnings

per share based on adjusted profit as the Board believes this to be

a better measure to judge the progress of the Group, as discussed

in note 1.

Six months ended 31 May

2023 2022

Unaudited Unaudited

Adjusted Earnings Weighted Per Earnings Weighted Per share

average share average

number number of Pence

GBP'000 of shares Pence GBP'000 shares

----------- ----------- -------- ----------- ----------- ------------

Profit for the

period - attributable

to owners of the

parent 8,849 7,376

Adjusting items

(note 1) 491 268

----------- ----------- -------- ----------- ----------- ------------

Adjusted profit

-attributable to

owners of the parent 9,340 7,644

----------- ----------- -------- ----------- ----------- ------------

Adjusted basic

EPS 9,340 45,933,595 20.3 7,644 45,912,523 16.6

Adjusted diluted

EPS 9,340 45,951,682 20.3 7,644 45,955,163 16.6

----------- ----------- -------- ----------- ----------- ------------

4. Dividends per share

Six months ended 31 May

------------------------------------------

2023 2022

Unaudited Unaudited

Per share GBP'000 Per share GBP'000

---------- -------- ---------- --------

Final dividend approved 3.8p 1,745 3.5p 1,606

---------- -------- ---------- --------

The final dividend approved for the year ended 30 November 2022

was paid to shareholders on 7 June 2023.

The Directors have declared an interim dividend of 2.0 pence

(2022: 1.9 pence) per share to be paid on 23 August 2023 to

shareholders on the register at the close of business on 21 July

2023; the ex-dividend date is 20 July 2023.

5. Provisions

Dilapidations Warranty Total

GBP'000 GBP'000 GBP'000

-------------- --------- ---------

At 1 December 2022 328 3,692 4,020

Additional charge in period - 428 428

Release of provision - (79) (79)

Unwinding of discount 17 - 17

Exchange - (13) (13)

-------------- --------- ---------

At 31 May 2023 345 4,028 4,373

-------------- --------- ---------

Provisions arise from potential claims on major contracts, sale

warranties, and discounted dilapidations for leased property.

Matters that could affect the timing, quantum and extent to which

provisions are utilised or released, include the impact of any

remedial work, claims against outstanding performance bonds, and

the demonstrated life of the filtration equipment installed.

6. Contingent liabilities

At 31 May 2023, the Group has performance bonds totalling $nil

and EUR0.2 million (30 November 2022: US$1.0 million and EUR0.3

million). The uncalled performance bonds are expected to be called

or released no later than December 2024.

7. Cash generated from operations

Six months ended

31 May

------------------------

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

----------- -----------

Operating profit 11,653 10,077

Adjustments for:

Fair value movement of derivatives through

profit and loss (100) 249

Share-based payments 552 387

Depreciation of property, plant and equipment

and amortisation of intangibles 2,127 1,862

Depreciation of right-of-use assets 1,124 1,098

Loss on disposal of property, plant and equipment - 23

Operating cash flows before movement in working

capital 15,356 13,696

----------- -----------

Increase in inventories (2,301) (3,044)

Increase in trade and other receivables (2,313) (6,162)

(Decrease)/increase in trade and

other payables (734) 4,582

Increase/(decrease) in provisions 351 (292)

Increase in working capital (4,997) (4,916)

----------- -----------

Post employment benefits (net cash

movements) (2,148) (1,541)

----------- -----------

Cash generated from operations 8,211 7,239

----------- -----------

8. Reconciliation of net cash flow to movement in net debt

Six months ended

31 May

------------------------

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

Net cash/(debt) at the beginning of the period 6,825 (2,006)

Increase in cash and cash equivalents 1,631 344

Decrease in borrowings - 1,350

Decrease in lease liabilities 348 878

Effects of exchange rate changes (140) 176

----------- -----------

Net cash at the end of the period 8,664 742

----------- -----------

Cash and cash equivalents 19,678 15,988

Borrowings - (3,754)

Lease liabilities (11,014) (11,492)

Net cash at the end of the period 8,664 742

--------- ---------

9. Acquisitions

On 3 March 2023, the Group acquired certain business and assets

from HRW Inc., a small engineering operation in Nampa, Idaho, and

key supplier to the Group's microelectronics filtration facility in

Idaho. The acquisition expands machining and product design skills

to that location.

The total maximum consideration is GBP0.9 million; consisting of

initial and deferred and consideration. In the period since

acquisition, the business has contributed GBP0.1 million of

adjusted operating profit to the Group results. Had the acquisition

been consolidated from 1 December 2022, the income statement would

show adjusted operating profit of GBP12.3 million.

The following table sets out the purchase consideration,

together with the provisional fair value of assets acquired and

liabilities assumed:

Total

Purchase consideration: GBP'000

--------

Initial cash consideration 668

Deferred cash consideration 200

--------

Total purchase consideration 868

Provisional fair value of net assets acquired

(below) (679)

--------

Goodwill 189

--------

Fair value

Provisional fair value of identifiable assets acquired GBP'000

and liabilities assumed:

-----------

Technology and know-how 343

Property, plant and equipment (including right-of-use

assets) 538

Inventory 37

Trade and other payables (including

lease liabilities) (239)

-----------

Provisional fair value of net assets

acquired 679

-----------

A preliminary valuation of the identifiable intangible assets

has been carried out in the period. Acquisition-related intangible

assets comprise technology and know-how of GBP0.3 million.

The goodwill is attributable to non-contractual relationships,

the synergies between the business acquired and the operations of

the Group, and the potential to develop the technologies acquired.

None of these meet the criteria for recognition of intangible

assets separable from goodwill. The goodwill recognised is

attributable to the Aerospace & Industrial division and is

expected to be deductible for income tax purposes.

These estimates of fair value may be adjusted in future in

accordance with the requirements of IFRS 3 Business

Combinations.

On 4 May 2023, Group announced that it will acquire, subject to

Hungarian regulatory approval, 100% of the issued share capital of

two businesses, Ratiolab GmbH and Ratiolab Kft. (together

"Ratiolab") as outlined in the Divisional review above.

The direct cost of acquisitions was GBP0.2 million. This cost

has been charged to the income statement and is presented as an

adjusting item (see note 1).

10. Exchange rates

Exchange rates for the US dollar and Euro during the period

were:

Average Average rate Closing Closing rate

rate to 31 to 31 May rate at 31 at 30 Nov

May 23 22 May 23 22

Unaudited Unaudited Unaudited Unaudited

------------ ------------- ------------ -------------

US dollar 1.22 1.31 1.23 1.19

Euro 1.14 1.19 1.15 1.16

------------ ------------- ------------ -------------

11. Basis of preparation

Porvair plc is a public limited company registered in the UK and

listed on the London Stock Exchange.

This unaudited condensed interim consolidated financial

information for the six months ended 31 May 2023 has been prepared

in accordance with the Disclosure and Transparency Rules ('DTR') of

the Financial Conduct Authority and with IAS 34 Interim Financial

Reporting as contained in UK-adopted International Accounting

Standards. The condensed interim consolidated financial information

should be read in conjunction with the annual financial statements

for the year ended 30 November 2022, which were prepared in

accordance with applicable law and UK-adopted International

Accounting Standards.

The accounting policies applied in these interim financial

statements are consistent with those applied in the Group's

consolidated financial statements for the year ended 30 November

2022. A number of new amendments are effective from 1 December 2022

but they do not have a material effect on the Group's financial

statements.

Taxes on income in the interim period are accrued using the tax

rate that would be applicable to expected total annual

earnings.

This condensed interim consolidated financial information has

been prepared on a going concern basis under the historical cost

convention, as modified by the recognition of certain financial

assets and financial liabilities (including derivative financial

instruments) at fair value through profit or loss.

The preparation of condensed interim consolidated financial

information, in conformity with generally accepted accounting

principles, requires the use of estimates and assumptions that

affect the reported amounts of assets and liabilities at the date

of the condensed interim consolidated financial information, and

the reported amounts of revenues and expenses during the reporting

period. Although these estimates are based on management's best

knowledge of the amount, event or actions, actual results may

ultimately differ from those estimates. In preparing the condensed

interim financial statements, the significant judgements made by

management in applying the Group's accounting policies and the key

sources of estimation uncertainty were the same as those applied to

the consolidated financial statements for the year ended 30

November 2022.

After having made appropriate enquiries, including a review of

progress against the Group's budget for 2023, its current trading

and medium-term plans; and taking into account the banking

facilities available until May 2026, the Directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for at least twelve months from

the date of approval of the condensed interim consolidated

financial information. Accordingly, they continue to adopt the

going concern basis in preparing this condensed interim

consolidated financial information.

This condensed interim consolidated financial information and

the comparative figures do not constitute full accounts within the

meaning of Section 434 of the Companies Act 2006. Statutory

accounts for the year ended 30 November 2022, which were approved

by the Board of Directors on 27 January 2023, and which include an

unqualified audit report, no emphasis of matter paragraph and no

statements under sections 498(2) or (3) of the Companies Act 2006,

have been delivered to the Registrar of Companies. This condensed

interim consolidated financial information has been reviewed, not

audited.

The condensed interim consolidated financial information does

not include all financial risk management information and

disclosures required in the annual financial statements; it should

be read in conjunction with the Group's annual financial statements

for the year ended 30 November 2022. There have been no changes in

any risk management policies since the year end.

This report will be available at Porvair plc's registered office

at 7 Regis Place, Bergen Way, King's Lynn, PE30 2JN and on the

Company's website, www.porvair.com .

Statement of directors' responsibilities

The Directors confirm that this condensed interim consolidated

financial information has been prepared in accordance with IAS 34

Interim Financial Reporting as contained in UK-adopted

International Accounting Standards , and that the interim

management report herein includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months of the year, their impact on the condensed

interim consolidated financial information and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

-- material related party transactions in the first six months

of the year and any material changes in the related party

transactions described in the last annual report.

The Directors of Porvair plc are listed in the Porvair plc

Annual Report for the year ended 30 November 2022. A list of

current Directors is maintained on the Porvair plc website,

www.porvair.com .

By order of the board

Ben Stocks James Mills

Group Chief Executive Group Finance Director

30 June 2023

INDEPENT REVIEW REPORT TO PORVAIR PLC

Conclusion

We have been engaged by Porvair plc ('the Company') to review

the condensed set of financial statements of the Company and its

subsidiaries (the 'Group') in the interim financial report for the

six months ended 31 May 2023 which comprises the condensed

consolidated income statement, the condensed consolidated statement

of comprehensive income, the condensed consolidated balance sheet,

the condensed consolidated cash flow statement, the condensed

consolidated statement of changes in equity and related notes 1 to

11. We have read the other information contained in the interim

financial report and considered whether it contains any apparent

misstatements of fact or material inconsistencies with the

information in the condensed set of financial statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim financial report for the six months ended 31 May

2023 is not prepared, in all material respects, in accordance with

International Accounting Standard 34, "Interim Financial Reporting"

as contained in UK-adopted International Accounting Standards, and

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ('ISRE (UK) 2410') issued for use in the United Kingdom. A

review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

As disclosed in note 11, the annual financial statements of the

Group are prepared in accordance with UK-adopted International

Accounting Standards. The condensed set of financial statements

included in this interim financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting" as contained in UK-adopted International

Accounting Standards.

Conclusions Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that management have inappropriately adopted

the going concern basis of accounting or that management have

identified material uncertainties relating to going concern that

are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the Group and the Company to cease to continue as a going

concern.

Responsibilities of Directors

The interim financial report, is the responsibility of, and has

been approved by, the directors. The directors are responsible for

preparing the interim financial report in accordance with

International Accounting Standard 34, "Interim Financial Reporting"

as contained in UK-adopted International Accounting Standards and

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

In preparing the interim financial report, the directors are

responsible for assessing the Group's and the Company's ability to

continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of

accounting unless the directors either intend to liquidate the

Group or the Company or to cease operations, or have no realistic

alternative but to do so.

Auditor's Responsibilities for the Review of the Financial

Information

In reviewing the interim financial report, we are responsible

for expressing to the Company a conclusion on the condensed set of

financial statements in the interim financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK) 2410 "Review of

Interim Financial Information performed by the Independent Auditor

of the Entity". Our review work has been undertaken so that we

might state to the Company those matters we are required to state

to them in an independent review report and for no other purpose.

To the fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company, for our review

work, for this report, or for the conclusions we have formed.

RSM UK Audit LLP

Chartered Accountants

25 Farringdon Street

London EC4A 4AB

30 June 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDLBGXDGXG

(END) Dow Jones Newswires

July 03, 2023 02:00 ET (06:00 GMT)

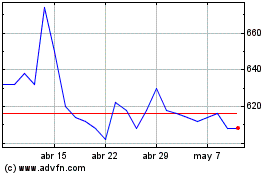

Porvair (LSE:PRV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Porvair (LSE:PRV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024