TIDMRNEW

RNS Number : 1831M

Ecofin US Renewables Infrastr.Trust

20 May 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, NEW ZEALAND, CANADA, SOUTH AFRICA OR

JAPAN, OR ANY MEMBER STATE OF THE EEA (OTHER THAN ANY MEMBER STATE

OF THE EEA WHERE THE COMPANY'S SECURITIES MAY BE LEGALLY MARKETED),

OR ANY OTHER JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO

DO SO MIGHT CONSTITUTE A VIOLATION OR BREACH OF ANY APPLICABLE LAW

OR REGULATION. PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS

ANNOUNCEMENT.

20 May 2022

ECOFIN U.S. RENEWABLES INFRASTRUCTURE TRUST PLC

Results of Placing and REX Retail Offer

Further to the announcement on 10 May 2022, the Board of Ecofin

U.S. Renewables Infrastructure Trust PLC ("RNEW" or the "Company")

announces that it has raised aggregate gross proceeds of $13.1

million. $10.8 million was raised pursuant to the Placing and

GBP1.8 million (equivalent to approximately $2.3 million using the

Relevant Sterling Exchange Rate, as defined below) was raised

pursuant to the REX Retail Offer.

Accordingly, the Company will issue a total of 12,927,617 new

Ordinary Shares at the Issue Price of $1.015 per new Ordinary

Share, of which 10,687,323 new Ordinary Shares will be issued

pursuant to the Placing and 2,240,294 new Ordinary Shares will be

issued pursuant to the REX Retail Offer (together, the "New

Ordinary Shares").

Applications will be made for the admission of the New Ordinary

Shares to the premium listing category of the Official List of the

Financial Conduct Authority and to trading on the premium segment

of the London Stock Exchange's Main Market. It is expected that

Admission will become effective and that dealings for normal

settlement in the New Ordinary Shares will commence at 8 a.m. on 24

May 2022.

The New Ordinary Shares will, when issued, be credited as fully

paid and will rank pari passu in all respects with existing

Ordinary Shares including the right to receive all dividends and

other distributions declared, made or paid after their date of

issue. The New Ordinary Shares will be entitled to receive the

interim quarterly dividend of 1.4 cents per Ordinary Share declared

on 28 April 2022 and expected to be paid on 10 June 2022.

Following Admission, the Company will have 138,026,751 Ordinary

Shares in issue in aggregate. The total voting rights in the

Company will be 138,026,751 and this figure may be used by

Shareholders as the denominator for the calculations by which they

may determine if they are required to notify their interest in, or

a change to their interest in, the share capital of the Company

under the FCA's Disclosure Guidance and Transparency Rules.

The following Directors of the Company have participated in the

Issue. Details of such subscriptions in the Issue are as

follows:

Director Number of shares Number of shares Number of shares Percentage

held prior subscribed for held after of shares outstanding

to the issue in the issue the issue after the issue

Patrick O'D

Bourke 54,436 50,000 104,436 0.08%

----------------- ----------------- ----------------- ----------------------

David Fletcher 41,633 15,311 56,944 0.04%

----------------- ----------------- ----------------- ----------------------

Louisa Vincent 28,057 4,899 32,956 0.02%

----------------- ----------------- ----------------- ----------------------

*Number of shares held after the Issue includes their respective

families' holdings

The Company shortly will also be making a notification and

public disclosure of transactions by the Directors and persons

discharging managerial responsibilities and persons closely

associated with them in accordance with the requirements of UK MAR

giving more details of the above dealings.

Dealing Codes

Ticker (in respect of shares RNEW

traded in USD)

ISIN for the Ordinary Shares GB00BLPK4430

SEDOL for the Ordinary Shares BLPK443

Ticker (in respect of shares RNEP

traded in GBP)

ISIN for the Ordinary Shares GB00BLPK4430

SEDOL for the Ordinary Shares BMXZ812

For the purposes of participation in the Issue, the Relevant

Sterling Exchange Rate, being the Sterling to U.S. Dollar spot

exchange rate published by Bloomberg at 1 p.m. on 19 May 2022 was

1:1.2432. The Sterling equivalent Issue Price is therefore 81.64

pence per Ordinary Share.

Unless the context otherwise requires, capitalised words and

expressions used in this announcement have the same meaning given

to them in the "Launch of Placing to fund attractive near-term

pipeline" announcement and/or "REX Retail Offer" announcement

published by the Company on 10 May 2022.

For further information, please contact:

Ecofin Advisors, LLC (Investment Manager)

Jerry Polacek

Matthew Ordway

Prashanth Prakash +1 913 981 1020

Stifel (Joint Broker and Joint Bookrunner)

Corporate:

Mark Bloomfield

Alex Miller

Jack McAlpine

Sales:

Phil Hopkins

Jonathan Crabtree +44 207 710 7600

Peel Hunt (Joint Broker, Joint Bookrunner

and REX Retail Offer Co-ordinator)

Investment Banking:

Liz Yong

Luke Simpson

Huw Jeremy

Al Rae/Sohail Akbar (ECM/Syndicate)

Sales:

Alex Howe

Richard Harris

Chris Bunstead +44 207 418 8900

Sanne Fund Services (UK) Limited (Company

Secretary)

Martin Darragh

Maria Matheou +44 203 327 9720

FTI Consulting (Financial PR)

Matthew O'Keeffe

Mitch Barltrop

Vee Montebello +44 797 607 5797

Further information on the Company can be found on its website

at

https://uk.ecofininvest.com/funds/us-renewables-infrastructure-trust-plc/

.

The Company's LEI is 2138004JUQUL9VKQWD21.

Important Information

This Announcement does not constitute or form part of, and

should not be construed as, any offer or invitation or inducement

for sale, transfer or subscription of, or any solicitation of any

offer or invitation to buy or subscribe for or to underwrite, any

share in the Company or to engage in investment activity (as

defined by the Financial Services and Markets Act 2000) in any

jurisdiction nor shall it, or any part of it, or the fact of its

distribution form the basis of, or be relied on in connection with,

any contract or investment decision whatsoever, in any

jurisdiction. This Announcement does not constitute a

recommendation regarding any securities.

The New Ordinary Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the " U.S.

Securities Act ") or with any securities regulatory authority of

any State or other jurisdiction of the United States (as defined

below), and accordingly may not be offered, sold or transferred

within the United States of America, its territories or

possessions, any State of the United States or the District of

Columbia (the "United States"). The Issue is being made outside the

United States in reliance on the exemption from the registration

requirements of the U.S. Securities Act provided by Regulation

S.

The Company has not been and will not be registered under the

U.S. Investment Company Act of 1940 (the "U.S. Investment Company

Act") and investors will not be entitled to the benefits of the

U.S. Investment Company Act. This Announcement does not constitute

an offer to sell or issue or a solicitation of an offer to buy or

subscribe for New Ordinary Shares in any jurisdiction including,

without limitation, the United States, Australia, Canada, New

Zealand Japan or South Africa or any other jurisdiction in which

such offer or solicitation is or may be unlawful (an " Excluded

Territory "). This Announcement and the information contained

herein are not for publication or distribution, directly or

indirectly, to persons in an Excluded Territory unless permitted

pursuant to an exemption under the relevant local law or regulation

in any such jurisdiction.

The distribution of this Announcement, and/or the issue of New

Ordinary Shares in certain jurisdictions may be restricted by law

and/or regulation. No action has been taken by the Company, the

Joint Bookrunners, Ecofin or any of their respective affiliates as

defined in Rule 501(b) under the U.S. Securities Act (as applicable

in the context used, "Affiliates") that would permit an offer of

the New Ordinary Shares or possession or distribution of this

Announcement or any other publicity material relating to the New

Ordinary Shares in any jurisdiction where action for that purpose

is required. Persons receiving this announcement are required to

inform themselves about and to observe any such restrictions.

Peel Hunt is authorised and regulated in the United Kingdom by

the Financial Conduct Authority (the "FCA"). Peel Hunt is acting

exclusively for the Company and for no one else (whether or not a

recipient of this announcement) in connection with the Placing and

the REX Retail Offer and will not be responsible to anyone other

than the Company for providing the protections afforded to its

clients or for providing advice in relation to the Placing, the REX

Retail Offer, Admission and/or the other arrangements referred to

in this announcement or any other matters referred to herein.

Stifel is authorised and regulated in the United Kingdom by the

FCA. Stifel is acting exclusively for the Company and for no one

else (whether or not a recipient of this announcement) in

connection with the Placing and will not be responsible to anyone

other than the Company for providing the protections afforded to

its clients or for providing advice in relation to the Placing, the

REX Retail Offer, Admission and/or the other arrangements referred

to in this announcement or any other matters referred to

herein.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("Directive 2014/65/EU"); (b)

Articles 9 and 10 of MiFID II; and (c) local implementing measures;

and/or (d) (where applicable to UK investors or UK firms) the

relevant provisions of the UK statutory instruments implementing

Directive 2014/65/EU and Commission Delegated Directive (EU)

2017/593, Regulation (EU) No 600/2014 of the European Parliament,

as they form part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended (together, the " UK MiFID Laws ")

(together, the " MiFID II Product Governance Requirements "), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the MiFID II Product Governance Requirements) may otherwise have

with respect thereto, the New Ordinary Shares have been subject to

a product approval process, which has determined that the New

Ordinary Shares are: (i) compatible with an end target market of

retail investors who do not need a guaranteed income or capital

protection and investors who meet the criteria of professional

clients and eligible counterparties, each as defined in Directive

2014/65/EU and the UK MiFID Laws (as applicable) (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of New Ordinary Shares may decline and

investors could lose all or part of their investment; the New

Ordinary Shares offer no guaranteed income and no capital

protection; and an investment in New Ordinary Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Issue.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Directive 2014/65/EU or the UK MiFID Laws; or

(b) a recommendation to any investor or group of investors to

invest in, or purchase, or take any other action whatsoever with

respect to New Ordinary Shares. Each distributor is responsible for

undertaking its own target market assessment in respect of the New

Ordinary Shares and determining appropriate distribution

channels.

PRIIPs Regulation

In accordance with the UK version of Regulation (EU) No

1286/2014 of the European Parliament and of the Council of 26

November 2014 on key information documents for packaged retail and

insurance-based investment products (PRIIPs), which forms part of

UK law by virtue of the European Union (Withdrawal) Act 2018, as

amended, a key information document in respect of the Ordinary

Shares has been prepared by the Company and is available to

investors on the Company's website

uk.ecofininvest.com/funds/ecofin-us-renewables-infrastructure-trust-plc.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAPSNFDXAEFA

(END) Dow Jones Newswires

May 20, 2022 02:01 ET (06:01 GMT)

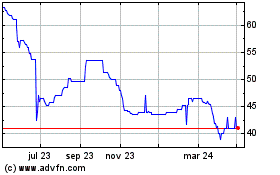

Ecofin U.s. Renewables I... (LSE:RNEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

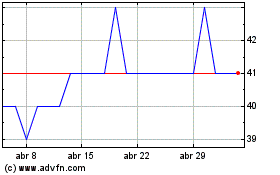

Ecofin U.s. Renewables I... (LSE:RNEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024