Ecofin US Renewables Infrastr.Trust Net Asset Value(s) (2050S)

02 Noviembre 2023 - 4:07AM

UK Regulatory

TIDMRNEW

RNS Number : 2050S

Ecofin US Renewables Infrastr.Trust

02 November 2023

2 November 2023

ECOFIN U.S. RENEWABLES INFRASTRUCTURE TRUST PLC

(the "Company")

Q3 2023 Operational Update and Net Asset Value

Ecofin U.S. Renewables Infrastructure Trust PLC today announces

an update on portfolio operations and its unaudited net asset value

("NAV") as at 30 September 2023.

Quarterly Operational Update

-- The Company's portfolio generated 52.1 GWh of clean

electricity, equivalent to powering c.19,300 households, during the

three months of Q3 2023 from a fully-contracted portfolio of

diversified assets with investment-grade equivalent off-takers and

a weighted average remaining PPA term of 13.9 years (18.6 years

excluding Whirlwind).

-- Progress continues in completing commissioning and financing

of the Echo Solar Portfolio, a 36.0 MWdc commercial solar portfolio

in Minnesota, Virginia and Delaware, including the completion of

several tax equity milestone fundings during the quarter and the

close of a back-leverage debt facility with Fifth Third Bank on 31

October 2023. Currently, three projects have achieved commercial

operation, and the three remaining projects are mechanically

complete and are being commissioned for commercial operation during

Q4 2023.

-- As announced on 27 July and 2 August 2023, the Investment

Manager continues to work closely with Whirlwind's asset and

operations managers, AEP (the owner of the Matador substation) and

the Electric Reliability Council of Texas (ERCOT) authorities to

resume operations at its 59.8 MW Whirlwind asset which has been out

of service since a tornado on 21 June 2023 destroyed the Matador

substation through which it transmits electricity.

o An updated interconnection agreement has been executed with

AEP, which allows the project to operate and dispatch power through

an alternative substation in Paducah, TX at up to 50 MW of capacity

during which time AEP will rebuild the Matador substation;

o The Company expects the temporary interconnection through

Paducah to be established by the end of November 2023;

o The Company has actively pursued business interruption

insurance in order to recoup lost revenue during the downtime since

the 21 June 2023 incident and tentatively expects proceeds to be

paid before the end of Q4 2023;

o The estimated impact of these arrangements has been reflected

in the Company's unaudited NAV as at 30 September 2023.

Q3 2023 NAV

The Company announces that its unaudited NAV as at 30 September

2023 on a cum-income basis was $0.8910 per Ordinary Share (30 June

2023: $0.9180) or $123.0 million (30 June 2023: $126.8

million).

The key contributors to the changes in NAV were:

-- a $6.1 million increase ($0.0442 per Ordinary Share) due to

updates to various assumptions including the useful life of certain

projects (Beacon 2 & 5 and the SED Solar portfolio) and O&M

and insurance expenses across the portfolio;

-- a $2.7 million decrease ($0.0198 per Ordinary Share) due to

the conversion to a third-party consultant's merchant energy price

forecast (from EIA);

-- a $6.2 million decrease ($0.0446 per Ordinary Share) due to

an increase of approximately 34 bps in the portfolio's weighted

average unlevered pre-tax discount rate to 7.4% as at 30 September,

as advised by the Company's independent third-party valuation

services provider, Marshall & Stevens;

-- a $1.6 million decrease ($0.0151 per Ordinary Share) in cash

and accrued financial assets as quarterly income did not cover

operating expenses, financing costs and dividend payments,

primarily driven by lack of revenue at Whirlwind and high

corrective O&M costs at several solar sites, and increased

insurance premiums across the portfolio; and

-- a $0.6 million increase ($0.0042 per Ordinary Share) due to a

decrease in the deferred tax accrual, largely driven by the

decrease to FMV of investments.

As part of the Strategic Review announced on 8 September 2023,

the Company has engaged several third-party consultants and

independent engineers to evaluate potential value-enhancing capital

opportunities. Subsequent to the reporting period, the Company

received preliminary findings from a congestion study of the ERCOT

zone, which is anticipated to positively impact the future

valuation of the Whirlwind project based on an outlook of reduced

curtailment events impacting the project. This outlook is largely

driven by significant expected load increases in the ERCOT west

zone from crypto-mining and oil & gas drilling activity,

limited new wind projects expected to come into the market in the

ERCOT west zone, and a large volume of production tax credits

(PTCs) existing wind projects between 2024 and 2029.

For further information, please contact:

Ecofin Advisors, LLC (Investment Manager)

Edward Russell

Eileen Fargis

Jason Benson

Michael Hart +1 913 981 1020

Peel Hunt LLP (Joint Corporate Broker)

Liz Yong

Luke Simpson

Huw Jeremy +44 20 7418 8900

Stifel (Joint Corporate Broker)

Edward Gibson-Watt

Rajpal Padam

Madison Kominski +44 20 7710 7600

Apex Listed Companies Services (UK) Limited

(Company Secretary)

Martin Darragh

Maria Matheou +44 20 3327 9720

Further information on the Company can be found on its website

at

https://uk.ecofininvest.com/funds/us-renewables-infrastructure-trust-plc/

.

The Company's LEI is 2138004JUQUL9VKQWD21.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVUPGAUGUPWGUP

(END) Dow Jones Newswires

November 02, 2023 06:07 ET (10:07 GMT)

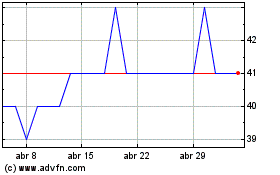

Ecofin U.s. Renewables I... (LSE:RNEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

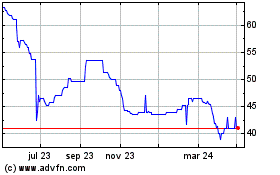

Ecofin U.s. Renewables I... (LSE:RNEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024