Renold PLC Acquisition of Industrias YUK S.A. (8559U)

04 Agosto 2022 - 1:00AM

UK Regulatory

TIDMRNO

RNS Number : 8559U

Renold PLC

04 August 2022

4 August 2022

Renold plc

("Renold", the "Company" or the "Group")

Acquisition of Industrias YUK S.A.

Renold, a leading international supplier of industrial chains

and related power transmission products, is pleased to announce

that it has acquired the entire issued share capital of Industrias

YUK S.A. ("YUK"), (the "Acquisition") for a total cash

consideration of EUR24 million.

Highlights

-- Established in 1964, YUK is a Valencia-based, manufacturer

and distributor of high quality conveyor chain ("CVC") and

ancillary products.

-- YUK's well invested CVC manufacturing facility, based near

Valencia, Spain, adds a high quality European based CVC manufacturing

capability to Renold's current transmission ("TRC") and tooth

chain manufacturing capability in Europe.

-- The acquisition substantially increases the Group's access

to the Iberian Chain market, where historically it has been

under represented.

-- Opportunities exist for meaningful manufacturing synergies

between YUK and Renold's current international operations.

-- The Acquisition will allow Renold to leverage YUK's strong

CVC market position in Spain and Portugal to expand sales

of the Group's existing range of premium European TRC products,

and enable sales of YUK products throughout Renold's extensive

European sales network, beyond Iberia.

-- The YUK management team, which brings many years of industry

and market knowledge, will transfer to the Group on completion

of the Acquisition, and continue to lead YUK, joining Renold's

European management team.

-- The Acquisition is expected to be immediately enhancing to

Group earnings per share, as well as accretive to the Group's

operating margin.

-- ROIC is expected to be in line with management's targets.

The Acquisition and Financial Considerations

YUK is being acquired, subject to normal completion accounts

adjustments, on a cash free, debt free basis, and will consist of

an initial cash consideration of EUR20.0 million, followed by two

further cash payments of EUR2.0 million each, payable 12 months and

24 months from the date of completion of the Acquisition.

The total consideration for the Acquisition of EUR24.0 million

represents an acquisition multiple of c. 7.6x June 2022 LTM EBITDA.

Identified cost synergies will reduce the multiple comfortably

below 7.0x, with additional benefits to be expected through

commercial collaboration.

The Acquisition will be funded utilising the Group's existing

borrowing facilities. As at 31 March 2022, the Group's net debt to

EBITDA multiple was 0.6x and following completion of the

Acquisition, is expected to remain below 1.5x. This allows the

Group to retain sufficient headroom to execute on an identified

pipeline of further bolt-on opportunities.

YUK delivered revenue of EUR18.6m for the 12 month period ended

June 2022, generating an EBITDA of EUR3.1m million.

Commenting on the Acquisition, Robert Purcell, Group Chief

Executive of Renold plc, said:

"We are delighted that YUK is to join the Renold Group and that

not only are we buying an excellent business, but also retaining

the services of a very talented group of managers and employees.

The acquisition of YUK considerably expands and strengthens our

European Conveyor Chain offering, while also allowing us to grow

within the Iberian market. YUK has a long-established track record

of manufacturing and supplying high quality chain products which

fit well with our own premium product offering.

"The acquisition is expected to be earnings enhancing from year

one and gives rise to considerable business synergies. We are

delighted to welcome the YUK team as part of the Renold family of

companies."

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014), as it forms part of domestic law by

virtue of the European Union (Withdrawal) Act 2018) ("MAR") prior

to its release as part of this announcement and is disclosed in

accordance with the Company's obligations under Article 17 of those

Regulations.

ENQUIRIES:

Renold plc IFC Advisory Limited

Robert Purcell, Chief Executive Tim Metcalfe

Jim Haughey, Group Finance Director Graham Herring

renold@investor-focus.co.uk

0161 498 4500 020 3934 6630

Nominated Adviser and Joint Joint Broker

Broker

Peel Hunt LLP FinnCap Limited

Mike Bell Ed Frisby / Tim Harper (Corporate

Finance)

Ed Allsopp Andrew Burdis / Harriet Ward

(ECM)

020 7418 8900 020 7220 0500

NOTES FOR EDITORS

Renold is a global leader in the manufacture of industrial

chains and also manufactures a range of torque transmission

products which are sold throughout the world to a broad range of

original equipment manufacturers and distributors. The Company has

a well-deserved reputation for quality that is recognised

worldwide. Its products are used in a wide variety of industries

including manufacturing, transportation, energy, steel and

mining.

Further information about Renold can be found on the website at:

www.renold.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFFFFLTDIVIIF

(END) Dow Jones Newswires

August 04, 2022 02:00 ET (06:00 GMT)

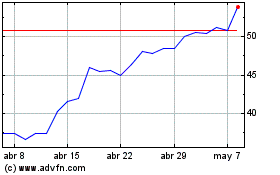

Renold (LSE:RNO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Renold (LSE:RNO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024