TIDMRSE

RNS Number : 4265J

Riverstone Energy Limited

16 August 2023

LEI: 213800HAZOW1AWRSZR47

Riverstone Energy Limited

Results for the half year ended 30 June 2023

London, UK (16 August 2023) - Riverstone Energy Limited ("REL"

or the "Company") announces its Half Year Results from 1 January

2023 to 30 June 2023 (the "Period").

Summary Performance

30 June 2023

NAV $604 million[1] (GBP479 million)[2]

NAV per share $12.90 / GBP10.23(2)

Profit/(loss) for Period ended ($105.3 million)

Basic profit/(loss) per share for (213.18 cents)

Period ended

Total liquidity (cash and cash $396 million (GBP315 million)(2)

equivalents & public portfolio)

Market capitalisation $334 million (GBP265 million)(2)

Share price $7.14 / GBP5.66(2)

Highlights

-- As of 30 June 2023, REL had a NAV per share of $12.90

(GBP10.23), representing a decrease in USD and GBP of 11 and 15 per

cent., respectively, compared to the 31 December 2022 NAV.

-- Enviva, Anuvia and GoodLeap were the largest drivers of REL's

NAV downturn over the Period.

-- During the Period, under the Company's modified investment

programme, the Company invested $4.5 million in two existing

decarbonisation investments, bringing the total invested in this

area to $214 million, which, in aggregate, were valued at $156

million, or 0.73x Gross MOIC, at 30 June 2023.

-- Total invested capital during the Period of $4.5 million:

Enviva ($3.5 million) and Our Next Energy ($1.0 million).

-- Total net realisations and distributions during the Period of

$54.3 million: Permian Resources ($28.1 million), Onyx ($20.2

million), Carrier II ($4.6 million), and an aggregate of $1.4

million from Hammerhead, Tritium DCFC and Enviva

-- REL finished the Period with a cash balance of $133 million

and remaining potential unfunded commitments of $6 million[3].

-- Since the initial announcement of the Share Buyback Programme

on 1 May 2020, the Company has bought back a total of 33,096,218

ordinary shares at an average price of approximately GBP4.12 per

ordinary share, which has contributed to the share price increase

of 157 per cent. from GBP2.20 to GBP5.66 over the period to 30 June

2023.

Share Buyback Programme

Since the Company's announcement on 24 May 2023 of the

authorized increase of GBP30 million for the share buyback

programme, 1,703,495 ordinary shares have been bought back at a

total cost of approximately GBP9.7 million ($12.2 million) at an

average share price of approximately GBP5.70 ($7 .18). As of 30

June 2023, GBP29.5 million was available for repurchasing.

In addition, pursuant to changes to the Investment Management

Agreement announced on 3 January 2020, the Investment Manager

agreed for the Company to be required to repurchase shares or pay

dividends equal to 20 per cent. of net gains on dispositions. No

further carried interest will be payable until the $193 million of

realised and unrealised losses to date at 30 June 2023 are made

whole with future gains. REL continues to seek opportunities to

purchase shares in the market at prices at or below the prevailing

NAV per share.

Investment Manager Outlook

-- REL's $130 million aggregate net cash balance at 30 June 2023

makes the Company well positioned to both fund the capital needs of

the portfolio, make new investments, and weather the difficult

capital formation environment.

-- REL's portfolio will continue to benefit from foundational

value in its legacy energy investments, widely recognized as

requisite for a just and equitable energy transition, and

anticipates uplift from the tech-driven business in which the

Investment Manager has invested under the modified investment

programme.

-- The energy transition and decarbonisation space continues to

benefit from macroeconomic and regulatory tailwinds which offer

advantageous risk-reward investment opportunities. While the

Investment Manager continues to pursue energy transition and

decarbonisation assets, it is primarily focussed on supporting

existing portfolio companies to optimize operational efficiency,

manage liquidity, and support capital formation in a persistently

difficult fundraising environment for tech-heavy growth-stage

companies.

Richard Horlick, Chair of the Board of Riverstone Energy

Limited, commented:

"As the demand for energy and sustainable business models and

practices continues to grow, REL sits well-positioned to benefit.

We are pleased both with the consistent performance of the legacy

commodity-linked portfolio and confident in the prospects of

investments made under the modified investment programme. Whether

supporting a just and equitable energy transition or

decarbonisation writ large, both aspects of the portfolio stand to

benefit from the already substantial and growing macroeconmic and

regulatory tailwinds bolstering sector growth."

David M. Leuschen and Pierre F. Lapeyre Jr., Co-Founders of

Riverstone, added:

"Economic volatility seeded in geopolitical uncertainty and

systematic risk to the financial sector dominated market and,

consequently, portfolio performance through the first six months of

the year. We believe strongly that the current REL portfolio is

balanced to take advantage of imminent uplift driven by undeniable

and widespread support for decarbonisation and supported by a

strong foundation in mission critical, reliable energy assets. We

will continue to focus on portfolio management and deploy our

capital in the most profitable manner for our shareholders, be it

in new decarbonisation investments or share repurchases."

- Ends -

Riverstone Energy Limited's 2023 Interim Report is available to

view at: www.RiverstoneREL.com .

2Q23 Quarterly Portfolio Valuation

Previously, on 27 July 2023, REL announced its quarterly

portfolio summary as of 30 June 2023, inclusive of updated

quarterly unaudited fair market valuations:

Current Portfolio - Conventional

Gross

Gross Gross Realised 30 Jun

Gross Invested Realised Unrealised Capital & 31 Mar 2023

Investment Committed Capital Capital Value Unrealised 2023 Gross

(Public/Private) Capital ($mm) ($mm) ($mm)[4] ($mm)[5] Value ($mm) Gross MOIC(5) MOIC(5)

------------------- ------------- --------- ---------- ------------- ------------- -------------- -------------

Permian

Resources[6]

(Public) 268 268 223 110 333 1.22x 1.24x

Onyx ( Private

) 66 60 81 98 179 3.00x 3.00x

Hammerhead(6)

(Public) 308 296 24 111 135 0.48x 0.46x

Total Current

Portfolio

- Conventional

- Public[7] $576 $564 $ 246 $222 $468 0.83x 0.83x

------------------- ------------- --------- ---------- ------------- ------------- -------------- -------------

Total Current

Portfolio

- Conventional

- Private(7) $66 $60 $ 81 $98 $179 3.00x 3.00x

------------------- ------------- --------- ---------- ------------- ------------- -------------- -------------

Total Current

Portfolio

- Conventional

- Public

& Private(7) $642 $624 $328 $320 $647 1.04x 1.04x

------------------- ------------- --------- ---------- ------------- ------------- -------------- -------------

Current Portfolio - Decarbonisation

Gross

Gross Gross Gross Realised

Committed Invested Realised Unrealised Capital & 31 Mar 30 Jun

Investment Capital Capital Capital Value Unrealised 2023 2023

(Public/Private) ($mm) ($mm) ($mm)(4) ($mm)(5) Value ($mm) Gross MOIC(5) Gross MOIC(5)

GoodLeap (formerly

Loanpal) (Private) 25 25 2 36 38 1.80x 1.50x

FreeWire (Private) 10 10 - 20 20 2.00x 2.00x

Infinitum (Private) 18 18 - 18 18 1.30 1.05x

Solid Power

6 (Public) 48 48 - 18 18 0.64x 0.39x

T-REX Group

(Private) 18 18 - 18 18 1.00x 1.00x

Tritium DCFC

6 25 25 1 13 14 0.75x 0.56x

(Public)

Our Next Energy

(Private) 13 13 - 13 13 1.00x 1.00x

Enviva 6 (Public) 22 22 0 8 9 1.04x 0.41x

Group14 (Private) 4 4 - 4 4 1.00x 1.00x

Ionic I & II

(Samsung Ventures)

(Private) 3 3 - 3 3 1.00x 1.00x

Hyzon Motors

6 (Public) 10 10 - 1 1 0.08x 0.10x

Anuvia Plant

Nutrients

(Private) 20 20 - - - 0.70x 0.00x

Total Current

Portfolio -

Decarbonisation

- Public(7) $105 $105 $1 $41 $43 0.57x 0.41x

--------------------- ------------ --------- ---------- ------------- ------------- ------------- -------------

Total Current

Portfolio -

Decarbonisation

- Private(7) $109 $109 $2 $111 $113 1.27x 1.03x

--------------------- ------------ --------- ---------- ------------- ------------- ------------- -------------

Total Current

Portfolio -

Decarbonisation

- Public &

Private(7) $214 $214 $3 $152 $156 0.92x 0.73x

--------------------- ------------ --------- ---------- ------------- ------------- ------------- -------------

Total Current

Portfolio -

Conventional

& Decarbonisation

- Public &

Private(7) $856 $837 $331 $472 $803 1.01x 0.96x

--------------------- ------------ --------- ---------- ------------- ------------- ------------- -------------

Cash and Cash Equivalents $133

----------------------------------- --------- ---------- ------------- ------------- ------------- -------------

Total Liquidity (Cash and Cash Equivalents

& Public Portfolio) $396

---------------------------------------------------------- ------------- ------------- ------------- -------------

Total Market Capitalisation $334

----------------------------------- --------- ---------- ------------- ------------- ------------- -------------

Realisations

Gross

Gross Gross Gross Realised 31 Mar

Investment Committed Invested Realised Unrealised Capital & 2023 30 Jun

(Initial Investment Capital Capital Capital Value Unrealised Gross 2023

Date) ($mm) ($mm) ($mm)(4) ($mm)(5) Value ($mm) MOIC(5) Gross MOIC(5)

Rock Oil

([8]) (12

Mar 2014) 114 114 233 3 236 2.06x 2.06x

Three Rivers

III (7 Apr

2015) 94 94 204 - 204 2.17x 2.17x

ILX III (8

Oct 2015) 179 179 172 - 172 0.96x 0.96x

Meritage

III[9] (17

Apr 2015) 40 40 88 - 88 2.20x 2.20x

RCO [10]

(2 Feb 2015) 80 80 80 - 80 0.99x 0.99x

Carrier II

(22 May 2015) 110 110 67 - 67 0.60x 0.61x

Pipestone

Energy (formerly

CNOR) (29

Aug 2014) 90 90 58 - 58 0.64x 0.64x

Sierra (24

Sept 2014) 18 18 38 - 38 2.06x 2.06x

Aleph (9

Jul 2019) 23 23 23 - 23 1.00x 1.00x

Ridgebury

(19 Feb 2019

) 18 18 22 - 22 1.22x 1.22x

Castex 2014 52 52 14 - 14 0.27x 0.27x

(3 Sep 2014)

---------------------- ------------ --------- ------------ ----------- ------------ ------------- -------------

Total

Realisations(7) $819 $819 $1,000 $3 $1,002 1.22x 1.22x

---------------------- ------------ --------- ------------ ----------- ------------ ------------- -------------

Withdrawn

Commitments

and Impairments[11] 350 350 9 - 9 0.02x 0.02x

---------------------- ------------ --------- ------------ ----------- ------------ ------------- -------------

Total Investments(7) $2,024 $2,006 $1,339 $475 $1,813 0.91x 0.90x

---------------------- ------------ --------- ------------ ----------- ------------ ------------- -------------

Total Investments & Cash and Cash Equivalents $607

------------------------------------------------------------- ----------- ------------ ------------- -------------

Draft Unaudited Net Asset Value $605

------------------------------------------------------------- ----------- ------------ ------------- -------------

Total Shares Repurchased to-date 33,096,218 at average price per share of

GBP4.12 ($5.28)

------------------------------------------------------------- ----------- ------------------------------------------

Current Shares Outstanding 46,800,513

------------------------------------------------------------- ----------- ------------ ------------- -------------

About Riverstone Energy Limited:

REL is a closed-ended investment company which invests in the

energy industry that has since 2020 been exclusively focussed on

pursuing and has committed $193 million to a global strategy across

decarbonization sectors presented by Riverstone's investment

platform. REL's ordinary shares are listed on the London Stock

Exchange, trading under the symbol RSE. REL has 15 active

investments spanning decarbonisation, oil and gas, renewable energy

and power in the Continental U.S., Western Canada, Europe and

Australia.

For further details, see www.RiverstoneREL.com

Neither the contents of Riverstone Energy Limited's website nor

the contents of any website accessible from hyperlinks on the

websites (or any other website) is incorporated into, or forms part

of, this announcement.

Media Contacts

For Riverstone Energy Limited:

Josh Prentice

+44 20 3206 6300

Note:

The Investment Manager is charged with proposing the valuation

of the assets held by REL through the Riverstone Energy Investment

Partnership, LP ("Partnership"). The Partnership has directed that

securities and instruments be valued at their fair value. REL's

valuation policy follows IFRS and IPEV Valuation Guidelines. The

Investment Manager values each underlying investment in accordance

with the Riverstone valuation policy, the IFRS accounting standards

and IPEV Valuation Guidelines. The Investment Manager has applied

Riverstone's valuation policy consistently quarter to quarter since

inception. The value of REL's portion of that investment is derived

by multiplying its ownership percentage by the value of the

underlying investment. If there is any divergence between the

Riverstone valuation policy and REL's valuation policy, the

Partnership's proportion of the total holding will follow REL's

valuation policy. There were no valuation adjustments recorded by

REL as a result of differences in IFRS and U.S. Generally Accepted

Accounting Policies for the period ended 30 June 2023 or in any

period to date. Valuations of REL's investments through the

Partnership are determined by the Investment Manager and disclosed

quarterly to investors, subject to Board approval.

Riverstone values its investments using common industry

valuation techniques, including comparable public market valuation,

comparable merger and acquisition transaction valuation, and

discounted cash flow valuation.

For development-type investments, Riverstone also considers the

recognition of appreciation or depreciation of subsequent financing

rounds, if any. For those early stage privately held companies

where there are other indicators of a decline in the value of the

investment, Riverstone will value the investment accordingly even

in the absence of a subsequent financing round.

Riverstone reviews the valuations on a quarterly basis with the

assistance of the Riverstone Performance Review Team ("PRT") as

part of the valuation process. The PRT was formed to serve as a

single structure overseeing the existing Riverstone portfolio with

the goal of improving operational and financial performance.

The Board reviews and considers the valuations of the Company's

investments held through the Partnership.

[1] Since REL has not yet met the appropriate Cost Benchmark at

30 June 2023, $29.6 million in Performance Allocation that would

have been due under the prior agreement were not accrued, and

thereby would have reduced the NAV on a pro forma basis to $574

million or $12.27 per share

[2] GBP:USD FX rate of 1.2614 as of 30 June 2023

[3] Excludes the remaining unfunded commitment for Hammerhead of

$12.2 million, which is not expected to be funded. The expected

funding of the remaining unfunded commitments at 30 June 2023 are

$nil and $nil for the remainder of 2023 & 2024. The residual

amounts are to be funded as needed in 2025 and later years.

[4] Gross realised capital is total gross proceeds realised on

invested capital. Of the $1,339 million of capital realised to

date, $1,016 million is the return of the cost basis, and the

remainder is profit.

[5] Gross Unrealised Value and Gross MOIC (Gross Multiple of

Invested Capital) are before transaction costs, taxes

(approximately 21 to 27.5 per cent. of U.S. sourced taxable income)

and 20 per cent. carried interest on applicable gross profits in

accordance with the revised terms announced on 3 January 2020, but

effective 30 June 2019. Since there was no netting of losses

against gains before the aforementioned revised terms, the

effective carried interest rate on the portfolio as a whole will be

greater than 20 per cent. No further carried interest will be

payable until the $192.6 million of realised and unrealised losses

to date at 30 June 2023 are made whole with future gains, so the

earned carried interest of $0.8 million at 30 June 2023 has been

deferred and will expire in October 2023 if the aforementioned

losses are not made whole. Since REL has not yet met the

appropriate Cost Benchmark at 30 June 2023, $29.6 million in

Performance Allocation fees that would have been due under the

prior agreement were not accrued. In addition, there is a

management fee of 1.5 per cent. of net assets (including cash) per

annum and other expenses. Given these costs, fees and expenses are

in aggregate expected to be considerable, Total Net Value and Net

MOIC will be materially less than Gross Unrealised Value and Gross

MOIC. Local taxes, primarily on U.S. assets, may apply at the

jurisdictional level on profits arising in operating entity

investments. Further withholding taxes may apply on distributions

from such operating entity investments. In the normal course of

business, REL may form wholly-owned subsidiaries, to be treated as

C Corporations for US tax purposes. The C Corporations serve to

protect REL's public investors from incurring U.S. effectively

connected income. The C Corporations file U.S. corporate tax

returns with the U.S. Internal Revenue Service and pay U.S.

corporate taxes on its taxable income.

([6]) Represents closing price per share in USD for publicly

traded shares Permian Resources Corporation (formerly Centennial

Resource Development, Inc.) (NASDAQ:PR - 30-06-2023: $10.96 per

share / 31-03-2023: $10.50 price per share); Enviva, Inc. (NYSE:EVA

- 30-06-2023: $10.85 per share / 31-03-2023: $28.88 price per

share); Solid Power, Inc. (NASDAQ:SLDP - 30-06-2023: $2.54 per

share / 31-03-2023: $3.01 price per share); Hyzon Motors, Inc.

(NASDAQ:HYZN - 30-06-2023: $0.96 per share / 31-03-2023: $0.82

price per share); Tritium DCFC Limited (NASDAQ:DCFC - 30-06-2023:

$1.09 price per share / 31-03-2023 $1.28 price per share); and

Hammerhead Energy, Inc. (NASDAQ: HHRS - 30-06-2023: $7.25 per share

/ 31-03-2023: $7.75 per share). )

[7] Amounts vary due to rounding

[8] The unrealized value of Rock Oil investment consists of

rights to mineral acres

[9] Midstream investment

[10] Credit investment

[11] Withdrawn commitments consist of Origo ($9 million) and

CanEra III ($1 million), and impairments consist of Liberty II

($142 million), Fieldwood ($80 million), Eagle II ($62 million) and

Castex 2005 ($48 million)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KELFFXVLFBBE

(END) Dow Jones Newswires

August 16, 2023 02:00 ET (06:00 GMT)

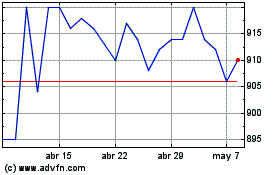

Riverstone Energy (LSE:RSE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Riverstone Energy (LSE:RSE)

Gráfica de Acción Histórica

De May 2023 a May 2024