TIDMRSG

RNS Number : 0566K

Resolute Mining Limited

22 August 2023

22 August 2023

Appendix 4D

Half Year Report for the six months ended 30 June 2023

Reporting Period

The reporting period is for the half year ended 30 June 2023

with the corresponding reporting period being for the six months

ended 30 June 2022.

Results for Announcement to the Market

30 June 30 June Increase Increase

2023 2022

$'000 $'000 $'000 %

---------------------------------------- --------- --------- ---------- -----------

Revenues from ordinary activities 329,499 317,658 11,841 4%

Earnings before interest, tax,

depreciation, amortisation and

fair value adjustments (EBITDA) 101,378 78,416 22,962 29%

Profit/(loss) after income tax 87,679 (24,146) 111,825 463%

Profit/(loss) from ordinary activities

after income tax attributable to

members/net profit for the year 73,842 (24,286) 98,128 404%

---------------------------------------- --------- --------- ---------- -----------

Dividend Information

Amount per share Franked amount per share

$ $

------------------------------------------------------ ----------------- -------------------------

Interim dividend for the half-year ended 30 June 2023 Nil Nil

------------------------------------------------------ ----------------- -------------------------

Net Tangible Assets

30 June 2023 31 December 2022

$ $

------------------------------- -------------- ------------------

Net tangible assets per share 0.25 0.22

------------------------------- -------------- ------------------

This half year report should be read in conjunction with the

most recent annual financial report for the year ended

31 December 2022. All dollar figures are United States dollar

($) currency unless otherwise stated.

Corporate Directory

Directors Share Registry

Non-Executive Chairman Martin Botha Computershare Investor Services

Managing Director & CEO Terence Pty Limited

Holohan Level 11, 172 St Georges Terrace

Non-Executive Director Simon Jackson Perth, Western Australia 6000

Non-Executive Director Mark Potts Home Exchange

Non-Executive Director Sabina Shugg Australian Securities Exchange

Non-Executive Director Adrian Reynolds Level 40, Central Park

Non-Executive Director Keith Marshall 152 St Georges Terrace

Company Secretary Perth, Western Australia 6000

Richard Steenhof

Registered Office Quoted on the official lists of

Level 2, Australia Place the

15-17 William Street Australian Securities Exchange (ASX)

Perth, Western Australia 6000 and London Stock Exchange (LSE)

PO Box 7232 Cloisters Square ASX/LSE Ordinary Share Code: "RSG"

Perth, Western Australia 6850 Securities on Issue (30/06/2023)

Telephone: + 61 8 9261 6100 Ordinary Shares 2,129,006,569

Facsimile: + 61 8 9322 7597 Performance Rights 23,795,006

Email: contact@rml.com.au Auditor

Australian Business Number Ernst & Young

ABN 39 097 088 689 Ernst & Young Building

Website 11 Mounts Bay Rd

Resolute Mining Limited maintains Perth, Western Australia 6000

a website where all announcements

are available: www.rml.com.au Shareholders wishing to receive

copies of Resolute's ASX announcements

by e-mail should register their

interest by contacting the Company

at contact@rml.com.au

Table of Contents

Directors' Report

Auditor's Independence Declaration 9

Consolidated Statement of Comprehensive Income 10

Consolidated Statement of Financial Position

Consolidated Statement of Changes in Equity

Consolidated Cash Flow Statement

Notes to the Financial Statements

Directors' Declaration 23

Directors' Report

Your directors present their half year report on the

consolidated entity (referred to hereafter as the "Group" or

"Resolute") consisting of Resolute Mining Limited and the entities

it controlled at the end of or during the half year ended 30 June

2023 (H1 2023).

Corporate Information

Resolute Mining Limited ("Resolute" or "the Company") is a

company limited by shares that is incorporated and domiciled in

Australia.

Directors

The names of the Company's directors in office during the entire

half year period and until the date of this report are set out

below. Directors were in office for this entire period unless

otherwise stated.

Martin Botha (Non-Executive Chairman)

Terence Holohan (Managing Director and CEO)

Simon Jackson (Non-Executive Director)

Mark Potts (Non-Executive Director)

Sabina Shugg (Non-Executive Director)

Adrian Reynolds (Non-Executive Director)

Keith Marshall (Non-Executive Director) (appointed 19 June

2023)

Company Secretary

Richard Steenhof

Key Highlights

Key highlights for half year ended 30 June 2023 include:

-- Production (gold poured) for H1 of 176,629 ounces (oz) compared to 170,903oz in H1 2022.

-- All-In Sustaining Cost (AISC) of $1,469/oz for the first half

of the year, which is stable compared H1 2022.

-- H1 gold sales of 173,058oz at an average realised gold price

of $1,906/oz compared to 173,717oz at an average realised gold

price of $1,824/oz in H1 2022.

-- Cash generation of $17.3 million excluding interest payments

and working capital movements. H1 capital expenditure of $36.7

million with non-sustaining capital of $18.6 million, sustaining

capital expenditure of $15.6 million, and exploration spend of $2.5

million.

-- Net Debt of $17.2 million (down 14% from $19.9 million in

Q1-2023), including Cash and Bullion of $85.7 million. Available

liquidity (Cash, Bullion and undrawn Revolving Credit Facility

(RCF)) of $165.7 million.

Operations Review

In H1 2023, a total of 176,630oz of gold was produced (poured)

at an All-In Sustaining Cost (AISC) of $1,469/oz with total gold

sales of 173,058oz at an average realised price of $1,906/oz.

During H1 2023, 2.9 million tonnes (Mt) of ore was milled at an

average grade of 2.25 grams per tonne (g/t Au) for 178,795oz of

gold recovered.

Directors' Report

Production and Cost Summary for H1 2023

Units Syama Syama Syama Mako Group

sulphide oxide Total Total

UG Lateral Development m 2,191 - 2,191 - 2,191

------- ----------- ----------- ----------- ----------- -----------

UG Vertical Development m 20 - 20 - 20

------- ----------- ----------- ----------- ----------- -----------

Total UG Development m 2,211 - 2,211 - 2,211

------- ----------- ----------- ----------- ----------- -----------

UG Ore Mined t 1,153,689 - 1,153,689 - 1,153,689

------- ----------- ----------- ----------- ----------- -----------

UG Grade Mined g/t 2.87 - 2.87 - 2.87

------- ----------- ----------- ----------- ----------- -----------

OP Operating Waste BCM - 3,932,837 3,932,837 3,765,640 7,698,477

------- ----------- ----------- ----------- ----------- -----------

OP Ore Mined BCM - 470,994 470,994 472,184 943,178

------- ----------- ----------- ----------- ----------- -----------

OP Grade Mined g/t - 1.69 1.69 1.91 1.80

------- ----------- ----------- ----------- ----------- -----------

Total Ore Mined t 1,153,689 972,309 2,125,998 1,334,922 3,460,920

------- ----------- ----------- ----------- ----------- -----------

Total Tonnes Processed t 1,074,980 809,849 1,884,829 1,047,790 2,932,619

------- ----------- ----------- ----------- ----------- -----------

Grade Processed g/t 2.94 1.55 2.34 2.09 2.25

------- ----------- ----------- ----------- ----------- -----------

Recovery % 79.2 82.9 80.7 92.0 84.8

------- ----------- ----------- ----------- ----------- -----------

Gold Recovered oz 80,505 33,327 113,832 64,963 178,795

------- ----------- ----------- ----------- ----------- -----------

Gold in Circuit Drawdown/(Addition) oz (775) (271) (1,046) (1,120) (2,166)

------- ----------- ----------- ----------- ----------- -----------

Gold Poured oz 79,730 33,056 112,786 63,843 176,629

------- ----------- ----------- ----------- ----------- -----------

Gold Bullion in Metal

Account Movement (Increase)/Decrease oz (1,909) (986) (2,895) (677) (3,572)

------- ----------- ----------- ----------- ----------- -----------

Gold Sold oz 77,822 32,070 109,892 63,166 173,058

------- ----------- ----------- ----------- ----------- -----------

Achieved Gold Price $/oz - - - - 1,906

------- ----------- ----------- ----------- ----------- -----------

Mining $/oz 489 561 510 719 586

------- ----------- ----------- ----------- ----------- -----------

Processing $/oz 517 602 542 396 489

------- ----------- ----------- ----------- ----------- -----------

Site Administration $/oz 155 297 197 119 169

------- ----------- ----------- ----------- ----------- -----------

Site Operating Costs $/oz 1,161 1,460 1,249 1,234 1,244

------- ----------- ----------- ----------- ----------- -----------

Royalties $/oz 111 109 110 95 107

------- ----------- ----------- ----------- ----------- -----------

By-Product Credits

+ Corp Admin $/oz (3) (3) (3) - 38

------- ----------- ----------- ----------- ----------- -----------

Total Cash Operating

Costs $/oz 1,269 1,566 1,356 1,329 1,389

------- ----------- ----------- ----------- ----------- -----------

Sustaining Capital $/oz 103 218 137 3 88

------- ----------- ----------- ----------- ----------- -----------

Non-cash adjustments $/oz 9 (17) 1 (24) (8)

------- ----------- ----------- ----------- ----------- -----------

All-In Sustaining Cost

(AISC)

AISC is calculated

on gold poured $/oz 1,381 1,767 1,494 1,308 1,469

------- ----------- ----------- ----------- ----------- -----------

Directors' Report

Syama Gold Mine

At the Syama Gold Mine in Mali (Syama), gold production for 6

months to 30 June 2023 was 112,787oz at an AISC of $1,494/oz.

Sulphide Operations

During the six months ending 30 June 2023, gold production from

the Syama sulphide circuit was 79,731oz at an AISC of $1,381/oz.

Gold production increased by 9% in H1 2023 compared to H1 2022

despite maintenance carried out on the tertiary crusher which has

been scheduled for replacement in H2 2023. The improved performance

was due to higher grades milled and higher plant throughput

achieved prior to the crusher breakdown. Syama sulphide AISC per

ounce poured decreased by 2% due to steps being taken to

sustainably reduce cost at the operations.

Oxide Operations

During the first half of 2023, production was 33,056oz at an

AISC of $1,767/oz. Ore tonnes continued to be sourced from the

Tabakoroni Splay pit and Syama North at Paysans and Folona.

Preparatory activities involving stripping and grade control were

stepped up during the first half of the year in readiness to mine

the A21 pit.

During H1 2023, total tonnes processed from the Syama oxide

circuit was 9% higher compared to H1 2022 despite the lower

recovery rate on account of the higher organic carbon content in

the mill feed during the second quarter of the year - the mining of

this ore was immediately curtailed.

Exploration

Total exploration expenditure for the first half of 2023 was

$9.0 million (made up of $2.5 million of capital and $6.5 million

of exploration expenditure) with the majority of the focus on Syama

North.

An updated Mineral Resource estimate for Syama North was

announced on 19 January 2023 with an increase to 34 million tonnes

at 2.9g/t Au for 3.18 million ounces.

The infill drilling program at Syama North, which commenced in

early 2023, has continued throughout the year with the strategy of

converting inferred resources to indicated category. This program

was completed in late June and after the return of analytical

results, the Mineral Resource Estimate will be updated. Resolute is

expected to provide an updated Mineral Resource model for Syama

North during Q3 2023 which will further feed and optimise the Syama

Phase I Expansion study.

Diamond drilling continues at Syama North with the focus now on

expanding the Mineral Resource, given the recent completion of the

in-fill drilling for Ore Reserves, as the deposit remains open

along strike and down dip.

Oxide Mineral Resources exploration has been ongoing throughout

2023 in Syama with Reverse Circulation drilling on several newly

identified targets. This program will continue for the remainder of

2023.

Exploration activities continued in Senegal with drilling

programs carried out on the Petowal Mining Lease and the Laminia

Joint Venture which is located 10km east of Petowal.

In Guinea, surface exploration programs undertaken in the past

two years have identified a strong gold anomaly in the western

portion of the Niagassola Research Permit which is now named the

Mansala prospect. Reverse Circulation (RC) drilling at the Mansala

Prospect has intersected encouraging gold mineralisation. Drilling

continues, and a more detailed report will be announced in Q3

2023.

Mako Gold Mine

During H1 2023, production from the Mako Gold Mine was 63,843oz

at an AISC of $1,308/oz. During H1 2023, production decreased by 5%

due to the planned focus on mining the medium grade sections of the

ore body while the scheduled waste stripping continued to expose

higher grade ore to be mined later in the year.

Directors' Report

Financial Overview

Profit and Loss Analysis H1 2023 H1 2022

($'000s) Group Group

-------------------------------------------------------------- ---------- ----------

Revenue 329,499 317,658

Cost of sales excluding depreciation and amortisation (182,551) (193,116)

Royalties and other operating expenses (29,777) (30,030)

Administration and other corporate expenses (9,081) (7,562)

Share-Based payments expense (344) (291)

Exploration and business development expenditure (6,368) (8,187)

---------- ----------

EBITDA 101,378 78,472

-------------------------------------------------------------- ---------- ----------

Depreciation and amortisation (47,459) (43,566)

Net interest and finance costs (7,121) (5,725)

NRV inventory movements and unrealised treasury transactions 37,924 (35,440)

Other 352 3,702

Indirect tax expense (5,273) (5,451)

-------------------------------------------------------------- ---------- ----------

Net profit/ (loss) before tax 79,801 (8,008)

-------------------------------------------------------------- ---------- ----------

Income tax benefit/ (expense) 7,878 (16,138)

-------------------------------------------------------------- ---------- ----------

Net income/ (loss) after tax 87,679 (24,146)

-------------------------------------------------------------- ---------- ----------

Financial Performance

Revenue for H1 2023 was $329.5 million, from gold sales of

173,058oz at an average realised price of $1,906/oz. Earnings

before interest, tax, depreciation, and amortisation (EBITDA) was

$101.4 million. In H1 2023 the Group reversed historic provisions

related to the tax exoneration in Senegal totalling $26.1 million.

This resulted in an increase of $16.4 million to EBITDA relating to

the reversal of operating costs. Resolute reported a Net Profit

After Tax of $87.7 million. Resolute continued to invest in the

business in H1 2023 with capital expenditures on development,

property, plant and equipment totalling $36.7 million, and

exploration and evaluation expenditure of $4.6 million.

Directors' Report

Financial Position

As at 30 June 2023, Resolute had cash of $65.8 million and

bullion with a market value of $20.0 million. In addition at 30

June 2023 the Company had listed investments with a market value of

$8.5 million and Promissory notes and contingent consideration

receivable carried at $53.4 million. The Group's net debt inclusive

of the syndicated facilities and in-country overdraft facilities

was $17.2 million at 30 June 2023. Resolute also held receivables

of $17.6 million associated with Malian VAT paid and

refundable.

Significant Events After Balance Date

Since the end of the period and to the date of this report, no

matter or circumstance has arisen that has significantly affected,

or may significantly affect, the operations of the Group, the

results of operation or the state of affairs of the consolidated

group in subsequent periods.

Auditor's Independence

Refer to page 9 for a copy of the Auditor's Independence

Declaration to the Directors of Resolute Mining Limited.

Rounding

Resolute is a company of the kind specified in Australian

Securities and Investments Commission Corporations (Rounding in

Financial Directors' Reports) Instrument 2016/191. In accordance

with that Instrument, amounts in the financial report and the

Directors' Report have been rounded to the nearest thousand dollars

unless specifically stated to be otherwise.

Signed in accordance with a resolution of the directors.

Terence Holohan

Managing Director & CEO

Perth, Western Australia

22 August 2023

AUDITOR'S INDEPENCE DECLARATION

Declaration available on full report at www.rml.com.au

Consolidated Statement of Comprehensive Income

For the half year ended 30 June 2023 For the half year ended 30 June 2022

Note $'000 $'000

Revenue from contracts with

customers for gold and

silver sales 3 329,499 317,658

Costs of production relating

to gold sales 3 (182,551) (193,116)

------------------------------ ------ -------------------------------------- --------------------------------------

Gross profit before

depreciation, amortisation

and other operating costs 146,948 124,542

------------------------------ ------ -------------------------------------- --------------------------------------

Depreciation and amortisation

relating to gold sales 3 (46,538) (42,411)

Other operating costs

relating to gold sales 3 (29,777) (30,030)

------------------------------ ------ -------------------------------------- --------------------------------------

Gross profit from operations 70,633 52,101

------------------------------ ------ -------------------------------------- --------------------------------------

Interest income 3 1,411 3,743

Other income/ (expense) 3 (104) 4,549

Exploration and business

development expenditure 3 (6,368) (8,187)

Administration and other

corporate expenses 3 (9,081) (7,562)

Share-based payments expense 3 (344) (291)

Treasury - realised gains 3 456 51

NRV inventory movements and

unrealised treasury

transactions 3 37,924 (35,440)

Share of associates' losses 3 - (898)

Depreciation of non-mine site

assets 3 (921) (1,155)

Finance costs 3 (8,532) (9,468)

Indirect tax expense 3 (5,273) (5,451)

Profit/(loss) before tax 79,801 (8,008)

------------------------------ ------ -------------------------------------- --------------------------------------

Tax benefit/(expense) 3&5 7,878 (16,138)

------------------------------ ------ -------------------------------------- --------------------------------------

Profit/(loss) for the period 87,679 (24,146)

------------------------------ ------ -------------------------------------- --------------------------------------

Profit/(Loss) attributable

to:

Members of the parent 73,842 (24,286)

Non-controlling interest 13,837 140

------------------------------ ------ -------------------------------------- --------------------------------------

Profit/(loss) for the period 87,679 (24,146)

------------------------------ ------ -------------------------------------- --------------------------------------

Consolidated Statement of Comprehensive Income (continued)

For the half year ended 30 June 2023 For the half year ended 30 June 2022

Note $'000 $'000

Profit/(loss) for the period (brought

forward) 87,679 (24,146)

-------------------------------------- -------------------------------------- --------------------------------------

Other comprehensive

income/(loss)

Items that may be

reclassified subsequently to

profit or loss

Exchange differences on

translation of foreign

operations:

- Members of the parent (23,623) (6,363)

Items that may not be

reclassified subsequently to

profit or loss

Exchange differences on

translation of foreign

operations:

- Non-controlling interest (1,226) 6,362

- Changes in the fair

value/realisation of financial

assets at fair value through other

comprehensive

income, net of tax - (1,045)

Other comprehensive loss for the

period, net of tax (24,849) (1,046)

-------------------------------------- -------------------------------------- --------------------------------------

Total comprehensive income/(loss) for

the period 62,830 (25,192)

-------------------------------------- -------------------------------------- --------------------------------------

Total comprehensive

income/(loss) attributable

to:

Members of the parent 50,219 (31,694)

Non-controlling interest 12,611 6,502

-------------------------------------- -------------------------------------- --------------------------------------

Total comprehensive income/(loss) for

the period 62,830 (25,192)

-------------------------------------- -------------------------------------- --------------------------------------

Profit/(loss) per share for net loss

attributable for operations to the

ordinary equity holders

of the parent:

-------------------------------------- -------------------------------------- --------------------------------------

Basic earnings/(loss) per share 4.31 cents (2.20) cents

-------------------------------------- -------------------------------------- --------------------------------------

Diluted earnings/(loss) per share 4.31 cents (2.20) cents

-------------------------------------- -------------------------------------- --------------------------------------

Profit/(loss) per share for net loss

attributable for continuing

operations to the ordinary

equity holders of the parent:

-------------------------------------- -------------------------------------- --------------------------------------

Basic earnings/(loss) per share 4.31 cents (2.20) cents

-------------------------------------- -------------------------------------- --------------------------------------

Diluted earnings/(loss) per share 4.31 cents (2.20) cents

-------------------------------------- -------------------------------------- --------------------------------------

Consolidated Statement of Financial Position

Note 30 June 2023 31 December 2022

$'000 $'000

Current assets

Cash and cash equivalents 65,777 80,873

Other financial assets - restricted cash 1,406 1,406

Receivables 6 4,044 48,793

Inventories 7 157,456 146,430

Prepayments and other assets 13,430 11,141

Asset sale receivable 2,500 -

Total current assets 244,613 288,643

------------------------------------------ ----- ------------- -----------------

Non current assets

Income tax asset 6,092 10,545

Receivable 6 13,795 -

Inventories 7 51,268 42,434

Promissory note receivable 40,123 40,015

Contingent consideration receivable 13,280 13,636

Exploration and evaluation 3,901 3,211

Mine properties 8 205,103 222,395

Property, plant and equipment 240,308 234,461

Right-of-use assets 11,720 13,453

------------------------------------------ ----- ------------- -----------------

Total non current assets 585,590 580,150

------------------------------------------ ----- ------------- -----------------

Total assets 830,203 868,793

------------------------------------------ ----- ------------- -----------------

Current liabilities

Payables 55,750 63,700

Financial derivative liabilities 1,730 1,546

Interest bearing liabilities 9 105,259 95,634

Provisions 10 50,463 100,377

Current tax liability 2,028 19,107

Lease liabilities 3,298 3,373

Total current liabilities 218,528 283,737

------------------------------------------ ----- ------------- -----------------

Non current liabilities

Interest bearing liabilities 9 - 29,482

Provisions 10 65,960 71,544

Lease liabilities 10,988 12,536

------------------------------------------ ----- ------------- -----------------

Total non current liabilities 76,948 113,562

------------------------------------------ ----- ------------- -----------------

Total liabilities 295,476 397,299

------------------------------------------ ----- ------------- -----------------

Net assets 534,727 471,494

------------------------------------------ ----- ------------- -----------------

Consolidated Statement of Financial Position (continued)

Note 30 June 2023 31 December 2022

$'000 $'000

Equity attributable to equity holders of the parent

Contributed equity 11 882,731 882,731

Reserves (45,176) (21,956)

Retained earnings/(accumulated losses) (243,499) (317,341)

----------------------------------------------------------- ----- ------------- -----------------

Total equity attributable to equity holders of the parent 594,056 543,434

----------------------------------------------------------- ----- ------------- -----------------

Non-controlling interest (59,329) (71,940)

Total equity 534,727 471,494

----------------------------------------------------------- ----- ------------- -----------------

Consolidated Statement of Changes in Equity

Contributed Net Employee Other Foreign Retained Non-controlling Total

equity unrealised equity reserves currency earnings/ interest

gain/(loss) benefits translation accumulated

reserve reserve reserve losses

At 1 January

2023 882,731 (9,348) 20,447 4,152 (37,207) (317,341) (71,940) 471,494

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- -----------

Profit for the

period - - - - - 73,842 13,837 87,679

Other

comprehensive

(loss)/income,

net of tax - - - - (23,623) - (1,226) (24,849)

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- -----------

Total

comprehensive

(loss)/income

for the

period, net of

tax - - - - (23,623) 73,842 12,611 62,830

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- -----------

Dividend paid - - - - - - - -

Share-based

payments to

employees - - 403 - - - - 403

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- -----------

At 30 June 2023 882,731 (9,348) 20,850 4,152 (60,830) (243,499) (59,329) 534,727

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- -----------

Contributed Net Employee Other Foreign Retained Non-controlling Total

equity unrealised equity reserves currency earnings/ interest

gain/(loss) benefits translation accumulated

reserve reserve reserve losses

At 1 January

2022 777,021 (8,631) 19,813 4,152 (19,040) (277,682) (70,073) 425,560

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- ---------

Profit/(loss)

for the period - - - - - (24,286) 140 (24,146)

Other

comprehensive

(loss)/income,

net of tax - (1,045) - - (6,363) - 6,362 (1,046)

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- ---------

Total

comprehensive

(loss)/income

for the

period, net of

tax - (1,045) - - (6,363) (24,286) 6,502 (25,192)

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- ---------

Dividend paid - - - - - - (4,398) (4,398)

Share-based

payments to

employees - - (452) - - - - (452)

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- ---------

At 30 June 2022 777,021 (9,676) 19,361 4,152 (25,403) (301,968) (67,969) 395,518

---------------- ------------ ------------ --------- --------- ------------ ------------ ---------------- ---------

Consolidated Cash Flow Statement

For the half year ended 30 June 2023 For the half year ended 30 June 2022

$'000 $'000

Cash flows from operating activities

Receipts from customers 330,209 317,200

Payments to suppliers, employees, and

others (266,974) (249,904)

Exploration expenditure (4,446) (7,268)

Net interest paid (5,756) (7,834)

Indirect tax payment (4,787) (4,896)

Income tax payment (3,261) (2,549)

-------------------------------------- -------------------------------------- --------------------------------------

Net cash inflows from operating

activities 44,985 44,749

-------------------------------------- -------------------------------------- --------------------------------------

Cash flows used in investing

activities

Payments for property, plant &

equipment (13,526) (20,866)

Payments for development activities (22,557) (14,895)

Payments for evaluation activities (1,047) (1,305)

Proceeds from sale of property, plant

& equipment 297 18,121

Proceeds from sale of assets - (356)

Other investing activities (382) -

Proceeds from investment in associate 1,000 30,000

-------------------------------------- -------------------------------------- --------------------------------------

Net cash flows From/(used in)

investing activities (36,215) 10,699

-------------------------------------- -------------------------------------- --------------------------------------

Cash flows from/(used in) financing

activities

Repayment of borrowings (30,000) (55,000)

fcr

Subsidiary dividend paid to

non-controlling interest - (3,069)

Dividend paid (1,430) -

Repayment of lease liability (1,988) (1,960)

-------------------------------------- -------------------------------------- --------------------------------------

Net cash flows used in financing

activities (33,418) (60,029)

-------------------------------------- -------------------------------------- --------------------------------------

Net decrease in cash and cash

equivalents (24,648) (4,581)

-------------------------------------- -------------------------------------- --------------------------------------

Cash and cash equivalents at the

beginning of the period 35,460 25,237

Exchange rate adjustment 1,967 381

-------------------------------------- -------------------------------------- --------------------------------------

Cash and cash equivalents at the end

of the period 12,779 21,038

-------------------------------------- -------------------------------------- --------------------------------------

Cash and cash equivalents comprise

the following:

Cash at bank and on hand 65,776 65,613

Bank overdraft (52,997) (44,575)

-------------------------------------- -------------------------------------- --------------------------------------

Cash and cash equivalents at the end

of the period 12,779 21,038

-------------------------------------- -------------------------------------- --------------------------------------

Notes to the Financial Statements

Note 1: Corporate Information

The financial report of Resolute Mining Limited and its

controlled entities ("Resolute", the "Group" or "consolidated

entity") for the half year ended 30 June 2023 was authorised for

issue in accordance with a resolution of directors on 22 August

2023.

Resolute Mining Limited (the parent) is a for profit company

limited by shares incorporated and domiciled in Australia whose

shares are publicly traded on the Australian Securities Exchange

and the London Stock Exchange.

The principal activities of entities within the consolidated

entity during the half year were:

-- gold mining; and,

-- prospecting and exploration for minerals.

There has been no significant change in the nature of those

activities during the half year.

Note 2: Basis of Preparation and Summary of Significant

Accounting Practices

a) Basis of Preparation

This interim financial report for the half year ended 30 June

2023 has been prepared in accordance with AASB 134 Interim

Financial Reporting and the Corporations Act 2001.

The half year financial report does not include all notes of the

type normally included within the annual financial report and

therefore cannot be expected to provide as full an understanding of

the financial performance, financial position and financing and

investing activities of the Group as the full financial report.

It is recommended that the half year financial report be read in

conjunction with the Annual Report for the year ended 31 December

2022 and considered together with any public announcements made by

Resolute Mining Limited during the half year ended 30 June 2023 in

accordance with the continuous disclosure obligations of the

Australian Securities Exchange listing rules and London Stock

Exchange rules. The consolidated financial report is presented in

United States dollars ("$") rounded to the nearest thousand

dollars, unless otherwise stated.

The accounting policies and methods of computation are the same

as those adopted in the most recent annual financial report.

Notes to the Financial Statements

Note 3 (a): Segment revenue and expenses

For the half year ended 30 June 2023 Mako (Senegal) Syama (Mali) Corp/Other Total

$'000 $'000 $'000 $'000

Revenue

Gold and silver sales at spot to external customers (a) 121,910 207,589 - 329,499

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Total segment gold and silver sales revenue 121,910 207,589 - 329,499

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Costs of production (48,989)(1) (139,937) - (188,926)

Gold in circuit inventories movement 1,162 5,213 - 6,375

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Costs of production relating to gold sales (47,827) (134,724) - (182,551)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Royalty expense (6,096) (14,164) - (20,260)

Operational support costs (8,518) (999) - (9,517)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Other operating costs relating to gold sales (14,614) (15,163) - (29,777)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Administration and other corporate expenses - - (9,081) (9,081)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Share-based payments expense - - (344) (344)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Exploration and business development expenditure (2,016) (4,352) - (6,368)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Earnings/(loss) before interest, tax, depreciation and

amortisation 57,453 53,350 (9,425) 101,378

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Amortisation of evaluation, development and

rehabilitation costs (16,998) (13,479) - (30,477)

Depreciation of mine site properties, plant and

equipment (7,273) (8,788) - (16,061)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Depreciation and amortisation relating to gold sales (24,271) (22,267) - (46,538)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Segment operating result before treasury, other

income/(expenses) and tax 33,182 31,083 (9,425) 54,840

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Interest income 4 - 1,407 1,411

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Other income/ (expense) - (135) 31 (104)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Interest and fees (370) (2,719) (3,981) (7,070)

Rehabilitation and restoration provision accretion (526) (936) - (1,462)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Finance costs (896) (3,655) (3,981) (8,532)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Realised foreign exchange gain/(loss) (846) 379 923 456

Treasury - realised gains/(loss) (846) 379 923 456

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Inventories net realisable value movements and obsolete

consumables 928 7,615 - 8,543

Unrealised foreign exchange (loss) (691) - (1,499) (2,190)

Unrealised foreign exchange gain on intercompany

balances - - 31,571 31,571

--------------------------------------------------------- ---------------- ------------- ----------- ----------

NRV inventory movements and unrealised treasury

transactions 237 7,615 30,072 37,924

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Depreciation of non-mine site assets (69) - (852) (921)

Indirect tax (expense)/benefit (5,000) (1) (273) - (5,273)

Income tax (expense)/benefit 14,463 (1) (4,608) (1,977) 7,878

--------------------------------------------------------- ---------------- ------------- ----------- ----------

(Loss)/profit for the period 41,075 30,406 16,198 87,679

--------------------------------------------------------- ---------------- ------------- ----------- ----------

1 - The Group has settled the Mako tax exoneration and fully

extended the exoneration period from 5 to 7 years. The prior year

recognised provision has been reversed in the current period. For

the half year ended 30 June 2023, cost of production and income tax

expense has reversed by $16.4 million and $14.5 million,

respectively.

Notes to the Financial Statements

Note 3 (a): Segment revenue and expenses (continued)

For the half year ended 30 June 2022 Mako (Senegal) Syama (Mali) Corp/Other Total

$'000 $'000 $'000 $'000

Revenue

Gold and silver sales at spot to external customers (a) 122,746 194,912 - 317,658

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Total segment gold and silver sales revenue 122,746 194,912 - 317,658

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Costs of production (58,976) (124,190) - (183,166)

Gold in circuit inventories movement 342 (10,292) - (9,950)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Costs of production relating to gold sales (58,634) (134,482) - (193,116)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Royalty expense (6,137) (12,865) - (19,002)

Operational support costs (8,986) (2,042) - (11,028)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Other operating costs relating to gold sales (15,123) (14,907) - (30,030)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Administration and other corporate expenses (2,543) (748) (4,271) (7,562)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Share-based payments expense - - (291) (291)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Exploration and business development expenditure (2,928) (5,075) (184) (8,187)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Earnings/(loss) before interest, tax, depreciation and

amortisation 43,518 39,700 (4,746) 78,472

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Amortisation of evaluation, development and

rehabilitation costs (15,228) (12,459) - (27,687)

Depreciation of mine site properties, plant and

equipment (6,017) (8,707) - (14,724)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Depreciation and amortisation relating to gold sales (21,245) (21,166) - (42,411)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Segment operating result before treasury, other

income/(expenses) and tax 22,273 18,534 (4,746) 36,061

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Interest income - - 3,743 3,743

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Other Income - 15 4,534 4,549

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Interest and fees (47) (1,619) (7,170) (8,836)

Rehabilitation and restoration provision accretion (199) (433) - (632)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Finance costs (246) (2,052) (7,170) (9,468)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Realised foreign exchange gain (loss) 660 1,393 (2,002) 51

Treasury - realised gains (loss) 660 1,393 (2,002) 51

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Inventories net realisable value movements and obsolete

consumables (1,638) (155) - (1,793)

Unrealised foreign exchange gain/(loss) (2,252) - (8,134) (10,386)

Unrealised foreign exchange loss on intercompany

balances - - (23,261) (23,261)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

NRV inventory movements and unrealised treasury

transactions (3,890) (155) (31,395) (35,440)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Share of associates' losses - - (898) (898)

Depreciation of non-mine site assets (78) - (1,077) (1,155)

Indirect tax expense - (5,389) (62) (5,451)

Income tax (expense)/benefit (11,388) (2,057) (2,693) (16,138)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

(Loss)/profit for the period 7,331 10,289 (41,766) (24,146)

--------------------------------------------------------- ---------------- ------------- ----------- ----------

Notes to the Financial Statements

Note 3 (a): Segment revenue and expenses (continued)

(a) Revenue from external sales for each reportable segment is

derived from several customers.

(b) This information does not represent an operating segment as

defined by AASB 8 'Operating Segments' and forms part of the

reconciliation of the results and positions of the operating

segments to the financial statements.

Note 3 (b): Segment assets and liabilities

For the half year ended 30 June 2023 Mako (Senegal) Syama (Mali) Corp/Other Total

$'000 $'000 $'000 $'000

Segment balance sheet items

Segment assets 220,904 512,185 97,114 830,203

Segment liabilities 65,088 166,003 64,385 295,476

(a) This information does not represent an operating segment as

defined by AASB 8 'Operating Segments' and forms part of the

reconciliation of the results and positions of the operating

segments to the financial statements.

Note 4: Dividend

There were no interim dividends paid or provided for Resolute

Mining Limited during the half year end up to the date of this

report (half year ended 30 June 2022: $nil).

Note 5: Taxes

At 30 June 2023, the Group recognised an income tax benefit of

$7.9 million (30 June 2022: tax expense of $16.1 million). A $14.5

million reduction in the income tax expense in Senegal relating to

the finalisation of the tax exoneration extension was offset by a

$4.6 million income tax expense for local statutory purposes.

Note 6: Receivables

Receivables of $17.8 million at 30 June 2023 (31 December 2022:

$48.8 million) primarily relate to indirect taxes owing to the

Group by the Republic of Mali and Senegal. Significant movement for

the year relates to the reversal of $34.9 million of VAT provision

raised in relation with the Senegalese tax authority as the

exoneration was settled.

Notes to the Financial Statements

Note 7: Inventories

30 June 2023 31 December 2022

$'000 $'000

Current

Ore stockpiles - at cost 30,041 27,223

Ore stockpiles - at net realisable value 31,767 28,286

Gold in circuit - at cost 5,739 4,186

Gold in circuit - at net realisable value 1,687 373

Gold bullion on hand - at cost 15,308 10,276

Consumables at net realisable value 72,914 76,086

------------------------------------------- --------------- -------------------

Total Inventory (current) 157,456 146,430

------------------------------------------- --------------- -------------------

Non current

Ore stockpiles - at cost 3,142 1,959

Ore stockpiles - at net realisable value 4,189 3,279

Gold in circuit - at net realisable value 43,937 37,196

------------------------------------------- --------------- -------------------

Total Inventory (non current) 51,268 42,434

------------------------------------------- --------------- -------------------

Note 8: Mine properties

At 30 June 2023, the Group's mine properties amount to $205.1

million (31 December 2022: $222.4 million). During the six-month

period to 30 June 2023, further additions for development

activities were made of $22.6 million, fully offset by amortisation

recognition on production assets.

Note 9: Interest bearing liabilities

30 June 2023 31 December 2022

$'000 $'000

Interest bearing liabilities (current)

Bank overdraft 52,996 45,414

Insurance premium funding 2,395 -

Borrowings 49,868 50,220

-------------------------------------------------- --------------- -------------------

Total Interest bearing liabilities (current) 105,259 95,634

-------------------------------------------------- --------------- -------------------

Interest bearing liabilities (non current)

Borrowings - 29,482

-------------------------------------------------- --------------- -------------------

Total Interest bearing liabilities (non current) - 29,482

-------------------------------------------------- --------------- -------------------

Total 105,259 125,116

-------------------------------------------------- --------------- -------------------

Notes to the Financial Statements

Note 10: Provisions

30 June 31 December

2023 2022

$'000 $'000

Current

Site restoration 3,139 1,220

Employee entitlements 3,373 4,336

Provision for direct and indirect taxes(1) 42,011 92,936

Other provision 1,940 1,885

-------------------------------------------- ---------- --------------

Total provisions (current) 50,463 100,377

-------------------------------------------- ---------- --------------

Non Current

Site restoration 65,028 70,874

Employee entitlements 932 670

-------------------------------------------- ---------- --------------

Total provisions (non current) 65,960 71,544

-------------------------------------------- ---------- --------------

1. Based on the facts and circumstances at 30 June 2023 and in

line with requirements of the accounting standards, the Group has

reversed $66.7 million (comprised of $34.9 million VAT, $17.3

million indirect taxes, and $14.5 million income tax) of the tax

claim by the Senegalese tax authority as the exoneration dispute

was settled for an amount of $5 million. The factual basis and

validity of the remaining demands (primarily in Mali) are being

strongly disputed by Resolute due to fundamental misinterpretations

of the application of certain tax law. Resolute continues to work

with its legal and tax advisors to contest the demand and will

resist any efforts to enforce payment. The demand for Income Tax

has been disclosed as a contingent liability.

Notes to the Financial Statements

Note 11: Contributed Equity

Total Number Number Quoted $'000

At 1 January 2023 2,129,006,569 2,129,006,569 882,731

Changes during current period, net of issue costs: - - -

At 30 June 2023 2,129,006,569 2,129,006,569 882,731

---------------------------------------------------- -------------- -------------- --------

Fair Value per Right at Grant Date

Issue Date Total Number (A$) Vesting Date

Performance rights on issue

Band A1 and A2 26/10/2018 13,550 $0.92 30/06/2021

Band A1 and A2 21/05/2019 73,377 $0.93 31/12/2021

Band A1 and A2 22/05/2020 121,130 $0.85 31/12/2022

Band A0 14/07/2021 443,716 $0.43 31/12/2023

Band A1, A2 and B1 14/07/2021 1,398,849 $0.57 31/12/2023

Band A1 and A2 06/12/2021 211,276 $0.37 31/12/2023

Band B1 06/12/2021 219,942 $0.31 31/12/2023

Band A1 and A2 06/12/2021 264,171 $0.32 31/12/2023

Band A0 22/06/2022 1,958,147 $0.19 31/12/2024

Band A1, A2 and B1 22/06/2022 5,275,334 $0.19 31/12/2024

Band A0 30/06/2023 1,000,000 $0.23 30/06/2025

Band A0 30/06/2023 3,548,554 $0.34 31/12/2025

Band A1, A2 and B1 30/06/2023 9,266,960 $0.35 31/12/2025

As at 30 June 2023 23,795,006

--------------------------------------------------- ------------- ----------------------------------- -------------

Fair Value

per Right

Date Total at Grant Vesting

of Change Number Date (A$) Date

Opening number of performance rights 10,916,506

Decrease through lapsing of

performance

rights (Band A0) 30/06/2023 (194,352) $0.56 31/12/2022

Decrease through lapsing of

performance

rights (Band A1 to A2) 30/06/2023 (742,662) $0.85 31/12/2022

Increase through issue of

performance

rights to eligible employees (Band

A0) 30/06/2023 1,000,000 $0.23 30/06/2025

Increase through issue of

performance

rights to eligible employees (Band

A0) 30/06/2023 3,548,554 $0.34 31/12/2025

Increase through issue of

performance

rights to eligible employees (Band

A1, A2 and B1) 30/06/2023 9,266,960 $0.35 31/12/2025

------------------------------------- ------------ ------------- ---------------- -----------------

Closing number of performance rights 23,795,006

------------------------------------- ------------ ------------- ---------------- -----------------

*The terms and conditions of the Remuneration Framework are

consistent with those disclosed in the Annual Report for the year

ended 31 December 2022 and the Notice of Annual General Meeting

sent to shareholders on 18 April 2023.

Notes to the Financial Statements

Note 12: Gold forward contracts

As part of its risk management policy, the Group enters into

gold forward contracts to manage the gold price of a proportion of

anticipated sales of gold.

Gold forward contracts commitment at 30 June 2023 (not recorded

as derivatives):

Average Gold for Value

Contracted Physical of Committed

Gold Sale Delivery sales

Price per oz $'000

oz ($)

30 June 2023

Within one year 1,929 162,500 313,462

Total 162,500 313,462

----------------- ------------ ---------- --------------

Note 13: Events Occurring after Balance Date

Since the end of the period and to the date of this report, no

matter or circumstance has arisen that has significantly affected,

or may significantly affect, the operations of the Group, the

results of operation or the state of affairs of the consolidated

group in subsequent periods.

Directors' Declaration

In the opinion of the directors:

a) the financial statements and notes are in accordance with the

Corporations Act 2001, including:

(i) complying with Accounting Standard AASB 134 Interim

Financial Reporting, the Corporations Regulations 2001; and

(ii) giving a true and fair view of the Group's financial

position as at 30 June 2023 and of its performance, as required by

Accounting Standards, for the half year ended on that date.

b) there are reasonable grounds to believe that the Group will

be able to pay its debts as and when they become due and

payable.

This declaration has been made in accordance with a resolution

of the directors.

Terence Holohan

Managing Director & CEO

Perth, Western Australia

22 August 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UUSNROBUWURR

(END) Dow Jones Newswires

August 22, 2023 02:50 ET (06:50 GMT)

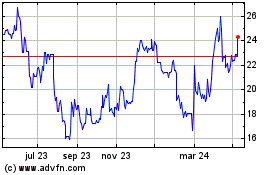

Resolute Mining (LSE:RSG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

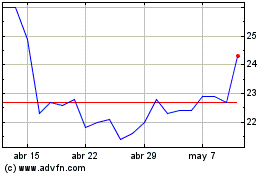

Resolute Mining (LSE:RSG)

Gráfica de Acción Histórica

De May 2023 a May 2024