TIDMRTW

RNS Number : 9962E

RTW Biotech Opportunities Ltd

05 July 2023

LEI: 549300Q7EXQQH6KF7Z84

5 July 2023

RTW Biotech Opportunities Ltd

Capital allocation plans from Prometheus Biosciences sale

including share buyback

RTW Biotech Opportunities Ltd ("RTW Biotech Opportunities" or

the "Company"), a London Stock Exchange-listed investment company

focused on identifying transformative assets with high growth

potential across the biopharmaceutical and medical technology

sectors , today provides an update on its intended use of proceeds

from its holding in previous Prometheus Biosciences, Inc.

("Prometheus"), following its acquisition by Merck.

Completion of Prometheus acquisition by Merck

Further to the Company's 17 April announcement that portfolio

company Prometheus Biosciences, Inc. had agreed to be acquired by

Merck for $200.00 per share in cash, a 75% premium to the prior

closing price, the Company can confirm the acquisition was

completed on 16 June. Proceeds from the sale of Prometheus shares

subsequent to the announcement have amounted to $92.4 million.

Including sales prior to the announcement, total proceeds amounted

to $99.1 million on total invested capital of $8.4 million,

representing a 11.8x multiple.

RTW Biotech Opportunities first invested in Prometheus in

November 2020 as it co-led a private financing round which raised

$130 million to advance Prometheus' lead antibody program (PRA023).

The Company then increased its holding in Prometheus at its IPO in

March 2021, and also participated in a further $500m fundraise in

December 2022 (to advance PR023 into Phase 3) in an upsized equity

offering priced at $110. At 31 March 2023, just prior to the Merck

acquisition announcement, the Company's holding in Prometheus

represented 14.8% of NAV amounting to $50.2m.

Roderick Wong, M.D., Managing Partner and Chief Investment

Officer at the Investment Manager, said:

"This transaction is a great example of RTW Biotech

Opportunities' investment strategy at work. Our ability to invest

across the company life cycle provides us with significant

advantages. Access to early-stage private assets provides us with

access to experimental data that typically isn't shared in the

public markets. Investing early also gives us time to build

relationships with entrepreneurs and management teams. Given our

blended public-private structure, we do not have any structural

pressure to exit post-IPO, and typically we aim to increase the

size of the most promising investments. It was this flexibility,

enabled by our listed investment company structure, that allowed us

to build our conviction in Prometheus, which, in turn allowed us to

grow our position through multiple inflection points right up to

the end."

Use of Prometheus sale proceeds

In light of this significant success in demonstrating the value

of the Company's full life cycle investment strategy, the Board has

given careful consideration to the Company's capital allocation

framework.

The Company's primary focus is to identify and invest in

transformative assets with growth potential. With the biotech

sector only just recovering from the second deepest and second

longest bear market in its history, the Board consider now to be an

opportune time to take receipt of such gains. Valuations are

attractive, fundamentals have turned around with the maturation of

some modalities and companies, and M&A has become a significant

tailwind. As a result, the Company will retain an appropriate level

of the Prometheus proceeds which it believes can be invested into

highly attractive opportunities (across the private, core public

and other public portfolios) over the medium term as per the

Company's core objective.

Financing conditions in the sector remain tight, however. This

environment allows the Investment Manager to flex the transactional

capabilities it has built up over the years to help support

exciting companies by offering strategic financing solutions

including royalty financing. The Board intends to deploy some of

the Prometheus proceeds into such opportunities through the

Investment Manager's "4010 Royalty Fund". There will be no

double-charging as fees will be taken at the Company level only.

The Board considers that this presents an attractive uncorrelated,

income-generating investment that would complement the core

portfolio. The Board intends to limit the Company's royalty

investment exposure to approximately 15% of NAV including the

current royalty holding in the portfolio.

Share buyback

The Board also believes that distributing a portion of the

Prometheus proceeds will help to further demonstrate the life cycle

of RTW Biotech Opportunities' invested capital. Given that the

Board believes that the discount to NAV per Ordinary Share at which

the Company's shares currently trade materially undervalues the

Company and its portfolio, it therefore intends to initiate, and

implement over time at its discretion, capital returns to

shareholders through an NAV-accretive share buyback of up to

approximately $10 million (equivalent to c. 7.92 million shares at

current mid-market price).

The Board believes that this allocation clearly demonstrates 1)

its confidence in the outlook for the biotech sector and the

Company's portfolio; 2) capital allocation discipline; and 3) the

proven value of the Company's model. Since admission to 31 May

2023, the Company's NAV per Ordinary Share increased by +65.3%

versus a

-0.7% return for the Russell 2000 Biotech Index and a +20.6%

return for the Nasdaq Biotech Index.

For Further Information:

RTW Investments, LP +44 (0)20 7959 6361

Woody Stileman, Managing Director

Krisha McCune, Director, Client Service

Buchanan +44 (0)20 7466 5107

Charles Ryland

Henry Wilson

George Beale

Numis +44 (0)20 7260 1000

Freddie Barnfield

Nathan Brown

Euan Brown

BofA Securities +44 (0) 20 7628 1000

Edward Peel

Kieran Millar

Cadarn Capital +44 (0) 73 6888 3211

David Harris

Elysium Fund Management Limited +44 (0) 14 8181 0100

Joanna Duquemin Nicolle, Chief Executive Officer

Sadie Morrison, Managing Director

Morgan Stanley Fund Services USA LLC +1 (914) 225 8885

About RTW Biotech Opportunities Ltd:

RTW Biotech Opportunities Ltd (LSE: RTW & RTWG) is an

investment fund focused on identifying transformative assets with

high growth potential across the biopharmaceutical and medical

technology sectors. Driven by a long-term approach to support

innovative businesses, RTW Biotech Opportunities invests in

companies developing next-generation therapies and technologies

that can significantly improve patients' lives.

RTW Biotech Opportunities Ltd is managed by RTW Investments, LP,

a leading healthcare-focused entrepreneurial investment firm with

deep scientific expertise and a strong track record of supporting

companies developing life-changing therapies.

RTW Biotech Opportunities Ltd retains absolute discretion as to

the execution, pricing and timing of any share buybacks, subject to

the conditions set out in the authority to execute share buybacks

approved at the 2023 annual general meeting. Any shares repurchased

will be held in treasury. Any repurchase of shares will be

announced no later than 7.30 a.m. on the business day following the

calendar day on which the repurchase occurred.

Visit the RTW website at www.rtwfunds.com for more

information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUVRAROVUBRRR

(END) Dow Jones Newswires

July 05, 2023 02:00 ET (06:00 GMT)

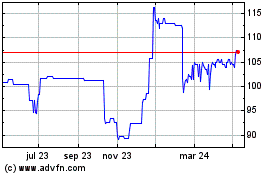

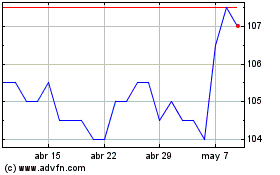

Rtw Biotech Opportunities (LSE:RTWG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Rtw Biotech Opportunities (LSE:RTWG)

Gráfica de Acción Histórica

De May 2023 a May 2024