TIDMRTW

RNS Number : 2172M

RTW Biotech Opportunities Ltd

13 September 2023

LEI: 549300Q7EXQQH6KF7Z84

13 September 2023

RTW Biotech Opportunities Ltd

Interim Report for the period ended 30 June 2023

Strong NAV performance, significantly outperforming benchmark

indices

RTW Biotech Opportunities Ltd (the "Group"), the London Stock

Exchange-Premium listed investment company focused on identifying

transformative assets with high growth potential across the

biopharmaceutical and medical technology sectors, is pleased to

announce its Interim Report for the six months ended 30 June

2023.

Financial Highlights:

The Group continued to outperform the benchmark indices in the

period since Admission, demonstrating the strength of the

Investment Manager, investment strategy and the portfolio:

RTW Biotech Opportunities Interim reporting Previous Interim Admission

Ltd period reporting period (30/10/2019)-

(01/01/2023-30/06/2023) (01/01/2022-30/06/2022) 30/06/2023

Ordinary NAV - start of US$326.1 million US$363.0 million US$168.0 million

period

------------------------- ------------------------- -----------------

Ordinary NAV - end of period US$356.5 million US$265.7 million US$356.5 million

------------------------- ------------------------- -----------------

NAV per Ordinary Share US$1.54 US$1.71 US$1.04

- start of period

------------------------- ------------------------- -----------------

NAV per Ordinary Share US$1.68 US$1.25 US$1.68

- end of period

------------------------- ------------------------- -----------------

NAV movement per Ordinary

Share +9.3% -26.8% +61.5%

------------------------- ------------------------- -----------------

Price per Ordinary Share US$1.21 US$1.78 US$1.04

- start of period

------------------------- ------------------------- -----------------

Price per Ordinary Share US$1.25 US$0.97 US$1.25

- end of period

------------------------- ------------------------- -----------------

Share price return (i) +2.9% -45.7% +19.7%

------------------------- ------------------------- -----------------

Benchmark returns (ii)

---------------------------------------------------------------------------------------------------------

Russell 2000 Biotech +5.3% -39.1% -0.3%

------------------------- ------------------------- -----------------

Nasdaq Biotech -3.2% -20.7% +20.7%

------------------------- ------------------------- -----------------

(i) Total shareholder return is an alternative performance measure

(ii) Source: Capital IQ

Portfolio Highlights

-- As at 30 June 2023, the Group had decreased the number of

core portfolio companies to 37 (H1 2022: 41).

o 10 publicly-listed (H1 2022: 15)

o 27 privately-held (H1 2022: 26)

-- A stand-out event for the period was the sale of Prometheus

Biosciences, which at the time was the Group's largest holding

(14.8% of NAV). Prometheus was acquired by Merck at a 75% premium

to the prior closing price. Total proceeds from the sale of

Prometheus shares amounted to US$99.1 million on total invested

capital of US$8.4 million, representing an 11.8x multiple. The

multiple on capital invested in the private rounds was 22x.

-- CinCor Pharma announced an agreement to be acquired by

AstraZeneca for US$1.3 billion. The total consideration amounted to

a 207% premium to the prior closing price. At the time of the

announcement, the position represented 0.6% of NAV.

-- 5 new core portfolio companies were added during the period (H1 2022: 2).

o Co-led Cargo Therapeutics Series A financing round in March

2023 (0.4% NAV)

o Co-led Oricell Therapeutics Series B financing round in

February 2023 (0.6% NAV)

o Participated in Abdera Therapeutics Series B financing round

in April 2023 (0.3% NAV)

o Participated in a bridge financing in Allurion Technologies in

February 2023 (0.01% NAV)

o Participated in Tourmaline Bio's Series A financing round in

May 2023 (0.2% NAV)

-- 24/37 core portfolio companies had pipeline products in

clinical stage programmes (H1 2022: 28/41) on 30 June 2023.

-- As at 30 June 2023, 51% of NAV was invested in core portfolio

companies (H1 2022: 62%), whilst 31% was invested in other public

portfolio companies (H1 2022: 33.5%) and 18% was held in cash plus

assets and current liabilities (H1 2022: 5%).

-- 3 private portfolio companies - Mineralys, Acelyrin and

Orchestra BioMed - successfully listed on the Nasdaq during the

period, and Tourmaline Bio entered into a merger agreement with

Nasdaq-listed Talaris Therapeutics, which is expected to close in

the fourth quarter.

o Mineralys successfully launched an upsized initial public

offering (IPO) in February 2023, raising US$192 million.

-- On the first day of trading, Mineralys' share price rose by

15.25%, to close at US$18.44 per share.

o Acelyrin successfully launched an upsized IPO in May 2023,

raising US$540 million.

-- On the first day of trading, Acelyrin's share price traded up

by 30.55% to close at US$23.50 per share.

o Orchestra BioMed announced the closing of its merger with

RTW's Health Sciences Acquisitions Corporation 2 and started

trading on the Nasdaq.

-- The Group participated in a US$125 million strategic

financing deal with Milestone Pharmaceuticals. The strategic

financing included US$50 million in convertible notes from

RTW-managed funds, including the Group, as well as a commitment by

the Investment Manager of US$75 million in royalty funding.

Post Period-End Highlights

-- Apogee Therapeutics successfully listed on the Nasdaq via an

upsized IPO in July 2023, raising US$300 million.

o On the first day of trading, Apogee's share price traded up by

24.9% to close at $21.23 per share. At 30 June 2023, Apogee

represented 0.6% of the Group's NAV.

-- Following a February 2023 announcement that Allurion

Technologies would go public via a business combination transaction

that would include a PIPE led by RTW-managed funds, including the

Group, and a synthetic royalty financing, the transaction was

completed on 1 August 2023, and Allurion began trading on the NYSE

on 2 August, raising US$100 million.

-- The Company announced a share buyback programme, given the

Board's belief that the share price materially undervalues the

Company.

Roderick Wong, MD, Managing Partner and Chief Investment Officer

of RTW Investments, LP (the "Investment Manager") commented:

"We are pleased to report the Group achieved strong performance,

particularly in comparison with our benchmarks, which we have

outperformed not only during the period but also on a one and

three-year basis. During the six months to 30 June 2023, RTW's NAV

increased by +9.3% compared with +5.3% for the Russell 2000 Biotech

index.

"Performance since inception remained significantly ahead of

both the Nasdaq Biotech and Russell 2000 Biotech indices with RTW

achieving a +61.5% NAV performance since inception compared with

+20.7% for the Nasdaq Biotech index and -0.3% for the Russell 2000

Biotech index, over the same periods.

"It has been a very active six months for the Group, with three

portfolio companies listing on the Nasdaq and one announcing a

merger with a listed entity. We have also seen two take-outs in the

portfolio at very healthy premiums, one of which was RTW's largest

position at the time, Prometheus Biosciences. Additionally, there

have been five new core portfolio companies added to the portfolio,

while five core public portfolio companies were exited.

"With the second longest and deepest bear market for the biotech

sector now behind us, this is an exciting time to invest in highly

attractive opportunities across our private, core public and other

public portfolios. We look ahead to the remainder of 2023 with

confidence as we look to add both public and private companies to

our portfolio of transformative assets with high growth potential

across the biopharma and med-tech sectors. We look forward to

updating shareholders with our continued progress throughout the

remainder of the year."

For Further Information

RTW Investments, LP +44 20 7959 6361

Woody Stileman, Managing Director

Krisha McCune, Director, Client

Service

---------------------

Elysium Fund Management Limited +44 (0)14 8181 0100

---------------------

Joanna Duquemin Nicolle, Chief Executive

Officer

Sadie Morrison, Managing Director

---------------------

Numis +44 (0)20 7260 1000

---------------------

Freddie Barnfield

Nathan Brown

Euan Brown

---------------------

BofA Securities +44 (0)20 7628 1000

---------------------

Edward Peel

Kieran Millar

---------------------

Buchanan +44 20 7466 5107

---------------------

Charles Ryland

Henry Wilson

George Beale

---------------------

Cadarn Capital +44 (0)73 6888 3211

---------------------

David Harris

---------------------

Morgan Stanley Fund Services USA

LLC +1 (914) 225 8885

---------------------

About RTW Biotech Opportunities Ltd: RTW Biotech Opportunities

Ltd (LSE: RTW & RTWG) is an investment fund focused on

identifying transformative assets with high growth potential across

the biopharmaceutical and medical technology sectors. Driven by a

long-term approach to support innovative businesses, RTW Biotech

Opportunities Ltd invests in companies developing next-generation

therapies and technologies that can significantly improve patients'

lives. RTW Biotech Opportunities Ltd is managed by RTW Investments,

LP, a leading healthcare-focused entrepreneurial investment firm

with deep scientific expertise and a strong track record of

supporting companies developing life-changing therapies.

Visit the website at www.rtwfunds.com/rtw-biotech-opportunities-ltd for more information.

Highlights

30 June 2023 Financial Highlights

US$1.68 NAV per Ordinary Share

US$356.5 million Ordinary NAV 30 June 2022: US$1.25

30 June 2022: US$265.7 million

+61.5% Ordinary NAV growth since inception +19.7% total shareholder return since inception

30 June 2022: +20.1% 30 June 2022: -7.1%

--------------------------------------------------

+9.3% Ordinary NAV per share growth YTD +2.9% total shareholder return YTD

30 June 2022: -26.8% 30 June 2022: -45.7%

--------------------------------------------------

US$9.5 million in cash / cash equivalents US$1.25 price per Ordinary Share (1)

30 June 2022: US$7.6 million 30 June 2022: US$0.97

--------------------------------------------------

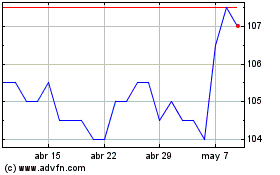

1 The share price has since recovered to US$1.26 at 11 September

2023.

Portfolio Highlights in the period

Capital markets activity in the core portfolio(1): 5 new core portfolio companies added

2 take-outs, 2 IPOs, 1 SPAC merger, 1 reverse merger, 5 core public portfolio companies exited

and 2 announced strategic financings

24/37 core portfolio companies have clinical programs

51% of NAV invested in the core portfolio 30 June 2022: 28/41

30 June 2022: 62%

37 core portfolio companies in total:

27 private, 10 public

30 June 2022: 26 private, 15 public

------------------------------------------------------

1 Core portfolio consists of companies that were initially added

to the portfolio as private investments, reflecting the key focus

of the Group's strategy. As initially private investments continue

to be held beyond IPO, the core portfolio consists of both

privately-held and publicly-listed companies.

Our Purpose

Transforming the lives of millions

RTW's long-term strategy is anchored in identifying sources of

transformational innovations with significant commercial potential

by engaging in deep scientific research and a rigorous idea

generation process, which is complemented by years of investment,

company building, and both transactional and legal expertise.

Identify

Identify transformational innovations

RTW has developed expertise through a comprehensive study of

industry and academic efforts in targeted areas of significant

innovation. Thanks to the decoding of the human genome, there is

more clarity around the causes of disease. Coupled with exciting

new modalities that can address genetic diseases in a targeted way,

drug innovation is accelerating.

Engage

Engage in deep research to unlock value

RTW has developed repeatable internal processes combining

technology and manpower to comprehensively cover critical drivers

of innovation across the globe. We seek to identify, through

rigorous scientific analysis, biopharmaceutical and medical

technology assets that have a high probability of becoming

commercially viable products, dramatically changing the course of

treatment and in some cases bringing effective and/or fully

curative outcomes to patients.

Build

Build new companies around promising academic licences

RTW has the capabilities to partner with universities and

in-license academic programs, by providing capital and

infrastructure to entrepreneurs to advance scientific programs.

Particularly in rare disease there is often little existing

research and are few treatment options, so forming a rare

disease-focused company is a way of shining a light on this space

and creating a roadmap to eventually developing curative

treatments.

Support

Support full life cycle investment

A key part of RTW's competitive advantage is the ability to

determine at which point of a company's life cycle we should

support the target asset or pipeline. As a full life cycle

investor, we can provide growth capital, creative financing

solutions, capital markets expertise, or guidance through

contributing our time and sharing our collective experience as

directors and stewards of tomorrow's most exciting and innovative

companies. Taking a long-term full life cycle approach and having a

truly evergreen structure enables us to avoid the pitfalls and

structural constraints of venture-only or public-only vehicles. Our

focus is on becoming the best investors and company builders we can

be, delivering exceptional results to shareholders and making a

positive impact on patients' lives.

Chair's Statement

I am pleased to report that the Investment Manager ("RTW") has

achieved a solid performance for the Group. The Group's NAV

returned +9.3% over the six-month period, materially outperforming

both the Russell 2000 Biotech and the Nasdaq Biotech Index ("NBI")

which returned +5.3% and -3.2% respectively. The Group's NAV has

also strongly outperformed its biotech benchmarks over one year and

three years.

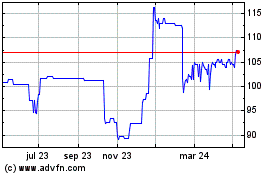

Since admission in October 2019, the Group's NAV has

significantly outperformed its biotech benchmarks returning +61.5%

versus -0.3% and +20.7% for the Russell 2000 Biotechnology Index

and the NBI, respectively. However, the Company's share price has

lagged NAV growth with a +19.7% return as the shares fell to a

discount to NAV in 2022, alongside many of our peers, after having

traded at a small premium for most of the prior years since

admission. The discount widened in the early part of the year as

the shares traded sideways despite a pickup in the Group's NAV but

started to narrow again towards the end of the reporting

period.

H1 2023 Overview and Outlook

There has been no shortage of positive activity in the portfolio

in the first half of 2023 with two take-outs, two IPOs, a SPAC

merger, a reverse merger, two announced strategic financings, five

new private investments and five exits (not including the

take-outs). At the end of the period, the Group had thirty-seven

core portfolio holdings, a decrease from forty-one last year. The

core portfolio represents 51.2% of NAV, down from 61.8% at the same

time last year. The "other public" portfolio (a replica of the long

names held in RTW's private funds, devised to mitigate the cash

drag of setting aside cash for future deployment into core

positions) remains at about one third of NAV. The reduced

allocation to the core portfolio and the currently elevated

Available Cash position (18%) is a result of the Group recently

receiving substantial proceeds from the sale of Prometheus

Biosciences to Merck

The Prometheus sale was the stand-out event in the first half of

the year. At 14.8% of NAV, Prometheus was the Group's largest

holding when it was acquired by Merck at a 75% premium to the prior

closing price. Total proceeds from the sale of Prometheus shares

amounted to US$99.1 million on total invested capital of US$8.4

million, representing an 11.8x multiple. The multiple on capital

invested in the private rounds was 22x. This transformational

transaction is a perfect example of the Group's successful

investment strategy at work. The ability to invest across a

company's life cycle provides significant advantages. Surveying

early-stage private assets provides access to experimental data

that typically isn't shared in the public markets and investing

early allows time to build relationships with entrepreneurs and

management teams. Without the pressure to exit at an IPO, the

Investment Manager typically aims to increase the size of the most

promising investments as they enter the public markets. It was the

duration and flexibility offered by our listed investment company

structure that allowed the Investment Manager to increase

conviction and grow the position through the IPO and multiple

inflection points right up to the end.

In light of this significant success in demonstrating the value

of a full life cycle investment strategy, the Group announced a

capital allocation plan after the end of the reporting period. This

included a share buyback, given the Board's belief that the share

price materially undervalues the Group and its portfolio. The Board

believes that this further demonstrates: 1) its confidence in the

outlook for the biotech sector and the Group's portfolio; 2)

capital allocation discipline; and 3) the proven value of the

Group's model. The Board is pleased with the reaction from our

shareholders and the market.

With the biotech sector only just recovering from the second

deepest and second longest bear market in its history, now is a

particularly opportune time to take receipt of the Prometheus

proceeds. Valuations are attractive, fundamentals have turned

around and M&A has become a significant tailwind. As a result,

the Group will retain an appropriate level of the proceeds to

invest in highly attractive equity opportunities across the

private, core public and other public portfolios over the medium

term, as per the Group's core objective.

Financing conditions in the sector remain tight, however, and

this environment enables RTW to flex the transactional capabilities

it has built over the years to help support exciting companies by

offering strategic financing solutions including royalty financing.

The Company's shareholders will access royalty opportunities

through an investment in RTW's "4010 Royalty Fund." There will be

no double-charging, as fees will be taken at the Company level

only. The Board considers that this presents an attractive,

uncorrelated, cash-yielding investment that complements the Group's

portfolio. The Group intends to limit royalty investment exposure

to approximately 15% of NAV including the current royalty holding

in the portfolio, which was 4.0% of NAV as at 30 June.

In a time when private market valuations are so heavily

scrutinised, it is important to have a robust valuation process. We

strongly believe this to be the case with RTW's Valuation

Committee's fair value approach to marking the private portfolio on

a monthly basis, in conjunction with two independent third-party

valuation firms, Alvarez & Marsal and Houlihan Lokey. The proof

comes when private investments become public companies. With two

IPOs in the first half and another just after the end of the

reporting period, we have a reasonable sample to assess the private

portfolio's fair value. With all of these events seeing a step-up

from their prior private holding value by an average of 58%, we

emphasise our confidence in the Group's portfolio and outlook for

the sector.

AGM Results and Name Change

The Group held its Annual General Meeting on 21 June 2023 to

consider the audited consolidated financial statements and other

matters, including a change of name from RTW Venture Fund Limited

to RTW Biotech Opportunities Ltd. We are grateful to shareholders

who cast their votes. The results have been announced to the market

and published on the Investment Manager's website

https://www.rtwfunds.com/rtw-biotech-opportunities-ltd/.

The Board believes that this name better places it amongst its

listed healthcare and biotech investment company peers and more

accurately reflects the Group's full life cycle approach to biotech

investing as a partner that can invest in both the private and

public domains and across the capital structure with the

flexibility to focus on where the most attractive opportunities

exist.

New Corporate Broker and Distribution Partner

In April, the Board appointed Numis as a corporate broker

alongside BofA Securities, which remains as Joint Corporate Broker.

Soon after, the Group started working with Cadarn Capital, a

specialist investment company distribution and investor relations

partner to accelerate the Group's brand recognition, particularly

in the UK, after more than three years of peer-leading performance

since admission.

On behalf of the Board, I would like to express our gratitude

for your continued support and wish you all the best for the

remainder of 2023.

William Simpson

Chair of the Board of Directors

RTW Biotech Opportunities Ltd

12 September 2023

Report of the Investment Manager

Executive Summary

Since listing on the London Stock Exchange in October 2019, the

Group has grown the NAV attributable to Ordinary Shareholders from

US$168.0 million to US$356.5 million as of 30 June 2023. The NAV

per Ordinary Share has increased 61.5% from US$1.04 to US$1.68 in

the same period. Disappointingly, the share price has not kept pace

with NAV, returning +19.7%, as the shares fell to a discount in

early 2022 and have remained there despite a substantial pick-up in

the Group's NAV from the low in May 2022. From that point in time

until the end of the current reporting period, the NAV has

increased by 37.7% from US$1.22, while the share price has

increased by only 8.7%. With continued NAV outperformance versus

the market and peers, and with the sector's recovery gaining

momentum, it is our expectation that the share price should

follow.

Financial Highlights, Performance Drivers and Significant

Events

Table 1. Financial Highlights

RTW Biotech Opportunities Interim reporting Previous Interim Admission

Ltd period reporting period (30/10/2019)-

(01/01/2023-30/06/2023) (01/01/2022-30/06/2022) 30/06/2023

Ordinary NAV - start US$326.1 million US$363.0 million US$168.0 million

of period

------------------------- ------------------------- -----------------

Ordinary NAV - end US$356.5 million US$265.7 million US$356.5 million

of period

------------------------- ------------------------- -----------------

NAV per Ordinary Share US$1.54 US$1.71 US$1.04

- start of period

------------------------- ------------------------- -----------------

NAV per Ordinary Share US$1.68 US$1.25 US$1.68

- end of period

------------------------- ------------------------- -----------------

NAV movement per

Ordinary Share +9.3% -26.8% +61.5%

------------------------- ------------------------- -----------------

Price per Ordinary US$1.21 US$1.78 US$1.04

Share - start of period

------------------------- ------------------------- -----------------

Price per Ordinary US$1.25 US$0.97 US$1.25

Share - end of period

------------------------- ------------------------- -----------------

Share price return

(i) +2.9% -45.7% +19.7%

------------------------- ------------------------- -----------------

Benchmark returns (ii)

----------------------------------------------------------------------------------------------------

Russell 2000 Biotech +5.3% -39.1% -0.3%

------------------------- ------------------------- -----------------

Nasdaq Biotech -3.2% -20.7% +20.7%

------------------------- ------------------------- -----------------

(i) Total shareholder return is an alternative performance measure

(ii) Source: Capital IQ

RTW Investments, LP, the "Investment Manager", a leading global

healthcare-focused investment firm with a strong track record of

supporting companies developing life-changing therapies, created

the Group as an investment fund focused on identifying

transformative assets with high growth potential across the

biopharmaceutical and medical technology sectors. Driven by deep

scientific expertise and a long-term approach to building and

supporting innovative businesses, we invest in companies developing

transformative next-generation therapies and technologies that can

significantly improve patients' lives while creating significant

value for our shareholders.

NAV performance in the first half of 2023 has overwhelmingly

been driven by the core public portfolio (+12.6% contribution) with

two of those positions being acquired by large cap pharma companies

at significant premiums. In particular, our largest holding

Prometheus Biosciences, which contributed +12.6% to NAV, announced

in April that it was to be acquired by Merck for US$200.00 per

share in cash, a 75% premium to the prior closing price. In

January, CinCor Pharma (+0.9% contribution) announced an agreement

to be acquired by AstraZeneca for US$1.3 billion upfront. CinCor

shareholders also received a non-tradable contingent value right,

payable upon receipt of FDA approval. Combined, these payments

represent a 206% premium. There were no other contributors of note.

Core public holding, Avidity Biosciences, was the only noticeable

detractor (-2.4%) after it announced clinical data in May that did

not meet expectations.

The core private portfolio made a small negative contribution

(-0.6%) to NAV. Within that, RTW Royalty 2 (Urogen) contributed

+0.5%, incorporating distributions received this year and a 7%

increase in the valuation as sales revenue forecasts provided by

independent analysts were added to our valuation models. This was

offset by write-downs in Alcyone (-0.4%) which is in a challenged

financing position, and Neurogastrx (-0.5%) which suffered a

clinical setback and is being wound down. The "other public"

portfolio contributed -1.2% to NAV.

Orchestra BioMed was not a significant contributor or detractor

in the reporting period (-0.2% when combined with the contribution

from HSAC2 founder shares); however, it is worth commenting on as

its merger in January with our SPAC ("HSAC2") was a notable event.

A strong start saw the shares trade above US$20 (versus US$10 at

the de-merger), then trade down to US$7 at the end of the reporting

period. With the majority of its market cap in cash, an EV of less

than US$100 million, and backed by global medical devices leader,

Medtronic, we remain excited for the future of the company and

continue to believe that SPACs are a useful financing vehicle,

especially in bear markets, in spite of the challenges they have

had in recent times in the general market.

Figure 1. Performance Drivers as of 30 June 2023

* Exited positions

Key updates for Core Portfolio Companies during H1 2023:

Clinical & Commercial

-- In January, Rocket announced the addition of a new cardiac

gene therapy program, RP-A601, for arrhythmogenic cardiomyopathy

due to plakophilin 2 pathogenic variants (PKP2-ACM).

-- In March, Avidity Biosciences announced that discussions were

ongoing with the US FDA regarding the partial clinical hold on new

participant enrolment in its Phase 1/2 clinical trial for AOC 1001

(treats Mytonic Dystrophy).

-- In March, Immunocore positively surprised the market with

US$42 million of net sales of Kimmtrak in Q4 2022.

-- In May, Rocket posted several positive data updates from

their PKD, Fanconi Anaemia, LAD-I and Danon Disease programs at the

American Society of Cell and Gene Therapy ("ASGCT") conference.

-- In May, Avidity's partial clinical hold was eased. However,

the data from the higher dose of AOC 1001 in the muscular dystrophy

trial didn't appear to further reduce expression of toxic DMPK, the

hallmark of the disease.

-- In May, Rocket received FDA clearance for the company's

RP-A601 programme to enter the clinic.

-- In April, Neurogastrx announced the latest data from its

NG010 trial that indicated the top-line primary end point did not

meet statistical significance and its resultant potential

liquidation.

Financing

-- In January, CinCor Pharma announced an agreement to be

acquired by AstraZeneca for $1.3 billion upfront. CinCor

shareholders will also receive a non-tradable contingent value

right, payable upon receipt of FDA approval. Combined, these

payments represent a 206% premium.

-- In January, Orchestra BioMed announced the closing of its

merger with RTW's Health Sciences Acquisitions Corporation 2 and

started trading on the Nasdaq under the ticker "OBIO". Medtronic

joined as Orchestra's commercial partner, anchoring the combination

alongside RTW.

-- In February, Mineralys Therapeutics went public through an

upsized initial public offering, which raised US$192 million, under

the ticker "MLYS".

-- In February, the Group participated in a bridge financing

round in Allurion Technologies, a company with a swallowable,

procedure-less gastric pill balloon for weight loss. Earlier that

month the company announced its intention to go public via a

business combination that would include a fully committed PIPE led

by RTW Investments and a non-dilutive, synthetic royalty financing

to close concurrently with the business combination.

-- In March, the Group and other funds managed by RTW co-led a

US$45 million Series B-1 financing round of OriCell Therapeutics, a

China-based cell therapy company.

-- In March, the Group and other funds managed by RTW co-led a

US$200 million Series A financing round in Cargo Therapeutics, a

clinical stage CAR T-cell therapy company.

-- In March, the Group announced its participation in a US$125

million strategic financing deal with Milestone Pharmaceuticals.

The strategic financing included US$50 million in convertible notes

from RTW-managed funds, including the Group, as well as a

commitment by RTW of US$75 million in royalty funding.

-- In April, Prometheus Biosciences announced that it agreed to

be acquired by Merck for US$200.00 per share in cash, a 75% premium

to the prior closing price, for a total consideration of US$10.8

billion.

-- In April, the Group participated in a Series B financing of

Abdera Therapeutics; a pre-clinical stage biopharmaceutical company

focused on small cell lung cancer and other solid tumours. The

company raised US$142 million in a combined series A and B.

-- In May, Acelyrin went public through an upsized US$540

million initial public offering under the ticker "SLRN".

-- In June, Prometheus Biosciences announced that its

acquisition by Merck had been completed.

-- In June, Tourmaline Bio announced a merger with Talaris

Therapeutics alongside a US$75 million private placement that will

provide the company with a cash runway through 2026. The merger is

expected to close in the fourth quarter of 2023.

Portfolio Breakdown, New Investments & Capital Allocation

Plan

We define the core public portfolio as companies that were

initially added to our portfolio as private investments, reflecting

the key focus of the Group's strategy. Our investment approach is

defined as full life cycle and therefore involves retaining private

investments beyond their IPOs; hence the core portfolio consists of

both privately-held and publicly-listed companies.

As of 30 June 2023, the Group's core portfolio accounted for

51.2% of NAV (H1 2022: 61.8%) and included 37 companies (H1 2022:

41), ranging from biotechnology companies developing preclinical to

clinical-stage therapeutic programs, companies developing

traditional small molecule pharmaceuticals, and med-tech companies

developing or commercialising transformative devices. We selected

these companies based upon our rigorous assessment of scientific

and commercial potential and with regard to the valuation of the

assets at the time of investment. Table 4 shows the top fifteen

portfolio companies at the end of the reporting period.

Private companies accounted for 21.7% of NAV on 30 June 2023 and

core public companies accounted for 29.5%. The small decrease in

exposure to private investments primarily reflects the migration of

three positions into the core public portfolio as a result of IPOs

(Mineralys and Acelyrin) and a SPAC merger (Orchestra BioMed).

These events outweighed the addition of the new private positions

shown in Table 3. The lower exposure to the core public portfolio

reflects the aforementioned sale of Prometheus to Merck and the

exiting of our holdings in Monte Rosa, Ventyx, Tenaya, Third

Harmonic and C4.

Approximately one third of the Group's NAV is invested in other

publicly listed companies, which is similar to the same period last

year. The "other public" portfolio is designed to mitigate the drag

of setting aside cash for future deployment into core positions.

This portfolio of assets has been carefully selected, matching, on

a pro-rated basis, the long investments held in our private funds.

The investments represented in this portfolio are similarly

categorised as innovative biotechnology and medical technology

companies developing and commercialising potentially disruptive and

transformational products.

As of 30 June, the Group had an Available Cash position of 18%

of NAV. This primarily reflects proceeds received from the sale of

Prometheus stock. We will retain an appropriate level of these

proceeds to invest in highly attractive opportunities across the

private, core public and other public portfolios. We also plan to

leverage the sector's current tight financing conditions by

offering strategic financing solutions including royalty financing

deployed through "4010 Royalty Fund", another fund managed by RTW

Investments. The Board also plans to distribute a portion of the

Prometheus proceeds through a share buyback, which has now

commenced. We share the Board's view that the current discount to

NAV undervalues the Group and its portfolio, and we feel that this

action represents an attractive, NAV-accretive investment.

As of 30 June 2023, the portfolio was diversified across

treatment modalities, therapeutic focus, and clinical stage. While

the portfolio is still majority invested in US-based companies, we

are committed to adding UK and EU companies in an effort to support

the best assets across the globe and help foster local biotech

ecosystems. By constructing the portfolio in such a way, investors

get exposure to the most innovative parts of a highly specialised

sector with the explosive potential of companies like Prometheus

Biosciences.

Looking forward, we expect the total portfolio sector allocation

to remain close to 80% biopharmaceutical assets and 20% medical

technology assets. In line with prior prospectus guidance, we

anticipate two-thirds of new investments will be made in mid- to

later-stage venture companies and one-third focused on active

company building around the discovery and development or licensing

and distribution of promising assets. As per our recently announced

capital allocation plan, royalty investments (across biopharma and

medtech) will be limited to approximately 15% of NAV.

Table 2. NAV capital breakdown as of 30 June 2023 compared to 30

June 2022

Portfolio grouping % of NAV % of NAV

30 June 2023 30 June 2022

Core private 21.7% 31.1%

-------------- --------------

Core public 29.5% 30.7%

-------------- --------------

"Other public" 30.8% 33.5%

-------------- --------------

Available Cash 18.0% 4.7%

-------------- --------------

Total 100.0% 100.0%

-------------- --------------

Table 3. New investments added in the first half of 2023

Company name Description % NAV

Clinical stage biotech company targeting

Cargo Therapeutics large B-cell lymphoma 0.4%

---------------------------------------------------- ------

Medtech company with a swallowable, procedure-less

gastric pill balloon for weight loss,

commercially available in 5 countries,

Allurion Technologies clinical stage in the U.S. 0.01%

---------------------------------------------------- ------

Preclinical stage pharmaceutical company

OriCell Therapeutics focusing on multiple myeloma 0.6%

---------------------------------------------------- ------

Preclinical biopharma company developing

Abdera Therapeutics radiopharmaceuticals for lung cancer 0.3%

---------------------------------------------------- ------

Late-stage biotech company developing

medicines for thyroid eye disease and

Tourmaline Bio atherosclerotic cardiovascular disease 0.2%

---------------------------------------------------- ------

Figure 2. Core Portfolio breakdown as a percentage of NAV,

adjusted to be out of 100%, by (A) Therapeutic Focus, (B) Modality,

(C) Clinical Stage and (D) Geography as of 30 June 2023

Table 4. Top fifteen core positions as of 30 June 2023

Portfolio Company Description Therapeutic Area Clinical stage of Expected upcoming % NAV

lead program catalyst

Gene therapy

platform company

for rare paediatric

diseases. Four

clinical programs

for Fanconi

anaemia, Danon,

Rocket LAD, and PKD. Rare Disease Phase 2 Q3 2023 12.5%

--------------------- --------------------- ------------------- ---------------------- ------

T-cell receptor

therapy company

focused on oncology

and infectious

Immunocore disease Oncology Commercial Q3 2023 7.3%

--------------------- --------------------- ------------------- ---------------------- ------

NewCo focused on

acquiring rights

from innovative

therapies for

development and

commercialisation Cardiovascular,

Ji Xing in China Ophthalmology Phase 3 Series D Q4 2023 7.3%

--------------------- --------------------- ------------------- ---------------------- ------

Royalty deal with

Urogen for JELMYTO,

the first

FDA-approved

treatment for

low-grade upper

tract urothelial

RTW Royalty 2 cancer Oncology Commercial Q3 4.0%

--------------------- --------------------- ------------------- ---------------------- ------

Clinical stage

company developing

interventions for FDA filing

Milestone tachycardias Cardiovascular Phase 3 Q3 2023 2.5%

--------------------- --------------------- ------------------- ---------------------- ------

Medical device

company focused on

developing products

for the treatment

of coronary artery

disease and

Orchestra hypertension Cardiovascular Phase 3 - 1.8%

--------------------- --------------------- ------------------- ---------------------- ------

Antibody conjugated

RNA medicines

company. Lead

program for

myotonic dystrophy,

a degenerative

disease with no P1 Data

Avidity therapy Myotonic Dystrophy Phase 1 Q4 2023 1.8%

--------------------- --------------------- ------------------- ---------------------- ------

Closed-loop

pancreatic system

for automated and

autonomous delivery

Beta Bionics of insulin Type 1 Diabetes Phase 3 - 1.3%

--------------------- --------------------- ------------------- ---------------------- ------

Biotech using a

structure-based

design to develop

innovative small

molecules against

promising

molecular targets Data

NiKang in oncology Oncology Phase 1 Q1 2024 1.2%

--------------------- --------------------- ------------------- ---------------------- ------

Medical device

company developing

products that

target dysfunction

of the left

ventricle,

the underlying

cause of heart

Ancora failure Cardiovascular Phase 3 - 1.1%

--------------------- --------------------- ------------------- ---------------------- ------

Clinical stage

biotech developing

first-in-class

therapeutics for

ophthalmic

Tarsus conditions Ophthalmology Phase 3 PDUFA Q3 2023 1.1%

--------------------- --------------------- ------------------- ---------------------- ------

Clinical stage

biotech developing

therapies to manage Data

GH Research mental disease CNS Phase 2 YE 2023 1.0%

--------------------- --------------------- ------------------- ---------------------- ------

Biopharma company

focused on

accelerating the

development and

delivery of

transformative

medicines

Acelyrin in immunology Inflammation Phase 2 - 0.8%

--------------------- --------------------- ------------------- ---------------------- ------

Medical diagnostics

company that has

patented a

technique and

technology for

blood culture

Magnolia Medical collection Inflammation, sepsis Commercial - 0.7%

--------------------- --------------------- ------------------- ---------------------- ------

China-based pharma

company developing

tumour cellular

immunotherapeutics

to treat relapsed

and refractory

OriCell multiple myeloma Multiple myeloma Preclinical - 0.6%

--------------------- --------------------- ------------------- ---------------------- ------

Table 5. Core portfolio positions as of 30 June 2023 compared to

30 June 2022

Portfolio Private(1)/ Valuation % of Valuation % of

Company Public(2) in US$ Group's in US$ Group's

at 30/06/2023 net assets at 30/06/2022 net assets

at 30/06/2023 at 30/06/2022

---------------

Rocket Public 47,705,037 12.5% 32,538,657 11.5%

------------------ --------------- --------------- --------------- ---------------

Immunocore Public 27,716,450 7.3% 12,034,341 4.2%

------------------ --------------- --------------- --------------- ---------------

Ji Xing Private 27,586,548 7.3% 24,451,819 8.6%

------------------ --------------- --------------- --------------- ---------------

RTW Royalty

2 Private 15,086,772 4.0% 14,474,522 5.1%

------------------ --------------- --------------- --------------- ---------------

Milestone

(5) Public 9,577,632 2.5% 3,772,913 1.3%

------------------ --------------- --------------- --------------- ---------------

Orchestra

(3) (4) Public 6,979,837 1.8% 2,471,736 0.9%

------------------ --------------- --------------- --------------- ---------------

Avidity Public 6,952,998 1.8% 10,171,421 3.6%

------------------ --------------- --------------- --------------- ---------------

Beta Bionics Private 5,117,893 1.3% 5,673,324 2.0%

------------------ --------------- --------------- --------------- ---------------

NiKang Private 4,452,023 1.2% 4,359,087 1.5%

------------------ --------------- --------------- --------------- ---------------

Ancora Private 4,240,240 1.1% 2,754,042 1.0%

------------------ --------------- --------------- --------------- ---------------

Tarsus Public 4,181,963 1.1% 3,161,080 1.1%

------------------ --------------- --------------- --------------- ---------------

GH Research Public 3,639,221 1.0% 3,061,056 1.1%

------------------ --------------- --------------- --------------- ---------------

Acelyrin (3) Public 3,008,053 0.8% 1,306,017 0.5%

------------------ --------------- --------------- --------------- ---------------

Magnolia Medical Private 2,628,698 0.7% 2,589,231 0.9%

------------------ --------------- --------------- --------------- ---------------

OriCell Private 2,339,375 0.6% - -

------------------ --------------- --------------- --------------- ---------------

Apogee Private 2,303,380 0.6% - -

------------------ --------------- --------------- --------------- ---------------

Umoja Private 2,248,947 0.6% 2,669,948 0.9%

------------------ --------------- --------------- --------------- ---------------

Encoded Private 2,216,591 0.6% 2,881,595 1.0%

------------------ --------------- --------------- --------------- ---------------

Mineralys

(3) Public 1,982,335 0.5% 1,034,231 0.4%

------------------ --------------- --------------- --------------- ---------------

Kyverna Private 1,863,590 0.5% 1,292,043 0.5%

------------------ --------------- --------------- --------------- ---------------

Numab Private 1,852,448 0.5% 1,642,139 0.6%

------------------ --------------- --------------- --------------- ---------------

Nuance Private 1,665,286 0.4% 1,526,120 0.5%

------------------ --------------- --------------- --------------- ---------------

Lenz Private 1,451,751 0.4% 1,471,248 0.5%

------------------ --------------- --------------- --------------- ---------------

Cargo Private 1,412,351 0.4% - -

------------------ --------------- --------------- --------------- ---------------

Abdera Private 1,136,802 0.3% - -

------------------ --------------- --------------- --------------- ---------------

Lycia Private 979,462 0.3% 969,864 0.3%

------------------ --------------- --------------- --------------- ---------------

Tourmaline

Bio Private 891,289 0.2% - -

------------------ --------------- --------------- --------------- ---------------

Artiva Private 865,532 0.2% 919,286 0.3%

--------------- --------------- --------------- ---------------

Artios Private 741,774 0.2% 681,351 0.2%

--------------- --------------- --------------- ---------------

Swift Health Private 645,171 0.2% 740,211 0.3%

--------------- --------------- --------------- ---------------

CinCor Public 541,706 0.1% 3,329,206 1.2%

--------------- --------------- --------------- ---------------

Prometheus

Labs Private 175,734 0.05% 207,885 0.1%

--------------- --------------- --------------- ---------------

Alcyone Private 149,750 0.04% 4,054,228 1.4%

--------------- --------------- --------------- ---------------

Yarrow Private 149,231 0.04% 463,044 0.2%

--------------- --------------- --------------- ---------------

Neurogastrx Private 114,535 0.03% 1,597,646 0.6%

--------------- --------------- --------------- ---------------

Allurion Private 39,247 0.01% - -

--------------- --------------- --------------- ---------------

Visus Private 149 0.00004% 2,237,667 0.8%

------------------ --------------- --------------- --------------- ---------------

1 Valuations for private portfolio companies on a fair value

basis.

2 The valuations of public positions were calculated using their

market capitalisation as of 30 June 2023

3 Position was private at the last interim reporting period end

and has since gone public. In accordance with the Group's valuation

policy in practice prior to 2023, as at 30 June 2022, the Group

applied a discount to its investments in private companies that

became public companies subject to customary post-IPO lock-up

provisions. As of 1 January 2023, the Group has elected to early

adopt FASB's ASU 2022-03, ASC Topic 820, "Fair Value Measurement of

Equity Securities Subject to Contractual Sale Restrictions" which

eliminated this practice. Refer to Note 1 to these unaudited

interim consolidated financial statements.

4 Includes shares held in the initial SPAC vehicle (HSAC2) that

merged with Orchestra in January 2023

5 Includes pre-funded warrants

Table 6. RTW representation on portfolio company boards as of 30

June 2023

Portfolio Company (1) RTW representative on the board

Alcyone Piratip Pratumsuwan

-------------------------------------------

Ji Xing Rod Wong, Peter Fong, Gotham Makker

-------------------------------------------

Magnolia Ovid Amadi

-------------------------------------------

Nikang Chris Liu

-------------------------------------------

Rocket Rod Wong, Gotham Makker, Naveen Yalamanchi

-------------------------------------------

Yarrow Rod Wong, Peter Fong, Gotham Makker

-------------------------------------------

1 In aggregate these represent 22% of the NAV of the Group at 30

June 2023

Table 7. Top 5 "Other Public" portfolio holdings as of 30 June

2023

Position Ticker % of Description

NAV

Argenx SE ARGX 3.8% Commercial stage multi-pipeline immunology

company

------- ----- -------------------------------------------

PTC Therapeutics PTCT 2.4% Commercial stage biotech making therapies

for rare genetic diseases.

------- ----- -------------------------------------------

Axsome Therapeutics AXSM 2.1% Commercial stage biotech focused on

CNS

------- ----- -------------------------------------------

Stoke Therapeutics STOK 2.0% Clinical stage biotech developing

RNA treatments for severe genetic

diseases

------- ----- -------------------------------------------

Establishment ESTA 1.9% Commercial stage medtech manufacturing

Labs Holdings innovative breast health solutions

------- ----- -------------------------------------------

Private Portfolio Valuations and Cash Runway Analysis

The core private and public portfolios are the foundation of the

Group's strategy. They are built on our rigorous assessment of the

best private market investment opportunities. We have always been

highly selective in this area, focusing only on companies with both

well-founded science and attractive commercial opportunities. We

are now benefiting from this discipline in a challenging capital

markets environment as our private portfolio is a good size and

well-funded.

As of 30 June 2023, the average cash runway of the twenty-four

companies in our private portfolio that burn cash was twenty-six

months, which gives them a good amount of time to focus on their

clinical development plans until funding markets improve. There are

eleven companies with less than twelve months of runway, two of

which are RTW company creations, which is by design. Of the

remainder, most have reasonable and well-formed capital raising

plans in place. Two are in more challenging financial positions and

one of those is being wound down with residual cash being returned

to shareholders.

Which brings us to our private valuations. We hold our private

company investments at 'fair value' i.e., the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants. This is assessed

in accordance with US GAAP, utilizing valuation techniques

consistent with the International Private Equity and Venture

Capital Guidelines including, but not limited to, the income

approach and the market approach. Valuations are adjusted both

during regular valuation cycles and on an ad hoc basis in response

to 'trigger events' which may include changes in fundamentals, an

intention to carry out an IPO, or changes to the valuations of

comparable public companies. Our valuation process ensures that

private companies are valued in both a fair and timely manner.

The process is overseen by the RTW Valuation Committee. The

Committee is supported by RTW's valuation team that is independent

from the investment team and receives advice from two independent

third-party valuation firms, Alvarez & Marsal and Houlihan

Lokey. The Committee approves valuations of private company

investments on a monthly basis and utilises the analysis of an

independent third-party valuation firm no less frequently than

twice in a year in determining the fair value of each material

private investment. The valuations are also reviewed twice per year

by the Board and are subject to the scrutiny of KPMG in the annual

audit process.

In the first half of this year, the private portfolio saw a

total of thirty-six valuation adjustments. Twelve positions were

marked up by an average of 16.8%; twelve were marked lower by any

average of -26.6%. The balance remained at cost given the recent

date of the investment. At 30 June, the average time since the last

third-party valuation was 4.7 weeks and with an average of 1.2

years having elapsed since the last financing round.

The value of the private portfolio is best demonstrated by the

three portfolio IPOs that have completed so far this year

(including Apogee Therapeutics which occurred after the reporting

period). In all cases, we saw a step-up in valuation from prior

private holding value by c. 58% on average and a 1.82x multiple on

invested capital. It is worth noting that this is happening in an

environment where there have only been a few meaningful biopharma

IPOs, highlighting the quality of the portfolio. Figure three shows

the pickup in IPO and new investment activity in our core portfolio

versus last year.

Figure 3. New private investments and IPOs by year since

admission

Figure 4. Core Portfolio Cash Runway Analysis

Figure 5. Private portfolio year to date valuation changes

*Position that went public during the period

Table 8. RTW's Private Valuation Statistics for H1 2023

Number of revaluations 36

Average time since last third-party 4.7 weeks

valuation (at 30 June)

----------

Average time since last financing 1.2 years

round (at 30 June)

----------

Average valuation change -3.7%

----------

Average write-up 16.8%

----------

Average write-down -26.6%

----------

Average step-up to IPO price 58%

----------

Average MOIC to IPO price 1.82x

----------

Table 9. Performance of core portfolio investments since

inception as of 30 June 2023

Portfolio Holding Initial Valuation MOC(1) XIRR(1) Holding

Investment Date or Period

Exit Date (yrs)

(3)

Inivata (2) 24/12/2020 18/06/2021 2.6 635.5% 0.5

------------- ------------ ------- -------- --------

Prometheus Bio (2) 30/10/2020 13/06/2023 24.7 275.8% 2.6

------------- ------------ ------- -------- --------

RTW Royalty Holdings

(2) 13/11/2020 30/12/2022 3.4 129.6% 2.6

------------- ------------ ------- -------- --------

iTeos (2) 24/03/2020 17/03/2022 3.6 108.2% 2.0

------------- ------------ ------- -------- --------

Frequency (2) 17/07/2019 23/03/2021 2.8 85.3% 1.7

------------- ------------ ------- -------- --------

Mineralys 01/06/2022 30/06/2023 1.8 74.8% 1.1

------------- ------------ ------- -------- --------

Cincor (2) 22/09/2021 24/02/2023 2.1 68.3% 1.8

------------- ------------ ------- -------- --------

Acelyrin 20/10/2021 30/06/2023 2.0 58.5% 1.7

------------- ------------ ------- -------- --------

Athira (2) 29/05/2020 30/06/2022 1.6 56.8% 2.1

------------- ------------ ------- -------- --------

Immunocore 13/08/2019 30/06/2023 3.0 35.2% 3.9

------------- ------------ ------- -------- --------

RTW Investments ICAV

for RTW Fund 2 05/05/2021 30/06/2023 1.5 20.4% 2.2

------------- ------------ ------- -------- --------

Apogee Therapeutics 15/11/2022 30/06/2023 1.1 15.8% 0.6

------------- ------------ ------- -------- --------

Pulmonx (2) 17/04/2020 04/11/2022 1.3 13.1% 2.6

------------- ------------ ------- -------- --------

Prometheus Labs 31/12/2020 30/06/2023 1.3 12.2% 2.5

------------- ------------ ------- -------- --------

Tarsus 24/09/2020 30/06/2023 1.3 9.7% 2.8

------------- ------------ ------- -------- --------

Magnolia 02/07/2021 30/06/2023 1.2 9.1% 2.0

------------- ------------ ------- -------- --------

Avidity 08/11/2019 30/06/2023 1.3 7.8% 3.6

------------- ------------ ------- -------- --------

Ji Xing 10/02/2020 30/06/2023 1.1 5.9% 3.4

------------- ------------ ------- -------- --------

Encoded 12/06/2020 30/06/2023 1.1 3.4% 3.0

------------- ------------ ------- -------- --------

Numab 07/05/2021 30/06/2023 1.1 3.3% 2.1

------------- ------------ ------- -------- --------

Ancora 20/01/2021 30/06/2023 1.0 1.7% 2.4

------------- ------------ ------- -------- --------

NiKang 09/09/2020 30/06/2023 1.0 1.6% 2.8

------------- ------------ ------- -------- --------

Abdera 04/04/2023 30/06/2023 1.0 0.0% 0.2

------------- ------------ ------- -------- --------

Allurion 23/02/2023 30/06/2023 1.0 0.0% 0.3

------------- ------------ ------- -------- --------

Cargo 09/02/2023 30/06/2023 1.0 0.0% 0.4

------------- ------------ ------- -------- --------

Oricell 24/02/2023 30/06/2023 1.0 0.0% 0.3

------------- ------------ ------- -------- --------

Tourmaline 02/05/2023 30/06/2023 1.0 0.0% 0.2

------------- ------------ ------- -------- --------

Ventyx (2) 26/02/2021 20/03/2023 1.0 0.0% 2.1

------------- ------------ ------- -------- --------

Kyverna 09/11/2021 30/06/2023 1.0 0.0% 1.6

------------- ------------ ------- -------- --------

GH Research 09/04/2021 30/06/2023 1.0 -1.7% 2.2

------------- ------------ ------- -------- --------

Artios 27/07/2021 30/06/2023 1.0 -2.2% 1.9

------------- ------------ ------- -------- --------

Nuance 07/12/2020 30/06/2023 0.9 -2.4% 2.6

------------- ------------ ------- -------- --------

Artiva 23/02/2021 30/06/2023 0.9 -3.4% 2.3

------------- ------------ ------- -------- --------

C4 Therapeutics (2) 02/06/2020 08/02/2023 0.9 -4.9% 2.7

------------- ------------ ------- -------- --------

Lenz Therapeutics 13/04/2022 30/06/2023 0.9 -5.3% 1.2

------------- ------------ ------- -------- --------

Beta Bionics 28/06/2019 30/06/2023 0.8 -7.0% 4.0

------------- ------------ ------- -------- --------

Lycia 02/09/2021 30/06/2023 0.9 -7.6% 1.8

------------- ------------ ------- -------- --------

Milestone 23/07/2020 30/06/2023 0.9 -8.7% 2.9

------------- ------------ ------- -------- --------

Orchestra 28/06/2019 30/06/2023 0.8 -9.3% 4.0

------------- ------------ ------- -------- --------

Biomea (2) 23/12/2020 24/01/2022 0.9 -10.2% 1.1

------------- ------------ ------- -------- --------

Swift Health 27/08/2021 30/06/2023 0.7 -15.4% 1.8

------------- ------------ ------- -------- --------

Umoja 09/06/2021 30/06/2023 0.7 -16.3% 2.1

------------- ------------ ------- -------- --------

Monte Rosa (2) 12/03/2021 02/02/2023 0.7 -19.2% 1.9

------------- ------------ ------- -------- --------

Tenaya (2) 17/12/2020 08/02/2023 0.2 -51.1% 2.1

------------- ------------ ------- -------- --------

Landos (2) 09/08/2019 02/11/2022 0.1 -55.0% 3.2

------------- ------------ ------- -------- --------

Third Harmonic (2) 17/12/2021 12/04/2023 0.2 -67.1% 1.3

------------- ------------ ------- -------- --------

Pyxis (2) 08/03/2021 08/07/2022 0.2 -70.5% 1.3

------------- ------------ ------- -------- --------

Neurogastrx 25/06/2021 30/06/2023 0.1 -73.2% 2.0

------------- ------------ ------- -------- --------

Alcyone 08/06/2021 30/06/2023 0.0 -87.5% 2.1

------------- ------------ ------- -------- --------

Yarrow 14/05/2021 30/06/2023 0.1 -97.0% 2.1

------------- ------------ ------- -------- --------

Visus 26/01/2021 30/06/2023 0.0 -98.2% 2.4

------------- ------------ ------- -------- --------

AVERAGE 1.6 18.0% 2.0

------------------------------------------------- ------- -------- --------

1 Alternative Performance Measure

2 Exited position

3 The valuation date for all investments still held at the

period end was 30 June 2023. Dates other than 30 June 2023 are the

dates that a position was exited.

Table 10. Performance of Rocket Pharmaceuticals from admission

to 30 June 2023

Share price at admission Share price at 30 June 2023 Share price return %

Rocket Pharmaceuticals US$14.00 US$19.87 42%

-------------------------- ----------------------------- ---------------------

Sector review and outlook

Pharma went shopping in the first half of the year. Total deal

value of US$93 billion puts sector M&A activity on track to be

at the highest level since 2019. 2019's US$328 billion total was

driven by two large deals, Bristol-Meyers' US$74 billion for

Celgene Corporation and AbbVie's US$63 billion for Allergan plc,

both focused on diversification and cost savings. In contrast,

recent deals have been about innovative assets that can deliver

growth. Deal highlights include Pfizer's US$43 billion for Seagen

Inc., Merck's US$11 billion for Prometheus, Novartis' US$3.2

billion for Chinook Therapeutics, Sanofi's acquisition of

Provention Bio for US$2.9 billion and Lilly's US$2.4 billion for

Dice Therapeutics. Premiums ranged from 30% for Seagen up to 270%

for Provention Bio and proxies tell the story of competitive

processes. Of the three large cap pharma companies we have

highlighted as most in need of patent cliff revenue replenishment

(Bristol, Pfizer, and Merck), only Pfizer has addressed a

significant part of its exclusivity losses this decade, not to

mention the potential impact of the Inflation Reduction Act (IRA)

on small molecule portfolios. With attractive valuations for midcap

biotech companies and record (and growing) cash piles on large cap

pharma balance sheets, we think these deals will continue.

Despite the strong pick-up in M&A, the biotech sector's

burgeoning recovery from the second worst bear market in its

history flattered to deceive in the first half of the year. From

the low in mid-May last year to the end of January this year, the

Russell 2000 Biotech Index rallied over 40%, but then finished the

first quarter -7.3%. It rallied back slightly in the second quarter

to finish the first half +5.3%, but it was the only sector index to

finish the half in meaningfully positive territory. The pharma

heavy Arca index was +0.7%, the large cap heavy NBI was -3.2%, and

the most commonly traded small cap index, the XBI, was +0.2%. At

US$85.00, the XBI is trading at approximately the same level as it

was in 2015 and only marginally above last year's lows when

adjusting for subsequent take-outs and transformational clinical

data. As a result, sector valuations remain attractive. The NBI is

trading at 5.8x price to sales, which is still only 29% above

Global Financial Crisis lows. At the smaller end of the spectrum,

180 of the 578 companies with less than US$10 billion of market

capitalisation are trading at less than the cash on their balance

sheets.

We suspect that some negative sector headlines might have

impacted sentiment in the short term (without impacting

fundamentals too much). The FTC Chair Lina Khan's push to expand

the definition of anti-competitiveness beyond portfolio overlap

likely dampened excitement about M&A. In the FTC's lawsuit to

block Amgen's acquisition of Horizon Therapeutics, Khan introduced

theoretical product bundling of non-overlapping products as an

argument to block the deal. While we think the odds are low, should

courts decide in favour of the FTC, agreements not to bundle across

products seem a straightforward remedy in the same way that there

were no pharma deals in the last decade that were blocked due to

portfolio overlap - any issues were solvable with the divestiture

of overlapping products.

The banking crisis in the first quarter also likely weighed on

sentiment, especially with "biotech bank", Silicon Valley Bank

("SVB"), featuring so heavily. This was made moot by the deposit

backstop, and SVB's orderly wind-down should have no material

impact on biotech funding. However, it did conceal two significant

M&A deals that happened on the same weekend: Pfizer-Seagen was

the biggest deal since 2019 and Sanofi-Provention was the biggest

premium paid so far this year.

Another reason the sector's recovery has decelerated is likely

the strong performance in the technology sector, driven by interest

in AI. The year-to-date performance divergence between tech and

biotech is as wide as it has ever been. For biotech, the near-term

opportunity to apply AI is in the laborious idea generation and

screening phases of target discovery and molecular design, making

these processes more efficient. This is clearly more incremental

rather than transformational, as the market thinks AI will be for

some large cap tech names, which have driven the sector's returns,

pulling growth capital flows away from other sectors.

The good news is that capital markets activity is showing some

improvement on top of the M&A already mentioned. Follow-on

activity has been solid, rewarding those drug developers that can

deliver successful data or news, with many of these offerings being

oversubscribed and upsized. IPO activity is still slow with only

three significant biotech debuts this year. Two more IPOs took

place after the end of the reporting period, and they performed

well on debut. We think that our portfolio company Apogee

Therapeutics' upsized IPO in July may augur well for a better IPO

environment ahead given its strong performance despite its being a

pre-clinical company.

Finally, we believe that there is room for upside surprises with

the Inflation Reduction Act ("IRA"), as we approach implementation

later this year. The market appears to have assumed that Medicare

price negotiations are effectively early genericisation with

dramatic and immediate price drops. Amid this sentiment, we think

there could be some upside optionality. For example, the

negotiation framework leaves the door open for more modest price

reductions, especially for drugs that address high unmet needs with

limited alternatives. What's more, pharma companies are now

challenging the IRA in courts. In our view, if there is anything

that ameliorates the worst-case scenarios, then this will likely be

interpreted as positive for the sector.

Key portfolio company events post period end

On 17 July 2023, Apogee Therapeutics, a pre-clinical company

focused on inflammation, went public through an upsized IPO,

raising US$300 million. The company started trading on the Nasdaq

under the ticker symbol "APGE".

Outlook for the remainder of 2023: A plan for future

sustainability reporting and policy

Following the Board's directive in the second quarter to develop

an approach to ESG for RTW Biotech Opportunities Ltd, the Group

engaged sustainability advisory firm, Terra Instinct, to be its

partner in developing a new policy and investor reporting. As an

independent third party, Terra Instinct will take stock of the

Investment Manager's investment process, governance infrastructure,

and other relevant controls and procedures to help craft an ESG

policy and framework for future reporting, including the

presentation of estimates and carbon emissions metrics, all with a

view to being in line with relevant standards. The first reporting

is expected in the 2023 Annual Report.

RTW Investments, LP

12 September 2023

Statement of Principal Risks and Uncertainties for the Remaining

Six Months of the year to 31 December 2023

As described in the Group's annual consolidated financial

statements for the year ended 31 December 2022, the Group's

principal and emerging risks and uncertainties include the

following:

- Failure to achieve investment objective;

- Counterparty risk;

- The Investment Manager relies on key personnel;

- Portfolio companies may be subject to litigation;

- Exposure to global political and economic risks;

- Clinical development and regulatory risks;

- Imposition of pricing controls for clinical products and services;

- Inflation;

- Ukraine war;

- Availability of capital;

- Liquidity risk.

The Board believes that these risks are unchanged in respect of

the remaining six months of the year to 31 December 2023.

Further information in relation to these principal risks and

uncertainties may be found on pages 34 to 36 of the Group's annual

report and audited consolidated financial statements for the year

ended 31 December 2022.

These inherent risks associated with investments in the biotech

and pharmaceutical sector could result in a material adverse effect

on the Group's performance and value of the Ordinary Shares.

Risks are mitigated and managed by the Board through continual

review, policy setting and regular reviews of the Group's risk

matrix by the Audit Committee to ensure that procedures are in

place with the intention of minimising the impact of the

above-mentioned risks. The Board carried out a formal review of the

risk matrix at the Audit Committee meeting held on 27 July 2023.

The Board relies on periodic reports provided by the Investment

Manager and Administrator regarding risks that the Group faces.

When required, experts will be employed to gather information,

including tax advisers and legal advisers.

Statement of Directors' Responsibilities

The Directors confirm to the best of their knowledge that:

- the unaudited interim consolidated financial statements have

been prepared in conformity with US generally accepted accounting

principles; and

- the interim management report (which includes the Chair's

Statement, Report of the Investment Manager and Statement of

Principal Risks and Uncertainties) together with the unaudited

interim consolidated financial statements include a fair review of

the information required by:

a. DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

unaudited interim consolidated financial statements; and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

b. DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place during the

first six months of the financial year and that have materially

affected the financial position or performance of the Group during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the Group's

website (https://www.rtwfunds.com/rtw-biotech-opportunities-ltd).

Legislation in Guernsey governing the preparation and dissemination

of financial statements may differ from legislation in other

jurisdictions.

By order of the Board

William Simpson Paul Le Page

Chair Director

12 September 2023 12 September 2023

INDEPENT REVIEW REPORT TO RTW BIOTECH OPPORTUNITIES LTD

(formerly RTW Venture Fund Limited)

Conclusion

We have been engaged by RTW Biotech Opportunities Ltd (formerly

RTW Venture Fund Limited)(the "Company") to review the consolidated

financial statements in the half-yearly financial report for the

six months ended 30 June 2023 of the Company and its subsidiary

(together, the "Group"), which comprises the unaudited interim

consolidated statement of assets and liabilities including the

unaudited interim consolidated condensed schedule of investments,

the unaudited interim consolidated statements of operations,

changes in net assets and cash flows and the related explanatory

notes.

Based on our review, nothing has come to our attention that

causes us to believe that the consolidated financial statements in

the half-yearly financial report for the period ended 30 June 2023

do not give a true and fair view of the financial position of the

Company as at 30 June 2023 and of its financial performance and its

cash flows for the six month period then ended, in conformity with

U.S. generally accepted accounting principles and the Disclosure

Guidance and Transparency Rules ("the DTR") of the UK's Financial

Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity ("ISRE (UK) 2410") issued by the Financial Reporting Council

for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the consolidated financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Scope of review

section of this report, nothing has come to our attention to

suggest that the directors have inappropriately adopted the going

concern basis of accounting or that the directors have identified

material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410. However future events or conditions

may cause the Group or the Company to cease to continue as a going