TIDMSNX

RNS Number : 5532F

Synectics PLC

11 July 2023

RNS 11 July 2023

Synectics plc

("Synectics" or the "Company" or the "Group")

Interim results for the six months ended 31 May 2023

Synectics plc (AIM: SNX) , a leader in advanced security and

surveillance systems, reports its unaudited interim results for the

six months ended 31 May 2023 ("H1 2023" or "the period").

Headlines(1)

-- H1 2023 revenue 14% ahead of H1 2022 at GBP21.9 million

(H1 2022: GBP19.2 million)

-- Underlying operating profit increased by 61% to GBP0.8

million (H1 2022: GBP0.5 million)

-- Underlying profit before tax up 62% to GBP0.7 million

(H1 2022: GBP0.4 million)

-- Order book as at 31 May 2023 strong at GBP28.4 million

(31 May 2022: GBP24.5 million)

-- Underlying earnings per share up 76% to 3.7p (H1 2022:

2.1p)

-- Net cash as at 31 May 2023 solid at GBP4.0 million (31

May 2022: GBP4.2 million)

-- Results were underpinned by a strong oil & gas market

with progress in other markets being more modest

-- Based on the Company's strong order book, the Board expects

significantly improved trading in the second half of this

financial year

-- The Board's expectations for the year to 30 November 2023

remain unchanged

Commenting on the results, Paul Webb, Chief Executive of

Synectics, said:

"Synectics has now had four consecutive periods of progress in

revenue and profits and is confident of delivering further progress

in H2 2023. Operating in markets that are strong and recovering,

the Company has solid long-term growth potential, from a sound

platform.

The Board expects the Company's results for the year ending 30

November 2023 to be in line with market expectations, despite being

weighted to the seasonally stronger H2. "

Craig Wilson, recently appointed Chair of Synectics, added:

"After conducting a comprehensive business review, it is evident

that Synectics possesses excellent technology in thriving global

markets, including oil & gas, gaming, and public safety, which

are experiencing renewed growth. With a robust financial position

and a clear strategic direction, it is now all about

execution."

(1) All income statement comparatives set out in this

announcement reflect continuing operations unless otherwise

stated.

For further information, please contact:

Synectics plc Tel: +44 (0) 114 280 2828

Paul Webb, Chief Executive

Officer

Amanda Larnder, Chief Financial

Officer

email: info@synecticsplc.com www.synecticsplc.com

Shore Capital Tel: +44 (0) 20 7408 4050

Tom Griffiths / David Coaten

Media enquiries:

Intelligent Conversation Tel: +44 (0) 161 694 3979

Claire Evans

email: claire@weareic.com

About Synectics

Synectics plc (AIM: SNX) is a leader in advanced security

and surveillance systems that help protect people, property,

communities, and assets around the world.

The Company's expertise is in providing solutions for specific

markets where security and surveillance are critical to operations.

These include gaming, oil and gas, public space, transportation,

and critical infrastructure.

Synectics has deep industry experience in these markets and

works closely with customers to deliver solutions that are

tailored to meet their needs. Technical excellence, combined

with decades of experience and long-standing customer relationships,

provides fundamental differentiation from mainstream suppliers

and makes the Company a stand out in its field.

Find out more at www.synecticsplc.com

Chief Executive's Statement

Overview

The Company's performance in H1 2023 was in line with the

Board's expectations, continuing the good progress made

period-on-period over the last two years.

Progress was underpinned by a strong performance in the global

oil & gas market, which is expected to continue. There was some

recovery in the Asian gaming market whilst progress in other

markets was more modest, with further improvement expected.

The Company's order book at 31 May 2023 was materially ahead of

the same date last year, with a significant proportion expected to

trade in the second half of the year (" H2 2023 ").

Order intake since the period end has been strong with around

GBP5.0 million of new orders booked in June 2023 alone, including

the further contract for Saudi Aramco which was announced by the

Company on 4 July 2023.

This order book, and the pipeline of anticipated business,

supports the Board's expectations of significantly improved trading

in H2 2023.

The Board expects the Company's results for the year ending 30

November 2023 (" FY 2023 ") to be in line with market expectations,

despite being weighted to the seasonally stronger H2.

Results

Synectics' revenues for the period were 14 per cent. ahead of H1

2022 at GBP21.9 million (2022: GBP19.2 million) driven mainly by

growth in Synectic Systems, particularly in the global oil &

gas market.

The Group recorded an increased underlying operating profit for

H1 2023 of GBP0.8 million (H1 2022: GBP0.5 million) which was

negatively impacted by GBP0.2 million of foreign exchange losses.

Underlying profit before tax was up 61 per cent. at GBP0.7 million

(H1 2022: GBP0.4 million). Underlying earnings per share were 76

per cent. ahead at 3.7p (H1 2022: 2.1p).

The Company's balance sheet remains solid, with net cash as at

31 May 2022 of GBP4.0 million (31 May 2022: GBP4.2 million),

following planned and well managed increased levels of working

capital. The Company has no bank debt and available undrawn

facilities of GBP3.0 million.

The consolidated firm order book as at 31 May 2022 was strong at

GBP28.4 million (31 May 2022: GBP24.5 million), with almost

two-thirds of it expected to trade in H2 2023 - well ahead of the

same point last year, with the balance being largely long-term

service and support contracts.

More details on these results are set out below in the Business

Review section.

Dividend

The Board has previously set out its intention to recommend only

a final dividend, therefore no interim dividend is being

declared.

Strategic Review

Synectics' primary focus includes oil & gas, gaming, and

public safety markets. These markets have stringent functional and

regulatory requirements, which the Company's advanced technology

effectively fulfils. Both the global scale and recent return to

growth in these markets reinforces the Board's view that the

Company can deliver strong revenue growth by expanding sales

coverage in markets it already knows well. Furthermore, we

anticipate that the Company will benefit from heightened public

attention towards supply chain security risks within our targeted

markets.

The Company acknowledges the immense potential for sales growth

through collaborations with local specialist partners and

integrators in each market. Consequently, it is actively engaged in

developing robust partner sales channels across various territories

and markets. The partners' deep understanding of local dynamics

plays a pivotal role in efficiently and swiftly expanding

Synectics' sales coverage, eliminating the need for establishing a

direct sales approach in every new geography.

A crucial element of the Company's expansion strategy involves

enhancing the ease of deploying its core technology, Synergy, for

its partners. The Company has also made significant investment to

facilitate the product's deployment in cloud environments such as

Microsoft Azure. Additionally, it has integrated further artificial

intelligence capabilities to provide real time alerts, ensuring

operators are immediately notified of potentially suspicious

events.

Our long-standing customer relationships contribute

significantly to the Group's revenue through repeat business,

encompassing upgrades, expansions, and ongoing support. However, it

is important for the Company to increase the level of contracted

recurring revenue through long-term support contracts, software

subscriptions, and licenses. This remains a crucial priority for

the Company.

The Group recognises the importance of engagement with all of

its stakeholders. A recently re-launched website and increasing

levels of social media activity are part of this, with further

activities planned over H2 2023.

Business Review

Synectic Systems

Synectic Systems provides specialist surveillance systems, based

on its own proprietary technology, to global end customers with

large-scale highly complex security requirements, particularly for

gaming, oil & gas, public space, transportation, and critical

infrastructure applications.

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 30 Nov

31 May 31 May 2022

GBP000 2023 2022

Revenue 13,847 11,816 24,201

Gross margin(2) 49.4% 50.4% 50.6%

Operating profit(2) 1,367 722 1,882

Operating margin(2) 9.9% 6.1% 7.8%

(1) Before Group central costs.

Revenues in H1 2023 were over 17 per cent. ahead of H1 2022,

driven primarily by a strong performance in the global oil &

gas market, which is expected to continue.

In the gaming sector globally, whilst interest and activity

levels continue to increase, expected projects and orders are still

experiencing delays. Performance in other markets continued at

similar levels to the previous year.

The current pipeline of oil & gas opportunities is strong

and extends well into 2024. The Company has increased supply chain

and production capacity in line with the expected increased demand

later this year and beyond, and the Company's manufacturing output

of specialist camera stations in H2 2023 is expected to be at a

level not seen since 2014.

In addition to the significant contract win for Saudi Aramco,

which it announced on 13 April 2023, the Company has secured a

further related contract for its specialist COEX(TM) camera

stations, as announced on 4 July 2023. A significant proportion of

this additional contract is expected to be delivered by the end of

this financial year, with the balance to follow in H1 2024.

Gross margins in the period remained strong, despite ongoing

cost pressures in the supply chain. There was no material impact

from supply chain challenges on either customer delivery or

margins, with longer lead times in most cases having already been

factored into project schedules.

As outlined above, increasing the level of contracted recurring

revenue is an important priority for the Company, which continued

to increase during the period to GBP2.0 million (H1 2022: GBP1.7

million) with the order book of long-term contracts increasing

materially to GBP10.5 million (31 May 2022: GBP8.9 million).

Europe, Middle East & Africa (Revenue GBP6.8 million (H1

2022: GBP5.1 million))

Revenues in EMEA were ahead of H1 2022 due to a strong

performance in the oil & gas market, with progress in other

markets relatively flat.

Work continued with the City of London Police on their Safe City

programme, and with the West Midlands Police. Both projects provide

powerful references for Synectics' position at the forefront of

operational control systems for Safe City programmes. Significant

new awards in the region include:

-- The Saudi Aramco contracts referred to above, which will deliver revenue in H2 2023; and

-- A large contract for a multi-site surveillance system for

Sheffield NHS Trust, which has generated significant interest from

this sector.

Asia Pacific (Revenue GBP4.9 million (H1 2022: GBP2.7

million))

A strong oil & gas market and continued recovery in the

gaming sector drove solid revenue growth in the region.

Whilst casino operations in the region have now largely returned

to normal, expected projects across the sector have still been

experiencing delays. The Company announced the award of a large

casino resort project in the Philippines on 28 April 2023, which

was later than had been expected. The Board expects further

progress in H2 2023 and beyond. Recent contract wins of note

include: -

-- A casino contract for Solaire in the Philippines, which will

deliver revenue in H2 2023; and

-- Major expansion to an existing oil and gas project in Australia.

North America (Revenue GBP2.2 million (H1 2022: GBP4.0

million))

Since the effective re-opening of the gaming market in the

region last year, the Company's efforts have necessarily been

focused on supporting existing customers and partners with services

and upgrades as their operations have returned to normal, and the

level of support contract renewal has been good.

Oil & gas performance in the region was solid, with H1

2022's results including a large refinery project that was not

repeated.

The disappointing progress in the region regarding new casino

projects was partly due to a continued delay in the expected award

of some projects, but also as the Company's strategy of developing

new business closely with partners is only now getting off the

ground.

The Board expects progress to be made in H2 2023, and contracts

for two new casino projects have been received since the period

end. A number of casino projects in the pipeline of expected orders

are now not slated to generate revenue for the Company until early

in 2024. Additionally: -

-- A replacement system for an existing long-term casino

customer and a project for a new customer awarded since the period

end will deliver H2 2023 revenue in excess of $1.0 million; and

-- A long-term support agreement with an existing major

corporate account covering multiple sites will be worth around $1.0

million over the next five years.

Synectics Security

Synectics Security is a UK-focused provider of electronic

security systems for critical and regulated environments. Its main

markets are in public space, transport, high security, and

infrastructure projects. Its capabilities include UK Government

security-cleared personnel and facilities, with nationwide project

delivery, service and support. Synectics Security delivers products

and technology both from Synectic Systems, and other partners.

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 30 Nov

31 May 31 May 2022

GBP000 2023 2022

Revenue 8,676 8,203 16,595

Gross margin(2) 26.2% 28.6% 26.4%

Operating profit(2) 429 523 1,164

Operating margin(2) 4.9% 6.4% 7.0%

(2) Before Group central costs.

Synectics Security delivered a modest increase in revenues in H1

2023, mainly from the unwinding of delays due to supply chain

constraints affecting on-vehicle business late in FY 2022. This was

offset by slightly lower gross margins realised in closing out some

delayed projects. Contracted recurring revenue in the period was

GBP1.6 million (H1 2022: GBP1.7 million).

Work to re-position the business beyond its traditional

heartland in public space into more complex, critical and highly

regulated security environments is continuing: -

-- A strategically important maintenance contract with the City

of London Police that consolidates Synectics' position as preferred

supplier;

-- Security upgrade projects at multiple UK sites for a major

critical national infrastructure customer, worth more than GBP1.0

million in FY 2023; and

-- New recording systems for Stagecoach London Buses, fully compliant with new TfL requirements.

Technology Development

As outlined above, investment in the Company's intellectual

property and technology base remains an important strategic

priority for the Board.

Expenditure on technology development during H1 2023 was flat at

GBP1.6 million (H1 2022: GBP1.6 million) of which GBP0.4 million

(H1 2022: GBP0.2 million) was capitalised and the remainder

expensed to the income statement. In addition, GBP0.4 million (H1

2022: GBP0.5 million) of previously capitalised development was

amortised in the period. These figures are all included within the

results of Synectic Systems set out above.

Technology development expenditure, which includes investment in

product management, documentation, training resources and quality

assurance, along with hardware and software development, is

expected to increase in H2 2023. A successful recruitment drive in

the period has enhanced development capabilities, bringing in

exciting new talent and building on the proven, world-class

expertise of the core team. This is continuing with momentum into

H2 2023, in line with the Company's investment plans.

This continued investment supports the future-proofing of the

Synergy software platform with web-centric technology to enhance

user experience and capabilities "beyond the control room", and a

suite of intelligent deployment tools make systems less reliant on

the Company's own experts to deploy and support. Other future

developments include modules that customers can utilise on-demand

via a recurring revenue model which are due to be launched early

next year. Immediate development priorities include:

-- Enhanced cloud services, providing significant reporting and

dashboard improvements, allowing users to see data from numerous

subsystems at a glance;

-- Further integrations to best-in class artificial intelligence capabilities; and .

-- New-generation COEX(TM) specialist camera stations for oil

& gas applications to include built-in AI technology that is

market leading.

Summary and Outlook

The Company operates in markets that are strong and recovering,

with solid long-term growth potential. Synectics has deep

experience and a clearly defined position in these markets.

The fundamentals of the business are healthy, with a strong

balance sheet that provides a robust platform for future growth.

The depth of customer relationships, the calibre of people, and the

quality of technical expertise are the core pillars upon which

Synectics is built.

Since its return to profit in H2 2021, the Company has now had

four consecutive periods of progress in revenue and profits and is

confident of delivering further progress in H2 2023.

The Company's consolidated order book is significantly ahead of

that as at 30 November 2022, with a significant proportion expected

to trade in H2 2023. Order intake has continued strongly since the

period end with around GBP5.0 million of new orders booked in June

2023 alone.

Based on the current order book and pipeline of anticipated

business, the Board expects the Company's results for the year

ending 30 November 2023 to be in line with market expectations,

despite being weighted to the seasonally stronger H2.

Paul Webb

Chief Executive

11 July 2023

Consolidated income statement

For the six months ended 31 May 2023

Unaudited Unaudited

six months six months

ended ended

31 May 31 May

2023 2022

Continuing operations Notes GBP000 GBP000

---------------------------------------------- ----- ------------ -----------

Revenue 3 21,851 19,159

Cost of sales (12,736) (10,862)

---------------------------------------------- ----- ------------ -----------

Gross profit 9,115 8,297

Operating expenses (8,351) (7,823)

---------------------------------------------- ----- ------------ -----------

Operating profit before non-underlying

items 764 474

Non-underlying items 5 (87) -

---------------------------------------------- ----- ------------ -----------

Operating profit 677 474

Finance costs (46) (32)

---------------------------------------------- ----- ------------ -----------

Profit before tax 631 442

Income tax expense 6 (66) (80)

---------------------------------------------- ----- ------------ -----------

Profit for the period from continuing

operations 565 362

Profit for the period from discontinued

operations(3) 4 - 43

---------------------------------------------- ----- ------------ -----------

Profit attributable to equity holders

of the Parent 565 405

---------------------------------------------- ----- ------------ -----------

Earnings per share from continuing operations 8

---------------------------------------------- ----- ------------ -----------

Basic 3.3 2.1p

Diluted 3.3 2.1p

---------------------------------------------- ----- ------------ -----------

Earnings per share from continuing and

discontinued operations 8

Basic 3.3 2.4p

Diluted 3.3 2.4p

---------------------------------------------- ----- ------------ -------------

(3) Discontinued operations relates to the sale of SSS

Management Services Limited on 30 November 2022

Consolidated statement of comprehensive income

For the six months ended 31 May 2023

Unaudited Unaudited

six months six months

ended ended

31 May 31 May

2023 2022

Continuing operations GBP000 GBP000

------------------------------------------------- ------------ -----------

Profit for the period from continuing operations 565 362

Items that may be reclassified subsequently

to profit or loss

Exchange differences on translation of foreign

operations (8) 18

Losses on a hedge of a net investment taken

to equity (13) (7)

------------------------------------------------- ------------ -----------

(21) 11

------------------------------------------------- ------------ -----------

Total comprehensive income from continuing operations 544

373

Total comprehensive income from discontinued operations - 43

Total comprehensive income for the period attributable

to equity holders of the Parent 544 416

------------------------------------------------------- ----------------------- ---

Consolidated statement of financial position

As at 31 May 2023

Unaudited Unaudited

31 May 31 May 30 Nov

2023 2022 2022

GBP000 GBP000 GBP000

-------------------------------------- --------- --------- --------

Non-current assets

Property, plant and equipment 4,359 4,464 4,598

Goodwill and intangible assets 20,801 21,389 20,776

Deferred tax assets 2,660 2,387 2,741

--------------------------------------- --------- --------- --------

27,820 28,240 28,115

-------------------------------------- --------- --------- --------

Current assets

Inventories 4,345 4,481 4,219

Trade and other receivables 9,688 10,586 9,090

Contract assets 6,917 6,701 6,317

Tax assets 5 - 425

Cash and cash equivalents 3,996 4,201 4,256

--------------------------------------- --------- --------- --------

24,951 25,969 24,307

-------------------------------------- --------- --------- --------

Total assets 52,771 54,209 52,422

--------------------------------------- --------- --------- --------

Current liabilities

Trade and other payables (7,861) (10,961) (8,111)

Contract liabilities (2,477) (3,169) (1,875)

Lease liabilities (683) (494) (683)

Tax liabilities - (15) -

Provisions (783) (517) (796)

--------------------------------------- --------- --------- --------

(11,804) (15,156) (11,465)

-------------------------------------- --------- --------- --------

Non-current liabilities

Provisions (752) (1,037) (746)

Lease liabilities (1,901) (1,959) (2,137)

Deferred tax liabilities (1,072) (549) (1,072)

--------------------------------------- --------- --------- --------

(3,725) (3,545) (3,955)

-------------------------------------- --------- --------- --------

Total liabilities (15,529) (18,701) (15,420)

--------------------------------------- --------- --------- --------

Net assets 37,242 35,508 37,002

--------------------------------------- --------- --------- --------

Equity attributable to equity holders

of the Parent

Called up share capital 3,559 3,559 3,559

Share premium account 16,043 16,043 16,043

Merger reserve 9,971 9,971 9,971

Other reserves (1,436) (1,436) (1,436)

Currency translation reserve 919 7 26 940

Retained earnings 8,186 6,645 7,925

--------------------------------------- --------- --------- --------

Total equity 37,242 35,508 37,002

--------------------------------------- --------- --------- --------

Consolidated statement of changes in equity

For the six months ended 31 May 2023

Called

up Share Currency

share premium Merger Other translation Retained

capital account reserve reserves reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

At 1 December 2021 3,559 16,043 9,971 (1,436) 715 6,492 35,344

Profit for the period - - - - - 405 405

Other comprehensive income

Currency translation adjustment - - - - 11 - 11

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

Total other comprehensive

income - - - - 11 - 11

---------------------------------- -------- -------- --------- ---------- ------------ ---------- ----------

Total comprehensive income 11 405 416

Dividends paid - - - - - (253) (253)

Credit in relation to share-based

payments - - - - - 1 1

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

At 31 May 2022 3,559 16,043 9,971 (1,436) 726 6,645 35,508

Profit for the period - - - - - 1,060 1,060

Other comprehensive income

Currency translation adjustment - - - - 276 - 276

Tax relating to components

of other comprehensive income - - - - (62) 172 110

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

Total other comprehensive

income - - - - 214 172 386

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

Total comprehensive income - - - - 214 1,232 1,446

Credit in relation to share-based

payments - - - - - 48 48

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

At 30 November 2022 3,559 16,043 9,971 (1,436) 940 7,925 37,002

Profit for the period - - - - - 565 565

Other comprehensive income

Currency translation adjustment - - - - (21) - (21)

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

Total other comprehensive

income - - - - (21) - (21)

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

Total comprehensive income - - - - (21) 565 544

Dividends paid - - - - - (338) (338)

Credit in relation to share-based

payments - - - - - 34 34

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

At 31 May 2023 3,559 16,043 9,971 (1,436) 919 8,186 37,242

---------------------------------- -------- -------- --------- ---------- ------------ ---------- --------

Consolidated cash flow statement

For the six months ended 31 May 2023

Unaudited Unaudited

six months six months

ended ended

31 May 2023 31 May 2022

GBP000 GBP000

------------------------------------------- ------------- ------------

Cash flows from operating activities

Profit from continuing operations 565 362

Profit from discontinued operations - 43

Profit for the period 565 405

Income tax expense 66 80

Finance costs 46 40

Depreciation and amortisation charge 917 1,105

Loss on disposal of non-current assets - 22

Net foreign exchange differences 156 (121)

Net movement in provisions 4 48

Share-based payment charge 34 1

------------------------------------------- ------------- --------------

Operating cash flows before movement

in working capital 1,788 1,580

Increase in inventories (126) (540)

Increase in trade, other and contract

receivables (1,302) (689)

Increase in trade, other and contract

payables 420 52

Cash generated from operations 780 403

Tax received 418 28

------------------------------------------- ------------- --------------

Net cash from operating activities 1,198 431

------------------------------------------- ------------- --------------

Cash flows from investing activities

Purchase of property, plant and equipment (146) (51)

Capitalised development costs (430) (160)

Purchased software (11) (19)

------------------------------------------- ------------- --------------

Net cash used in investing activities (587) (230)

------------------------------------------- ------------- --------------

Cash flows from financing activities

Lease payments (431) (426)

Dividends paid (338) (253)

------------------------------------------- ------------- --------------

Net cash used in financing activities (769) (679)

------------------------------------------- ------------- --------------

Net decrease in cash and cash equivalents (158) (478)

Effect of exchange rate changes on

cash (102) 38

Cash and cash equivalents at the beginning

of the period 4,256 4,641

------------------------------------------- ------------- --------------

Cash and cash equivalents at the end

of the period 3,996 4,201

------------------------------------------- ------------- ------------

Notes

For the six months ended 31 May 2023

1 General information

These condensed consolidated interim financial statements were

approved by the Board of Directors on 10 July 2023.

2 Basis of preparation

These consolidated interim financial statements of the Group are

for the six months ended 31 May 2023.

These interim financial statements do not include all the

information and disclosures normally included in the annual

financial statements. Accordingly, these interim financial

statements should be read in conjunction with the Group's annual

financial statements for the year ended 30 November 2022.

These interim financial statements for the six months to 31 May

2023 have not been audited or reviewed by an auditor pursuant to

the Auditing Practices Board guidance on Review of Interim

Financial Information.

The condensed consolidated interim financial statements have

been prepared on the basis of the accounting policies expected to

be adopted by the Group for the year ending 30 November 2023. The

Group did not have to change its accounting policies as a result of

adopting new standards.

AIM-listed companies are not required to comply with IAS 34

'Interim Financial Reporting' and accordingly the Company has taken

advantage of this exemption.

Discontinued operations

Discontinued operations relate to operations of the Group which

have been disposed of in the previous year and where operations and

cash flows could be clearly distinguished from the rest of the

Group. The net results of discontinued operations are presented

separately in the consolidated income statement (and the restated

comparatives).

Notes to the consolidated statement of financial position are

presented on a total group basis and, as a result, income statement

and cash flow movements included in these notes for the comparative

period may not reconcile to those presented in the consolidated

income statement and the consolidated cash flow statement.

3 Segmental analysis

Revenue by operating segment

Unaudited

Unaudited six months

six months ended

ended 31 May

31 May 2023 2022

Revenue - continuing operations GBP000 GBP000

---------------------------------------- ------------- -----------

Systems 13,846 11,816

Security 8,676 8,203

---------------------------------------- ------------- -----------

Total segmental revenue 22,522 20,019

Reconciliation to consolidated revenue:

Intra-Group sales (671) (860)

---------------------------------------- ------------- -----------

21,851 19,159

---------------------------------------- ------------- -----------

Underlying operating result by operating segment

Unaudited

Unaudited six months

six months ended

ended 31 May

Underlying operating profit - continuing 31 May 2023 2022

operations GBP000 GBP000

------------------------------------------ ------------- -----------

Systems 1,367 722

Security 429 524

------------------------------------------ ------------- -----------

Total segmental underlying operating

profit 1,796 1,246

Reconciliation to consolidated underlying

operating profit:

Central costs (1,032) (772)

------------------------------------------ ------------- -----------

764 474

------------------------------------------ ------------- -----------

Underlying operating profit is reconciled to total operating

profit as follows:

Unaudited

Unaudited six months

six months ended

ended 31 May

31 May 2023 2022

Continuing operations GBP000 GBP000

---------------------------- ------------- -----------

Underlying operating profit 764 474

Non-underlying items (87) -

---------------------------- ------------- -----------

677 474

---------------------------- ------------- -----------

4 Discontinued operations

On 11 November 2022, the Group announced that it had reached an

agreement to sell SSS Management Services Limited ('SSS'), which

was previously part of the Group's Security division. On 30

November 2022 the transaction was subsequently completed for

GBP100,000 cash and further contingent consideration of

GBP100,000.

Under IFRS 5 Non-current assets held for sale and discontinued

operations, SSS was disclosed as a discontinued operation in the

Group's annual financial statements for the year ended 30 November

2022. SSS is no longer presented within the segmental note and its

result for the six months ended 31 May 2022 is instead presented

below.

Results from discontinued operations:

Unaudited

Unaudited six months

six months ended

ended 31 May

31 May 2023 2022

GBP000 GBP000

------------------------------------------------ ---------------

Revenue - 3,601

Cost of sales - (2,899)

------------------------------------------------ ---------------

Gross profit - 702

Operating expenses - (651)

------------------------------------------------ ---------------

Operating profit - 51

Finance costs - (8)

------------------------------------------------ ---------------

Profit before tax - 43

Income tax expense - -

------------------------------------------------ ---------------

Profit attributable to discontinued operations - 43

------------------------------------------------ ---------------

5 Non-underlying items

Unaudited

Unaudited six months

six months ended

ended 31 May

31 May 2023 2022

GBP000 GBP000

--------------------------------------------- -----------

Costs associated with legal matters 42 -

Costs associated with the buy-out of the

defined benefit pension scheme 45 -

------------------------------------------ -----------

87 -

------------------------------------------ -----------

6 Taxation

The tax expense of GBP66,000 (2022: GBP80,000) for the period is

based on the estimated rate of corporation tax that is likely to be

effective for the year ending 30 November 2023.

7 Dividends

The Board does not propose to pay an interim dividend (2022:

GBPnil).

8 Earnings per share

Earnings per share are as follows:

Unaudited

six months Unaudited

ended six months

31 May ended

Unaudited 2022 31 May

six months Pence 2022

ended per share Pence

31 May 2023 (continuing per share

Pence per share operations) (Total)

---------------------------- ---------------- ------------ -----------

Basic earnings per share 3.3 2.1 2.4

---------------------------- ---------------- ------------ -----------

Diluted earnings per

share 3.3 2.1 2.4

---------------------------- ---------------- ------------ -----------

Underlying basic earnings

per share 3.7 2.1 2.4

---------------------------- ---------------- ------------ -----------

Underlying diluted earnings

per share 3.7 2.1 2.4

---------------------------- ---------------- ------------ -----------

The calculations of basic and underlying earnings per share are

based upon:

Unaudited Unaudited

six months six months Unaudited

ended ended six months

31 May 31 May ended

2023 2022 Continuing 31 May

operations 2022 Total

GBP000 GBP000 GBP000

---------------------------------------- ----------- ---------------- -----------

Earnings for basic and diluted earnings

per share 565 362 405

Non-underlying items 87 - -

Tax thereon (20) - -

---------------------------------------- ----------- ---------------- -----------

Earnings for underlying basic and

diluted earnings per share 632 362 405

---------------------------------------- ----------- ---------------- -----------

Unaudited Unaudited

six months six months

ended ended

31 May

31 May 2023 2022

000 000

------------------------------------ ------------ -----------

Weighted average number of ordinary

shares - basic calculation 16,889 16,886

Dilutive potential ordinary shares

arising from share options 1 -

------------------------------------ ------------ -----------

Weighted average number of ordinary

shares - diluted calculation 16,890 16,886

------------------------------------ ------------ -----------

9 Availability of results

Copies of this statement are available on the Group's website

(www.synecticsplc.com) and will be available shortly from Synectics

plc, Synectics House, 3-4 Broadfield Close, Sheffield, England S8

0XN.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR RMMFTMTMBBLJ

(END) Dow Jones Newswires

July 11, 2023 02:00 ET (06:00 GMT)

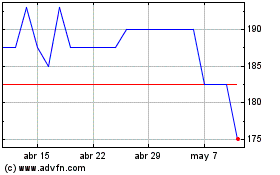

Synectics (LSE:SNX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Synectics (LSE:SNX)

Gráfica de Acción Histórica

De May 2023 a May 2024