TIDMSRT

RNS Number : 8851T

SRT Marine Systems PLC

20 November 2023

The information communicated in this announcement contains

inside information for the purposes of the UK Market Abuse

Regulations and is disclosed in accordance with the Company's

obligations.

SRT MARINE SYSTEMS PLC ("SRT" or the "Group")

HALF YEARLY REPORT FOR THE SIX MONTHSED 30 SEPTEMBER 2023

SRT, the AIM-quoted developer and supplier of maritime

surveillance, analytics and management systems and products

announces its unaudited interim results for the six months ended 30

September 2023 (the "Period").

Financial Highlights

-- Continued year on year growth of transceivers business.

-- GBP2.5m new product and technology investment.

-- GBP160m systems contract order book for System deliveries to commence in H2.

-- Gross cash balance at end of H1 GBP3.9m (H1 2022: GBP1.5m).

Operational Summary

-- NEXUS transceiver product commences testing and launch planning.

-- Final completion phase of Philippines - BFAR fisheries contract.

-- GBP40m Middle East Border Agency maritime surveillance

project - Phase 1 completed, and planning and preparation for final

Phase 2.

-- Planning and procurement for commencement of GBP145m SE Asia

coast guard project signed in May.

Commenting on today's results, Simon Tucker, CEO of SRT

said:

" The hard work and progress made across the business during the

first half has prepared us for a busy second half , with the

scheduled delivery of a number of system project milestones and

continued growth of our transceivers business . In line with this,

we are on track to complete our financial year end as

expected."

Contacts:

SRT Marine Systems plc www.srt-marine.com

+ 44 (0) 1761 409500

Simon Tucker (CEO) simon.tucker@srt-marine.com

Louise Coates (Marketing Manager) louise.coates@srt-marine.com

Cavendish

Jonny Franklin-Adams / Teddy Whiley (Corporate

Finance) +44 (0) 20 7220 0500

Tim Redfern / Charlotte Sutcliffe (Corporate

Broking)

Yellow Jersey PR

Charles Goodwin / Annabelle Wills +44 (0)

7747 788 221

About SRT:

SRT Marine Systems PLC ("SRT") is a global leader in maritime

domain awareness products and systems. Our solutions integrate

multiple technologies, advanced analytics, innovative digital

display systems, logistics and command and control to provide

enhanced maritime surveillance, security, safety and management

for national authorities such as coast guards and fishery authorities.

Applications include coastal and territorial water surveillance

and security, fisheries monitoring, management and IUU detection,

search and rescue, waterway management and aquatic environment

monitoring as well as individual leisure and commercial boat

owners.

Chairman's Statement

The first half of the financial year has been very busy with

much progress made across both our systems and transceivers

businesses. With systems contracts worth GBP160m to deliver, our

project teams have been working closely with the relevant customers

and third-party suppliers on the substantial preparatory and

planning work required for their delivery, with multiple milestones

scheduled for H2, several of which are substantial revenue

generating milestones. Alongside this our transceivers business has

made good progress growing its sales and distribution as well as

launching new products which we expect to sell well during H2.

As already reported in our October 2023 trading statement,

during the H1 period ending 30(th) September 2023, our systems

business did not generate any revenues having not completed any

revenue milestones and as such the GBP5.5m of Group revenues we are

reporting derives entirely from our transceivers business. Gross

profit was 37%, resulting in a loss for the period of GBP4.6m, and

a period end cash position of GBP3.9m.

Systems

Our systems business, which provides maritime surveillance and

monitoring systems for government agencies such as coast guards and

fisheries, has made good progress on existing, new and prospective

contracts. Our existing contract with BFAR in the Philippines is in

its final completion stage and is expected to be completed during

the second half. Having completed the first phase of our GBP40m

Middle East Border Agency project, we have been working closely

with the customer to aggregate and plan the next two phases into a

single phased implementation which we expect to commence during Q4

of this financial year. This work has included significant project

planning as well as preparation and staging of equipment ready to

make the first invoice and payment generating deliveries upon

instruction to proceed from the customer.

Much planning work has also been completed in respect of our

$180m (GBP145m) contract with a SE Asia National Coast Guard (as

announced on 18 May 2023), which is expected to commence in the

next few months upon completion of a government-to-government loan

agreement, which is in its final formal stages. This work has

included the completion of the substantial procurement planning

which includes supplier selection, price and terms negotiation and

detailed project planning with the customer and our local civil

works contractors. This has included multiple in-country meetings

as well as a recent multi-agency final project planning and review

meeting in the UK with the end customer and the UK government

present. We expect to commence first deliveries during Q4, which

will also include the first substantial revenue milestones.

We have also been working closely with an existing long-standing

Middle East Coast Guard who wishes to move on to the next stage of

their maritime surveillance system strategy and expand and enhance

their existing system. Following the usual period of consultations

which has defined the scope of this follow-on phase we have

received official notification that they are now ready to proceed

and are awaiting issue of the contract, expected shortly, whereupon

we shall immediately commence implementation with some deliverables

potentially falling into H2 depending on the exact timing of

contract and equipment procurement lead times.

In tandem with this focused work on existing customers, our

sales and support teams have substantially progressed negotiations

and project specification discussions with several of our validated

new contract opportunities and as such we expect to see further new

contracts in the near future. In general, we continue to see

growing interest and engagement from nation-state agencies who

desire to acquire independent maritime surveillance capabilities to

transform their understanding and monitoring of their marine

domains and adopt a digital intelligence lead approach to active

management and law enforcement.

The SRT-MDA System has continued its development journey and has

grown to be a sophisticated national scale integrated surveillance

and monitoring system which can be configured for either coast

guard and or fisheries users. Our development teams continue to

enhance its capabilities with particular focus around its data

fusion, analytics and command & control capabilities. This is a

long-term continuous improvement development roadmap which is the

foundation of our success and will support the long-term

relationships we form with customers.

Transceivers

Our transceivers business, which develops and sells maritime

navigation safety and communication transceivers, continues to

grow, with revenues 5% ahead of the comparative period last year.

This growth reflects the established long-term market trend of

marine navigation digitisation and SRT's position as the dominant

provider of AIS and related transceiver systems. We see a blend of

growing regulation and market-ripple adoption driving demand, for

example the Port of Antwerp has recently extended existing

regulation affecting certain classes of commercial vessels to make

it mandatory that all vessels operating there are required to have

an AIS.

We have continued to grow our global distribution network which

now consists of over 5,000 entities, from dealers and distributors

for our own em-trak brand to leading original equipment

manufacturers ("OEM's") located across the world from Australia,

Japan to Europe and USA. Of note is our high margin Digital ATON

Systems ("DAS") sub-division which is focused on providing

specialist navigation devices for buoys and infrastructure. We see

a substantial global opportunity and have launched new kitted

products which make it easy for ports, waterways, and marine

infrastructure owners to implement these systems with full

interoperability with their existing systems. This is revealing new

and unexpected opportunities, an example being a new opportunity

whereby many thousands of fish farms in the EU will require

tracking and monitoring using AtoN's from next year. We now have a

dedicated salesperson focused on this growing market, and this has

started to bear fruit with more sales and a growing pipeline of

opportunities.

Our new NEXUS marine communication VHF/DSC radio system is now

in its later stages of development and commenced its testing phase

along with a soft launch to our dealers in the November METS

exhibition. We have had a stronger market reaction than was

expected and received forward orders for over 100 units within the

first three days of the soft launch. We expect to complete all

final testing and pre-production by the summer of 2024 and start

shipping product in Autumn 2024. This is approximately 12 months

later than we had originally planned due to a conscious decision to

be cautious and undertake a much more extensive product testing and

refinement period due to the complexity of the product and to

ensure our first voice communications product is of a standard

commensurate with what the market expects from an SRT device.

Outlook

I acknowledge and appreciate shareholders concerns regarding the

financial performance imbalance between the two halves of this

financial year; however, this is the nature of the timing of

revenue related deliverables on our current systems projects and

was expected. With the revenue milestones scheduled for the second

half, we are confident of our full year performance.

Going forward, with multiple system contracts running in

parallel, we expect a smoother distribution of revenues across

financial periods. However, I must highlight that the exact timing

of deliverables on a project are influenced by multiple factors,

some of which beyond our control and thus they can easily slip

either side of an accounting line. This does not detract from the

fundamentals of our business which are now built on robust, proven

products that deliver multiple revenue streams with defensible

profit margins, being delivered by an experienced team into a

global market whose growth is driven by strong fundamentals of

security, safety and environment protection.

Kevin Finn

Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Six months Six months Year

ended ended ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

Unaudited Unaudited Audited

Notes GBP GBP GBP

---------------------------------- ------- -------------- ------------- -------------

Revenue 5,502,316 18,836,044 30,506,152

Cost of sales (3,441,404) (11,633,644) (19,467,188)

------------------------------------------- -------------- ------------- -------------

Gross profit 2,060,912 7,202,400 11,038,964

Administrative costs (6,268,250) (4,742,197) (10,903,940)

-------------- ------------- -------------

Operating (loss) / profit (4,207,338) 2,460,203 135,024

Finance expenditure (411,355) (337,628) (781,547)

Finance income 13 137 351

-------------

(Loss) / profit before income

tax (4,618,680) 2,122,712 (647,172)

Income tax credit - - 715,692

------------------------------------------- -------------- ------------- -------------

(Loss) / profit for the period (4,618,680) 2,122,712 69,520

------------------------------------------- -------------- ------------- -------------

Total comprehensive (loss)

/ profit for the period (4,618,680) 2,122,712 69,520

------------------------------------------- -------------- ------------- -------------

(Loss) / earnings per share:

Basic 2 (2.47)p 1.17 0.04p

Diluted 2 (2.47)p 1.16 0.04p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2023

As at As at As at

30 Sep 30 Sep 31 Mar

2023 2022 2023

Unaudited Unaudited Audited

Notes GBP GBP GBP

------------------------------- ------ ------------- ------------- -------------

Assets

Non-current assets

Intangible assets 12,989,804 10,705,675 11,756,717

Property, plant and equipment 1,246,425 1,287,004 1,256,223

Total non-current assets 14,236,229 11,992,679 13,012,940

Current assets

Inventories 4,304,490 2,672,582 3,465,626

Trade and other receivables 4,268,348 13,434,163 5,828,652

Current tax recoverable 973,188 978,963 968,607

Cash 3,930,126 1,522,079 2,181,548

Restricted cash 949,115 906,245 949,115

------------------------------- ------ ------------- ------------- -------------

Total current assets 14,425,267 19,514,032 13,393,548

Liabilities

Current liabilities

Trade and other payables (7,189,712) (11,592,880) (7,009,926)

Borrowings 3 (9,690,000) (3,962,500) (8,002,500)

Current tax liabilities - - (199,126)

Lease liabilities (250,840) (223,137) (237,371)

Total current liabilities (17,130,552) (15,778,517) (15,448,923)

Net current (liabilities)

/ assets (2,705,285) 3,735,515 (2,055,375)

Total assets less current

liabilities 11,530,944 15,728,194 10,957,565

Long term liabilities

Borrowings 3 - (2,985,000) -

Lease liabilities (638,159) (704,026) (649,946)

Total long term liabilities (638,159) (3,689,026) (649,946)

Net assets 10,892,785 12,039,168 10,307,619

------------------------------- ------ ------------- ------------- -------------

Shareholders' equity

Share capital 4 192,428 180,677 181,517

Share premium account 23,245,908 18,067,612 18,213,072

Other reserves 5,490,596 5,490,596 5,490,596

Retained loss (18,036,147) (11,699,717) (13,577,566)

Total shareholders' equity 10,892,785 12,039,168 10,307,619

------------------------------- ------ ------------- ------------- -------------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Six months Six months Year ended

ended ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

Unaudited Unaudited Audited

Notes GBP GBP GBP

------------------------------------------ -------------- -------------- --------------

Cash (used in) / generated

from operating activities 5 (1,683,914) (794,348) 778,840

Corporation tax (paid)/

received (203,707) - 925,174

------------------------------------- ---- -------------- -------------- --------------

Net cash (used in) / generated

from operating activities (1,887,621) (794,348) 1,704,014

------------------------------------- ---- -------------- -------------- --------------

Investing activities

Expenditure on product

development (2,494,889) (2,483,961) (4,795,292)

Purchase of property, plant

and equipment (83,042) (57,955) (199,061)

Interest received 13 137 351

------------------------------------- ---- -------------- -------------- --------------

Net cash used in investing

activities (2,577,918) (2,541,779) (4,994,002)

------------------------------------- ---- -------------- -------------- --------------

Financing activities

Gross proceeds on issue

of shares 5,408,231 - 146,300

Costs of issue of shares (364,484) - -

New loans issued 2,000,000 15,000 1,695,000

Loan repayments (312,500) (625,000) (1,250,000)

Lease repayments (124,357) (139,323) (258,835)

Loan interest paid (392,773) (317,072) (742,660)

------------------------------------- ---- -------------- -------------- --------------

Net cash generated from

/ (used in) financing activities 6,214,117 (1,066,395) (410,195)

------------------------------------- ---- -------------- -------------- --------------

Net increase / (decrease)

in cash and cash equivalents 1,748,578 (4,402,522) (3,700,183)

------------------------------------- ---- -------------- -------------- --------------

Net cash and cash equivalents

at beginning of period 3,130,663 6,830,846 6,830,846

------------------------------------- ---- -------------- -------------- --------------

Net cash and cash equivalents

at end of period 4,879,241 2,428,324 3,130,663

------------------------------------- ---- -------------- -------------- --------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Share Share Retained Other Reserves Total

Capital Premium Earnings

GBP GBP GBP GBP GBP

At 31 March 2022 180,677 18,067,612 (13,946,362) 5,490,596 9,792,523

Total comprehensive profit

for the period - - 2,122,712 - 2,122,712

Share based payment charge - - 123,933 - 123,933

At 30 September 2022 180,677 18,067,612 (11,699,717) 5,490,596 12,039,168

Total comprehensive loss

for the period - - (2,053,192) - (2,053,192)

Share based payment charge - - 175,343 - 175,343

Issue of equity share

capital 840 145,460 - 146,300

At 31 March 2023 181,517 18,213,072 (13,577,566) 5,490,596 10,307,619

Total comprehensive loss

for the period - - (4,618,680) - (4,618,680)

Share based payment charge - - 160,099 - 160,099

Issue of equity share

capital 10,911 5,397,320 - - 5,408,231

Cost of issue of shares - (364,484) - - (364,484)

At 30 September 2023 192,428 23,245,908 (18,036,147) 5,490,596 10,892,785

---------------------------- ---------- ------------- ------------------ ------------------ -------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Accounting Policies

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with International

Financial Reporting Standards (IFRS) as adopted by the United

Kingdom. IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and the IFRS

Interpretations Committee and there is an ongoing process of review

and endorsement by the UK Endorsement Board. The financial

information has been prepared on the basis of IFRS that the

Directors expect to be adopted by the UK Endorsement Board and

applicable as at 31 March 2024.

Non-statutory accounts

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ("the Act"). The statutory accounts for the

year ended 31 March 2023 have been filed with the Registrar of

Companies. The report of the auditors on those statutory accounts

was unqualified and did not contain a statement under section

498(2) or (3) of the Companies Act 2006. The audit report drew

attention by way of emphasis to a material uncertainty relating to

going concern and included an emphasis of matter paragraph in

relation to the uncertainties associated with the forecasting of

future revenues and profits.

The financial information for the six months ended 30 September

2023 and 30 September 2022 is unaudited. The interim financial

statements will be available to download on the Company's website

www.srt-marine.com from 20 November 2023.

Accounting policies

The accounting policies as applied by the Group are the same as

those applied by the Group in the consolidated financial statements

for the year ended 31 March 2023.

2. (Loss) / earnings per share

The basic (loss) / earnings per share has been calculated using

the loss for the period of GBP4,618,680 (six months ended 30

September 2022 - profit of GBP2,122,712, year ended 31 March 2023 -

profit of GBP69,520) divided by the weighted average number of

ordinary shares in issue of 187,174,103 (six months ended 30

September 2022 - 180,676,939 and year ended 31 March 2023 -

180,961,021).

During the period ended 30 September 2023, the Group has

incurred a loss for the period and therefore there is no impact of

the share options granted on diluted earnings per share.

For the previous period ended 30 September 2022, the calculation

of diluted earnings per share has been calculated on profit for the

period of GBP2,122,712 (year ended March 31 2023 profit of

GBP69,520). It assumes conversion of all potentially dilutive

ordinary shares, all of which arise from share options. A

calculation is performed to determine the number of shares to be

issued for no consideration. The number of dilutive shares under

option at 30 September 2022 was 1,787,866 (At March 31 2023

1,958,724) and the weighted average number of ordinary shares for

the purposes of dilutive earnings per share was 182,464,805 (year

to 31 March 2023 182,919,745).

3. Borrowings

30 Sep 30 Sep 31 Mar

2023 2022 2023

Unaudited Unaudited Audited

GBP GBP GBP

--------------------- ------------ ------------ ------------

Less than one year:

Bank loan 2,000,000 937,500 312,500

Other loan 7,690,000 3,025,000 7,690,000

Total 9,690,000 3,962,500 8,002,500

---------------------- ------------ ------------ ------------

More than one year:

Bank loan - - -

Other loan - 2,985,000 -

Total - 2,985,000 -

---------------------- ------------ ------------ ------------

The bank loan was drawn down in September 2023 as a short-term

loan provided under the UK Government Recovery Loan Scheme (RLS) at

an interest rate of 3.5% above base rate.

Other loans relate to drawdowns on a secured note programme

which has been arranged by LGB Capital Markets. The loan note

liabilities are secured by a floating charge over the Group's

assets. The loans have terms of up to 3 years and interest rates of

8-12%.

During the current period and previous year, a covenant in

relation to debt service cover was breached and a waiver from loan

note holders was obtained shortly after the period/year end. Due to

the waiver not being received prior to the period/year end, IAS 1

requires that the loans are classified as being repayable in less

than one year.

4. Share capital

30 Sep 30 Sep 31 Mar

2023 2022 2023

Unaudited Unaudited Audited

GBP GBP GBP

-------------------------------- ---------- ---------- ----------

Allotted:

Ordinary shares of 0.1p each 192,428 180,677 181,517

--------------------------------- ---------- ---------- ----------

Reconciliation of movement Number of

in share capital shares

Shares issued at 31 March 2022

and September 2022 180,676,939

Exercise of share options (a) 210,000

Exercise of share options (b) 530,000

Exercise of share options (c) 100,000

Shares issued at 31 March 2023 181,516,939

Exercise of share options (d) 8,000

Placing of shares (e) 10,720,000

Exercise of share options (f) 15,000

Exercise of share options (g) 48,000

Exercise of share options (h) 120,000

Shares issued at 30 September 2023 192,427,939

Notes:

a) 150,000 share options were exercised at a price of 18p in

November 2022 and a further 60,000 at a price of 23p in the same

month.

b) 500,000 share options were exercised at a price of 20p in December 2022 and a further

30,000 at a price of 18p in the same month.

c) 100,000 share options were exercised at a price of 0.1p in February 2023.

d) 8,000 share options were exercised at a price of 0.1p in April 2023.

e) The placing in June 2023 took place at 50p per share raising

gross proceeds of GBP5,360,000 before costs of GBP364,484.

f) 15,000 share options were exercise at a price of 0.1p in July 2023.

g) 40,000 share options were exercised at a price of 26p in

August 2023 and a further 8,000 at an exercise price of 0.1p in the

same month.

h) 120,000 share options were exercised at a price of 31.5p in September 2023.

5. Cash (used in) / generated from operating activities

Six months Six months Year ended

ended ended

30 Sep 30 Sep 31 Mar

2023 2022 2023

Unaudited Unaudited Audited

GBP GBP GBP

---------------------------------- -------------- -------------- --------------

Operating (loss) / profit (4,207,338) 2,460,203 135,024

Depreciation of property,

plant and equipment 200,296 241,005 474,226

Amortisation of intangible

fixed assets 1,261,803 1,146,354 2,406,644

Share-based payment charge 160,099 123,933 299,276

Increase in inventories (838,864) (312,660) (1,105,704)

Increase in trade and other

payables 179,786 5,133,245 550,291

Decrease / (increase) in

trade and other receivables 1,560,304 (9,586,428) (1,980,917)

Net cash (used in) / generated

from operating activities (1,683,914) (794,348) 778,840

----------------------------------- -------------- -------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFERLLLDLIV

(END) Dow Jones Newswires

November 20, 2023 02:00 ET (07:00 GMT)

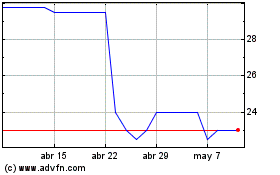

Srt Marine Systems (LSE:SRT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Srt Marine Systems (LSE:SRT)

Gráfica de Acción Histórica

De May 2023 a May 2024