SWEF: Proposed Orderly Realisation and Return of Capital to Shareholders (1475915)

31 Octubre 2022 - 8:35AM

UK Regulatory

Starwood European Real Estate Finance Ltd (SWEF) SWEF: Proposed

Orderly Realisation and Return of Capital to Shareholders

31-Oct-2022 / 14:35 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information in accordance with

the Market Abuse Regulation (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

Starwood European Real Estate Finance Limited

(the "Company")

Proposed Orderly Realisation and Return of Capital to

Shareholders

Starwood European Real Estate Finance Limited announces that

following a review of the Company's strategy and advice sought from

its advisers, the Board intends to recommend to shareholders that

the investment objective and policy of the Company are amended such

that the Board can pursue a strategy of orderly realisation and the

return of capital over time to shareholders.

Under the Company's current discount control mechanisms, the

Company is required to redeem up to 75 per cent. of the shares in

issue if the Company's discount to its Net Asset Value per share is

greater than 5 per cent. or more during the six-month period ending

31 December 2022 (the "Tender Offer"). The Board has determined

that, following discussions with its larger shareholders, the

likely take-up of a potential future Tender Offer would be

significant and that the Company would no longer be of a viable

size to provide shareholders with sufficient liquidity and scale.

Accordingly, the Board has resolved that the Company should be

placed into a managed wind-down with the aim of enabling

shareholders to realise their entire holdings in the Company over

time. It is expected that any managed wind-down would be on an

orderly basis and will align to the repayment dates of the relevant

loan positions.

In reaching this decision, the Board have considered a range of

options and several factors including the prevailing and persistent

discount to net asset value of the shares, feedback from

shareholders, and the market capitalisation and liquidity of the

shares.

The orderly realisation of the strategy will not result in the

liquidation of the Company in the immediate future or require the

Company to dispose of assets within a defined time frame. The

proposed new strategy, if approved, would be implemented in a

manner that would seek to maximise value to shareholders. It is

intended that the Company's listing would be maintained during the

orderly realisation.

The Board intends, subject to the prior approval of the

Financial Conduct Authority of the proposed amendments to the

investment objective and policy, to publish a circular to

shareholders to convene an extraordinary general meeting at which

it will seek approval from shareholders to amend the Company's

investment objective and policy, the Articles of Incorporation (to

the extent required) and approve any related matters necessary to

facilitate an orderly realisation. It is the Board's current

intention to maintain the current target level of dividend, whilst

the Company remains substantially invested, should the proposals be

approved by shareholders (this is a target only and does not

constitute a profit forecast).

The Board is available to discuss the proposed managed wind down

with shareholders ahead of publishing a circular to

shareholders.

This announcement contains inside information for the purposes

of Article 7 of the UK version of the Market Abuse Regulation (EU)

no.596/2014, which forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018 ("UK MAR").

For further information, please contact:

Apex Fund and Corporate Services (Guernsey) Limited as Company Secretary

Duke Le Prevost

+44 (0)20 3530 3630

Starwood Capital

Duncan MacPherson +44 (0)20 7016 3655

Jefferies International Limited

Neil Winward

Gaudi Le Roux +44 (0)20 7029 8000

Notes:

Starwood European Real Estate Finance Limited is an investment

company listed on the main market of the London Stock Exchange with

an investment objective to provide Shareholders with regular

dividends and an attractive total return while limiting downside

risk, through the origination, execution, acquisition and servicing

of a diversified portfolio of real estate debt investments in the

UK and the wider European Union's internal market.

www.starwoodeuropeanfinance.com.

The Company is the largest London-listed vehicle to provide

investors with pure play exposure to real estate lending.

The Group's assets are managed by Starwood European Finance

Partners Limited, an indirect wholly-owned subsidiary of the

Starwood Capital Group.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GG00B79WC100

Category Code: MSCU

TIDM: SWEF

LEI Code: 5493004YMVUQ9Z7JGZ50

OAM Categories: 2.3. Major shareholding notifications

3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 197971

EQS News ID: 1475915

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1475915&application_name=news

(END) Dow Jones Newswires

October 31, 2022 10:35 ET (14:35 GMT)

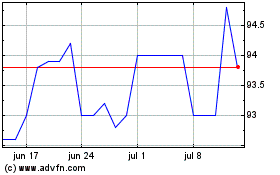

Starwood European Real E... (LSE:SWEF)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Starwood European Real E... (LSE:SWEF)

Gráfica de Acción Histórica

De May 2023 a May 2024