TIDMTENG

RNS Number : 0213L

Ten Lifestyle Group PLC

11 May 2022

11 May 2022

Ten Lifestyle Group plc

("Ten", the "Company" or the "Group")

Interim results for the six months ended 28 February 2022

Ten Lifestyle Group plc (AIM: TENG), a leading

technology-enabled global concierge platform for the world's

wealthy and mass affluent, announces its unaudited Interim Results

for the six months ended 28 February 2022 ("H1 2022", or "the

period").

Financial

-- Net Revenue (1) increased 21% to GBP20.8m (H1 2021: GBP17.2m)

with growth in all three global regions (EMEA, Americas, APAC)

o Corporate revenue of GBP18.4m (13% higher than H1 2021:

GBP16.3m)

o Supplier revenue of GBP2.4m (167% higher than H1 2021: GBP0.9m

and back to pre-COVID levels )

-- Operating expenses increased to GBP19.9m (H1 2021: GBP15.5m

after GBP2.1m benefit of payroll assistance (2) ) due to an

increase in employees during the period to support a recovery in

demand

-- Adjusted EBITDA (3) fell to GBP0.9m (H1 2022: GBP1.7m) due to

the higher cost base and the impact of Omicron (4) in Q2

-- Loss before tax improved to GBP(2.8)m (H1 2021: GBP(3.6)m)

largely due to a reduction in the share option charge and lower

depreciation

-- Cash and cash equivalents of GBP5.1m (H1 2021: GBP9.2m, FY 2021: GBP6.7m)

Operational

-- 100% retention of Material Contracts (5) with some key

contract renewals and contract extensions signed, including with

Barclays Bank, DNB Bank and St James's Place

-- High conversion rate of the new business pipeline has seen

new contract wins with market leading wealth managers in each of

EMEA, the Americas and APAC

-- Continued investment in proprietary digital platforms,

communications, and technologies to improve service quality and

efficiencies, GBP6.5m (H1 2021: GBP5.5m)

-- 9% increase in total Active Members (6) during the period to

221k (FY 2021: 203k (7) ), with growth in all regions

-- Recovery of high member satisfaction levels (8) following a

temporary decline at the start of the period due to an increase in

service demands while staff were recruited and trained

CURRENT TRADING AND OUTLOOK

In the two months since the end of February, monthly request

numbers have increased in all regions, with Net Revenue now above

pre-COVID levels (H1 2020: GBP 23.8 m) and travel bookings

increasing Supplier revenue above pre-COVID levels (H1 2020:

GBP2.5m). This is despite travel remaining subdued in parts of the

Americas and APAC and the closure of our Moscow office from 9

March.

Further easing of worldwide travel restrictions and concerns are

expected to result in further organic growth in request numbers and

related revenue. In addition, three previously announced new

Material Contracts are expected to launch in the second half of the

year and drive further growth across the rest of this financial

year.

We continue to make improvements to servicing, content, digital

and operational efficiencies, including the productive deployment

of new staff recruited before Omicron, to deliver improved

profitability in the second half and achieve full year Adjusted

EBITDA in line with the Board's expectations. We also continue to

invest in technology to further drive the growth engine whilst

maintaining a positive net cash position.

Alex Cheatle, CEO of Ten Lifestyle Group, said;

"As we anticipated, revenue from corporate clients grew at the

start of the period as we accelerated out of the pandemic. The

arrival of Omicron at the end of November then stalled growth.

However, we have now returned to growth and since February, Net

Revenue is tracking above levels last seen in the period before

COVID emerged (H1 2020: GBP23.8m).

In order to manage the increased level of demand, we recruited

new staff at the start of the period and retained them despite the

temporary fall in demand caused by Omicron, to support new contract

launches and the recovery in demand we are now seeing. This

increase in cost base, combined with the nonrecurrence of payroll

assistance, caused a short-term fall in profitability during the

period .

We believe the improvements made to our member proposition and

operational efficiencies, along with contracted launches in the

coming months, our strong pipeline of new business opportunities

and the gradual return of demand for our core services, means we

are well positioned to continue to drive our growth engine."

Analyst Presentation

An online analyst presentation will be held by video link today

at 9:00am.

The Group will also be presenting an Investor Webinar for

current and prospective investors on Tuesday 17 May 2022 at 5:30pm

BST .

To attend either the Analyst Presentation or the Investor

Webinar, please email investorrelations@tengroup.com .

For further information please visit www.tenlifestylegroup.com

or call:

Ten Lifestyle Group plc

Alex Cheatle, Chief Executive Officer +44 (0)20 7850

Alan Donald, Chief Financial Officer 2796

Peel Hunt LLP, Nominated Advisor and Broker

Edward Knight

Paul Gillam +44 (0) 20 7418

James Smith 8900

(1) Net Revenue excludes the direct cost of sales relating to

certain member transactions managed by the Group.

(2) During the COVID pandemic, Ten Group benefited from various

forms of payroll assistance from governments in countries where it

operated (i.e. furlough) and operated a voluntary Salary Sacrifice

Scheme in exchange for share options, as described on pages 52 and

53 of the 2021 Annual Report & Accounts.

(3) Adjusted EBITDA is operating profit/(loss) before interest,

taxation, amortisation, depreciation, share-based payment expense

and exceptional items.

(4) The Omicron variant of COVID-19 was first reported to the

World Health Organization on 24 November 2021 and quickly spread

around the world, causing countries to re-imposed lockdown

measures.

(5) Ten categorises its corporate client contracts based on the

annualised value paid, or expected to be paid, by the corporate

client for the provision of concierge and related services by Ten

as: Small contracts (below GBP0.25m); Medium contracts (between

GBP0.25m and GBP2m); Large contracts (between GBP2m and GBP5m); and

Extra Large contracts (over GBP5m). This does not include the

revenue generated from suppliers through the provision of concierge

services. Medium, Large and Extra Large contracts are collectively

Ten's "Material Contracts".

(6) Active Members are members eligible to use Ten's services by

virtue of them holding an account, card, employment or other such

position or product linked to a corporate client programme who have

used Ten's services at least once in the 12 months prior.

(7) The number of Active Members in the prior year has been

recalculated using a more accurate measure of member eligibility,

consistent with the definition of Active Members, which has

resulted in the figure for FY 2021 being revised from 210k to

203k.

(8) Ten measures member satisfaction using the Net Promoter

Score management tool, which gauges the loyalty of a firm's

customer relationships ( https://en.wikipedia.org/wiki/Net_Promoter

).

OPERATING AND FINANCIAL REVIEW

CHIEF EXECUTIVE'S STATEMENT

We started the financial year strongly with the launch of a

Large contract with Credit Saison, a leading premium credit card

issuer in Japan and expansion of an Extra Large contract with a

corporate client in EMEA. These, alongside the lifting of pandemic

restrictions in EMEA and the USA, resulted in the return to

pre-COVID levels of global travel bookings. Additional staff were

recruited in response to the growth in order to service increased

demand.

The Group's cost base increased as a result of this recruitment

and nonrecurrence of payroll assistance received in H1 2021, before

Omicron reduced member activity and revenue in the second half of

the period . The additional headcount was largely retained to

support the forecast expansion of existing contracts and new

contract launches. We saw this anticipated recovery in demand at

the end of the period and it has accelerated since the end of the

period.

Despite disruption to the recovery in levels of member activity

caused by Omicron, Net Revenue increased by 21% compared to prior

year.

The impact of lower demand due to Omicron, after the recruitment

of staff reduced Adjusted EBITDA to GBP0.9m compared to prior year

(H1 2021: GBP1.7m). Loss before tax fell to GBP(2.8)m compared to

the prior year (H1 2021: GBP(3.6)m), largely due to the absence of

a salary sacrifice scheme and a reduction in depreciation from

lower office costs.

Corporate client developments

Total Material Contracts Held by Size

Contract size Launched by 28 Signed and expected

February 2022 to be launched

by 31 August

2022

--------------- --------------------

Extra Large 3 3

--------------- --------------------

Large 6 6

--------------- --------------------

Medium 17 20

--------------- --------------------

Total 26 29

--------------- --------------------

During the period three new Material Contracts have been won as

well as multiple Small contract wins; all expected to launch by the

end of the financial year. These include a Medium contract with one

of Japan's largest wealth management businesses, a Medium contract

to initially launch in the USA with one of the world's largest

private banks and a Medium contract with one of the UK's largest

wealth managers.

The Group retained all its Material Contracts in the period,

securing contract renewals and extensions with existing corporate

clients, including Barclays Bank, DNB Bank and St James's Place.

This demonstrates the competitive resilience of Ten's competitive

position and the apparent value of our concierge service to our

clients as a customer retention tool.

Ten has been engaged by certain existing clients to deliver

bespoke, paid-for digital projects to develop and enhance the Ten's

proprietary digital platform and content to increase their customer

metrics.

Members

As the world progressively emerges from the pandemic, we are

seeing a gradual increase (+9%) in the number of Active Members

using the service in all regions, which generally results in

increased Net Revenue from corporate accounts.

Member satisfaction levels dipped in the Autumn due to increase

in demand and lag between hiring new staff and them becoming fully

trained, effective, and efficient. Service levels have recovered

during the second half of the period.

FINANCIAL REVIEW

Results

GBPm H1 2022 H1 2021

Revenue 21.3 17.5

-------- --------

Net Revenue 20.8 17.2

-------- --------

Operating expenses and Other income (19.9) (15.5)

-------- --------

Adjusted EBITDA 0.9 1.7

-------- --------

Adjusted EBITDA % of Net Revenue 4.3% 9.8%

-------- --------

Depreciation (1.3) (1.8)

-------- --------

Amortisation (2.2) (1.9)

-------- --------

Share-based payments and exceptional items charge (0.3) (1.2)

-------- --------

Operating loss before interest and tax (2.9) (3.2)

-------- --------

Net finance income/(expense) 0.1 (0.4)

-------- --------

Loss before taxation (2.8) (3.6)

-------- --------

Taxation charge (0.4) (0.3)

-------- --------

Loss for the period (3.2) (3.9)

-------- --------

Revenue

Revenue for the period was GBP21.3m, a 22% increase on H1 2021

(GBP17.5m). Net Revenue (which is our key revenue measure) for the

period was GBP20.8m, a 21% increase on the same period of the prior

year (H1 2021: GBP17.2m) and a 19% increase on the previous period

(H2 2021: GBP17.5m), however it remained 13% lower than H1 2020:

GBP23.8m, which was the last period before international lockdowns

took effect.

This revenue improvement was driven primarily by recovery in the

business at the start of the period offset by lower demand due to

the impact of the Omicron on member activity.

Corporate revenue was GBP18.4m, (paid by our corporate clients

to service their customers) compared to the prior year (H1 2021:

GBP16.3m) but remains 14% below pre-COVID levels (H1 2020:

GBP21.3m). Supplier revenue (predominantly travel related) was

GBP2.4m, an 167% increase compared to the prior year (H1 2021:

GBP0.9m) and a return to pre-COVID levels (H1 2020: GBP2.5m),

despite Omicron affecting global travel during the period.

Operating expenses & other income excluding depreciation,

amortisation, share based payments and exceptional items

Operating expenses increased to GBP19.9m (H1 2021: GBP15.5m

after benefit of GBP1.4m of government salary subsidies and GBP0.7m

salary sacrifice savings), driven by increased activity in the

period, particularly at the start of the period as we recruited

staff to service increases in requests alongside nonrecurrence of

payroll assistance from the previous year. Operating expenses

remain 8% lower than pre-COVID levels ( H1 2020: GBP21.7m ) due to

improved efficiencies.

When the impact of Omicron reduced activity, a decision was made

to retain staff as we saw Omicron as having a short-term impact on

the business and it was more efficient to retain staff rather than

reduce and then rehire.

Adjusted EBITDA

Adjusted EBITDA, as reported, takes into account all Group

operating costs, other than depreciation of GBP1.3m (H1 2021:

GBP1.8m), amortisation of GBP2.2m (H1 2021: GBP1.9m), share-based

payment expenses of GBP0.3m (H1 2021: GBP0.8m) and exceptional

charges of GBP0.0m (H1 2021: GBP0.4m). On this basis, Adjusted

EBITDA was a profit of GBP0.9m (H1 2021: GBP1.7m).

Depreciation has declined by GBP0.5m, primarily due to a

reduction in Right-of-use Asset (lower lease costs). Amortisation

increased by GBP0.3m, reflecting our continued technology

investment. Share-based payment expenses decreased by GBP0.5m as

the number of options granted in the period was lower than in the

prior year.

As a result of the above, Loss before tax has improved by 22% to

GBP(2.8)m (H1 2021: GBP(3.6)m).

Regional performance

Segmental Net Revenue reporting reflects our servicing location

rather than the location of our corporate clients. This allows us

to understand and track the efficiency and profitability of our

operations around the world.

GBPm H1 2022 H1 2021 % change

EMEA 10.0 8.7 +15%

-------- -------- ---------

Americas 6.5 5.0 +30%

-------- -------- ---------

APAC 4.3 3.5 +23%

-------- -------- ---------

Total 20.8 17.2 +21%

-------- -------- ---------

After fully allocating our indirect central costs including IT,

platform support, non-lease costs and management across the

regions, the Adjusted EBITDA profitability of each regional segment

is:

GBPm H1 2022 H1 2021

EMEA 1.8 3.0

-------- --------

Americas (1.1) (1.7)

-------- --------

APAC 0.2 0.4

-------- --------

Total 0.9 1.7

-------- --------

Adjusted EBITDA % of

Net Revenue 4.3% 9.8%

-------- --------

EMEA

Net Revenue in the region increased by 15% to GBP10.0m (H1 2021:

GBP8.7m). The increase in Net Revenue of GBP1.3m is primarily

driven by recovery of base business and higher supplier revenue due

to increased demand primarily at the start of the period offset by

slowing of activity in the second half of the period due to the

Omicron variant. Adjusted EBITDA of GBP1.8m is lower than prior

year of GBP3.0m due to additional staff and nonrecurrence of

payroll assistance, as previously explained.

AMERICAS

Net Revenue from the region increased by 30% to GBP6.5m (H1

2021: GBP5.0m). The GBP1.5m increase in revenue in the region also

reflected the recovery in base business activity and increase in

Supplier revenue as travel restrictions started to ease. As a

result, the Adjusted EBITDA loss of GBP(1.1)m is lower than prior

year of GBP(1.7)m.

APAC

Net Revenue increased by 23% to GBP4.3m (H1 2021: GBP3.5m). This

increase is primarily due to the new Large contract with Credit

Saison that launched in September 2021. The region remains

relatively subdued from an activity perspective as the impact of

various lockdowns have further delayed recovery in the region in

the period. Further revenue recovery is dependent on the timing on

international travel and domestic activity fully opening up again

in the region. Adjusted EBITDA profit of GBP0.2m compared to an

Adjusted EBITDA profit of GBP0.4m in the prior period.

Cash flow

H1 2022

GBPm

Loss before tax (2.8)

Movement in working capital 0.5

Non-cash items (share-based payments, depreciation,

amortisation charges and exceptional items) 3.7

--------

Pre-tax operating cash in flows 1.4

Capital expenditure (0.5)

Investment in intangibles (2.9)

Taxation (0.2)

--------

Cash outflow (2.2)

--------

Cash receipts from issue of new shares and sale

of treasury shares 1.8

Repayment of leases and net interest (1.2)

--------

Net Financing activities 0.6

Foreign currency movements 0.1

--------

Reduction in cash (1.5)

--------

Cash and cash equivalents balance 5.1

========

Pre-tax operating cash inflows of GBP1.4m, reflected a loss

before tax of GBP2.8m, increased net working capital of GBP0.5m,

and add back of non-cash items of GBP3.7m, as highlighted

above.

Additionally, as planned, there was GBP2.9m (H1 2021: GBP2.5m)

of capital investment in the period in both our global content, our

internal CRM platform (TenMAID) and the continued development of

our digital platform.

Cash receipts from issue of new shares of GBP1.3m, primarily

from exercising of salary sacrifice options and some CSOP options,

sale of treasury shares of GBP0.5m offset by Repayment of leases

and net interest of GBP1.2m has resulted in a cash outflow in the

period of GBP1.5m.

Balance sheet

GBP'm H1 2022 FY 2021

Intangible assets 12.3 11.6

-------- --------

Property, plant and equipment 0.7 0.6

-------- --------

Right-of-use assets 2.7 2.6

-------- --------

Cash 5.1 6.7

-------- --------

Other current assets 8.4 5.8

-------- --------

Current liabilities (17.2) (13.7)

-------- --------

Other non-current liabilities (1.3) (1.7)

-------- --------

Net assets 10.7 11.9

-------- --------

Share capital/Share premium 30.7 29.4

-------- --------

Reserves (20.0) (17.5)

-------- --------

Total equity 10.7 11.9

-------- --------

With the increase in business activity, other current assets

grew by GBP2.6m primarily due to trade receivables and current

liabilities, increased by GBP3.5m as deferred income increased. Net

assets of GBP10.7m includes cash of GBP5.1m as at 28 February

2022.

Principle Risks and Uncertainties

The principle risks and uncertainties facing the Group remain

broadly consistent with the Principle Risks and Uncertainties

reported in Ten's 2021 Annual Report. The conflict in Ukraine has

had limited macroeconomic impact on Ten's core service categories

in the affected region and the impact of the closure of the Group's

Moscow office from 9 March 2022 is expected to be limited (the

Russia business contributed <1.5% of the Group's Net Revenue in

the period). Additional steps have been taken to ensure the Group's

continued compliance with international sanctions.

Alex Cheatle Alan Donald

Chief Executive Officer Chief Finance Officer

10 May 2022 10 May 2022

Consolidated statement of comprehensive income

Note 6 months 6 months

to 28 Feb to 28 Feb

2022 2021

Unaudited Unaudited

GBP'000 GBP'000

Revenue 2 21,326 17,484

Cost of sales on principal member transactions (574) (318)

----------- -----------

Net Revenue 2 20,752 17,166

Other cost of sales (638) (328)

Gross profit 20,114 16,838

Administrative expenses (23,139) (20,202)

Other income 150 150

Operating profit before amortisation, depreciation,

interest, share based payments, exceptional

items and taxation ("Adjusted EBITDA") 886 1,689

Depreciation (1,305) (1,765)

Amortisation 3 (2,156) (1,877)

Share-based payment expense (300) (816)

Exceptional items - (445)

----------------------------------------------------- ----- ----------- -----------

Operating loss (2,875) (3,214)

Net Finance Income/(expenses) 36 (365)

----------- -----------

Loss before taxation (2,839) (3,579)

Taxation expense 4 (316) (351)

----------- -----------

Loss for the period (3,155) (3,930)

=========== ===========

Other comprehensive expense:

Foreign currency translation differences (174) (135)

Total comprehensive loss for the period (3,329) (4,065)

=========== ===========

Basic and diluted loss per ordinary share 5 (3.8)p (4.9)p

The consolidated statement of comprehensive income has been

prepared on the basis that all operations are continuing

operations.

Consolidated statement of financial position

Note 6 months to 31 August

28 Feb 2022 2021

Unaudited Audited

GBP'000 GBP'000

Non-current assets

Intangible assets 3 12,329 11,555

Property, plant and equipment 719 561

Right of use assets 2,674 2,601

----------

Total non-current assets 15,722 14,717

------------- ----------

Current assets

Inventories 70 98

Trade and other receivables 8,358 5,707

Cash and cash equivalents 5,122 6,662

----------

Total current assets 13,550 12,467

------------- ----------

Total assets 29,272 27,184

============= ==========

Current liabilities

Trade and other payables (14,761) (11,487)

Provisions (596) (568)

Lease Liabilities (1,819) (1,504)

Total current liabilities (17,176) (13,559)

------------- ----------

Net current liabilities (3,626) (1,092)

============= ==========

Non-current liabilities

Lease Liabilities (1,356) (1,678)

Total non-current liabilities (1,356) (1,678)

------------- ----------

Total liabilities (18,532) (15,237)

============= ==========

Net assets 10,740 11,947

============= ==========

Equity

Called up share capital 84 82

Share premium account 30,658 29,356

Merger relief reserve 1,993 1,993

Treasury reserve 523 5

Foreign exchange reserve (584) (410)

Retained deficit (21,934) (19,079)

Total equity 10,740 11,947

============= ==========

Consolidated statement of changes in equity

Share Merger Foreign

Share premium relief exchange Treasury Retained

capital account reserve reserve reserve deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 September

2020 (Audited) 81 28,480 1,993 (405) 15 (14,931) 15,233

--------- --------- --------- ---------- --------- --------- --------

Loss for the year - - - - - (5,774) (5,774)

Foreign exchange - - - (5) - - (5)

Total comprehensive

income for the year - - - (5) - (5,774) (5,779)

Shares purchased by

Employee Benefit Trust

(EBT) - - - - (10) - (10)

Issue of share capital 1 876 877

Equity-settled share-based

payments charge - - - - - 1,626 1,626

Balance at 31 August

2021 82 29,356 1,993 (410) 5 (19,079) 11,947

Period ended 28 February

2022

Loss for the year (3,155) (3,155)

Foreign exchange - - - (174) - - (174)

Total comprehensive

income for the year - - - (174) - (3,155) (3,329)

Equity-settled share-based

payments charge - - - - - 300 300

Shares sold by Employee

Benefit Trust (EBT) 518 - 518

Issue of new share

capital 2 1,302 - - - - 1,304

Balance at 28 February

2022 (Unaudited) 84 30,658 1,993 (684) 523 (21,934) 10,740

========= ========= ========= ========== ========= ========= ========

Condensed consolidated statement of cash flows

Note 6 months 6 months

to 28 Feb to 28 Feb

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Loss for the year, after tax (3,155) (3,930)

Adjustments for:

Taxation expense 4 316 351

Net Finance Income (36) 173

Amortisation of intangible assets 3 2,156 1,877

Depreciation of property, plant and

equipment 229 376

Depreciation of right-of-use asset 1,076 1,389

Equity-settled share based payment expense 300 816

Impairment - 445

Movement in working capital:

Decrease in inventories 28 5

(Increase)/Decrease in trade and other

receivables (2,723) 1,698

Increase/(Decrease) in trade and other

payables 3,201 (786)

Cash from by operations 1,392 2,414

Tax paid (236) (227)

Net cash from operating activities 1,156 2,187

----------- -----------

Cashflows from Investing activities

Purchase of intangible assets 3 (2,927) (2,525)

Purchase of property, plant and equipment (457) (49)

Net cash used by investing activities (3,384) (2,574)

----------- -----------

Cash flows from financing activities

Lease Liability repayments (1,093) (1,544)

Sale of treasury shares 518 -

Interest paid on IFRS16 lease liabilities (93) (167)

Cash receipts from issue of share capital 1,302 597

Net cash used by financing activities 634 (1,114)

----------- -----------

Foreign currency movements 54 (284)

Net decrease in cash and cash equivalents (1,540) (1,785)

Cash and cash equivalents at beginning

of period 6,662 10,957

Cash and cash equivalents at end of

period

Cash at bank and in hand 5,122 9,172

Cash and cash equivalents 5,122 9,172

=========== ===========

Notes to the Interim Financial Information

1. Basis of preparation

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted for

use in the EU. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 August 2021 Annual

Report. The financial information for the half years ended 28

February 2022 and 28 February 2021 does not constitute statutory

accounts within the meaning of Section 434 (3) of the Companies Act

2006 and both periods are unaudited.

The annual financial statements of Ten Lifestyle Group plc ('the

Group') are prepared in accordance with International standards in

conformity with the requirements of the Companies Act 2006 ('IFRS')

and with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS (except as otherwise stated). The

comparative financial information for the year ended 31 August 2021

included within this report does not constitute the full statutory

Annual Report for that period. The statutory Annual Report and

Financial Statements for year ended 31 August 2021 have been filed

with the Registrar of Companies. The Independent Auditors' Report

in the Annual Report and Financial Statements for the year ended 31

August 2021 was unqualified, did not draw attention to any matters

by way of emphasis and did not contain a statement under 498(2)-(3)

of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its year ended 31 August 2021 annual financial statements. The

Groups tax charge is not accounted for under the same basis as IAS

34. The tax charge is calculated using the expected effective tax

rate at the reporting date. There are no new standards effective

yet and that would be expected to have a material impact on the

entity in the current period.

Going Concern

As at 28 February 2022, the date of the interim consolidated

financial statements, the Group had cash of GBP5.1m. Subsequent to

the period's end, as announced on 28 March 2022, the Group borrowed

GBP1.5m from a related party for 15 months to support the business'

normal working capital cycles, to allow the Group to continue to

invest in its technology platform and to support revenue growth, in

line with management's expectations.

As indicated in the Current Trading and Outlook above, in the

two months since the end of February monthly request numbers have

increased in all regions with Net Revenue now above pre-COVID

levels (H1 2020: GBP23.8m) and travel bookings driving Supplier

revenue above pre-COVID levels (H1 2020: GBP2.5m).

The Directors have taken account of this position when

considering forecasts to support their going concern conclusion.

The following has been considered:

-- Base Case cashflow forecast to 31 August 2023

-- Downside cashflow forecast to 31 August 2023

-- Mitigating actions available

Base Case Scenario

The Base Case forecast reviewed by the Directors is in line with

expectations for the current financial year and FY 2023. The Net

Revenue assumptions in the Base Case forecast are consistent with

growth trends around base business growth, net contract wins and

Supplier revenue growth. Cost assumptions reflect changes in Net

Revenue as well as continual improvements in operational

efficiencies.

Under this scenario, the Group will remain in a net cash

position during the forecasted period.

Downside scenario and mitigating actions

The Directors consider that the major risks in the Base Case

forecast is that our Net Revenue growth assumptions are not met and

remain flat during the period. If this scenario were to develop,

the Group has a number of mitigating actions available to it,

including reducing direct operating costs to align to Net Revenue

growth rates as well as reducing indirect costs supporting the

business.

The Directors are confident that the impact of these mitigating

actions would ensure the Group remains in a net cash position

during the forecasted period.

Conclusion

Having considered the forecast scenarios, including the main

risks within them and mitigating actions described, there is a

reasonable expectation that the Group has adequate financial

resources to continue to operate for at least the next twelve

months from the date of this interim report. Accordingly, the

consolidated financial statements have been prepared on a going

concern basis.

The Board of Directors approved this interim report on 10 May

2022.

2. Segmental Information

The total revenue for the Group has been derived from its

principal activity; the provision of concierge services.

6 months 6 months

to 28 Feb to 28 Feb

2022 2021

(Unaudited) (Unaudited)

GBP'000 GBP'000

EMEA 10,014 8,735

Americas 6,483 4,997

APAC 4,255 3,434

------------ ------------

Net Revenue 20,752 17,166

Add back: Cost of sales on principal member transactions 574 318

------------ ------------

Revenue 21,326 17,484

EMEA 1,830 2,956

Americas (1,143) (1,653)

APAC 199 386

------------ ------------

Adjusted EBITDA 886 1,689

Amortisation (2,156) (1,877)

Depreciation (1,305) (1,765)

Share-based payment expense (300) (816)

Exceptional Items - (445)

------------ ------------

Operating loss (2,875) (3,214)

Foreign exchange gain/(loss) 129 (192)

Other net finance expense (93) (173)

------------ ------------

Loss before taxation (2,839) (3,579)

Taxation expense (316) (351)

------------ ------------

Loss for the year (3,155) (3,930)

============ ============

Net Revenue is a non-GAAP Group measure that excludes the direct

cost of sales relating to member transactions managed by the Group,

such as the cost of airline tickets sold under the Group's ATOL

licence's. Net Revenue is the measure of the Group's income on

which segmental performance is measured.

Adjusted EBITDA is a Group non-GAAP specific measure excluding

interest, taxation, depreciation, amortisation, share-based

payments and exceptional costs, the latter being expenses which are

considered to be one-off and non-recurring in nature (where

applicable).

Adjusted EBITDA is the main measure of performance used by the

Group's Chief Executive Officer, who is considered to be the chief

operating decision maker. Adjusted EBITDA is the principal profit

measure for a segment.

The statement of financial position is not analysed between

reporting segment. Management and the chief operating

decision-maker consider the statement of financial position at

Group level.

3. Intangible Assets

The Group capitalised GBP2.9m (H1 2021: GBP2.5m, FY 2021:

GBP5.4m) of costs representing the development of Ten's global

digital platform, TenMAID (Ten's proprietary customer relationship

management system) resulting in a net book value of GBP12.3m (H1

2021: GBP10.7m, FY 2021: GBP11.6m) after an amortisation charge of

GBP2.2m (H1 2021: GBP1.9m, FY 2021: GBP4.0m).

4. Taxation

The income tax expense has been recognised based on the best

estimate of the weighted average annual effective UK corporation

tax rate expected for the full financial year. The Group currently

forecasts a loss for the financial year ending 31 August 2021 and

therefore no charge has been recognised in regard to UK corporation

tax in the period.

The income tax expense of GBP0.4m (H1 2021: GBP0.4m) includes

foreign taxes recognised by overseas Group companies on a territory

by territory basis using the expected effective tax rate for the

full year.

5. Earnings Per Share

6 months 6 months

to 28 Feb to 28 Feb

2022 2021

GBP'000 GBP'000

Loss attributable to equity shareholders of the parent (3,155) (3,930)

----------- -----------

Weighted average number of ordinary shares in issue

(net of treasury) 83,195,255 80,302,498

Basic loss per share (pence) (3.8)p (4.9)p

----------- -----------

Where the Group has incurred a loss in the six-month period to

28 February 2022, the diluted earnings per share is the same as the

basic loss per share as the loss has an anti-dilutive effect.

6. Post-period events

As a result of the conflict in Ukraine, the Group ceased its

limited business activities in Russia (c. 1-2% of the Group's

annual Net Revenue) and closed its Moscow office from 9 March.

Additional steps have been taken to ensure compliance with

international sanctions.

As announced on 28 March 2022, the Group borrowed GBP1.5m from a

related party for a 15 month term to support the business' normal

working capital cycles, to allow the Group to continue to invest in

its technology platform and to support revenue growth, in line with

management's expectations.

7. Cautionary Statement

This document contains certain forward-looking statements

relating to Ten Lifestyle Group plc. The Company considers any

statements that are not historical facts as "forward-looking

statements". They relate to events and trends that are subject to

risk and uncertainty that may cause actual results and the

financial performance of the Company to differ materially from

those contained in any forward-looking statement. These statements

are made by the Directors in good faith based on information

available to them and such statements should be treated with

caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking

information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BBLLFLELLBBE

(END) Dow Jones Newswires

May 11, 2022 02:01 ET (06:01 GMT)

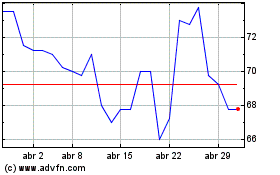

Ten Lifestyle (LSE:TENG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ten Lifestyle (LSE:TENG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024