TIDMTGA

RNS Number : 8452J

Thungela Resources Limited

21 August 2023

THUNGELA RESOURCES LIMITED

(Incorporated in the Republic of South Africa)

Registration number: 2021/303811/06

JSE Share Code: TGA

LSE Share Code: TGA

ISIN: ZAE000296554

Tax number: 9111917259

('Thungela' or the 'Company' and, together with its affiliates,

the 'Group')

2023 Interim results announcement and cash dividend

declaration

THUNGELA REPORTS RESILIENT PERFORMANCE FOR THE SIX MONTHSED 30

JUNE 2023 ("H1 2023") AND DECLARES R10 PER SHARE DIVID, REAFFIRMING

DIVID POLICY

KEY FEATURES

-- Total recordable case frequency rate (TRCFR) improved to 1.33, from 1.59 in June 2022

-- Profit for the reporting period of R3.0 billion reflecting a

significant decrease in thermal coal prices (H1 2022: R9.6

billion)

-- Headline earnings of R22.46 per share (H1 2022: R67.23)

-- Adjusted operating free cash flow* of R4.3 billion (H1 2022:

R8.9 billion) and net cash* position of R13.6 billion (H1 2022:

R14.8 billion)

-- Interim ordinary cash dividend declared of R10 per share, 33%

of adjusted operating free cash flow*, resulting in R1.4 billion

returned to shareholders

-- Sisonke Employee Empowerment Scheme and Nkulo Community

Partnership Trust to receive a contribution of R156 million

collectively in keeping with commitment to create shared value

-- Increased life of mine by 10 years through approval of the Zibulo North Shaft project

-- Ensham transaction expected to complete by 31 August 2023

-- Full year guidance range for export saleable production

narrowed to between 11.5Mt and 12.5Mt

-- Full year guidance for FOB cost per export tonne* revised to

R1,120 to R1,200 excluding royalties, or R1,170 to R1,250 per tonne

including royalties. Guidance for capital expenditure, both

sustaining and expansionary, reiterated

KEY FINANCIAL INFORMATION

Financial overview

Rand million (unless otherwise H1 2023 H1 2022 % change

stated)

------------------------------------------ ---------------- ----------------

Revenue 14,359 26,176 (45)

------------------------------------------ ---------------- ----------------

Operating costs (10,604) (10,119) 5

------------------------------------------ ---------------- ----------------

Profit for the reporting period 3,005 9,630 (69)

------------------------------------------ ---------------- ----------------

Earnings per share (cents/share) 2,245 6,723 (67)

------------------------------------------ ---------------- ----------------

Headline earnings per share (cents/share) 2,246 6,723 (67)

------------------------------------------ ---------------- ----------------

Dividend per share (cents/share) 1,000 6,000 (83)

------------------------------------------ ---------------- ----------------

Alternative performance measures*

------------------------------------------ ---------------- ----------------

Adjusted EBITDA 4,380 16,679 (74)

------------------------------------------ ---------------- ----------------

Adjusted EBITDA margin (%) 31 64 (33pp)

------------------------------------------ ---------------- ----------------

Adjusted operating free cash flow 4,298 8,934 (52)

------------------------------------------ ---------------- ----------------

Net cash 13,579 14,815 (8)

------------------------------------------ ---------------- ----------------

Capital expenditure 893 568 57

------------------------------------------ ---------------- ----------------

pp - percentage points change period on period

Message from July Ndlovu, Chief Executive Officer

Thungela continued to advance its strategic priorities, amid

challenging market conditions in the first half of 2023, by

investing through the cycle and focusing on what we can

control:

-- Continued to prioritise safety - TRCFR improved to 1.33, from 1.59 in June 2022 (1).

-- Took measures to strengthen business resilience in the face

of softer coal prices and persistent Transnet Freight Rail (TFR)

underperformance.

-- Increased life of mine profile through approval of the Zibulo North Shaft project.

-- Announced the acquisition of Ensham, marking a significant

step in Thungela's strategy to pursue geographical

diversification.

-- Maintained disciplined capital allocation and reaffirmed

dividend policy: interim dividend of R10 per share - 33% of

adjusted operating free cash flow*.

Safety is our first value and we remain focused on operating a

fatality-free business. Tragically our colleague Mr Breeze Mahlangu

passed away in February following complications after an accident

in December 2022. We have continued our relentless pursuit to

eliminate fatalities in our business and I am encouraged by the

improvement in our safety performance, with TRCFR of 1.33 for the

first six months of 2023.

We have continued to focus on 'controlling the controllables' in

the face of the challenging external factors which characterised

the first half of the year and, notwithstanding the softer price

environment and the lack of any improvement in rail performance,

Thungela recorded R3.1 billion (R22.45 per share) in earnings

attributable to shareholders of the Group, and adjusted EBITD A* of

R4.4 billion in the first half of 2023.

The Group generated adjusted operating free cash flow * of R4.3

billion for the reporting period. The net cash* position stood at

R13.6 billion at 30 June 2023. Adjusted operating free cash flow*

for the period benefited from the fact that sustaining capital

spend is traditionally weighted towards the second half of the

year, as well as from the unwind of working capital.

Market fundamentals remain strong despite softer short-term

prices

The pricing environment in the first half of 2023 was

substantially weaker compared to the first half of 2022.

Seaborne coal prices fell sharply as European buying slowed

significantly on the back of record coal and gas stock levels

coming out of a milder winter. This resulted in the redirection of

coal volumes to Asian markets which also showed signs of weaker

demand, especially from Japan and China.

Efforts to curb inflation through monetary tightening policies

globally have also resulted in a growth slow down with reduced

economic activity and demand for energy.

Market fundamentals however remain strong and there are reasons

to remain optimistic on thermal coal prices. LNG prices are now

starting to find support, which will make coal more competitive as

a fuel source towards the end of the year as the European winter

approaches. Coal production from Russia's western regions is also

slowly being curtailed at current pricing levels.

We believe the current price headwinds have marked a pause in

attractive prices, rather than heralded a sustained downturn. We

expect demand for coal to remain robust in developing countries,

especially in Asia which remains reliant on thermal coal, as

countries such as China and India continue to build coal-fired

power plants.

Underinvestment into coal supply has continued, with the

exception of China and India (both focusing on domestic supply) and

Indonesia, which produces lower quality coal. At the same time, we

have seen an increase in new coal-fired power generation coming

online, especially in China, all of which should be supportive of

coal prices in the medium to longer term.

Continued underperformance on the part of TFR has again hampered

our ability to operate optimally. TFR achieved an annualised run

rate of 48Mtpa for the industry in the first half of 2023, a

deterioration of 13% compared to the 55Mtpa run rate achieved in

the first half of 2022. TFR suffered two derailments in May 2023

which cost Thungela at least 340kt in rail capacity. After a

particularly poor first quarter, the rail performance stabilised in

the second quarter - following the derailments TFR performance

averaged 50Mtpa for the six-week period preceding its annual

maintenance shut in July. The stabilisation is the result of

intensive collaboration between TFR and the South African coal

industry, including Thungela.

A consistently performing and well managed bulk rail

infrastructure remains critical to the coal mining industry and the

South African economy. TFR has stated that it will achieve 60Mt in

the 2023/2024 contractual year. The recent formation of the

President's National Logistics Crisis Committee and significant

changes to the Transnet board are positive indications of the

intent to achieve improved performance. TFR's ability to improve

rail performance hinges on several important factors, critical of

which is the resolution of an impasse which currently prevents TFR

from procuring much needed spares and locomotives.

Resilience and readiness

While softer coal prices and poor rail performance have weighed

heavily on Thungela's performance in the first half of 2023, we

expect these factors to improve over time. The Group must therefore

ensure that it is both resilient to weaker short-term market

conditions and ready to take advantage of improved conditions as

they arise. This implies a continuum of decisive actions and

strategies.

Creating a resilient business requires focusing on two facets in

order to optimise the business for current and future

volatility.

The first is our decision to structurally resize the portfolio

in response to rail constraints. Previously, we had curtailed

high-cost operations such as Khwezela. We have subsequently ramped

up Khwezela and reduced underground sections that are starting to

face increasingly complex geological conditions.

The second is to improve our competitiveness by increasing

productivity and ensuring the optimal cost base for our business.

In the event that prices remain depressed for a protracted period

and rail performance does not improve, we may be required to

consider further revisions to our portfolio.

Thungela's ability to take these actions, to protect cash flow

through resizing the portfolio and to improve our competitiveness,

is underpinned by the Group's strong balance sheet and liquidity

position. This allows us to weather the challenging market

conditions and focus on operational excellence, while continuing to

fund our capital projects.

Readiness for improved market and infrastructure conditions is

premised on structuring the Group for success regardless of market

cycles. While the softer prices and continued uncertainty relating

to TFR performance present near-term challenges, this does not

change the Group's longer-term strategic priorities: to drive our

ESG aspirations, maximise the full potential of our existing

assets, create future diversification options and optimise capital

allocation.

Maximising value from existing assets

Investing through the cycle in projects which realise the full

potential of our existing assets has been a key tenet of Thungela's

strategy since listing. We are pleased to report that we continue

to make good progress on the Elders production replacement project,

approved by the board last year, and we expect first coal from the

underground operation by the first half of 2024, in line with our

original target.

In June 2023, the board also approved the Zibulo North Shaft

project at a total capital cost of R2.4 billion. The project will

extend the life of our flagship Zibulo operation by at least 10

years from 2025.

Both projects secure the future of the business by improving the

quality and overall cost competitiveness of the portfolio.

Acquisition of Ensham Coal Mine in Australia

The proposed acquisition of the Ensham Business in Australia

announced in February marks the first milestone of our geographic

diversification strategy which aims to further enhance the

resilience of our portfolio.

Ensham is a large, high quality asset with long life potential

and provides Thungela with entry into the southern Bowen Basin in

Queensland, a leading mining jurisdiction, with mature and well

established infrastructure.

The transaction was structured to enable the Group to benefit

from the economics of the Ensham Business (subject to a limit)

between 1 January 2023 and the completion date.

Ensham will be acquired at a cost of approximately R4.1 billion

and this investment is set to be earnings and cash flow accretive,

with strong potential for a short payback period. The acquisition

also brings increased scale and marketing capability, providing

access to Japan and other Asian markets.

Thungela will assume operational control of the Ensham Business

following completion of the transaction, which is expected on 31

August 2023 given that all key regulatory conditions precedent have

now been met, with only a few commercial conditions (such as the

transfer of material supplier contracts) yet to be concluded. A

comprehensive roadmap has been prepared to ensure alignment in

terms of priorities, governance and other aspects of

integration.

Commitment to capital allocation framework

The board reaffirms its commitment to Thungela's dividend policy

to target a minimum payout of 30% of adjusted operating free cash

flow *. The board has accordingly declared an interim dividend of

R10 per share. Thungela shareholders will receive R1.4 billion in

total, which represents 33% of adjusted operating free cash flow*

for the period ended 30 June 2023. The Sisonke Employee Empowerment

Scheme and the Nkulo Community Partnership Trust will receive a

further R156 million in aggregate.

The board's commitment to maximising shareholder value

underscores the importance of the completion of the Elders and

Zibulo North Shaft projects. Approximately R3.8 billion is yet to

be spent on these projects, which will not only enhance our

portfolio's quality and competitiveness but also extend the life of

our business.

The board also continues to monitor the appropriate timing for

the execution of a potential share buyback. The prevailing market

conditions, and resultant need for balance sheet flexibility, call

for a cautious approach to capital allocation until clarity emerges

on the trajectory of a possible recovery in market conditions and

rail performance.

Looking ahead

It is prudent to narrow our full year export saleable production

guidance range for 2023 to between 11.5Mt and 12.5Mt. Achieving the

lower end of this range requires an annualised TFR industry run

rate of 47Mtpa in the second half of the year - the ongoing

collaboration between TFR and industry should ensure that this run

rate is achieved.

The long-term coal market remains structurally attractive and

Thungela is building its own export marketing capabilities as the

offtake agreement with Anglo American comes to an end in

mid-2024.

We will continue to closely monitor the trajectory of thermal

coal prices and rail performance, and the impact this will have on

the future size and shape of an appropriate portfolio in terms of

cost, productivity and sustaining capital.

Thungela's objectives remain clear: we must continue to focus on

the factors we can control in order to safeguard performance,

invest in our strategic projects and maintain disciplined capital

allocation. This will ensure that we are able to continue to

responsibly create value for our stakeholders.

While much of the focus will be on productivity and cost

improvements, it is important to emphasise that focusing on what we

are able to control goes hand in hand with operating responsibly,

ensuring the safety and health of our employees, meeting our

responsibilities to the environment and delivering on our social

obligations. It also requires us to step up our efforts together

with industry, government and Transnet to find sustainable

solutions to the logistics challenges facing South Africa.

Finally, we are confident that our strategy, disciplined capital

allocation approach and enhanced resilience will allow us to

navigate the challenging market conditions we are currently facing;

while improvements to the overall competitiveness of our portfolio

will continue to create superior returns for our shareholders in

the long-term.

July Ndlovu

21 August 2023

Operational Outlook

2023 2023

Revised Previous guidance

Export saleable production (Mt) 11.5 - 12.5 10.5 - 12.5

---------------------------------------- -------------

FOB cost per export tonne* (Rand/tonne) 1,170 - 1,250 1,131 - 1,264

---------------------------------------- -------------

FOB cost per export tonne excluding

royalties* (Rand/tonne) 1,120 - 1,200 1,047 - 1,180

---------------------------------------- -------------

Capital - sustaining (Rand billion) 1.3 - 1.5 1.3 - 1.5

---------------------------------------- -------------

Capital - expansionary (Rand billion) 1.6 - 1.8 1.6 - 1.8

---------------------------------------- -------------

Looking ahead, the Group is updating its operational outlook for

the 2023 year, based on operations for the first six months of the

year. The range for export saleable production is accordingly

narrowed to between 11.5Mt and 12.5Mt. Achieving the lower end of

this range requires an annualised TFR industry run rate of 47Mtpa

in the second half of the year.

Our guidance for FOB cost per export tonne * for 2023 has been

revised to between R1,120 and R1,200 excluding royalties. Including

royalties, the guidance range is revised to between R1,170 and

R1,250 per tonne using a forecast Benchmark coal price of USD100

per tonne. This increase is primarily due to a lower domestic

by-product revenue offset from Isibonelo and Mafube.

Capital expenditure guidance remains unchanged. Our sustaining

capital expenditure guidance for 2023 remains between R1.3 billion

and R1.5 billion. Expansionary capex is expected to be between R1.6

billion and R1.8 billion, relating primarily to R1.2 billion for

the Elders project and R0.5 billion for the Zibulo North Shaft

project.

The 2023 cost guidance provided reflects the impact of the

reduction in underground sections already undertaken this year. We

have embarked on a programme to improve productivity across our

operations as well as to reduce costs where we have removed

production. The outcome of this work will be reflected in our 2024

guidance which we expect to provide when we report our full year

results in March 2024.

The guidance for 2023 excludes the Ensham Business and we will

accordingly only provide guidance after completion of the

transaction.

Interim dividend

The board has declared an interim ordinary cash dividend of

R10.00 per share payable on 26 September 2023 and 9 October 2023 to

shareholders on the JSE and LSE respectively. Further details

regarding the dividend payable to shareholders of Thungela may be

found in a separate announcement on SENS and RNS dated 21 August

2023.

Footnote

(1) TRCFR for H1 2022 was previously reported in the Interim

Financial Statements for the six months ended 30 June 2022 as 1.48.

This figure was subsequently updated at year end to reflect the

reclassification of an injury from a first-aid case to a medical

treatment case.

FORWARD -LOOKING STATEMENTS

This document includes forward-looking statements. All

statements included in this document (other than statements of

historical facts) are, or may be deemed to be, forward-looking

statements, including, without limitation, those regarding

Thungela's financial position, business, acquisition and divestment

strategy, dividend policy, plans and objectives of management for

future operations (including development plans and objectives

relating to Thungela's products, production forecasts and resource

and reserve positions). By their nature, such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Thungela, or industry results, to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Thungela

therefore cautions that forward-looking statements are not

guarantees of future performance.

Any forward-looking statement made in this document or elsewhere

is applicable only at the date on which such forward-looking

statement is made. New factors that could cause Thungela's business

not to develop as expected may emerge from time to time and it is

not possible to predict all of them. Further, the extent to which

any factor or combination of factors may cause actual results to

differ materially from those contained in any forward-looking

statement are not known. Thungela has no duty to, and does not

intend to, update or revise the forward-looking statements

contained in this document after the date of this document, except

as may be required by law. Any forward-looking statements included

in this document have not been reviewed or reported on by the

Group's independent external auditor.

Investors are cautioned not to rely on these forward-looking

statements and are encouraged to read the Interim Financial

Statements for the six months ended 30 June 2023, which are

available from the Thungela website via the following web link:

https://www.thungela.com/investors/results

ALTERNATIVE PERFORMANCE MEASURES

Throughout this results announcement a range of financial and

non-financial measures are used to assess our performance,

including a number of financial measures that are not defined or

specified under International Financial Reporting Standards (IFRS),

which are termed 'Alternative Performance Measures' (APMs).

Management uses these measures to monitor the Group's financial

performance alongside IFRS measures to improve the comparability of

information between reporting periods. These APMs should be

considered in addition to, and not as a substitute for, or as

superior to, measures of financial performance, financial position

or cash flows reported in accordance with IFRS. APMs are not

uniformly defined by all companies, including those in the Group's

industry. Accordingly, they may not be comparable with similarly

titled measures and disclosures by other companies. In this results

announcement, APMs are

denoted with an asterisk (*).

ABOUT THIS RESULTS ANNOUNCEMENT

This results announcement is the responsibility of the board of

directors of Thungela.

Shareholders are advised that this results announcement is only

a select extract of the information contained in the Interim

Financial Statements and does not contain full or complete details.

Any investment decisions by investors and/or shareholders should be

based on a consideration of the Interim Financial Statements as a

whole and investors and/or shareholders are encouraged to review

the Interim Financial Statements which are available on the

Thungela website via the following web link:

https://www.thungela.com/investors/results and has been published

on SENS, the Johannesburg Stock Exchange News Service, at

https://senspdf.jse.co.za/documents/2023/JSE/ISSE/TGAE/Int2023.pdf

A conference call and audio webinar relating to the details of

this announcement will be held at 12:00 SAST (11:00 BST) on Monday

21 August 2023. A recording of the webinar will be made available

on the Thungela website from 15:00 SAST (14:00 BST) on the same

date.

Conference Call registration:

https://services.choruscall.za.com/DiamondPassRegistration/register?confirmationNumber=4803796&linkSecurityString=c5e389d68

Webinar registration:

https://78449.themediaframe.com/links/thungela230821_1200.html

The condensed consolidated interim financial statements for the

six months ended 30 June 2023 were reviewed by

PricewaterhouseCoopers Incorporated who have issued an unmodified

review report. This results announcement and the operational

outlook have not been audited or reviewed by the Group's

independent external auditor.

Copies of the Interim Financial Statements for the six months

ended 30 June 2023 may be requested by contacting Thungela Investor

Relations by email at ryan.africa@thungela.com and are also

available for inspection at the Company's registered office and at

the offices of the Company's sponsor, to investors and/or

shareholders at no charge, on any business day between the hours of

08:00 - 17:00. The Company's registered office is located at: 25

Bath Avenue, Rosebank, Johannesburg, 2196, South Africa. The

Company's sponsor's office is located at: 1 Merchant Place, Cnr

Rivonia Road and Fredman Drive, Sandton, 2196, South Africa.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the market abuse regulation (EU) no. 596/2014 as amended by the

market abuse (amendment) (UK mar) regulations 2019. Upon the

publication of this announcement via the regulatory information

service, this inside information is now considered to be in the

public domain.

On behalf of the board of directors

Sango Ntsaluba, Chairperson

July Ndlovu, Chief executive officer

Johannesburg (South Africa)

Date of SENS release: 21 August 2023

Investor Relations

Ryan Africa

Email: ryan.africa@thungela.com

Media Contacts

Tarryn Genis

Email: tarryn.genis@thungela.com

UK Financial adviser and corporate broker

Liberum Capital Limited

Tel: +44 20 3100 2000

Sponsor

Rand Merchant Bank

(A division of FirstRand Bank Limited)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSDTVIIFIV

(END) Dow Jones Newswires

August 21, 2023 02:00 ET (06:00 GMT)

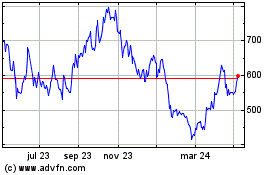

Thungela Resources (LSE:TGA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thungela Resources (LSE:TGA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024