TIDMTHR

RNS Number : 8377E

Thor Mining PLC

15 March 2022

15 March 2022

Thor Mining PLC

("Thor" or the "Company")

Half year report

The Directors of Thor Mining plc (AIM, ASX: THR) are pleased to

announce the Company's results for the six months ended 31 December

2021.

The Company's Half Year Report was also today lodged with the

Australian Stock Exchange ("ASX") as required under the listing

rules of the ASX. A copy of the Half Year Report will shortly be

available on the Company's website www.thormining.com .

Key Highlights

Gold, Lithium, Nickel, Copper-Gold (Ragged Range in the Pilbara

region of Western Australia)

-- Maiden reverse circulation ("RC") drilling program at the

Sterling Prospect highlighted encouraging quartz veining and

sericite-pyrite-fuchsite alteration

Uranium & Vanadium (Colorado & Utah, USA)

-- The Company received Bureau of Land Management (BLM) approvals

-- Continued progress with the Colorado County approvals for an

initial drilling program over several of the Colorado claims

Tungsten-Molybdenum-Copper (Molyhil, NT, Australia)

-- Completed diamond drilling to test a newly modelled magnetic

target, adjacent to the Molyhil deposit

-- Drilling intercepted massive magnetite skarn with

disseminated scheelite, molybdenite, and chalcopyrite

Copper-Gold (SA, Australia)

Alford East

-- Results from the Company's first phase of diamond drilling

highlighted broad high-grade copper-gold intercepts and identified

key structural and lithological constraints on mineralisation,

suggesting potential zones for extended zones of higher grade

copper-gold along strike and at depth

-- The Company earned a 51% interest in Alford East by

completing the Stage 1 requirements by funding A$500,000 of

expenditure and issued the Stage 1 consideration of A$250,000 in

fully paid Thor shares

-- Initial favourable hydrometallurgical results demonstrate the

potential for the metal recovery of copper and gold using

environmentally friendly lixiviants

-- New 3D geological framework completed to assist drill targeting and hydrological studies.

Kapunda and Alford West

-- EnviroCopper Ltd (ECL), the holder and operator of the

Kapunda and Alford West projects, in which Thor has 30% equity

interest, continued to advance the Kapunda project with push-pull

hydrometallurgical test-work for copper extraction for In Situ

Recovery ("ISR") assessment

-- Alford West activities have focused on desktop

hydrogeological studies in preparation for field pump tests

Pilot Mountain

-- Pilot Mountain project in Nevada USA was divested in 2021 for US$1.8 million

Nicole Galloway Warland, Managing Director of Thor Mining,

commented:

"We are very pleased with the progress made across our project

portfolio during the six months ended 31 December 2021. Thor's

business model focuses on creating value through the advancement of

our diverse asset base targeting critical and battery minerals,

positioning the Company well for future growth.

During the period, Thor completed simultaneous drilling programs

at the Ragged Range Project in the Pilbara region of Western

Austrlalia and Molyhil in the Northern Territory, and, having

received Bureau of Land Management (BLM) approvals at our Uranium

& Vanadium Project in USA, has begun working through the

Colorado County approvals for an initial drilling program over

several of the Colorado claims.

At the Sterling Prospect, Ragged Range, our maiden RC drilling

program highlighted encouraging quartz veining and

sericite-pyrite-fuchsite alteration. Unfortunately, due to

mechanical issues, not all targets at the prospect were tested, so

the remaining targets will be subject to follow up testing in the

program planned for 2022, alongside further exploration for lithium

prospectivity, which could enhance the fundamentals of the project.

At Molyhil, we are pleased to have announced that diamond drilling

has reinforced the newly discovered extension of

scheelite-molybdenite-chalcopyrite mineralisation, confirming the

project as a new critical minerals discovery. Further exploration

drilling is expected at Molyhil in 2022.

We continue to be encouraged by the potential for the recovery

of copper and gold using environmentally friendly lixiviants at

Alford East, where the first phase of diamond drilling highlighted

broad high-grade copper-gold intercepts and identified key

structural and lithological constraints on mineralisation,

suggesting potential zones for extended zones of higher copper-gold

along strike and at depth. A second phase of drilling is currently

being designed which will also assess ISR viability. During the

period, EnviroCopper Ltd also completed push-pull

hydrometallurgical test-work at the Kapunda project and Site

Environment Lixiviant Testing (SELT) is anticipated in 2022 with

the aim of recovering copper in solution from the deposit.

"Commodity prices have performed well during the period and

forecasts are favourable that these conditions will continue

further into 2022. With a strong pipeline of news flow expected for

the coming months, and project milestones across the portfolio, we

look forward to providing further updates on our progress in due

course."

This announcement is authorised for release to the market by the

Board of Directors.

For further information, please contact:

Thor Mining PLC

Nicole Galloway Warland, Managing Director Tel: +61 (8) 7324

Ray Ridge, CFO / Company Secretary 1935

Tel: +61 (8) 7324

1935

WH Ireland Limited (Nominated Adviser Tel: +44 (0) 207

and Joint Broker) 220 1666

Jessica Cave / Darshan Patel / Megan Liddell

SI Capital Limited (Joint Broker) Tel: +44 (0) 1483

413 500

Nick Emerson

Yellow Jersey (Financial PR) thor@yellowjerseypr.com

Sarah Hollins / Henry Wilkinson Tel: +44 (0) 20 3004

9512

Updates on the Company's activities are regularly posted on

Thor's website www.thormining.com , which includes a facility to

register to receive these updates by email, and on the Company's

twitter page @ThorMining .

About Thor Mining PLC

Thor Mining PLC (AIM, ASX: THR; OTCQB: THORF) is a diversified

resource company quoted on the AIM Market of the London Stock

Exchange, ASX in Australia and OTCQB Market in the United

States.

The Company is advancing its diversified portfolio of precious,

base, energy and strategic metal projects across USA and Australia.

Its focus is on progressing its copper, gold, uranium and vanadium

projects, while seeking investment/JV opportunities to develop its

tungsten assets.

Thor owns 100% of the Ragged Range Project, comprising 92 km(2)

of exploration licences with highly encouraging early-stage gold

and nickel results in the Pilbara region of Western Australia, for

which initial drilling was carried out in 2021

At Alford East in South Australia, Thor is earning an 80%

interest in copper deposits considered amenable to extraction via

In Situ Recovery techniques (ISR). In January 2021, Thor announced

an Inferred Mineral Resource Estimate of 177,000 tonnes contained

copper & 71,000 oz gold(1).

Thor also holds a 30% interest in Australian copper development

company EnviroCopper Limited, which in turn holds rights to earn up

to a 75% interest in the mineral rights and claims over the

resource on the portion of the historic Kapunda copper mine and the

Alford West copper project, both situated in South Australia, and

both considered amenable to recovery by way of ISR.(2)(3)

Thor holds 100% interest in two private companies with mineral

claims in the US states of Colorado and Utah with historical

high-grade uranium and vanadium drilling and production

results.

Thor holds 100% of the advanced Molyhil tungsten project,

including measured, indicated and inferred resources , in the

Northern Territory of Australia, which was awarded Major Project

Status by the Northern Territory government in July 2020.

Adjacent to Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including Inferred

resource estimates for the Bonya copper deposit, and the White

Violet and Samarkand tungsten deposits.

Notes

(1)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210127-maiden-copper.gold-estimate-alford-east-sa.pdf

(2)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20172018/20180222-clarification-kapunda-copper-resource-estimate.pdf

(3)

www.thormining.com/sites/thormining/media/aim-report/20190815-initial-copper-resource-estimate---moonta-project---rns---london-stock-exchange.pdf

(4)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210408-molyhil-mineral-resource-estimate-updated.pdf

(5)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20200129-mineral-resource-estimates---bonya-tungsten--copper.pdf

MAR

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Thor Mining Plc

Half-year Report

For the six months ended

31 December 2021

HIGHLIGHTS

Gold, Lithium, Nickel, Copper-Gold

The Company focused its attention on the 13km trend of anomalous

gold defined by stream and soil sampling at the Sterling Prospect,

Ragged Range in the Pilbara region of Western Australia. A small

maiden RC drilling program highlighted encouraging quartz veining

and sericite-pyrite-fuchsite alteration, which will assist with

vectoring in on the stream and soil gold source. Drilling was

co-funded by the Western Australian government for A$160,000.

Uranium & Vanadium

The Company has Bureau of Land Management (BLM) approvals and is

working through the Colorado County approvals for an initial

drilling program over several of the Colorado claims.

Tungsten-Molybdenum-Copper

Diamond drilling to test a newly modelled magnetic target,

adjacent to the Molyhil deposit, was completed in December 2021.

Drilling intercepted massive magnetite skarn with disseminated

scheelite, molybdenite, and chalcopyrite. Drilling was co-funded by

the Northern Territory government for A$110,000.

Pilot Mountain project, Nevada USA was divested in 2021 for an

agreed value of US$1.8 million.

Copper-Gold

The Company's first phase of diamond drilling highlighted broad

high-grade copper-gold intercepts and identified key structural and

lithological constraints on mineralisation, suggesting potential

zones for extended zones of higher copper-gold along strike and at

depth. Initial favourable hydrometallurgical results demonstrate

the potential for the metal recovery of copper and gold using

environmentally friendly lixiviants. The Company continues to

progress the ISR assessment of the Alford East project. The Company

earned a 51% interest in Alford East by completing the Stage 1

requirements by funding A$500,000 of expenditure and issued the

Stage 1 consideration of A$250,000 in fully paid Thor shares. The

South Australian government is co-funding these initial ISR

assessment through a grant of A$300,000.

Thor has 30% equity interest in EnviroCopper Ltd (ECL), the

holder and operator of the Kapunda and Alford West projects. ECL

continued to advance the Kapunda project with push-pull

hydrometallurgical test-work for copper extraction for ISR

assessment.

OUTLOOK FOR 2022

Gold, Lithium, Nickel, Copper-Gold

Newly defined lithium targets identified in the highly

prospective untested area adjacent to the Split Rock Supersuite in

the north of the Ragged Range tenure. Ground truthing and potential

drilling are planned.

RC drilling is scheduled over the Sterling gold prospect

following encouraging sulphides and alteration intercepted in

maiden drillholes completed in 2021.

Uranium & Vanadium

The Company is working closely with Colorado County for drilling

approvals, for an initial drill program on several of the Colorado

claims.

Tungsten-Molybdenum-Copper

Exploration drilling at Molyhil is anticipated in 2022 following

the success of the recent magnetic modelling at Molyhil.

Copper

The second phase of drilling at Alford East is being designed,

including continuing hydrogeological and hydrometallurgical

studies, to assess the ISR viability in contrast to conventional

open cut or underground mining.

Kapunda Site Environment Lixiviant Testing (SELT) is anticipated

following on from the push-pull test work, aimed at recovering

copper in solution from the deposit.

REVIEW OF OPERATIONS

Commodity Prices (source: Argus Metals)

Commodity prices have all taken a run with favourable outlooks

for 2022.

Lithium price has soared over the last six months, with lithium

carbonates prices ranging from US$11.92/kg to US$38.19/kg in the

six-month reporting period. The current price is around

US$68.85/kg, forecast to increase further with high global demand

and projection of scarcity.

Uranium is on a steady upward trend with prices ranging from

US$31.87/lb to US$43.9/lb in the six-month period, as it moves into

the green energy space. The uranium futures is currently trading

above US$50/lb with a very positive global outlook for nuclear

energy following the Russian invasion of Ukraine and the impact of

Russian sanctions.

Copper prices have continued to perform well over the six-month

period in a tight range between US$9,400/tonne and US$9,681/t. As

copper usage surges based on increase demand for electric vehicles,

wind turbines and solar panels and the possibility of supply

disruption following the Russian invasive of Ukraine a robust

demand for copper is forecast with the current price at

US$10,220/t.

Due to the ongoing conflict between Russia and Ukraine, gold

prices have strengthened to around US$1,900/oz, with the price

outlook remaining positive.

Tungsten and molybdenum prices over the last six months have

been stable, with tungsten sitting around US$274/mtu and molybdenum

at US19.1/lb. The Molyhil project remains very well positioned,

with expected production costs of US$90/mtu at the lower end of

global production costs.

Copper Portfolio (South Australia)

Alford East

The Alford East Copper-Gold Project is located on EL6529, where

Thor is earning up to 80% interest (currently a 51% interest) from

unlisted Australian explorer Spencer Metals Pty Ltd, covering

portions of EL6255 and EL6529 (ASX: THR Announcement 23 November

2020). The Alford East Project covers the northern extension of the

Alford Copper Belt, located on the Yorke Peninsula, SA. The Alford

Copper Belt is a semi-coherent zone of copper-gold oxide

mineralisation, within a structurally controlled, north-south

corridor consisting of deeply kaolinised and oxidised troughs

within metamorphic units on the edge of the Tickera Granite, Gawler

Craton, SA. Utilising historic drillhole information, Thor

completed an inferred Mineral Resource Estimate (MRE) (ASX: THR

Announcement 27 January 2021):

-- 125.6Mt @ 0.14% Cu containing 177,000t of contained copper

-- 71,500oz of contained gold

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210127-maiden-copper.gold-estimate-alford-east-sa.pdf

The first phase of drilling, completed by Thor in September

2021, comprised nine diamond drillholes totalling 878m. This

initial program focussed only on the northern portion of the Alford

East copper-gold deposit, around the AE-5 mineralised domains, with

drilling targeting areas open at depth and along strike.

Significant intercepts included (ASX: THR 21 February 2022):

-- 21AED001 32.9m @ 0.4% Cu and 0.31g/t Au from 81.5m,

-- 21AED002 59.9m @ 0.3% Cu from 21.9m,

-- 21AED003 32.4m @ 0.2% Cu from 15m,

-- 21AED004 55.9m @ 0.53% Cu from 7m, including 11.7m @ 1.0% Cu

from 17.3m, including 5.7m @ 1.23% and 0.16g/t Au from 17.3,

and

-- 21AED005 72.7m @ 1.0% Cu and 0.19g/t Au from 6.3m, including

18.2m @ 2.0% Cu and 0.34g/t Au from 15.8m.

Drill targeting, vectoring in on the hanging wall side of the

north-south trending controlling structure, now referred to as

Netherleigh Park Fault, intercepted zones of high-grade copper and

gold grades resulted in a significant grade uplift in comparison to

the MRE.

Initial pump testing on 21AEDD001 which was developed into a

water bore showed favourable hydrogeological conditions for In-situ

recovery. The ground water Is classified as saline, precluding it

from agriculture or potable use, suitable for industrial use

only.

Thor's objective is to identify an In-Situ Recovery pathway,

ideally for both the copper and gold mineralisation at the Alford

East Project, that is socially and environmentally friendly rather

than using conventional acid In-Situ Recovery (ISR). This has led

to Thor engaging Mining Processing Solutions (MPS), trialling their

alkaline Glycine Leaching Technology (GLT), branded as their

GlyCat(TM) and GlyLeach(TM) processes, that have the capability to

selectively leach base and precious metals using glycine as the

principal, eco-friendly, reagent. Initial laboratory bottle roll

testing from samples in 21AED001 performed well, with GLT

extracting up to 98.1% of the gold and over 40% of the copper.

These activities, completed in 2021, were co-funded by the South

Australian Accelerated Discovery Grant (ADI) for A$300,000.

Based on a new geological model, approximately 10 diamond drill

holes have been designed to test potential high-grade zones along

strike and at depth. In addition, hydrogeological water bores and

pump testing is in planning to determine aquifer connectivity

between holes, with an initial focus in the northern area of the

mineralisation. Concurrent to drilling, hydrometallurgical work

will continue to investigate and optimise both copper and gold

metal extraction using environmentally friendly lixiviants.

EnviroCopper Limited

Thor holds a 30% interest in Australian private company

EnviroCopper Limited (ECL). ECL is earning a 75% effective

interest, in two stages, on rights over metals which may be

recovered via in-situ recovery ("ISR") contained in the Kapunda

deposit from Australian listed company Terramin Australia Limited

("Terramin", ASX: TZN), and up to 75% of the Alford West copper

project, comprising the northern portion of exploration licence

EL5984, held by Andromeda Metals Limited (ASX: ADN).

Kapunda Project

During the period, ECL completed the installation of test well

arrays and commenced ISR trials, including tracer and push-pull

test work. These tests are the final hydrometallurgical assessments

before ECL commences Site Environmental Lixiviant Trials (SELT).

The purpose of lixiviant trials, or 'push-pull tests', is to assess

the solubility of copper mineralisation, and therefore copper

recovery, using a specially designed solution called a "lixiviant"

under in-situ conditions. The trial is to be undertaken in two

stages. The first stage involves injecting and extracting a tracer

solution (Sodium Bromide - NaBr) from the same well to demonstrate

hydraulic connectivity between the observation and environmental

monitor well network. This is followed by injecting and extracting

lixiviant from the same well to test copper solubility from the

mineralisation.

Key outcomes anticipated from lixiviant trials:

i) Hydraulic connectivity between wells

ii) Copper solubility and recovery

iii) Establish lixiviant and time parameters for design of the

Site Environmental Lixiviant Trials (SELT)

It is anticipated that ECL will move into the SELT test work

with scoping study released in the first half of 2022.

Ragged Range Gold, Lithium, Nickel, Copper-Gold Project

(Pilbara, Western Australia) (100% Thor)

Thor now holds a 100% interest in five granted tenements in the

Pilbara region of Western Australia, approximately 40km west of the

township of Nullagine.

With the recent granting of E46/1393, Thor undertook a

geological review of the Ragged Range Project, highlighting the

lithium prospectivity in addition to gold, nickel and copper-gold.

The Pilbara Craton is highly prospective for

lithium-caesium-tantalum enriched (LCT) pegmatites and hosts two

large and globally significant spodumene deposits at Wodgina

(Mineral Resources Ltd) and Pilgangoora (Pilbara Minerals). The

lithium rich pegmatites in the Pilbara are spatially and appear to

be genetically related to the Split Rock Supersuite (2.85 to

2.83Ma), which outcrops in the northern portion of the Ragged Range

tenure, with three priority targets identified ready for ground

truthing in 2022.

During the reporting period, Thor completed 41 shallow (50-96m)

RC drillholes totalling 2,155m at the Sterling Prospect (ASX: THR

25 January 2022). This maiden RC program was designed to test eight

strong gold anomalies at Sterling Central and Sterling South

prospects, defined from soil and stream sediment sampling programs.

Drilling intercepted strong broad zones of quartz veining,

sericite, silica alteration, sulphides and fuchsite, characteristic

of gold mineralisation in the Pilbara; these are positive

indicators of proximity to the gold source. Unfortunately, due to

mechanical issues, not all targets were tested. Drilling was

co-funded by the West Australian Geological Survey for A$160,000.

Full drilling details may be viewed via following link:

https://www.thormining.com/sites/thormining/media/pdf/asx-announcements/20220125-gold-explorationupdate,

-ragged-range-wa.pdf

The program for 2022 includes follow up drilling at the Sterling

prospect, completing the planned program and targeting the fault

contact in the area between Sterling Central and Sterling South. In

parallel to the gold exploration activities at the Sterling

Prospect, the following exploration program is planned with

particular focus on lithium:

1) Airborne magnetic/radiometric survey to be flown over the

eastern portion of the tenure including E46/1340 and E46/1393

2) Ground 'fixed loop' electromagnetics (FLEM) is scheduled over the nickel gossan

3) Proposed lithium activities include:

a. A detailed review of all available high-resolution imagery

and aster data, to see if the presence of pegmatites can be

visually detected

b. Reconnaissance rock sampling and prospecting along the

contact of the Mondana Monzogranite, Split Rock Supersuite

(E46/1262, E46/1190, E461393 and E46/1340), with detailed

sampling

c. Investigation of all small granitic and pegmatitic bodies in the target area

Uranium & Vanadium Projects (Colorado & Utah USA) (100%

Thor)

Thor holds a 100% interest in two US companies with mineral

claims in Colorado and Utah, USA. The claims host uranium and

vanadium mineralisation in an area known as the Uravan mineral

belt, which has a history of high-grade uranium and vanadium

production.

Within probable economic transport distance is a processing

plant (Energy Fuels White Mesa Mill) which may be a low hurdle

processing option for any production from these projects.

Details of the project may be found on the Thor website:

https://www.thormining.com/projects/us-uranium-and-vanadium

Thor has completed BLM environmental approvals and is now

working through the Colorado County approvals. Thor is hoping to be

drilling by June quarter 2022.

Molyhil Tungsten/Molybdenum project (NT, Australia) (100%

Thor)

The Molyhil project is located 220 km north-east of Alice

Springs (320 km by road).

A full background on the project is available on the Thor Mining

website:

www.thormining.com/projects .

Three diamond drillholes (21MHDD001 - 21MHDD003) totalling

995.4m were completed in December 2021, designed to test a newly

identified large magnetic target to the south of the known Molyhil

tungsten-molybdenum-copper mineralisation (ASX: THR 7 December

2021). Both 21MHDD002 and 21MHDD003 intercepted disseminated

mineralisation, consisting of scheelite, molybdenite and

chalcopyrite within massive magnetite skarn. Drillhole 21MHDD002

intercepted over 45m of disseminated mineralisation, whilst

21MHDD003 intercepted two zones over 29m of disseminated

mineralisation. It appears 21MHDD001 intersected the edges of the

magnetite skarn drilling over the top of the magnetite skarn lode,

with negligible mineralisation. Initial interpretation of data

highlights a potential south-east plunging lode extending southeast

of the Southern lode with a possible offset (yet to be

determined).

Thor expects to receive assay results back in the first quarter

of 2022, with follow up drilling to be designed at Molyhil, as well

as regional exploration drilling targeting additional magnetic

targets.

The drilling program was co-funded by the Geophysics and

Drilling Collaborations (GDC) program as part of the Resourcing the

Territory initiative, with Thor Mining granted A$110,000 (ASX: THR

4 June 2021).

Bonya (Tungsten, Copper, Vanadium) (40% Thor)

The Bonya project sits approximately 30 km east of Molyhil and

holds tungsten and copper resources which are expected to

complement the Molyhil project. Thor, in joint venture with

Arafura, holds 40% equity interest in the resources.

A full background on the project is available on the Thor Mining

website:

www.thormining.com/projects .

Pilot Mountain Tungsten Project (Nevada, USA) (100% Thor)

During the reporting period, Thor divested the Pilot Mountain

Tungsten Project in Nevada, USA for an agreed value of US$1.8

million to Power Metal Resources Plc ("Power Metal") (ASX: THR

Announcement 1 September 2021).

Given the consideration was paid as a combination of cash and

equity in Power Metal, Thor currently maintains an indirect

interest in the project through it's holding of 44,118,920 shares

in Power Metal, representing a holding of 3.0%, as well as 12.5

million warrants to subscribe for ordinary shares in Power Metal,

with an exercise price of 4p and expiry period of 3 years. The

Pilot Mountain project is located approximately 200 km south of the

city of Reno and 20 km east of the town of Mina located on US

Highway 95.

The project is comprised of four tungsten deposits: Desert

Scheelite, Gunmetal, Garnet and Good Hope.

Capital Raisings

During the period, the Company's cash balances were augmented by

two placements. In August 2021, the Company raised GBP800,000 via

the placing of 123,076,923 new ordinary shares of 0.01p each

("Ordinary Shares") at a price of GBP0.0065 (0.65 pence) per

Ordinary Share (approximately A$0.0123).

In December 2021, the Company raised gross proceeds of A$2.75m

via the placement of 220,000,000 Ordinary Shares at a price of

A$0.0125 (1.25 cents) per Ordinary Share. All placees received two

options for each three Ordinary Shares to subscribe for a further

new Ordinary Share at i) one option exercisable at A$0.015,

expiring 12 months from issue, ii) one option at A$0.02, expiring

24 months from issue.

The Board believes that these capital raisings put the Company

in a strong position to deliver on our 2022 drill programmes and

project developments.

Board and Management Changes

During the period, Mick Billing resigned as Executive Chair,

with Mark Potter appointed Non-Executive Chair and Alastair Clayton

joining the Board as Non-executive Director. The Board would like

to express appreciation and gratitude to Mick Billing for his

service lasting over 13 years.

Comprehensive Income

The comprehensive income statement records a comprehensive loss

of GBP1,004,000 (2020: GBP512,000 loss) after taking into account

unrealised exchange loss of GBP221,000 (2020: GBP115,000 loss).

Nicole Galloway Warland

Managing Director

15 March 2022

Competent Person's statements

The information in this report that relates to exploration

results is based on information compiled by Nicole Galloway

Warland, who holds a BSc Applied geology (HONS) and who is a Member

of The Australian Institute of Geoscientists. Ms Galloway Warland

is an employee of Thor Mining PLC. She has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which she is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Nicole Galloway

Warland consents to the inclusion in the report of the matters

based on her information in the form and context in which it

appears.

The Company confirms that it is not aware of any new information

or data that materially affects the information included in the

original market announcements and, in the case of estimates of

Mineral Resources or Ore Reserves, that all material assumptions

and technical parameters underpinning the estimates in the relevant

market announcement continue to apply and have not materially

changed. The Company confirms that the form and context in which

the Competent Person's findings are presented have not been

materially modified from the original market announcement.

Condensed Consolidated Statement of Comprehensive Income

For the 6 months ended 31 December 2021

Note GBP'000 GBP'000 GBP'000

6 months ended 6 months ended Year

31 December 31 December ended

2021 2020 30 June

2021

Unaudited Unaudited Audited

Administrative expenses (58) (54) (94)

Corporate expenses (347) (331) (635)

Share-based payments expense 8 (245) (106) (126)

Realised gain/loss on financial

assets (1) - (2)

Exploration expenses (26) (79) (81)

Write-off/impairment of exploration

assets 3 - (15) (1,450)

Operating Loss (677) (585) (2,388)

Interest Paid (1) (1) (1)

Share of (loss)/profit of associate,

accounted for using the equity

method 6 (36) (72) 22

Fair value decrement on financial

assets FVTPL (204) - -

Profit/(loss) on Sale of Investments 4 93 222 222

Sundry income 42 39 41

Loss before Taxation (783) (397) (2,104)

Taxation - - -

-------------- -------------- --------

Loss for the period (783) (397) (2,104)

-------------- -------------- --------

Other comprehensive income:

Items that may be subsequently

reclassified to profit or loss:

Exchange differences on translating

foreign operations (221) (115) (570)

Other comprehensive income for

the period, net of income tax (221) (115) (570)

Loss for the year and total comprehensive

loss attributable to the equity

holders (1,004) (512) (2,674)

============== ============== ========

Basic earnings per share 2 (0.05)p (0.03)p (0.14)p

Condensed Consolidated Statement of Financial Position

For the 6 months ended 31 December 2021

Note GBP'000 GBP'000 GBP'000

31 December 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

ASSETS

Non-current assets

Intangible assets (deferred

exploration costs) 3 11,359 12,459 10,120

Assets held for sale 4 - - 1,050

Financial assets 5 744 - -

Investments accounted for

using the equity method 6 523 492 564

Deposits to support performance

bonds 42 43 41

Right of use asset - 27 10

Plant and equipment 14 9 7

Total non-current assets 12,682 13,030 11,792

------------ ------------ --------

Current assets

Cash and cash equivalents 1,579 685 783

Trade receivables and other

assets 124 70 60

Total current assets 1,703 755 843

------------ ------------ --------

Total assets 14,385 13,785 12,635

------------ ------------ --------

LIABILITIES

Current liabilities

Trade and other payables (206) (277) (306)

Employee annual leave provision (22) (1) (10)

Lease liability - (27) (10)

------------ ------------ --------

Total current liabilities (228) (305) (326)

------------ ------------ --------

Total non-current liabilities - - -

------------ ------------ --------

Total liabilities (228) (305) (326)

------------ ------------ --------

Net assets 14,157 13,480 12,309

============ ============ ========

Equity

Issued share capital 7 3,811 3,762 3,773

Share premium 26,576 23,485 24,379

Foreign exchange reserve 1,453 2,129 1,674

Merger reserve 405 405 405

Share based payments reserve 8 911 325 314

Retained earnings (18,999) (16,626) (18,236)

------------ ------------ --------

Total equity 14,157 13,480 12,309

============ ============ ========

Condensed Consolidated Statement of Change in

Equity

For the 6 months ended 31 December

2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Issued Share Retained Foreign Merger Share Total

share premium losses Currency Reserve Based

capital Translation Payment

Reserve Reserve

Balance at 1 July

2020 3,733 22,288 (16,339) 2,244 405 275 12,606

Loss for the

period - - (397) - - - (397)

Foreign currency

translation

reserve - - - (115) - - (115)

Total

comprehensive

loss for the

period - - (397) (115) - - (512)

-------- -------- -------- ------------- --------- --------- ----------

Transactions with owners in their capacity

as owners

Shares issued 29 1,396 - - - - 1,425

Cost of shares

issued - (199) - - - - (199)

Share options

lapsed - - 110 - - (110) -

Share options

issued - - - - - 160 160

-------- -------- -------- ------------- --------- --------- ----------

At 31 December

2020 3,762 23,485 (16,626) 2,129 405 325 13,480

-------- -------- -------- ------------- --------- --------- ----------

Balance at 1 July

2020 3,733 22,288 (16,339) 2,244 405 275 12,606

Loss for the

period - - (2,104) - - - (2,104)

Foreign currency

translation

reserve - - - (570) - - (570)

Total

comprehensive

(loss) for the

period - - (2,104) (570) - - (2,674)

-------- -------- -------- ------------- --------- --------- -------

Transactions with owners in their capacity

as owners

Shares issued 40 2,337 - - - - 2,377

Cost of shares

issued - (246) - - - - (246)

Share options

exercised - - 207 - - (207) -

Share options

issued - - - - 246 246

At 30 June 2021 3,773 24,379 (18,236) 1,674 405 314 12,309

-------- -------- -------- ------------- --------- --------- -------

Balance at 1 July

2021 3,773 24,379 (18,236) 1,674 405 314 12,309

Loss for the

period - - (783) - - - (783)

Foreign currency

translation

reserve - - - (221) - - (221)

Total

comprehensive

loss for the

period - - (783) (221) - - (1,004)

-------- -------- -------- ------------- --------- --------- ----------

Transactions with owners in their capacity

as owners

Shares issued 38 2,480 - - - - 2,518

Cost of shares

issued - (283) - - - - (283)

Share options

exercised - - 20 - - (20) -

Share options

issued - - - - - 617 617

-------- -------- -------- ------------- --------- --------- ----------

At 31 December

2021 3,811 26,576 (18,999) 1,453 405 911 14,157

-------- -------- -------- ------------- --------- --------- ----------

Condensed Consolidated Statement of Cash Flow

For the 6 months ended 31 December

2021

GBP'000 GBP'000 GBP'000

6 months ended 6 months ended Year

31 December 31 December ended

2021 2020 30 June

2021

Unaudited Unaudited Audited

Cash flows from operating activities

Operating loss (677) (585) (2,388)

Sundry income 33 39 41

(Increase)/decrease in trade and other

receivables (47) (17) 4

Increase/(decrease) in trade and other

payables 7 6 (9)

Increase/(decrease) in provisions 11 (53) (42)

Depreciation 11 19 38

Exploration expenditure written-off - 15 1,450

Share-based payments 245 106 126

Director fees settled by share issue - 23 23

Net cash outflow from operating activities (417) (447) (757)

Cash flows from investing activities

Interest paid (1) (1) (1)

Tenement Bond (1) - -

Investment in associated entity - (170) (170)

Purchase of property, plant & equipment (9) (6) (8)

Payments for exploration expenditure (1,124) (391) (706)

R&D Grants - 98 98

Proceeds from sale of assets 84 222 222

Net cash outflow from investing activities (1,051) (248) (565)

Cash flows from financing activities

Lease liability repayments (10) (16) (30)

Net issue of ordinary share capital 2,276 1,163 1,902

--------

Net cash inflow from financing activities 2,266 1,147 1,872

Net decrease in cash and cash equivalents 798 452 550

Non-cash exchange changes (2) - -

Cash and cash equivalents at beginning

of period 783 233 233

-------------- -------------- --------

Cash and cash equivalents at end of

period 1,579 685 783

-------------- -------------- --------

Notes to the Half-year Report

For the 6 months ending 31 December 2021

1. PRINCIPAL ACCOUNTING POLICIES

(a) Presentation of Half-year results

The half-year results have not been audited but were the subject

of an independent review carried out by the Company's auditors, PKF

Littlejohn LLP. Their review confirmed that the figures were

prepared using applicable accounting policies and practices

consistent with those adopted in the 2021 annual report and to be

adopted in the 2022 annual report. The financial information

contained in this half-year report does not constitute statutory

accounts as defined by Section 435 of the Companies Act 2006.

The half-year report has been prepared under the historical cost

convention.

The Directors acknowledge their responsibility for the half-year

report and confirm that, to the best of their knowledge, the

interim consolidated financial statements for the six months ended

31 December 2021 have been prepared in accordance with

International Financial Reporting Standards, including IAS 34

"Interim Financial Statements", and complies with the requirements

for companies with securities admitted to trading on the AIM Market

of the London Stock Exchange. This half-year report does not

include all the notes of the type normally included in an annual

financial report. Accordingly, this report should be read in

conjunction with the annual report for the year ended 30 June

2021.

The Directors are of the opinion that on-going evaluations of

the Company's interests indicate that preparation of the accounts

on a going concern basis is appropriate. Refer Note 11 for further

information.

(b) Basis of consolidation

The consolidated financial statements comprise the financial

statements of Thor Mining PLC and its controlled entities. The

financial statements of controlled entities are included in the

consolidated financial statements from the date control commences

until the date control ceases. All inter-company balances and

transactions have been eliminated in full.

The financial statements of subsidiaries are prepared for the

same reporting period as the parent Company, using consistent

accounting policies.

(c) Investments in Associates

Investments in associate companies are recognised in the

financial statements by applying the equity method of accounting.

The equity method of accounting recognises the Group's share of

post-acquisition reserves of its associates.

Where there has been a change recognised directly in an

associate's equity, the Group recognises its share of any changes

and discloses this in the statement of profit of loss and other

comprehensive income. The reporting dates of the associates and the

Group are identical and the associates accounting policies conform

to those used by the Group for like transactions and events in

similar circumstances.

(d) Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's medium

term performance and the factors that mitigate those risks have not

substantially changed from those set out in the Company's 2021

Annual Report and Financial Statements. The key financial risks are

liquidity risk, credit risk, interest rate risk and fair value

estimation.

(e) Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in the Company's 2021 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

Notes to the Half-year Report

For the 6 months ending 31 December 2021

2. EARNINGS PER SHARE

No diluted earnings per share is presented for the six months

ended 31 December 2021 as the effect on the exercise of share

options would be to decrease the loss per share .

GBP'000 GBP'000 GBP'000

6 months ended 6 months ended Year

31 December 31 December ended

2021 2020 30 June

2021

Unaudited Unaudited Audited

Loss for the period (783) (397) (2,104)

Weighted average number of 1,724,133,775 1,388,190,687 1,497,215,458

Ordinary shares in issue

Loss per share - basic (0.05)p (0.03)p (0.14)p

3. DEFERRED EXPLORATION COSTS

GBP'000 GBP'000 GBP'000

31 December 31 December 30 June

2021 2020 2021

Cost Unaudited Unaudited Audited

At commencement 10,120 12,252 12,252

Net additions 989 187 612

Acquired through acquisition 330 157 310

Exchange gain/(loss) (80) (122) (554)

Write off exploration tenements for

year - (15) (1,450)

Transfers to held for sale assets

(note 4) - - (1,050)

At period end 11,359 12,459 10,120

------------ ------------ -------

Impairment

At commencement - - -

Exchange loss - - -

Impairment for period - - -

At period end - - -

------------ ------------ -------

Net book value at period end 11,359 12,459 10,120

------------ ------------ -------

Notes to the Half-year Report

For the 6 months ending 31 December 2021

3. DEFERRED EXPLORATION COSTS (continued)

Acquired through acquisition

In the half year period ending 31 December 2021, Thor paid

consideration of GBP330,000 for completion of the Stage 1 earn-in

under the binding term sheet for Thor to acquire an interest in the

oxide mineral rights from Spencer Metals Pty Ltd (Spencer) over the

Alford East copper-gold project, located on the Yorke Peninsula,

South Australia. Under the term sheet, Thor is to acquire an

interest of 80% directly in the project, over two stages:

Stage 1: Thor has earned a 51% interest by funding A$500,000

expenditure over the 2 years to 11 November 2022, with the

GBP330,000 consideration comprising:

-- GBP128,000 fair value of 15,625,000 Thor Ordinary Shares

issued on 26 November 2021. The fair value was based on the closing

price of Thor Ordinary Shares of GBP0.0082 (0.82 pence) on the AIM

market of the London Stock Exchange on 10 November 2021 (being the

day prior to shareholder approval of the issuance of the Ordinary

Shares); and

-- GBP202,000 fair value of 31,250,000 unlisted options to

acquire Thor Ordinary Shares at an exercise price of A$0.03 (3

cents) at any time through to the expiry date of 25 November 2026.

The fair value was estimated using a Black Scholes model (refer

Note 8).

Stage 2: Thor may earn a further 29% interest (80% in total) by

funding an additional A$750,000 of expenditure over a subsequent 2

years to 11 November 2024 and for additional consideration of

A$250,000 in fully paid Thor shares, issued at the 5 day ASX VWAP

on the date immediately prior to allotment and two free attaching

options per share issued, exercisable at a$0.03 within years from

the date of issue (stage 2 expenditure). If Thor does not proceed

with the Stage 2 earn-in, then its interest in the project is

relinquished.

Upon Thor completing the acquisition of an 80% interest in the

project, Spencer will hold a free carried 20% interest in the

project, until a decision to mine.

The parties have agreed to use reasonable commercial endeavours

to negotiate and execute a formal Joint Venture agreement for the

development and operation of a mine and associated facilities

within 60 days from the end of Stage 2.

Notes to the Half-year Report

For the 6 months ending 31 December 2021

4. HELD FOR SALE ASSET

GBP'000 GBP'000 GBP'000

31 December 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

Opening balance 1,050 - 1,050

Asset divested (1,050) - -

- - 1,050

------------ ------------ -------

On 31 August 2021, Thor Mining Plc announced the execution of an

Option Agreement with AIM listed Power Metal Resources Plc (AIM:

POW) ("Power Metal"), for the divestment of Thor's Pilot Mountain

Tungsten Project in Nevada in line with their focus on core copper

and gold projects. Accordingly, the carrying value of the

investment at 30 June 2021 was reclassified in the Statement of

Financial Position from 'Intangible assets - deferred exploration

costs; to 'Held for sale assets'. Thor received an exclusivity fee

of 500,000 Power Metal Ordinary Shares with an estimated fair value

of GBP9,750.

The divestment was successfully completed on 29 October 2021

with consideration of GBP1,022,000 received by Thor,

comprising:

-- GBP84,000 in cash (being US$115,000 at the exchange rate on 29 October 2021 of 0.7304); and

-- GBP938,000 fair value of 48,118,920 Ordinary Shares in Power

Metal. The fair value was determined by the closing price of

GBP0.0195 for Power Metal Ordinary Shares on the London Stock

Exchange on 31 August 2021 (being the day prior to execution of the

Option Agreement).

The consideration of GBP1,022,000, resulted in a loss of

(GBP28,000) compared to the book value of GBP1,050,000. The loss

was recognised as a (GBP121,000) loss through Other Comprehensive

Income as a reversal of the foreign currency translation reserve

and a GBP93,000 gain through the Profit or Loss.

In addition, Power Metal granted Thor 12.5 million unlisted

warrants to subscribe for Power Metal Ordinary Shares with an

exercise price of GBP0.04 (4 pence) per Ordinary Share at any time

through to the expiry date of 29 October 2024, subject to an

acceleration clause if the Power Metal Ordinary Share price is

above GBP0.10 (10 pence) for five consecutive days. Any warrants

exercised by 29 October 2022 receive replacement warrants with an

exercise price at GBP0.08 (8 pence) for a further 3 years to the

expiry date.

As part of the divestment Thor was also entitled to receive a

milestone payment of US$500,000, payable in Power Metal Ordinary

Shares, if Golden Metal publishes a JORC or 43-101 compliant

resource at Pilot Mountain increasing the existing declared levels

by 25% across the total indicated and inferred categories, within

two years. Subsequent to the half year period ended 31 December

2021, Thor agreed to relinquish this milestone entitlement in

return for GBP50,000 in cash and 4,000,000 Ordinary Shares in Power

Metal with an estimated fair value of GBP57,200 based on the

closing price of Power Metal Ordinary Shares on the London Stock

Exchange of GBP0.0143 (1.43 pence) on 21 January 2022 (being the

last trading day prior to execution of the variation

agreement).

Notes to the Half-year Report

For the 6 months ending 31 December 2021

5. FINANCIAL ASSETS

GBP'000 GBP'000 GBP'000

31 December 31 December 30 June

2021 2020 2021

Unaudited Unaudited Audited

Investment in Power Metal Resources

Plc 744 - -

744 - -

------------ ------------ -------

The investment balance at 31 December 2021, comprises 48,618,920

Power Metal Ordinary shares being the 50,000 Ordinary Shares

received as part of the exclusivity fee under the Option Agreement

and 48,118,920 Ordinary Shares received upon completion of the

divestment on 29 October 2021.

The 48,618,920 POW shares were initially recognised at

GBP948,000 being valued at the closing price of GBP0.0195 for Power

Metal Ordinary Shares on the London Stock Exchange on 31 August

2021 (being the day prior to execution of the Option

Agreement).

The shares were then revalued to fair value at 31 December 2021

of GBP744,000, based on the closing price of GBP0.0153 for Power

Metal Ordinary Shares on that date. The revaluation decrement of

(GBP204,000) was recognised as a fair value adjustment through the

Company's Profit or Loss (FVTPL), on the basis that Thor does not

consider the Ordinary Shares held as a strategic investment.

48,118,920 of the Ordinary Shares are subject to a voluntary

escrow, with 25% becoming tradeable at each of the following dates:

30 April 2022, 30 June 2022, 30 September 2022 and 30 December

2022.

6. INVESTMENTS ACCOUNTED FOR USING GBP'000 GBP'000 GBP'000

THE EQUITY METHOD

31 December 31 December 30 June 2021

2021 2020

Unaudited Unaudited Audited

A reconciliation of the carrying

amount of the investments in the

company is set out below:

EnviroCopper Limited

Conversion of loan to equity 391 391 391

Additional investment 170 170 170

------------ ------------ ------------

Initial cost of investment 561 561 561

Cumulative share of (loss)/profit

of associate, accounted for using

the equity method (14) (72) 22

Share of foreign currency translation

reserve (24) 3 (19)

------------ ------------ ------------

523 492 564

============ ============ ============

ECL is a copper development company which holds rights to earn

up to a 75% interest in the mineral rights and claims over the

resource on the portion of the historic Kapunda copper mine, in

South Australia, recoverable by way of in situ recovery (ISR) and

holds rights to earn a 75% interest in a portion of the Moonta

Copper Project, also in South Australia, that is considered

amenable to recovery by the way of in-situ recovery.

Notes to the Half-year Report

For the 6 months ending 31 December 2021

6. INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD (continued)

On 30 July 2020, Thor announced the conversion of its $700,000

(GBP391,000) convertible loan to a 25% interest in ECL and

exercised its right to nominate a Board representative.

Accordingly, the investment is being accounted for using the equity

method from the date of loan conversion to equity.

On the 11 November 2020, the Company increased its ownership

interest to 30% through the payment of A$300,000 (GBP170,000).

The tables below provide summarised consolidated financial

information for EnviroCopper Limited and its wholly owned

subsidiaries Environmental Copper Recovery SA Pty Ltd and

Environmental Metals Recovery Pty Ltd. The information disclosed

reflects the amounts presented in the financial statements of the

relevant associate and not Thor's share of those amounts. They have

been amended to reflect adjustments made by Thor when using the

equity method, including modifications for differences in

accounting policies.

Summarised financial information for EnviroCopper Ltd

GBP'000 GBP'000 GBP'000

31 December 31 December 30 June 2021

2021 2020

Unaudited Unaudited Unaudited

Summarised balance sheet:

Current Assets

Cash and cash equivalents 43 10 648

Other current assets 119 62 14

Provision for income tax 132 772 129

------------ ------------ -------------

Total current assets 295 844 791

Non-current Assets

Plant & Equipment 44 10 22

------------ ------------ -------------

Total non-current assets 44 10 22

------------ ------------ -------------

Total assets 339 854 813

------------ ------------ -------------

Current Liabilities

Trade payables - -

Other current liabilities 118 - 472

------------ ------------ -------------

Total current liabilities - 472

Non-current Liabilities

Other non-current liabilities 17 - -

------------ ------------ -------------

Total non-current liabilities 17 - -

------------ ------------ -------------

Total Liabilities 135 - 472

------------ ------------ -------------

Net Assets 204 854 341

============ ============ =============

Notes to the Half-year Report

For the 6 months ending 31 December 2021

6. INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD (continued)

Summarised statement of comprehensive income:

GBP'000 GBP'000 GBP'000

31 December 31 December 30 June 2021

2021 2020

Unaudited Unaudited Unaudited

Total Income 616 44 666

Less Expenses (734) (319) (595)

---------------- --------------- ----------------

Net Profit (118) (275) (71)

================ =============== ================

7. SHARE CAPITAL GBP'000 GBP'000 GBP'000

31 December 31 December 30 June 2021

2021 2020

Unaudited Unaudited Audited

Issued fully paid (Nominal Value)

982,870,766 'Deferred Shares' of

GBP0.0029 each 2,850 2,850 2,850

7,928,958,483 'A Deferred Shares'

of GBP0.000096 each 761 761 761

Ordinary shares of GBP0.0001 each 200 151 162

---------------- --------------- -------------

3,811 3,762 3,773

================ =============== =============

Number Number Number

31 December 31 December 30 June 2021

2021 2020

Unaudited Unaudited Audited

Movement in share capital

Ordinary Shares of 0.01 pence

At commencement 1,625,719,488 1,224,996,863 1,224,996,863

Shares issued for cash(1) 343,076,923 231,583,333 319,818,629

Warrants exercised(2) 11,800,000 11,566,667 12,566,667

Shares issued to Directors in lieu

of cash payment for Directors fees - 5,821,663 5,821,663

Shares issued to service providers(3) 7,200,000 - 8,015,666

Shares issued for acquisition(4) 15,625,000 42,000,000 54,500,000

---------------- --------------- -------------

At period end 2,003,421,411 1,515,968,526 1,625,719,488

================ =============== =============

(1) Comprises two separate placements. The first in August 2021,

being the issue of 123,076,923 Ordinary Shares at GBP0.0065 (0.65

pence), together with one free unlisted warrant for every two Ordinary

Shares subscribed, exercisable at GBP0.013 (1.3 pence) expiring 17

August 2023. The second in December 2021, being the issue of 220,000,000

Ordinary Shares at A$0.0125 (1.25 cents), together with two free listed

options for every three Ordinary Shares subscribed, one option exercisable

at A$0.015 (1.5 cents) expiring 20 December 2022, and the other option

exercisable at A$0.02 (2.0 cents) expiring 20 December 2023.

Notes to the Half-year Report

For the 6 months ending 31 December 2021

7. SHARE CAPITAL (continued)

(2) Comprises 8,000,000 Ordinary shares issued 17 September 2021

following the exercise of options at a price of A$0.0095 (0.95 cents),

and 3,800,000 Ordinary shares issued 23 December 2021 following the

exercise of options at a price of A$0.01 (1.0 cent).

(3) Ordinary Shares issued on 22 December 2021 to PAC Partners as

part payment of commission as broker to the December 2021 placement.

(4) Ordinary shares issued 26 November 2021 as part consideration

for the acquisition of a 51% direct interest in the oxide mineral

rights over the Alford East copper-gold project, located on the Yorke

Peninsula, South Australia. Refer Note 3.

GBP'000 GBP'000 GBP'000

31 December 31 December 30 June 2021

2021 2020

Nominal Value Unaudited Unaudited Audited

At commencement 3,773 3,733 3,733

Issued for cash 34 23 32

Warrants exercised 1 1 1

Shares issued to Directors in lieu

of cash payment for Directors fees - 1 1

Issued to service providers 1 - 1

Issued for acquisition 2 4 5

At period end 3,811 3,762 3,773

---------------- --------------- -------------

Notes to the Half-year Report

For the 6 months ending 31 December 2021

8. SHARE BASED PAYMENTS RESERVE

Options are valued at an estimate of the cost of the services

provided. Where the fair value of the services provided cannot be

estimated, the value unlisted options granted are calculated using

the Black-Scholes model taking into account the terms and

conditions upon which the options are granted.

GBP'000 GBP'000

31 December 30 June 2021

2021

Unaudited Audited

Opening balance at 1 July 314 275

36,000,000 options issued GBP0.00656 236 -

31,250,000 options issued GBP0.00646 202 -

22,000,000 listed options issued @ GBP0.00466 103 -

22,000,000 listed options issued @ GBP0.00306 67 -

Exercised 3,8000,000 options @ GBP0.00156 (6) -

Exercised 8,000,000 options @ GBP0.001720 (14) -

5,000,000 options to a service provider @ GBP0.003620

(1) 9 9

Exercised 9,450,000 options @ GBP0.0013 - (12)

Lapsed 10,000,000 @ GBP0.0098 - (98)

Lapsed 5,000,000 @ GBP0.0034 - (17)

Lapsed 15,000,000 @ GBP0.0053 - (80)

Issued 24,000,000 to Directors @ GBP0.0017 - 41

Issued 7,500,000 ESOP @ GBP0.0051 - 38

Issued 4,000,000 to service provider @ GBP0.0066 - 27

Issued 2,433,526 to service a provider @ GBP0.0045 - 11

Issued 5,647,058 to a service provider @ GBP0.0058 - 32

Issued 35,000,000 to a service provider @ GBP0.0016 - 55

Issued 8,333,000 for tenements acquired @ GBP0.0039 - 33

Closing balance 911 314

----------- ------------

(1) In June 2021, 6,000,000 options were issued to a service

provider. The options vested at 1,000,000 per month. The fair value

of the options was being expensed over their vesting periods.

1,000,000 of the options were relinquished prior to vesting.

Notes to the Half-year Report

For the 6 months ending 31 December 2021

8. SHARE BASED PAYMENTS RESERVE (continued)

The following table lists the inputs used for the calculation of

share options granted as Share Based Payments during the half year

ended 31 December 2021.

36,000,000 issued to Directors on 22 November 2021

Dividend yield 0.00%

Underlying Security spot price GBP0.0087

Exercise price GBP0.0130

Standard deviation of returns 126%

Risk free rate 0.87%

Expiration period 4yrs

Black Scholes valuation per option GBP0.00656

Fair value expensed as a share-based payment*

31,250,000 issued for acquisition 26 November 2021

Dividend yield 0.00%

Underlying Security spot price A$0.015

Exercise price A$0.030

Standard deviation of returns 126%

Risk free rate 1.44%

Expiration period 5yrs

Black Scholes valuation per option GBP0.00646

Fair value capitalised as part of the cost of acquisition

(refer Note 3)

22,000,000 issued to a service provider on 20 December

2021

Dividend yield 0.00%

Underlying Security spot price A$0.015

Exercise price A$0.02

Standard deviation of returns 126%

Risk free rate 0.53%

Expiration period 2yrs

Black Scholes valuation per option GBP0.00466

Fair Value recognised as part of the cost of the capital

raising.

22,000,000 issued to a service provider on 20 December

2021

Dividend yield 0.00%

Underlying Security spot price A$0.015

Exercise price A$0.015

Standard deviation of returns 98%

Risk free rate 0.53%

Expiration period 1yr

Black Scholes valuation per option GBP0.00306

Fair Value recognised as part of the cost of the capital

raising.

Notes to the Half-year Report

For the 6 months ending 31 December 2021

8. SHARE BASED PAYMENTS RESERVE (continued)

* The total value of options expensed as share-based payments

during the half year ended 31 December 2021 is GBP245,000

comprising GBP236,000 for the options issued to the Directors and

GBP9,000 for expensing the remaining value of the 5,000,000 options

issued to a service provider in the year ended 30 June 2021 (being

expensed over their vesting period).

9. TURNOVER AND SEGMENTAL ANALYSIS - GROUP

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors that makes

strategic decisions.

The Group's operations are located Australia and the United

States of America, with the head office located in the United

Kingdom. The main tangible assets of the Group, cash and cash

equivalents, are held in the United States of America and

Australia. The Board ensures that adequate amounts are transferred

internally to allow all companies to carry out their operational on

a timely basis.

The Directors are of the opinion that the Group is engaged in a

single segment of business being the exploration for commodities.

The Group currently has two geographical reportable segments -

United States of America and Australia.

GBP'000 GBP'000 GBP'000 GBP'000

Half Year ended 31/12/2021 Head office/ Australia United States Consolidated

Unallocated

Operating Expenditure (399) (248) (30) (677)

Non-Operational items (70) (36) - (106)

------------ --------- ------------- ------------

Loss from Ordinary Activities

before Income Tax (469) (284) (30) (783)

Income Tax Benefit/(Expense) - - - -

------------ --------- ------------- ------------

Retained (loss) (469) (284) (30) (783)

------------ --------- ------------- ------------

As at 31/12/2021 Head office/ Australia United States Consolidated

Unallocated

Assets and Liabilities

Segment assets - 11,933 218 12,151

Corporate assets 2,234 - - 2,234

------------ --------- ------------- ------------

Total Assets 2,234 11,933 218 14,385

------------ --------- ------------- ------------

Segment liabilities - (202) - (202)

Corporate liabilities (26) - - (26)

------------ --------- ------------- ------------

Total Liabilities (26) (202) - (228)

Net Assets 2,208 11,731 218 14,157

------------ --------- ------------- ------------

Notes to the Half-year Report

For the 6 months ending 31 December 2021

9. TURNOVER AND SEGMENTAL ANALYSIS - GROUP (continued)

GBP'000 GBP'000 GBP'000 GBP'000

Half Year ended 31/12/2020 Head office/ Australia United States Consolidated

Unallocated

Total Segment Expenditure (257) (179) - (436)

Non-operational items 39 - - 39

------------ --------- ------------- ------------

Loss from Ordinary Activities

before Income Tax (218) (179) - (397)

Income Tax Benefit/(Expense) - - - -

------------ --------- ------------- ------------

Retained (loss) (218) (179) - (397)

------------ --------- ------------- ------------

As at 31/12/2020 Head office/ Australia United States Consolidated

Unallocated

Assets and Liabilities

Segment assets - 10,656 2,432 13,088

Corporate assets 697 - - 697

------------ --------- ------------- ------------

Total Assets 697 10,656 2,432 13,785

------------ --------- ------------- ------------

Segment liabilities - (217) - (217)

Corporate liabilities (88) - - (88)

------------ --------- ------------- ------------

Total Liabilities (88) (217) - (305)

Net Assets 609 10,439 2,432 13,480

------------ --------- ------------- ------------

GBP'000 GBP'000 GBP'000 GBP'000

10. POST BALANCE SHEET EVENTS

As part of the divestment of the Pilot Mountain project, Thor

was also entitled to receive a milestone payment of US$500,000,

payable in Power Metal Ordinary Shares, if Golden Metal publishes a

JORC or 43-101 compliant resource at Pilot Mountain increasing the

existing declared levels by 25% across the total indicated and

inferred categories, within two years. Subsequent to the half year

period ended 31 December 2021, Thor agreed to relinquish this

milestone entitlement in return for GBP50,000 in cash and 4,000,000

Ordinary Shares in Power Metal with an estimated fair value of

GBP57,200 based on the closing price of Power Metal Ordinary Shares

on the London Stock Exchange of GBP0.0143 (1.43 pence) on 21

January 2022 (being the last trading day prior to execution of the

variation agreement). Refer RNS Announcement dated 23 January 2022

(ASX Announcement 24 January 2022). For further details in relation

to the divestment of the Pilot Mountain project, refer Note 4.

Other than the above t here were no other material events

arising subsequent to 31 December 2021 to the date of this report

which may significantly affect the operations of the Group, the

results of those operations and the state of affairs of the Group

in the future.

Notes to the Half-year Report

For the 6 months ending 31 December 2021

11. GOING CONCERN BASIS OF ACCOUNTING

The financial report has been prepared on the going concern

basis of accounting.

The Group incurred a net loss after tax from continuing

operations of GBP783,000 for the half year ended 31 December 2021,

and net cash outflows of GBP1,468,000 from operating and investing

activities. The Group is reliant upon completion of asset sales or

a capital raising to fund continued operations and the provision of

working capital.

In this regard, the Company notes a cash balance of GBP1,579,000

as at 31 December 2021.

If additional capital is not obtained, the going concern basis

of accounting may not be appropriate, with the result that the

Group may have to realise its assets and extinguish its

liabilities, other than in the ordinary course of business and at

amounts different from those stated in the financial report. No

allowance for such circumstances has been made in the financial

report.

DIRECTORS, SECRETARY AND ADVISERS

Directors Mark Potter (Non-executive Chairman)

Nicole Galloway Warland (Managing Director)

Mark McGeough (Non-executive Director)

Alastair Clayton (Non-executive Director) - appointed 4 October

2021

Michael Billing (Executive Chairman) - retired 3 September

2021

In UK In Australia

------------------------ ----------------------------

Registered Office Salisbury House 58 Galway Avenue

and Directors' business London Wall Marleston, South Australia

address London, EC2M 5PS Australia 5033

United Kingdom

Company Secretaries Stephen Frank Ronaldson Ray Ridge

Website www.thormining.com www.thormining.com

Nominated Adviser to WH Ireland Limited

the Company 24 Martine Lane

London,

EC4R 0DR

Auditors to the Company PKF Littlejohn LLP

1 Westferry Circus

Canary Wharf

London, E14 4HD

Solicitors to the Druces LLP

Company Salisbury House

London Wall

London, EC2M 5PS

United Kingdom

Registrars Computershare Investor Computershare Investor

Services Plc Services Pty Ltd

The Pavilions Level 5, 115 St Grenfell

Bridgewater Road St

Bristol BS99 6ZY Adelaide, South Australia

United Kingdom 5000

REPORT ON REVIEW OF INTERIM FINANCIAL INFORMAITON

INDEPENDENT REVIEW REPORT TO THOR MINING PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 December 2021 which comprises the consolidated

income statement, consolidated balance sheet, consolidated

statement of changes in equity, consolidated cash flow statement

and related notes. We have read the other information contained in

the half-yearly financial report and considered whether it contains

any apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the Directors. The Directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Market of London Stock Exchange Rules for Issuers.

The annual financial statements of the Group are prepared in

accordance with UK adopted International Accounting Standards. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting", as adopted

by the UK.

Our responsibility

Our responsibility is to express to the Group a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

This report, including the conclusion, is made solely to the

Group for the purpose of the AIM Market of London Stock Exchange

Rules for Issuers. We do not, in producing this report, accept or

assume responsibility to anyone, other than the Group, for our

work, for this report, or for the conclusion we have formed. This

report may not be provided to third parties without our prior

written consent.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK), and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

December 2021 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the UK and the AIM Market of London Stock Exchange Rules for

Issuers.

Use of our report

This report is made solely to the company's directors, as a

body, in accordance with the terms of our engagement letter. Our

review has been undertaken so that we may state to the company's

directors those matters we have agreed to state to them in a

reviewer's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company and the company's directors as a body

for our work, for this report or the conclusion we have formed.

PKF Littlejohn LLP

15 Westferry Circus

Canary Wharf

London

E14 4HD

15 March 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UVSARUNUOAAR

(END) Dow Jones Newswires

March 15, 2022 08:16 ET (12:16 GMT)

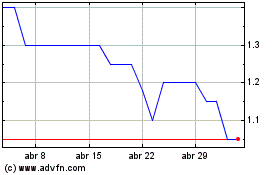

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024